It’s not an easy job to rebuild your company’s budget from the start and doing this is a challenging undertaking. This entails wiping your company’s financial slate clean and starting over. This is usually a last resort and is never considered an option in normal situations. But today, more companies have chosen to do this – an extreme budgeting method called zero-based budgeting. This process involves the use of zero based budget forms.

Table of Contents

- 1 Zero-Based Budget Templates

- 2 What is a zero-based budget plan?

- 3 Zero-Based Budget Forms

- 4 How does it differ from traditional budgeting?

- 5 What’s the 50 30 20 budget rule?

- 6 Zero-Based Budgeting Examples

- 7 Pros and cons of this budgeting method

- 8 How do you create a zero-based budget?

- 9 Zero-Budget Plans

- 10 After budgeting

Zero-Based Budget Templates

What is a zero-based budget plan?

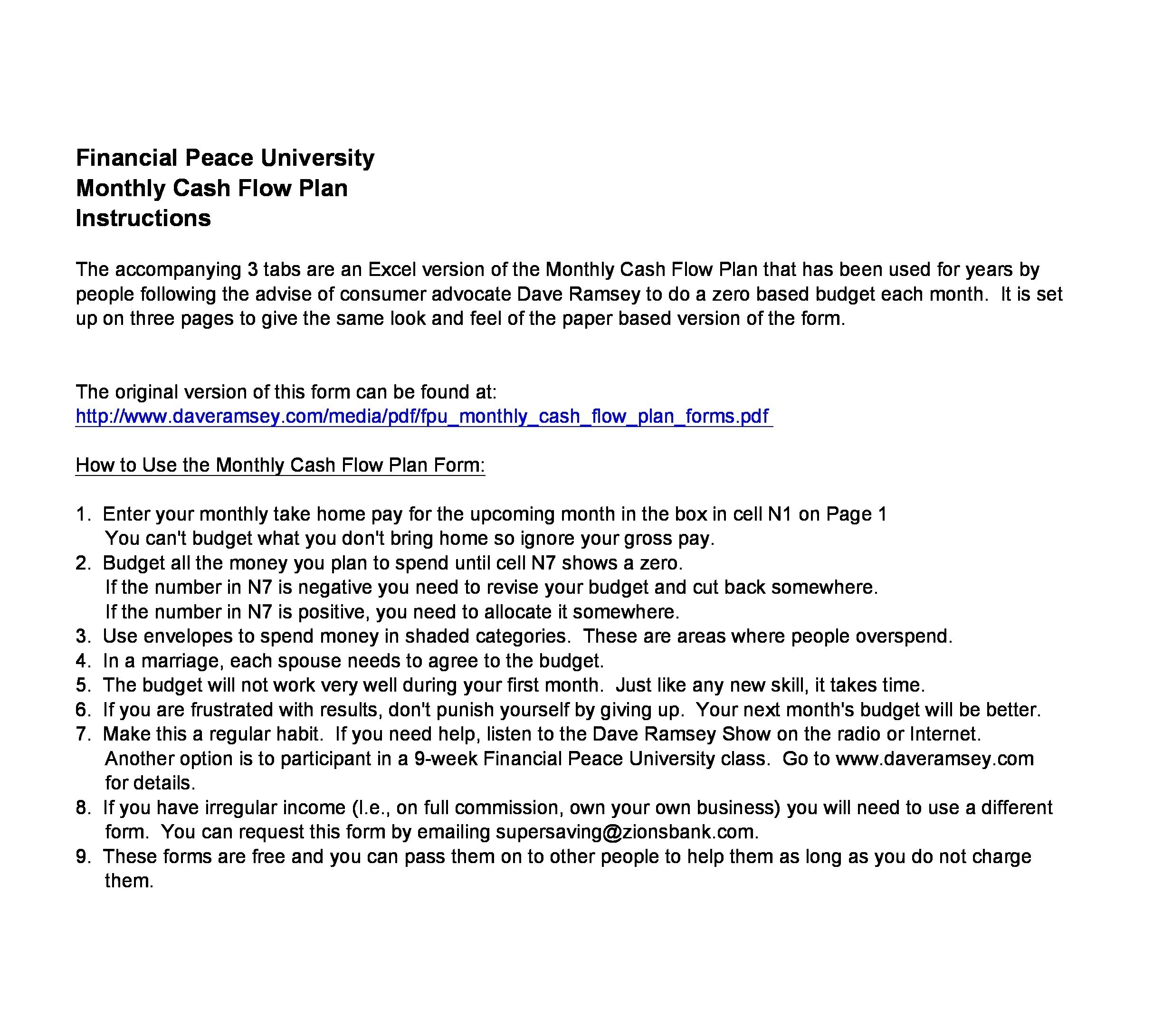

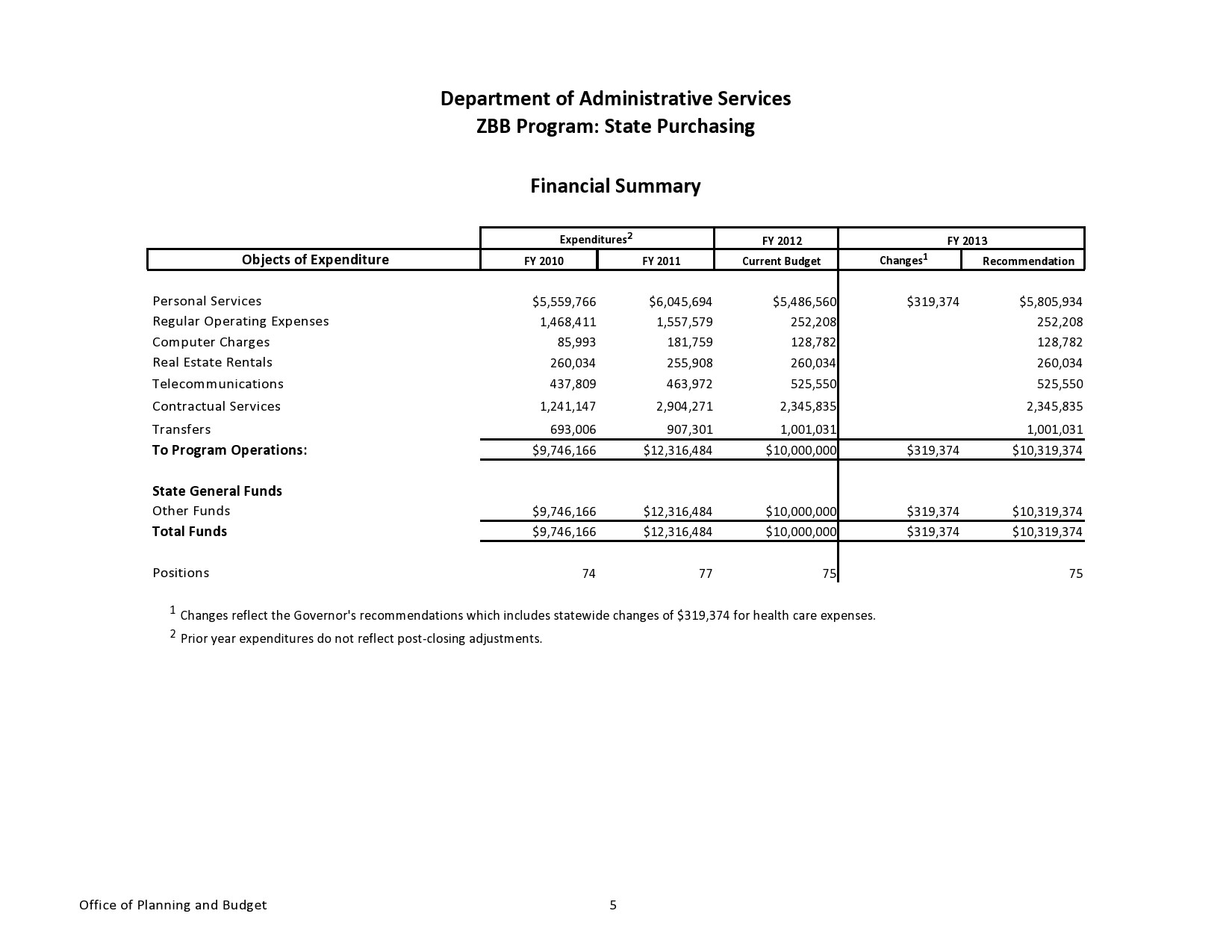

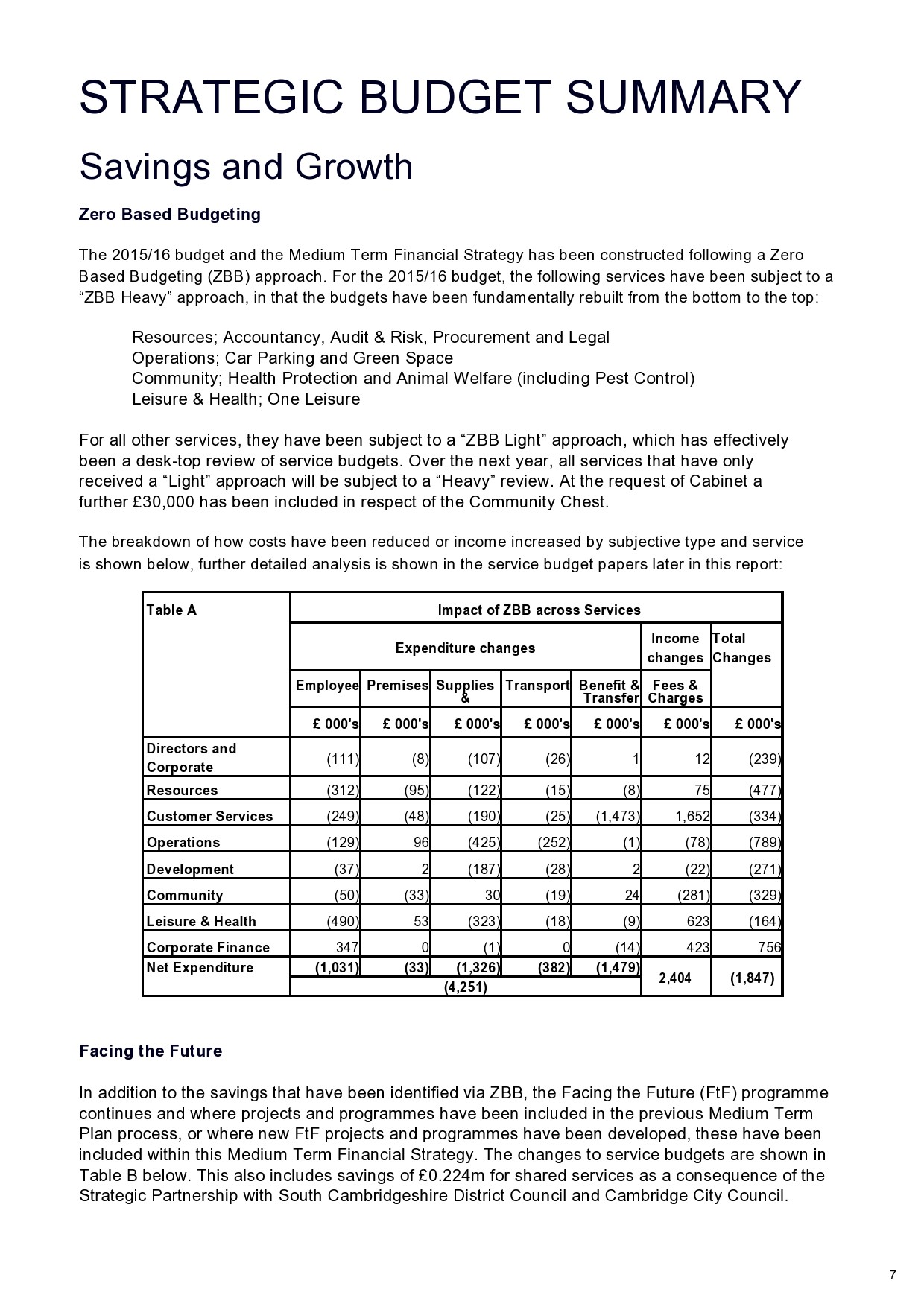

Zero-based budgeting or ZBB is a budgeting strategy created for the purpose of dealing with the limitations of the traditional budgeting method. The ZBB differs from the conventional or incremental budgeting system since it starts with a base of zero. You would start budgeting from scratch without using previous trends as your basis.

The ZBB is an accounting practice that will force you as a manager to be more accountable for how they spend every dollar in each budgeting period. Like any other system, it has both benefits and disadvantages. A man named Pete Pyhrr developed this budgeting system in the late 60s while working at Texas Instruments as an account manager. Recently, private equity companies have started using this budgeting strategy, which means that each company has its own zero based budgeting example too.

With traditional budgeting, you would start with the budget of the previous period as your template and start building upon it. Each new budget goes up incrementally as compared to the previous budgets. You need to provide justifications for the new expenses.

The ZBB doesn’t follow this system because you would create the budget for each new period starting with a zero base. Another difference is that you should all of your expenses before you add them to the new budget. This also applies to recurring and old expenses. Here are the main advantages of the ZBB method:

- Focused operations.

- Flexible budgets.

- Disciplined execution.

- Lower costs.

