Italy

Key facts

Turnover

€56 billion

Capital spending

€2.2 billion

Direct employees

112,700

Number of companies

2,800

R&D investment

€642 million

National contact

Federazione Nazionale dell’ Industria Chimica (Federchimica)

Claudio Benedetti

Director General

c.benedetti@federchimica.it

CHEMICAL INDUSTRY SNAPSHOT

An important industry providing high qualified jobs

With a turnover of more than 56 billion Euros (excluding pharmaceuticals) generated in 2021 by more than 2,800 companies, Italy is the third European chemical producer. About 112,700 highly qualified employees work in the sector and an even greater number of indirect jobs, more than twice as much as through direct employment, is activated in the economic system leading to an overall count of almost 278 thousand jobs connected to the chemical industry.

Strong and growing specialization in downstream chemicals

Italy maintains a significant and strategic presence in basic chemicals but it is relatively more specialized in specialties and consumer chemicals, accounting for more than 61% of total production value, compared to 44,5% of European average and realizing an export surplus of more than €3.8 billion in 2021. In downstream chemicals scale economies are not so relevant; the key to success is rather the ability to provide customers with high-performance and tailor-made products such as auxiliaries and additives for industry, paints and adhesives, cosmetics and detergents. Italy is also leader in the fields of active pharmaceutical ingredients, with export quotas exceeding 85% of production, and in bio-based chemicals.

A science-based industry operating in partnership with Italian Districts

The Italian chemical industry supports the sustainability and competitiveness of virtually all other industrial sectors through its innovative products and solutions. Being a country with a strong and diversified industrial basis, Italy represents a large market for chemicals accounting for about €58 billion. In particular, there are about 150 Industrial Districts – including so-called traditional sectors but also medium-high technology ones – which are known around the world for their high quality and innovative products: their success very often relies on sophisticated chemical intermediates made in Italy and responding to specific requirements.

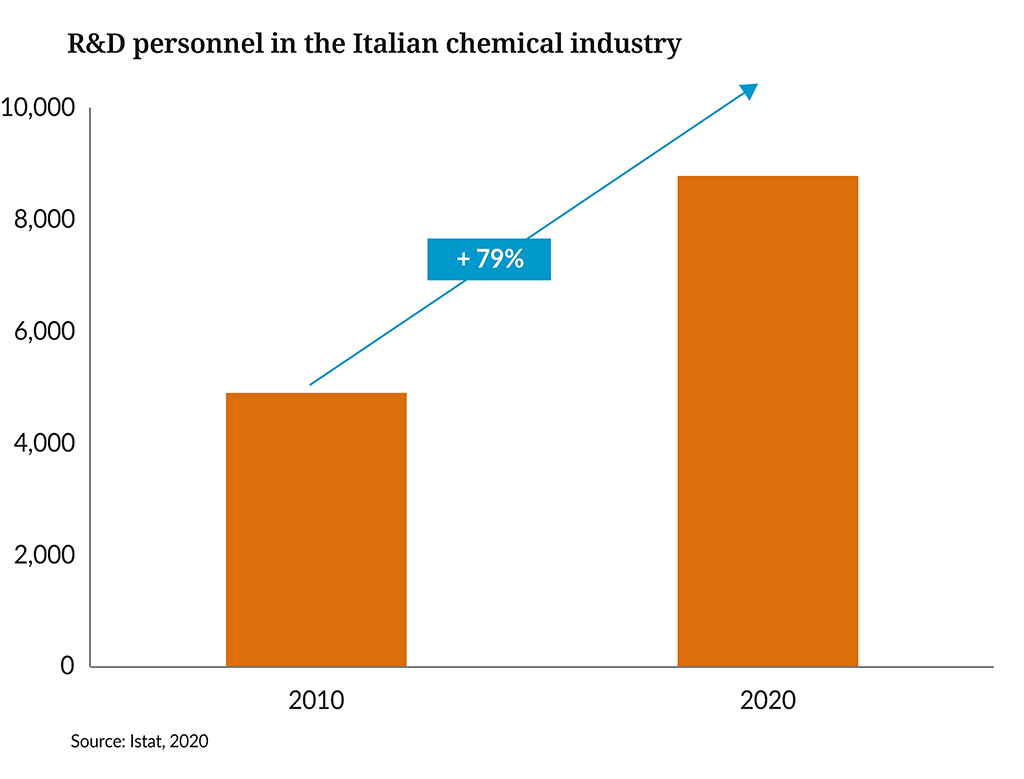

Chemical companies have been strengthening significantly their commitment to research in Italy: R&D personnel has increased by 79% over the last decade 2010-2020 and is close to 9,000 employees. R&D is fundamental also to pursue sustainability and circular economy. According to GreenItaly Report, chemical companies toghether with plastic manufacturers have been the sectors investing the most in eco-friendly technologies and products over the period 2016-2019.

Source: Istat, 2019

A well-balanced industry structure

The chemical industry in Italy is characterized by the well balanced presence of three different actors, all of them playing a very important role: Italian SMEs (34% of total chemical production value), medium-large Italian groups (27%) and foreign capital companies (39%).

Chemical SMEs represent a significant reality and suffer particularly from regulatory burden. Main Italian chemical groups include some big players of basic chemicals but also several dynamic specialized players leading in their specific niche at European or world level. Most of them have also production units in foreign markets. Foreign capital companies have chosen Italian location not only to produce for domestic market, but also to export and for R&D.

A high international attitude

Italian chemical companies are taking advantage of globalization by providing their international customers solutions according to the features developed for the domestic market: i.e. high quality standards and innovation, customization, flexibility and just-in-time supply, even in small quantities of products.

