"Follow the money trail," — a catchphrase popularized after All the President's Men, is now the fundamental tenet of investigating white-collar crimes. But did you know that it also holds immense significance in the world of business? Understanding your business's financial landscape, tracking every dollar, and predicting future outcomes are essential for sustainable growth and success. While it is a financial investigation for crimes, for businesses, its Budget Analysis.

What is Budget Analysis

Budget analysis is the systematic evaluation of your company's financial data to gain insights into its financial performance, identify trends, and make informed decisions. It involves dissecting revenue, expenses, and internal/industry financial metrics to determine areas of improvement, allocate resources in an effective manner, and plan for a sustainable future.

Budget Analysis Transforms Business Fortunes

Studies say that 9 of ten successful businesses attribute their growth to effective budget analysis practices. For businesses, budget analysis is crucial. The major reasons are:

- Did you know that companies that conduct budget analysis on a regular basis are 30% more likely to achieve their financial goals? It provides a clear picture of your financial health, allowing you to assess profitability and cash flow and identify potential risks or inefficiencies.

- It helps set data-based and realistic financial objectives, ensuring that your resource allocation is wise. In fact, a study found that businesses that actively engage in budget analysis experience 40% more positive growth.

- The budget analysis enables you to monitor and measure performance, comparing actual against projected figures and adjusting your strategies.

Budget Analysis Templates

Conducting budget analysis is challenging. Managing and organizing large volumes of financial data can be overwhelming, leading to errors and overlooked details during manual data entry or calculations. Analyzing financial metrics and understanding their relationships can be complex and challenging. Presenting budget analysis findings in a clear and concise manner is often difficult, especially when communicating complex financial information to stakeholders.

Our budget analysis templates resolve all these pain points. These presentation designs streamline data management by providing built-in tools for input and organization, reducing the chances of errors and saving time. They simplify analysis by breaking down complex financial concepts into manageable sections and offering predefined formulas and calculations for easy interpretation of data.

The 100% customizable nature of these templates provides you with the desired flexibility to conduct a comprehensive budget analysis. The content-ready slides give you the much-needed structure that saves your accounts team time and effort.

Lets’s explore these budget analysis templates together to get you the ideal virtual finance manager.

1. Budget Vs. Actual Variance Analysis Presentation Deck

Discover the reasons behind variances in finance as you explore this budget PPT presentation template. This comprehensive deck is packed with research-driven templates, including actual cost vs. budget, month-wise forecasting, overhead cost analysis, quarterly budget analysis, variance analysis, actual vs. target variance, budget vs. plan vs. forecast, and more. It will help you stay ahead of the game with periodic reviews of actual expenses compared to the budget. Use this slide to identify potential cost overruns and revenue shortfalls that impact your business's bottom line. Download it now!

Download this presentation deck

2. Quarterly Budget Analysis Presentation Template

Take your budget analysis to new heights with this content-ready PPT Template crafted to help you analyze and assess your financial performance over a quarter. Delve into the intricacies of your budget and explore quarter revenue trends, expense patterns, and budget variances. It contains a budget table that highlights variable expenses, total variable expenses, fixed expenses, and non-income statement items, along with other sub-elements. Gain insights into the financial health of your business and make data-driven decisions. Get it now!

