Incentive Stock Option (ISO) Basics

Incentive stock options (ISOs) give employees a way to purchase stock at potentially steep discounts. ISOs can be hard to understand, and so can their tax effects, but this article will provide you the basic knowledge of your ISOs so you can make the most of them.

We’ll do this by going through a fake scenario of someone who has received ISOs so we can simply teach the basics.

If you’re wanting more advanced topics related to ISOs and not just the basics, we’ve written about when you should exercise ISOs and when exercising ISOs works well.

ISOs are Like Coupons

Here’s a comparison to help understand how ISOs work. A grant of ISOs is like receiving a coupon book.

It gives you the right to purchase some product at a discount to the current price.

Allows you choose when you want to redeem the coupon.

The coupon book will eventually expire.

The company granting you ISOs lets you keep them in your “coupon book” until you exercise them or until they expire. Once you decide to redeem your coupon/exercise an ISO, you use your right to purchase company stock at a discount and the company gives you a share of company stock. You don’t have to use all the coupons at once, but once you use up some, it’s up to you to track what’s already been used and what hasn’t

Basic Scenario of Someone Holding ISOs

Let’s say you work for Gryzzl, a fast-growing tech company and the Pawnee version of Facebook. You did a fantastic job this year and they reward you with some Incentive Stock Options (ISOs). You’re obviously grateful, but you have no idea what the heck you just received or what to do with them.

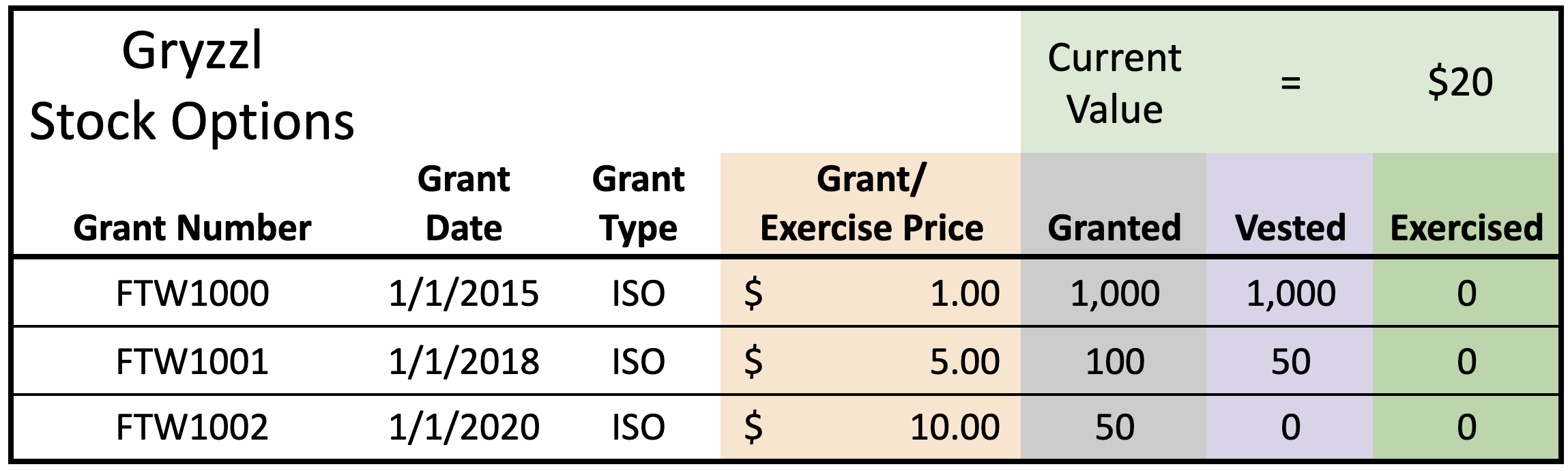

Here’s an example of what an ISO summary may look like over the span of a few years (it won’t ever be this colorful, but we’re going to be doing some color coordinating):

There are a lot of terms in the table above most of which are self-explanatory. Grant Number, Grant Date, and Grant Type are all important but likely don’t need much explaining.

Highlighted in gray is the amount of ISOs you’ve been Granted. Each option you’ve been granted equals one potential share. To go from one ISO to one share, you need to exercise your ISO.

The Grant/Exercise Price is the amount you must pay to your company to receive a share of stock in exchange for the option. When you do this, it’s called an Exercise. It's also commonly referred to as a "Strike Price"

The Current Value is the current market value of your company. This will either be the company price on the stock market or if your company isn’t traded on the stock market, the Current Value will be published in your company’s latest 409a valuation.

