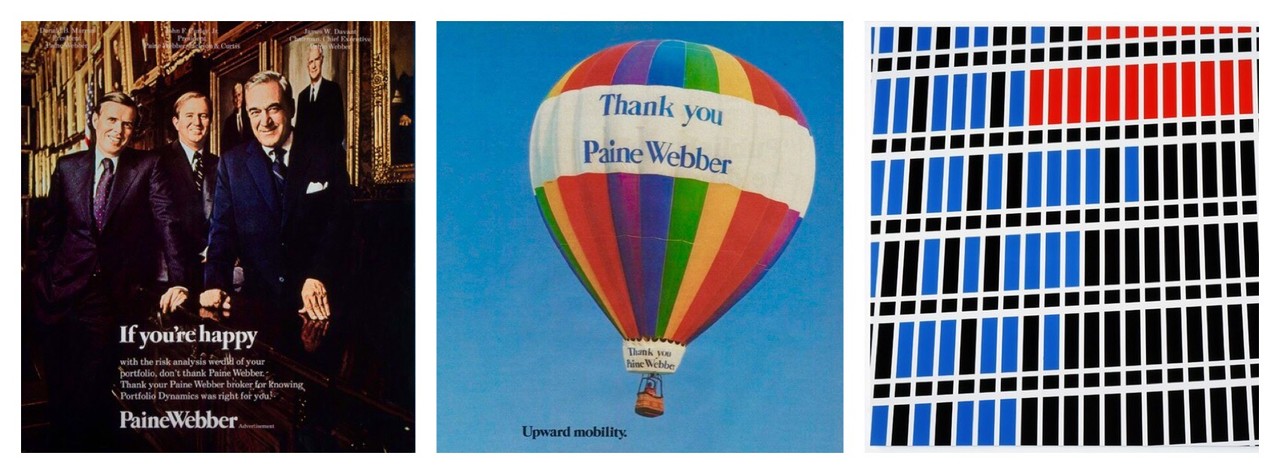

Thank you, PaineWebber

William A. Paine and Wallace G. Webber founded their namesake brokerage in Boston in 1880. Boston, New York and Philadelphia were the three major American money centers in the nineteenth century, the domestic capital market having developed in large part to meet the financing demands of railroad and infrastructure development. Boston had specialized in equity offerings and in 1840 was the nation's most important money center, but by the second half of the century, New York and its bond issues had achieved dominance.[Chandler, Patterns of American Railroad Finance 1830-1850]. PaineWebber became an NYSE member in 1890, merged in 1942 with another old-line Boston brokerage Jackson & Curtis (1879), relocated in 1963 to 140 Broadway in New York City and went public in 1974 (NYSE ticker PWJ).

In 1985 PaineWebber moved to its final location at 1285 Avenue of the Americans between 51st and 52nd street (which had been the old Equitable Life Building), christened its new home the PaineWebber Building and hung its red neon trademark on all four corners, 500 feet above street level. You could see it up there from half a mile south on 6th avenue.

PaineWebber in the early 1990s was something like the fifth- or sixth-largest brokerage firm in the country with some 5,000 brokers. It had grown by virtue of the massive brokerage consolidation beginning in the late 1960s. It had also been diversifying by quietly building up its capital markets business. CEO Donald Marron had declared his ambition to make PWJ a top-five investment bank in a September 30, 1985 FORTUNE article "Why PaineWebber is on a Hiring Binge." That same article dryly observed that the firm would have to abandon its "relatively relaxed style for which it is known and foster more aggressiveness and creativity."

In 1992 PaineWebber had taken notice of the burgeoning Mortgage Backed Securities and Collateralized Mortgage Obligations product sectors. The timing was right. The still-fresh Tax Reform Act of 1986 had created the REMIC, which surmounted the limitations of Grantor Trust MBS to facilitate the creation of bonds with custom maturities and priorities: Sequentials, PACs, Floaters, as well as cleanup calls. [Source: Peaslee, The Federal Income Taxation of Mortgage-Backed Securities] Overnight, the industry could transform mortgage debt into hundreds of billions of dollars of bonds tailored to the needs of institutional investors. And it did. In 5 years, Agency CMO issuance grew 30-fold from $9.9B in 1987 to $301.5B in 1992, by 1997 total mortgage securities issuance ($723B) would exceed that of Treasuries, and in 2003 Mortgage issuance ($3.5T) would equal Treasuries, Corporates, Municipals, Agency Debentures and Asset Backs combined. [Source: SIFMA]

With ambition and opportunity in alignment, PWJ engaged top mortgage talent. To head Fixed Income Quantitative Research and create the sophisticated models needed to trade CMO and MBS, PaineWebber recruited Stanley Diller from Bear Stearns. Diller was one of the original and best-known "Quants," having founded Financial Strategies at Goldman Sachs in 1976, publishing seminal research and making Negative Convexity an industry term. For Investment Strategy, PWJ hired Laurie Goodman from Merrill Lynch, who would amass more #1 rankings (11 Agency and 10 Non-Agency) in the history of the Institutional Investor fixed income polls. In late 1994 PaineWebber acquired Kidder Peabody -- yet another old-line Boston-founded brokerage firm -- from parent GE. The synergy behind the acquisition was Kidder's broker presence of over 1,000 financial advisors, which would elevate PWJ into the 4th-largest brokerage position. Kidder also happened to create more CMOs than anyone else quarter after quarter from 1990-1993, issuing in total about 20% of the market, double that of nearest rival Lehman Brothers. By means of the acquisition of the brokerage, PWJ would into the bargain obtain a top CMO trading team.

