Journal Entry for Prepaid Expenses

Journal Entry for Prepaid Expenses

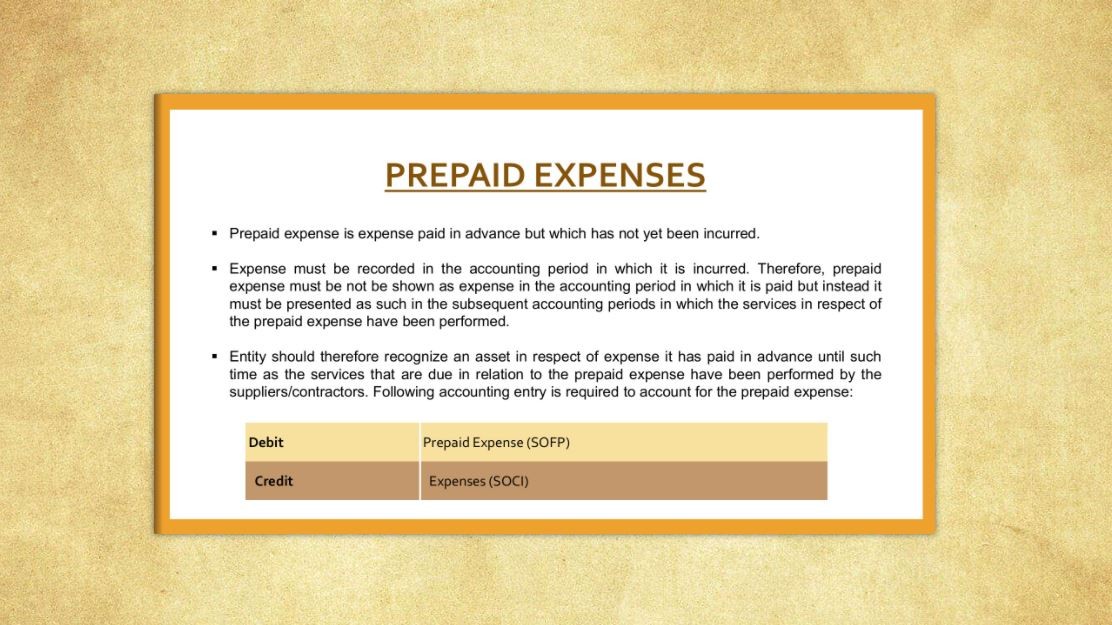

The following different prepaid expenses journal entries give an understanding of the most common type of situations of how prepaid expense is recorded and accounted for. As there are situations where the Journal Entry for Prepaid expense can be passed, it is not possible to provide all the types of situations.

How to Record Prepaid Expenses?

Example #1

Company X Ltd. started a business, and for that, it requires the property on rent. It signed an agreement with Mr. Y to take the property on rent for one year. As per the agreement, X Ltd has to pay rent of full 12 months in advance (at the beginning of the year on 01.01.2019) itself to the landlord amounting to $ 60,000 for a whole year.

Also, after taking the property on rent and paying the amount of rent as an advance for one whole year, it took the insurance of the property for which it paid $ 12,000 upfront for the insurance policy of the 12 months to the insurance company on 01.01.2019. Analyze the treatment of the amount paid as rent and insurance for the property by the company and pass the necessary journal entries recording the payment and the adjusting entries for January 2019.

Solution

The date when the rent expense and insurance expense

is paid for the whole year: January 01, 2019.

In the present case, the company X ltd. paid the full rent and insurance amount of the 12 months at one time in the beginning. So, the X ltd will recognize the $ 60,000 rent expense and the $12,000 insurance expense as the prepaid insurance

in the monthly financial statements of the company

because the amount is paid in advance benefit of which is not yet received and the same is to be received in the future date.

The company will initially record the amount paid as the prepaid expense at the time of payment of money and adjust it subsequently every month for the next 12 months as its expense once the amount gets due. Following are the accounting entry

for recording rent and insurance expense in the monthly financial statements for the year 2019:

Entry to record the payment of rent and Insurance amount in advance

The company will pass this adjusting journal entry

every month for the next 12 months to prepare and present the correct monthly financial statement of the company, after which the balance of prepaid rent and insurance account will become nil.

Prepaid expenses are the current asset of business then it will post to the asset side of Balance sheet it will deduct from the Main expenses head and post it to then P/L a/c.

Example #2

On December 31, 2018, Company Y Ltd paid the salaries for January 2019, amounting to $ 10,000 in advance to the employees of the company. Analyze the treatment of the amount paid as an advance salary by the company to its employees and pass the necessary journal entries recording the payment and the adjusting entries.

Solution

ending in 2018, on December 31, 2018, the salary has been paid in advance to the employees, which will get due in the next month. So in the present case, the company Y Ltd. paid the expense in one accounting year (ending on December 31, 2018), which will get due in the next accounting year (ending on December 31, 2019). The company has to recognize the payment as the prepaid expense in the accounting year in which it is actually paid and adjust the same when the expense actually gets due. The following are the necessary journal entries to record the transactions

Conclusion

are the amount of the expenses of which has been paid in advance by one person to another, but the benefit of the same is not yet received. The benefits of such expenses are to be utilized by the person on the future date. Once the amount has been paid for the expenses in advance (prepaid), a journal entry should be passed to record it on the date when it is paid. The date when the benefits have been received against it, then the entry should be passed to record it as actual expense in the books of accounts.

The adjusting journal entry should be passed at the end of every period in order to prepare and present the correct monthly financial statement of the company to the stakeholders.

(Note- I am hasting accounting sessions on you from the next week , please be there to watch those because accounting lectures can be important for the interview process)

If you like this please share your feedback and do subscribe to my channel as well.

Accounts Payable (Looking for Job)

1yToday my Interview Questions Anybody Please reply my question. 1) salary paid 120000 Accucally paid salary amount is 100000 worgly paid 20000 how to pass the journal entries our books of accounts 2) prepaid insurance payment 120000 one year sep 14 th 2022 done this transaction. How to pass the journal entries September 2022 books of accounts and October 2022 books of accounts

Immediately looking for job change in Fund Accounting, NAV, investment Banking

2yThanks Shivraj for sharing this usefull information!! Helping 👍

Consultant(Asst Manager) at Hexaware Technologies

2yNice