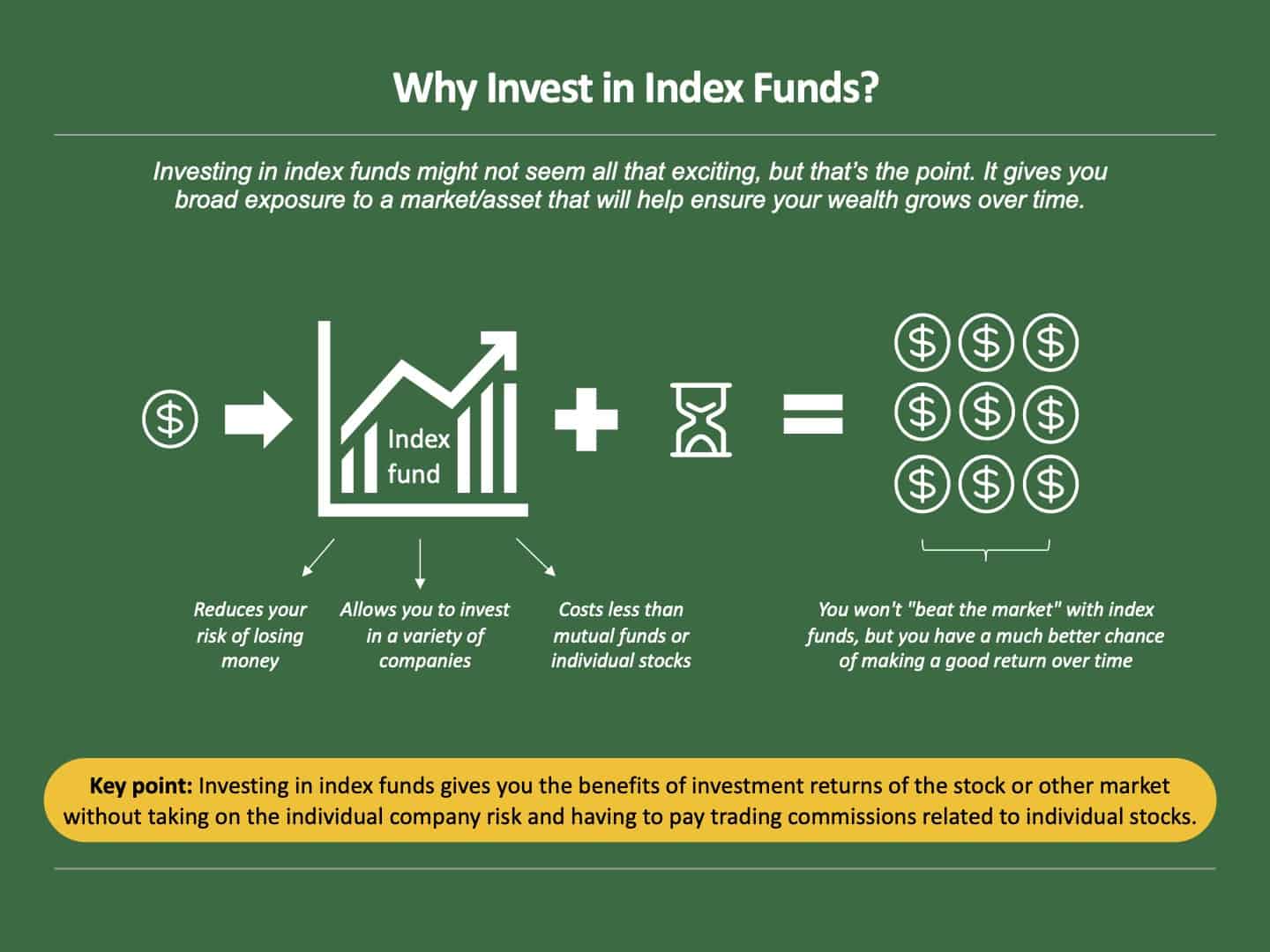

Looking to make your money grow in a convenient and diversified way, with low fees? Index funds, exchange traded fund, or mutual funds can be great options, but today we are going to focus on index funds.

If you have a handle on the personal finance fundamentals (i.e. you are earning income and saving some money each month), the next step is to start investing. For most people, index fund investing is a great way to do this.