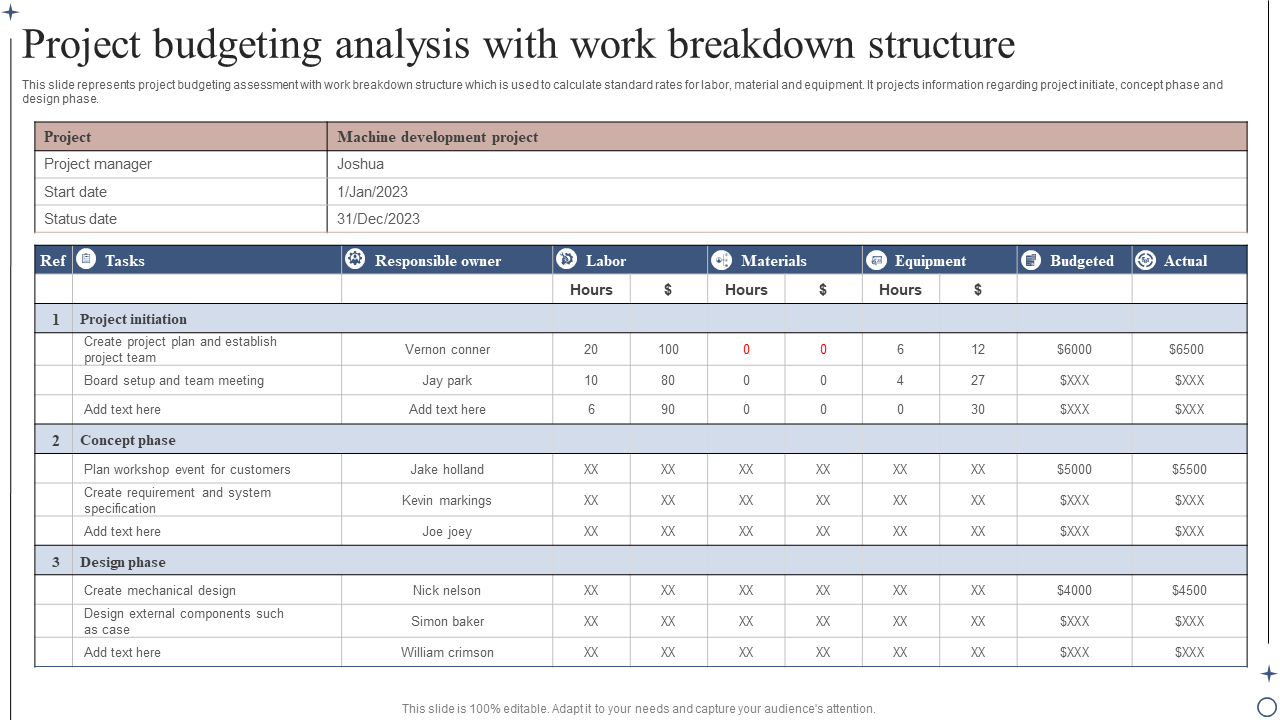

3. Project Budgeting Analysis With Work Breakdown Structure PPT Template

Analyze and manage project budgets using a structured approach with this structured presentation layout. It allows you to create a multi-phase Work Breakdown Structure (WBS) of your project with manageable components. Use this template to organize project tasks, resources, and costs with precision, allowing you to gain a holistic view of your budget allocation. You can assign a responsible person for each task and budget item in this PPT Design, which makes the project flow and financial implications easy to follow. Grab it today!

