Table of Contents

SAP Asset Accounting Overview

The Asset Accounting component is used for managing and supervising fixed assets with the SAP System. In Financial Accounting, it serves as a subsidiary ledger to the General Ledger, providing detailed information on transactions involving fixed assets. Asset Accounting will be covered in this tutorial in below steps

| Description | Topics covered |

| Organization Structure | Check Country Specific Settings |

| Copy Reference Chart of Depreciation | |

| Create 0% tax codes for Sales and Purchases | |

| Assign Input Tax indicator for Non-Taxable Asset Acquisitions | |

| Assign Chart of Depreciation to Company codes | |

| Structuring Fixed Assets | Create Asset Class |

| Create Account Determination key | |

| Create Screen layout | |

| Define Number range interval | |

| Define Screen Layout for Asset Master | |

| Assign Screen layout Rule to the Asset Class | |

| Depreciation Areas | Real Depreciation area |

| Derived Depreciation area | |

| Define Depreciation areas | |

| Specify Depreciation area types | |

| Specify Transfer of APC values | |

| Activate depreciation areas that will be used in asset class | |

| Define Screen layout for Depreciation areas | |

| Assign Screen layout to Depreciation Areas | |

| Integration | Create GL accounts |

| Assign GL Accounts to Account Determination key | |

| Specify Posting key for asset posting | |

| Specify Document type to post depreciation | |

| Activate Account Assignment | |

| Specify Controlling Object (WBS, CC, IO) for APC and Dep | |

| Specify Memo Value | |

| Specify Memo Value not considered for an ASSET Class | |

| Depreciation | Depreciation Overview |

| Define Multilevel Depreciation method | |

| Define Period Control Depreciation Method | |

| Maintain Depreciation Key | |

| End Users Transactions | Main Asset creation |

| Sub asset creation | |

| Post Purchase to main assets | |

| Post Purchase to Sub assets | |

| Asset Explorer | |

| Reports to view assets | |

| Monthly Depreciation run | |

| Asset Under Construction | Define Settlement Profile |

| Assign Settlement profile to company code | |

| Create Number range for settlement document | |

| Create AuC Asset Master | |

| Post purchases to AuC | |

| Line Item settlement from AuC to Main Asset | |

| Asset Retirement with Revenue | Create Asset Master Record |

| Post External Acquisition to AMR | |

| Verify in Asset Explorer | |

| Run Planned Depreciation | |

| Retire Asset with Revenue-Customer | |

| Asset Scrap | Create Asset Master Record |

| Post External Acquisition to AMR | |

| Verify in Asset Explorer | |

| Run Planned Depreciation | |

| Asset Scrap | |

| Intra Company Asset Transfer | Create Asset Master Record |

| Post External Acquisition to AMR | |

| Verify in Asset Explorer | |

| Run Planned Depreciation | |

| Intra company transfer asset- Change Asset Class | |

| Asset Accounting Yr .End Closing | Execute Depreciation run |

| Execute Periodic Asset posting | |

| Execute Fiscal Year Change | |

| Asset Accounting Year End close |

For detailed, step-by-step instructions on SAP Asset Accounting business process, configuration and development follow along with my video tutorial below

Organization Structure

Check Country Specific Settings

Transaction code: OA08

- Max LVA: If you set a maximum amount for low value assets, this prevents postings of amount greater than specified here to Asset class LVA

- Post Net Book Value: Set this indicator, if you do not want the system to create a gain/loss posting for an asset retirement by sale, or if you do not want a loss posting when the asset is scrapped. Instead, the system then generates a posting in the amount of the net book value of the given asset. This indicator applies only to depreciation area 01.