At this point, you’re probably aware that your hard-earned money will lose its value unless you invest it. Like when I started, you probably have many questions and may feel uncertain about your next steps. You may have been exposed to terms like “exchange traded fund,” “mutual fund,” and “index fund,” but don’t know where to start.

In this article, we’ll break down index fund investing by answering the following 7 questions:

Table of Contents

What is an Index?

An index is a grouping of stocks and securities of a segment of the stock market like a certain sector of industry, or country-specific companies, or top-performing companies, etc. There are index funds that cover a wide range of areas you may be interested in. A lot of index funds are created and managed by firms that have expertise in the respective business sector.

In the U.S., the most recognized index is the S&P 500 Index. As the name suggests, it’s a group of the top 500 companies representing well-known U.S industries listed on the U.S stock market.

Similarly, there are other indexes like Dow Jones Industrial Average, S&P SmallCap 600, MSCI Emerging Markets, etc.

An index is made up of the prices of all the underlying stocks that are a part of it, and by its nature the index aims to have a diverse set of companies that align with their target benchmark. Although there are some differences, in general most total stock market indexes are similar. So, when you pick one, it really just comes down to fees, or which account you have. Low-cost index funds that have broad diversification are usually the best bet for most investors, depending on your risk tolerance.

Now, let’s look at what an index fund is…

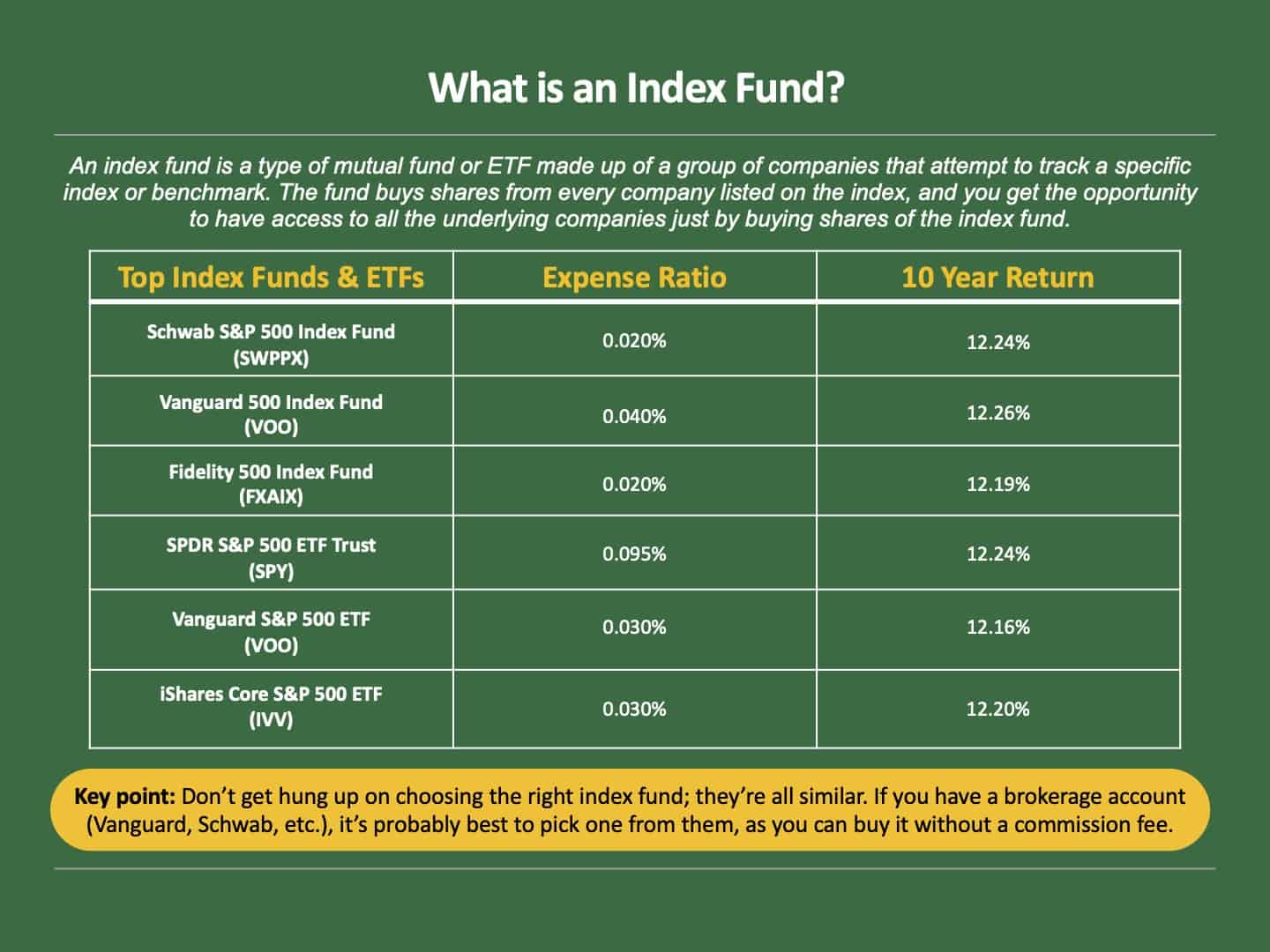

What is an Index Fund?

An index fund is a type of mutual fund or ETF made up of a group of companies or assets that attempt to track a specific index or benchmark. Index fund are not actively managed funds like mutual funds. The fund buys shares from every company listed on the index, and you get the opportunity to have access to all the underlying companies just by buying shares of the index fund. Essentially, index funds provide exposure to many different stocks without requiring you to pay for each stock individually. Accordingly, index funds can reduce the impact of market volatility on your investments.

Note: ETFs or Exchange Traded Funds are similar to index funds. The main difference is that ETFs can be bought or sold throughout the day like stocks, while you can buy an index fund only at the price available at the close of the stock market’s trading day. Also, the ETF version of most index funds don’t have investment minimums so you can get started with less money vs. the typical $1-3k minimums for many index funds. |

Index funds or index ETFs can help you reduce the risk in your portfolio since market changes across an index are typically not as volatile as they would be if you owned just a few individual stocks. Index funds don’t try to beat the market, rather they try to mirror the performance of the index and track the average return of all companies within it. This strategy and the first index fund ever, the S&P 500 Index, was pioneered by John Bogle, founder of Vanguard.

Simply stated, instead of investing individually in the 500 top companies of the U.S., you could buy a share of the S&P 500 index and get access to all 500 companies at once.

