Here’s how Chinese stocks have performed during the tenures of various CSRC chiefs

- Yi Huiman, 54, the former chairman of ICBC, has taken over as the ninth chairman of the CSRC. It remains to be seen if the stock markets will do better under his leadership than they did than under his predecessor Liu Shiyu

In an unexpected move over the weekend, the State Council named a new chairman of the China Securities Regulatory Commission – its ninth overall – to oversee the world’s third-largest stock market.

Yi Huiman, 54, the former chairman of Industrial and Commercial Bank of China, takes over from Liu Shiyu, who was in the post for nearly three years.

The most uphill task facing Yi, who rose all the way to the top at ICBC, will be to restore confidence in what was the world’s worst-performing equity market in 2018.

He would also need to kick start a technology board in Shanghai this year, a plan unveiled by President Xi Jinping to develop the nation’s unicorn companies, loosen restrictions on derivatives to attract institutional investors and further open up Chinese stocks to the outside world and integrate them with the global markets.

Here’s how the benchmark Shanghai Composite Index performed during the terms of each of the CSRC chairmen:

Liu Shiyu

February 2016 to January 2019

Shanghai Composite -8.9%

The former chairman of Agricultural Bank of China successfully handled the aftermath of a 2015 meltdown that wiped out US$5 trillion in market capitalisation, bringing down price swings on the world’s most volatile stock market to record-low levels.

He also started one of the strongest regulatory reforms in history, intensifying crackdown on insider trading and manipulation and meting out record fines to violators.

At an asset-management industry meeting Liu famously compared insurance firms to “barbarians” for using illegal funds for leveraged stock buyouts. But, the intensified surveillance came at the cost of significant decrease in market liquidity and a standstill in innovation.

During Liu’s stint, China ceded the title of the world’s No 2 stock market to Japan and stocks once again slipped into a bear market. Until Liu was appointed deputy party secretary of the All China Federation of Supply and Marketing Cooperatives over the weekend, the Shanghai Composite had fallen almost 9 per cent during his tenure.

Xiao Gang

March 2013 to February 2016

Shanghai Composite +28%

Xiao was brought to the fore when a major crash swept through China’s market in 2015, erasing US$5 trillion in value as leveraged traders fled stock bubbles.

He introduced a controversial circuit breaker system in early 2016 that was meant to calm investors amid quick market declines. But the move backfired, causing even faster declines as investors tried to pull out before trading was suspended. The circuit breaker was immediately scrapped and Xiao quit afterwards.

Still, the Shanghai Composite rose 28 per cent during Xiao’s term.

Guo Shuqing

October 2011 to March 2013

Shanghai Composite -7.9%

Guo was complimented by investors as the most hard-working chairman in CSRC’s history, introducing more than 70 rules to iron out flaws and develop the market. Still, the Shanghai Composite lost 7.9 per cent during his term.

He encouraged more dividend payouts among listed companies, had zero tolerance for insider trading and strengthened delisting rules, while introducing margin trading and over-the-counter market as well as restoring bond futures trading.

