What Is Crowdfunding?

Crowdfunding is a funding alternative for an idea, project, or business to raise a small number of funds as contributions from a large public group via crowdfunding platforms. So far, the Securities Exchange Board of India (SEBI) allows all forms of crowdfunding, except equity crowdfunding (more on this later). The amount raised can be collected digitally or manually.

How Does Crowdfunding Work In India?

There are multiple platforms dedicated to helping individuals raise funds for their businesses. One can select any of these recognised crowdfunding platforms in India once they have clarity on their cause and have set a specific goal amount.

Once the goal is set, you can create a campaign that clearly states the objective, the impact of the business and all the funding requirements. You can then share your campaign on all social media platforms to promote it and attract more people to help you with your business.

Once you have successfully raised funds for your business, the platform will transfer the amount to your account after deducting its fees.

Examples Of Top Crowdfunding Platforms In India

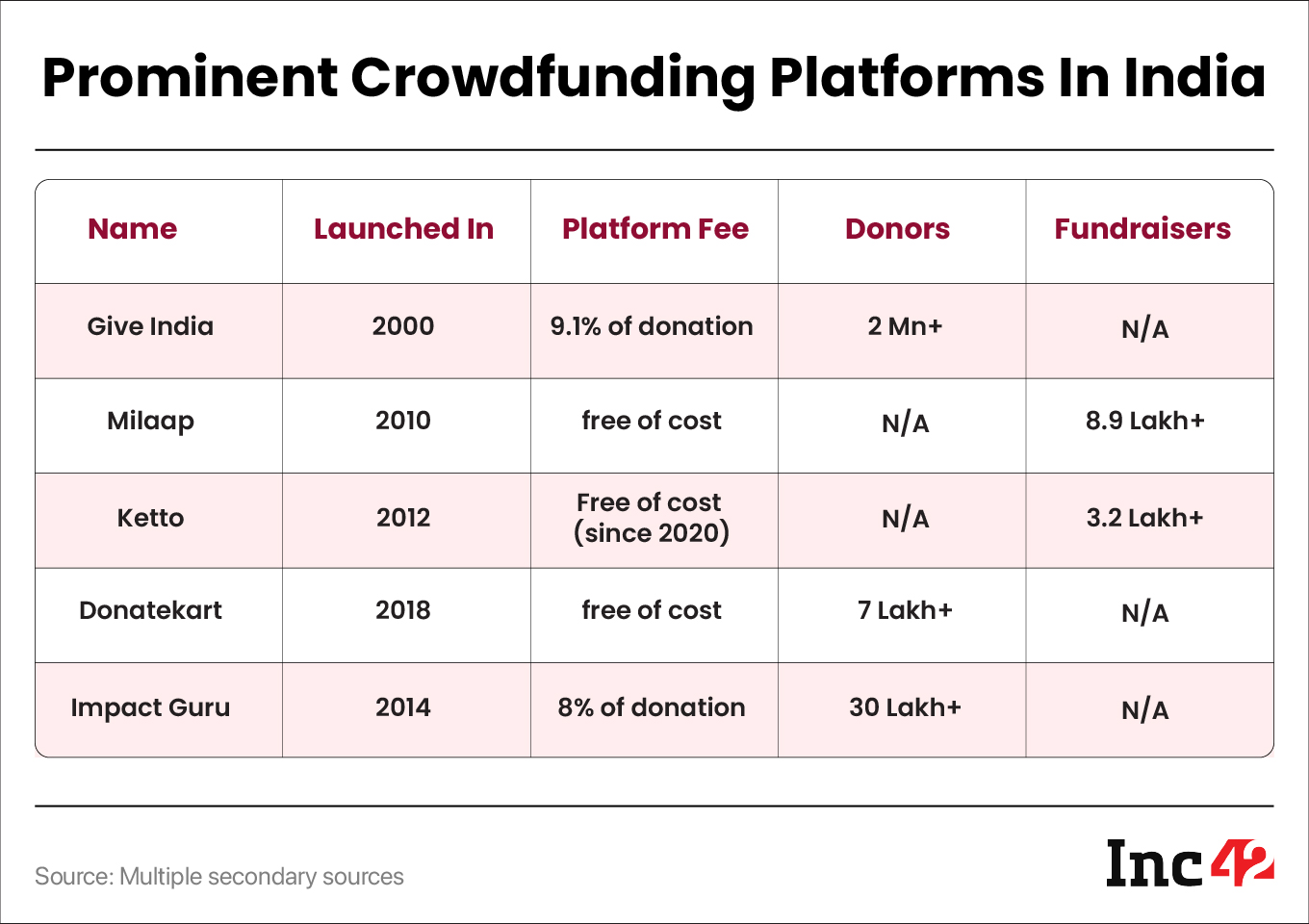

Here’s a list of some of the top crowdfunding platforms in India:

- Give India

- Milaap

- Ketto

- Donatekart

- Impact Guru

What Are The Different Types Of Crowdfunding?

