Singapore HQ & China Online Gaming Shanda Interactive Billionaire Chen Tianqiao Listed as 2nd Largest Foreign Owner of United States Land & 82nd Largest Owner in United States with Acquisition of 198,000 Acres of Oregon Timberland in 2015 for $85 Million with Beneficial Owner Disclosed as Shanda Asset Management, Shanda Privatized by Founder in 2012 for $2.3 Billion

11th January 2024 | Hong Kong

Singapore headquartered & China online gaming Shanda Interactive billionaire Chen Tianqiao has been listed as the 2nd largest foreign owner of United States land & the 82nd largest owner in United States with the acquisition of 198,000 acres of Oregon timberland in 2015 for $85 million, with beneficial owner disclosed as Shanda Asset Management. Shanda was privatized in 2012 by founder Chen Tianqiao for $2.3 billion. Profile: “Tianqiao Chen is the founder of the Shanda Group, founded in 1999. Tianqiao is considered a pioneer of the online game and online literature industries in China and he has been described as one of the most innovative entrepreneurs of his time. In 2012, Chen and his family took Shanda’s parent company private and Shanda Group became a family-owned, global investment company. Mr. Chen and his wife, Chrissy Luo, have always been active in philanthropy. In late 2016, they created the Tianqiao & Chrissy Chen Institute and committed US $1 billion to support the advancement of fundamental brain science.” Shanda Group comprises of Shanda Interactive Entertainment, Shanda Investment (Public market investment, venture capital, incubator), Shanda Asset Management (Real estate, natural resource) & Philanthropy.”

“ Singapore HQ & China Online Gaming Shanda Interactive Billionaire Chen Tianqiao Listed as 2nd Largest Foreign Owner of United States Land & 82nd Largest Owner in United States with Acquisition of 198,000 Acres of Oregon Timberland in 2015 for $85 Million with Beneficial Owner Disclosed as Shanda Asset Management, Shanda Privatized by Founder in 2012 for $2.3 Billion “

Singapore HQ & China Online Gaming Shanda Interactive Billionaire Chen Tianqiao Listed as 2nd Largest Foreign Owner of United States Land & 82nd Largest Owner in United States with Acquisition of 198,000 Acres of Oregon Timberland in 2015 for $85 Million

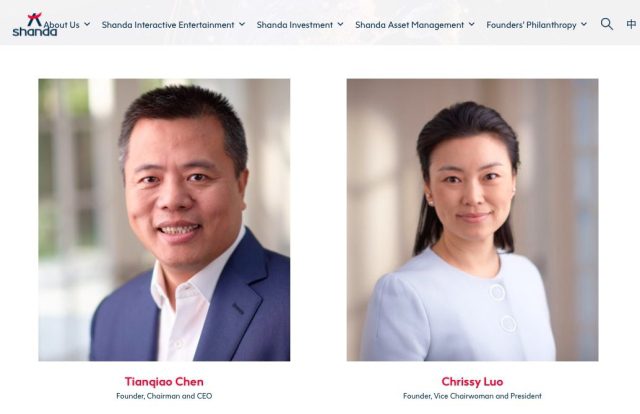

Tianqiao Chen, Shanda Group Founder, Chairman & CEO

Tianqiao Chen is the founder of the Shanda Group which, since 1999, has had three subsidiaries listed on NASDAQ and one on KOSDAQ. Tianqiao is considered a pioneer of the online game and online literature industries in China and he has been described as one of the most innovative entrepreneurs of his time. In 2012, Chen and his family took Shanda’s parent company private and Shanda Group became a family-owned, global investment company. Mr. Chen and his wife, Chrissy Luo, have always been active in philanthropy. In late 2016, they created the Tianqiao & Chrissy Chen Institute and committed US $1 billion to support the advancement of fundamental brain science. By first creating strategic partnerships with Caltech, Huashan Hospital and Shanghai Mental Health center the couple quickly established themselves in the sector. Since then, they have built on this strong foundation by creating the Chen Frontier Labs and launching programs to support hundreds of young scientists and brain-focused conferences around the world. Tianqiao holds a Bachelor of Arts degree in Economics from Fudan University.

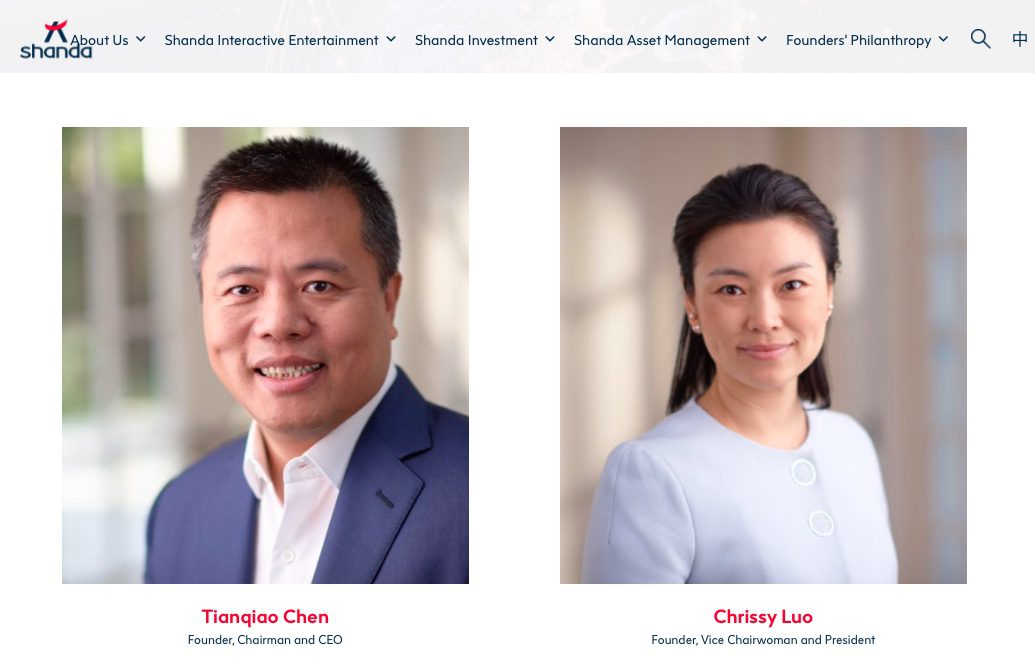

Chrissy Luo, Shanda Group Founder, Vice Chairwoman & President

Chrissy Luo is founder, Vice Chairwoman and President of Shanda Group. She is also the founder of the Tianqiao and Chrissy Chen Institute which she and her husband created in 2016 to help advance fundamental brain science. Directly involved in Shanda’s day-to-day operations, as President, Chrissy oversees company-wide operations, group communications, and the group’s timberland operations., Since its inception, she has held a number of executive positions at the company including the role of Group CFO from 1999 – 2004. Prior to co-founding Shanda, Chrissy was an investment banker at Zhe Jiang Jin Xin Security Company in Shanghai. As experienced philanthropists, Chrissy and her husband emphasize patience, flexibility and due diligence as the hallmark of strategic philanthropy and thoughtful giving. With their commitment to donate a total of one billion dollars to brain research, they are creating a historic initiative that they hope will help humanity better understand ourselves and the world. To support science and education and to serve the community, Chrissy became a member of the California Academy of Sciences’ Board of Trustees in September 2022. She is also on the board of Governors at the Huntington Library, Art Museum, and Botanical Gardens and a member of the China Leadership Board at the 21st Century China Center at University of California, San Diego. Chrissy has a Bachelor of Economics degree from the China Institute of Finance (now part of the University of International Business and Economics).

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit