Mutual Funds: Everything You Need To Know

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

A mutual fund pools money from many investors and invests it in securities such as stocks, bonds and and other assets. The combined holdings of the mutual fund are known as its portfolio. Investors who buy shares in the fund receive part ownership of it and the income generated when investments in the fund’s portfolio increase in value.

If you have a 401(k) plan at work or an IRA on your own, you might already own mutual funds. But how do mutual funds work? How can you buy mutual funds? Learn the answers to these questions and more.

How Do Mutual Funds Work?

A mutual fund is like a basket of investments. When you buy shares in the whole basket, you gain exposure to each asset the basket contains but own shares only in the basket itself. Suppose you purchase 100 shares of XYZ mutual fund. This fund includes shares of IBM, Microsoft, General Motors, short-term municipals bonds and long-term corporate bonds. You don’t own shares of the securities individually, but you own shares of the mutual fund that owns the individual securities.

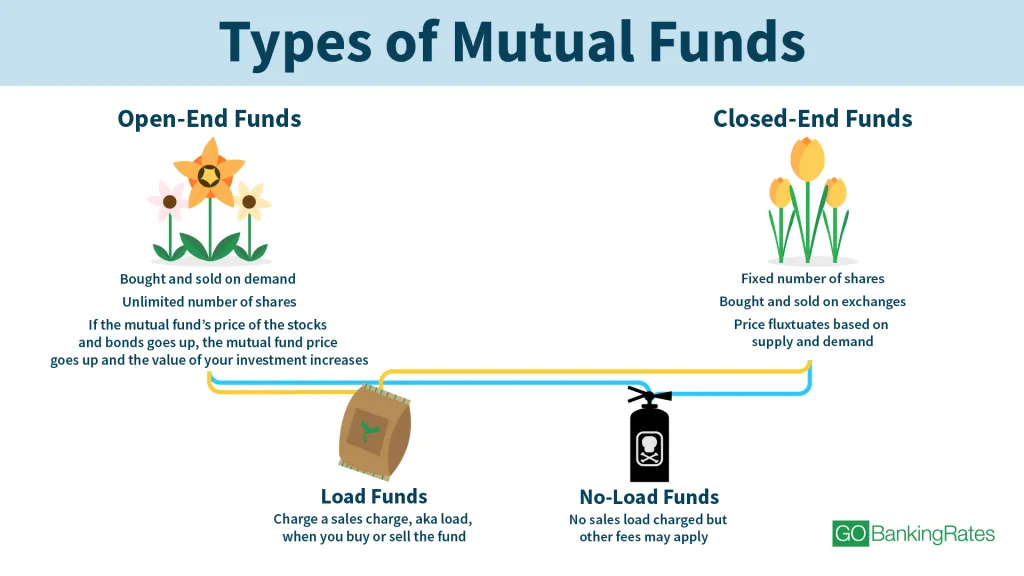

Mutual funds can be structured in several different ways:

Open-End Funds

Open-end funds are the most common type of mutual fund. They are bought and sold on demand, and they are not limited as to the number of shares they can offer. The price of each share in open-end funds is calculated at the end of each trading day by dividing the market value of the securities in the fund, minus expenses, by the number of shares.

So, if the price of the stocks and bonds held in your mutual fund goes up, the price of the mutual fund goes up and the value of your investment increases.

Closed-End Funds

Closed-end funds have a fixed number of shares that are issued at the initial public offering, or IPO. Like individual stocks, they are bought and sold on exchanges, and their price fluctuates based on supply and demand. For this reason, the price of a closed-end fund can be more volatile than that of an open-end fund.

Load Funds

Load funds charge a sales charge, or load, when you either buy or sell the fund. When you are deciding whether or not to purchase a mutual fund, make sure you factor in the load, because it can vary and can impact the average mutual fund return. The law doesn’t set limits on mutual fund loads, but the Financial Industry Regulatory Authority caps them at 8.5% of the purchase or sale price.

No-Load Funds

No-load funds do not charge a sales load, but that doesn’t mean they’re necessarily cheaper than load funds. They may charge other fees for operating expenses, so understand any fees that you will be charged when you purchase mutual funds.

“No-load funds sound tempting since you don’t have to pay a commission, but there’s plenty of ongoing fees that add up, which could make them more expensive than loaded funds,” said Chris Hogan, financial expert and author of “Everyday Millionaires.” “A no-load fund isn’t automatically a better deal just because you don’t have to pay a commission. Do your research!”

Things To Know About Mutual Funds

What is the average return on a mutual fund?

