Consumption , Architecture of Trade

Tomato News recently commissioned Euromonitor International to collect and interpret data on the consumption of tomato products at regional and global levels. This compilation of data and information has led to a report summarizing the performance, outlook and key trends/drivers for the worldwide processed tomato industry.

The full report is available to free of charge here, but we give you some highlights and interpretation in this article.

Study overview

By "processed tomatoes", the study refers to canned tomatoes, ketchup, soups, ready meals, tomato pastes and purees, pizza toppings, liquid sauces, sauces for dry recipes and pasta sauces.

The tonnages indicated in this article and the study as "processed tomatoes" refer to finished products containing tomatoes, but also other ingredients, and should not be confused with the volume of fresh tomatoes which has been used to manufacture these products. *

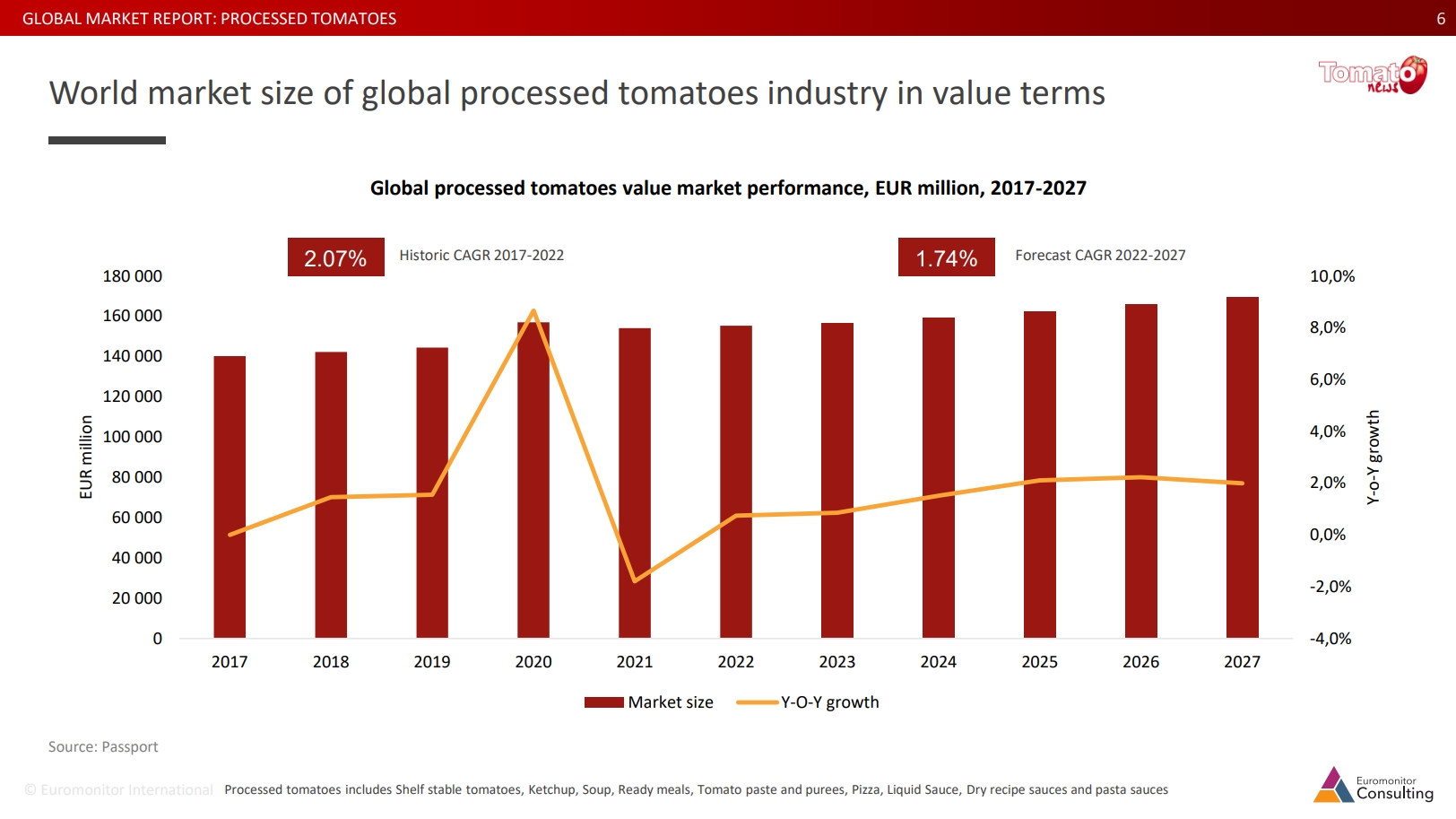

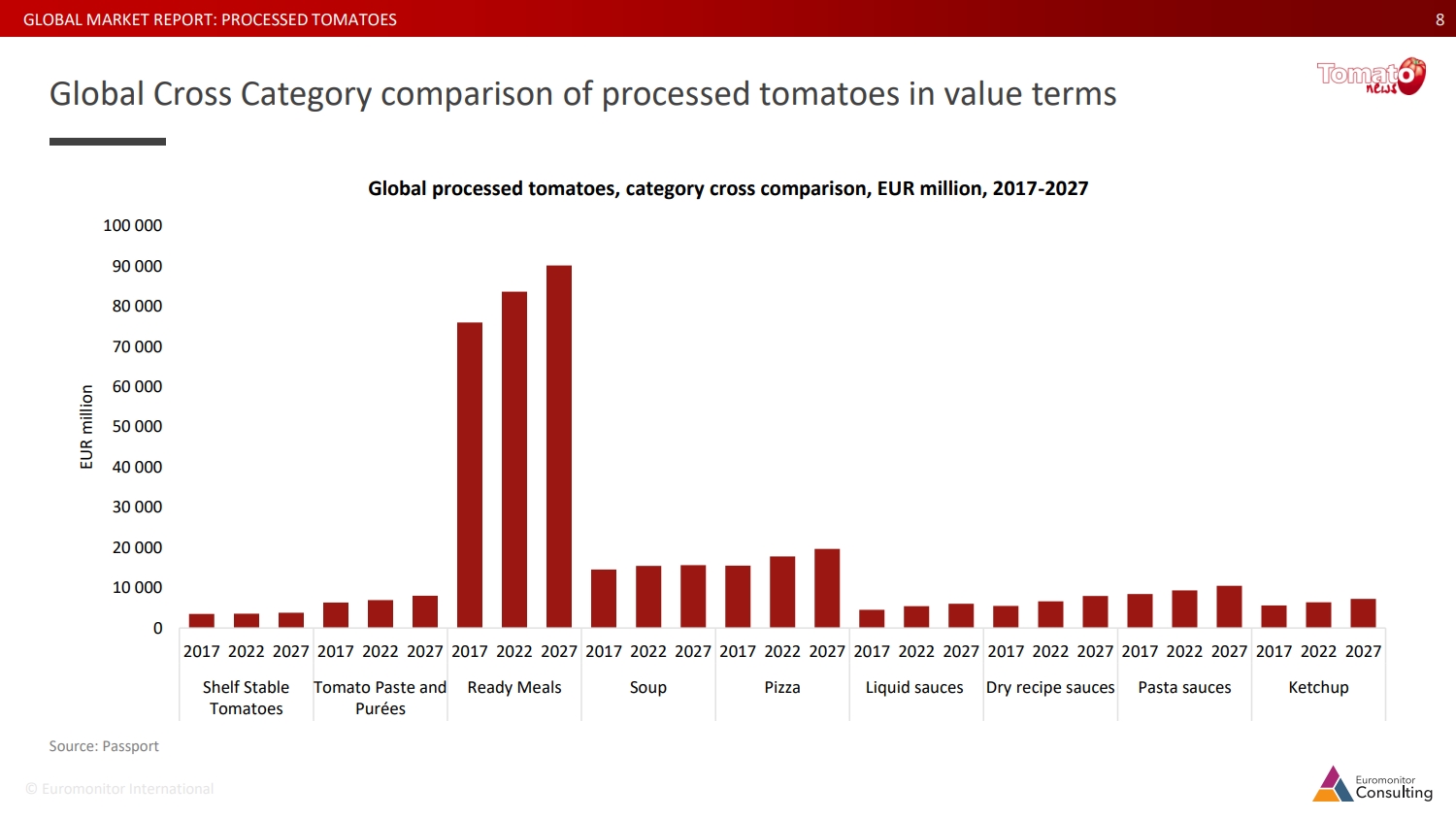

Euromonitor's findings show that the size of the worldwide processed tomato industry market has grown in value terms from EUR 140 billion in 2017 to almost EUR 157 billion in 2023, and could reach just over EUR 169 billion by 2027.