The Vested column in this scenario shows how many options you’re able to exercise. Many companies grant options under a 4-year vesting schedule. This means that for each year you work at the company after the grant, 25% will become available to exercise.

The Exercised column The Exercised column shows how many options you have exercised (i.e. paid the grant/exercise price to the company).

Exercising a Batch of ISOs

In the table above, you have 1,000 Vested ISOs that can be exercised. For each one of those ISOs, you’ll need to pay the Grant/Exercise Price of $1 Let’s say you do this on 1/1/2024.

To exercise the full 1,000 ISOs you pay $1,000 to Gryzzl. This is a killer deal because each share is actually worth $20! You’re paying $1,000 to receive $20,000 in value. It’s like paying someone a dollar bill in exchange for a twenty.

This is one thing that makes ISOs so special. Even though you’re receiving value by exercising, the IRS doesn’t tax you until you sell.

There is an important note here: Exercising ISOs with gains cause an Alternative Minimum Tax adjustment and can potentially cause taxes before you sell. (We’ll ignore the complicated details here, but you’ll want to check out the other articles we linked if you have gains of more than $25k.)

I’ve Exercised ISOs, Now What?

You now exercised 1,000 options on 1/1/2024 so you now own 1,000 shares of Gryzzl.

Exercised ISOs have a unique benefit if you meet certain holding requirements and it has the potential to lower the total taxes you have to pay after selling. If you meet certain requirements it’s called a Qualified Disposition.