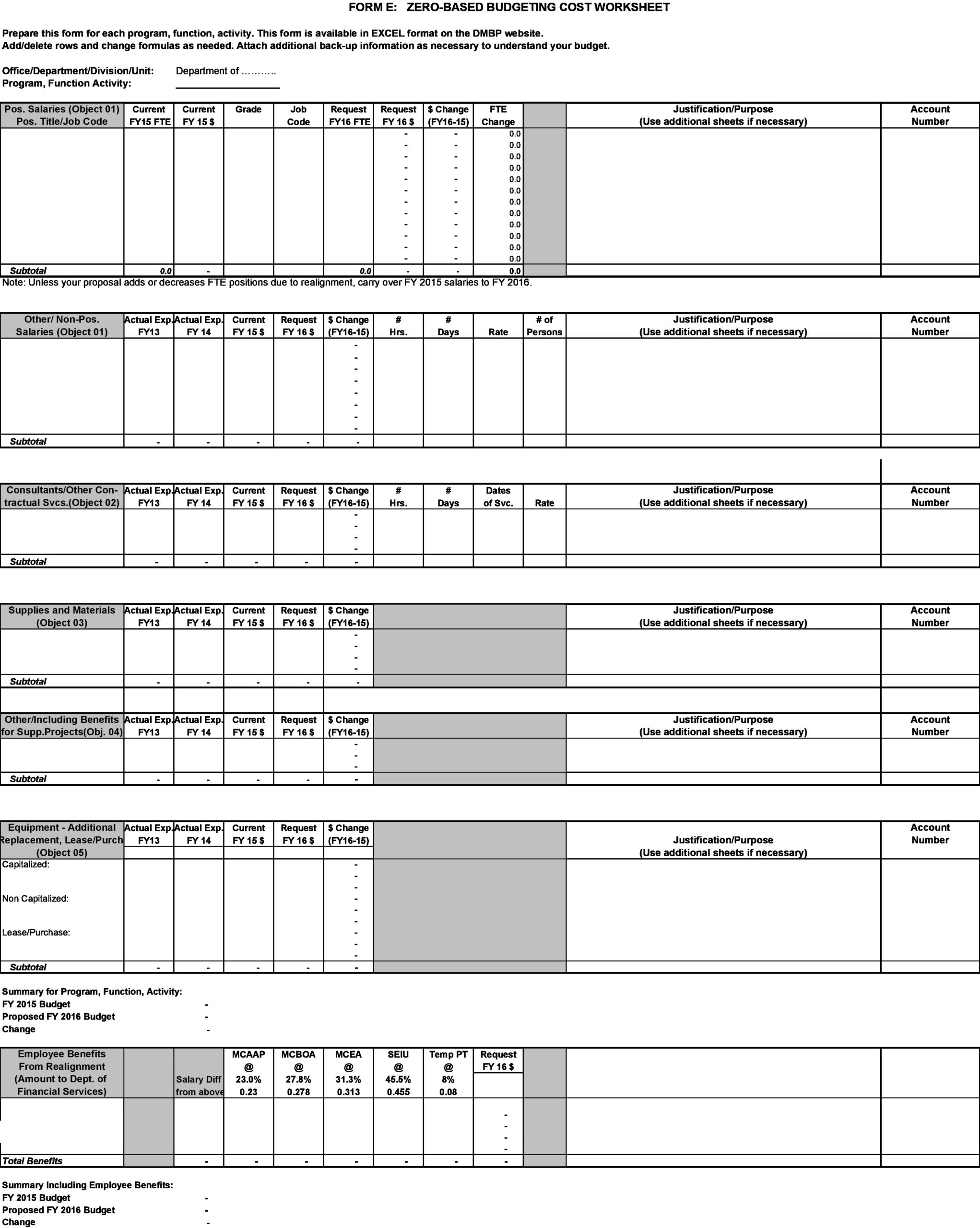

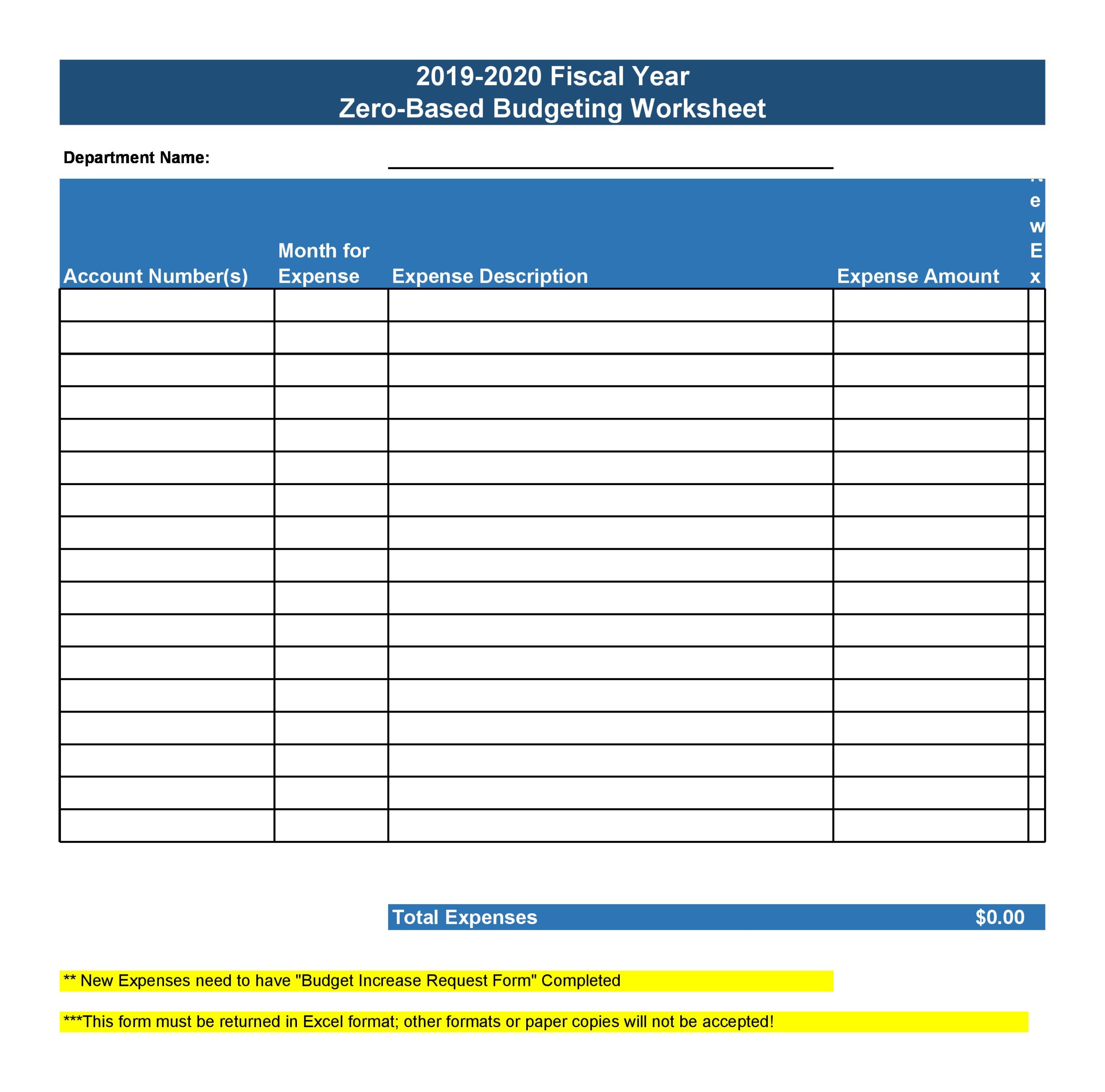

Zero-Based Budget Forms

How does it differ from traditional budgeting?

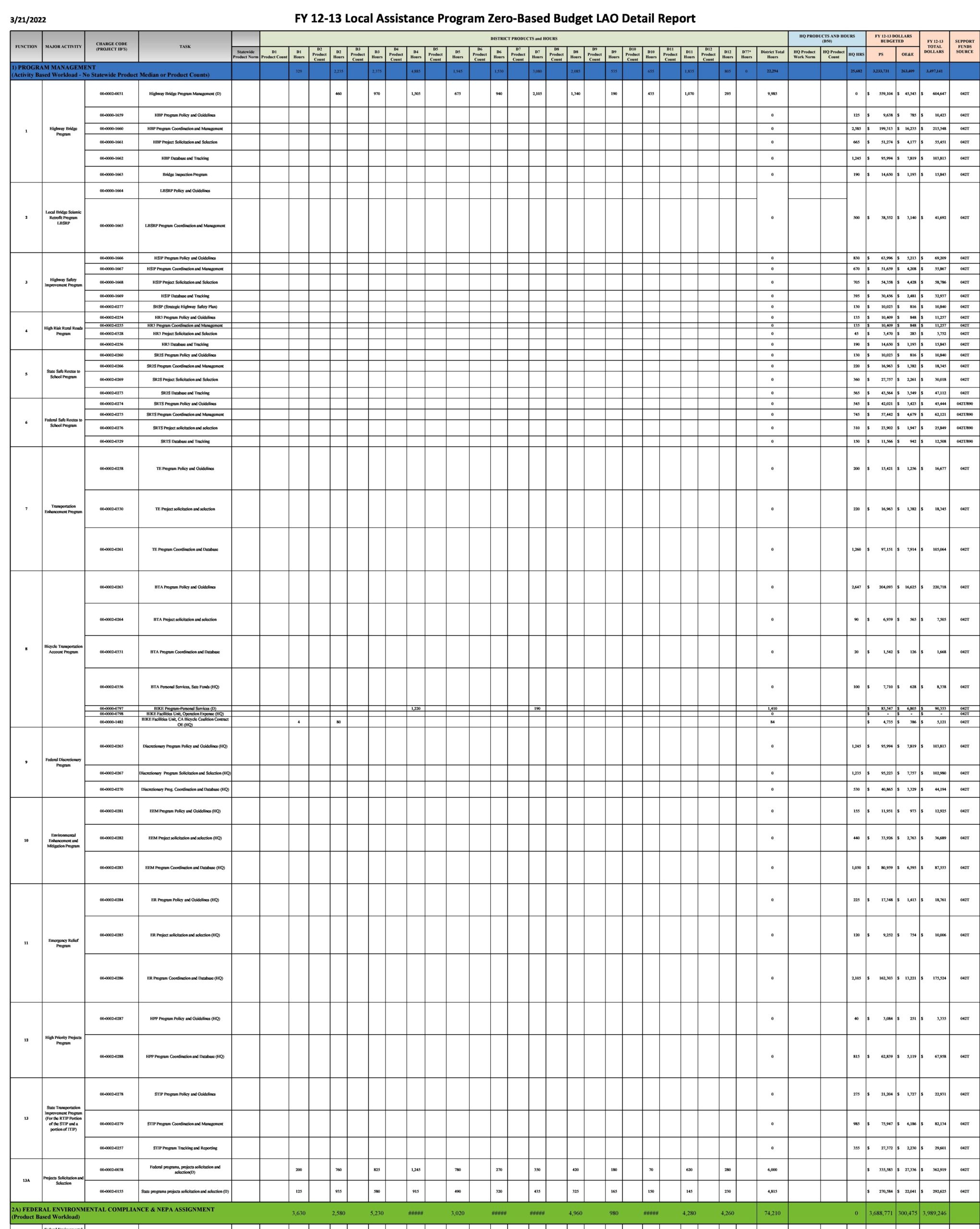

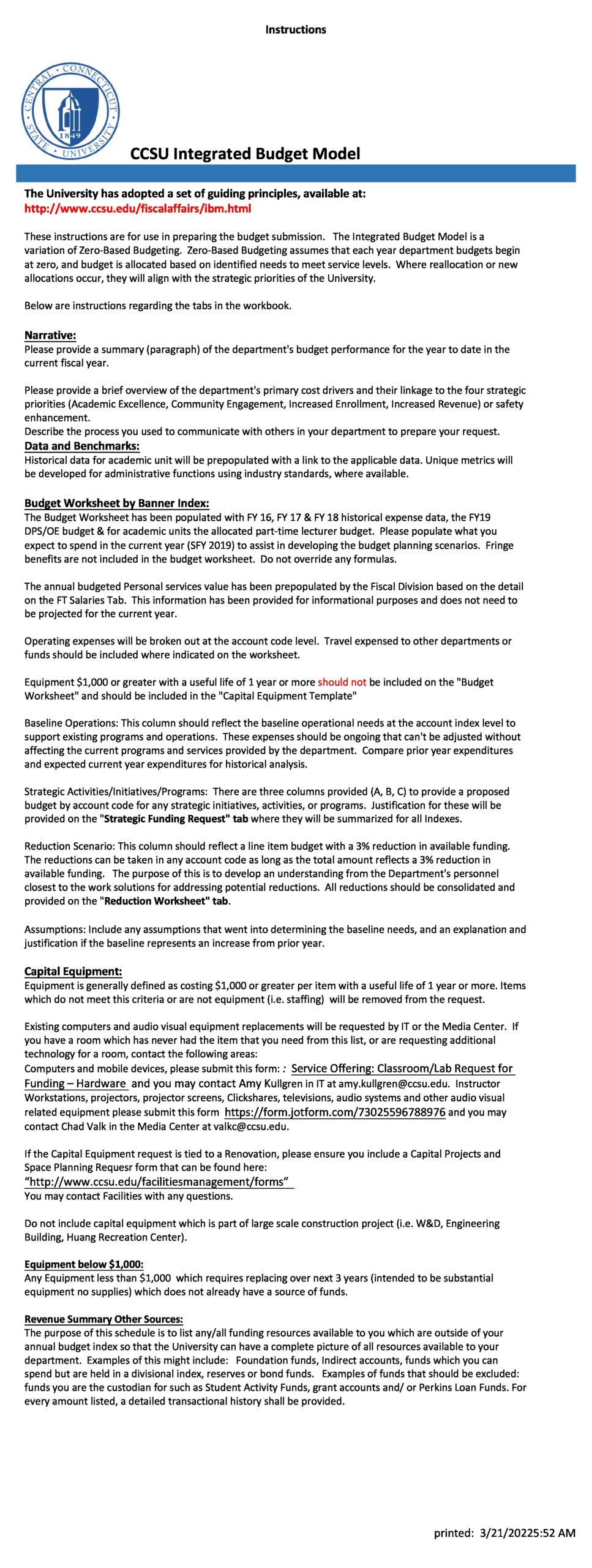

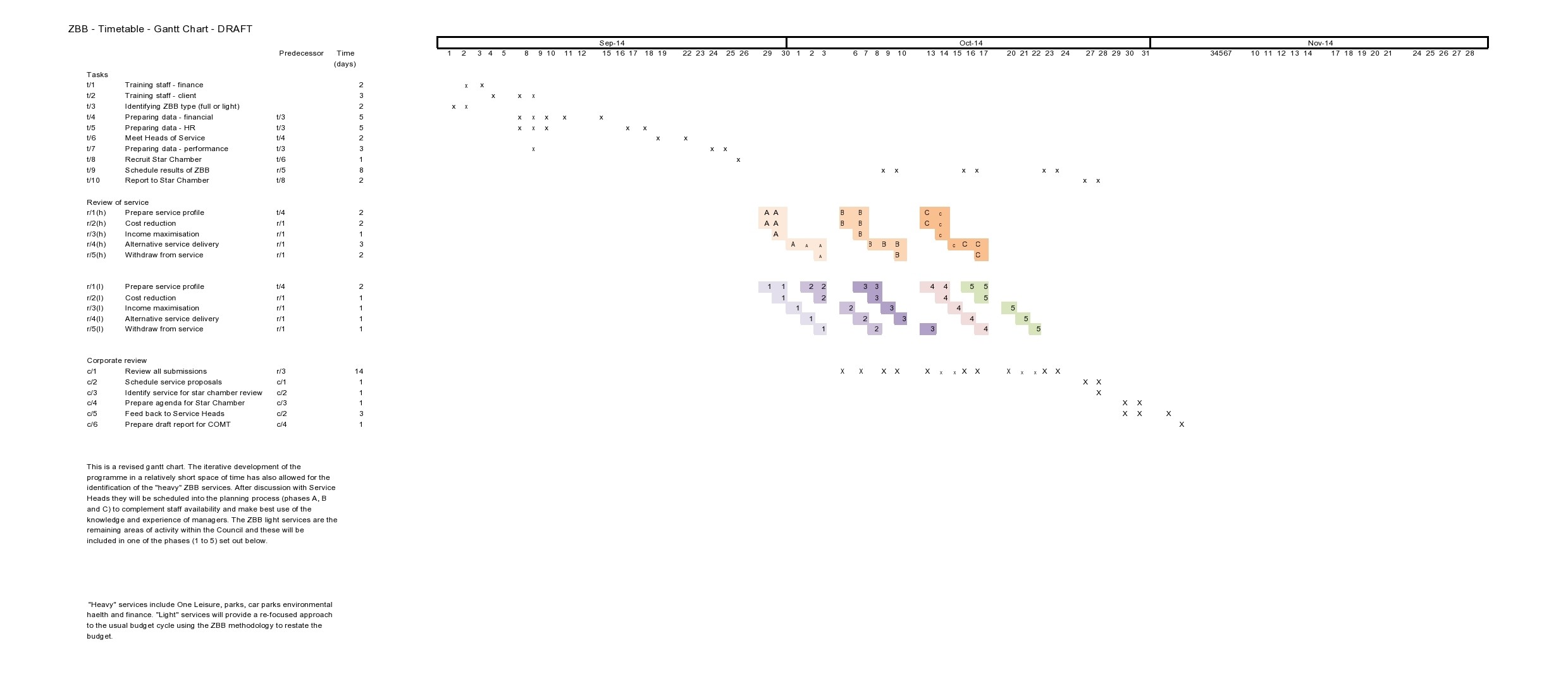

In business, ZBB allows high-level strategic objectives that you can apply to the budgeting process. You can do this by tying your goals to certain functional areas of your company where costs can be first categorized and measured against current expectations and previous results. Since ZBB is detail-oriented, it’s a continuous process that you can accomplish over many years, with only a couple of functioning areas reviewed at a time by group leaders or managers. ZZB can also help reduce costs since you can avoid blanket decreases or increases to the previous period’s budget.

