Incentive Stock Options: The Good, the Bad and the Ugly

Wikimedia Commons

Article Highlights

The Pros & Cons of Incentive Stock Options (ISOs)

Taxation Infographic for ISOs

ISO Strategies for Mitigating the AMT

How to Manage Career Risk If You're Offered ISOs from a Startup

Questions to Ask Before Joining a Private Startup with an ISO Plan

The Basics of ISOs

ISOs are popular among publicly-traded companies and private firms planning a future IPO. Many find ISOs convenient because they help attract talent and incentivize employees while preserving cash. Since the cost of ISOs are not deductible for companies, they're often the preferred choice for high-growth startups that do not yet have taxable income.

ISOs are usually granted at a strike price equal to fair market value as of the grant date. In time, as the company grows and reaches important milestones, the hope is that the fair market will rise above the strike price. Then when the ISOs vest, employees could be in a position to exercise ISOs and buy shares at a significant discount to fair market value.

ISOs are almost always provided to employees subject to a vesting schedule. One of the more common vesting schedule is four years with a "one year cliff". Under this arrangement ISOs cannot be exercised until the first anniversary of the employee's start date, at which point 25% of the ISOs vest in one fell swoop.

There are two primary ways to exercise ISOs:

Pay Cash. You could simply pay cash to buy stock at the grant price.

Cashless Exercise. If you lack the necessary funds, you could opt for a cashless exercise by enlisting the help of a broker to receive a short-term loan. Proceeds from the loan are used to buy shares at the exercise price. All the shares or a portion thereof are then immediately sold to pay back the loan and cover commissions and withholding taxes. A cashless exercise is usually available for publicly traded shares, but this is rarely the case for shares in private companies.

What's so special about ISOs?

Incentive Stock Options (ISOs) were designed to give employees the option to purchase company stock at a discount — without having to pay tax at the time of purchase, otherwise known as the exercise date. When they first appeared in the 1950's, ISOs were a big improvement over non-qualified stock options (NSOs), which are taxed when exercised at ordinary income tax rates. Shares bought through ISOs are instead taxed when sold. What's more, if certain conditions are met, the sale qualifies for favorable long term capital gain rates. The Pros & Cons of Incentive Stock Options Before diving into the complexity of ISO taxation, let's take a look at their advantages and disadvantages from the employee's point of view.

