Private Investors are the individuals or firm that shows a keen interest in investing their money in a company to lend a financial hand to the company & contribute to its growth & earning a value for their investments.

Private Investors are a key source to raise startup capital for the businesses. Startups looking for Private Investors have not only received good financial aid but also the assistance of experts’ knowledge.

With every Private Investor investing in your firm, a range of opportunities and exposure comes through it. As your business grows, the requirement of capital rises, & raising capital from financial individuals & institutions becomes a herculean quest. So here we have listed crucial particulars that every founder must know before approaching private investors.

Types of Private Investors

Private Investors are individuals with pockets full of knowledge, experience, expertise & of course money. There are different forms of investors. These private investors have varied interests, preferences, strengths, terms, & distinct work patterns with founders.

To find the right investor, every entrepreneur must be aware & have an understanding of different types of private investors, their approaches to investments, and the motivation to invest in startups. Generally, there are four types of private Investors.

-

Friends & Family

This comes under the easiest & the most cost-effective method to raise funds i.e. through the immediate social circle. A great source for initial startup money, as the trust and association with the founders, pre-exists, whereas, usually it requires to be built from scratch while raising through other investors.

CHECKOUT: Fundability – What is It and How Can You Ensure It For Your Startup

Discuss with friends & family. Decide, if you want them to invest or just a loan is enough from them. A loan wiil be the easiest choice, as you will pay it back. Whereas an investment means giving a proportionate stake in the company & sharing of risks.

An investment will get you more money, with no installments to be paid in-between, like in the case of loans.

However, maintain professionalism when it comes to money. Because private investors will make money only if the company proves profitable. Give them a proper pitch, present your business plan & make sure they understand the risks involved in investing their money.

-

Angel Investors

Angel Investors can be professionals, including, doctors, lawyers, or business associates, or seasoned entrepreneurs. The first thing that matters for any individual to invest is Interest, Willingness & Wealth to invest hundreds and thousands of dollars in businesses in return for profits,

However, SEC or Securities Exchange Commission defines angel investors as accredited investors, that reach a net worth of at least $1 million and earn $200,000 a year or $300,000 a year jointly with a spouse.

Although angels invest a “limited” amount. The angel investment market in the US & Canada is more than $26 billion. As the pandemic hit the global crisis by 12 percent, & a decrease in the number of deals by 30 percent, that means USD 1.5 trillion of unallocated capital is yet to be invested.

This shows better opportunities, as the global crisis is at the onset of showing a downward trend.

-

Equity Investors

Equity investment is based on the valuation of the company, It’s an ideal option for those, who are likely to grow to large size businesses and are on their way towards an exit strategy, or looking for more business growth.

Technically, equity investments, are for later-stage companies that already have a good amount of assets to leverage. To get noticed or to find good equity investors, the key is to have strong growth projections and a secured business plan.

As they take big risks, show them the big returns. Once they found good ROI in your company, they will take the risk to commit to the business.

-

Venture Capital

Venture Capital is required, when businesses look to expand and venture into riskier opportunities. In 2020, the global venture capital investment market reached US$ 197.7 Billion. Venture capitalists invest their for business expansion, in a return ownership stake in the firm.

Venture capitalists invest a higher amount than angels. Thus, it gets very important for founders to have a well-established business, a solid management team, and a proven business track.

Venture Capital is a longer form of investment, thus it’s good to think about long-term involvement with venture capitalists, in the form of active participation in decision making, marketing strategies, managerial support, network access, and many more.

