The Energy Collective Group

This group brings together the best thinkers on energy and climate. Join us for smart, insightful posts and conversations about where the energy industry is and where it is going.

Post

Oil and Gas Limits Underly Syria's Conflict

In my view, oil and gas resource limits are major contributors to the conflict in Syria. This is happening in several ways:

1. Syria is an oil exporter that is in increasingly perilous financial condition because of depleting oil resources. When oil production is increasing, it can help an oil exporter in two ways: (a) part of the of the oil supply can be used internally, to grow more food and to support increased industry, and (b) exports of oil can be used to provide revenue for governmental programs such as food subsidies, education, and building highways. Syria’s population grew from 8.8 million in 1980 to 22.8 million in 2012, at least in part because of the wealth available from oil extraction.

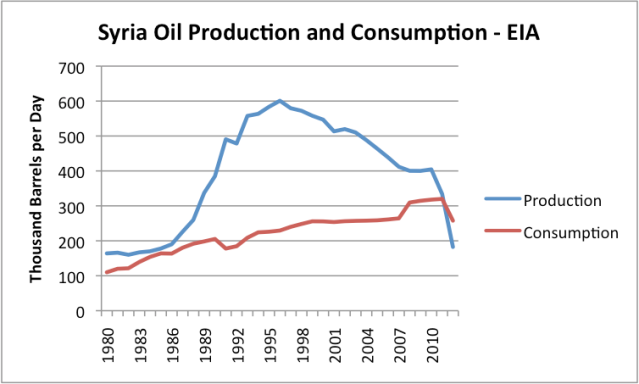

Figure 1. Syria’s oil production and consumption, based on data of the US Energy Information Administration.

Now Syria’s oil production is dropping. The drop between 1996 and 2010 reflects primarily the effect of depletion. The especially steep drop in the last two years reflects the disruption of civil war and international sanctions, in addition to the effect of depletion.

When oil exports drop, the government finds itself suddenly less able to pay for programs that people have been expecting, such as food subsidies and new irrigation programs to support agriculture. If revenue from oil exports is sufficient, desalination of sea water is even a possibility. In Syria, wheat prices doubled between 2010 and 2011, for a combination of reasons, including drought and a cutback in subsidies. When basic commodities become too high priced, citizens tend to become very unhappy with the status quo. Civil war is not unlikely. Thus, oil depletion is likely a significant contributor to the current unrest.

Egypt has many Similarities to Syria

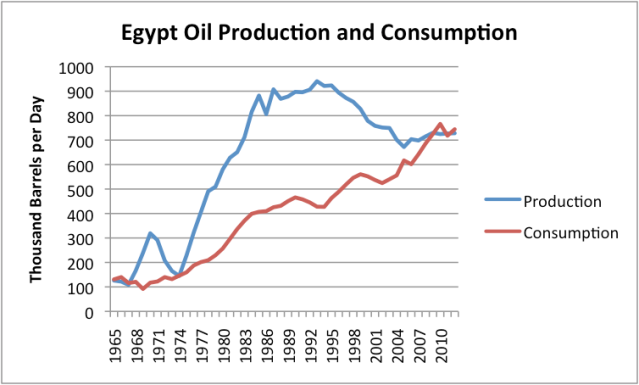

Egypt is another example of an oil exporter whose oil production has dropped because of geological decline. Its chart of oil production and consumption (Figure 2) looks very much like Syria’s (Figure 1).

Figure 2. Egypt’s oil production and consumption, based on BP’s 2013 Statistical Review of World Energy data.

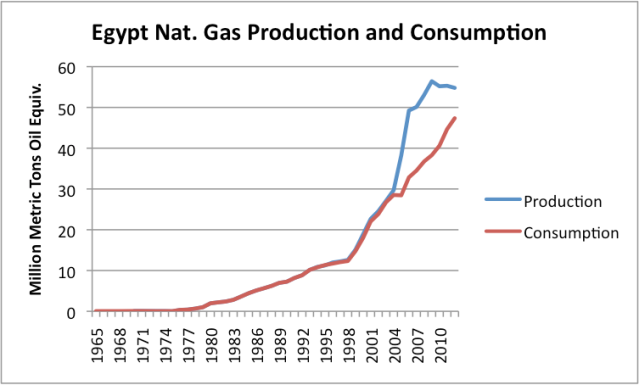

Egypt is actually doing a little better than Syria. One of the things that has helped Egypt is its natural gas production, because it has been another source of export revenue. Unfortunately, Egypt’s natural gas production suddenly flattened starting in 2009, again because of depletion (Figure 3).