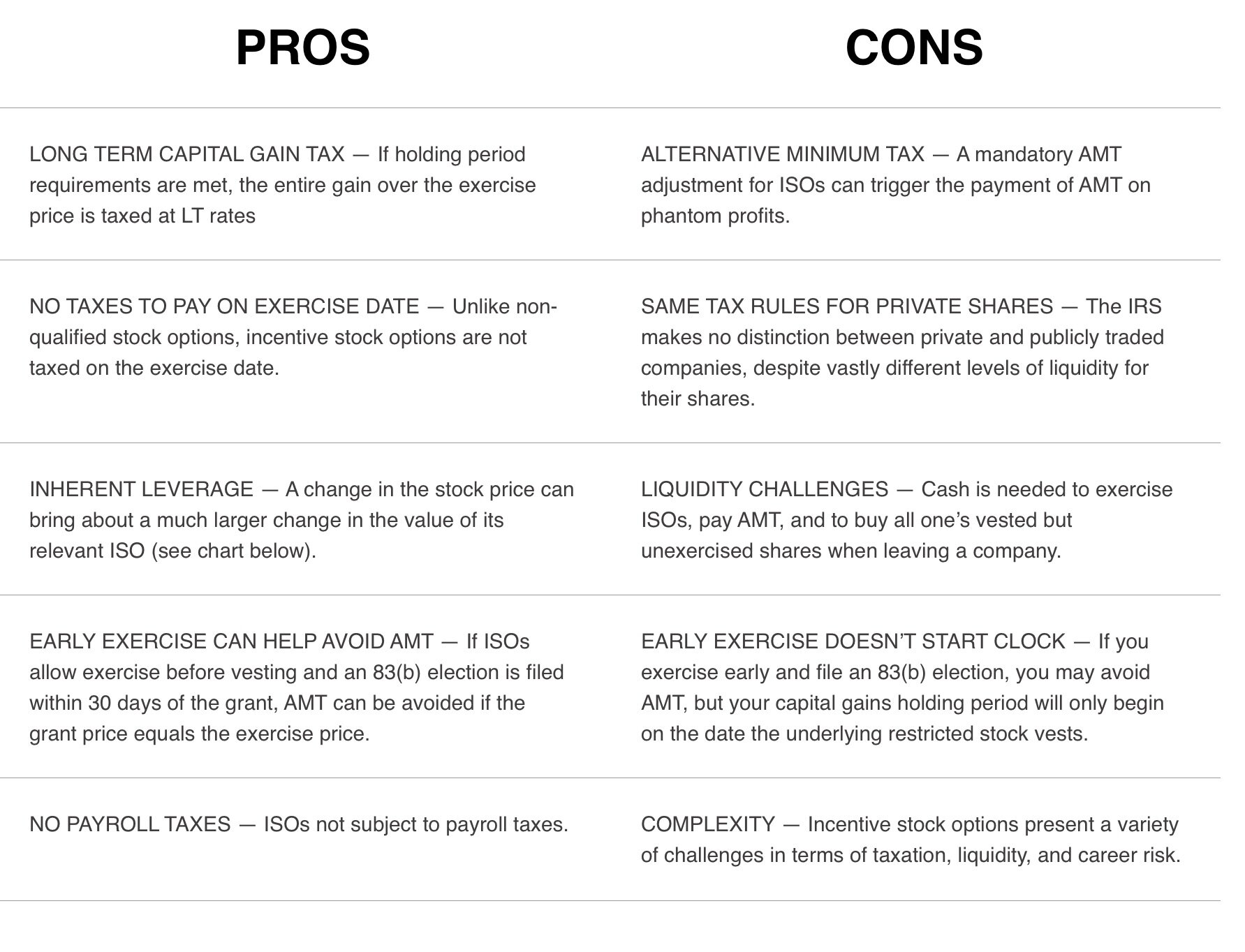

The Pros & Cons of Incentive Stock Options

Before diving into the complexity of ISO taxation, let's take a look at their advantages and disadvantages from the employee's point of view.

How ISOs Qualify for Long Term Capital Gain Rates

Two conditions must be met if an ISO is to qualify for long term capital gain rates:

The shares must be sold at least 1 year and a day after the exercise date (the date when you purchased the shares).

The shares must be sold at least 2 years and a day after the grant date (the date when you officially receive the incentive stock option)

Put differently, to qualify for favored tax treatment you must own the stock for a longer period of time — and bear the risk that comes with it. (Most people tend to focus on taxes and overlook the risk of holding a concentrated position in one stock.)

“It sounds too good to be true!

There’s not a catch, is there?”

Introducing the Alternative Minimum Tax

In 1969 Congress and President Nixon introduced the Alternative Minimum Tax (AMT). Their goal was to target wealthy tax filers who had been using deductions and tax credits to reduce their income tax to zero. One consequence of the new legislation was to make ISOs a lot more complicated.

Why Do People Love to Hate the AMT?

The AMT is not a tax applied to a particular income item. It's an entire system running parallel to regular income tax to determine an alternative tax on all your income. Awfully ambitious, no? Because the AMT is so comprehensive, it's difficult to forecast. It's especially hard to estimate early in the year when you may not yet have an accurate picture of your income for the year.

To make matters worse, back in 1969 Congress didn't bother to index the AMT exemption for inflation. Although many wealthy tax filers began to pay an alternative minimum tax instead of zero tax under regular income tax rules, by the 2000s a good swathe of the middle class was paying AMT, too. Technology heavy regions like Silicon Valley were especially hard hit. In such areas, the middle class has a higher cost of living and is more likely to receive incentive stock options in place of a cash bonus. A double whammy.

Some good news, some bad news

The Tax Cuts and Jobs Act of 2017 significantly reduced the number of people subject to AMT. Unfortunately, ISO holders are now likely to make up a larger percentage of the tax filers still paying AMT.

How are ISOs Affected by AMT?