Diller's team had in 1992-1993 built a portfolio analytics system from the ground up and named it SuperBond. It was roughly a million and a half lines of C++ and ran on Sun SPARC workstations, leading edge Wall Street technology at the time. SuperBond ran every kind of fixed income cashflow; treasuries, callables, swaps, structured notes, but of course its premiere products were MBS and CMOs. Because of its elegant object-oriented architecture, adding new models and product types to SuperBond was straightforward.

My first task was programming ARM pass-throughs, which began with many impromptu meetings on the desk, taking notes as they patiently explained how periodic and lifetime resets worked and what COFI indexes were and how index lookback worked. It was great experience: the product was hot, the desk needed responsive modeling of new features, I was eager to contribute and glad nobody had figured out how little I knew about finance at the time. Emanuel Derman, who had worked for Diller at Goldman, wrote about how much he disliked analyzing ARMs because--and I'm paraphrasing here--there are no elegant closed form methods to express them. I'll never be half as smart as Prof Derman, so let's say that I'm gratified just to get all the details and cashflows correct, modeled efficiently and tied out, so as to be able to throw it into a Monte Carlo engine and let the computer do the work.

After the Kidder acquisition, life really became exciting. In the basket of assets PaineWebber have bought, there was this jewel of a CMO cashflow engine, as the heart of a structuring tool which had created all those deals that had put Kidder on top for 20 straight quarters. Morris Pearl was the wizard behind this model, he taught me everything about CMOs and we worked together for many years. By virtue of the fact that issuance structured on this model had made Kidder #1, would also make UBS the #1 dealer from 2001-2005, as well as the fact that the code base was incorporated into INTEX Dealmaker, I reckon Morris is responsible for making more CMOs than anybody. I recall a few years later, I was integrating INTEX's cashflow model into SuperBond to handle product types we didn't want to reverse-engineer. I was floored to find Morris' model could run Agency CMOs something like 100 times faster than INTEX. Genius.

I guess the ARM thing had worked out OK, because I was lucky enough to get the assignment of integrating the Kidder CMO cashflow engine into the SuperBond OAS system. First there was the bifurcating the code into library and front-end application, conversion of the C functions into C++ classes, cleaning up the global variables, creating the hooks for taking inputs and outputs from the SuperBond user interface and its historical databases, creating the OAS calculator class and connections for the prepayment model, term structure model, index generation, mortgage rate generation, and user scalar and vector prepayments and indexes. "A lot of plumbing" is what we called it. I was learning how these models worked at barely a step ahead of coding, integrating and testing--thank goodness for encapsulation, inheritance and polymorphism. In 1995 there was many a late night spent tying out cashflows and yield tables with Bloomberg. And the desk would keep doing new things like REREMICs which kept us busy. But as 1995 drew to a close, we were deploying the model to the trading desk and sales force, some as far away as Tokyo.

I recall early on messing up handling forward-settles which manifested itself in some bad metrics for a particular issue CMO, and one of the senior traders justifiably made his displeasure known to me. As I was walking off the floor, another senior trader put an arm on my shoulder and said "Sometimes you're gonna get yelled at, but it's OK." And it was.

Business just got better and bigger, our analytics got better and faster. We were all suits and ties until the Internet boom convinced management you could still be professional while wearing polos and loafers. I don't think PaineWebber ever got bigger than 20,000 employees and it felt much closer than that. We'd take the elevators up to the 38th floor to hear Chairman Don Marron give us the quarterly earnings. He was certainly an inspiring speaker and you'd get back to your desk all fired up. And the MBS unit remained super tight. Even the UBS merger in 2000 did not disrupt our business, which continued to occupy the 11th floor of 1285 rather than relocating to world's largest trading floor in Stamford.

It's hard looking back to believe how incredibly fortunate I'd been to have started my career at PaineWebber, 25 years ago today, on August 9, 1993. Through no plan of my making, at PaineWebber I was able to work with some of the most respected names, and some of the biggest producers in the business, learn from some of the most knowledgeable teachers, and generally sit along side some of the most talented and nicest folks I've ever met.

Thank you, PaineWebber.

Trusted and influential senior talent advisor building strong consultative relationships with internal clients and external business partners.

5yFond memories.

Compensation Administrator -AD at UBS Wealth Management

5yCongrats on 25 years! Interesting read...enjoyed the trip down memory lane. I celebrated 25 years in April...

What a great read. Took a nice walk down memory lane..

Senior Business Analyst at BNY Mellon

5yThanks Rei, the experience and group was very special and you captured it so well, like one of your great photographs. I'm so glad I was part of it.