ZBB favors the areas that achieve direct production or revenues because the contributions from these are much easier to justify compared to those in departments like research and development or client service. ZZB places the burden on managers to justify expenses while driving value to your organization by optimizing revenues and costs. You would use ZBB in business but you can also use it for your personal budget.

Traditional budgeting involves increasing your budget incrementally with each new period. This differs from ZBB as you wouldn’t consider your previous budgets. Traditional budgeting only analyzes new expenses while ZBB starts from zero even though it still requires justification of recurring and old expenses along with new expenditures. One downside of ZBB compared to traditional publishing is that it takes more time to perform.

What’s the 50 30 20 budget rule?

Senator Elizabeth Warren popularized the term “50/20/30 budget rule” in her book titled, “All Your Worth: The Ultimate Lifetime Money Plan.” According to her, the basic rule is to allocate your income after taxes for the following:

- 50% for your needs

These are the bills you need to pay and the things you need to survive. These include mortgage or rent, groceries, car payments, health care, insurance, utilities, and debt payment. If you spend more than 50%, you should either take it out on your wants budget or change your spending habits. You can live in a smaller home, commute instead of spending money on gas or cook your own meals instead of eating out all the time.

- 30% for your wants

These are the things that aren’t absolutely necessary for your survival. Some examples are eating at restaurants, watching movies, buying designer brand clothes, taking vacations, getting the latest electronic gadgets, and more.

This category can also include upgrade decisions like choosing an Angus beef burger instead of a regular one when dining out or buying a BMW rather than a more economical model. Your wants are the “little extras” that you spend your money on to make your life more comfortable and enjoyable.

- 20% for your savings

The final 20% of your income should go to either savings or investments. This category includes the money you add to emergency funds, IRA contributions, and even investments like stocks or bonds. You must have at least 3 months of emergency savings on hand in case any unforeseen events occur. After that, you can focus on retirement funds and work toward your financial goals for the future.

There might be times when you encounter an emergency situation where you need money. Should this happen, the first allocation of your additional income should be to replenish your emergency fund. You can also consider debt repayments under this category. While minimum debt payments are part of your needs category, any additional payments you can put into these will lower your future and principal interests owed, which makes them part of your savings.