Copy Reference Chart of Depreciation

Chart of Depreciation

- The chart of depreciation, therefore, is a directory of depreciation areas organized according to business management requirements. Asset Accounting component enables you to manage values for assets in parallel in up to 99 depreciation areas

- Specify description of Chart of Deprecation

- Delete unwanted Depreciation Areas

- One or more company codes can be assigned to a Chart of Depreciation

Tcode: EC08

Path: SPRO – Financial Accounting – Asset Accounting – Organizational Structures– Copy Reference Chart of Depreciation

| Reference COD | Copied COD | Company Codes |

| 0US | MK14 | MK14 |

Create 0% tax codes for Sales and Purchases

Transaction Code: FTXP

Create 0% input tax code: V0

Create 0% Output Tax Code: AO

Assign Input Tax indicator for Non-Taxable Asset Acquisitions

Tcode: OBCL

Assign Chart of Depreciation to Company codes

Tcode: OAOB

Path: SPRO – Financial Accounting – Asset Accounting – Organizational Structures – Assign Chart of Depreciation to Company code

Structuring Fixed Asset

Asset can be structured at below levels:

- Balance Sheet Level: Assets here can be grouped as per B/S version, Balance sheet items, GL accounts

- Classification Level: Assets are structured using asset classes

- Asset-Related Level: Asset can be structured based on Group asset, Main Asset and sub asset

Asset Class Configuration in SAP

- Asset class is a classification criterion for Assets. E.g. Plant, Building, machinery, Software Internally developed

- The asset class provides default values to all asset master records in the class.

- The screen layout, tab layout and the field characteristics (required/optional/suppressed) of the asset master record can be set for the asset class.

- The assignment of asset numbers can also be controlled by the asset class.

- To create Asset Class following must be first configured:

- Account Determination Keys

- Screen Layout Rule

- Number Range Interval

Transaction code to create asset class: OAOA

Create Below Asset classes in SAP

| Asset Class | Description | Acct Determination | Screen Layout | No. Range | Inventory |

| LANDMK14 | Land | 61000 | 1000 | 01 | X |

| BU_MK14 | Building | 62000 | 1100 | 02 | X |

| PM_MK14 | Plant and Machinery | 63000 | 2000 | 03 | X |

| FF_MK14 | Furniture and Fixtures | 64000 | 3000 | 04 | X |

| VEH_MK14 | Vehicles | 65000 | 3100 | 05 | X |

| AUC_MK14 | AuC | 66000 | 4000 | 06 | Line Item settlement |

AuC: Asset under Construction. Shown as separate Item in BS. When completed transferred to regular assets through line Item settlement (AIAB). Select Depreciation key which does not provide Depreciation for AuC. Select Negative APC in Depreciation areas to allow credit memo posting during capitalization

Account Determination Key

Asset class establish the connection between the asset master records and the GL account in Financial Accounting through account determination key

Tcode to create account determination key: S_ALR_870009195

Path: SPRO-Financial Accounting- Asset Accounting- Organizational Structures- Asset Classes – Specify account Determination

Create Screen Layout Rule

Tcode: S_ALR_870009209

Whenever you create an asset the system checks first the table ANKP. If you have chart-of-depreciation-dependent account determination, then an entry in the table ANKP is made. If you than make a copy from such an asset class in the asset class there is another account determination than in the table ANKP and the system takes the account determination from the table ANKP and not from the asset class.

Normally you can’t define chart-of-depreciation-dependent assignments (with transaction ANK1) if there is only one chart of depreciation. If you’d like to change (or delete) this assignment you can use following workaround:

SM34 -> View ANKA_ALL -> Maintain

– select asset class ART (for example)

– Then click in the left column on “Chart of dep – dep data”

Define Number Range Interval

Tcode: AS08

Enter company code MK14. Now click Change interval button and enter the below details:

Define Screen Layout for Asset Master (AS01 Screen)

Tcode: S_ALR_87009044

Path: SPRO – Financial Accounting- Asset Accounting – Master Data – Screen Layout – Define Screen Layout for Asset Master Data

Select Screen layout 1000-Land and Select folder ‘Logical field group’

Select field group Posting information. Make ‘Capitalization date’ as required field

Assign Screen layout Rule to the Asset Class

Transaction code: OAOA

Depreciation Areas

- Depreciation areas are used to manage a fixed asset value for multiple purpose. For e.g. asset value as per Income Tax act, Companies act and for management purpose could be different. One of the reasons for this difference could be different depreciation rate under Income tax act and Companies act. Depreciation areas allow us to maintain parallel value of asset for different purposes.

