Everything you need to know about working capital requirement (WCR): method, calculation, analysis

Working capital requirement is a concept that anyone starting a company has to know and understand. To ensure the success of their company, it is vital for leaders and financial executives to have a handle on any discrepancies between incomings and outgoings. In this article, we will help you learn about working capital requirements (frequently known as WCR), a term that is unique to the world of finance. What exactly is it? How do you calculate it? How do you interpret it and what actions do you take?

Defining working capital requirement

Working capital requirement (WCR) is the amount of money required to cover your operating costs. It represents your company’s short-term financing requirements. These requirements are caused by gaps in your cash flows (money coming in and out) corresponding to cash inflow and cash outflow linked to your business operations, in other words your company’s primary activity.

There are three main reasons why these gaps can appear:

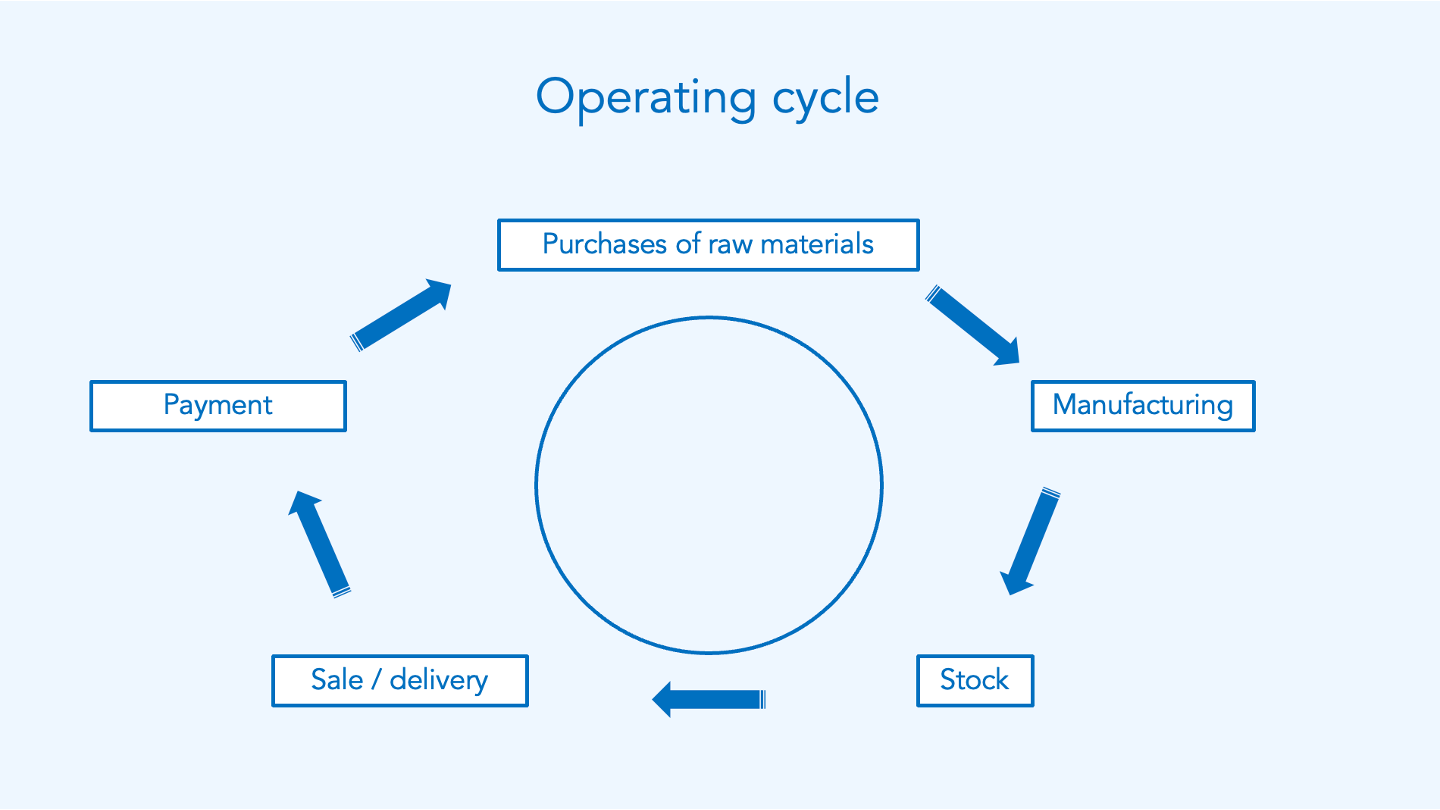

Lead times for selling inventory

When a company produces a certain quantity of goods, it often takes time to liquidate this inventory. The result is a time lag between the points when money is spent on production and the cash flows in after the goods or services are sold. This is one of the leading causes of insolvencies that can affect your working capital on an ongoing basis.

Client payment periods

Although payment may be earned and specified at a given moment in time, you often have to wait a while before it is settled. This means that a company can spend money to produce goods or provide services but may not receive the amount owed to it for another few days, weeks or months.

Payment periods for suppliers

Companies rarely produce their goods from scratch – they often rely on suppliers to source raw materials. If this is the case, once the production cycle has started, the company is indebted to these external parties for the period that it takes to receive the money from selling its products or services. In certain circumstances, however, suppliers may claim repayment before the company has received sufficient funds to cover its costs. A premature cash outflow such as this will increase the company’s WCR.

Related article: Days Inventory Outstanding

Calculating working capital requirement

Now that we know what WCR is, let’s look at why calculating it is so crucial and how you can calculate it accurately.

Why should you calculate your working capital requirement?

There are two main reasons for calculating and monitoring WCR.

1. Ensuring your business launches successfully

Calculating WCR is an indispensable step when starting a business. In fact, one of the main reasons that new companies fail is that they have inaccurate WCR estimates. Too large a gap between cash inflow and cash outflow must be anticipated to avoid any complications that could, in extreme cases, lead to bankruptcy.

This is why a well-calculated WCR is an essential piece of data for your business plan. To include WCR in your business plan, simply add a dedicated row containing a WCR estimate that is as accurate as possible.

2. Being able to make the right decisions throughout the life cycle of your company

Estimating your WCR before launching your business does not mean that you can save yourself from doing this at a later point in time. That’s right: WCR has to be calculated throughout the life cycle of your company. This is because it’s a key indicator of your company’s financial health, so it has to be calculated as you go, and its performance has to be anticipated if you are to make the most appropriate decisions for your situation.

Download our free guide to manage your cash flows more effectively.

👉 What are formulas for Working Capital Requirement?

Key calculations for working capital requirement

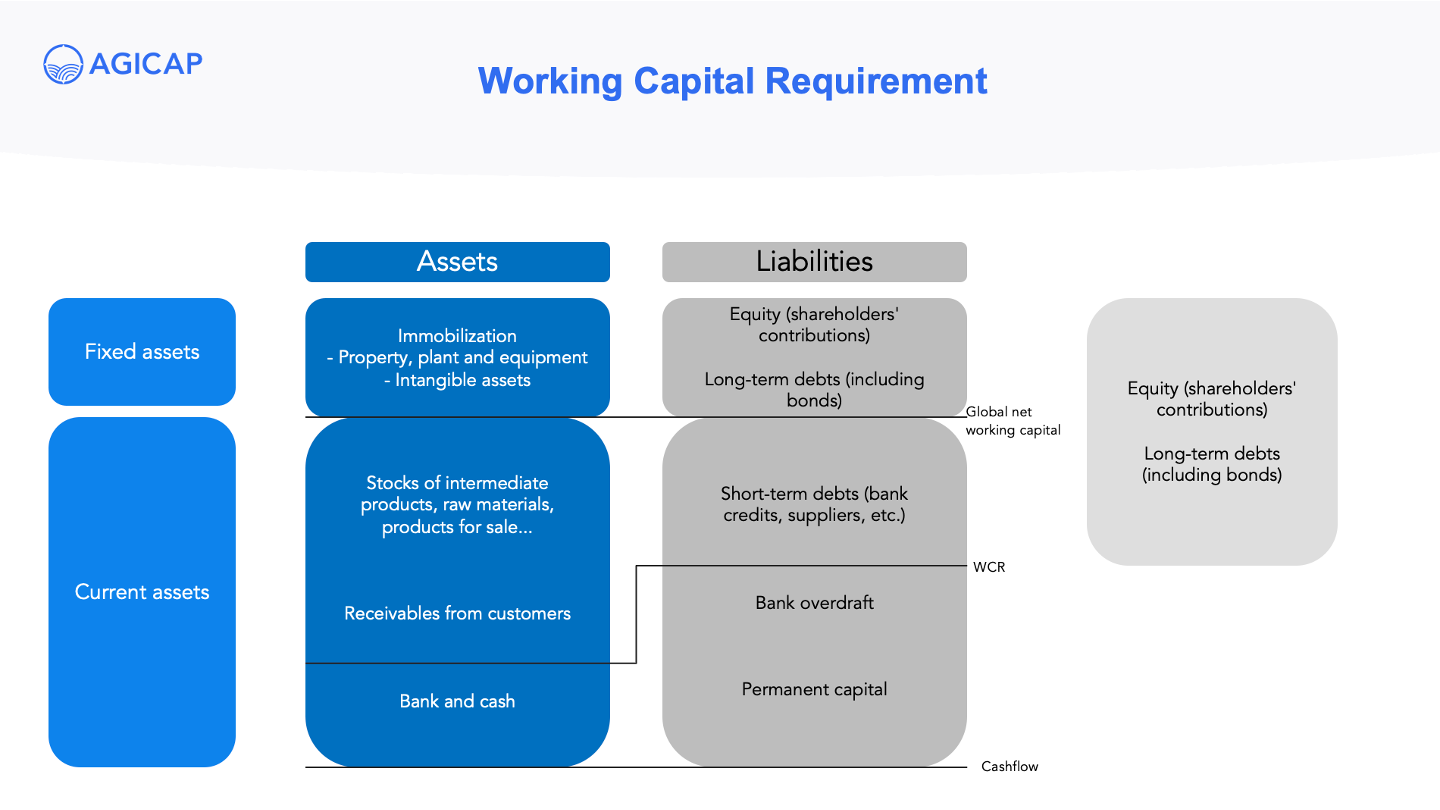

Finally, let’s look at the specifics for calculating WCR. WCR is part of the information calculated in your company’s balance sheet. It shows the difference between your current assets and current liabilities.

WCR = current assets − current liabilities

Be careful: here we are looking both at non-cash current assets and non-cash current liabilities. More specifically, current assets include inventory and client receivables, while current liabilities are made up of accounts payable and tax and social security liabilities. You should also note that some amounts will be posted with taxes included and some will not. This is due to the fact that there can be delays between paying tax and receiving tax rebates. Remember that when calculating your WCR the aim is to be able to visualise this potential gap, for example when you receive your VAT and when you pay this to the relevant authorities.

In a nutshell,

Current assets include:

- Cash, including money in bank accounts and cheques not deposited by customers.

- Marketable securities, such as US Treasury bills and money market funds.

- Short-term investments that the company intends to sell within one year.

- Accounts receivable, less allowances for accounts where payment is unlikely.

- Notes receivable - such as short-term loans to customers or suppliers - that are due within one year.

- Other receivables, such as income tax refunds, cash advances to employees and insurance claims.

- Inventories, including raw materials, work in progress and finished goods.

- Prepaid expenses, such as insurance premiums.

- Prepayments on future purchases.

Current liabilities include:

- Accounts payable.