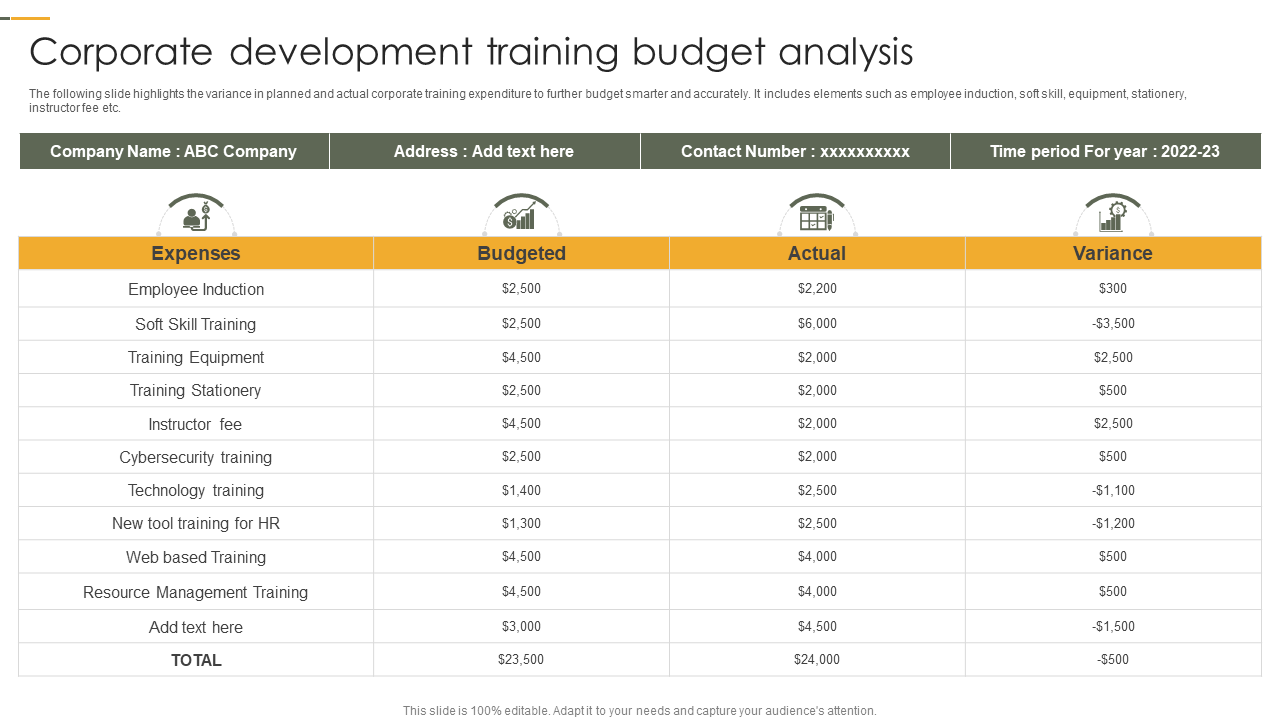

4. Corporate Development Training Budget Analysis PowerPoint Slide

Use this ready-to-use budget analysis PPT Design to maximize the impact of your training initiatives. The slide helps you analyze and manage training budgets, ensuring optimal utilization of resources. With this PowerPoint Set, you can track and evaluate training expenses, projected costs, actual expenditures, and variance. Evaluate and refine budget allocations for training programs like employee induction, soft skill training, and cybersecurity training, and make informed decisions to optimize this investment. Download it now!