- You need at least 1 depreciation area -01

- Maximum number of Depreciation areas allowed are 99

- Chart of Depreciation is made up of a list of Depreciation areas

Real Depreciation Area

- Denoted by 01

- Also called Book Depreciation

- Automatic Posting to FI Deprecation Accumulations, Asset Acquisition and Depreciation Account in company code currency

- Legacy data is always transferred to this Depreciation Area

Derived Depreciation Area

- This Depreciation area takes values from Real depreciation area. To these values it applies mathematical formula to arrive at Asset value as per derived depreciation area

- Derived depreciation area is denoted by a key (say 32) which should have higher value than the depreciation area ( say 10) from which it derives value

Define Depreciation Areas in Chart of Depreciation

Tcode: OADB

To create new depreciation area, copy and rename an existing Depreciation Area

Specify Depreciation area Type

Transaction code: OADC

Specify Transfer of APC (Acquisition and Production cost) Values

Tcode: OABC

Specify how values are transferred from Real Depreciation Area to Derived Depreciation Area

Depreciation Area. Values transferred from Real Dep area 01 to Derived Depreciation areas

If selected system, ensure that all APC-relevant posting values to this depreciation area are transferred from the transferring depreciation area with no opportunity for changing the values

Activate Depreciation Areas which will be used in an Asset Class

Tcode: OAYZ

SPRO – Financial Accounting – Asset Accounting – Valuation – Determine Depreciation areas in the Asset Class

- Select the Asset Class (LANDMK14)

- Deselect Depreciation Areas Book Depreciation, Cost-accounting

- Assign Layout 2000 to these depreciation and Save

Activate Depreciation areas for asset class AUC_MK14 (AuC) and PM_MK14 (Plant and Machinery)

Specify Intervals and Posting Rules

Tcode: OAYR

- Specify interval at which planned depreciation will be posted – Monthly, Bi-Monthly, Quarterly

- Smoothing: If selected Remaining/ Balance depreciation is equally distributed for the remaining periods

- Catch Up: If smoothing not selected system follows catch up method. It posts the short / excess depreciation amount along with the planned depreciation. E.g. Depreciation for 12 months period is 12000. Posted in 6 months 5000. So in 6th month post 2000 ( 1000+1000 short)

Select company code MK14 and Select ‘Monthly Postings’. Save

Specify rounding off Net book value and Depreciation

Transaction: OAYO

Define Screen layout for Depreciation areas

Tcode: AO21

Select Screen Layout 2000-Depreciation on Asset sub-no. level. Click field group rules. Select Depreciation key as required field

Assign Screen layout to Depreciation Areas

Tcode: OAYZ

Integration

Create GL Accounts

Transaction Code: FS00

Assign GL Account to Account Determination Key

Tcode: AO90

SPRO – Financial Accounting – Asset Accounting – Integration with General Ledger – Assign GL Accounts

Assign which GL Accounts to which Acquisition, Depreciation, and other APC + Depreciation cost are posted for an Asset Class

Select the Chart of Depreciation

Select the Account Determination key (Linked to Asset class in OAOA)

Enter the balance Sheet Accounts

Click Save and go back. Click depreciation and enter the below details:

Specify Posting Key for Asset Posting

Tcode: OB41

Use Standard SAP key

70 – Debit Asset

75 – Credit Asset

Specify Document Type to Post Depreciation

Tcode: AO71

Activate Account Assignment

Tcode: SPRO-FA-AA-Integration with GL- Additional Account Assignment-

Activate Controlling objects (CC, IO, WBS) which are required for entry in Asset master record (AS02)

Cost objects can be assigned to assets in asset master records (AS02)

- Real Order

- Cost Center + Statistical Order

- WBS Element

- Cost center + Statistical WBS

- To assign 2/ more cost center to assets master, assign internal order and allocate it’s cost to these cost centers periodically

