COVID-19 Uber-trage Hits Mobility

If you’re wondering what the long-term impact of Uber Technologies has been on the transportation industry you need look no further than this weekend’s Chapter 11 bankruptcy filing from Hertz Rental Car (which includes Dollar and Thrifty). In the 11 years since its arrival on the market, Uber has been steadily shoving aside both taxis and rental car companies – with serious pain being felt by those organizations beginning in 2015.

Just as Amazon has leveraged the arrival of COVID-19 to hoover up an even larger share of all retail transactions – producing Bezos-as-trillionaire headlines – Uber is seeking to consolidate as much or all of the mobility marketplace at the precise moment when valuations are low and operators are vulnerable. Uber’s latest moves include massive layoffs and location closings combined with strategic investments and, potentially, an acquisition.

It’s suddenly become clear that Uber’s seeming struggle to achieve profitability, another Amazon parallel, was a thin disguise concealing a highly profitable ride hailing operation that was funding an active expansion of services and an ambitious and expensive autonomous vehicle development effort. When news of Uber’s initial round of layoffs was disclosed we learned that the company had a 4,000-person software development team – though the combined cuts of 6,700 personnel reportedly reduced overall headcount 25%.

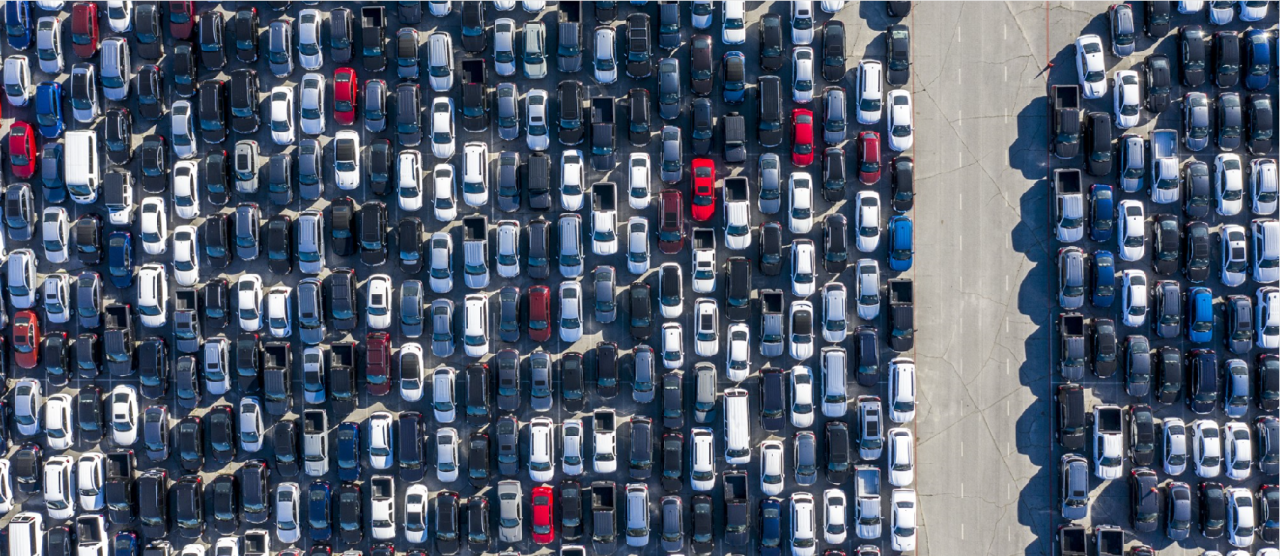

The cynical extraction and creation of wealth from the under-compensated toils of Uber driver/contractors has now been revealed for the cash engine that it is. While Uber and its ride-hailing brethren Lyft-Gett-Yandex-Grab-Ola may be struggling through a 75% downturn in business – they can more easily weather the current financial storm than rental car companies with their massive capital investment exposures: tens of thousands of leased cars.

Hertz long struggled with the added burden of nearly $20B in debt, but had been rounding out a successful recovery in its business prior to the COVID-19 outbreak. Still, rental car companies Avis, Hertz, Enterprise, and others have struggled to compete with ride-hailing operators – the presence of which applied downward pressure to rental rates globally.

With its normal ride-hailing business tanking and $9B of cash on hand, Uber has sought to simultaneously trim its sails and consolidate its already massive mobility footprint. Uber’s first step was to lead an investment round in Lime, at a point when the shared e-scooter operator has seen a massive reduction in its business from COVID-19 and a corresponding decline in its value.