Investing in index funds is a great strategy because it requires less money to get started and it enables you to be diversified across many companies very quickly – something that would take a lot more money to do if you bought individual company stocks. Additionally, studies show that it is very difficult to “beat the market” despite what the broader investment industry might claim.

The S&P 500 Index has had an average return of ~11% since its inception, and over 7% in the majority of 10-year time periods you look at. For example, if you invested $100 in the S&P 500 at the beginning of 2007 and reinvested all dividends, you would have about $422.38 at the beginning of 2021. This is a return on investment of 10.32% per year.

Is Investing in Index Funds a Good Idea?

I’d say “Yes, it’s a good idea”! Here’s why:

- Passive funds like index funds generally cost less to invest in than most other mutual funds or individual stocks. You’d have to pay commission to buy each stock individually or pay a lot more in the form of an expense ratio (fees) for an actively managed fund.

- Diversification with an index allows you to invest in a variety of companies and reduce your risk of losing money.

- Total market index funds (e.g., total stock market, total bond market, etc.) are simple ways to invest and watch your money grow over the long run without much active work or management fees.

By investing in an index fund, you can get the benefits of investment returns of the stock or other market without taking on the individual company risk and having to pay trading commissions related to individual stocks.

Are Index Funds a “Safe Investment"?

No investment is 100% safe, but due to the built-in diversification, simplicity and low costs, index funds are one of the safer ways to get started investing. Like all investing, there is a direct trade-off between risk and returns. Investing is a long-term strategy to build wealth, and the longer you hold an index fund investment, the greater your odds of making money.

How risky an index fund is depends on the index (or group of companies/assets) it tracks. For instance, a bond index will be much less risky than an emerging markets index. Stock index funds do not necessarily offer guaranteed returns to the investor, while bond index funds do.

For this reason, one of the best places to start is a total stock market index, or a total bond market index, which are very well diversified and tend to be weighted towards the large, established companies.

How Does Investing in Index Funds Work?

When you invest in an index fund, you invest in a slice of a group of stocks that make up an index. As previously mentioned, investing in index funds can be a good idea as they represent diverse industries while keeping the management cost low. Index funds’ management fees are lower than those of financial advisors because an index fund manager trades holdings less often.

For this reason, many investors who want to focus their time on other things, like spending time with their families, being active, or giving back, tend to rely on investing via more “passive” options like index funds. This is because they tend to perform well over time and require little ongoing analysis or active trading/adjustments.

