ETAs and The Hype Cycle

A client asked me how our Enterprise Technology Adoption (ETA) profiles mapped to the Gartner Hype Cycle. It was not something I had thought about before, but there is a pretty logical way to do this. The document “Understanding Gartner’s Hype Cycles” (link for clients) explains a couple of things that start to frame the thinking:

A Hype Cycle carries a technology to the early stage of mainstream markets (if it even makes it that far)

The Trough of Disillusionment can bee associated with the original chasm (from Crossing the Chasm).

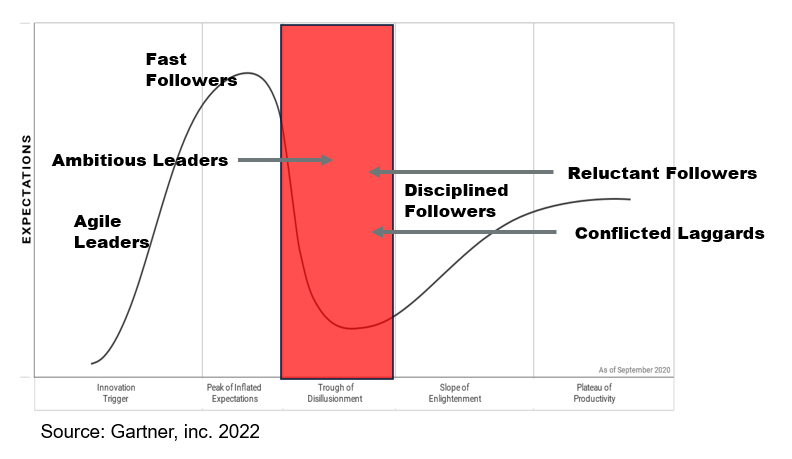

With that in mind, here is my added perspective with ETAs:

The graphic reflects that groups that are likely to be the most active (highest percentage of customers in the profile group) during each phase. Here is the rationale:

Agile Leaders are aggressive in their pursuit of advantage through technology. They are the fastest adopters of new technologies and either find a way to get value or abandon and move on to the next new things.

Ambitious Leaders will move once some clear business use cases are identified as possibilities, but they make mistakes that contribute to the trough of disillusionment.

Fast Followers are looking for a bit of proof.

Disciplined Followers move when the risks are highly mitigated.

Reluctant Followers and Conflicted Laggards follow as the mainstream market is established, but some move earlier, getting frustrated and further contributing the the trough.

Disinterested Laggards don’t even make the picture–they will wait even longer.

I’ve highlighted the trough of disillusionment because it deserves special treatment.

Ambitious Leaders will be on the forefront of the fall into the trough. They often buy without a full view of implications and disappointment is quite common.

The trough will also be littered with a decent amount of customers from the right side of the New Chasm, namely Reluctant Followers, Conflicted Laggards, and Disinterested Laggards. These groups won’t have a high percentage of companies active, but the ones that do pursue technologies in the early stages of the life cycle (due to business situations or the influence of individuals). are likely to be disappointed as well. These groups often don’t put in the effort to work through issues. This goes back to the idea of models being clean while markets are messy. Companies don’t adopt technology in a perfectly rational manner and that is the challenge. The New Chasm reflects companies that find collaborative decision making to be challenging and lack confidence and conviction for their decisions. They effectively live in the trough for most of their decisions.

But there is one other view of the trough and that relates to the Fast Followers. They are the group that can help vendors work through the issues that create the trough. They will push for best practices, detailed plans and examples, and other things that reduce the risk and create more predictable results. Responding to this group effectively can help both markets and vendors reduce the impact of the trough to some extent. The challenge is how you take all of that hard work that you and the Fast Followers do and leverage it with other profiles. The Disciplined Followers are easy–they will appreciate all of those things and use them quite willingly. The others will be more reluctant, so you will have to find ways to make it an easy, low effort experience. But doing so can accelerate success in the mainstream (where the majority of organizations, overall, are most active).

The hype cycle is most important for newer technologies and markets. I hope this mapping of ETAs helps you if you have products and services in these early stages.

Helping companies unlock the power of UX research throughout their organization!

6moHank Barnes, I've admired your insights since my time working for Gartner. But since I've had the opportunity to move into the UX/CX research field, your thought leadership and insights are invaluable to the impact on my work and how I get to work with my clients! Thank you!

Innovative Leader Driving Digital Transformations | C-Suite Trusted Advisor & Value Consultant | Customer Buying Journey, GTM, Revenue Enablement Expert | Featured in HBR, Forbes, Gartner as Thought Leader, Keynotes

6moNice mapping Hank. The characteristic of the groups across the chasm and trough of disillusionment is “perceived risk” is high for these groups and it has more to do with organizational risk rather than technological risk.

Helping Vendors & Service Providers Grow | Senior Business Development Director @ Gartner

1yThis is great Hank Barnes. Would love to see one of these for vendors, e.g. how tech vendors can effectively message and position to buyers at each stage. Is there a silver bullet in reaching slower adopters earlier?