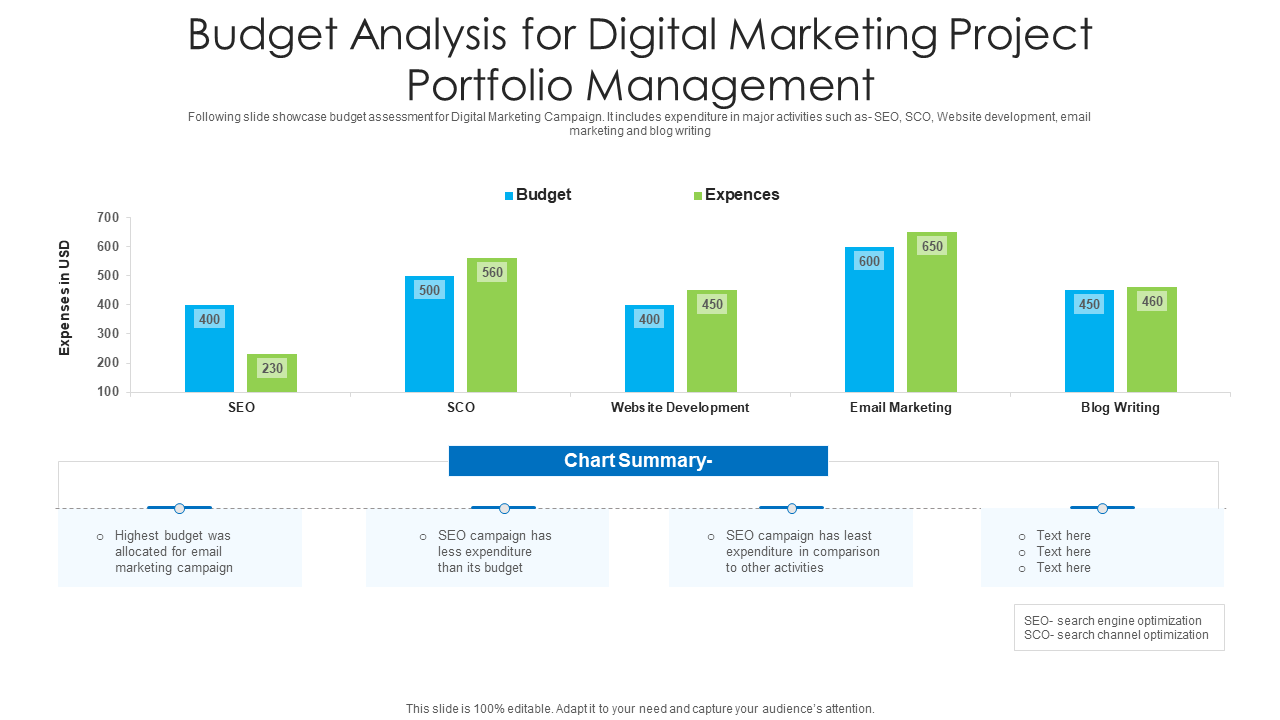

5. Budget Analysis Template for Digital Marketing Project

This easy-to-read presentation template is designed to help you analyze and compare expenses across five key digital marketing channels: SEO, SCO, Web Development, Email Marketing, and Blog Writing. The centerpiece of this PowerPoint Layout is a bar graph featuring blue bars that represent the allocated budget and green bars depicting the actual expenses for each channel. Use the spaces provided to present chart summaries or key insights derived from the bar graph. Highlight trends, cost-saving opportunities, and potential areas for improvement, fostering data-driven decision-making and enhanced budget optimization. Get this presentation template now!

