After sharing the article about my 618k unrealised loss, some folks asked me, how can I sleep well and eat well, when I am losing this amount of money that can buy me a 4-room HDB flat in many estates in Singapore? So, in this article, I wish to share some perspectives on how I am coping with the losses and hopefully, it can help you in some ways too.

It Ain’t Over Till The Fat Lady Sings

If you have seen your investment portfolio drop by a substantial amount, which makes you feel like you are totally defeated, remember this:

As real as the situation/ warning/ total stock market collapse may seem, it has not happened yet. Our mind has the power to perceive that it has already happened so that makes us feel depressed. The stock market behaves in the same way too. It has the ability to inflate the share price of growth stocks to their future value based on hype and speculation. On the other hand, it also has the ability to absorb all the worst-case scenarios and bring the share prices to their knees.

So, until the day that the stock market totally collapses or the day when you throw in the towel to sell off all your positions, your losses will still remain as unrealised losses. If you buy into fundamentally strong companies and have holding power because you do not need the money in the next few years, you can wait it out for the stock prices to rise. There will be naysayers who said that strong companies like Apple, Microsoft, and Alphabet (Google) will never go back to their previous highs again, but how do they know for sure?

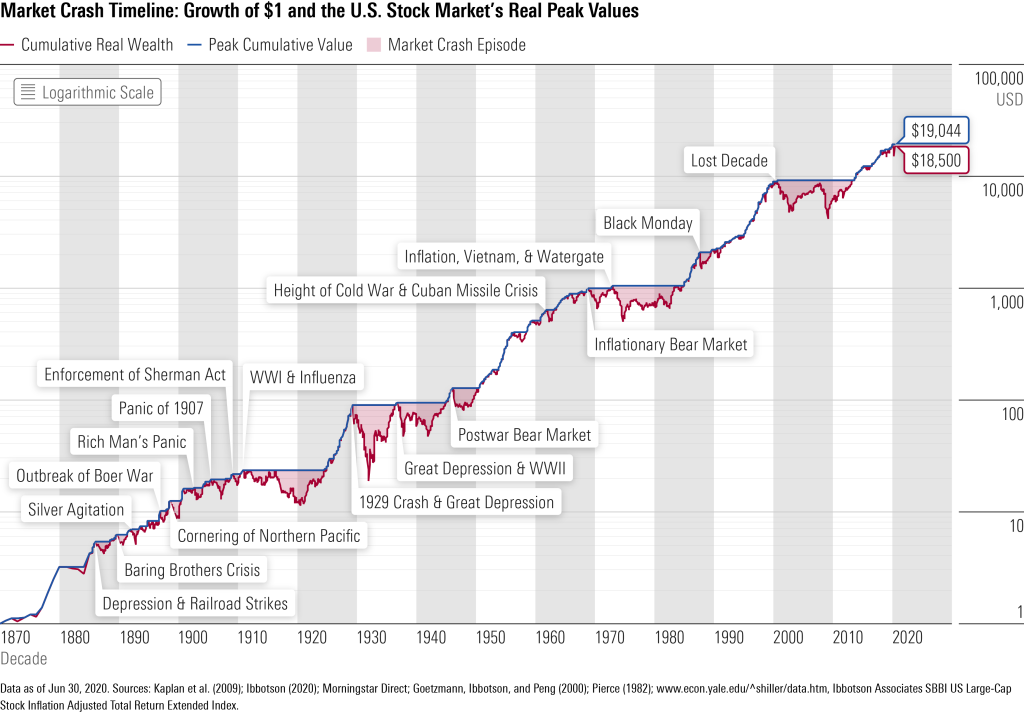

The stock market has gone through many crashes in the last 200 years but still manage to recover and reach higher highs after each crash.

What About My Growth Stocks? Are The Companies Going To Bankrupt Soon?