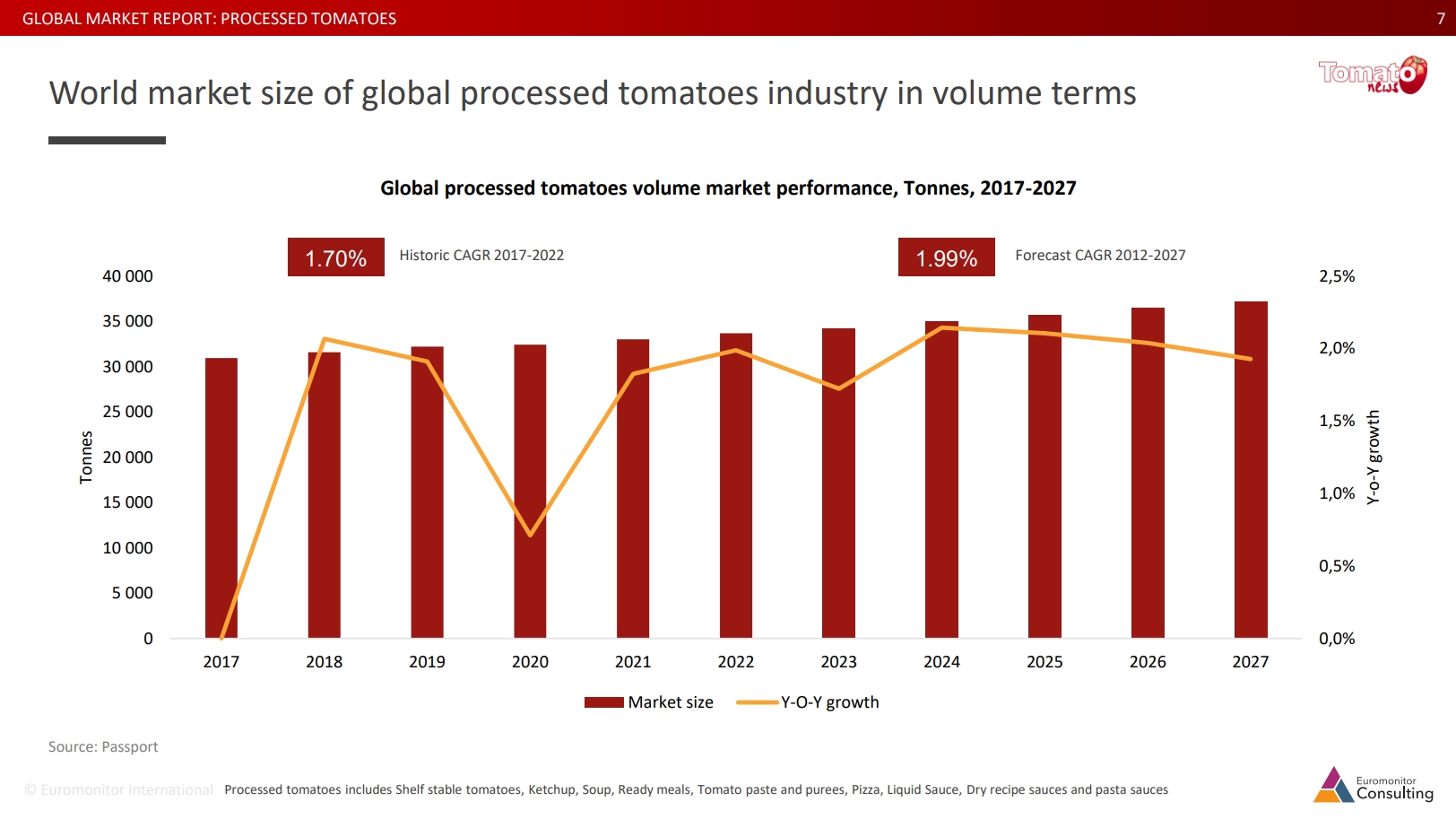

In terms of quantities, the worldwide "processed tomatoes" market has grown from 31 million tonnes (t) in 2017 to over 34.2 million t in 2023. The growth forecast by Euromonitor should take this market to around 37.2 million t in 2027.