Specify Controlling Object (WBS, CC, IO) available for APC and Depreciation

System determine Account assignment – 1st specific and then Generic

Transaction code: ACSET

Path: SPRO – Financial Accounting – Asset Accounting – Integration with GL – Additional Account Assignment Objects – Specify Account Assignment types for account assignment objects

Account Assignment for company Codes

Specify Default Account Assignment object

Transaction Code: OKB9

Specify Memo Value

Tcode: OAYI

- Memo Value: Also called scrap value / junk value

- Asset is not reduced below this value in the books at any point of time

- Memo value is specified per Company code and Depreciation Area

Specify Doc Type for Periodic Posting of Asset Values

Path: IMG –> FINANCIAL ACCOUNTING –> ASSET ACCOUNTING –>INTEGRATION WITH THE GENERAL LEDGER –> POST APC VALUES PERIODICALLY TO THE GENERAL LEDGER –>SPECIFY DOC TYPE FOR PERIODIC POSTING OF ASSET VALUES.

Depreciation

- Depreciation: Permanent reduction in value of the Asset

- Planned Depreciation is the Ordinary depreciation

- Unplanned Depreciation is sudden reduction in value of Asset due to fire, accident etc.

- Depreciation Key: It contains control for valuing an asset in a Depreciation area including its APC (Acquisition and Production cost) and Depreciation. Also known as valuation key

Define Multilevel Depreciation method

Transaction: AFAMS

Path: SPRO- Financial Accounting – Asset Accounting- Depreciation – Valuation Methods – Depreciation Key- Calculation Methods – Define Multilevel Methods

Click on New entries

Multilevel Method: Straight line Method for company code MK14

Validity Start: From Ordinary start date

Save. Double click Levels

Save. Back arrow twice. Next entry as below:

Multilevel Method: WD (Written down value method for company code MK14)

Validity Start Date : From Ordinary Depreciation Start date

Acquisition Year: 9999

Years: 999

No. of Periods: 12

Base Value: 24 (Net Book value)

Percentage: 10

Define Period Control Depreciation Method

Transaction: AFAMP

Path: SPRO- Financial Accounting – Asset Accounting- Depreciation – Valuation Methods – Depreciation Key – Calculation Methods – Maintain Period Control Methods

Click new entries

Acquisition: 01 (Pro rata at period start date)

Addition: 01 (Pro rata at period start date)

Retirement: 01 (Pro rata at period start date)

Transfer: 01 (Pro rata at period start date)

Maintain Depreciation Key

Transaction: AFAMA

Path: SPRO- Financial Accounting – Asset Accounting- Depreciation – Valuation Methods – Depreciation Key- Maintain Depreciation Key

Click New entries

Depreciation Key: SL14 (Straight line for company code MK14)

Period Control according to fiscal years: Select

Dep to the day: Select

Base Method: 0014 (Ordinary: explicit percentage)

Period Control: MK0 (Defined Earlier)

Multilevel Method: SL (Straight line defined earlier)

Class: Straight line depreciation

Save – Click back arrow – Activate – Save again

Similarly create Depreciation key WD14 for Written down value method

This complete our discussion on asset accounting configuration in SAP. In the next tutorial we will discuss asset accounting business process and test end user transactions for asset accounting configuration completed in this tutorial