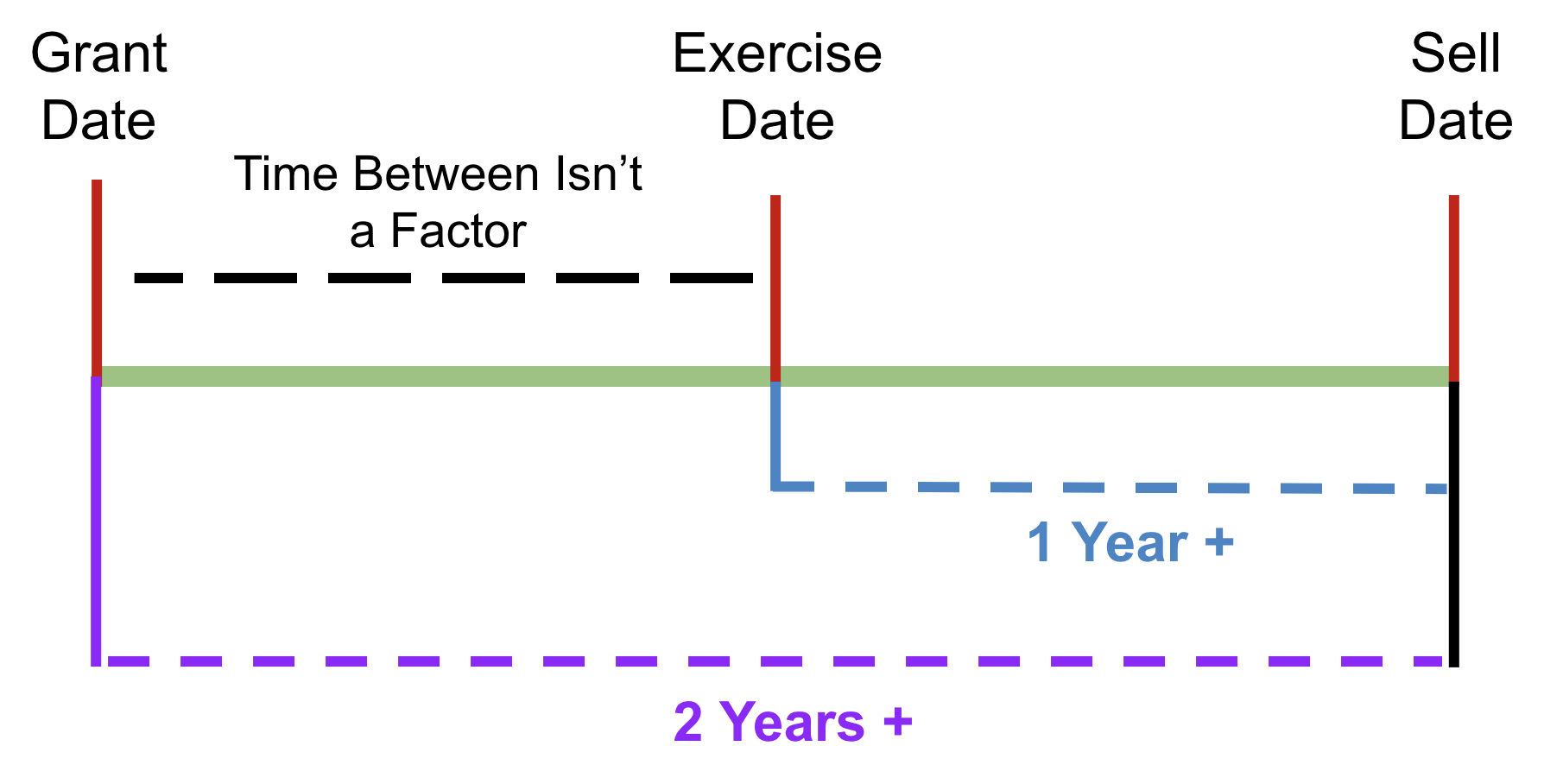

A Qualified Disposition is defined as the following:

- Sell exercised ISOs 2 years or more from the Grant Date.

- Sell exercised ISOs 1 year or more from the Exercise Date.

In our scenario, to have a Qualified Disposition, you’ll need to sell your Exercised ISOs on 1/2/2025 or later.

You’ve already met the requirement to sell two years from the grant since the ISOs were granted on 1/1/2015.

However, since you exercised 1,000 ISOs on 1/1/2024, you will need to wait a full year to meet the second requirement. 1/2/2021 is the soonest you could do a Qualified Disposition.

Here’s what it looks like mapped on a timeline:

One last time. To have a Qualified Disposition of an ISO, you will need to (1) sell 2 years or more from the grant date and (2) sell 1 year or more from the exercise date.

In the timeline above, you’re selling 10 years from the grant date and 1 year from the exercise date. You have successfully completed a Qualified Disposition.

Disqualifying Disposition

Now let’s say you sold your exercised ISOs on 12/23/2025. This would mean you completed a Disqualifying Disposition since you sold before the one year since exercise rule.

A Disqualifying Disposition happens anytime you don’t meet the two rules for ISOs. It’s not the end of the world if you don’t follow those two rules, but it could mean you’re going to pay more in taxes… and who wants to do that?