-

Peer-to-Peer Investors

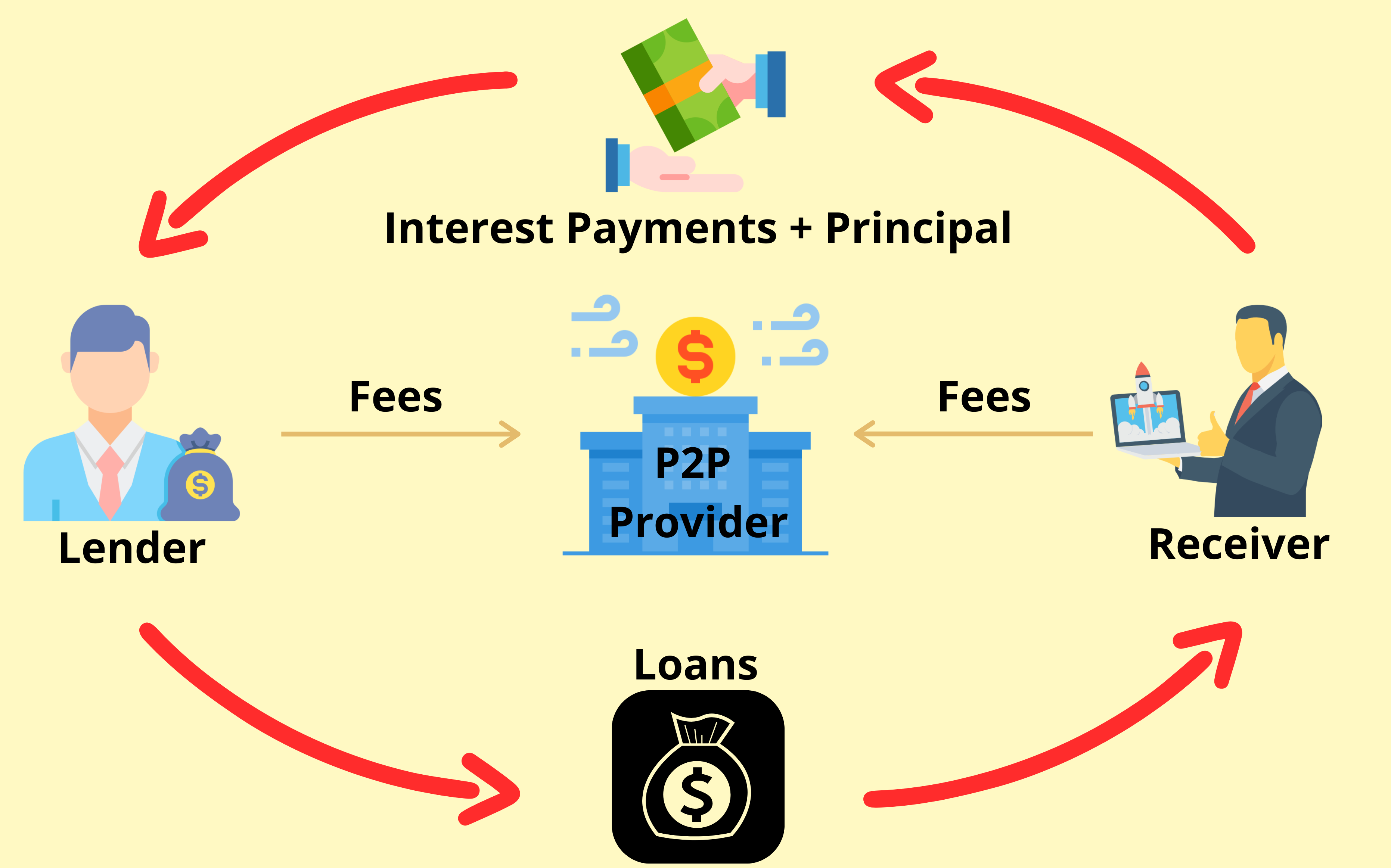

Peer to Peer investment involves three parties, i.e. borrower, lender & a middle-party firm. The investment process happens when a borrower seeks loan options from middle party firms.

This middle-party is a well-established platform, that collects funds from a group of investors & provides it in the form of loans to borrowers. The investors(lenders) are here, to benefit through new revenue streams.

The middle P2P party handles the repayment of the interests and principal amount from borrowers to lenders. In return, both parties, pay a certain amount of fees to the platform.

As the money is paid back along with interests, none of the investors has ownership, any of the firms. The interests, investors earn are higher than traditional bank loans. However, the risks are more, as there is no government protection for such money investments.

Pros of Private Investors:

-

Not a Loan

Firstly, it is not a loan & an easier funding option than sourcing loans from the bank. The loan option comes with a mandatory tag of “Repayment” at any cost. Whereas, it isn’t applicable for private funding. Private Investors understand that if the business fails, their money gets lost & you’re not responsible for the payment.

-

No need for Proven Credit History

Private money financing doesn’t imply a traditional bank finance process. It doesn’t require any credit or proven financial history, like in the case of business lenders & bank financing. Thus, saving a great deal of time for yours.

Private Investors are generally concerned about the profits they can make in the future and not what you’ve done in the past.

-

Access to Investor’s Expertise

Investors are backed with years of knowledge and investment experience. Their accomplishments and mastery are a great source of knowledgeable insights.