Under AMT, your income is calculated by starting with ordinary income and adding back a a list of items to arrive at an alternative minimum tax income. One of the items to be added back is the bargain element of ISOs — that is, the value of the spread between the fair market value of shares and the grant price when the ISO is exercised.

Though ISOs were originally designed to avoid taxation upon exercise, if you hold the shares beyond December 31st into the next calendar year they'll be subject to an AMT calculation that effectively does just that. The spread between the fair market value and price paid for shares on the exercise date is multiplied by the AMT tax rate (26% or 28%, depending upon one's income).

This is essentially a tax on paper profits. After all, you haven't sold the shares. If your total income tax under the alternative system turns out to be higher than your regular income tax, you'll pay AMT. On the bright side, when you pay AMT an AMT credit is created that can be used to reduce income tax in subsequent years— but more on that later.

“Getting taxed on paper profits that you can’t turn into cash?”

Is There a Silver Lining to the AMT?

Well, yes, there are several:

AMT tax rates, at 26 and 28%, are lower than the higher tax brackets for ordinary income (32%, 35%, 37%).

The exemption for AMT has been substantially increased by the Tax Cuts and Jobs Act of 2017. It now stands at:

3. When you incur AMT, you also receive the aforementioned AMT credit. This credit can be used in future tax years to reduce any regular income tax when it exceeds tax as calculated under the alternate system. I warned you the AMT was complicated!

ISO Taxation Infographic

Now let's combine the AMT with the requirements for preferential tax treatment, bringing it all together to get a bird's eye view of the most important tax rules affecting incentive stock options.

ISO Strategies for Dealing with the AMT

There are a variety of strategies one can deploy to mitigate, lower, and even avoid the AMT. The taxation of incentive stock options are a complicated matter, so this list of strategies is meant only as a general overview and should not be taken as legal or tax advice. To find a solution for your particular situation, speak to your tax and financial advisors or contact us for a consultation.

1. EXERCISE AT THE BEGINNING OF THE YEAR

Exercising ISOs at the beginning of the calendar year (ideally in January) gives you more time to accumulate funds for any AMT that will come due the following year on April 15th. That's 15 months! This holding period also allows you more control over risk, since it gives you more opportunity to bail out and avoid AMT altogether if a fall in the stock price makes it advantageous to do so.

2. BAIL OUT BEFORE DEC 31 TO AVOID AMT WHEN IT MAKES SENSE

If the share price takes a nosedive after you've exercised your ISOs, consider selling the shares before December 31st. Selling in the same calendar year allows you to avoid paying AMT on the bargain element of your shares (i.e. the spread between the fair market value and the exercise price on the exercise date). It may be more beneficial to pay a higher ordinary income tax rate on a smaller profit than to pay AMT on large paper profits that have evaporated. Just be aware of trading windows and blackout periods that may restrict your ability to get out of the stock in time.

3. MAKE A MINI EXERCISE TO USE UP YOUR AMT CUSHION

Most people end up paying regular income tax because it exceeds their tax under the AMT system. If you're nearing the end of the tax year and haven't yet exercised any ISOs, you're in a good position to calculate your AMT cushion using TurboTax or other tax software. Before accounting for any ISOs, calculate your regular tax as well as the tax under the AMT. Once you've determined the size of the gap between the two, enter into the software just enough exercised ISOs so that you close the gap without actually triggering any AMT payment for your tax return. Get as close as you can without going over the AMT crossover point.

4. IMMEDIATELY SELL ENOUGH ISO STOCK TO COVER YOUR AMT LIABILITY

Some people exercise ISOs with little thought for the AMT that will come due the following year on April 15th. If there's a good chance you could be short on cash to pay the AMT, you should consider immediately selling enough stock to cover the AMT liability for the shares you plan on holding. When raising cash to cover the AMT liability, remember that the shares you sell immediately after exercise will themselves need to be taxed. Also, keep in mind that your employer is not required to withhold any amount upon the sale of those shares to cover your potential income tax liability.

