TIMOTHY · JANUARY 2021

Top 5 Social Networking Apps in Brazil: Q4 2020 Performance Insights

Sensor Tower's analysis on the top 5 social networking apps in Brazil for Q4 2020 reveals significant user engagement and download figures. Insights into the performance of these apps provide a snapshot of the social networking landscape.

Top 5 Social Networking Apps in Brazil: Q4 2020 Performance Insights

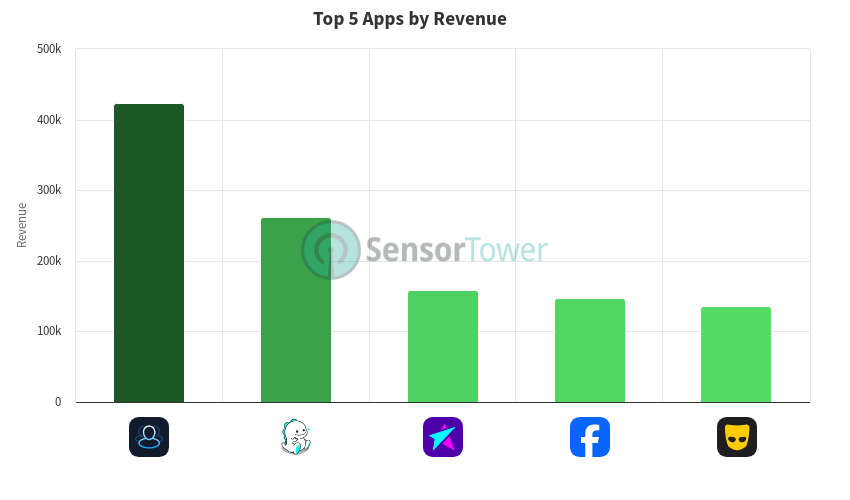

In the fourth quarter of 2020, Brazil's social networking app landscape saw varied performance among the top players. The data, provided by Sensor Tower, offers a glimpse into the downloads, revenue, and active users for these key apps.

Reports+ for Instagram experienced a stable trend in downloads, ranging between 17 thousand and 19 thousand weekly, with a slight peak in late November. Revenue figures showed a general upward trend from 28 thousand to 36 thousand, before dipping to 29 thousand by year-end. Weekly active users saw a decline, starting at 427 thousand and dropping to 184 thousand.

BIGO LIVE-Live Stream, Go Live showed a strong start with 110 thousand downloads in the last week of September, peaking at 118 thousand in mid-October, and then a gradual decrease to 72 thousand by the end of December. Revenue peaked at 62 thousand in the third week of October but then fluctuated, ending the quarter at 26 thousand. The app's weekly active users remained robust, starting at 871 thousand and finishing the year at over 904 thousand.

LiveMe – Live Stream & Go Live saw modest download numbers, maintaining around 3 thousand to 4 thousand per week, with a notable increase to over 7 thousand in late November. Revenue trends were inconsistent, with a high of 24 thousand in early October, declining to around 9 thousand by December's end. Active users showed slight fluctuations, starting at 31 thousand and ending at 26 thousand.

Facebook dominated in downloads, with figures starting at 804 thousand and reaching over 1 million in early October, then gradually decreasing to 600 thousand by the close of the quarter. Revenue trends were relatively stable, with a slight peak at 38 thousand in mid-November. Weekly active users remained high, with over 144 million at the quarter's start, dipping to around 140 million at the end.

Grindr - Gay Dating & Chat maintained steady download numbers, starting at 18 thousand and peaking at 25 thousand in late December. Revenue was consistent, with a slight increase from 22 thousand to 23 thousand at the quarter's end. Active users numbered over 1.2 million at the beginning of the quarter, with a slight decrease to 1.23 million by the end of December.

For more detailed insights and data on app performance, visit Sensor Tower. The information provided paints a picture of the social networking app market in Brazil during the last quarter of 2020, showing the dynamic nature of app engagement and popularity in the region.