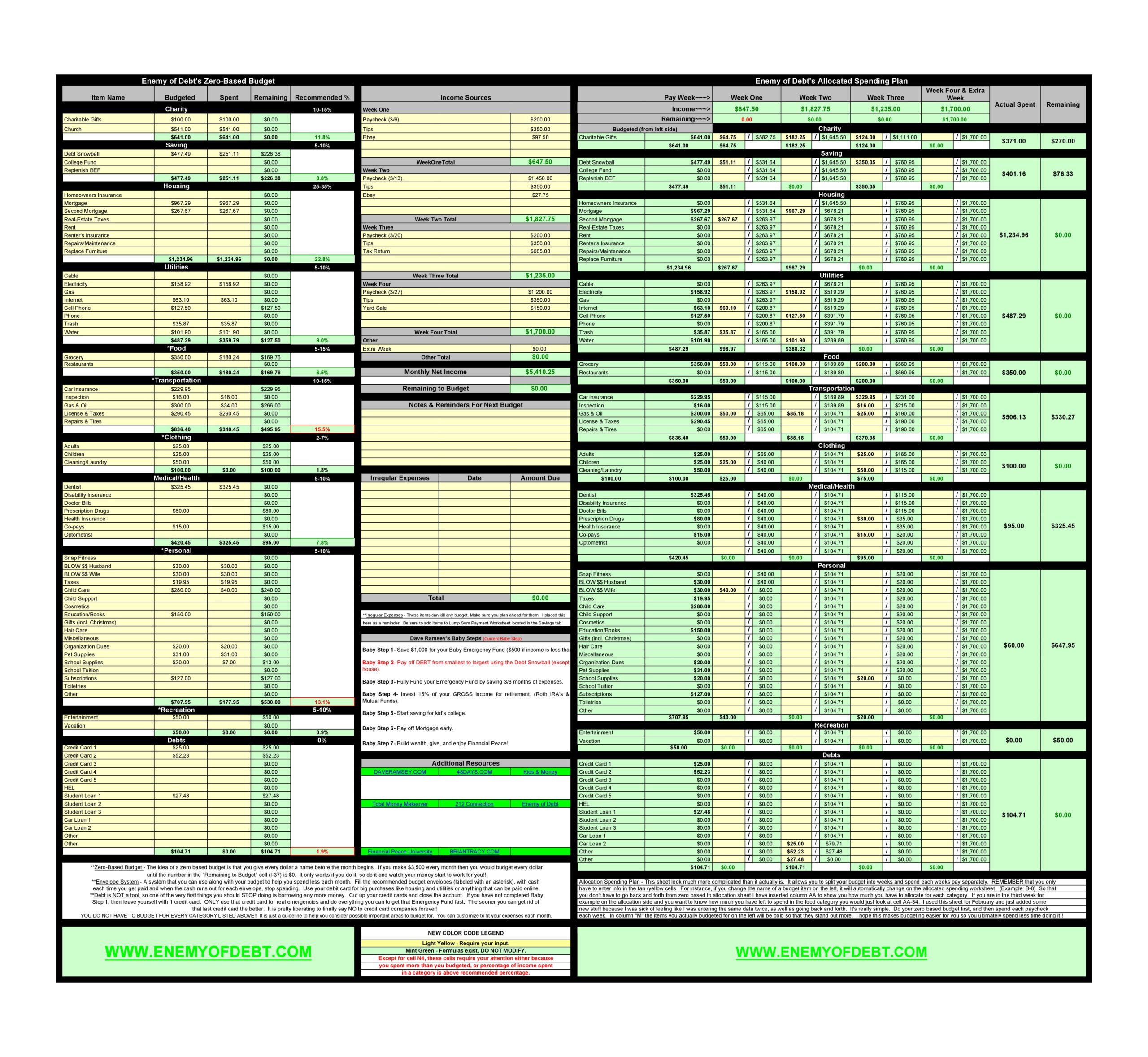

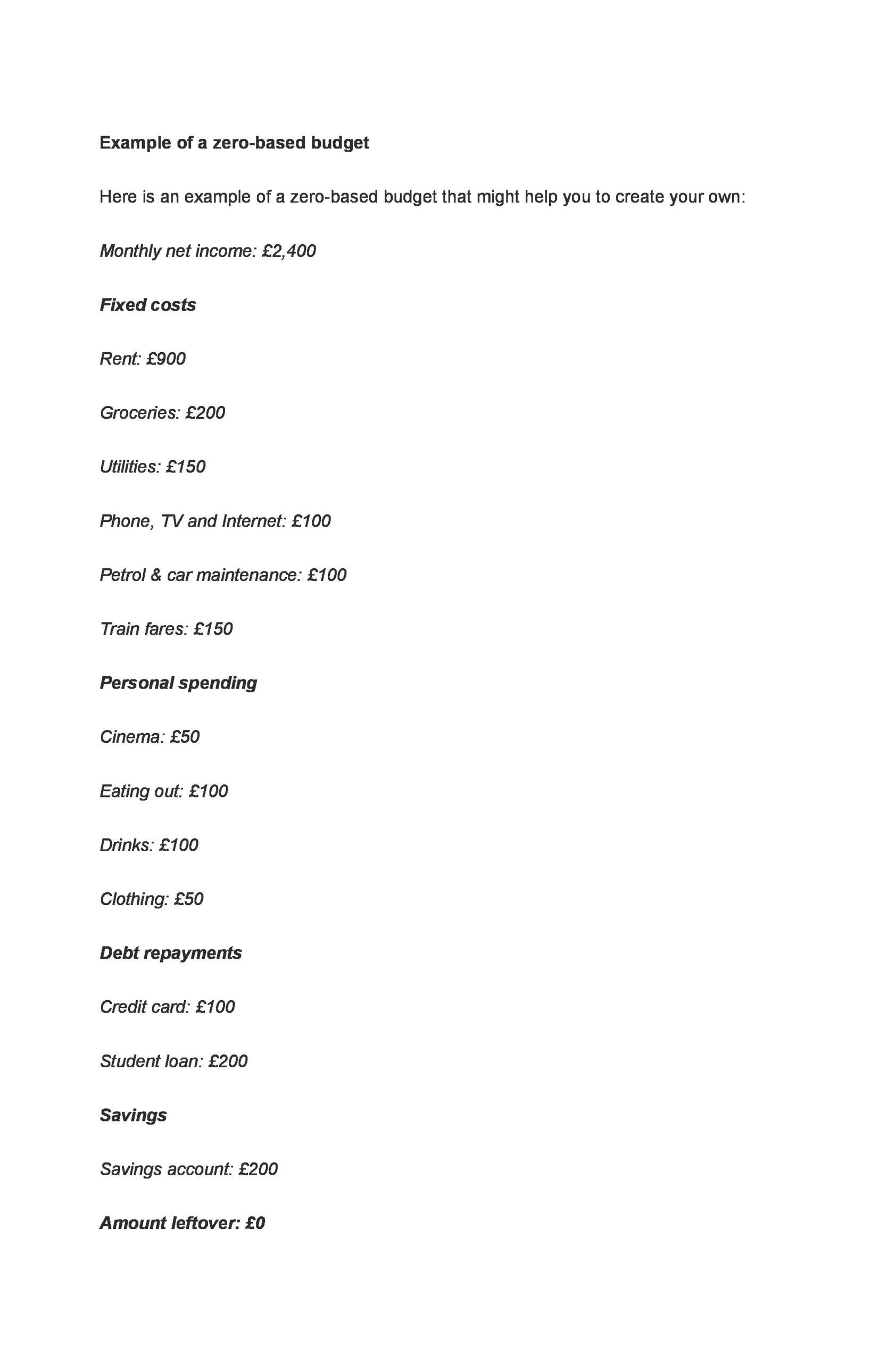

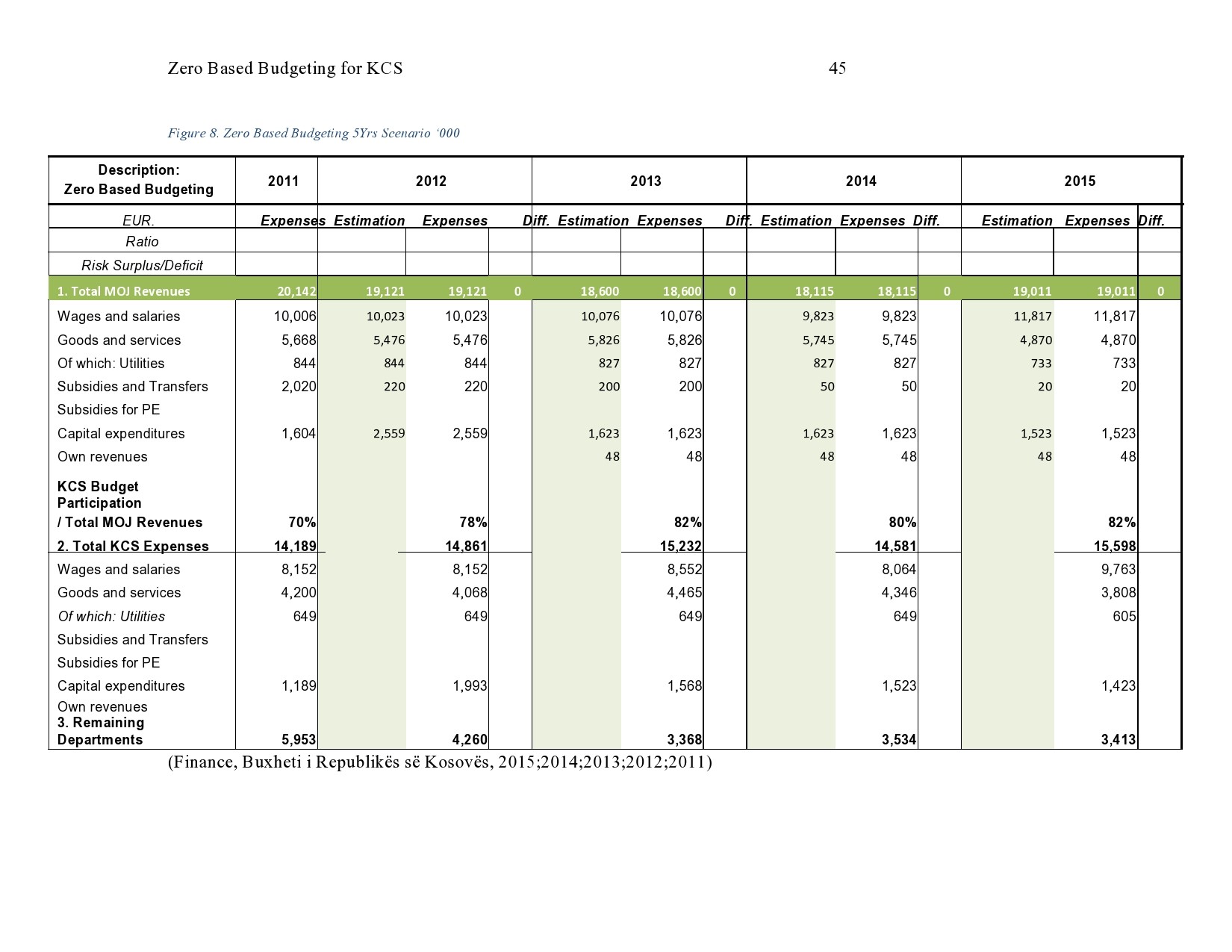

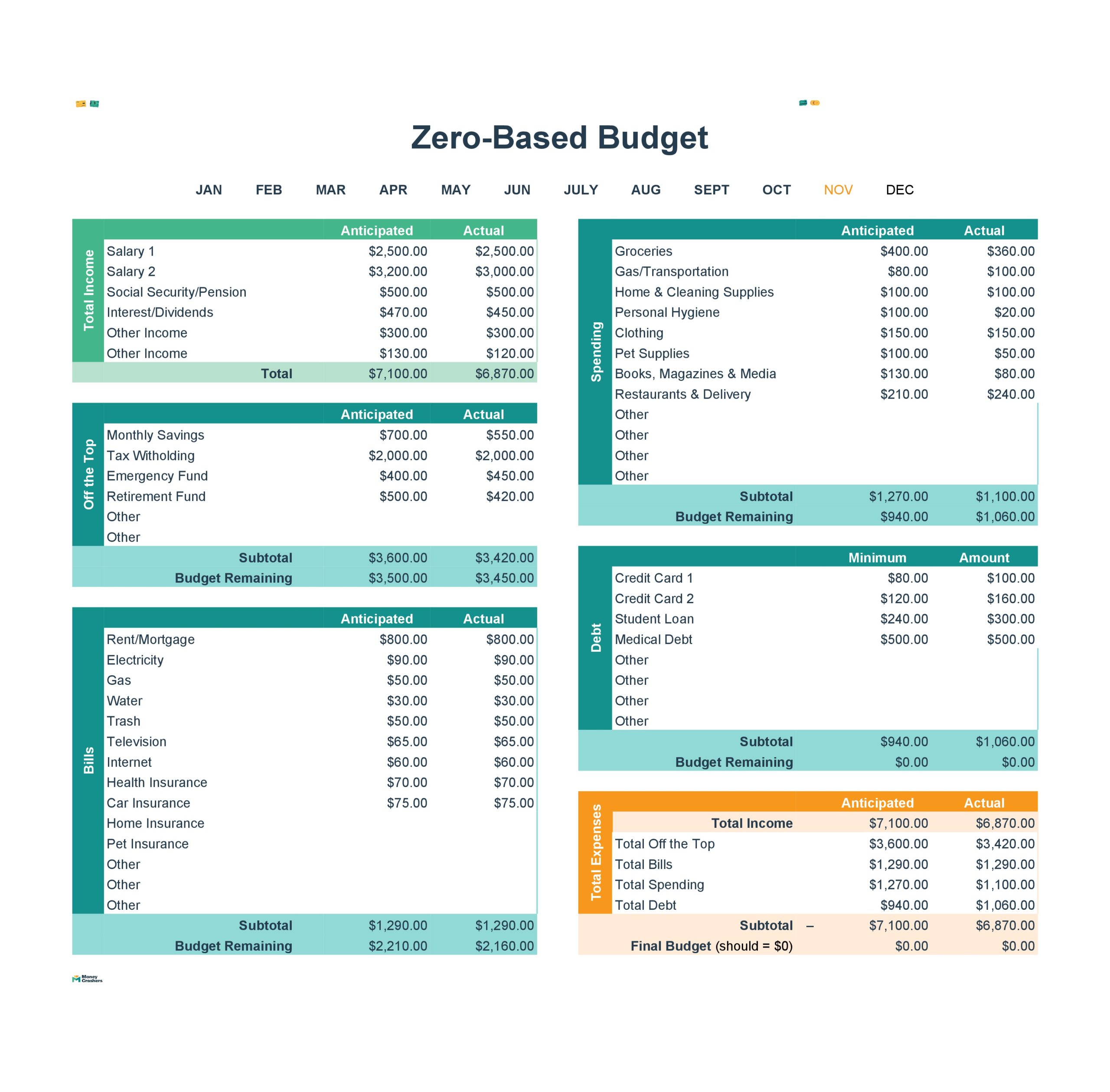

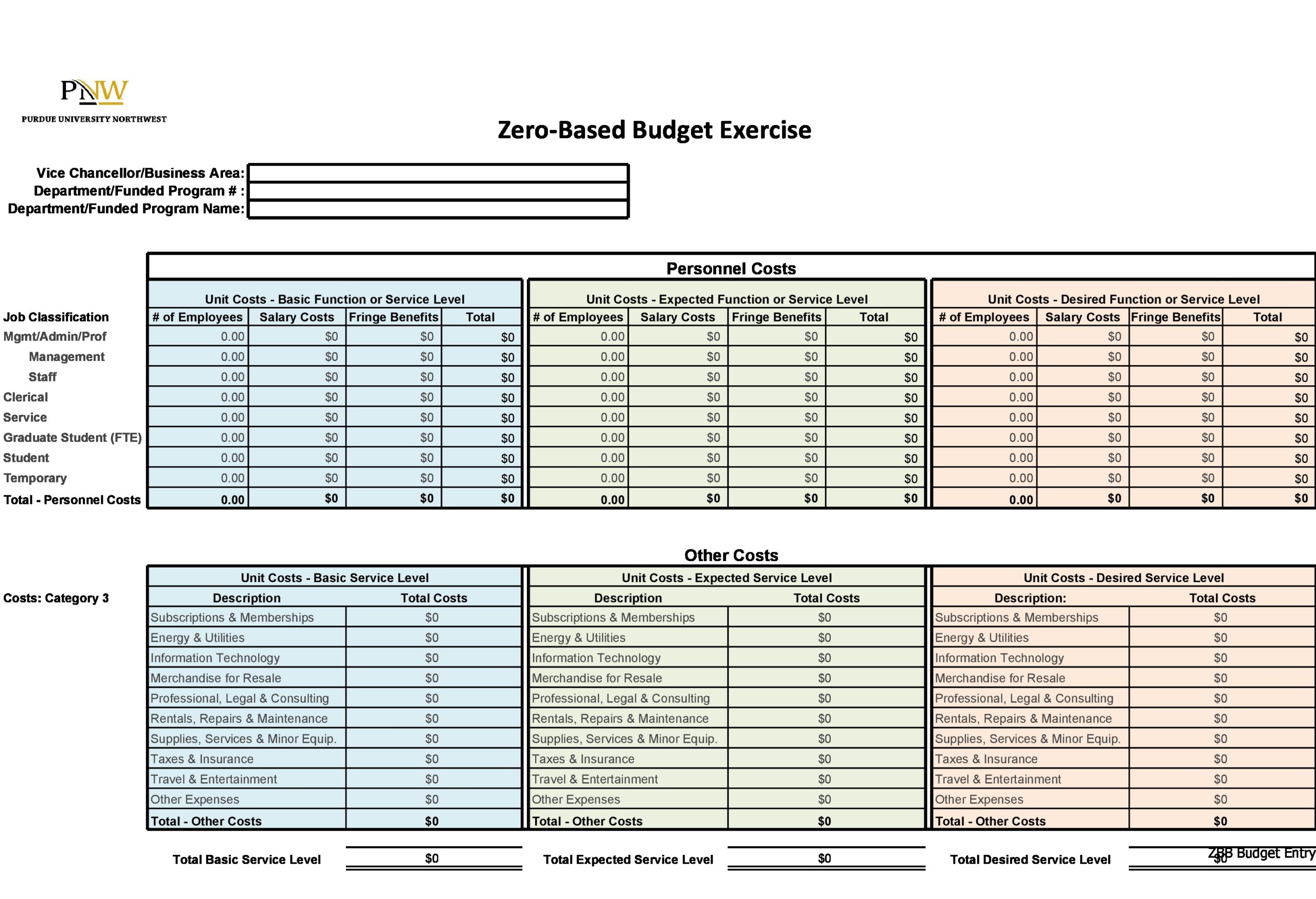

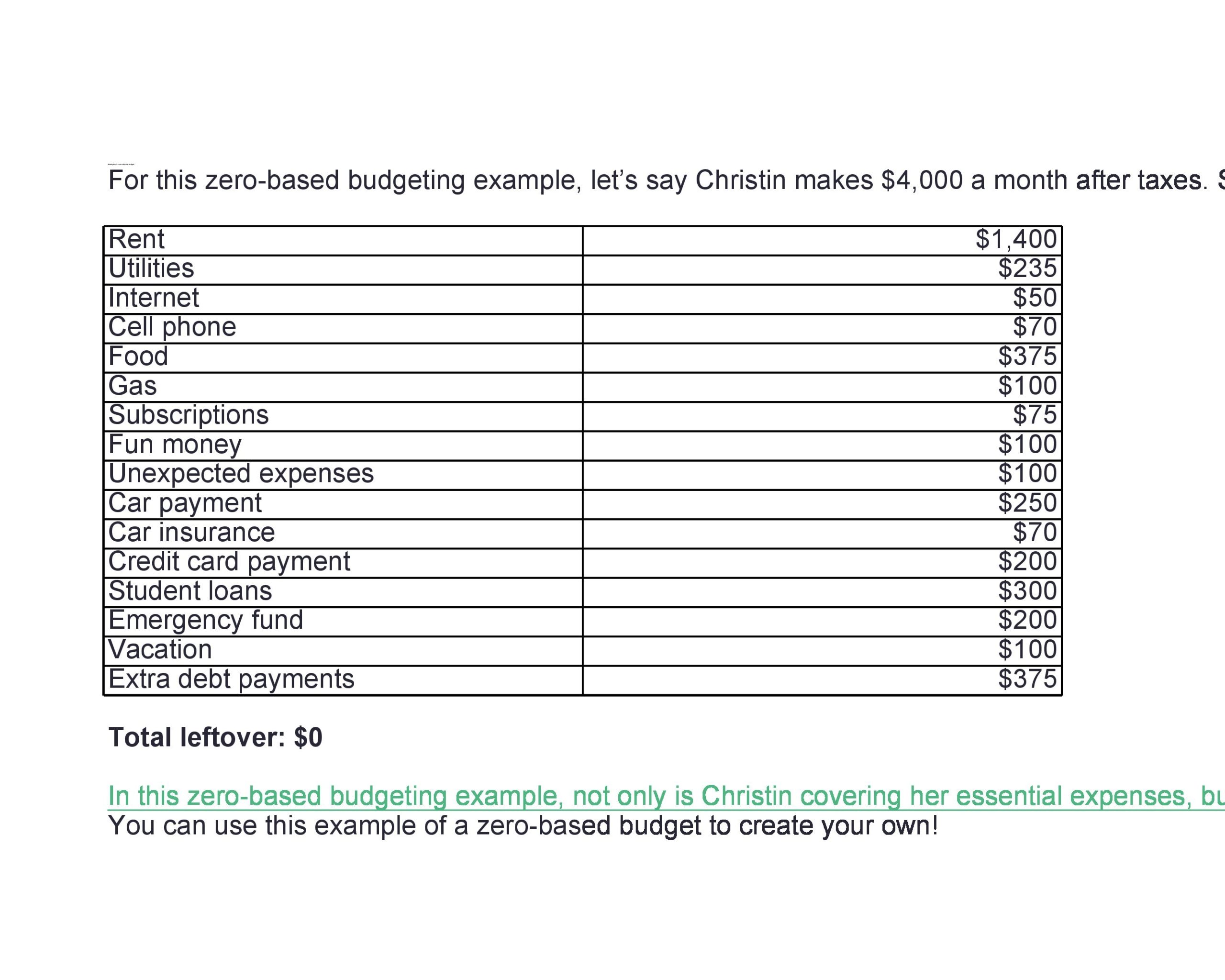

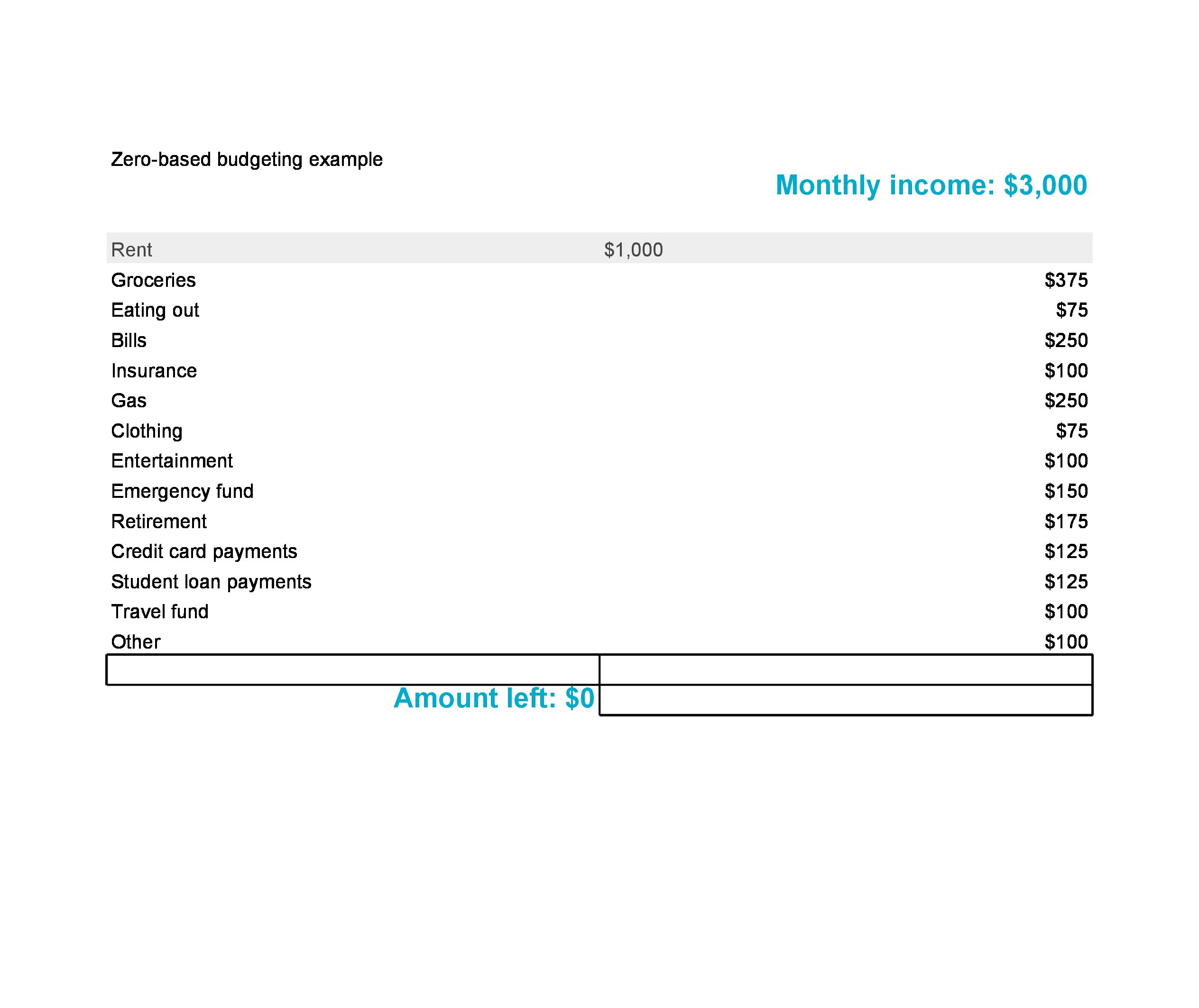

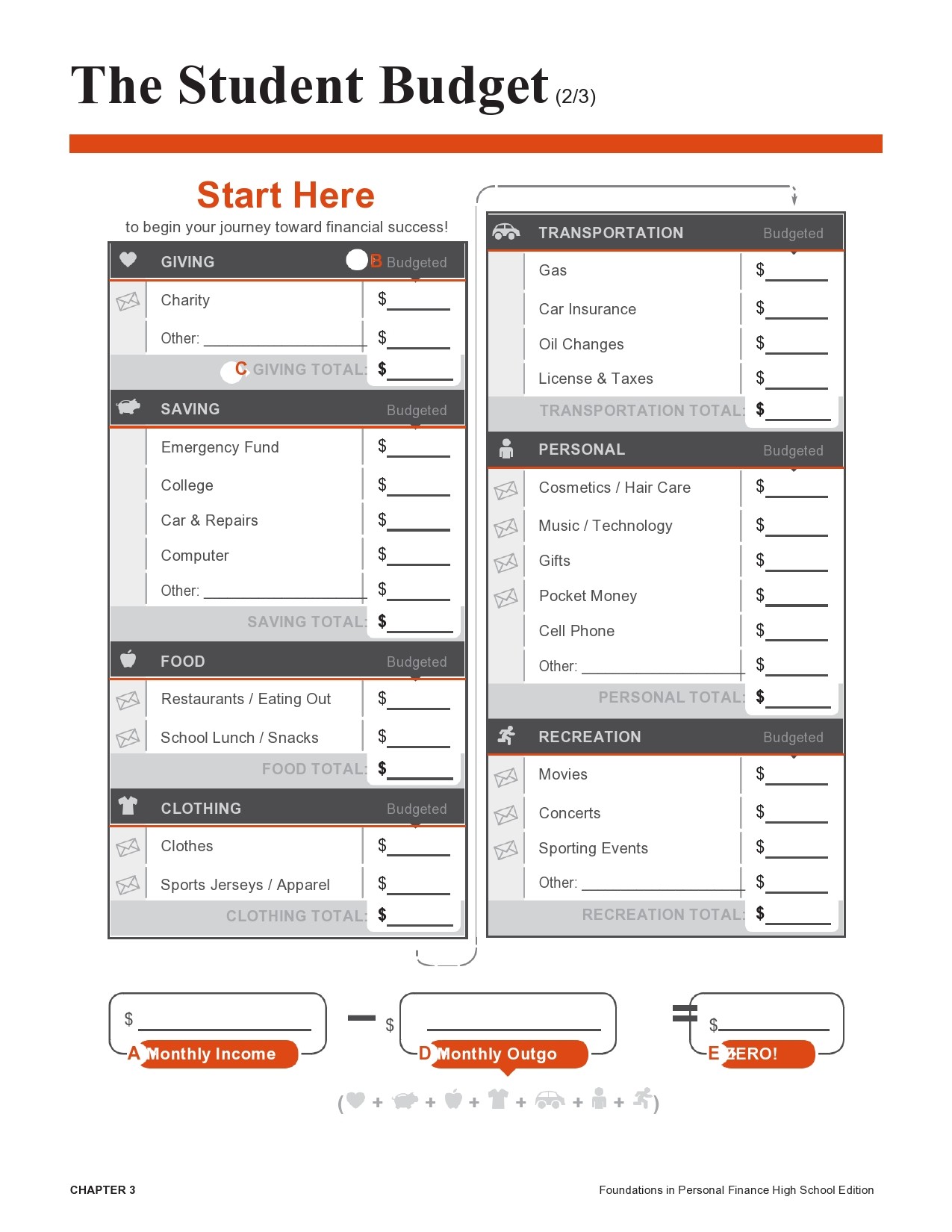

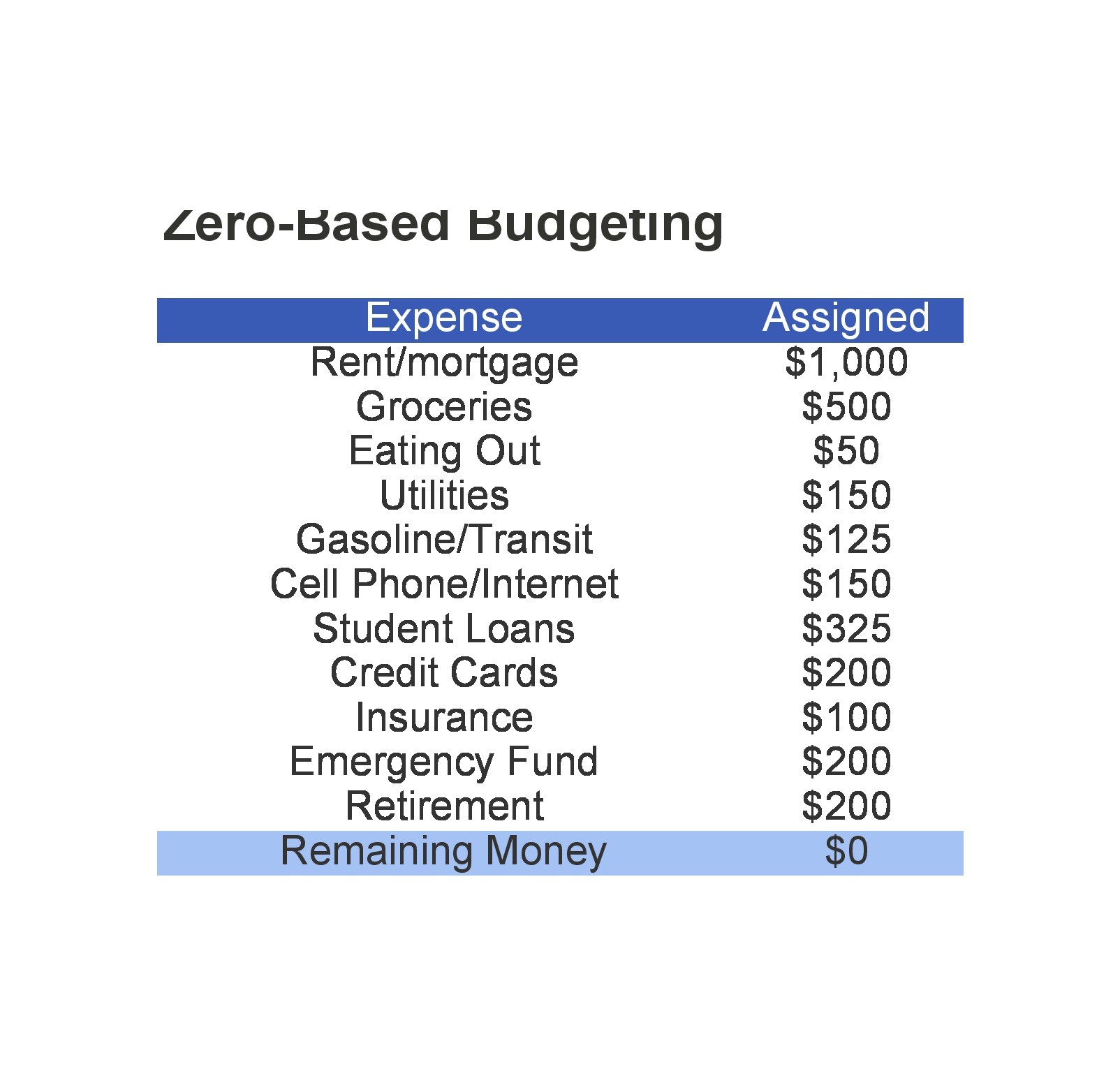

Zero-Based Budgeting Examples

Pros and cons of this budgeting method

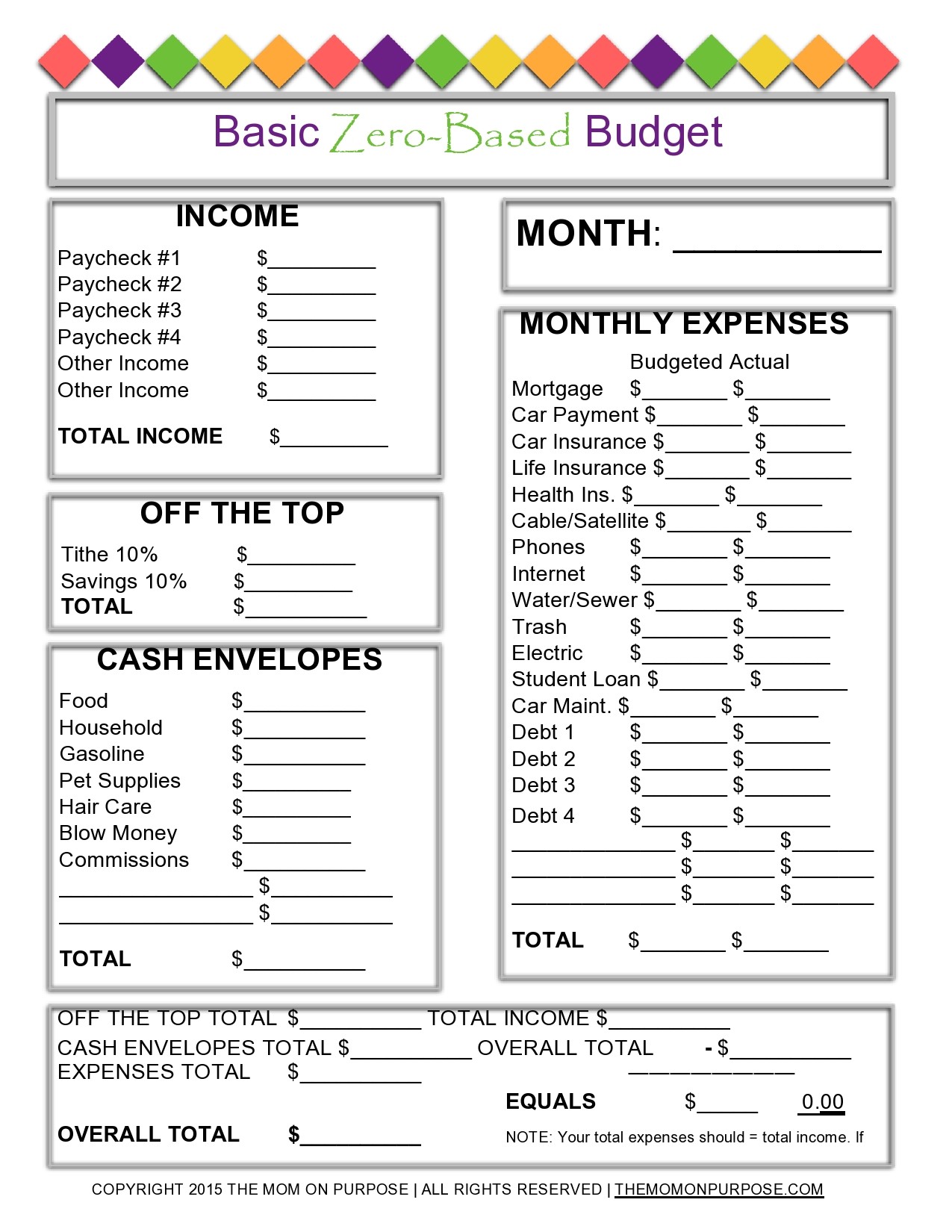

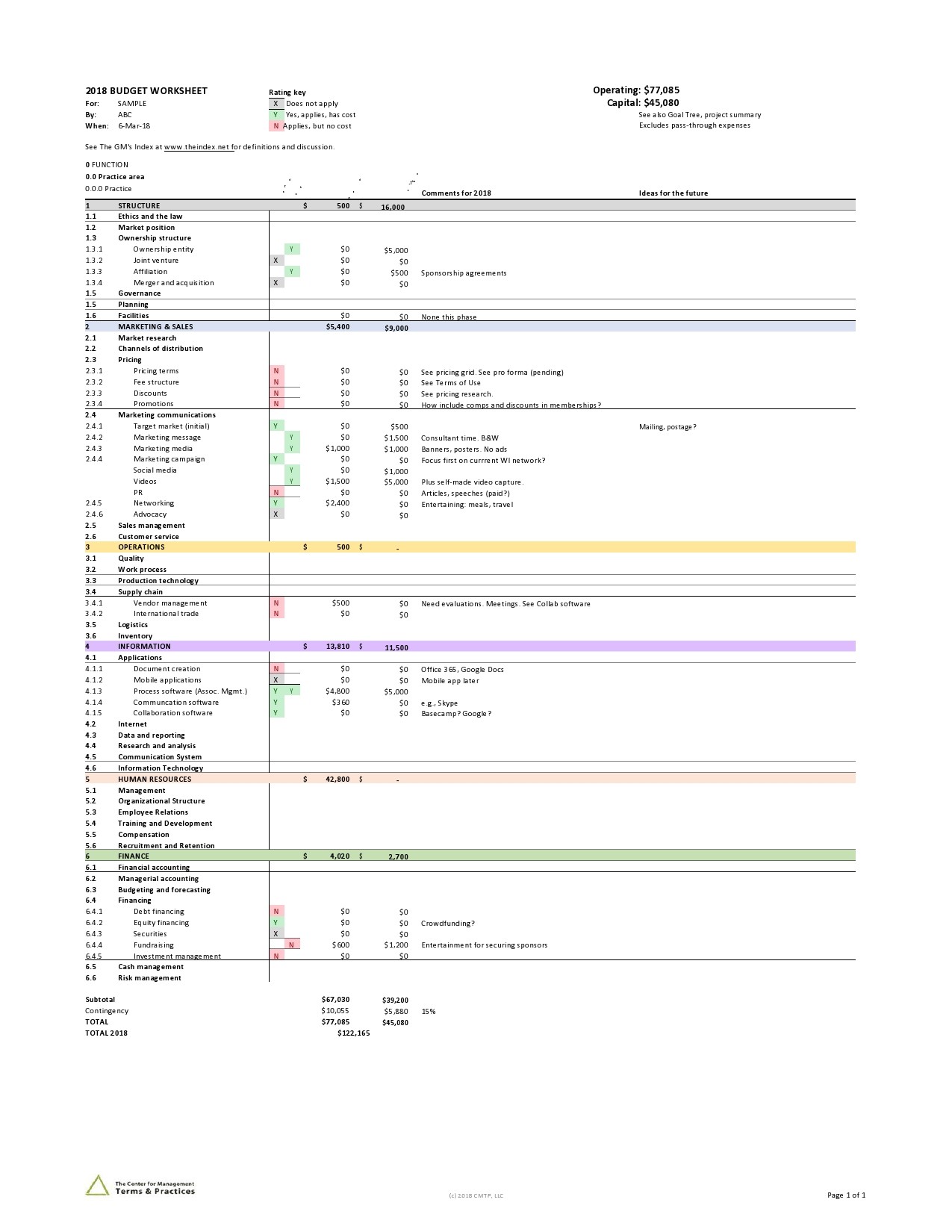

The zero budget plan or ZBB is a budgeting process that focuses on the allocation of funding based on program necessity and efficiency, instead of your budget history. Compared with traditional budgeting, you won’t add any items automatically included in your new budget. You need to review each expenditure and program at the start of each budget cycle and justify each item before you receive any funding. Here are the pros and cons of this budgeting method:

Pros

- You will have a well-justified budget that’s aligned with your strategy.

- It allows for better collaboration across your organization.

- It supports the reduction of cost since it avoids automatic budget increases, which can lead to savings.

- It enhances operational efficiency through rigorously challenging assumptions.

Cons

- It’s quite time-consuming and complex because you have to build your budget from scratch.

- It could be cost-prohibitive if your organization has limited funding.

- It could pose some risks if you aren’t certain of potential savings.

- It requires specialized personnel or training to accomplish.

- It could cause disruptions to the operations of your organization.

- It might have a negative effect on your organizational brand or culture.

How do you create a zero-based budget?