5. TAKE ADVANTAGE OF THE AMT CREDIT

When you pay AMT, an AMT credit is created that can be used to reduce regular income tax in the future. But to use the AMT credit, you'll need to file form 8801. Be sure to file Form 8801 every year until you've exhausted the balance of the AMT credit — even in a year when you can't use it. Continuity is key.

6. AVOID AN EXCESSIVE AMOUNT OF UNRECOVERABLE AMT CREDIT

Because long term capital gain tax rates are lower than AMT rates, you could end up generating more AMT credits than you can ever use. This is more likely for individuals who have most of their wealth tied up in ISOs with a large bargain element. Work with a tax specialist to find the optimal amount of shares to keep without creating excessive AMT credits that can never be recovered.

7. MINIMIZE AMT WITH AN EARLY EXERCISE

Some companies allow an "early exercise", or exercising shares before they have vested. This can be a viable strategy with private startups under the right conditions. If the fair market value is equal to the grant price, and if the shares can be exercised without a substantial cash outlay, then an early exercise could reduce AMT to zero without risking an excessive amount of capital on illiquid stock that you may never receive (i.e you may leave or be terminated before your vesting dates). Just be sure to file an 83(b) election within 30 days of the grant date so that your AMT will be calculated as of the exercise date when the bargain element is near $0.

ISO CHALLENGES WHEN WORKING IN A PRIVATE COMPANY

Paying the Piper To exercise incentive stock options, you need to pay two parties: 1) first you pay your company the exercise price of the shares to be purchased, 2) then you pay the IRS the taxes due on those shares.

Liquidity be Damned If you work for a pre-IPO company, your shares are probably not very liquid, so a cashless exercise is probably not a possibility. To complicate matters, should you decide to leave your company, you may be given as little as 30 to 90 days to exercise your vested ISOs. If you're unable to source the necessary funds in time, you lose your ISOs and along with it the opportunity to participate in the upside that you helped create. Any paper profits you had in those ISOs will go up in smoke.

Unfortunately, the IRS does not make a distinction between the illiquid stock of private firms and the liquid shares of publicly traded companies. Its one-size-fits all tax policy for ISOs makes working for pre-IPO startups much more risky.

Managing Career Risk When Receiving ISOs from a Private Company If you receive ISOs related to your employment at a private company, you might find yourself short of cash to exercise the options and pay the tax. Even if you do have the necessary funds, exercising ISOs may turn out to be a bad investment. So before hastily accepting that new position with a private company offering ISOs, consider the following issues to help you make a more informed decision:

QUESTIONS TO ASK BEFORE JOINING A PRIVATE STARTUP WITH AN ISO PLAN

What will be my stake in the company? — Be sure to ask for the number of outstanding shares and the most recent valuation of the company. Without this information it will be impossible to figure out your stake in the company.

What's the minimum value the company should sell for if my equity is to have value? — This question is designed to help you understand whether investors have negotiated a liquidation preference. A liquidation preference guarantees a minimum return on investment upon a sale of the company. But if the preference is too high, there might not be any money left over for employees.

What is my vesting schedule? — A four year vesting period with a 1-year cliff is common, but there are longer vesting schedules. Since you'll need to wait for the cliff date before your first batch of ISOs vest, the shorter the cliff, the less risk for you as an employee. After all, no one wants to be terminated just before the cliff date. The same principle holds for the entire vesting schedule, too. From your point of view as a new hire, the shorter, the better. Avoid conditioning vesting on any milestones or performance metrics. Working for a startup is risky enough already!

How long a post-termination exercise (PTE) window do you give employees? — The IRS disqualifies an employee's ISOs 90 days after the last day of employment. Converting ISOs to NSOs presents an administrative burden for firms, so the default position across the vast majority of companies is a PTE of just 90 days. It can be a rude awakening for departing employees to realize they can't afford to exercise the vested options they've worked so hard to earn. For this reason, many employees decide to stay with their company and end up feeling trapped in their job. In recent years, a number of companies like Pinterest and Quora have addressed this problem by introducing longer PTEs for departing employees. This requires converting ISOs to NSOs at the 90 day threshold. If you are not cash rich and are concerned you could lose your vested ISOs should you leave the company, look for a company offering a longer PTE window.