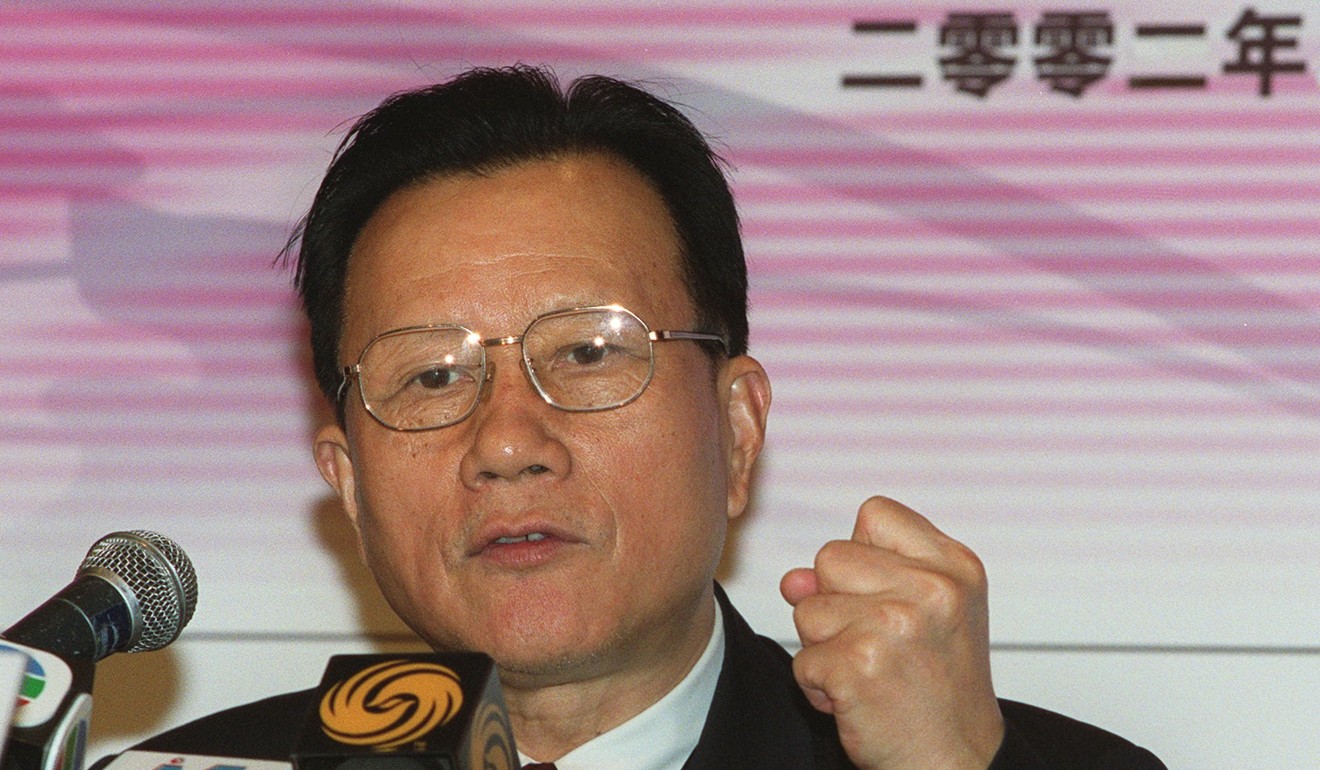

Shang Fulin

December 2002 to October 2011

Shanghai Composite +79%

As the longest-serving CSRC chairman, Shang’s biggest feat was to start the state share reform, converting non-tradeable shares held by state shareholders into stocks that could be commonly traded on the exchanges. The move aligned the interests of both major shareholders and small investors, helping stock prices to perform well.

The Shanghai Composite rose to a then record high of 6,092.06 in October 2007 after surging six fold in two years. It rose 79 per cent during Shang’s term.

Zhou Xiaochuan

February 2000 to December 2002

Shanghai Composite -15%

Before becoming China’s longest-serving central bank governor, Zhou was the fourth chairman of the stock market regulator.

While Zhou took on reforms to change the IPO mechanism to one that was approval-based and to allow foreign investors to buy Chinese stocks through the qualified foreign institutional investor programme, the stock market was at the centre of public criticism after a well-known mainland economist Wu Jinglian likened it to a casino. Besides, a slew of cases involving manipulation and insider trading shattered investors’ confidence.

Zhou also failed to tackle the hangover of non-tradeable shares that led to a conflict of interest between the state owners and small investors.

The Shanghai Composite dropped 15 per cent until Zhou moved to the central bank.

Zhou Zhengqing

July 1997 to February 2000

Shanghai Composite +38%

Zhou’s biggest achievement was to crack down on illegal off-exchange trading and clean up brokerages. His term coincided with the dotcom boom on the Nasdaq market. The frenzy that spilled over to China’s market saw the Shanghai Composite surge by 70 per cent in less than two months starting in May 1997. The index rose an overall 38 per cent during Zhou’s term.

Zhou died in July last year.

Zhou Daojiong

March 1995 to July 1997

Shanghai Composite Index +79%

The most pressing task Zhou faced when he became the CSRC chairman was how to deal with the excesses on bond futures trading. He finally decided to shut it down, causing funds to switch to stocks, which led to a spurt in equities.