Figure 3. Egypt natural gas production and consumption based on BP 2013 Statistical Review of World Energy.

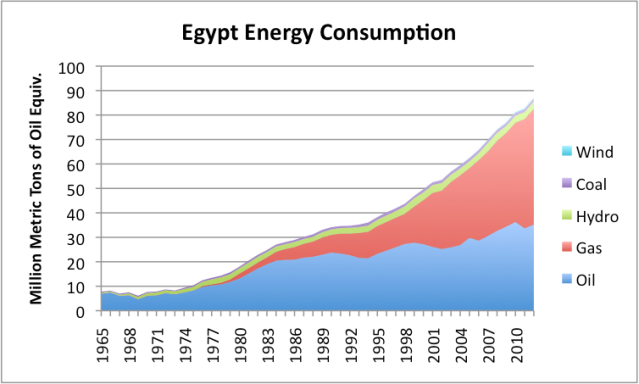

As Egypt started losing oil supplies, it was able to keep its own energy consumption growing (to keep up with growing population) by rapidly cutting back on exported natural gas (even though it had contracts in place to sell some of the this natural gas). Part of this cutback was to its pipeline customers, namely Israel, Lebanon, and Syria. Of course, this left Egypt with less foreign revenue to fund subsidies, education, and many other programs, but Egypt’s own energy consumption (Figure 4) was able to keep growing, helping agriculture and industry to function as normal.

Figure 4. Egypt’s energy consumption by source, based on BP 2013 Statistical Review of World Energy.

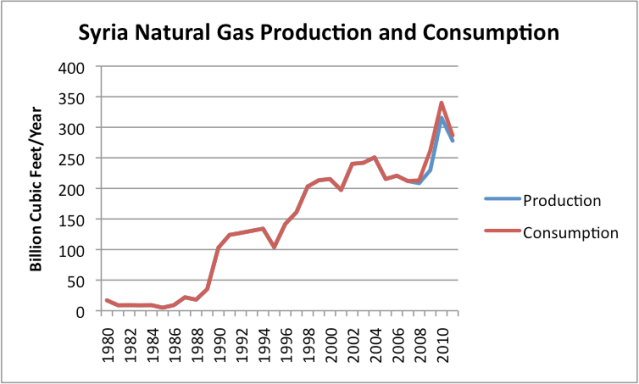

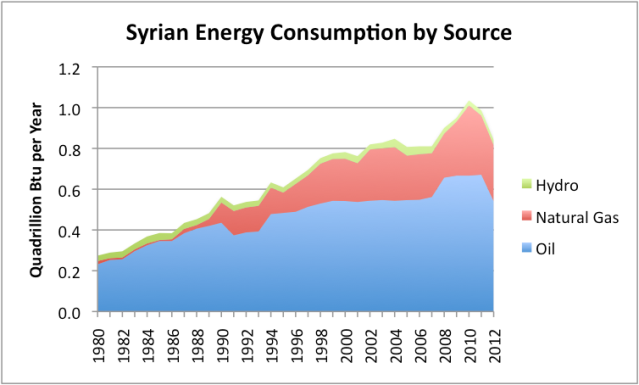

Syria, on the other hand, was consuming all of the natural gas it produced. In fact, is was importing a little gas from Egypt, so it had no exports it could cut back on. In fact, Egypt’s cutback worked the wrong way from Syria’s perspective–it lost a small amount of natural gas imports from Egypt.

Figure 5. Syria Natural Gas production and consumption, based on data of the US Energy Information Administration.

As a result, Syria found its energy consumption decreasing (Figure 6), even as population continued to rise.

At least part of the decline in Syria’s energy consumption occurred because of damage to oil and gas pipelines and to electrical transmission equipment. According to the CIA Fact Book, Syria’s industrial production shrank by 36% in 2012. Thus, geological depletion and the civil war that grew out of inadequate resources both contributed to the drop in energy consumption.

Going forward, this tendency toward civil disorder is likely to get worse, whether or not the US decides to attack. The underlying issue in Figure 1 is depletion. Population remains high. Even if damage to pipelines and transmission lines get fixed, the depletion issue will continue, and the population will need to be fed.

2. Economic sanctions, to the extent they have an affect, can be expected to act similarly to resource depletion and increase the tendency toward civil disorder.

