Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

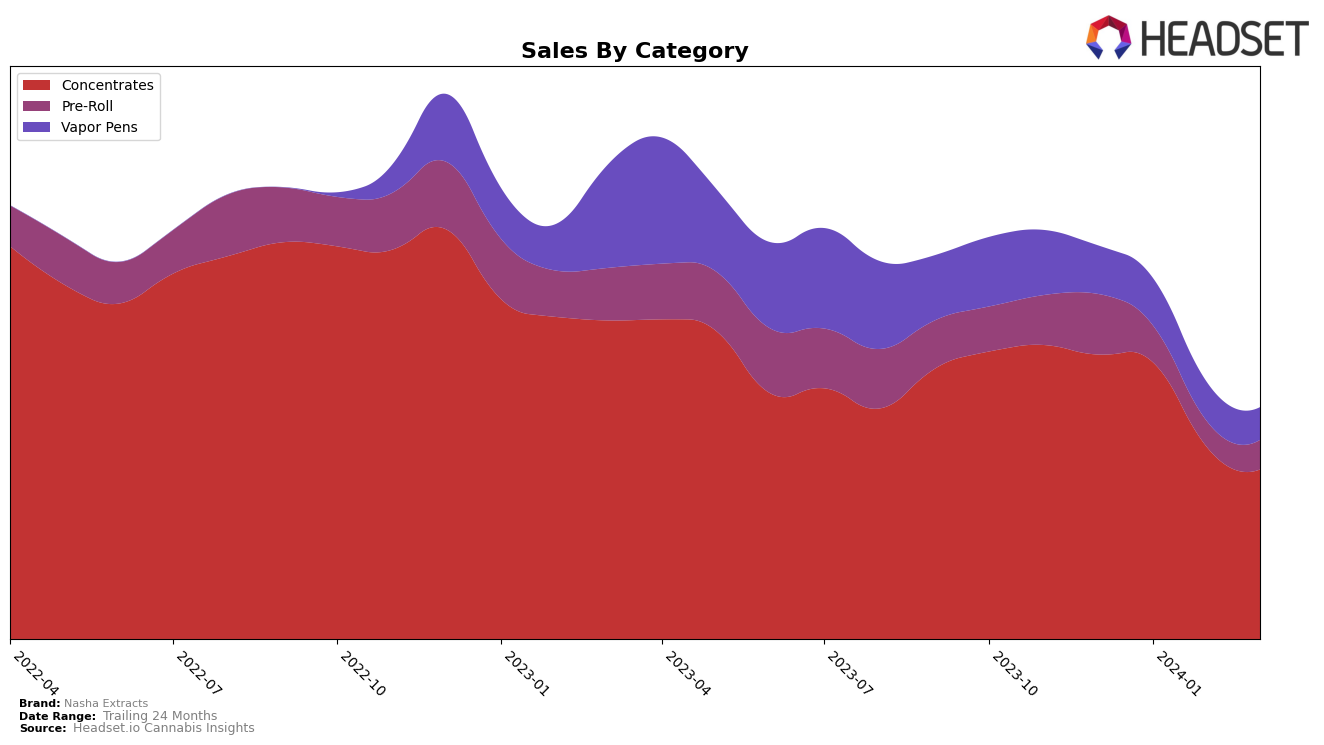

In the competitive cannabis market of California, Nasha Extracts has shown a consistent presence in the Concentrates category, maintaining its position among the top brands. Starting in December 2023, Nasha Extracts was ranked 12th, holding steady into January 2024. However, February and March saw a slight dip in its ranking, sliding down to 18th. This shift could indicate a challenge in maintaining its market share amidst stiff competition or could reflect changes in consumer preferences within the state. Despite this drop in rankings, Nasha Extracts managed to generate significant sales, with December 2023 sales reaching $342,360. The subsequent months saw a decrease in sales, aligning with its drop in rankings, which could be a point of concern for the brand as it indicates a potential decrease in market demand or competitive positioning.

While the data provided focuses solely on the state of California, it offers valuable insights into the performance of Nasha Extracts within a key market. The consistent ranking in the top 20 for the Concentrates category over a four-month period suggests a solid foundation and recognition in the market. However, the decline in both ranking and sales from December 2023 to March 2024 highlights an area for improvement and possibly an opportunity for Nasha Extracts to reassess its market strategy or product offerings. The absence of information from other states or provinces prevents a comprehensive analysis of its overall performance across different markets, but the California data alone suggests that while Nasha Extracts has a foothold in a competitive market, sustaining and improving its position will require addressing the challenges highlighted by the recent downward trend.

Competitive Landscape

In the competitive landscape of the concentrates category in California, Nasha Extracts has experienced a notable shift in its market position. Initially ranked 12th in December 2023, Nasha Extracts maintained its rank in January 2024 but saw a decline to 18th place by March 2024. This change in rank is indicative of a decrease in sales over the same period, highlighting challenges in maintaining its market share against competitors. Notably, LMFAO Cannabis made a significant leap from being outside the top 20 to securing the 16th position by March 2024, surpassing Nasha Extracts with a remarkable increase in sales. Meanwhile, Bear Labs and Pistil Whip have also shown fluctuating yet competitive positions, with Bear Labs slightly declining to 17th and Pistil Whip reaching the 20th position by March 2024. UP!, despite its lower initial ranking, has managed to climb closer to Nasha Extracts, ending up in the 19th position by March 2024. These dynamics underscore the competitive pressures and the need for Nasha Extracts to innovate and adapt to retain and grow its market share in the evolving concentrates market in California.

Notable Products

In Mar-2024, Nasha Extracts saw Topper Bubble Hash (1g) from the Concentrates category retain its top position for the third consecutive month, with sales peaking at 2153 units. Altitude Infused Pre-Roll (1g) made a notable entry into the rankings, securing the second position with impressive sales figures. Following closely, Papaya Punch Unpressed Hash (1g) also made its first appearance in the rankings, claiming the third spot. Submerge Infused Pre-Roll (1g) experienced a slight shift in its ranking, moving down to fourth place from its previous third position in Feb-2024. Lastly, Gush Mintz Red Pressed Hash (1.2g) entered the rankings at fifth place, rounding out the top five products for Nasha Extracts in Mar-2024.

Top Selling Cannabis Brands