- The average mutual fund returned about 10.16% in 2021, according to Finder. However, over a 15-year-period, mutual fund returns averaged 6.39%.

What are the disadvantages of a mutual fund?

- Mutual funds charge fees. Sales charges — also referred to as loads — service fees and commissions all reduce the return on your investment. Fees are highest on actively managed funds.

- Mutual funds are professionally managed. That means you have no say in which securities the fund trades.

- High minimum investment: You’ll generally have to invest at least $1,000, and most actively traded funds require a minimum of $3,000.

- Trading limitations: Mutual funds only trade once a day, after the market closes. Trades are executed for whatever the price happens to be at that time, so you have less control over the price you pay or sell for than you’d have with individual stocks or an ETF.

What is the highest risk of mutual funds?

How Are Mutual Funds Managed?

Mutual funds can be managed in one of two ways: actively or passively. An actively managed mutual fund has a fund manager who buys and sells investments within the fund with the goal of outperforming the market relative to a benchmark, such as the S&P 500. The performance of an actively managed fund is based on how well it does compared with the benchmark.

A passively managed mutual fund includes investments that mirror the investments in the benchmark with the goal of having the same performance as the benchmark. So a passively managed fund that uses the S&P 500 as its benchmark will include stocks in the 500 companies that make up the S&P 500 index. These are the 500 largest companies traded on U.S. stock exchanges.

| Active Management | Passive Management | |

|---|---|---|

| What the Manager Does | Manager buys and sells according to their opinion of the stock’s potential | Mirrors the stocks on an index |

| Performance | May outperform or underperform any benchmark | Equals the performance of the index |

| Examples | Vanguard Wellington, Fidelity Puritan | Vanguard 500 Index Fund Investor Shares, Fidelity 500 Index Fund |

Understanding the Types of Mutual Funds

There are five major types of mutual funds.

Bond Funds

Bond funds may contain various types of bonds. Bonds are actually debt instruments that corporations and governments issue when they need to raise money. Bonds often pay dividends and usually don’t appreciate in value.

Individual bonds will mature, meaning that the issuer will pay the investor back the face value of the bond, but bond mutual funds replace maturing bonds with new bonds to keep the fund going.

Stock Funds

Stock funds invest in the stock of corporations. They may invest in several companies in a given industry, such as technology or energy. Or, the fund may seek to invest in new companies or those in emerging markets. The stocks may be chosen for their ability to provide income in the form of dividends or growth in the form of price appreciation.

Money Market Funds

Money market funds invest in high-quality, short-duration investments issued by U.S. corporations or government entities. They are very safe and produce relatively low but consistent returns.

Balanced Funds

Balanced funds own both stocks and bonds in an attempt to have consistent growth in any type of market. Often, when bond returns increase, stock returns decrease, and vice versa, so a fund that holds both bonds and stocks has a good chance of growth over time.

Target-Date Funds

Target-date funds hold stocks, bonds and other investments and are bought with a specific date in mind, such as retirement. They start out with a relatively aggressive mix of investments, meaning a high percentage of stocks. As the target date approaches, the investment mix becomes more conservative.

When you’re saving for retirement, you want to take less risk the closer you are to retirement, so a target-date fund is a good way to accomplish this.

What’s the Difference Between a Mutual Fund and an Exchange-Traded Fund?

Exchange-traded funds are similar to mutual funds in that they pool investors’ money to invest in baskets of securities. However, ETFs are traded like stocks, so you can buy and sell shares whenever the markets are open, whereas mutual funds trade at the end of the day.

ETFs also require less of a minimum investment. Whereas a mutual fund share generally costs at least $1,000 and you must buy whole shares, ETFs, like stocks, can cost as little as a few dollars, and you can, in many cases, purchase fractional shares.

How Do You Make Money in Mutual Funds?

There’s no specific amount an investor can make by investing in mutual funds. Your gains, if any, will depend on many factors, including how much you invest, market conditions, fund management and fees. That said, mutual funds offer three different ways for you to earn money on your investment.

- Dividend payments: Many stocks pay quarterly or annual dividends to shareholders. If a stock that’s included in your mutual fund pays a dividend, the fund receives that dividend, and you get part of it relative to the number of shares you have.

- Capital gains distributions: When a security that’s held in a mutual fund increases in value and is then sold, the difference between the price it was bought for and the price it was sold for is a capital gain. At the end of the year, mutual fund companies distribute these gains to the shareholders of the fund.

- Increased net asset value, or NAV: If the prices of the stocks held in your mutual fund increase, the value of the shares of the fund also increases. When that happens, your shares are worth more than what you paid for them, so the value of your investment has increased.