As part of the deal, Lime will take over Uber’s Jump e-scooter operation. In this way, Uber buys into its unprofitable e-scooter competitor at a massive discount and offloads its own unprofitable e-scooter business. It’s a smart play for Uber. Uber is likely to see the value of its Lime share skyrocket as the world recovers from COVID-19, and Uber will be in position to leverage the Lime relationship by cultivating greater degrees of integration of Lime’s scooter offering onto Uber’s ride-hailing platform.

Following up the Lime investment, Uber is said to be pursuing an acquisition of Grubhub which Uber could combine with its own UberEats food delivery offering. Grubhub is regarded as the number two operator in the market behind DoorDash, with UberEats in third.

This deal looks very much like the Lime deal, except that food delivery operators have done well during the COVID-19 pandemic – filling in for the lack of human passengers in vehicles. Like the e-scooter business, though, the food delivery sector is unprofitable and highly competitive. Uber no doubt desires to either dominate or exit the sector if it’s only going to bleed resources. A Grubhub acquisition is a vote for domination.

All of this activity, which shows a shift away from the development of freight and autonomous vehicle services, reveals an Uber returning to its ride-hailing roots with a side order of food delivery. More likely is that Uber is preparing to roll up as much of the mobility marketplace as possible while rivals contend with perilously low valuations.

It appears that COVID-19 is driving Uber back to being a pure-play ride hailing operator. That is good news, indeed, for investors and may mean even further layoffs and consolidation ahead.

As for any expansion in its business, Uber already commands a sweetspot in the market and it is a position the company will have to concentrate on defending. In the context of defending that position distractions such as freight or autonomous vehicle development take a back seat.

Uber will need all the cash it can get as expectations for a swift recovery fade. Uber’s “uber-trage” – while good for the company and its investors – will do little to improve working conditions for Uber drivers. But a laser-like focus on ride hailing is likely to deliver vastly enhanced profitability while firing up municipal taxing authorities to up their fees and surtaxes.

Uber’s COVID-19 recovery will therefore likely be characterized by increased competition, regulatory scrutiny, and taxation. One imagines Uber revving its cash-pumping engines in anticipation of a roaring return to business in the U.S. and elsewhere as COVID-19 restrictions are lifted.

A more reasonable path forward might emphasize greater integration with public transport. While some municipalities have taken a dim view of Uber shifting passengers away from public transit, a growing roster of cities around the world have turned to Uber to fill in for public transportation in underserved neighborhoods – going so far as to subsidize Uber fares.

In a post-COVID-19 environment, Uber and other ride hailing operators will benefit due to increased demand from consumers hesitant about returning to trams, subways, and buses, including those maybe reducing their own spending on an owned vehicle. Municipalities will simultaneously turn to Uber as a source of tax revenue and as a partner to fill in public transit gaps. COVID-19 recovery could be very kind indeed to Uber, Lyft, Yandex, Grab, and their ilk. Hard to see the silver lining in the midst of today's dark cloud.

National Account Manager, eMobility. ABM Technical Solutions

3yVery well written article as usual Roger C. Lanctot. I always look forward to your posts. I feel our company is better positioned to ride the Covid storm and hope consumers in need of transportation switch from the habit/ease of ride-share and opt for a clean/sanitized car rental or go back to a vehicle of their own. Speaking for myself, I don't want to ride in a strangers car to get around town. :-/ We already have customers coming back to us that we lost years ago to ride-share. Fingers-crossed, this keeps growing as restrictions loosen up.

Confidential

3yGood Riddance to all Wall Street Pyramid Ponzi Schemes, including Dr Evil.

Technology Executive | Passion for Innovation & Diversity | Global 🇺🇸🇮🇳🇩🇪🇯🇵🇳🇱 | IIT, RPI, Chicago Booth alumni

3yInteresting perspective. Thank you

CEO @ Vulog | Driving Sustainable Mobility Globally

3yI would not kill the car rental giants too quickly. Hertz will come back much stronger (and leaner) and on what is known to be a profitable business.... which is not the case for the ridehailing business. I also believe the challenges the Ubers of this world will be increasingly challenging : more constraint from cities to reduce the number of cars running empty, constraints to run EV fleets in Europe, more cost conscious customers (individuals and companies), professional trips going down, local employment regulations, ...

Multi-Threat: Telecoms, Transportation/Mobility, Fleet Electric/Autonomous/Digital Transformation, Outdoor Recreation & Hospitality Innovation

3yYour viewpoint always manages to capture what most the rest of us miss Roger. All makes sense for Uber and their lesser counterparts. And yet while most people may come back to Ridehailing in very large numbers (eventually), another more fortunate result of the pandemic dilemma and reality is a growing number of urbanists and citizens who don’t want the vehicle numbers and Vehicle Miles Traveled-VMTs gobbling up roadways again. Walkers, Runners and Bicyclists (e-bike enthusiasts especially) want to change the world now, and I’m rooting for them!