Debt-Based Crowdfunding/Peer-To-Peer (P-2-P) Lending

In debt-based crowdfunding, individuals borrow small amounts of capital as loans from multiple individuals online with small to no interest and collateral. Early stage startups and businesses opt for debt-based crowdfunding as it is quicker than traditional banks and financial institutions, especially for those with no credit history.

Reward-Based Funding

In the reward-based funding model, individuals receive funds from multiple individuals, however, the borrower returns the borrowed capital in the form of rewards, which can be tangible or intangible.

For example, if an individual aims to start a news platform online, he/she will borrow a certain amount of capital from borrowers. Once the business takes off, the founder will repay its lenders by giving them a lifetime subscription to its news as a reward.

Donation-Based Crowdfunding

In donation-based crowdfunding, people donate capital to support the cause or idea of a business without the expectation of any return or interest.

Pre-Order Crowdfunding

This model of crowdfunding is more suitable for those individuals or entrepreneurs who are looking to launch new products in the market. Businesses borrow capital from investors in exchange for promising their investors to send the first batch of the product before it even enters the market.

For example, to launch its own TWS (true wireless) audio device startup, an entrepreneur decides to borrow a certain amount of capital from multiple individuals. In return, the entrepreneur promises to send the first batch of its product before floating it in the market.

What Are The Benefits Of Crowdfunding For Startups And Entrepreneurs?

- Free of cost: Some platforms allow individuals, seeking to raise funds, to run their campaigns free of cost. However, some platforms may charge individuals for premium features like marketing assistance.

- Access to a user base: Crowdfunding allows fund seekers to accumulate a user base of prospective customers. Every individual who invests money in a startup usually believes in the scope of the idea.

- Product feedback: An important advantage of crowdfunding is that it allows the campaigner to test their products before finally launching them in the market. Once the product/service is launched, they can send it to their investors/donors, who then give feedback.

- Brainstorming: A crowdfunding campaign allows the campaigner to integrate multiple perspectives from the crowd regarding the campaign. This will expose them to a fresh perspective that can add value to the campaign.

- Speed: A traditional loan from a bank to start a venture can be a lengthy process due to due diligence and credit underwriting (a process to examine the borrower’s creditworthiness). In crowdfunding, the borrower gets access to the capital immediately once the target is achieved.

What Are The Investor-Related Risks Associated With It?

While crowdfunding is a lucrative option to raise funds for an entrepreneur, it may be a risky affair for investors. Here are some points to consider before donating or investing money in a crowdfunding campaign.

- Donors or investors need to be wary of fraud before putting their money on a crowdfunding platform or a campaign by conducting thorough research.

- In the context of equity-based crowdfunding, only accredited investors like HNIs and angel investors can invest in crowdfunding in India. This means that not every individual can participate as an investor in equity-based crowdfunding.

How Much Money Can Be Raised Through Crowdfunding?

A SEBI-accredited investor can invest in a crowdfunding project. The regulator prescribes the qualifications of an accredited investor as:

- Companies incorporated under the Companies Act, with a minimum net worth of INR 20 Cr

- HNIs with a minimum net worth of INR 2 Cr

- Eligible retail investors who fulfil the prescribed criteria

Which Are Some Of The Platforms That Can Be Used For Crowdfunding?

Some of the well-known platforms in India that are used for crowdfunding are Lenden Club, Lendbox, i2i Funding, Ketto, Catapooolt, TheHotStart, Milaap and TykeInvest

How To Create A Successful Crowdfunding Campaign?

- Decide which model of funding will suit you as per your venture requirement. Once that’s decided, you can choose any active crowdfunding platform. Ensure to research well and find the one with a good record.

- You must set a realistic goal as to how much amount of money is needed for your venture. Set a goal that doesn’t deter the potential donor/investor from putting in the money.

- Now that the goal is set, the entrepreneur must create a campaign that conveys his venture goals, its potential impact and realistic timelines around milestones.

- Regardless of the model you chose, consider rewarding your potential investors or donors to contribute to your campaign, depending on your project and amount.

- Leverage social media, networking platforms like LinkedIn, email marketing and messaging apps to promote your campaign and reach a wider audience. Word of mouth can be used by asking people within your network to spread the word.

- Once you kickstart your campaign, keep your donors/investors informed about the progress of your campaign journey. This helps in building trust.

- Now that the campaign is successful and the goal is achieved, make sure to timely fulfil the commitments and promises made to your backers.

Legal And Regulatory Considerations For Crowdfunding

- All crowdfunding platforms in India must be registered with SEBI as Alternative Investment Funds (AIFs)

- Such platforms in India must disclose all relevant information about the campaign to SEBI

- They are required to protect investors by conducting due diligence on the campaign creator

- They must comply with anti-money laundering laws

- They must also comply with the Payment and Settlement Systems Act, 2007 and the regulations issued by the RBI for payment gateway providers.