The chemical industry in Italy is highly integrated into global markets: more than 60% of production value refers to multinational companies, either domestic or foreign-owned. Exports to turnover ratio has reached 58% and has been increasing by 21 percentage points in the last 20 years. Moreover, in recent years, export performance has proved to be one of the most successful among main European producers (+30% in 2010-2020, only behind Spain).

Not only large firms, but also SMEs are strongly oriented to international markets.

Lombardy: a real vocation for chemicals

Italian chemical industry is concentrated in Northern Italy (78% of chemical employment), close to downstream European markets and local customer companies. In particular, Lombardy has a real vocation for chemicals: not only it represents 42% of Italian chemical employees, but it is among the top five chemical regions in Europe. Considering fine and specialty chemicals, Lombardy ranks second evn higher among European regions.

Chemical industry in Lombardy has different features from other European regions with strong chemicals presence: production is not concentrated in a handful of highly integrated sites, but widespread across a network of foreign multinationals, Italian medium and large groups and local SMEs. These companies can benefit from the presence of major universities and research centers, able to develop industry-oriented projects.

HOW ARE WE DOING?

Preparing the future

Strengths

- Strong interaction with Industrial Districts, i.e. SMEs belonging to the traditional and medium-high tech sectors of Made in Italy which are world trend setters, strongly oriented to innovation and always ready to test and develop new products.

- Talents: large pool of high quality and motivated Italian chemists with particular skills in areas including fluorine chemicals, woven and non-woven polyester, polyurethanes, special polymers, leather chemicals, adhesives, pharmaceuticals active ingredients and cleaning additives.

- Widespread research-based innovation: in Europe Italy is second only to Germany for the number of chemical companies engaged in R&D,with close to 1,000 companies (both national and foreign-owned). In the chemical industry R&D personnel represents almost 8% of total employment compared to 5.4% in manufacturing average.

- Constructive industrial relations: Italy’s chemical sector has a participatory and pragmatic industrial relations culture that supports innovation and often anticipates changes in regulation. The national collective labour contract aims at improving productivity also through organizational and working hours flexibility. It favours company-level bargaining and enables temporary agreements amending national rules. It also favours employability, training and youth employment. The chemical and pharmaceutical industry has been the first sector in Italy to adopt supplementary pension and healthcare funds. According to a recent survey involving foreign capital companies’ top management, organisational flexibility is the most important italian strength in a rapidely moving environment.

- Remarkable results in terms of environmental protection: all kind of emissions have experienced impressive reduction, in particular the chemical sector has reduced its direct GHG emissions (scope 1) by 67%, exceeding the new and ambitious target set by the New Green Deal for 2030 (-55%).

- Safety: long experience and efforts in promoting safety for both employees and customers.

Weaknesses

- High sensitivity to energy cost gaps compared to competitors.

- Logistics costs higher than in some other European countries.

- Lack of industrial culture and lack of confidence in new technologies in some parts of Society and Institutions.

- Possible vulnerability to external shocks (rising protectionism and global tensions) in the procurement of raw materials.

OUR CONTRIBUTION TO a COMPETITIVE europe

The set of incentive schemes and mechanisms supporting industrial innovation has been strengthened in order to further consolidate the competitiveness of Italian manufacturing base, positively impacting the chemical sector, a science-based industry which represents a technology infrastructure and a solution provider for the different industrial value chains collectively recognized from abroad as “Made in Italy”.

The financial resources assigned by the Recovery Plan to the Italian PNRR (National Recovery and Resilience Plan) have been made available for supporting the required investment needs, which are foreseeable in the future.

Fostering environmental sustainability

Italian Ministries have promoted several funding schemes to support sustainable manufacturing initiatives, including Circular Economy, Green Chemistry and Bioeconomy.Recently, R&D industrial projects focusing on Hydrogen and Batteries benefited from increased available funds, due to the industrial attractiveness of those strategic initiatives and their expected impacts over the national energy system and the economic development in general.

The mechanism incentivizing energy efficiency through the pivotal role assigned to energy distributors, which recognizes the “Titoli di Efficienza Energetica” (or “White Certificates”) to industrial companies that have implemented energy efficiency projects, has been refinanced and relaunched by the Italian Government. Lately, White Certificates have been valorized by the auction system managed by the Autorità per l’Energia Elettrica ed il Gas (“AEEG”) at about 250 € for each tonof oil equivalent actually saved.

Encouraging innovation and collaborations between public and private sectors

Existing fiscal incentives supporting R&D investments by industry have been further streamlined, in order to efficiently support operating and sustainable performances and innovation as well as digital transformation of manufacturing industries.

In particular it has modified the procedure to automatically benefit from the Patent Box, an optional fiscal scheme recognizing significant tax-breaks for income generated from patents and other intangibles (know-how in general), provided the compliance and adhesion to specific administrative provisions required by the competent Fiscal Agency.

The measure named “Nuova Sabatini” has been made available with the aim of facilitating companies’ access to credit and supporting investments to purchase or lease machinery, equipment, plant, capital goods for productive use and hardware, as well as software and digital technologies.

Other tax credits support R&D activities, the purchase of instrumental goods as well as the recruitment of new young human resources.

During 2022 CDP (“Cassa Depositi e Prestiti”) have been significantly increasing the volume of funds made available to promote the growth of Italian manufacturing industries and support their innovative and sustainable development plans, individually or in pool with other financial institutions (“Fondo Rotativo Imprese”). All these support measures underline Italy’s effort in improving conditions for companies’ innovation and in fostering industries’ competitiveness among Europe countries.

Take a “low-carbon industrial project journey” through Europe: discover our map

Low-carbon technologies projects: mapping investments and projects of the European chemical industry