SAP Asset Accounting Business Process and end user transactions Tutorial

SAP Asset Accounting Business Process

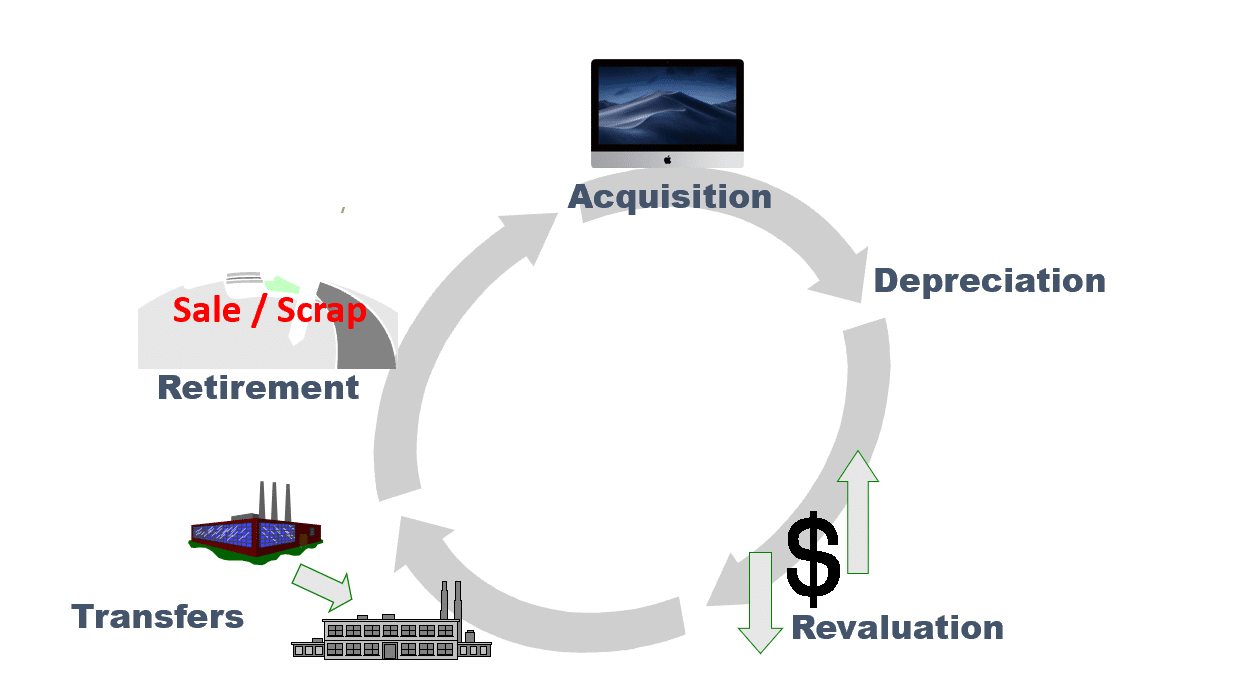

SAP Asset Accounting Overview

- The Asset Management module is used to create and monitor fixed assets

- Asset Management module calculates and posts monthly depreciation expense

- Asset Management manages the life-cycle of fixed assets

Asset Life Cycle

Asset Master Record Creation : AS01

An asset master record is master record of tangible and intangible assets maintained by the company. It is a shell in which asset acquisitions and sale are booked. An asset master record can be Simple Asset master record or Complex Asset master record.

A simple Asset has only Main asset number. There are no Sub Asset

A Complex Asset has Main Asset and one or more Sub Asset Number

Transaction to create an asset master record: AS01

Enter Asset Class as BU_MK14. Account determination link the asset to GL accounts. It is automatically derived from Asset Class

Click the depreciation tab. Enter below details:

- Depreciation key: SL14

- Useful life of asset in years: 20

- Period (No. of months) : 3. This implies useful life of asset is 20 years, 3 months

- Depreciation Start date: 1.04.2019

Save

Create Asset sub number in SAP : AS11

Transaction Code: AS11

Enter the Depreciation key and other details:

Post purchase to Main Asset : F-90

Transaction Code: F-90

Save. Asset purchase posted

Similarly post to sub asset

Asset Explorer SAP : AW01N

Transaction code: AW01N

Asset APC: 50000

SLM Rate: 10%

SLM / year: 5000

WDV Rate is 10%

WDV depreciation on Sub Asset

Report to view all Assets in SAP

Transaction Code: S_ALR_87011965

Monthly Depreciation Run in SAP

Transaction Code: AFAB

- Planned Posting: This is monthly planned posting run. It is normal decline in value of fixed asset

- Repeat: This select when a new asset has been added during month or changes in depreciation terms etc. Normally done at year end. the repeat run can be restricted to specific assets. In the repeat run, the system posts changes to depreciation, as compared to the depreciation amounts from the previous run.

