Why I wouldn't invest in or accept cryptocurrencies

Lately my LinkedIn profile has been overflown with news on cryptocurrencies and I even spent a deal of the holidays speaking with my brother and some family about this topic. I am kind of a risk taker, so it is not simple fear why I have told everybody I wouldn't invest in cryptocurrencies and I will leave some arguments here, drifting out from my topic on Gamification.

1. Money is about trust

Trusting a coin is not just a rational endeavour. A great deal of work on behavioral economics revolve around showing that our economic behaviors are more about feeling or bias, than about rational thinking. Right now, the data around cryptocurrencies show two sides of the picture: its incredible rise in value, which shows a lot of positive speculation, but also big temporary dips that shows fear. In the case of cryptocurrencies, the language used to speak of them resembles to me more the kind of talk you get from stocks markets than the one you get from solid currencies. Yes, you can invest in Dollars or Yen, but for the regular folk that live in the everyday economic world, currencies are about trade, about their power of exchange, and I still find that businesses, that are the main engine of products and services trade, are still reluctant to use bitcoins or else as a real payment possibility. If this changes, I might change my mind, but so many people calling cryptocurrencies a bubble will not help toward the consolidation of this marketplace.

2. Too many currencies

The technology behind the cryptocurrencies is the main driver behind the fad: the block-chain tech. But, as it has been seen, this is a relatively easily replicable technology. More and more cryptocurrencies appear, and many more will come from private hands. The more you have in the market, the more they will compete in the marketplace and the less of a globalize currency system they will become. So, many businesses might start receiving bitcoins, but they will not be as eager to accept Ethereum, Ripple and all of the other competitors that will appear. With different businesses supporting different currencies, people will find these currencies constricting and limited. If I have billions in bitcoins but can only use them to buy in Amazon, what would be the point of it. Right now, the main driver of the economic growth is the purchase and sell of the currency itself, another reason why they resemble more stocks than actual currencies. But this disseminated currency ecosystem will find itself struggling to become the pivotal economy it wants to be. And businesses having to choose from all the cryptocurrencies, not knowing which will survive and which will die will create paradox of choice and loss aversion.

3. Inflation

It has been said that one of the great thing of cryptocurrencies is that they are immune to inflation, because there is always a limited number of currencies available in the market and more will not be generated. I find this idea cute, but unfeasible, as it relates inflation only to adding more currencies to the system. Sure, this can create inflation, as more "coins" will reduce the value of the currency per coin, but inflation is really dependent on the power of trade that a currency has, and the perceived value of the coin. In this sense, the fact that each bitcoin increases its value with time, means that today you can buy more stuff with a single bitcoin than before, which means the coin has gained value. But again, this value has been created by the power of stock trading and trust, not because it has actual value in the trading marketplace. When all the cryptocurrencies have been released in the market (which they have not yet), their net value will depend on if people use them to trade for stuff. If not, bitcoins will get stuck in the hands of the few that got hold off them and will become valueless.

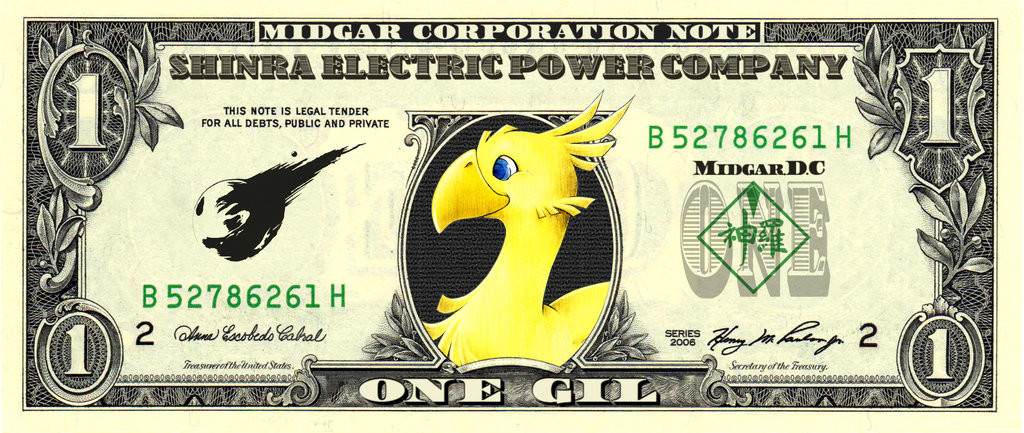

I will add to my case here that cryptocurrencies are nothing more than virtual currencies with some interesting technology behind. And, if there are people that know of the behavior of virtual currencies, are MMO game designers (because my lense of game design cannot be taken away). And one of the hardest stuff to control in an MMO is the inflation of the virtual currency. Why have game designers not used a free of inflation virtual currency in their games? Because they can't. Let's call our cryptocurrency CryptoGil (yes, as in the FF series, the game I learned the problems of virtual currency devaluation before WoW even existed). What if we create a fix amount of CryptoGil to avoid "emitting" money? New players will find themselves struggling to get hold of this currency. They would have to sell their services, but the buyer will be reluctant to pay for it, or he will have to struggle to get those currencies back. It kills the whole notion of farming and there is a good chance the coin will become stagnant. So what will happen to this currency? It will not get "emitted" but it will get divided. Imagine you have 100 gold coins in the system and a 100 players. If another player comes around the designers will begin fragmenting the gold coins into silver pieces so they can get redistributed. And after a while they will need to create bronze pieces and so on. This is a way of currency emission, as no more gold coins are being created, but you can virtually divide them into any number of parts. The thing is, those that had gold coins and start moving them around in the market system will find themselves ever more poorer, as getting to hold a single gold coin will become ever more harder (imaging 100 CryptoGil divided in 1 million players).