Syria has been operating under economic sanctions from the US since 2004. To the extent that these had an effect, one would expect that they would reduce economic activity, and thus energy consumption. It is hard to see a significant change in energy use patterns in the years immediately after 2004, from the charts provided.

Many other countries have added sanctions since hostilities broke out in 2011. It is difficult to tell how much effect the 2011 sanctions have actually had. It is possible that they contributed to Syria’s drop in energy consumption. It is also possible the civil disorder together with depletion explain the recent drop in oil production and consumption.

Even with sanctions, Syria continues to participate in international trade. According to the EIA, Syria continues to trade with Russia, Iran, Iraq, Malaysia, and Venezuela. Other sources mention China (here and here) as a trading partner with Syria. North Korea is also mentioned as being a trading partner, especially in the area of chemical weapons.

3. Oil pipelines from Iraq through Syria would be helpful if Iraq is to greatly ramp up its oil output in the next few years.

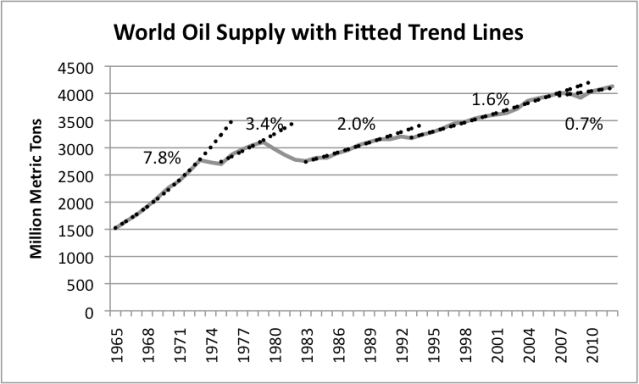

The United States has an interest in getting oil production from Iraq ramped up, in the hope that world oil production can continue to rise. World oil production has been increasingly flat, even taking into account liquid substitutes and new sources, such as biofuel and new US tight oil production.

7. Growth in world oil supply, with fitted trend lines, based on BP 2013 Statistical Review of World Energy.

One of the limits in ramping up Iraqi oil extraction is the limited amount of infrastructure available for exporting oil from Iraq. If pipelines through Syria could be added, this might alleviate part of the problem in getting oil to international markets. According to the EIA,

One particular project proposes to build two oil pipelines (and one for natural gas) that would send Iraqi crude to the Mediterranean coast in Syria, and from there to international markets. The first of the proposed pipelines would send heavier crudes from northern Iraq and have a capacity of 1.5 million bbl/d. The second pipeline would send lighter grades from southern Iraqi fields, and would follow the same route as the former Haditha-Banias pipeline; the second section is scheduled to have a 1.25 million bbl/d capacity.

4. The possibility of natural gas pipelines through Syria to alleviate potential shortages in Europe and elsewhere is contentious.

Russia currently is a major exporter of natural gas to Europe. It would like to keep natural gas prices as high as possible because of the high cost of its natural gas extraction, and because of the high cost of building new pipelines. Russia does not necessarily welcome new natural gas production from, for example, Qatar or Israel, carried by pipeline through Syria. Such new supply might reduce natural gas prices in Europe, either because of oversupply or because the other natural gas sources have a lower cost of extraction and transport.

If new pipelines are built through Syria, there are several countries that might theoretically ship natural gas through such pipelines, and there is considerable rivalry among these countries. For example, Israel and Iran are rivals as to which country might export natural gas to Europe. Also, as noted above, there is a possibility that natural gas from Iraq could be exported through Syria to the international market, if suitable pipelines were built. There is even theoretically a possibility that natural gas from Turkmenistan could be exported by pipeline through Iran, Iraq and Syria, cutting out Russia (and the profits it receives in buying, transporting and selling this gas).

It should be noted that even though many countries have their sights set on exporting natural gas to Europe and other parts of the world that need natural gas, it is not at all clear that this additional transport of natural gas will work out as planned. We have known for a long time about a large amount of “stranded” natural gas–gas that is theoretically available, but it simply too expensive to extract and ship to locations where it might be purchased. The limits on how much natural gas will be consumed are financial–how much can consumers really afford.

The affordability issue is clear if we think about a family in India, living on $2 a day, deciding whether to burn animal dung or compressed natural gas for cooking. If the price of natural gas is high, the family in India will choose to burn dung. A similar issue arises for a pensioner in the UK, deciding to what temperature to heat his home. It also arises for an electric power plant in Germany, deciding whether to burn natural gas or coal. If the cost of natural gas is too high, demand is likely to shift to cheaper fuels, or to disappear through alternative behavior–for example, wearing long underwear to keep warm in winter, instead of heating homes as warmly as today.