- Restart: Select on case of an erroneous earlier posting run. If the program is terminated during a posting run for various reasons, then the program has to be started again in the restart mode to clear the data base of possible inconsistencies. A restart run is performed

- Unplanned Posting run: Used for customize depreciation run. It is decline in fixed asset value due to unanticipated circumstances

Check the depreciation posted in Asset Explorer: AW01N

Asset Retirement with Revenue and customer in SAP: F-92

Transaction code: F-92

Asset Retirement without customer in SAP

| s.no. | Steps | Tcode |

| 1 | Create Asset Master Record | AS01 |

| 2 | Post External Acquisition to AMR | F-90 |

| 3 | Verify in Asset Explorer | AW01N |

| 4 | Run Planned Depreciation | AFAB |

| 5 | Retire Asset with Revenue | ABAON |

Intra Company Asset Transfer

| s.no. | Steps | Tcode |

| 1 | Create Asset Master Record | AS01 |

| 2 | Post External Acquisition to AMR | F-90 |

| 3 | Verify in Asset Explorer | AW01N |

| 4 | Run Planned Depreciation | AFAB |

| 5 | Intra company transfer asset- Change Asset Class | ABUMN |

Asset Scrap

| s.no. | Steps | Tcode |

| 1 | Create Asset Master Record | AS01 |

| 2 | Post External Acquisition to AMR | F-90 |

| 3 | Verify in Asset Explorer | AW01N |

| 4 | Run Planned Depreciation | AFAB |

| 5 | Asset Scrap | ABAVN |

Asset under Construction (AuC) in SAP

Assets under construction are a special form of tangible assets. They are displayed as a separate balance sheet item and therefore need a separate account determination in their asset classes. Ordinary depreciation is not allowed for assets under construction in most countries. Asset under construction depreciation key does not allow ordinary depreciation in the book depreciation area.

Define Settlement Profile

Path: Financial Accounting- Asset Accounting- Transaction – Capitalization of Asset under construction- Define / Assign Settlement profiles

Transaction Code: OKO7

Select settlement profile AA and make the below selections

Assign Settlement profile to company code

Transaction code: OAAZ

Create Number range for settlement document

Path: Controlling – Internal Orders – Actual Postings- Settlement – Maintain Number ranges

Double click on Maintain Group button

Find Element AT10 and assign Standard Accounting document to it

Create AuC Asset Master in SAP

Transaction code: AS01

Depreciation Key should be zero

Create Asset Master to which AuC will be settled

Transaction Code: AS01

Post purchases to AuC

Transaction: F-90

AuC Capitalization Process in SAP

Line Item settlement from AuC to Main Asset

Transaction: AIAB

Execute

Click enter and enter the below distribution rule

Asset Explorer: AW01N

Asset explorer SAP : AW01N

SAP Asset Accounting Year End Closing

Execute Depreciation Run in SAP: AFAB

Transaction code: AFAB

Complete Depreciation run till last period (12) of the fiscal year. This has to be done sequentially one after another

Execute Periodic Asset Posting in SAP

This will update depreciation area which are posted periodically ( Depreciation areas other than with real time posting) with any additional asset acquisition / sale. No additional posting should be carried out after its execution

Transaction code: ASKBN

Execute Periodic asset posting : ASKBN

Execute Periodic asset posting : ASKBN

Asset fiscal year change

Transaction code: AJRW

This is just a technical step. It has no business or accounting impact

SAP Asset accounting year end closing

This will close Asset accounting current year and open AA next year

Transaction code: AJAB

For detailed, step-by-step instructions on SAP Asset Accounting, follow along with my video tutorial below

Please refer below tutorials for asset accounting configuration

Pingback: SAP Finance Enterprise Structure | SAP FINANCE and Treasury

Pingback: sap accounts receivable

Pingback: SAP Asset Accounting Business Process | SAP FINANCE and Treasury

Pingback: sap controlling overview

Pingback: SAP Tutorials | AUMTECH Solutions-SAP Training