Mutual funds can increase in value in these three ways, but they can also decrease in value. If the value of the securities in the fund declines, the NAV of the fund will decline. You can lose money that is invested in mutual funds, so be sure that you understand the risk you’re taking on.

What Are the Benefits of Investing in Mutual Funds?

Here’s a look at the major reasons you might choose to invest in a mutual fund.

Diversify Your Portfolio

The expression “Don’t put all your eggs in one basket” is particularly relevant when it comes to investing. If you invest all your money in one company’s stock, you could lose everything if that stock does poorly. Diversification in investing means more than just buying stock in a few different companies, though. A diversified portfolio will include stocks, bonds and cash, and it will be invested in many different industries.

Mutual funds typically have a diverse selection of investments in the fund already, so buying shares of a single fund can do the diversification for you. If you don’t have a large amount of money to invest, mutual funds are an effective way to diversify your investments.

Benefit From Professional Management

Mutual fund companies hire professional fund managers to choose and monitor the investments in each mutual fund. These people are highly trained, and they spend their day watching the investments in their funds, removing those that perform poorly and replacing them with ones they think will perform better.

Access To Your Funds

You can sell your mutual fund shares on any day the markets are open. When you do, you’ll get the current price, or net asset value, as of the market’s close, less any fees for redeeming the shares.

Value

Whereas you’d need a large investment to buy a diverse portfolio of individual stocks and other assets, you can invest a relatively small amount of money in a mutual fund and add to your investment slowly, over time.

What Are the Drawbacks of Investing in Mutual Funds?

No investment vehicle is perfect. Here are some of the drawbacks to investing in mutual funds.

Risk of Losing Money

All investments have some level of risk. Unlike putting your money in the bank, when you invest, you could lose some or all of your money.

No Control Over Investments

Mutual funds are managed by professionals. When you buy shares in a fund, someone else controls the stocks your money is invested in.

Fees

Another drawback of investing in mutual funds is their fees. You may pay a sales charge (load) on the funds you buy. Mutual funds also charge operating fees, which can reduce the value of your portfolio. You may also pay a redemption fee when you sell shares, an exchange fee if you exchange shares in one fund for shares in another, an account fee if your account falls below a minimum or a purchase fee when you buy shares.

Potentially Lower Returns

Mutual funds hold cash to ensure they can pay shareholders who sell shares, and also to buy new securities for the fund’s portfolio. The value of cash doesn’t change like securities do, so the more cash a fund holds, the fewer appreciating assets it contains.

Taxes

All mutual fund shareholders receive the same distribution at the end of the year. If the fund appreciated during the year and you buy your share right before the distribution, you’ll pay tax on the year’s worth of capital gains even though you didn’t receive all those gains, according to Fidelity. High turnover among shares can also drive up capital gains tax, because the fund must report a gain each time a share is traded.

Are Mutual Funds Good Investments?

Mutual funds can be excellent investments for the right investor. The best funds to invest in are those that have a history of solid performance and low expenses and fees. Each fund has a prospectus, available on the company’s or broker’s website, that gives you the information you need to evaluate its quality and suitability for your portfolio.

How Do Beginners Invest In Mutual Funds?

To buy mutual funds, you must open an account with a broker, such as E-Trade or TD Ameritrade. Some brokerages, such as Vanguard and Fidelity, have their own funds but also sell funds from other companies.

Once you have an account, you can buy and sell funds by calling your broker or trading online. Each time you purchase a new fund, you should read the fund’s prospectus so you understand how the investments are selected and what the fees are.

Are Mutual Funds Right for You?

Before you invest in mutual funds, make sure you have the rest of your financial house in order. You should only invest in mutual funds if you’re completely debt-free — minus your mortgage — and have an emergency fund of three to six months of expenses, Hogan said.

Once you’re ready to invest, mutual funds are a good choice if you prefer to have someone else make the decisions about which companies to invest in, and if you want to buy and hold your investments. The fees associated with mutual funds make them a poor choice for someone who wants to buy and sell frequently.

Daria Uhlig contributed to the reporting for this article.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- Charles Schwab. "ETFs vs. mutual funds."

- Fidelity. "Mutual Funds and Taxes."

- U.S. Securities and Exchange Commission. "Mutual Funds."

- Charles Schwab. "Understanding mutual funds."

- Finder. 2022. "What’s the average mutual fund return?"

- U.S. Securities and Exchange Commission. "Sales Charge (or Load)."

- Vanguard. "Vanguard mutual fund fees and minimums."

- TIME NextAdvisor. 2022. "What Is a Mutual Fund?"

Written by

Written by  Edited by

Edited by