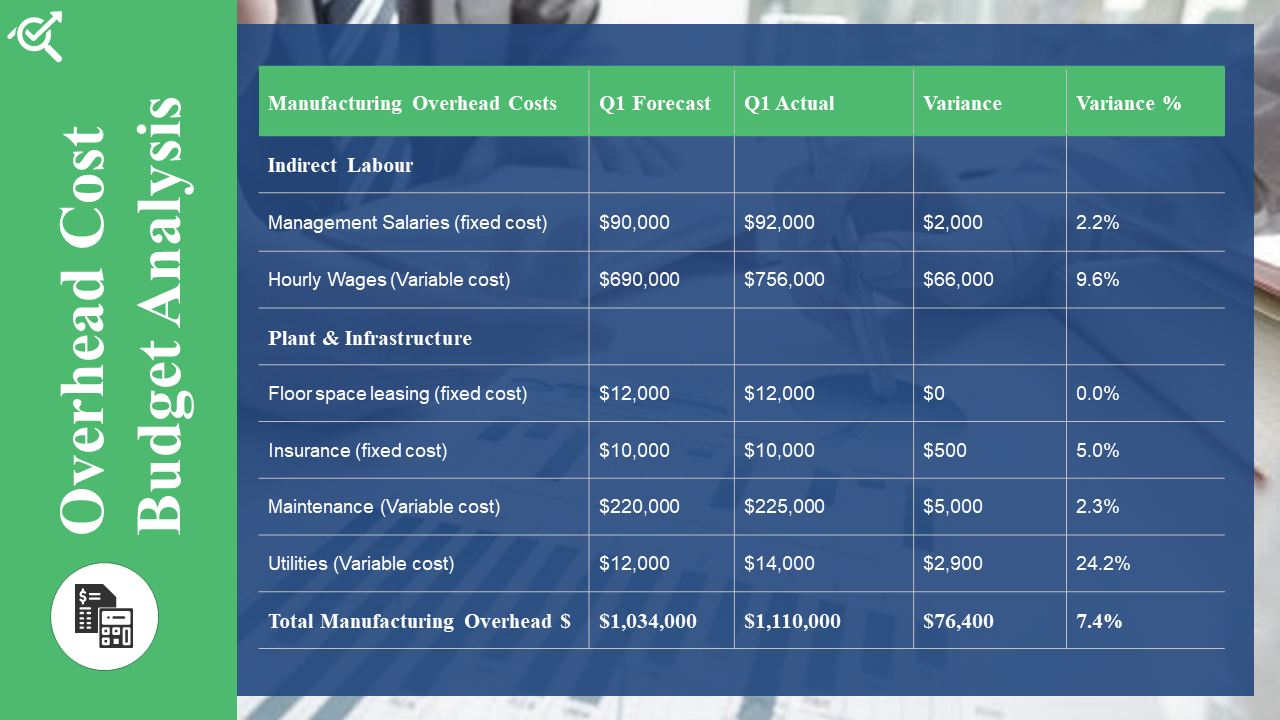

6. Overhead Cost Budget Analysis Presentation Template

Take advantage of this expert-designed PPT Slide to optimize your overhead cost management in an efficient way. It empowers you to analyze, assess, and control your overhead expenses, ensuring optimal financial performance for your organization. Our PowerPoint Set provides a structured framework to navigate overhead cost categories, such as indirect labor, plan & infrastructure, utilities, rent, salaries, maintenance, etc. It highlights each quarter's forecast, expense, variance, and variance percentage. Visualize the breakdown of your overhead costs with an easy-to-understand table and present the data in a clear and concise manner. Grab it today!