- Notes payable within one year.

- Wages and salaries payable.

- Taxes payable.

- Interest payable on loans.

- Any loan principal that must be paid within the year.

- Other accrued expenses.

- Deferred income, such as advance payments from customers for goods or services not yet delivered.

Change in working capital

Changes in working capital may therefore occur when either current assets, or current liabilities have been increased or decreased in their value. any big changes should be anticipated in order to

Another interesting step may be to calculate your company’s days working capital (DWC).

Days working capital formula:

DWC = (WCR/annual turnover)*365

This calculation can seem a bit abstract at first glance, so let’s look at an example to understand how it is used:

If your DWC number is 50 days, this indicates that your company should, on average, use the revenue it will generate in a period of 50 days to cover its operating cycle costs.

Analysing working capital requirement

How do you interpret your working capital requirement?

There can be three different scenarios, depending on the difference between your current assets and your current liabilities.

If your WCR is positive, your company has to find a way to finance its short-term requirements. Therefore, you have to be vigilant and anticipate that you may need to go in search of funding. We will look at the different ways of financing a company’s WCR later in this article. You might also like to read: Elevated WCR: how to anticipate and better manage your cash flow

If your WCR is zero, your company has enough operational resources available to cover all requirements. Your company does not need any additional financing, nor does it have a surplus. Although we mention it in this article, having a WCR of exactly zero is rare in reality.

If your WCR is negative, your company has no short-term financial requirements, so can free up resources to fund its net cash flow.

How do you get a handle on your working capital requirement?

To truly have an overview of your WCR, there are three different parameters that you can adjust: supplier payment periods, client payment periods and inventory turnover.

Adjust supplier payment periods

If you choose to take control of your WCR by focussing on supplier payment periods, you are essentially extending these by negotiating with your supplier. Doing this will allow you more time to receive the cash you need to repay your debts. It’s best to try your luck with your longer-time partners first, though, because they will be more likely to give you the extra time that you need.

When explaining the reasons for the extension request, you can, for example, emphasise your reputation as a reliable customer or the fact that you order large volumes from the supplier (if this is in fact the case). If your supplier agrees to extend your payment period, it can be a good idea to pay your bill just a few days before it is due – the aim is to preserve your cash for as long as possible.

Adjust client payment periods

If you decide to focus on client payment periods to manage your WCR, you will be looking at shortening the payment period by negotiating payment terms. The aim here is to receive payments more quickly. For example, if you usually stipulate a 60-day payment period, you could choose to shorten this to 30 days to receive payments sooner. However, you should be careful that changing a payment period does not damage your relationship with your client. Therefore, it may be wise to start negotiating with clients with whom you have had a good customer relationship for a long time, as they are likely to understand your situation and be more willing to help you.

Another solution may be to propose a discount – this can help you get around significant gaps in your cash flow. Alternatively, if an invoice deadline has passed, you can forward the invoice to an online collection platform. This is a way of simplifying and speeding up the recovery of your client’s debts while keeping the situation amicable.

You may also like: How unpaid invoices can impact your cash flow

Adjust inventory turnover

The third option for managing your WCR is to reduce inventory turnover. However, while this does not involve negotiating with external parties, it isn’t actually as simple as it seems: by reducing your inventory turnover, you risk being faced with inventory shortages. The just-in-time inventory management approach requires an extremely precise analysis of your anticipated sales in order to minimise potential complications.

How do you finance your working capital requirement?

Since managing your WCR is a rather complex task, you will often be asked to look for ways to finance your WCR, depending on how high or low your WCR is. There are four options available to suit your situation.

Financing WCR through cash

If you are fortunate enough to have cash reserves in your company, you may be able to use these to finance your WCR (as long as this isn’t too high). This is one of the reasons that keeping your cash flow table up to date is so vital.