You may read thousands of books about startups, funding, or product success. But access to high-level knowledge through direct connection of private investors is unmatchable than any other book.

Cons of Private Investors:

-

Dilution of Share of Earnings

Most private investors generally expect ownership & share of profits, in exchange for their investment. This limits your upside potential if the business gets successful. Hence, keep a check on the number of shares that you gave out to investors. High share ownership, will impact your share earnings & won’t be beneficial in the long period.

-

Higher Stakes at risks

As Investors, play with higher risks, they expect higher performance from the business they invest in. This can create a lot of pressure on the team if the expectations are not met.

On that account, make sure your investors’ expectations are in line with your capabilities and potentiality. If not so, it’s better to find other relevant investors & business financing options.

-

Affects Controlling Power

The admittance of Private Investors not only dilutes the share of earnings but also affects the founders controlling power. An increase in stakeholders leads to, makes founder more accountable to investors & hence, leading to a good delay in the decision process.

How to find Private Investors?

Before you began with the quest of finding Private Investors, there are few crucial things that every founder should understand. It ranges from being well-prepared with your elevator pitch, pitch profile, executive summary, pitch deck, a proven business plan, and financial projections with at least three to four years of projections.

There is a kind of investors that bet their money on a founder. They evaluate founders to find the skill, potential, charisma, and a can-do attitude, to make the business a success. So working on yourself is as important as building a startup.

CHECKOUT: Tick Off These Meaningful 15 Milestones For Your Early Startup Stage

The five crucial things an investor looks for include:

-

Good Cash Flow:

No investor is interested in a firm that hardly makes any money. They, put a close lookout for EBITDA (earnings before interest, taxes, depreciation, and amortization) while evaluating the business. Because the increasing trend of EBITDA implicates more money as the business gets sold.

-

Liquidity:

Investors need assurance, that the company stays within the liquidity agreement. As it’s difficult to estimate liquidity, weekly, monthly, and quarterly cash flow modeling is useful in maintaining track of it.

-

Clear Product Analysis:

As businesses expand, companies may lose track of how much they are making profits and how much cash they are developing. Analyze product by product to find the true margins of the product.

-

Expense Control:

High expenses can break the firm. Have a controlled structure and mechanism of expenses. Lookout and control the triggers that spike expenses.

-

Metrics:

There are numerous metrics & every business has it. However, measuring the right metrics is the key. Define them & research the parameters used by the competitors. Private Investors will definitely want to check these metrics to understand how the firm is performing in the market.

Finding the ”Right” investor will make a whole lot of difference from just finding an investor. Have a solid business plan, know your expectations, be aware of your capabilities and present the right information to the investors, to get accepted by the right investors.

Where to find Private Investors?

Finding the right Investor will be fruitful when you search for them at the right places. To search for the right investor for the business, first, figure out the type of investor you need.

By guessing it right, you must be here to know how to find the three crucial types of Investors- Venture Investor, Angel Investor & Equity Investor.

CHECKOUT: A Guide on How to Talk to Investors to Secure Startup Funding

Search online and look out for an online investor’s database. At AlcorFund, we have 9000+ active global investors, that are just specific to your industry & a right match for the business.

Some of the other databases are Angel capital Association, Angellist, and Angel Investment Network. Another tip is to promote yourself. This can do wonders when you are active in business networks, engage in the corporate activities, and participate in startup events.

On this quest, you will come across numerous investors, not all will work. Narrow down the list of potential investors to the “Most Relevant” Investors. A figure of 30 to 50 private investors with investor’s industry choice, preferences, average investment amount, country, and other vital information will work better than the big list.

The next is perfecting your pitch. Your pitch is the decision-maker for investors. Have good visual communication, incorporate diagrams for projections and future strategy. Make it informative and to the point.

Being clear and concise & mentioning key data, will make the investors engrossed and increase the likelihood of getting funds.

Conclusion:

Getting an investor on board is tough. However, while investigating each investor don’t hesitate to strike out the wrong ones. Understand their management style, their values, their goals and track their past records.

Examine the investors with proper due diligence, as the investors do for startups. Because as a fresh entrepreneur, there are few investors out there, with zero sense of handling business, and are just out there to target the newbies and run away with all you have.

Stay away from the ones who have vague clauses and follow lengthy contracts. Avoid those investors who are keen on gaining control of the business. Don’t go for the one who is into taking over ALL key decisions. Some extent of mentorship is acceptable but complete authorization is not.