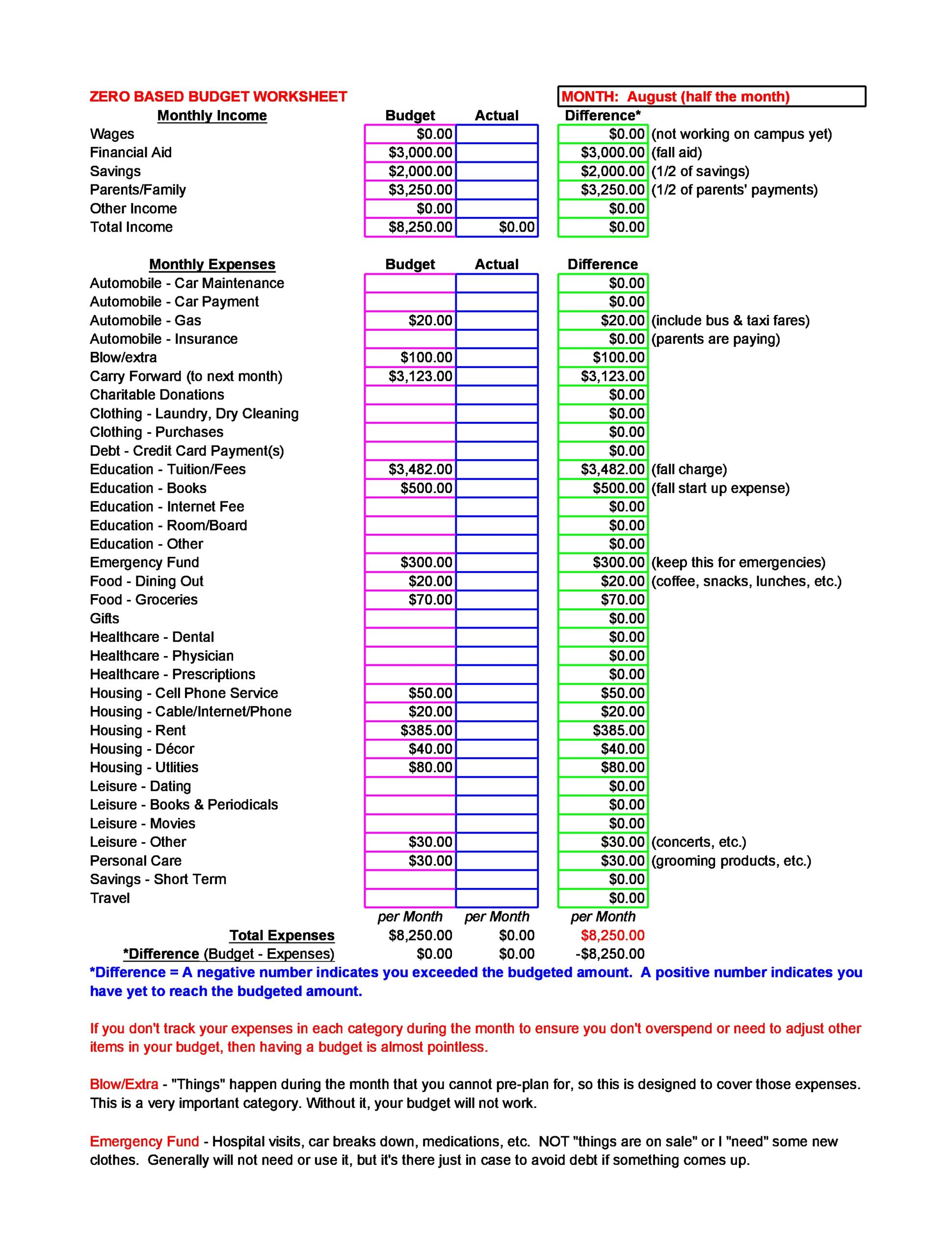

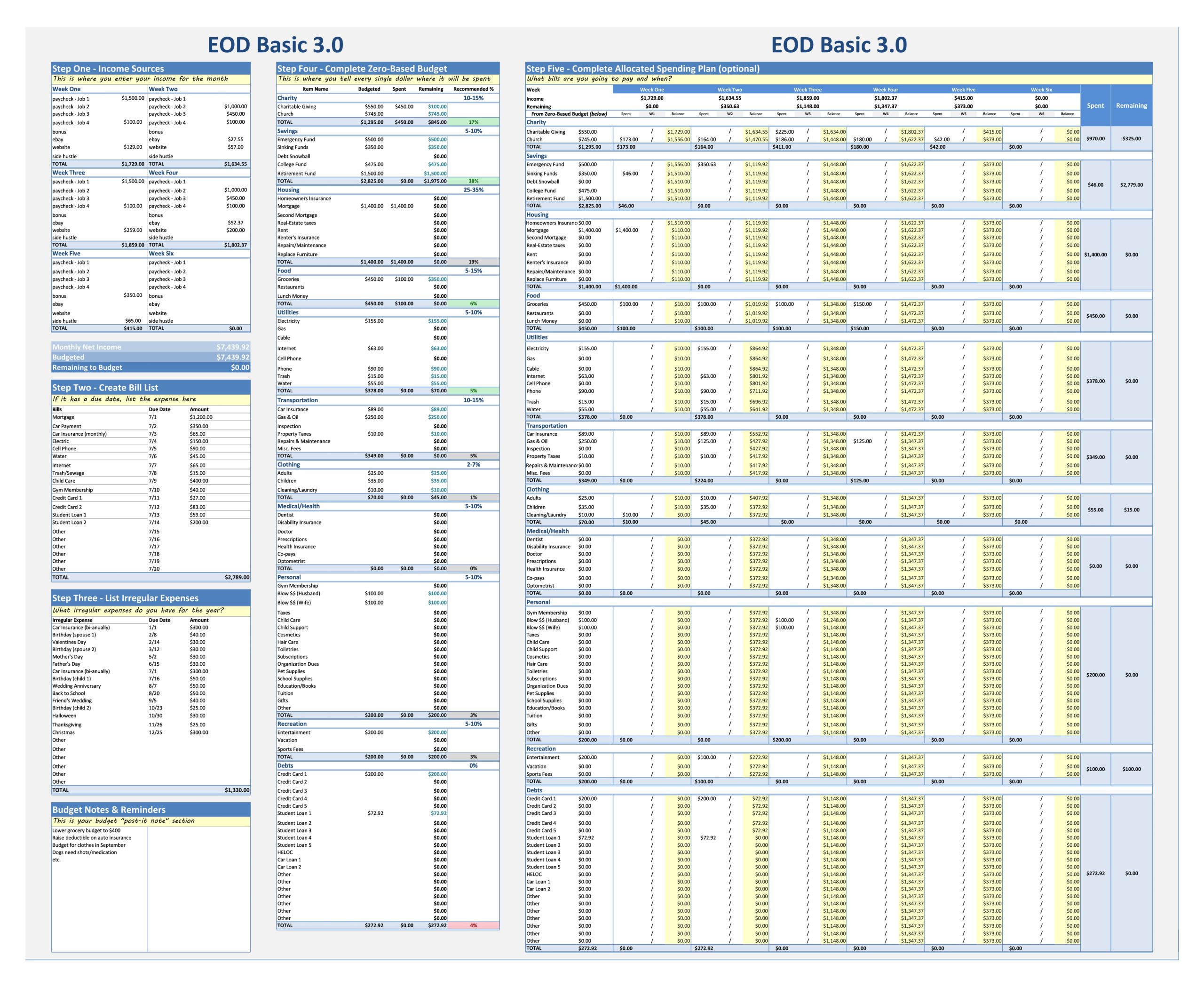

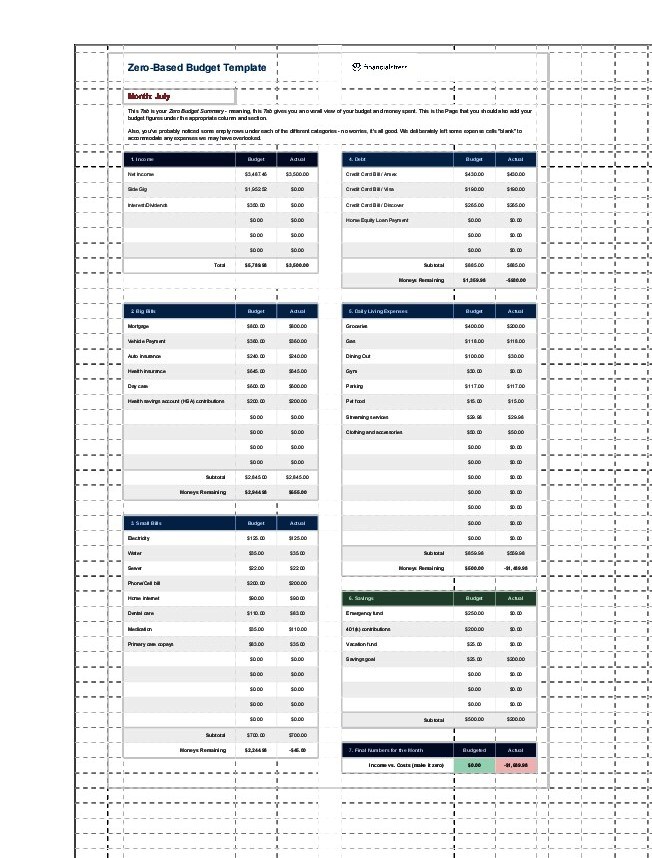

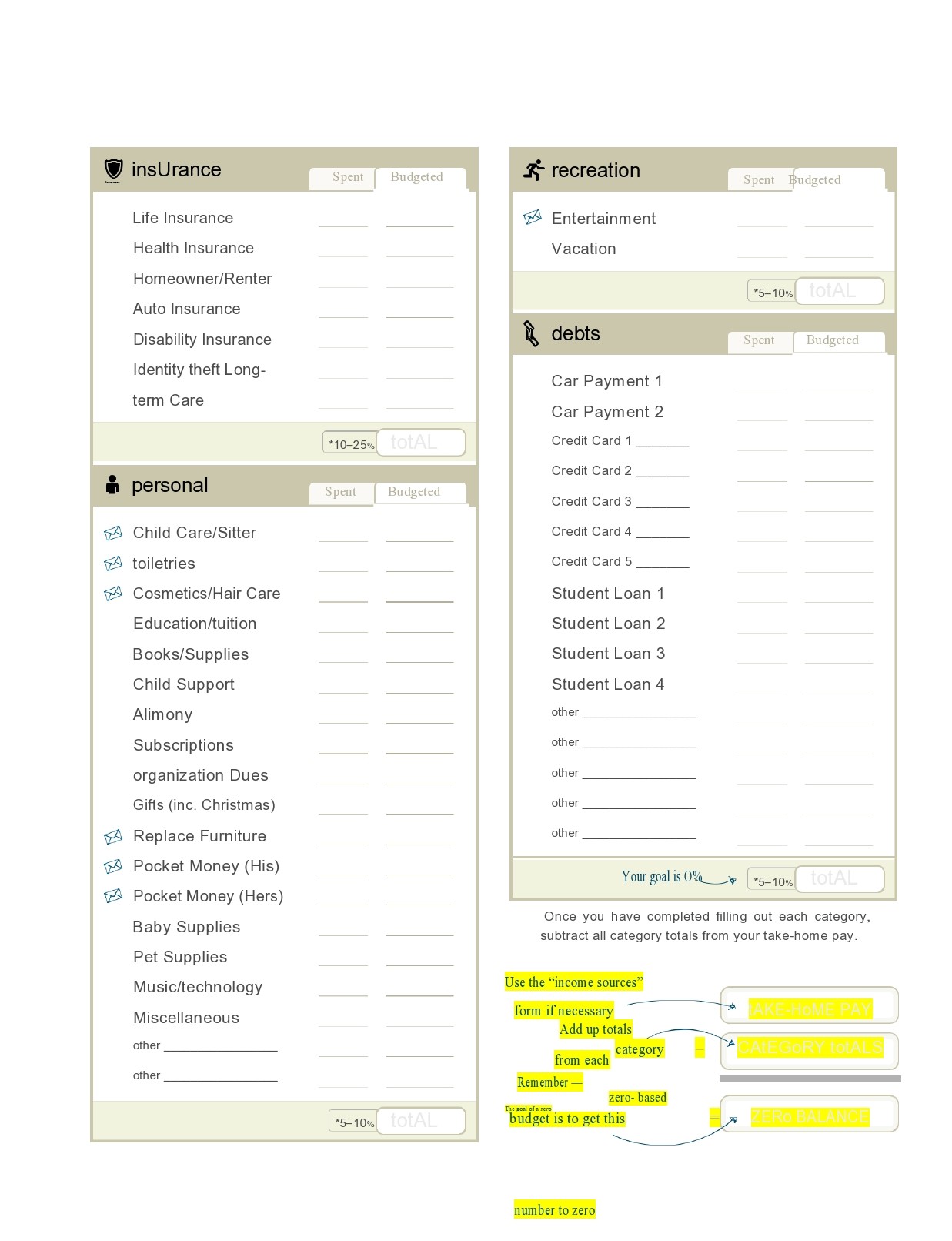

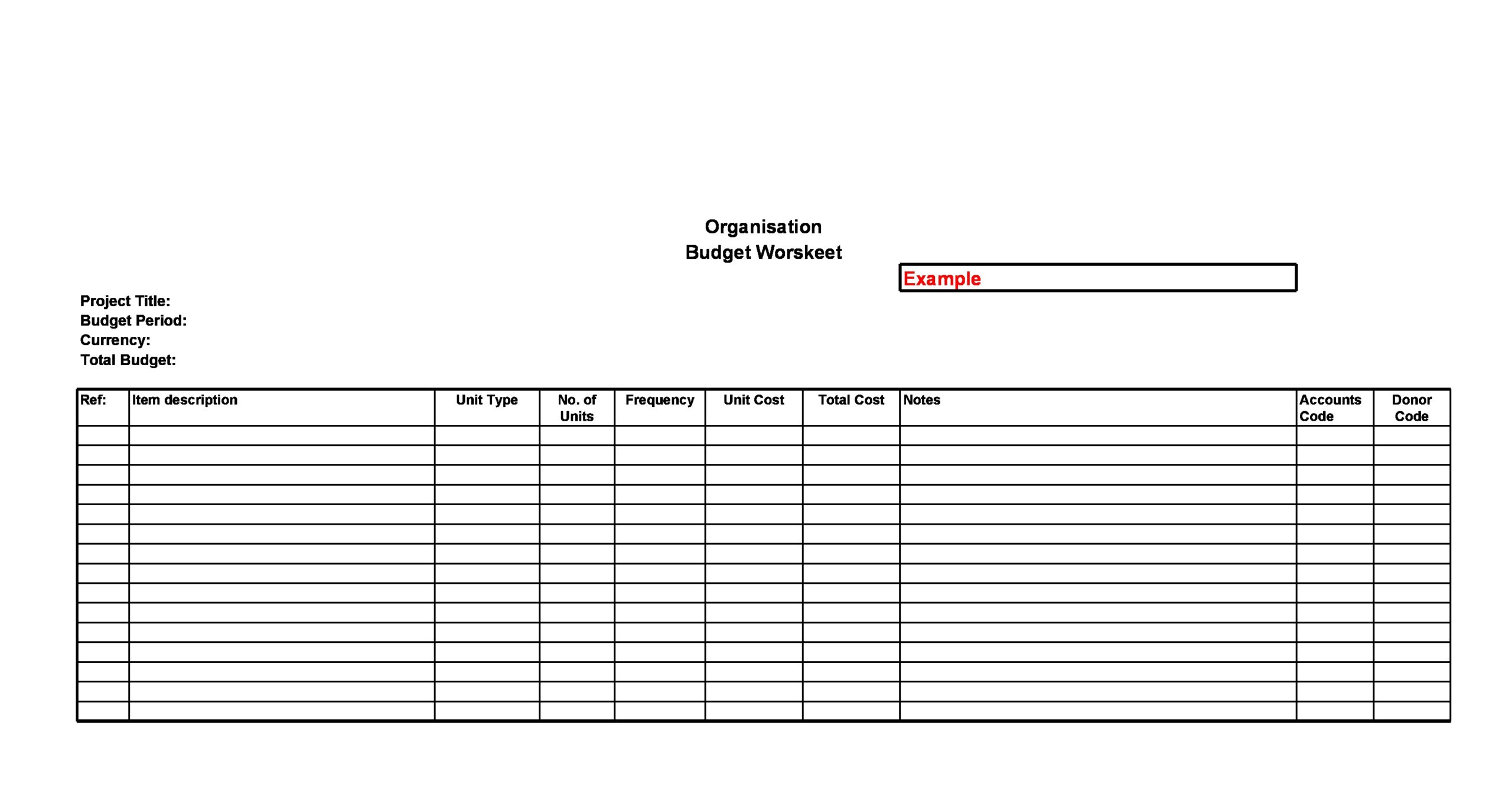

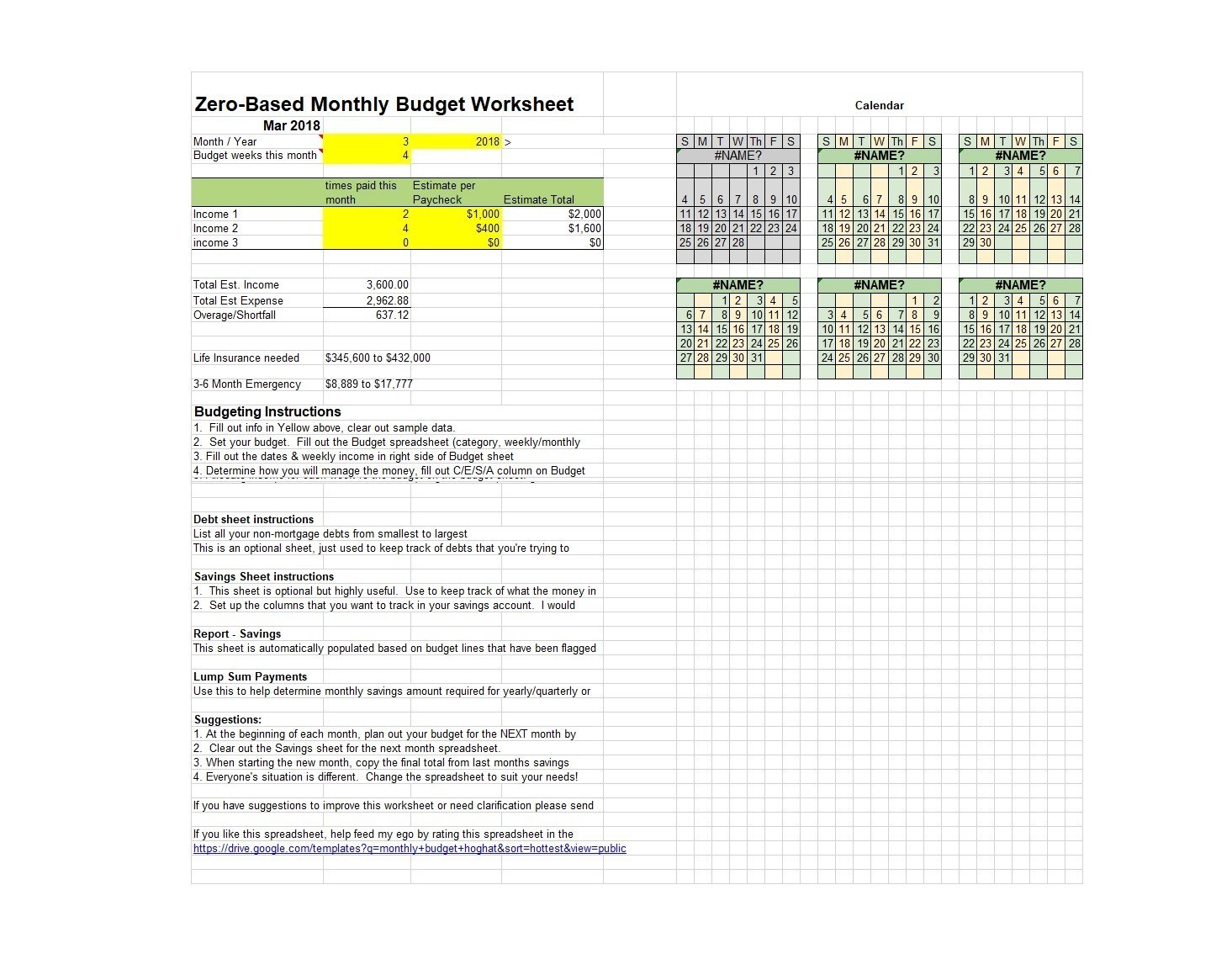

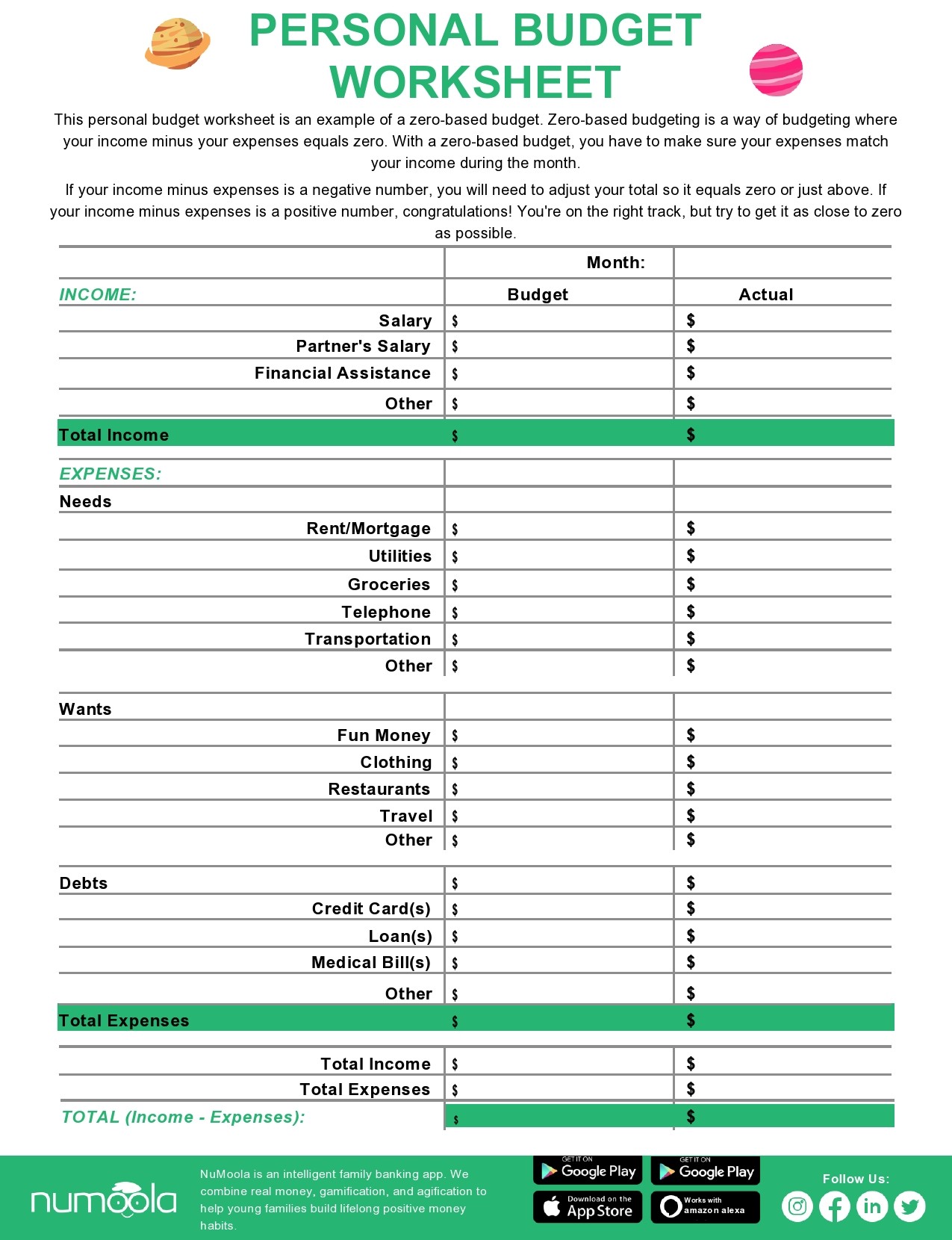

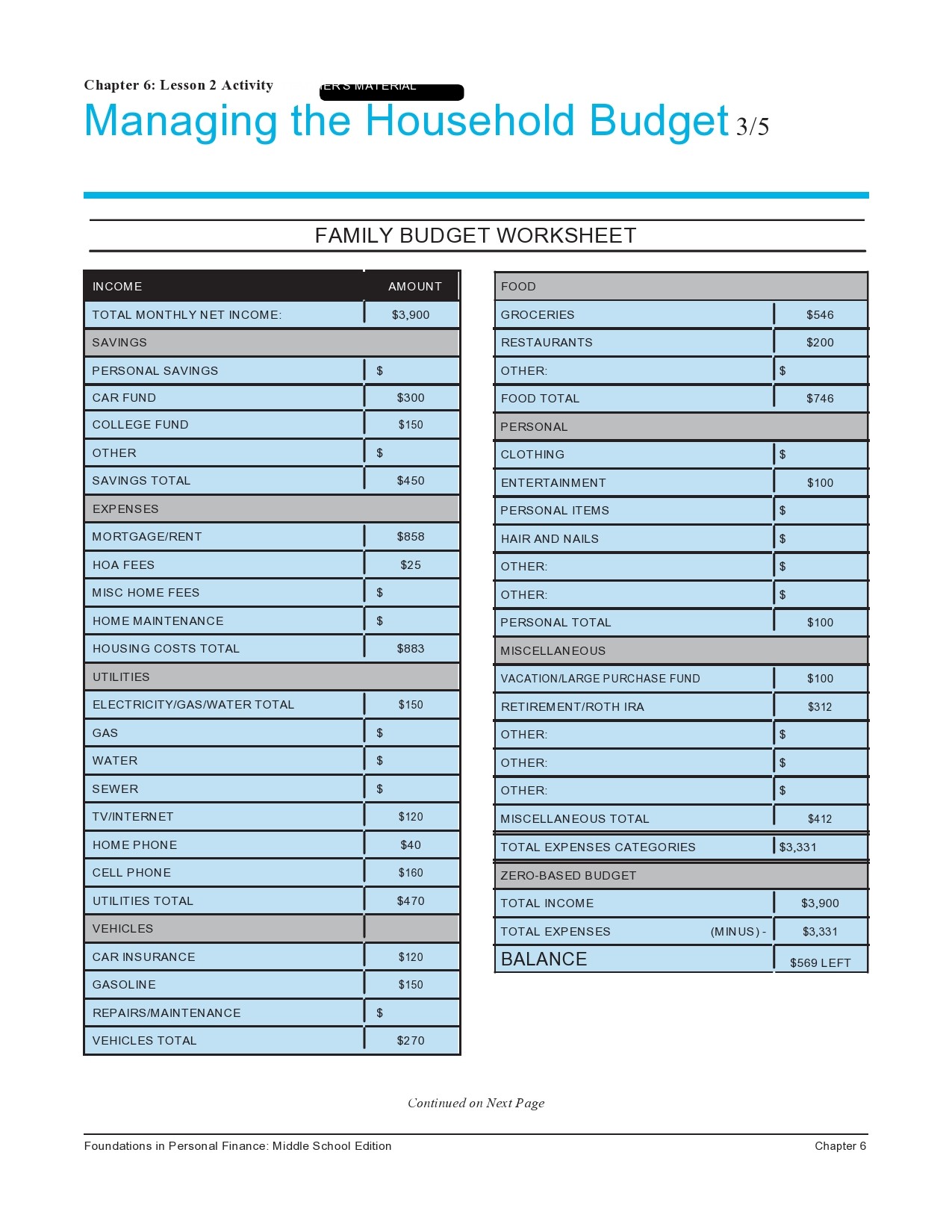

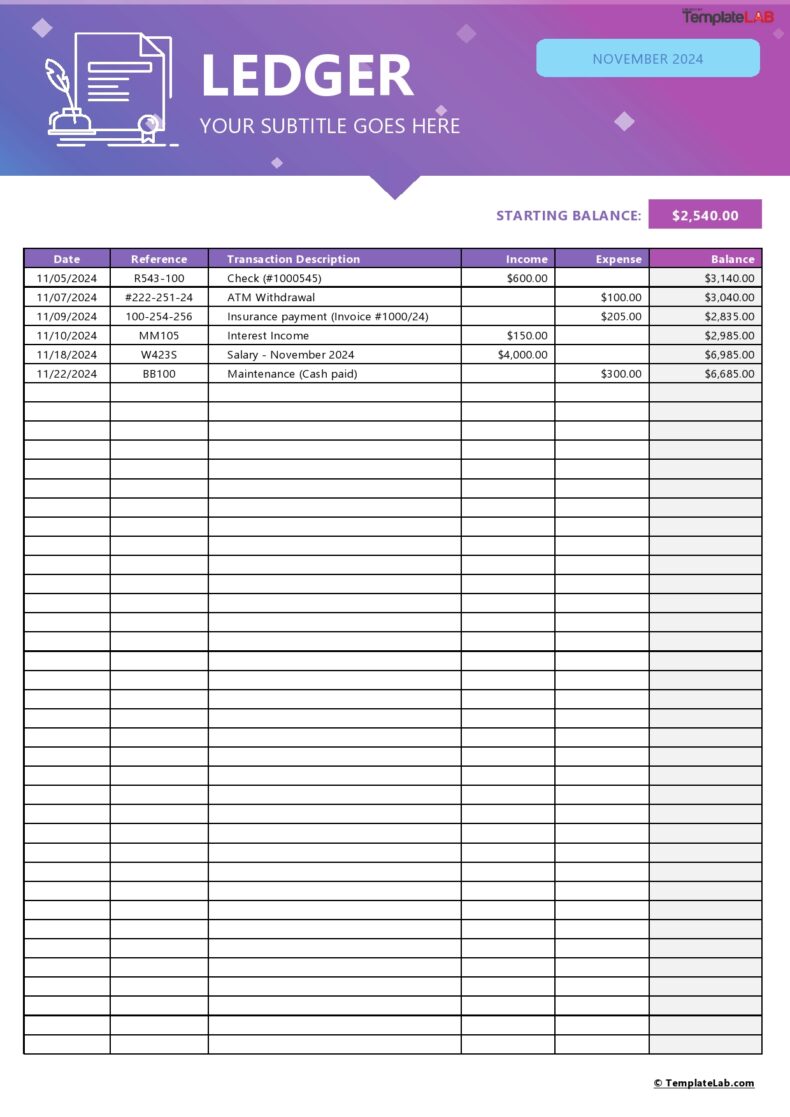

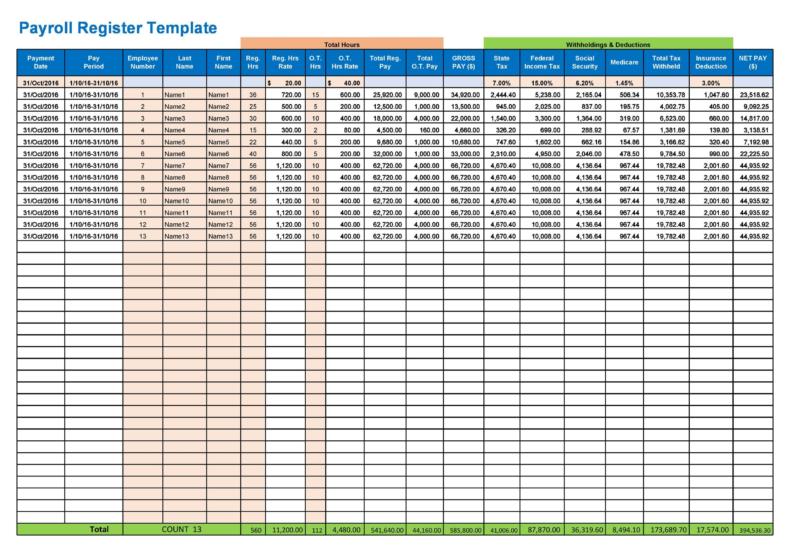

Before you can start with your ZBB or work on a zero based budget worksheet, you first need to gather your financial documents. You will need these if you