receivables

(redirected from receivable)Also found in: Dictionary, Thesaurus, Medical, Legal, Wikipedia.

Accounts Receivable

2. A unit within a company's accounting department that deals with accounts receivable.

receivables

receivables

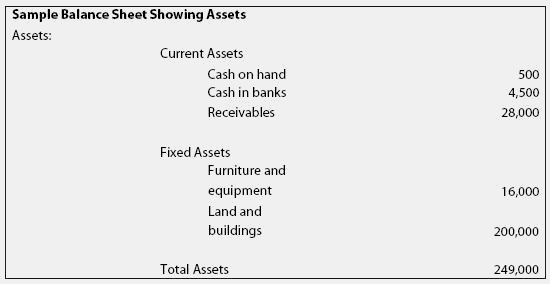

Money due from tenants or clients. Receivables are listed as an asset on the balance sheet. One can have a profit on paper, because all the rent charged to tenants counts as income, whether collected or not.One can also have a large amount of assets and be worth a lot of money, on paper, because unpaid rents—receivables—are listed as an asset. At the same time everything looks rosy on paper, you can be going broke because tenants are not paying their rent, you don't have any hope of ever collecting the past-due receivables,and there is no money to pay the bills.

(Remember this when reviewing financial information for a rental property: you must see the balance sheet and the financial statements at the same time to figure out what is really happening.)