Here are four reasons we like index funds:

You don’t have to conduct in-depth research into each company before investing. The fund’s composition imitates the index that it tracks, so it is easy to find the right index fund.

Diversification reduces the risk of taking a huge loss because even if a few companies in the index don’t perform, others often will do well to balance things out.

It’s significantly less expensive because these funds are managed passively (expense ratios of .05-.5% annually versus 1-2% annually for active funds). Thus, overall trading costs are lower.

These funds are not designed to outperform the market but rather to track the index or average performance – and they do so consistently. Over a long period of time, their average performance and steady returns can make you a lot of money as a component of your portfolio holdings.

How Do I Find the Best Index Funds?

You can start by looking at some popular brokers like Vanguard and Betterment, which offer lots of index fund options. Vanguard is known to give its investors a diverse set of index funds and ETF options at a very low cost or in most cases, without fees. Vanguard is the brokerage that we personally use.

If you want an even simpler investing option, Betterment is another good choice. It’s an automated investing service that makes investment choices using computer algorithms, building you a customized portfolio of index funds and ETFs based on your goals. Using automation to receive investing advice for something as low-risk as index funds is a great way to save time. All you have to do is input some basic information and, based on your risk appetite, it will automatically invest money for you into a variety of low-cost funds for you over time.

Whether you use Vanguard, Betterment, or another broker like Fidelity, you can (and should) set up a monthly electronic contribution from your checking account into the fund of your choice. You can start with a small amount (say $100 a month) and increase it over time. After setting things up, you can then go spend time doing the things you love while knowing you are building your nest egg for the future.

Investing in index funds for beginners is simple to do, inexpensive, and is a great place to start your investment journey.