encounter any uncertainty in terms of how much you normally spend or make. You should also check out your budget averages and percentages. After doing these, follow the simple steps:

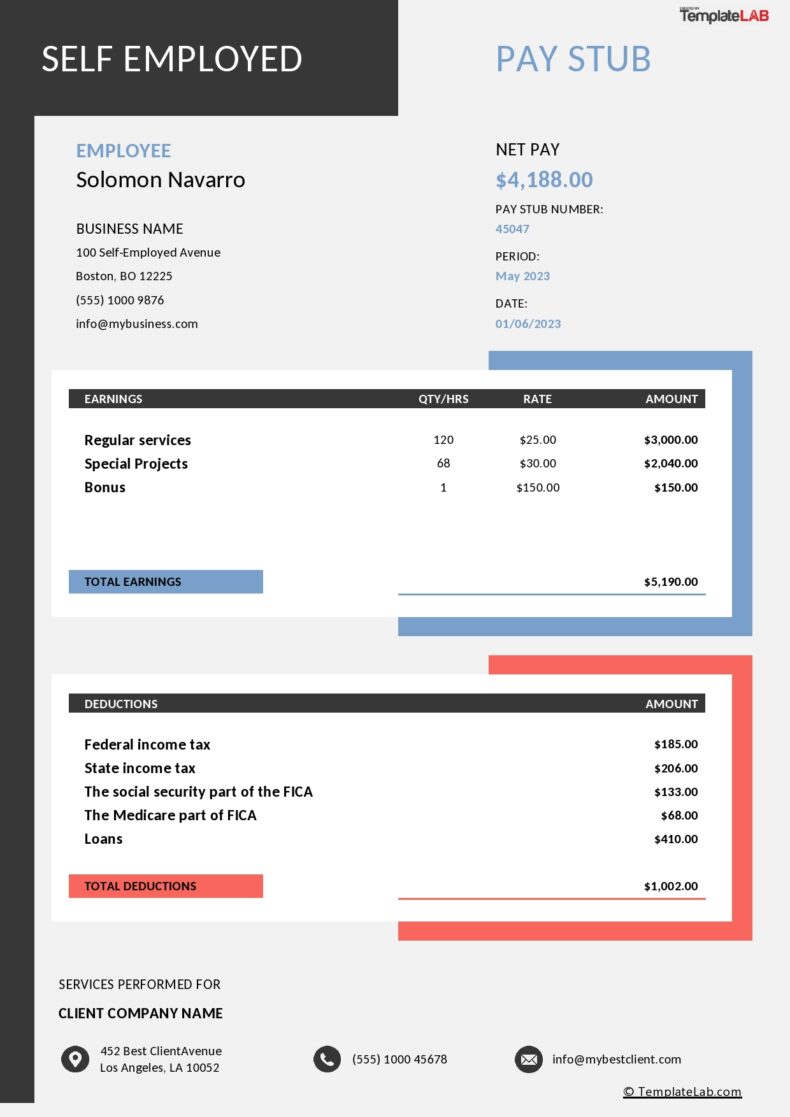

- Write down your monthly income

You can do this either by using a sheet of paper and a pen or you can use a budgeting app. Income refers to your regular paychecks and anything extra that you bring every month. Write all of these down and add the values to get your total monthly income. The value you get is what you will work with for the month.

