What is one of the key challenges facing Indonesia’s economy in the medium to long-term?

Indonesia’s economic growth is expected to remain solid in 2023, supported by resilient domestic demand amid an expected slowdown in global demand. Despite the robust growth in the short-term, the economic outlook for Indonesia has some challenges over the medium and long-term. In particular, one of the challenges facing Indonesia arises from the need to improve infrastructure development, given its large and dispersed land area.

What spurs infrastructure development in Indonesia?

Indonesia’s economy has grown with expanding infrastructure in recent years. Key to this is the National Strategic Projects (PSNs), which was established in 2016 under President Joko Widodo’s initiative to promote infrastructure projects, and for the past eight years, updated by the Coordinating Ministry for Economic Affairs (KPPIP).

The PSNs comprise 200 projects and 12 programs worth around USD351.2 billion as of 2022. The projects consist of road and dam construction, train networks, and clean water facilities, while the 12 programs comprise key initiatives, such as a waste-to-energy program and a regional development program.

Once a project is approved and listed in the PSNs, it can obtain special support from the government to ensure effective implementation. For example, the government supports land acquisition and appoints a state-owned enterprise (SOE) to implement such approved projects. The KPPIP, for instance, holds a coordination meeting among stakeholders to resolve regulatory issues on land acquisition. In order to ensure efficient support, the KPPIP constantly updates the PSNs on the progress of the projects and programs. If a project is declared “completed”, or no longer requires support from the PSNs, it is dropped from the project list.

Where does PSNs’ source of funding come from?

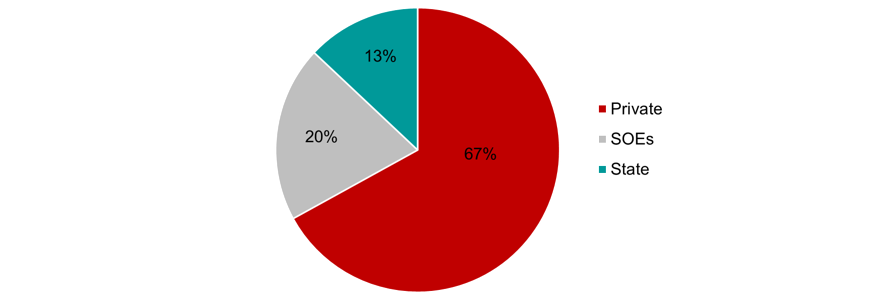

According to KPPIP’s estimation, the funding sources of PSNs comprise private sector, SOEs, and the state budget. Of these, 67 percent of total financing needs is estimated to come from the private sector. SOEs are the second most crucial funding source, accounting for approximately 20 percent of total funding, while the state budget contributes to the remaining 13 percent. (see Figure 1)

Figure 1. Estimated Share of PSNs’ Funding Sources

Source: Source: KPPIP; AMRO staff compilation

Note: The funding source amount is estimated by KPPIP

How does the private-sector participate in the funding of infrastructure projects?

The demand for infrastructure projects in Indonesia is still high, leading the government to encourage further private-sector participation, especially in funding. There are several schemes to mobilize private money, although each scheme is still relatively small, compared to the total size of infrastructure projects under PSNs.

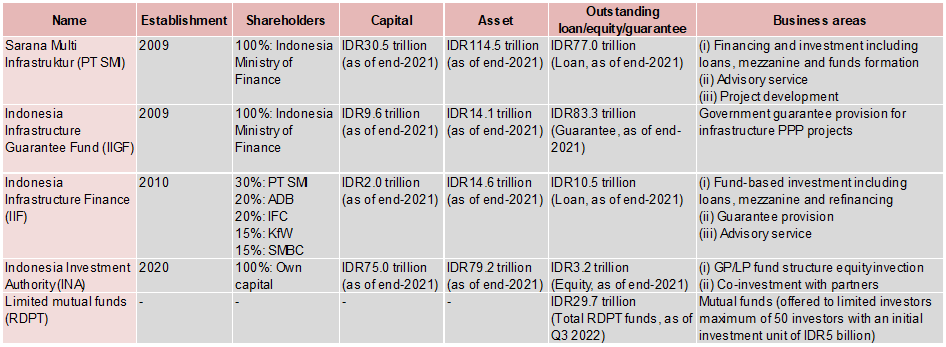

The first scheme is related to the public-private partnership (PPP). Since 2016, the authorities have created some specialized institutions to provide additional risk-sharing options for the PPP, i.e. guarantees, to foster infrastructure development (see Table 1). For example, the Indonesia Infrastructure Guarantee Fund (IIGF) and Indonesia Infrastructure Finance (IIF) offer guarantees for some PPP projects.

Another scheme is to leverage a couple of institutions mobilizing private money from investors. PT SMI is one example that creates and operates some vehicles as financing platforms to provide syndicated loans with private banks and multilateral development institutions, and mobilize financing from capital markets.

The Indonesia Investment Authority (INA) is another institution that contributes to the development of financially viable projects by attracting global investors primarily engaged in equity investment.

Meanwhile, mutual funds have also contributed to infrastructure development, such as revenue-backed securitization issued by specialized mutual funds (RDPT). Since 2018, more than 50 RDPT products have been issued, concentrating on the toll road sector, with a total value of about USD125 million

Table 1. Example of Institutions Providing Alternative Financing

Source: PT SMI; IIGF; IIF; INA; OJK

Is there another innovative scheme?

The limited concession scheme (LCS) is another scheme to facilitate infrastructure development with new money from the private sector. Although this scheme has not been implemented yet, under the LCS, the government will grant a concession to private firms to operate and develop existing infrastructure projects during the concession period in exchange for fixed upfront payments. The government or SOEs continue to own the projects, while they may invest the upfront payments on new infrastructure projects. The private-sector operators can enjoy flexible operational rights and boost revenues from the infrastructure projects.

As Indonesia still has a huge demand for infrastructure, the government should continue its efforts to update its national strategy and provide essential support for projects, such as assistance with land acquisition. Given the limited fiscal space to support infrastructure projects, it is essential to raise funds from the private sector through various schemes. However, some innovative financing schemes mentioned above are still on a small scale or have yet to be implemented. Therefore, efforts to scale up and improve these schemes are important to strengthen the Indonesian economy amid challenges and external headwinds.