7. Influencer Marketing Campaign Budget Analysis PPT Template

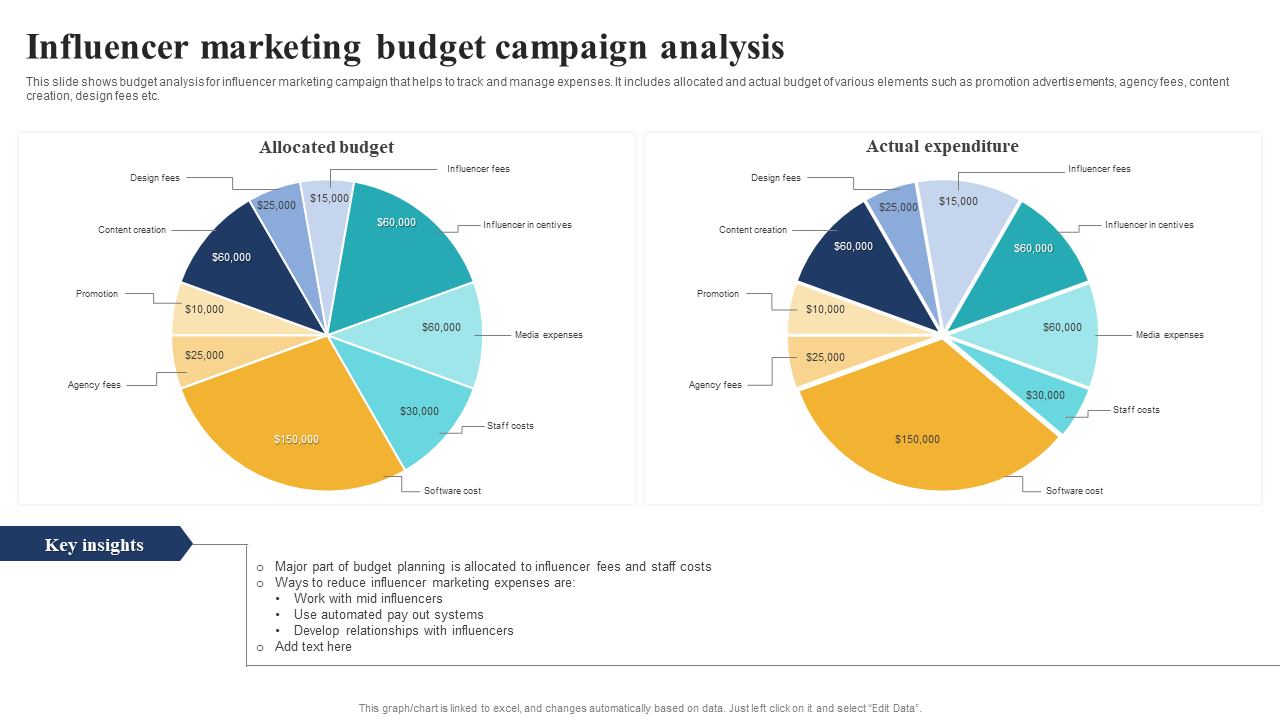

Elevate your influencer marketing campaigns with this PPT Template, designed to help businesses analyze and optimize their budget allocations and expenditures. It features two vibrant and identical pie charts, showcasing a clear breakdown of the allocated budgets and actual expenditure for elements of influencer marketing campaigns. The left pie chart represents the allocated budgets or shares, while the right pie chart reflects the actual expenditure for influencer fees, influencer incentives, media expenses, staff costs, software costs, agency fees, promotion, content creation, and design fees. Navigate through the template to assess the variance between the allocated budgets and actual expenditures for each element. Take advantage of the dedicated section provided at the bottom of the template to share key insights from the comparison of the two pie charts. Highlight trends, pinpoint areas of improvement, and communicate the financial impact of your influencer marketing strategies. Download it now!

8. Budget Scenario Analysis PowerPoint Presentation Template

Make informed decisions and plan for the future with this detailed template that explores and evaluates three distinct scenarios — worst, average, and best — across key budget drivers, revenue impact, and overall budget. It helps you visualize the impact on budget drivers, revenue projections, and overall budget allocation for each scenario, enabling you to assess risk, identify opportunities, and make strategic decisions. The budget scenarios highlight the budget amount, base case variance, and percentage to enhance strategic planning and proactive decision-making. Get it now!

9. Post Corporate Event Budget Analysis Presentation Template

This PPT Template helps you assess and analyze your event expenses with ease and clarity. The PPT Layout features a colorful pie chart on the left, providing a visual representation of the percentage of the budget allocated to each category. From this pie chart, event managers can identify the distribution of funds across categories such as food and beverage, marketing, transportation, venue, decorations, and speakers. On the right side of the template, you'll find a comprehensive and easy-to-read table showcasing the detailed cost breakdown. The first row lists the expense categories, followed by the estimated budget and the actual expenses in the second and third rows. The top section of this event budget analysis template provides spaces to add the event title and date, ensuring a personalized touch for your presentation. Grab it today!