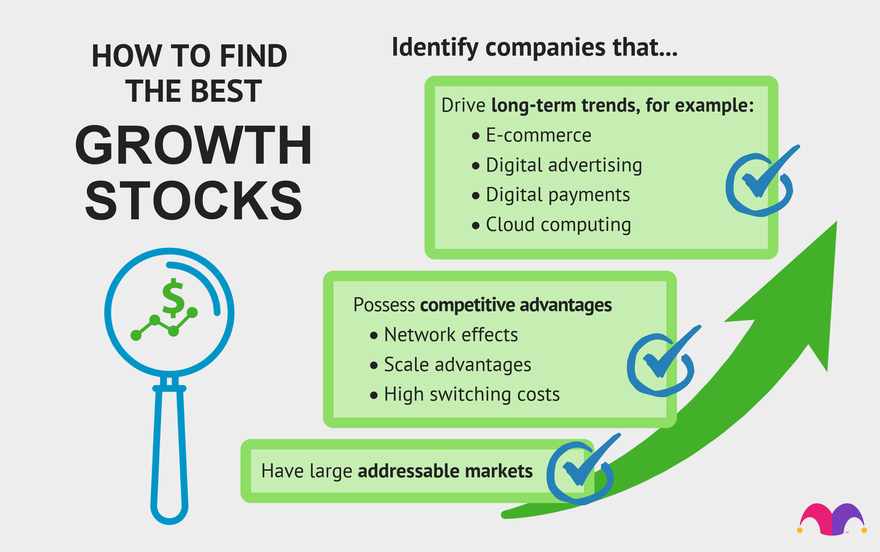

The high-interest rates, and slower growth recessionary conditions will definitely hurt growth stocks and may cause some companies to go bankrupt, especially if they are high on debt and not generating enough revenue for their business. However, it does not mean that ALL growth stocks WILL bankrupt eventually.

It is now a good time to understand the companies that you have invested in if you have previously bought them based on recommendations. Just do a search on YouTube or Google and you will see many articles trying to teach you how to value a company. If it is still too difficult to understand from scratch, you may want to search for the “Fundamental Analysis” of these growth stocks directly on these search portals and have analysts explain the business fundamentals of the stocks that you are holding to you.

What About My Options Contracts? Are They Going To Expire Worthless?

If you are in a similar situation as I am right now, where I am stuck of a 453k LEAPS CALL portfolio that is expiring latest in 2024, then let me share my thoughts on how I am coping with the possibility of losing all my money by 2024, whether I like it or not.

To put things into perspective, options contracts have expiry dates that are like ticking timebombs for options contract buyers because as time passes, the contract premium drops. The only way is for the share price to keep moving in the direction that the options contract buyer predicted (whether it is up for CALL options or down for PUT options), in order to make money off those contracts before they expire worthless.

For my situation, I came out with 3 plans to try to salvage something out of this portfolio but they each carry their own risks. In the worst-case scenario, I will have to part with this 453k and try to earn it back through other means. Having said that, there is still one year plus to go and anything can happen within this one year.

How Can You Eat Well And Sleep Well During This Period?

I know the feeling of being in a situation where your portfolio losses are increasing by the day, even if it is unrealised. With the recent fall after the FOMC meeting, my total unrealised loss now stands at a whopping 648.7k, up from the 618k that I shared in my previous article. This feeling sucks but let’s try to understand what is worse than losing money.

If you are too stressed up and it affects your mental health, you start to perform poorly at work, you fall sick more often or strain your relationship with your loved ones, then that is worse than just losing money in the stock market. There is a saying, “If a problem can be solved by money, then it is not a big problem”.

In a difficult situation like now, just as what happened in the pandemic where the world seems to be collapsing, we need to eat well, sleep well and live well. Otherwise, you will be like a frail and weak soldier who is going to the battlefield. The chances of dying in the battlefield is high because you are already defeated before the battle itself.

I know of a few friends and friends of friends who are currently suffering from late-stage cancer and to these people, if they can choose between losing health or losing money, I am pretty sure they will choose the latter. Without health, we are nothing. As someone who has been through cancer treatment myself, I priortise my health over everything. The worst place to be is to be broke and sick, you lose both material wealth and true wealth.

If you should need another example, let me share with you the story of a famous financial YouTuber called Adam. He has a YouTube channel, named “InTheMoney”, with more than 400k subscribers and he made really great videos teaching options trading. I used to watch many of his videos when I was learning about options trading.

8 months ago, he disappeared from the YouTube scene and only returned 7 months later. As it turned out, he was going through a very serious brain inflammation condition which turned his life upside down. He couldn’t do many of the things that he used to do and for a long time, the doctors couldn’t fathom what was wrong with him. He had hallucinations about the people he met (even to date) as their faces looked evil to him. You can watch his story being shared in the video below.

Concluding Thoughts

I am not some rich guy who thinks that 648k is peanuts in my total net worth. Neither am I bankrolled by rich parents. They are blue-collar workers who struggled to make ends meet throughout my growing up years. The reason that I am able to assemble almost a million worth of capital at the age of 40 is because I have worked hard and been frugal in my lifestyle.

I started taking vacation jobs when I was 10 years old, working as a food packer in my Auntie’s food stall. I took on various holiday jobs subsequently, such as working as a cashier in NTUC, working in a 5-star hotel delivering laundry for guests, giving tuition when I was serving NS, in Uni and when I was working full-time. I also sold fish as part of my fish-keeping journey and in recent years, sold a motivational book that I spent 6 years writing. Every penny was earned through my own effort and I feel the pain of losing them all.

However, I just want to get something out of this experience and be positive about it instead of wallowing in self-pity and pain. Every bad experience that has happened in my life has led me to better appreciate what I have now. For example, the sucky days of being confined when I was serving National Service and being constantly picked on by a nasty instructor made me appreciate my freedom and good bosses now.

The days spent in the operating theaters and hospital beds made me realise how wonderful it is to be alive and healthy. And if I were to lose the money that I have earned over the years, then I will hustle hard to earn them back again. As long as I am healthy and well, everything is possible. Maybe the early retirement plans would have to postponed but it may turn out to be a good thing after all. Retiring too early without nothing much to do can sometimes make a person lose all his drive and discipline.

Money is important in life but what is more important is your health (physical and mental). The road ahead may be rocky but in the right frame of mind, you will survive it and ascend to a whole new level. Many years later, you probably look back and thank life for giving you such a wonderful experience to learn and to grow. I wish you all the best and may you find something useful out of this sharing.

<< Subscribe to my blog to have all these articles delivered directly to your email address >>

*** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

*** EARN FREE MONEY ***

Sign up for WeBull Securities Brokerage and sure-win free shares:

Receive Free Money When You Sign Up With WeBull Securities Platform

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook, LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** MUST-READ BLOG POSTS ***

After accumulating more than 600k of unrealized losses on my portfolio, I wrote this article to encourage friends and investors who are also losing a lot of money to the market.

If You Are Feeling Depressed From Losing Lots Of Money In The Stock Market, Here’s An Article For You

In the 10 years of my investing journey, I have made many mistakes but also learned many lessons from these mistakes. I compiled the 10 most valuable lessons that I have learned and may they help you succeed in your investing journey.

Happy 10 Years Of Investing | 348k (Realised) Profit, 635k (Unrealized) Loss & 10 Lessons Learnt

The precious 6 lessons I learnt after cutting more than half a million of losses in the stock market through bad investments and risky trades.

6 Lessons Learnt After Losing 551k In 10 Years Of Investing & Options Trading | What Newbies Should Know They Start Investing/ Trading

How I managed to build a 1M investment/ trading portfolio despite coming from humble beginnings.

How A Poor Kid Got To A 1M Investment Portfolio | Tips & Principles Of Building Wealth

I did these 10 side hustles while holding a full-time job, so I share them here so you can be inspired to grow your wealth through a side hustle that you enjoy.

I Did These 10 Side Hustles While Working Full Time | 10 Side Hustle Ideas To Help You Earn An Extra Income

Struggling with inflation and high cost of living? Try these 10 methods to help you save money and accumulate more savings for investments or rainy days.

10 Ways To Save Money To Help You Fight Inflation & Rising Costs Of Living

Why I am building $120,000 of cash reserves in Singapore Savings Bonds (SSB) & 5 reasons why I think SSB is a worthy low or zero-risk investment that you can consider.

Why I Am Building $120,000 Of Cash Reserves In Singapore Savings Bonds (SSB)? | 5 Reasons Why SSB Is A Worthy Low-Risk Investment

Sharing why I am doing Dollar Cost Average (DCA) into SPY and QQQ ETF for long-term investments and a step-by-step guide to doing it automatically with Interactive Brokers.

Why I Am Doing DCA (Automatically) For SPY & QQQ For My Long Term Investment? (20% ~ 30% Upside Potential) | Step By Step Guide To Activating Automatic Recurring Investment On IBKR

Can options trading provide you with extra sideline income every month? In this post, I share my experience of generating income from options trading over the last 3 years.

Options Trading For Passive Income: Truth Or Myth?

Jason, I am learning how to be strong in difficult times and what is more important than money. As I always said, you are the source of light for many of us. We are in debt to you.

LikeLike

You are too kind with your words, Appasamy 🙂 I believe we will all learn valuable lessons out of these difficult times that would serve us well in future. Keep it going, one day at a time!

LikeLike

Jason, I really appreciate your articles. I mean no disrespect or judgment. I’m just looking for understanding. When you were up this large amount of gains, why didn’t you sell? You can always re-enter positions with less risk and get in again on retracements. Everything always drops and goes back up (have to believe and remember this). If this is too personal to answer, then I completely understand. Please let me know. Thanks.

LikeLike

Hey Scott, thanks for dropping by! I guess it was mainly due to my inexperience trading the US stock market. I was too naive thinking that the stock market was going through a short correction and it was a good opportunity to buy the dip. I did not expect the bear market in 2022 to last for the whole year and was in denial most of the time. In fact, I had a few chances to cut loss but did not take them until I lost most of my capital, as I was still hoping that the market would bottom and rebound from there. Little did I knew that most of my OTM LEAPS CALL options have lost a bulk of their premium, as the share price plunged and the contract got closer to expiration date. I have learnt my lesson and will trade more carefully now.

LikeLike

I understand. Are you still planning on trading OTM Leaps again? Do you have other strategies in place now?

LikeLike