What is an Open-Ended Investment Company (OEIC)?

Open-Ended Investment Companies or OEICs are collective investment vehicles established as companies that have evolved as an alternative to Unit Trusts in the UK. These funds offer investors a professionally managed portfolio of pooled funds that can invest in a range of underlying securities according to a predetermined investment strategy. OEICs have some similarities to both Unit Trusts and Exchange Traded Funds (ETFs) and all three options should be considered by those investors looking to outsource the day-to-day management of their investment capital.

What is an OEIC?

OEICs are close relations to European SIVAVs or US Mutual Funds in that they are designed to allow investors to access a diversified and managed portfolio in a relatively cost-effective and tax-efficient manner. OEICs are listed on the London Stock Exchange (LSE) and the price of the shares are based largely on the value of the underlying assets – be these stocks and / or other securities – of the fund. OEICs are described as "open-ended" because they can create new shares to meet investor demand and will cancel shares of investors who exit the fund. This allows these funds to easily adjust both their investment criteria and fund size.

What role does the regulator play?

As an open-end investment vehicle, investors can freely purchase and sell shares of their selected OEIC with the value of the shares owned reflecting the net asset value of the underlying assets. OEICs can be purchased directly or through a broker, fund supermarket or independent financial adviser and are regulated by the Financial Conduct Authority. This places several limitations on the OEIC investment framework that investors should be aware of. For example, FCA rules require that each OEIC is ‘sufficiently diversified’, meaning an actively managed OEIC may not hold more than 10% of its total value in the shares of any one company. Further, the aggregate of any holdings over 5% must not exceed 40%. OEICs may hold up to 20% of their value in units or shares of a single collective investment scheme, like other unit trusts or open-ended investment companies.

How do investors buy OEICs?

OEICs are easy to access either directly online, from a fund provider or broker or via a financial adviser. They can be held inside tax-efficient wrappers such as an Individual Savings Accounts (ISAs) or Self-Invested Personal Pensions (SIPPs). Investors can also choose between lump sum and / or regular monthly payment into their OEIC. An OEIC must either distribute or accumulate the whole of its distributable income for a particular distribution period, either as dividend income or as interest.

How are OEICs taxed?

OEICs and unit trusts have many similarities as collective investment vehicles and share the same tax treatment. For a UK resident, gains on shares in an OEIC are only taxable when the shares are sold and in-built profits are taxable as gains, unlike some structures where the profit/gain may be taxed as income. Therefore, any capital growth when an investor sells or disposes of units/shares may be subject to capital gains tax. This also includes fund switches although switches between different share classes within the same fund, for example switching between income and accumulation shares, are not treated as a disposal for CGT. Tax is only payable where gains in the tax year exceed the annual CGT allowance of £12,300. This allowance has been fixed at £12,300 until April 2026. For individuals, the gain is added on top of their total income to determine the rate payable. Any part of the gain which falls within the basic rate tax band is taxed at 10% and the balance will be taxed at 20%.

OEICs vs Unit Trusts

Unit trusts and OEICs have plenty in common in that they are both open-ended and the price of each unit (unit trust) or share (OEIC) depends on the net asset value of the fund’s investment portfolio. Both can generally invest across a wide range of asset classes, geographies and sectors. Dividends in OEICs or unit trusts can be paid out as income or reinvested in the fund. The major difference is in pricing as unit trusts quote a bid price (to redeem) and an offer price (when you buy) with a spread that aims to ensure new or redeeming investors don’t dilute the value of existing investors’ units. OEICs only quote one price each day, making it easier for investors to understand. Several unit trusts have converted to the more modern OEIC structure over the past decade and this trend is expected to continue.

OEICs vs ETFs

ETFs are generally funds that passively aim to mirror the performance of an index such as the FTSE100 in the UK. An ETF trades on the stock exchange, so they can be bought and sold like shares in a company. While traditional fund structures such as unit trusts and OEICs are still popular, the ETF industry's rapid rate of growth indicates that younger investors are increasingly using ETFs as an alternative way to access markets. As with OEICs and unit trusts, ETFs fall into the category of pooled investment vehicles and are regulated in a similar way. Most of the differences between ETFs and OEICs relate to the way that each product is traded. While traditional funds are bought and sold via the fund manager or a financial adviser, ETFs trade on an exchange like shares with investors buying and selling them through a brokerage account. And while OEICs are usually priced once a day, ETFs can be traded on the major stock exchanges at any time during the trading day and their prices fluctuate throughout the day just like shares. A passively managed ETF will almost certainly be cheaper than an actively managed traditional fund, but it may not be cheaper than a passively managed mutual fund.