Financing WCR through a bank overdraft

If you don’t have enough cash to finance your WCR but it is still relatively low, you may be able to afford to have a short-term bank overdraft. This should only be a one-off solution that you use for a short period of time, otherwise it is risky for your business – especially since unexpected things can happen at any time.

Financing WCR through current account contributions

Another solution is to make use of a current account contribution. This is a short-term contribution that is paid back at a later point in time with a fixed rate of additional compensation.

Financing WCR through working capital

Finally, you can also finance your WCR via surpluses of long-term resources, mainly consisting of capital contributions and bank loans. These resources are often referred to as working capital.

You can calculate the amount using the following calculation:

Working capital = permanent capital − fixed assets

Here are more details to help you better understand the calculation above:

Permanent capital = equity + long-term borrowings (with a term of longer than one year) Fixed assets = intangible assets + tangible assets + financial assets There you have it – you’re now ready to calculate, interpret and take control of your own working capital requirement.

Learn more about the relationship between cash flow and working capital in this article.

Limitations of working capital requirement

Despite all the positive aspects, it is not a good idea to assess the financial situation of a company by looking only at its working capital requirement. For example, to assess the long-term financial performance of a company, it is a good decision to use other indicators.

There are several limitations on the working capital requirement:

-

WCR does not reflect the quality or profitability of the current assets and liabilities. For example, a business may have a high WCR because it has a large inventory of unsold goods or a high amount of receivables that are overdue or doubtful. These assets may not generate any cash flow or income for the business and may even incur additional costs such as storage, maintenance, or bad debts. Similarly, a business may have a low WCR because it has negotiated favourable terms with its suppliers or creditors, such as discounts, extended payment periods, or low interest rates. These liabilities may not pose any financial burden or risk for the business and may even enhance its cash flow or profitability.

-

WCR does not account for the seasonality or cyclicality of the business. For example, a retail business may have a high WCR during the peak sales season when it has to stock up on inventory and increase its sales staff. However, this does not necessarily mean that the business is performing well or growing. Conversely, a retail business may have a low WCR during the off-season when it has to reduce its inventory and sales staff. However, this does not necessarily mean that the business is struggling or shrinking.

-

WCR does not capture the long-term financial position or strategy of the business. For example, a business may have a low WCR because it has invested heavily in fixed assets such as machinery, equipment, or property. These assets may not contribute to the current cash flow or income of the business, but they may generate future returns or competitive advantages for the business. Similarly, a business may have a high WCR because it has retained a large amount of cash or marketable securities. These assets may not be used for the current operations or growth of the business, but they may provide liquidity, flexibility, or diversification for the business.

Working Capital example

Let's take a look at the balance sheet of Tesla Inc. (TSLA), which shows the company's financial position as of a certain date. It includes the company's assets and liabilities, as well as shareholders' equity.

In 2022, the company reported $40.9 billion in total current assets and $26.7 billion in current liabilities. This means that Tesla's working capital at the end of 2022 was $14.2 billion ($40.9 billion - $26.7 billion = $14.2 billion). Thus, Tesla had enough liquidity to cover its short-term obligations and invest in its growth.

Tesla's balance sheet reflects its financial position as of a certain date, but it does not show its performance over a period of time. To evaluate Tesla's performance, it is also important to look at its income statement and cash flow statement, which show its revenues, expenses, profits, and cash flows for a given period.

Tesla's balance sheet also does not capture some of the intangible aspects of its business, such as its brand value, customer loyalty, innovation, and social impact. These factors may not be reflected in the numbers, but they may have a significant influence on Tesla's future growth and competitiveness.

Key takeaways on working capital management

All in all, the calculation of working capital is a crucial step for every company. It shows whether the company has sufficient resources to finance future operational expenses and reduces the risk of cash shortages. Knowing in advance that your business may need additional financing (for example, for new product development) can give you the opportunity to negotiate loans with attractive lending and reduce future liquidity problems.

If you want to learn more, discover free of charge and obligation how Agicap’s cash flow management software can help you efficiently track your company’s financial situation in real time.