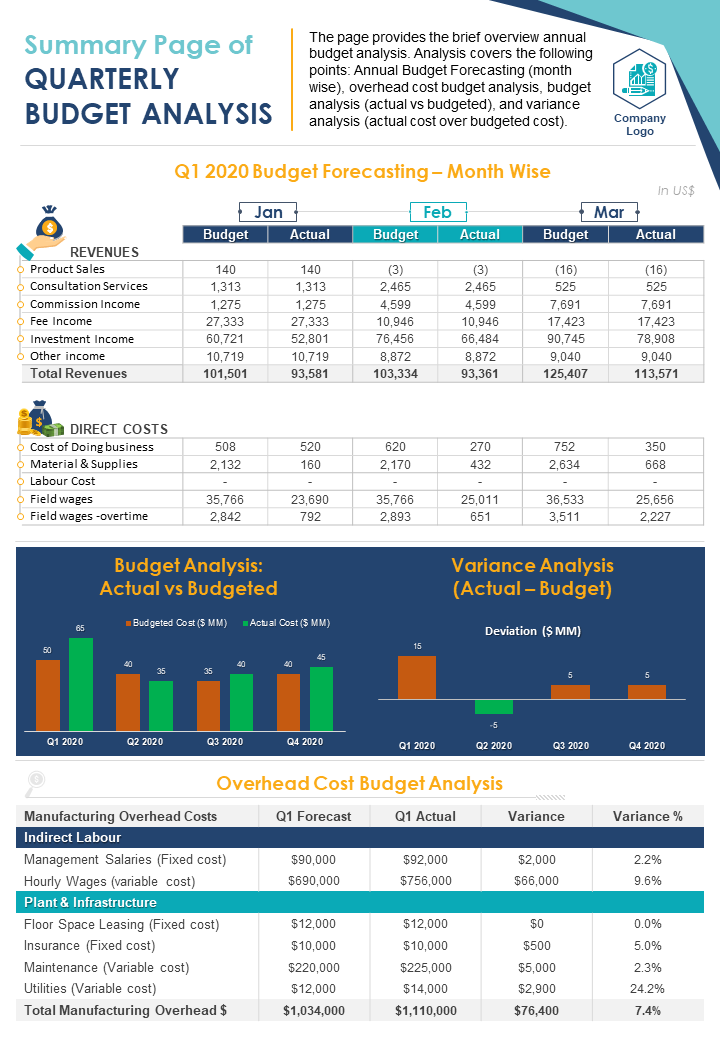

10. Annual Budget Analysis One-page Summary Template

This user-friendly template enables you to condense and present key financial insights. It features three tables and bar charts that provide a comprehensive overview of your annual budget analysis. The first table presents a month-wise breakdown of the revenue forecasted and generated from business sources. This allows you to compare and assess the financial performance of your business throughout the year. In the second table, you have estimated and levied costs for business components, including operations, materials & supplies, labor costs, field wages, overtime, and more. Below this, two bar charts showcase the budget and variance analysis for the four quarters of the year. Through this, you identify areas of over or under-spending and make informed adjustments. This one-page template provides a final table that offers detailed statistics on overhead cost budget analysis for a quarter. At the top, you'll find dedicated space to add an executive summary of the budget analysis report and your company logo, adding a personalized touch. Download it now!

From Chaos to Control

By leveraging budget analysis, you gain a competitive edge in the market, enhance financial stability, and maximize profitability. With our presentation templates enhance clarity and comprehension through charts, graphs, and infographics, making complex information more engaging and understandable.

With their polished and professional layouts, our budget analysis templates ensure that your presentations look impressive, maintaining consistent formatting, fonts, and design elements for a cohesive and professional appearance.

Download these budget analysis templates now and make the process more efficient by addressing data management, complexity, and communication challenges.

FAQs on Budget Analysis

1. What is a budget analysis?

A budget analysis is a systematic evaluation of financial data to assess the financial performance and effectiveness of a business or individual's budget. It involves reviewing income, expenses, and financial metrics to gain insights into the financial health and efficiency of budget allocation.

2. What are the stages of the budget analysis?

The stages of a budget analysis include:

- Data Collection: Gather relevant financial data, such as income statements, expense records, and cash flow statements, for the period under analysis.

- Data Organization: Arranging the collected data in a structured manner, categorizing income and expenses, and ensuring accuracy and completeness.

- Comparison and Evaluation: Comparing the actual financial performance with the budgeted or projected figures, assessing variances, and identifying areas where targets were met or missed.

- Identification of Trends and Patterns: Analyzing the data to identify trends, patterns, and potential causes for variances, such as changes in market conditions, pricing, or operational efficiency.

- Recommendations and Action Planning: Based on the analysis, developing recommendations for improving financial performance, optimizing resource allocation, and setting realistic financial goals. This stage may involve creating action plans and implementing strategies to address identified issues or capitalize on opportunities.

- Monitoring and Review: Scrutinizing the financial performance and reviewing the budget analysis results on a periodic basis to track progress, make adjustments, and ensure financial stability.

3. What are the three main types of budgets?

The three main types of budgets are:

- Operating Budget: An operating budget focuses on day-to-day operations and includes revenue and expense projections for a specific period, often a year. It outlines the projected sales, costs, and expenses related to the core business activities, such as production, marketing, and administration.

- Capital Budget: A capital budget is used for planning and managing long-term investments and expenditures. It involves budgeting for significant purchases or projects that have a lasting impact on the business, such as acquiring new equipment, expanding facilities, or launching new product lines.

- Cash Flow Budget: A cash flow budget focuses on the inflows and outflows of cash within a time frame, usually a month or quarter. It helps monitor and manage the timing and availability of cash to ensure that the business has sufficient liquidity to meet its financial obligations, such as paying bills, loan repayments, and managing working capital.

Customer Reviews

Customer Reviews