Pros and Cons of Fringe Benefits

Offering fringe benefits can be a valuable investment in the well-being and productivity of your employees, as well as in the long-term success of your organization. By carefully selecting and designing benefits that meet the needs of your employees, you can create a positive work environment and attract and retain top talent.

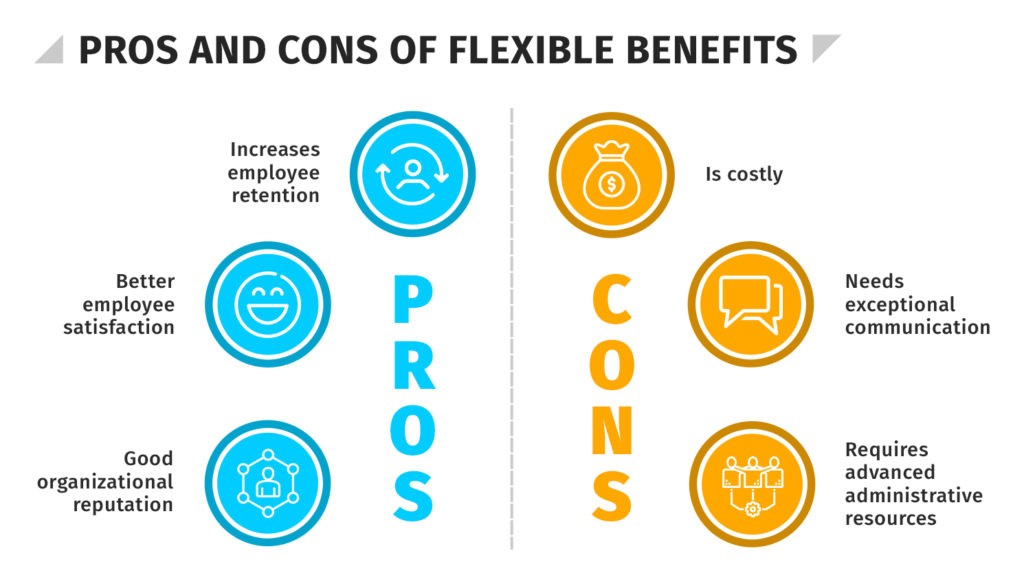

Advantages

- Attract and retain top talent: Offering fringe benefits can be an effective way to attract and retain top talent. In today's competitive job market, job seekers often evaluate potential employers based on the benefits and perks they offer. Offering attractive fringe benefits can help set your organization apart and make it more appealing to job seekers.

- Improve employee morale and productivity: Fringe benefits can help improve employee morale and job satisfaction. When employees feel that their employer cares about their well-being and invests in their professional development, they are more likely to feel motivated and engaged in their work. This can lead to increased productivity and higher levels of job performance.

- Reduce absenteeism and turnover: By offering benefits that support work-life balance, such as flexible work arrangements, child care services, and health and wellness programs, employers can help reduce absenteeism and turnover. When employees have access to benefits that support their personal and family needs, they are less likely to miss work or leave their job.

- Enhance organizational reputation: Offering attractive fringe benefits can enhance the reputation of your organization as a desirable place to work. This can help attract not only job seekers, but also customers and business partners who value organizations that invest in their employees.

- Tax advantages: Some fringe benefits may offer tax advantages for both employers and employees. For example, contributions to retirement plans are tax-deductible for employers, and contributions to health savings accounts are tax-deductible for employees.

Disadvantages

- Some employees need a larger cash salary than the combination of salary + benefits. Such employees do not stay for long with the organization.

- For managing the equal flow of benefits within the organization, administrative costs increase to that extent.

- Few benefits are compulsion by law & thus any non-compliance leads to paying of fines and penalties to the government. Thus, for the sake of compliance with labor-laws, the cost of a professional expert is also to be borne by the employer.

- Fringe benefits are standardized in nature. Customization is difficult given the big mob of the organization and thus, you cannot keep each employee satisfied.

- For a few organizations, the cost of providing fringe benefits is also high. The employer needs to cover up the cost through an increase in revenue or selling price of his products.