How Kyrgyzstan and other Central Asian countries help Russia import sanctioned goods

- Oops!Something went wrong.Please try again later.

Kyrgyzstan has sharply increased its import of goods from all over the world and their export to Russia over the past year and a half. Some product categories have increased tenfold. What other countries re-export Western goods to [dictator Vladimir] Putin’s Russia?

Kyrgyzstan and other Central Asian countries continue to serve as a transit hub between developed economies and sanctioned Russia.

This is stated in a series of publications made by the managing director and chief analyst of the Institute of International Finance (IIF), Robin Brooks, on Twitter in late November 2023. The institute has been analyzing the impact of Western sanctions on Russia’s economy for a long time and produces reports assessing their effectiveness.

NV Business combined Brooks’ publications and previous IIF reports to reveal how Western companies are bypassing sanctions against Russia, and who else besides Kyrgyzstan is involved in this global scheme to bypass sanctions.

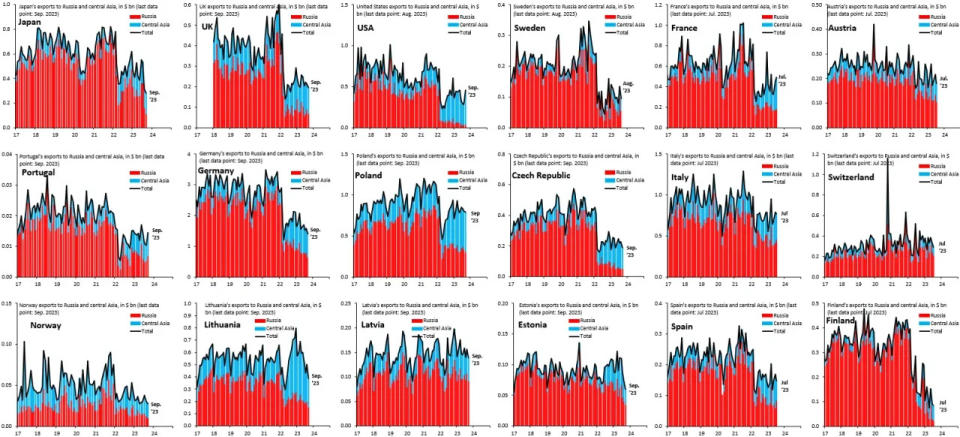

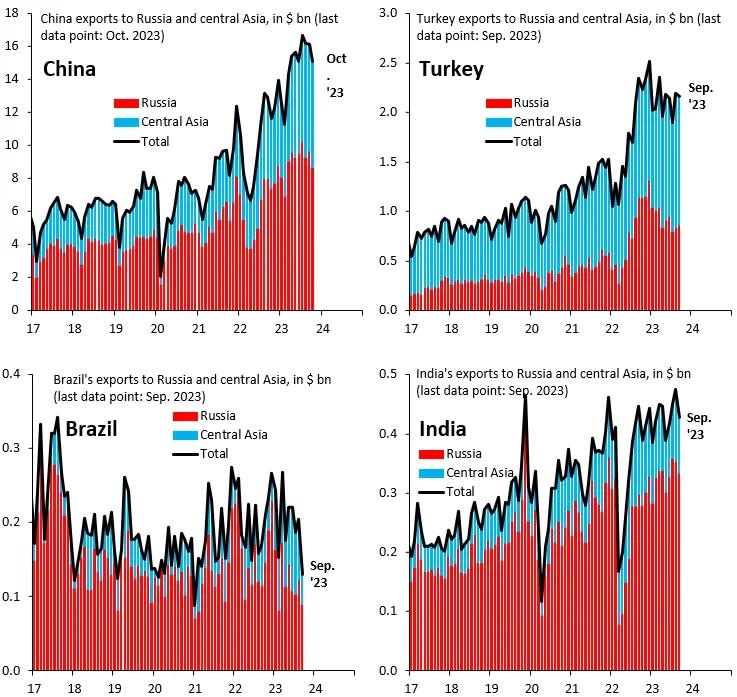

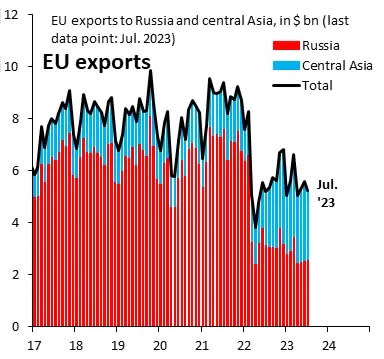

The imposition of export controls on Russia has upended global trade patterns. The IIF examines export data for 24 advanced countries and key emerging markets. In particular, the analysts find a widespread surge in exports to Central Asia from advanced countries where direct exports to Russia have fallen sharply.

The IIF analysts note that their results should not be read as indicating an obvious violation of export controls, as they only look at aggregate level export data, which do not shed light on what goods are being exported. However, the unprecedented boom in trade with Central Asia raises important questions. After all, why incur the added transportation cost of shipping goods to landlocked countries with often limited cargo capacity, unless shipments in question are at the very least questionable under current export controls.

After analyzing exports from 24 countries to Russia, Armenia, Azerbaijan, Belarus, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan, the experts highlighted two key trends:

• direct exports to Russia have fallen sharply;

• there is a boom in exports to Central Asia, which in part offsets the drop in direct exports to Russia.