The market expanded quickly during Zhou’s term, as he accelerated the pace of initial public offerings to help the listings of numerous state-owned enterprises.

The Shanghai Composite jumped 79 per cent up to the day he stepped down.

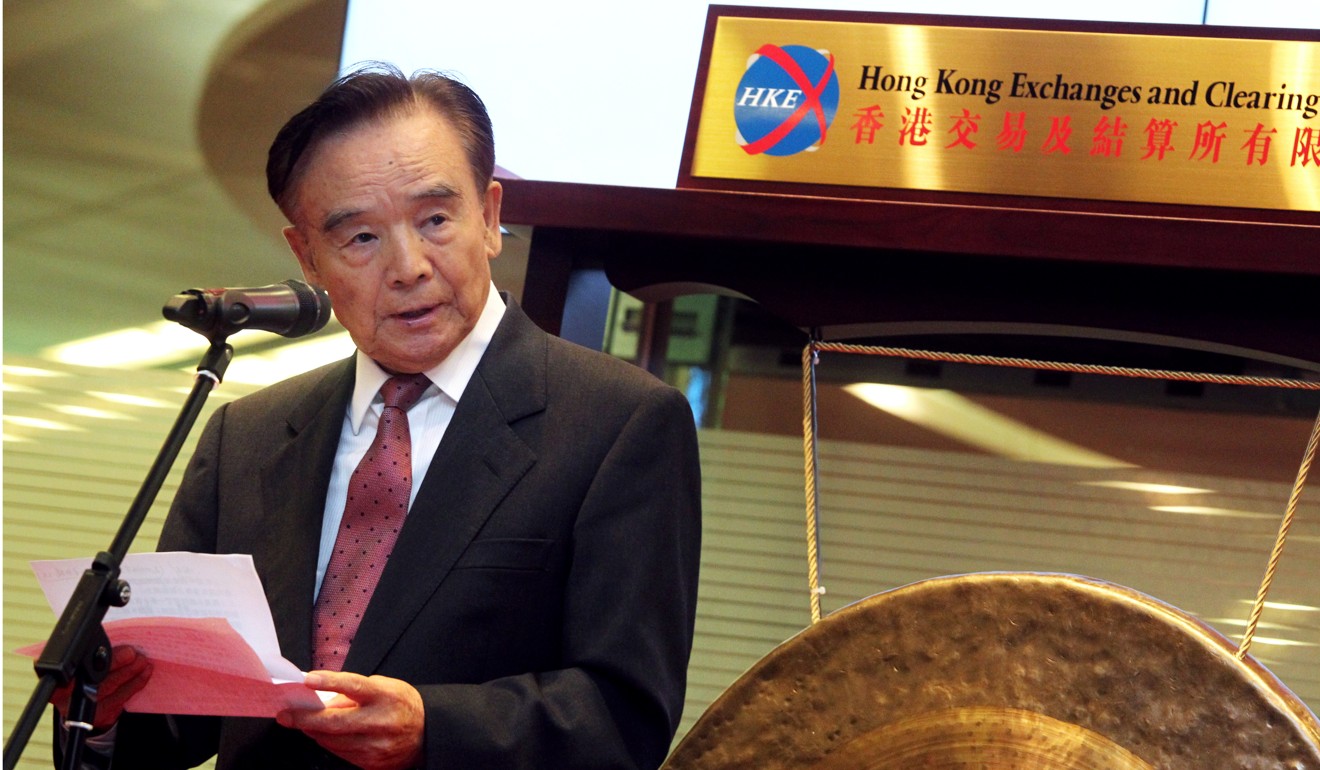

Liu Hongru

October 1992 to March 1995

Shanghai Composite Index +24%

Liu, an expert on monetary policy, was hand-picked by then vice-premier Zhu Rongji to lead the CSRC as its first chairman. He initiated innovation in securities products, such as H shares that allow Chinese companies to raise capital overseas by floating shares in Hong Kong.

The index posted a 24 per cent gain under his stewardship.