5. Need for America to prove its might, to maintain the US dollar’s reserve currency status.

Without the reserve currency status of the US dollar, America cannot continue to run a big balance of payment deficit importing large quantities of oil. This is important, because the world’s total oil supply is not growing much (Figure 7), regardless of price. If America is forced to consume less, more oil will be available for the rest of the world.

Conclusion

Because of its oil depletion, Syria will remain a problem country, regardless of whether the US decides to intervene militarily. Removing Assad as leader of Syria cannot be expected to solve Syria’s problems. Even if oil deletion were not the major issue, US’s recent experience in Libya suggests that removing a leader does not guarantee future stability. Associated Press reports this week, Libya’s oil exports plunge as problems escalate.

Some may argue that Syria has other gas and oil that it can exploit, and because of this, its depletion problems are only temporary. In particular, the EIA report on Syria notes that there are both shale oil resources in Syria and natural gas resources offshore that Syria might develop. In my view, there are several reasons that this optimism is unwarranted. As a practical matter, even if there were peace and plenty of investment capital, developing these resources would take several years. During this period, other countries would need to donate enough resources to keep the population pacified. Can this really be done, especially if other countries are reaching limits themselves?

Furthermore, it is not at all clear that extraction of oil from shale can really be developed profitably. No one outside North America has yet figured out how to do so. The US has laws and pipeline infrastructure that are different from elsewhere that help make shale development possible at reasonable cost. Available credit and low interest rates are also helpful. The US also has abundant water resources, and population that is not too dense, so that fracking is less of an issue than it would be elsewhere. A recent Wall Street Journal article talks about the difficulty China is having trying to extract hydrocarbons from shale.

There is also the question I mentioned above with respect to the economic feasibility of new natural gas resources. If the cost is too high, the cost may simply be too high for buyers. Furthermore, if buyers find a need to cut back on other expenditures to purchase gas products (or for that matter, high-priced oil products), they are likely to cut back in the purchase of other discretionary items. Layoffs are likely to occur in discretionary sectors, leading to recession and reduced demand through fewer jobs. Thus, one way or another, a reduction in demand is likely to occur.

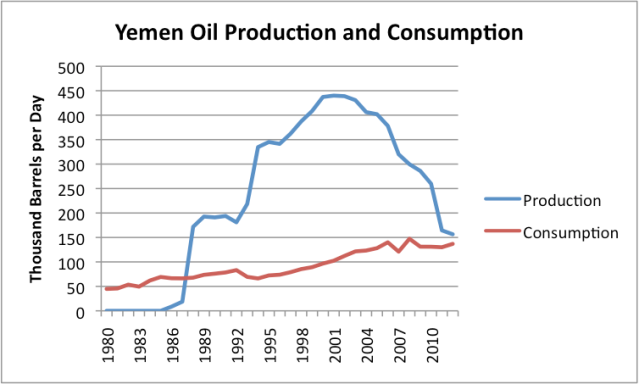

Egypt and Syria are not the only countries in the area with oil depletion problems. Yemen’s oil chart of oil production and exports (Figure 8) looks very much like that of Syria and Egypt.

Saudi Arabia may even be reaching limits on its extraction capability. It recently is reporting refocusing on unconventional resources, something it would not do if conventional oil were performing well. Saudi Arabia is also using a greater number of drilling rigs, reported to be necessary because of the increasing difficulty of extracting oil from mature fields.

If oil depletion is becoming an increasing problem, I am afraid we can expect increasing conflict in the Middle East, regardless of whether the US chooses to intervene in Syria because of increased oil depletion. A shortfall in one country can ripple to the next country, and on to the next country, as exports are reduced, and as civil unrest spreads.

It is easy to blame bad leaders for the problem, or a bad form of government. Much of the problem, however, is simply not having enough oil resources to go around for the size of population the world has today. We can kid ourselves about additional oil and natural gas resources being available, but these very much depend on the ability of buyers to pay higher prices, without excessive recessionary impacts.

Get Published - Build a Following

The Energy Central Power Industry Network® is based on one core idea - power industry professionals helping each other and advancing the industry by sharing and learning from each other.

If you have an experience or insight to share or have learned something from a conference or seminar, your peers and colleagues on Energy Central want to hear about it. It's also easy to share a link to an article you've liked or an industry resource that you think would be helpful.

Sign in to Participate