China’s debt piled up further, driven by corporates and local governments but their hidden debt is kept at bay

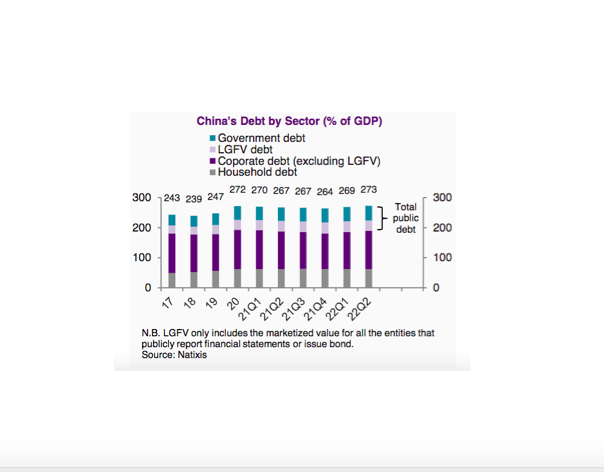

China’s debt-to-GDP ratio continued to rise over the second quarter of 2022 at a pace similar to that of the first quarter of 2022. Even though the Chinese economy has been slowing rapidly under the hit of Covid-19, which could have lowered the credit demand and debt ratio, the government’s strong intention to stimulate the economy brought the aggregate debt to increasing by 2.5% over the past quarter, and the debt-to-GDP ratio rose from 268.7% to 273.0% of GDP.

The most obvious increase in China’s debt took place in the corporate sector as cash-strapped companies were given more space to borrow. Excluding the local government financing vehicles (LGFV), China’s corporate debt increased rapidly from 123.3% in Q1 2022 to 127.6% of GDP in Q2 2022. Specially, both the short-term and long-term corporate loans have increased (4.3% and 2.9%, respectively) in the second quarter.

In the meantime, the on-balance-sheet government debt has also increased from 47.5% to 49.2% of GDP. The rise in government debt mainly stems from the frontloading of local government bond issuance. In fact, the outstanding value of local government bonds rose from 27.6% to 29.5% of GDP during this period. That said, the central government debt has been growing at a much slower pace, with its ratio to GDP even slightly decreasing from 19.9% to 19.7%.

Contrasting with the fast growing on-balance-sheet public debt was the stagnant growth of the off-balance-sheet local government debt, namely, LGFVs. The ratio of LGFV debt to GDP further decreased to 33.9% in Q2 2022 after it first shrank from 36.5% in Q4 2021 to 35.9% in Q1 2022. The decline in LGFV debt against the backdrop of government stimulus is a clear indication that the Chinese government has not given up on its goal to contain hidden debt and related systemic risk, even if the economic situation is calling for more accommodative policy environment.

Finally, the household sector also contributed positively, although much less than the corporates and the local governments, to the increase in China’s debt to GDP ratio, as its ratio to GDP going from 62.1% to 62.3% of GDP. Most of that increase was short-term consumption loans rather than mortgages, the latter of which has continued to shrink (from 34.9% in Q1 to 34.5% in Q2 2022) as housing transactions plummet.

However, there are signs that the debt growth may have moderated again on the back of the slowly growing economy in July. Not only the government has reduced the bond issuance compared to the previous two months (the new increase was 399.8 billion in July versus 1621.6 billion in June and 1058.2 billion in May), but also bank loans to both the household and corporate sectors decelerated year-on-year from June to July. As a whole, total social finance decelerated year-on-year during July.

All in all, China’s debt experienced another jump in Q2 2022, reflecting the strong push by the government’s stimulus, but, at the same time, the sluggish economic growth remains a drag for credit demand for the rest of the year. One thing is sure, though, that the government remains cautious about the off-balance-sheet component. In essence, China may pile up debt as a result of stimulating the economy but controlling hidden debt risk will still be key for the government.

Full report is available for Natixis clients.