Your private healthcare policy gives you peace of mind when you need it. You pay a monthly or annual premium, and your insurer covers any claims you make against your policy. Although most health insurers have simplified their processes, the fine print around making a claim can leave customers puzzled. In this guide, we’ll break down how claiming on your private healthcare policy affects your no claims discount and your policy premium. We’ll also dig into how this differs across leading private healthcare insurance providers.

If you have a car insurance policy, you might be familiar with the term No Claims Discount (NCD). Simply put, if you don’t make any claims within one policy term, you’ll be offered a discount on your premium at the following renewal. However, if you do claim, this may result in your premiums increasing or your NCD being removed due to the perceived risk involved.

For car insurance policies, if you’re a new starter on a policy, you would start with a 0% discount on the base premium you were quoted.

If you go one policy term without making a claim, this qualifies you as less of a risk, meaning you’ll be offered a discount on your premium at your next renewal. This continues for subsequent renewals, until the discount cap (set by your insurer) is reached.

When you first take out a private health insurance policy it’s slightly different. You’re still rewarded for any policy years where you don’t claim, but instead of starting at 0% discount (like with motor policies), you begin with a higher percentage discount on your base premium.

Most providers have a discount scale used to reflect the increase or decrease to your premium. This is based on the total claims you’ve made in one policy year.

Pictured is the current NCD scale for Aviva’s Healthier Solutions policies, with 14 levels of discount ranging from 0% to 75%. New starters on Healthier Solutions policies typically start with a 69% discount, which increases (with a cap of 75%) or decreases depending on the claims you made in a single policy year.

The main differences are around the specific risks involved for each type of insurance. Your health insurer encourages healthy living and preventative measures with an initial discount, while car insurance waits to reward drivers for low risk driving over time. Also, with health insurance, pre-existing conditions are usually excluded, and therefore any recent illnesses or injuries aren’t a risk to the insurer.

Your private healthcare policy incentivises you to lead a healthy lifestyle and rewards you for not claiming. This means you’ll receive a discount on your policy every renewal, provided you haven’t claimed in that policy term. It works as a cost saving measure, while still providing you with healthcare access, should you need it.

Depending on your insurer, you may be given the option to protect your NCD. This is offered as an optional extra for policyholders who wish to maintain their NCD level and premium cost.

NCD protection allows you to claim on your policy, while at the same time protecting your NCD level and premium. Without this feature, making a claim would cause you to drop down the NCD scale and likely increase your premium.

Having NCD protection also means that should you make a claim, your protection will be lost and NCD cover will apply as standard at your next renewal. If you remain claim free for the next policy year, you’ll be eligible to protect your discount again.

The way NCD works is fairly consistent across the leading insurers, however there are some key differences worth investigating. These can be helpful to know when deciding which insurer to go with.

There are instances where making a claim on your policy won’t affect your NCD level. When this happens, it’s likely because the policy benefit you’ve claimed for is excluded from your NCD assessment.

As this can vary depending on your insurer, it’s important to check which claims will and won’t affect your NCD level before making a claim.

Below is a comparison between Aviva and Bupa. It shows the policy benefits, that should you claim for them, won’t affect your no claims discount.

When choosing a healthcare policy, opting for a policy excess can lower your premium. It also means that should you need to claim, you’ll contribute that excess amount towards the cost of your treatment.

An example is: You have opted for £500 excess and were claiming for treatment costing £5000. In this case you would pay the first £500, while your insurer would contribute the remaining £4500.

With regards to your no claims discount, it only drops when your insurer has to pay out on a claim. This means, should you make a claim for treatment of equivalent or lower cost than your selected excess, your NCD would not be affected. Similarly, if your claim exceeds your selected excess amount, your NCD level will drop (because your insurer then has to contribute).

No Claims discount is a concept rooted in rewarding you for not claiming, therefore it doesn’t change too much across insurers. There are, however, nuances - such as slightly different discount levels - that may make opting for a particular provider beneficial to you. Let’s take a look:

As a new starter on an Aviva Healthier Solutions policy, you’ll usually be offered a 69% discount on your base premium with the ability for that to rise to 75% if you remain claim free in consecutive years.

Although Healthier Solutions are personal policies, you’re still able to add family members. With Aviva, each member has their own NCD level, meaning should one member make a claim, only their NCD level will be affected.

Another interesting feature of Aviva’s cover is how the cost of treatment affects your no claims discount. If the total paid out for a claim is less than £250, your no claims discount remains as is. However if it’s above this threshold, your discount will decrease by 3 levels on the scale. Luckily, Healthier Solutions policies have a condition in place where no policy will reduce more than 3 levels in a policy term.

.webp)

With Bupa health insurance policies, you’ll start with a 65% discount off your base premium. If you don’t make any claims in consecutive years, you’ll be eligible for up to 70% discount. In 2024, Bupa updated its NCD rules, improving its previous limits and making it now one of the more generous in the market. You can read more about that here: Bupa Improves No Claims Discount Rules.

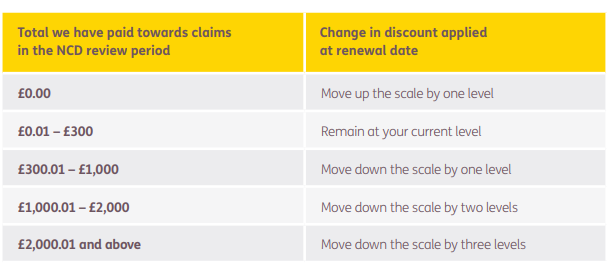

Bupa’s policies also work on a sliding scale of total claims paid. This means that you’ll move up or down the discount scale depending on the total claims Bupa pays out. If you don’t claim within one policy year, you’ll move up a level on the NCD scale. However, making subsequent claims, depending on the cost, may result in you moving down multiple discount levels.