- Write down all of your expenses

After calculating your income, it’s time to list what you spend. Think of all the things you spend money on every month. List all of your expenses according to categories:

- Savings would depend on your “Baby Step.” More on this later.

- Essentials including your basic bills like utilities, food, transportation, and shelter.

- Other essentials, including your debts, insurance, childcare, and more.

- Extras including vacation money, entertainment, restaurants, and more.

- Month-specific expenses like any celebrations, holidays, other regular expenses due each month.

It’s also a good idea to set aside an emergency category so that you will have an extra cushion for your spending. If anything unexpected occurs, it won’t pose a problem as you would have included it in your budget.

- Subtract the value of your expenses from the value of your income to equal zero

Make sure that when you subtract all of your expenses from your income, you should end up with a value equal to zero. If you don’t get this value, it means that you are like most people. That’s okay since most people don’t get this process right the first time. You just need to know how to fix this.

If you have any left-over money, you can put this to work by adding it to your Baby Step. The “7 Baby Steps” is a system that you can use as a guide when you want to save money, pay off your debts, and increase your wealth. It involves 7 money goals that will help you achieve your financial goals in the future.

Now, analyze the mathematical aspect of the ZBB. For instance, you subtract your planned expenses and end up with a negative value. This means that you are currently spending more than you earn, which isn’t a good thing.

But this shouldn’t be a reason to worry right away as you can still get that value up to zero. To achieve this, you need to reduce your planned spending amounts where you can. In other words, you need to cut your spending. You can also increase your income by starting a side job like selling your stuff or a second job where you can earn money regularly.

- Keep track of all your expenses

It’s not enough to set up your budget and leave it. This will get you nowhere with your money. You have to engage yourself in keeping track of all of your transactions each month. You must enter any money that comes in or goes out into your budget. For instance, you make $200 in your side hustle.

Add this to your income. When you pay rent, subtract that expense from your housing. When you fill up your gas tank, subtract that from your gas budget under the transportation category. Do this to stay on top of your spending and avoid overspending.

- Create a new budget before the next month starts

You can expect that your budget won’t change too much each month but it might still change because of varying circumstances. To deal with this, you can come up with a new ZBB every month. This is where you would pay attention to the month-specific expenses. It is also a good idea to create your ZBB before the month starts to prepare yourself for what’s coming your way.

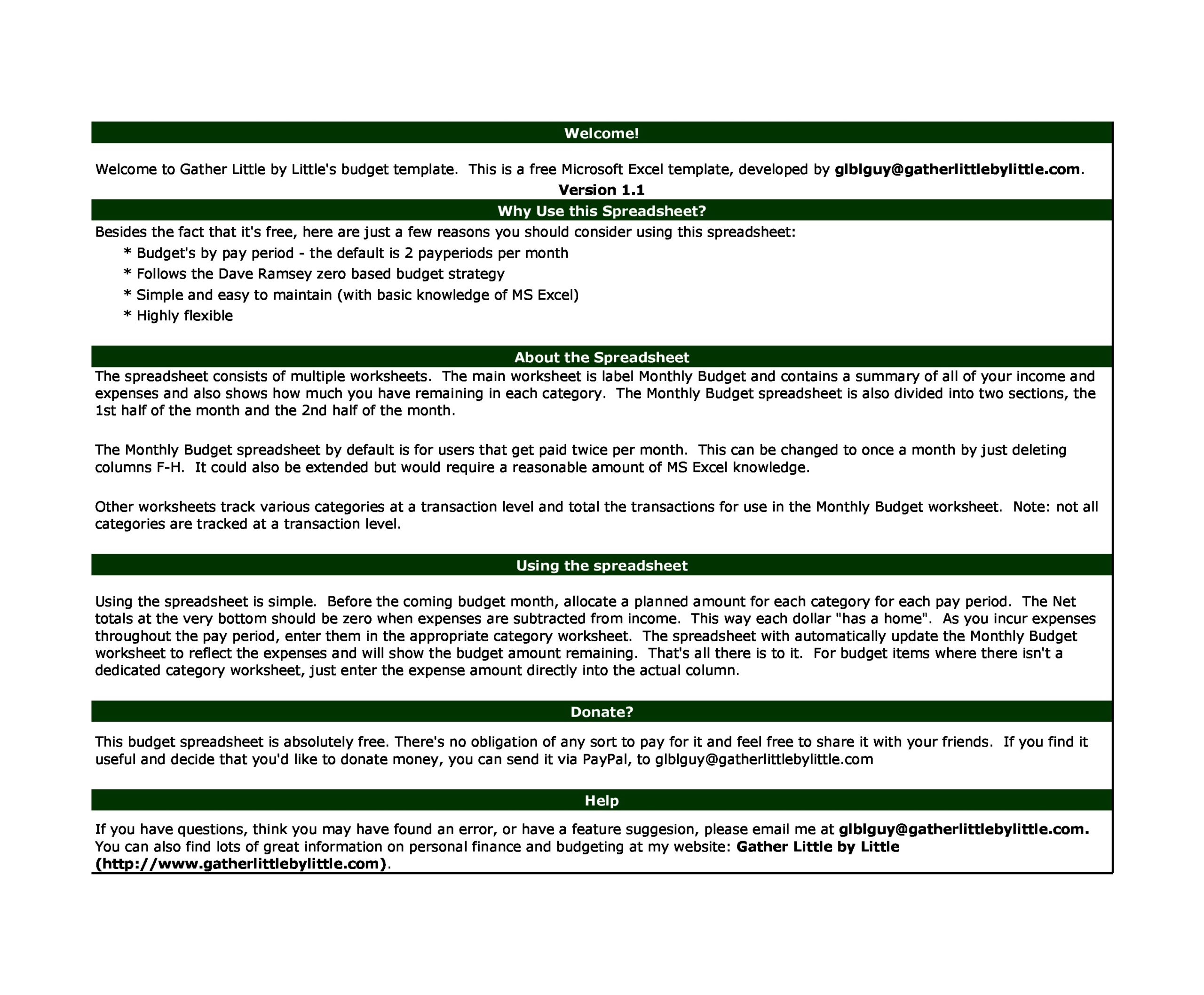

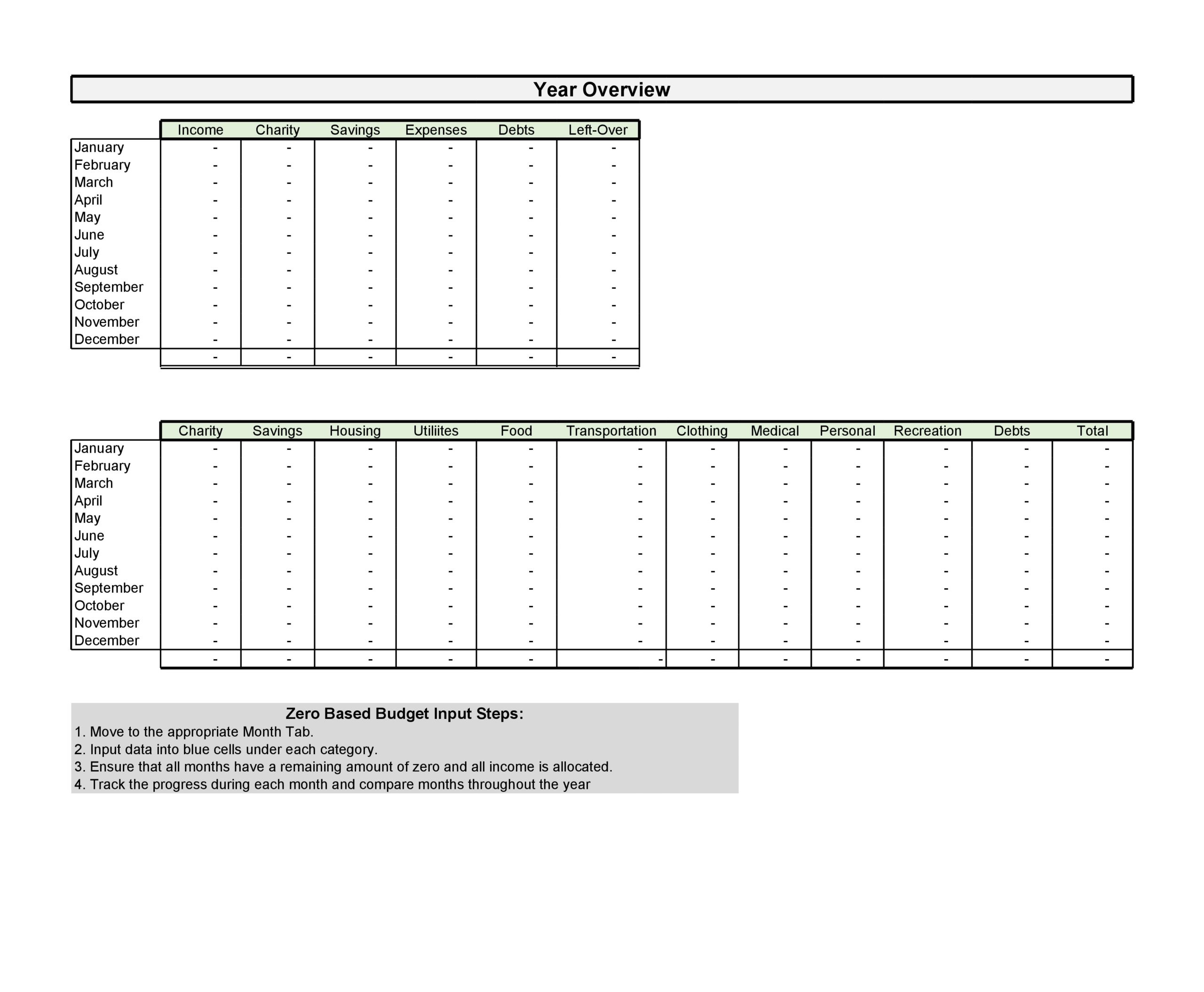

Zero-Budget Plans

After budgeting

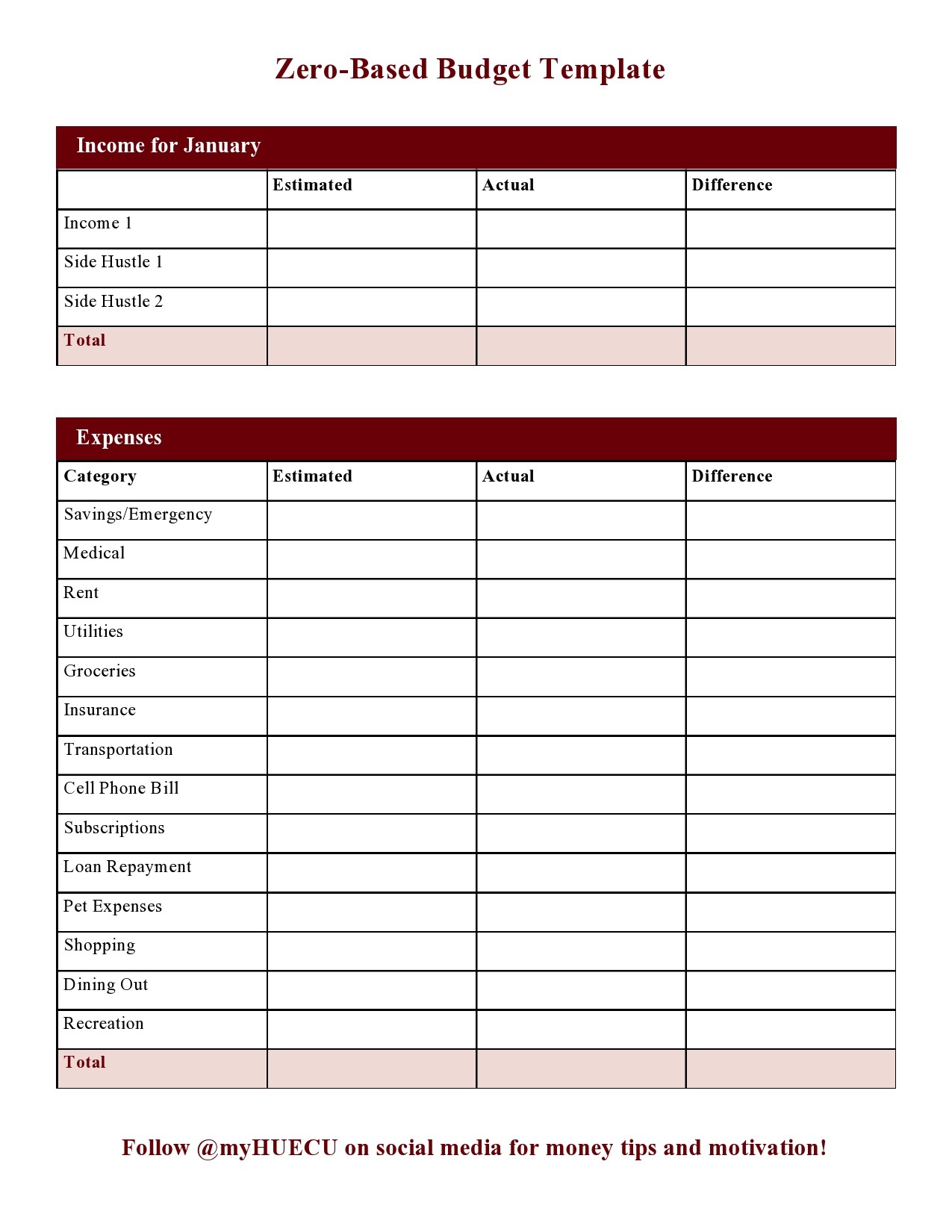

People who have difficulties paying off their debts, those who want to save more for their retirement, or have other financial goals should try using the Zero-Based Budget approach. By following this method, you will gain control over your situation as you will have options that could be better opportunities for you.

The ZBB works especially well if you want to control variable expenses like vacations or groceries because you need to plan and think about what you will spend in those categories. After completing the budget, you need to:

- Assess your spending habits. You have to think about where you always spend your money. It may come as a surprise to you how much you spend on dining out or ordering takeout instead of cooking when you can save so much by eating at home. Evaluate your needs, wants, goals, and how you can use your resources in the best possible way. When your expenses are significantly higher than your income, you need to make decisions because this situation isn’t sustainable for your future.

- Categorize your expenses and learn how to prioritize. After finishing the evaluation of your spending patterns and income, you can create new budget categories and calculate how much of your income you will allocate to each of the categories. Remember that you aren’t done with your budget until you have designated a purpose for every dollar you earn.