22 November 2022, 10:34

Tagline

22 November 2022, 10:34

Tagline

As a financial institution or DNFBP, it is important to understand where customers get the money they use for their transactions and investments. Money launderers’ methods are constantly evolving; they are becoming more creative in disguising the origin of illicit funds. As a result, it is increasingly difficult to trace the origin of funds and assets.

Therefore, companies need to implement KYC measures and controls as part of AML/CFT compliance. These include, for example, customer due diligence (CDD) and transaction monitoring measures. There is an obligation to verify the origin of funds.

When considering origin, a distinction is made between the source of a customer’s assets and the source of his or her funds. However, the difference is not clear to many. That is why we explain it in the blog article.

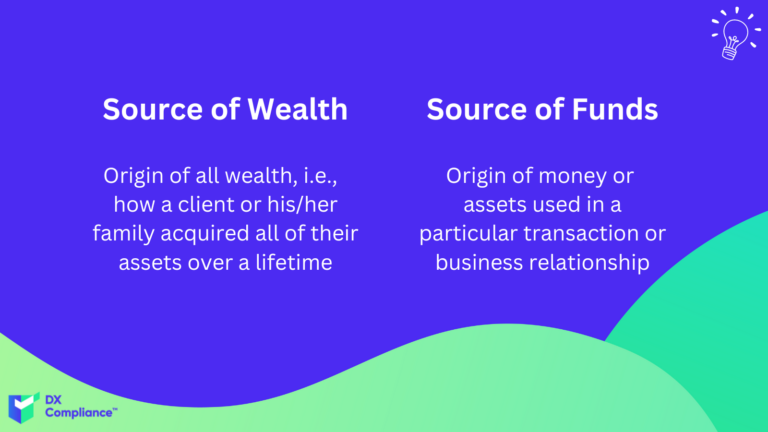

Source of Funds and Source of Wealth are not the same thing. They are two different terms that have different meanings.

Source of funds (SOF) refers to the origin of money or assets used in a particular transaction or business relationship. In other words, how the funds to be used in a particular transaction (or future transactions) were generated. For example, if a customer makes a transfer of 10,000 euros, the question is how the customer raised the money to fund the 10,000 pound transaction.

Source of wealth (SOW) refers to the origin of all wealth, i.e., a person’s accumulated wealth. It describes how a client or his or her family acquired all of their assets over a lifetime.

The source of funds and wealth is critical to anti-money laundering and counterterrorist financing efforts, as both can be good indicators that customers are involved in criminal activity. A fundamental element of due diligence to clients/customers is understanding the nature, background, and circumstances of the client. This includes financial circumstances – i.e., source of funds (SoF) and source of wealth (SoW).

There are many reasons why the origin of funds and the origin of assets are relevant and queried. Below we have compiled a list of relevant factors.

The explicit regulations may differ depending on the industry, consider e.g. the regulations from FAFT. at . Nonetheless, we have outlined the basic guidance below.

But: Basically, it can still be said, not all suspicious financial activities warrant inquiries into the origin of funds, and the financial authorities do not recommend them for every suspicious case. For example, sometimes customer identification discrepancies and other identification problems may be better resolved through enhanced due diligence (EDD) than through a SOF investigation.

In summary, when identifying sources, that is, collecting information on the origin of funds and assets, it is relevant that the information helps to identify the ML/FT risks associated with a customer. Andthat a customer profile can be created based on this information. Documentation is especially critical in higher risk scenarios, as it helps verify the customer’s information and ultimately serves as a control measure against such higher risk.

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access