Similar to Aviva’s cover, each member enrolled on your policy has a separate NCD level, meaning claims made by one member won’t affect the NCD levels of others enrolled on the policy.

During the first policy term, your renewal will be based on the first 10 months of your policy, with future years being based on the full 12-month term. This is because Bupa calculates your premium before your renewal date, basing it on months 11 and 12 of the previous policy year, and the first 10 months of the current year.

Axa’s policies (see p.35 for NCD) operate on a 17-step NCD scale, starting at 0%, with a cap of 80% discount on your base premiums. Choosing to take out a policy with Axa, you’ll be offered a 72% discount, with a maximum of up to 80% for subsequent claim free years.

If you claim against your policy, you’ll drop down 3 levels on the discount scale, however claim free years are eligible to move up the scale 1 level, delivering a cheaper premium.

An interesting aspect of Axa policies is the ‘Buyback’ feature. If you have a no claims discount on your policy, you’ll have the choice to buy back the cost of any claims made. This is beneficial, as your NCD level will remain the same, instead of decreasing (as it would if you made a claim ordinarily.)

Another useful option is Axa’s NCD protection, which you’ll be eligible for at each renewal, even when you’ve reached the maximum discount level. This means when you renew the following year, your policy will remain at the maximum no claims discount level, even if you have claimed.

The Exeter’s policies offer a 15 level NCD scale, with the maximum discount achievable being 75%. If you’re taking out a fresh policy, you’ll start with a generous 70% no claims discount, which is calculated by the total claims paid for each policy member.

Similar to Aviva and Bupa, each member has their own NCD level, meaning individual claims don’t affect other members NCD levels. Also similar to Aviva’s Healthier Solutions policies; you won’t ever drop more than 3 NCD levels in any one policy year.

The Exeter also operates a ‘per total claims cost’ model for making claims. Like Bupa, this means your no claims discount will increase or decrease based on the total cost of claims your insurer pays out in a single policy year.

Similar to other insurers, The Exeter offers the option to protect your no claims discount. Outside of purchasing protection, another way of preserving your NCD is what The Exeter calls ‘related claims’. These are claims which are ongoing across 2 NCD periods. However, where this would ordinarily cause your NCD to drop multiple levels – because it is a ‘related claim’, it will all be counted as one, therefore not dropping you even further down the NCD scale.

An example given by The Exeter for related claims is:

‘If we pay a claim that causes a member to move three levels down the scale during one review period, and we make a further payment for a related claim in the following review period, that member will not move further down the scale for that claim.’

.webp)

One of the more progressive insurers on the market, Vitality offers rewards for leading a healthy and active lifestyle, such as policy discounts and fitness equipment and technology. It is also an outlier in its market, choosing not to offer no claims discount.

Instead, their healthcare policies use the ABC system - calculating premiums by considering your age, current base rate price, the claims you’ve made, and finally your ‘Vitality status.’

Newly enrolled members on WPA’s ‘Complete Health’ policies start with a 67% discount. Relatively speaking, this is the highest discount on the market, with the next step on the scale being the maximum discount offered. WPA’s NCD operates on a 14-level scale, starting at 0%, with a cap of 70%.

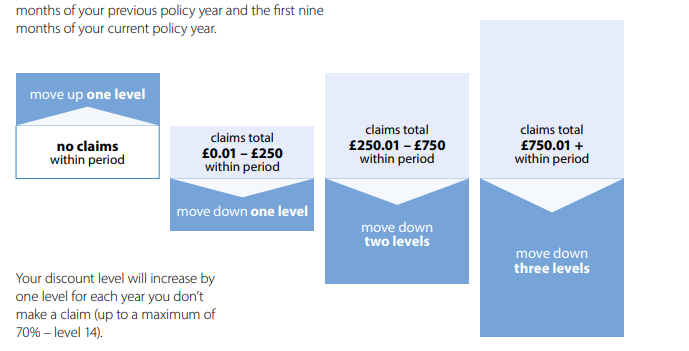

Differing slightly from other providers, your first year's renewal cost with WPA is based on the first 9 months of your policy (as opposed to the standard 10 months). All future renewal premiums then, are based on the last 3 months of the previous year and the first 9 of the current year.

Similar to Aviva and The Exeter, WPA uses a ‘per total claims cost’ model for making a claim.

Saga’s approach to no claims is the same over its Healthplan catalogue, with a 10-step discount scale, starting at 0%, with a maximum discount level of 60%. New starters will be enrolled on a fairly low discount of 35%, however this evens out due to policies having a lower maximum NCD cap.

Due to having a smaller NCD scale, you only drop two levels if you make a claim, never falling below zero. However, a claim-free year allows you to move up the scale one level until you reach the maximum discount, as is the industry standard.

With the exception of Vitality - the leading insurers have a similar yet nuanced approach to their no claims discount and claiming processes. Each has a sliding scale where new starters begin with a generous discount, which either increases or decreases depending on the claims made in a single policy year.

Where they differ, is how the monetary amount of ‘total claims paid’ affects your NCD level at renewal. An example of this range would be that Aviva Healtheir Solutions drops customers 3 NCD levels for claims over £500, whereas The Exeter does this for claims above £2000.

If you’re looking to take out a new private healthcare policy, it’s important to know what you’re investing in. Your no claims discount is one way to keep costs down, however it’s equally important when taking out cover, that you look into how insurers treat customers that claim.

Disclaimer: This information is general and what is best for you will depend on your personal circumstances. Please speak with a financial adviser or do your own research before making a decision.

Save up to 37%* on your insurance by comparing policies

*Based on 461 quotes between 01/22-01/23