Now, let's say you try to avoid this by creating 1 million CryptoGil in the first place. Until you reach 1 million players you have two options. Divide all the currency among every player (which would amount to the same case above, with any new player creating divisions on the currency), or you will emit them slowly until you get your million players (the case with current cryptocurrencies). If you never get to the million players, then your currency behaved as any other currency, creating emissions slowly (with a centralized entity controlling the emissions, call it an algorithm or a bank). If you get there, then every new player above that number will find itself dividing the CrytoGil into smaller chunks again. Or there is a third option: you don't divide them, and you get an economic system of inequality, with players who have CrytoGil and players who don't have any: extreme poverty.

In the real world, people that won't get their hands on this cryptocurrencies will continue using more trustworthy real life currencies. And if these currencies can't reach the middle and lower classes, the consumer classes, businesses will not make efforts towards accepting them. And when the fad goes away, each CrytoGil will amount to nothing or very little, which is another kind of devaluation, no money emitted.

4. They will get stuck in few hands

Economies are dynamic and to be healthy they need money to change hands. A country with a lot of money on very few hands is not a rich country. It seem like one in a globalized market, but the country itself struggles, as is the case with the US right now. Try to be a teacher in San Francisco and try to pay for rent or basic needs. An economy relying on big corporations will not create welfare to its citizens and trickle down economies have failed. For corporations, people are an expense and they strife to cut that expense in any means they can, like automation and outsourcing. And rich people buy from rich corporations, and not in the ratio of the money they make.

Right now cryptocurrencies are creating a bubble of rich people that will not create welfare and that will not have incentives to move the money around towards the middle and lower classes, again, the backbone of any economy as everyone repeats. They will become a centralized currency around the rich (another kind of centralization), but again, this will reduce trust in the currency. I will not be amazed if this new billionaires have as a strategy selling all those coins (for old-regular dollars) before the market reaches that tipping point, leaving the buyers of those cryptocurrencies in ruin (again, stock market rules). Again, I would only receive bitcoins if I get to spend them in the real world and I don't see this happening soon. If this changes, I will change my mind.

5. No Government trust or basic needs

Following that principle, one of the main ways money changes hands are the basic expenses of the population. Rent, food, public services, taxes, and so on are the main reason people moves money, the main currency sinks, and the main reason to get it in the first place (survivalism and security). This would mean that, for cryptocurrencies to become really powerful, they will need to be able to purchase basic level products and services. And right now, the current stores that are believing on accepting cryptocurrencies are all commodities stores. I think it will be difficult to get governments on board in favor of these currencies over their own centralized and regulated ones, so I don't believe we'll be seeing people paying their taxes and public services with bitcoins. Maybe if real state businesses hop on board, there could be something interesting happening in regards to paying for rent this way, but again, this all falls down to trust in the currency.

6. They will need their own banking system

If cryptocurrencies want to serve as means to buy more expensive stuff, like homes and cars, they will need a banking system for two reasons. First, many of this stuff is purchased using loans, which means that these unregulated coins would see, if it happens, a lot of informal banking with really high interests (the kind that started the banking business in the renaissance), so why not continue buying in good old dollars. Second, because credit scores are really important on some countries, like the US, and cryptocurrencies can't provide them. As the whole philosophical idea behind these coins is to avoid banking centralization, banks will be reluctant to support them. So you either have the money you need to buy stuff or someone creates banking services for cryptocurrencies that can become regulated or become regulators.

7. What can businesses do with bitcoins

If a business is willing to believe in the fad, and starts receiving bitcoins, what can it do with them. To pay providers, they would have to be willing to accept the cryptocurrency itself, and that will be a hard sell, as providers are companies as well and will find the same problems. They can try to pay taxes, but this goes agains point #5. It can pay its workers. This would be the way to create a solid economic system, but your workers would have to be willing to receive these cryptocurrencies, which falls down again to point #1. And I find it difficult to see a company like Amazon risk telling their employers that they will get payed in BitCoins. So, their final possibility, sell them in the "stock" market for regular currencies, which again depends on speculation and kills the whole purpose of the endeavour. Big dips on cryptocurrency prices can mean big losses to companies. It would feel like receiving payments in stocks.

---

I am not an economist but I am a system designer. When I work with Gamification, understanding the system I am designing for is one of the main aspects of my job, and I do believe that crytocurrencies have a nice philosophy, but they need to overcome some mayor systemic challenges before they can fulfill their potential. A decentralized currency that relies right now so heavily in centralized ones is hard to trust, specially when there will be several new coins released in the following years, competing for the market's attention. And since those cryptocurrencies right now seem more like cryptostocks to me, I am not eager to enter into that bubble, or I would buy some, waiting to sell them before they crash, which is against my view of the world. But I will be on the lookout for systemic changes that prove me wrong. I just hope this fad will not contribute to the ever-growing inequalities of the world, but I yet not have my hopes up.

Senior Software Engineer

6yhttps://news.bitcoin.com/miami-bitcoin-conference-stops-accepting-bitcoin-due-to-fees-and-congestion/?utm_source=OneSignal%20Push&utm_medium=notification&utm_campaign=Push%20Notifications