Taxes on Qualified Dispositions vs. Disqualified Dispositions

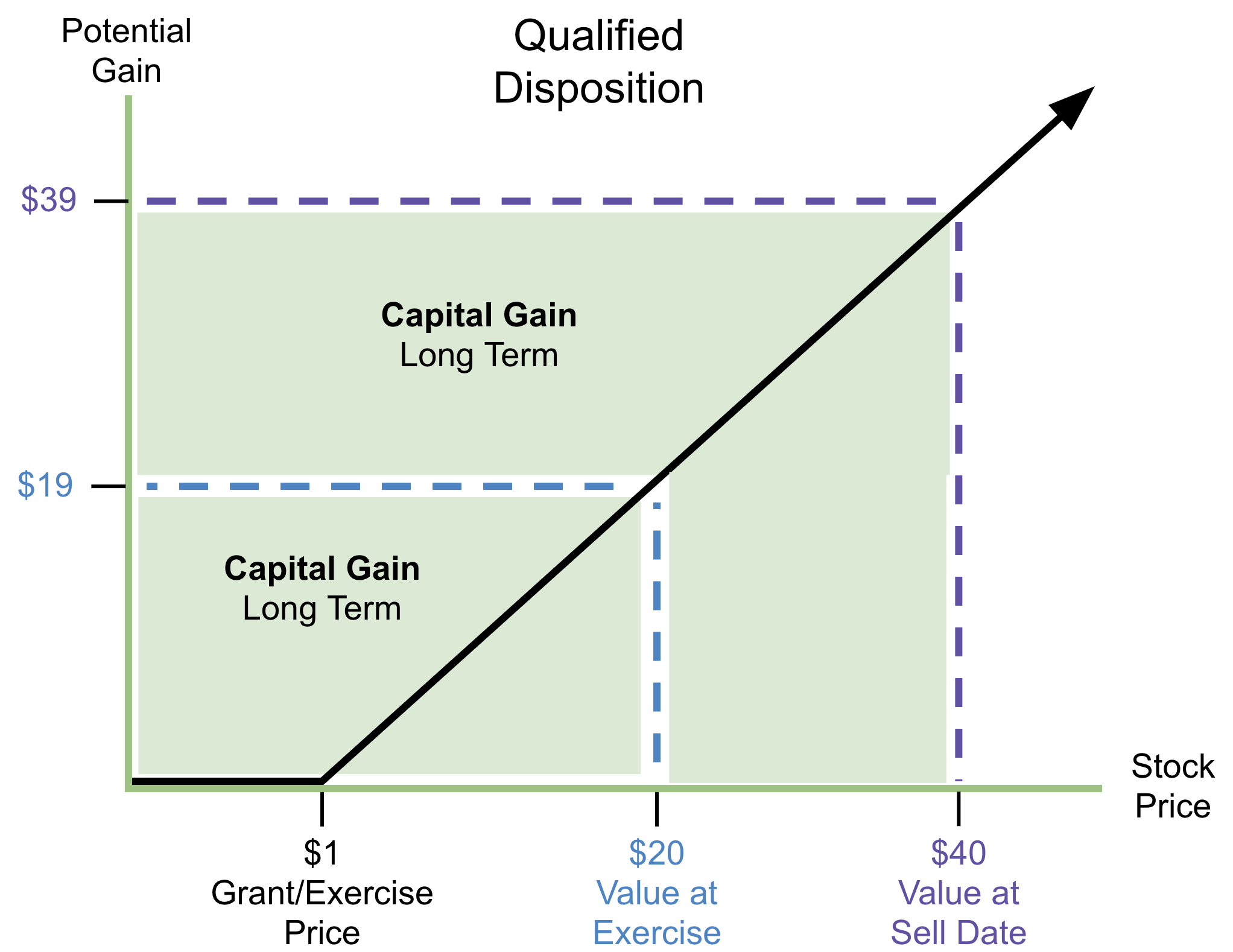

For Qualified Dispositions, taxes are easy to remember. Every bit of gain is taxed at Long Term Capital Gains rates.