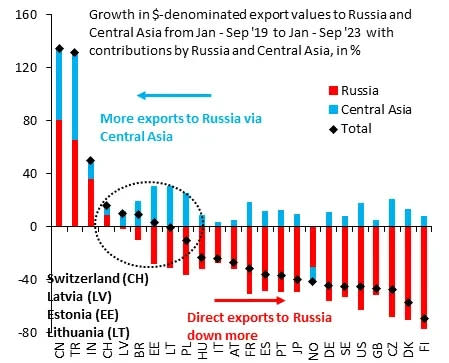

Trade diversion is especially pronounced for countries in geographic proximity to Russia, including Poland and Lithuania. In the latter case, the rise in exports to Central Asia is so big that it more than offsets the fall in direct trade with Russia.

On the other hand, the analyst notes the largest economies of the so-called “Global South,” including (TR), China (CN) and India (IN), are in a category of their own, with direct exports to Russia rising sharply and large increases in exports to Central Asia as well. Brazil is the only exception in this category, which even slightly reduced foreign economic cooperation with Russia.

Among western countries, positive overall export growth is recorded for Latvia (LV), Estonia (EE), Switzerland (CH) and Lithuania (LT). However, most western countries have substantially negative overall export growth, with trade diversion flows providing only a very partial offset. Trade diversion flows are most pronounced for countries where direct exports to Russia have fallen most, including Denmark, Finland, Great Britain, and the United States.

What exactly is delivered to Kyrgyzstan and why

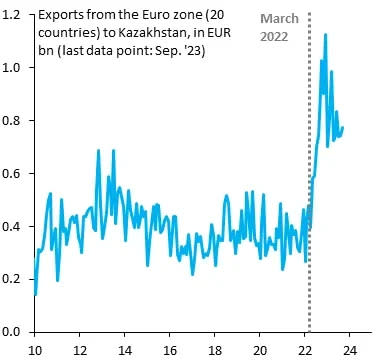

Kyrgyzstan is a member of the Customs Union of the Eurasian Economic Union countries. It includes Russia, Belarus, Armenia, Kazakhstan, and Kyrgyzstan. However, due to its open support for Russia in its armed aggression against Ukraine, Belarus is also under sanctions (exports to this country from China have increased sharply). The relations between Armenia and Russia have significantly cooled down after the Russians did not support the Armenians in the war against Azerbaijan. Due to its close integration with the global economy, Kazakhstan cannot support Russia too openly, although the growth of imports from the Eurozone is also noticeable.

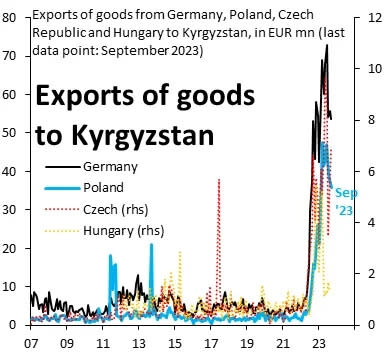

Therefore, Kyrgyzstan is the most convenient country for supplying goods to the Russian market through transit, without paying customs duties and having other privileges due to participation in the Customs Union.

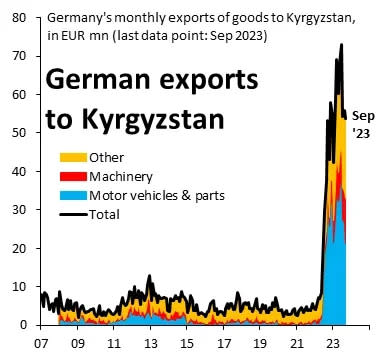

The supply of exactly what goods has increased to this Central Asian state? The IIF data shows a significant surge in exports of cars, spare parts, and engineering products from Germany.

The Dezan Shira & Associates consulting company, which specializes in cooperation between Russian and Asian businesses, notes in its research that Kyrgyzstan significantly increased the supply of cosmetics, clothing, and bags to Russia in 2022-2023. These goods are imported from China, Belarus, Turkey, and the United Arab Emirates. As an example, they give information about perfumery. Kyrgyzstan sold 50 tons of this product to Russia in eight months of 2022, compared to one ton a year earlier.

Read also: Moscow’s diminished influence in Central Asia

In total, the Kyrgyz earned about $410 million by mediating trade between Russia and third countries in 2022. This is about 4% of their country’s GDP.

According to Kyrgyzstan’s official statistics, exports of goods to Russia increased almost threefold in 2022, from $393 million to $1.07 billion.

Brooks also noted the rise of more complex export schemes. In particular, he recorded a significant increase in exports from Georgia to the Customs Union countries. The economist believes that all these goods eventually end up in Russia.

The IIF’s monitoring results underscore how difficult it is to police global trade effectively, given how dispersed and decentralized it is.

That’s why Brooks underscores the importance of the G7 oil price cap in limiting Russia’s purchasing power, which is what ultimately drives this trade diversion. If Russia earns less money on foreign markets, it will not be able to import Western goods for its own needs, even through third countries.

We’re bringing the voice of Ukraine to the world. Support us with a one-time donation, or become a Patron!

Read the original article on The New Voice of Ukraine