Will my ISOs come with early exercise rights? — Many ISO plans allow for early exercise of shares before they vest. This can be a great way to minimize or avoid AMT altogether, but it won't start the clock for the 1 year holding period necessary for long term capital gains. For that, you'll have to wait until the underlying restricted stock vests. In any event, if you exercise early, be sure to file an 83(b) within 30 days of the grant date.

Does the company offer accelerated vesting? — Many startups provide accelerated vesting upon the occurrence of a triggering event, the most common being acquisition and involuntary termination without cause. A single trigger is rare, but possible for founders and key employees. More common is a double trigger consisting of a change of control of the company and involuntary termination of the employee within some period following the acquisition. Accelerated vesting is a nice feature that can protect your unvested ISOs from events you have no control over.

ISO RULES

1. ANNUAL LIMIT OF $100,000

According to IRC 422(d), no more than $100,000 worth of ISOs can become exercisable in a given calendar year. Use your grant price and vesting schedule to calculate the value of ISOs that will become exercisable each year. If $100,000 is exceeded, the newer options above this threshold should be treated as non-qualified stock options. Stock grants that have early exercise rights should be counted, too, even though they have not yet vested.

2. EMPLOYEES ONLY

Unlike Non-Qualified Stock Options, ISOs are available to employees only.

3. EXERCISE WINDOW FOR DEPARTING EMPLOYEES

Generally speaking, the IRS requires that companies with ISO plans give their departing employees no more than 90 days to exercise vested ISOs. See below section "Managing Career Risk".

4. 10-YEAR EXPIRATION DATE

The IRS limits the period for exercising an ISO to 10 years from the grant date. This has become an issue for more and more people as companies stay private longer.

5. SETTING OF EXERCISE PRICE

The exercise price of the ISO on the date of the grant must not be less than the fair market value.

6. ISOs NOT SUBJECT TO FICA

ISOs are not subject to social security and medicare withholding. Non-qualified stock options (NSOs) and restricted stock units (RSUs) are.

ISO GLOSSARY

Grant:

An award of stock options to an employee designed to align the interests of employees and shareholders.

Vesting:

The process by which restricted stock becomes available for unconditional ownership. ISOs must vest before you can buy stock free and clear without the risk of forfeiture.

Exercise:

Buying stock by exercising one’s right per the stock option.

Exercise Price:

The price an employee pays to buy stock per the ISO. The exercise price is usually set to the fair market value on the grant date. Also sometimes called the “grant price”.

Fair Market Value:

Usually refers to the market value of the stock as of the exercise date.

Bargain Element:

The fair market value of shares on the exercise date less the exercise price.

Ordinary Income Tax Rate:

Ordinary income tax rates vary according to one’s income level. For most people receiving ISOs, their ordinary income tax rate will be higher than long term capital gain tax rates.

Short Term Capital Gain Tax Rate:

The tax rate applied to capital gains on investments of a year or less. Equal to ordinary income tax rates.

Long Term Capital Gain Tax Rate:

The tax rate applied to capital gains on investments of more than 1 year (0%, 15% or 20%, depending upon one’s level of income).

Alternative Minimum Tax (AMT):

A separate tax system parallel to regular federal income tax. The purpose of AMT is to ensure that anyone benefiting from tax privileges will pay some minimum tax.

Right of First Refusal:

A company’s right to purchase shares that you intend to sell to a third party. Prior to selling the shares an employee must give the company the opportunity to purchase the shares on the same terms.

Qualifying Disposition:

A sale of stock that qualifies for long term capital gain treatment. For ISOs, a sale qualifies if the stock was sold more than 1 year after the exercise date and more than 2 years after the grant date.

Non-Qualifying Disposition:

A sale of stock that does not meet the holding period requirements for qualifying disposition.

AMT disqualifying disposition

A sale of shares from exercising ISOs in the same tax year as the exercise. This disqualifies the sale for AMT. Instead, the actual gains are taxed at ordinary income tax rates.

Disclosures

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. All expressions of opinion are subject to change without notice in reaction to shifting market, economic or political conditions. This content was created as of the specific date indicated and reflects the author's views as of that date.Past performance is no guarantee of future results. Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.