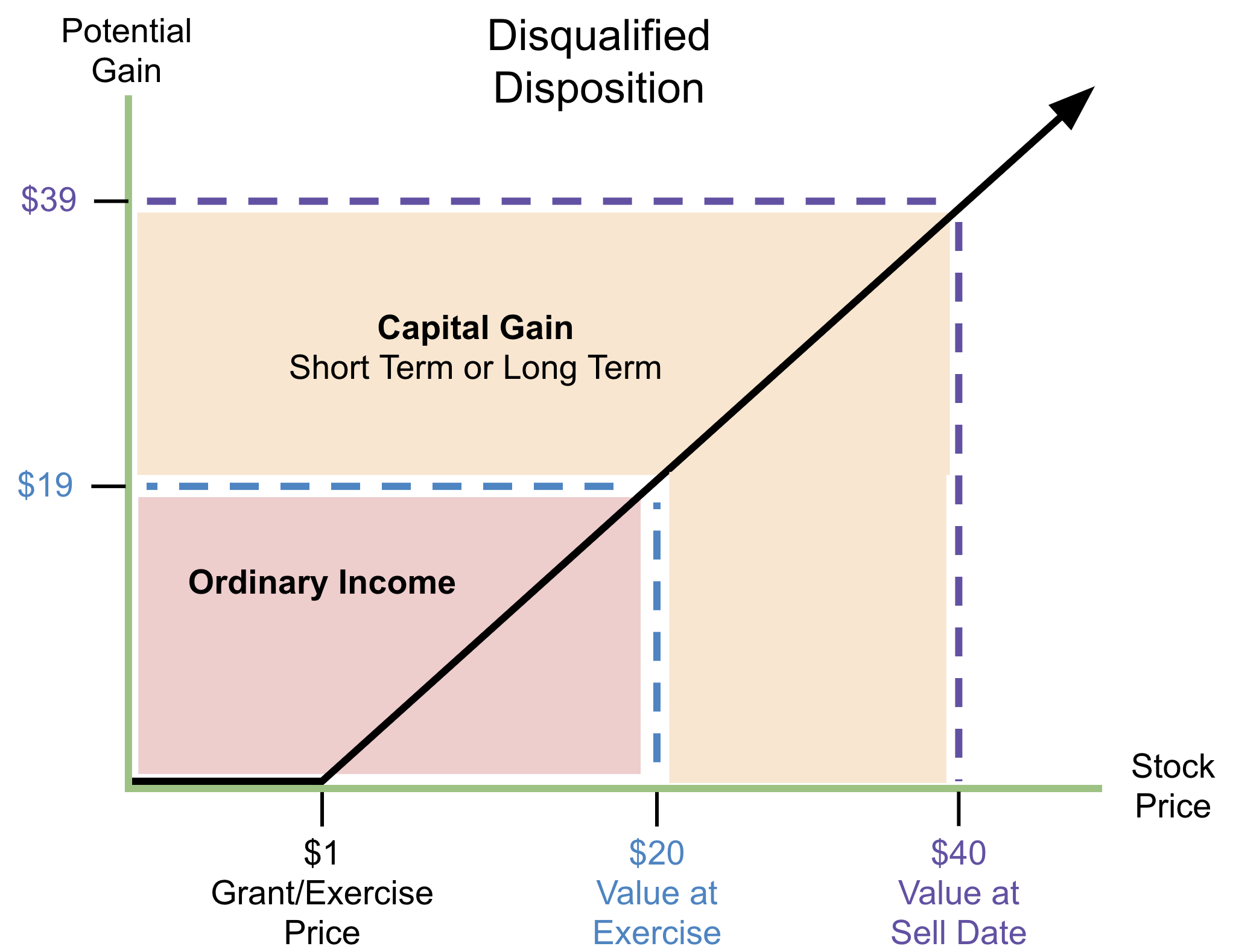

For Disqualified Dispositions there are two areas that will cause higher taxes:

The Spread, which is the difference between the Market Value at the Exercise Date and the Exercise Price, will be taxed as Ordinary Income.

If the company value has gone up since the Exercise Date, the difference between the sell price and the value at exercise will be taxed as either a Short Term or Long Term Gain. If sold after 365 days it will be Long Term. If sold before 365 days it will be Short Term.

Here are a couple of graphs to help illustrate both a Qualified Disposition and Disqualified Disposition of ISOs:

The tax savings from completing a Qualified Disposition can be massive. We won’t force you to memorize tax brackets, we’ve linked the tax brackets here if you want to look at them.

All you need to know for now is (1) Long Term Capital Gains result in less taxes than Ordinary Income or Short Term Capital Gains. (2) Short Term Capital Gains get added to your Ordinary Income which results in higher taxes.

This is what we’ll be assuming for our calculations:

Long Term Capital Gains = 15% Tax

Short Term Capital Gains & Ordinary Income = 32% Tax

ISO Qualified Disposition

The math here hopefully isn’t too difficult. We take the following:

($19,000 x .15) + ($19,000 x .15) = $5,850 taxes owes

ISO Disqualified Disposition

This one can get a little more complicated since the difference between the sell date and the exercise date could be either Short Term or Long Term.

In this scenario, we’re assuming Short Term and you’ll find the math below:

($19,000 x .32) + ($20,000 x .32) = $12,480 taxes owed

With a Qualified Disposition, you’ll pay $5,850 in taxes

With a Disqualified Disposition, you’ll pay $12,480 in taxes

In this scenario you’ll save $6,630 in taxes by completing a Qualified Disposition

When Would You Want to Do a Disqualified Disposition?

After seeing the tax benefits, you’re probably wondering why anybody would do a Disqualified Disposition? There can be lots of sophisticated reasons, but for the purpose of this ISO Basics article, the biggest reason you’d want to do a disqualified disposition is to invest in other things or use the money in other ways that are valuable to you.

Since a Qualified Disposition requires you to hold onto your ISOs for at least 2 years, there’s a lot of time for things to go poorly and a lot of things can change in the span of two years.

If the majority of your net worth is tied up in company stock and you’re waiting to do a Qualified Disposition of an ISO, you may lose some sleep as you watch the stock price move daily. We’ve written about how much company stock is too much and it’s a helpful guide for figuring out how much to keep on the table or take off.

A Few Warnings About ISOs

ISOs are usually granted before a company becomes publicly traded. If you exercise ISOs before the company goes public and the company goes out of business, you will lose the money you paid as part of the exercise. We’d recommend only putting money you can afford to lose towards the exercise of ISOs.

If the ISO spread is really big (there is a large difference between the current market value and the exercise price), you’ll want to discuss potential tax consequences with a CPA.

If you’ve exercised ISOs with a large spread and the value of the stock drops by 30%+, you’ll also want to consult a CPA.

Final Thoughts on ISO Basics

As you’ve discovered in this article, ISOs require a lot of learning to understand the basics. It can be a frustrating experience trying to get a hang of all the new words and personal finance ramifications, but seriously, making the most of your ISOs will be great for you in the long run.

ISOs are a fantastic way to grow your wealth and we’re here to help as much as we can. Please post any questions you have or shoot us an email with any questions.