Track investments in OIECs with Sharesight

If you’re not already using Sharesight to track your investments in OIECs, what are you waiting for? It’s free to sign up, and with Sharesight you can:

-

Track all your investments in one place, including stocks, mutual/managed funds (OEICs), property, and even cryptocurrency

-

Get the true picture of your investment performance, including the impact of brokerage fees, distributions, and capital gains with Sharesight’s annualised performance calculation methodology

-

Run powerful reports built for investors, including Performance, Portfolio Diversity, Contribution Analysis, Multi-Currency Valuation, and Future Income (upcoming distributions)

-

Securely share access of your portfolio with family members, your accountant or other financial professionals so they can see the same picture of your investments as you do

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

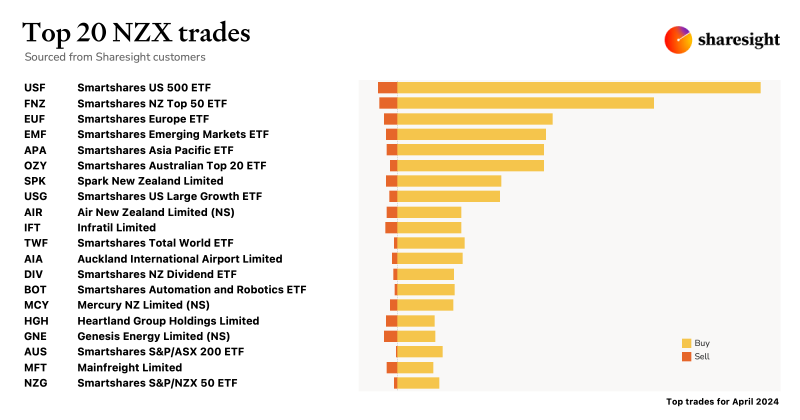

Top 20 NZX trades by Sharesight users – April 2024

Welcome to the April 2024 edition of Sharesight’s monthly NZX trading snapshot, where we look at the top 20 trades Sharesight users made on the NZX.

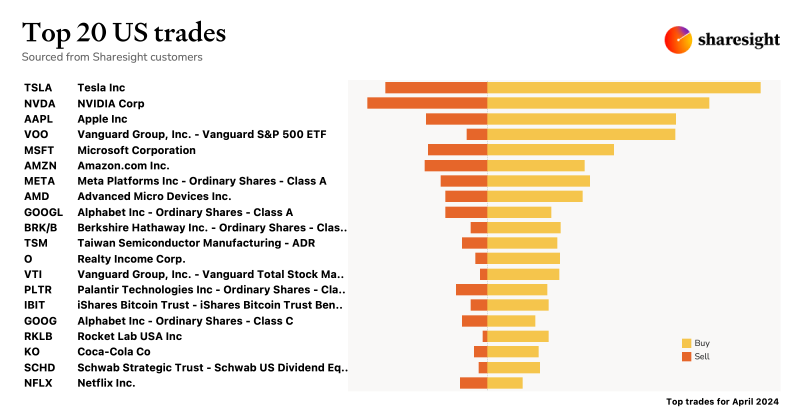

Top 20 trades in US stocks by Sharesight users – April 2024

Welcome to the April 2024 edition of Sharesight’s monthly USA trading snapshot, where we look at Sharesight users’ top 20 trades in US stocks.

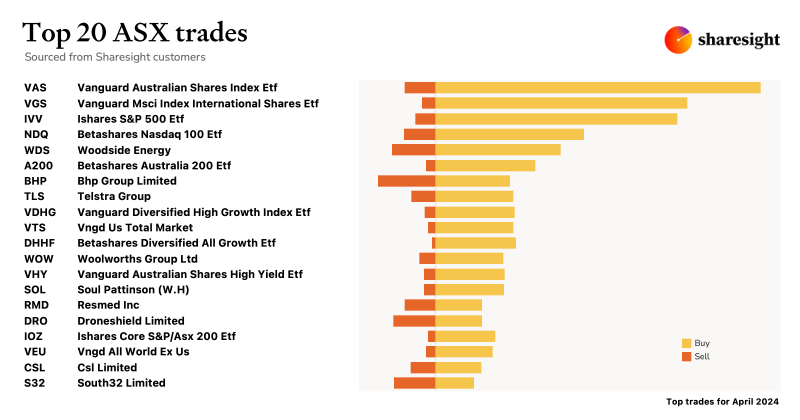

Top 20 ASX trades by Sharesight users – April 2024

Welcome to the April 2024 edition of Sharesight’s monthly ASX trading snapshot, where we look at the top 20 trades Sharesight users made on the ASX.