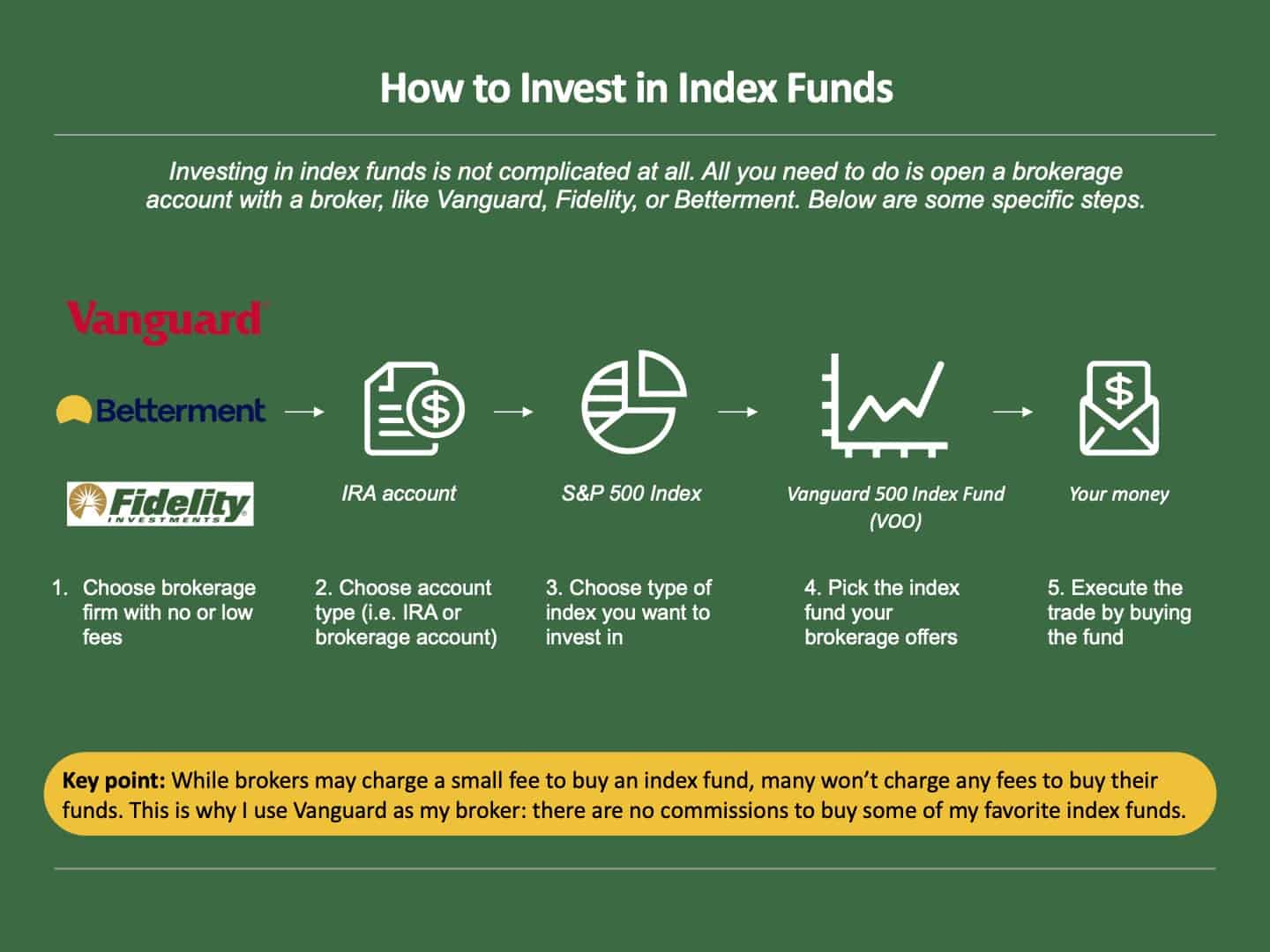

How Do I Begin to Invest in an Index Fund?

Investing in index funds for beginners is not complicated at all. All you need is to open a brokerage account with a broker, like Vanguard, Fidelity, or Betterment. While the broker may charge you a small fee to buy an index fund, many won’t charge you any fees to buy index funds they offer. There is also usually no investment minimum. This is why I use Vanguard as my broker: there are no commissions to buy some of my favorite index funds like the Vanguard Total Stock Market Index (VTSAX).

Here are some specific steps you can take to start investing in index funds:

Step 1: The first step to investing in an index fund is to pick a brokerage firm that has a good reputation and investment options. You can do this based on online reviews. Vanguard, Betterment, and Fidelity are all good examples.

Step 2: The next step is to open an account with them. If you don’t already have an IRA account, start here since they have tax advantages as you save/invest for retirement. If you already have an IRA and are contributing the max amount each year, then open a standard brokerage account.

Step 3: Choose which type of index fund you want to buy. We recommend you start with a Total Stock Market Index Fund, or a S&P 500 Index Fund for simplicity and broad market exposure.

Step 4: Pick the specific fund that your brokerage offers so that you don’t pay any commissions or fees to buy it. For example, if you opened a Vanguard account, then you would buy a Vanguard Total Stock Market Index Fund.

Step 5: Finally, execute the trade by buying some of the selected funds, either by transferring money into your account or linking your bank directly to make the purchase.

Note: Start with a Roth IRA account if you don’t have one and are not above the income limits to contribute (see our post “5 Most Important Accounts for Saving and Investing” for more details on Roth vs Traditional IRAs). Also, if you don’t have the minimum amount required to start with an index fund (typically $1-3k) then just buy the equivalent ETF fund, which won’t have an investment minimum. For example, if you don’t have the minimum for the Vanguard Total Stock Market Index Fund (VTSAX) then just buy the Vanguard Total Stock Market ETF (VTI). |

Let’s Recap:

- An index is a grouping of stocks and securities meant to track a segment of the market like the 500 biggest U.S. companies (S&P 500).

- An index fund is an investment fund made up of a portfolio of companies that are part of the index that you have chosen to track.

- You get the benefits of access and exposure to all the underlying companies in the index without having to individually buy and sell stocks.

- You can start investing with lower costs and fees, since you can just buy a few index funds and avoid lots of individual commissions and trading fees.

- These funds are managed passively (without the active help of fund managers), so their expense ratio (aka management fee) is low.

- You can invest in index funds through brokers like Vanguard and Betterment who will guide your fund selection if you call them or use their automated investing process.

As always, I’m happy to answer any questions you might have. Leave a comment below and I’ll be sure to get back to you.

Here’s to your financial future and foundation of index fund investing!

Disclosure: This article may contain references to products or services that we use and recommend. At no cost to you, we may receive compensation when you click on the links to those products or services. This helps us keep the site free for everyone.

Seavron Banus

Co-founder of Stepwise & passionate personal finance educator. My happy place is in the mountains with my wife and kids, whether on a board, bike, or my own two feet.