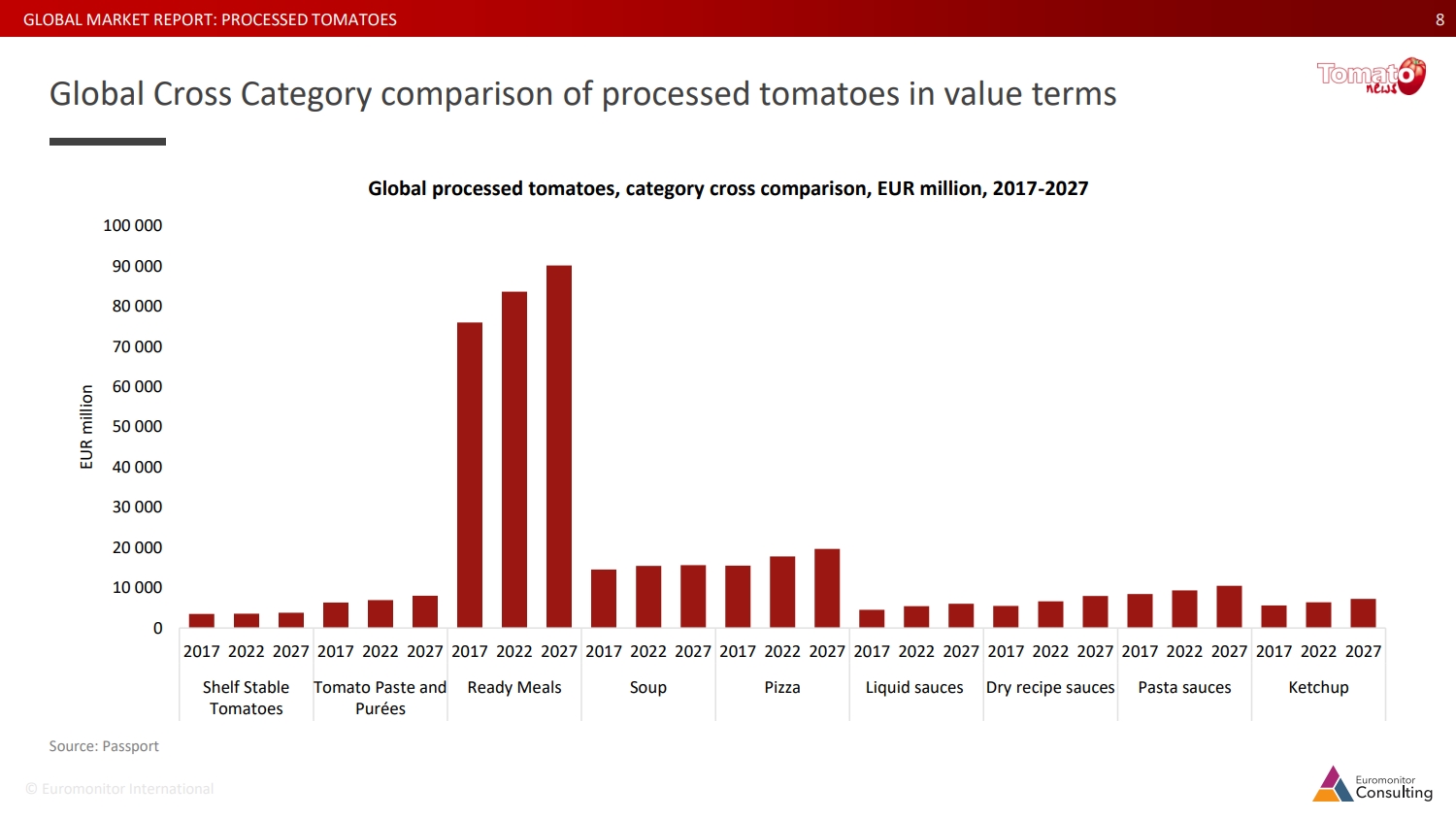

Comparative trends in the value in Euros of the various product categories reveal a clear predominance of ready meals, soups and pizzas, whose variations in terms of "relative weight" and cumulative value are very limited over the entire period, and represent around three-quarters of the total market value. However, liquid sauces (excluding pasta sauces) (3.6%) and powdered sauces (3.9%) have seen the biggest increases in value (CAGR) in recent years, with powdered sauces also recording the highest forecast growth rate over the next four years (3.7%).

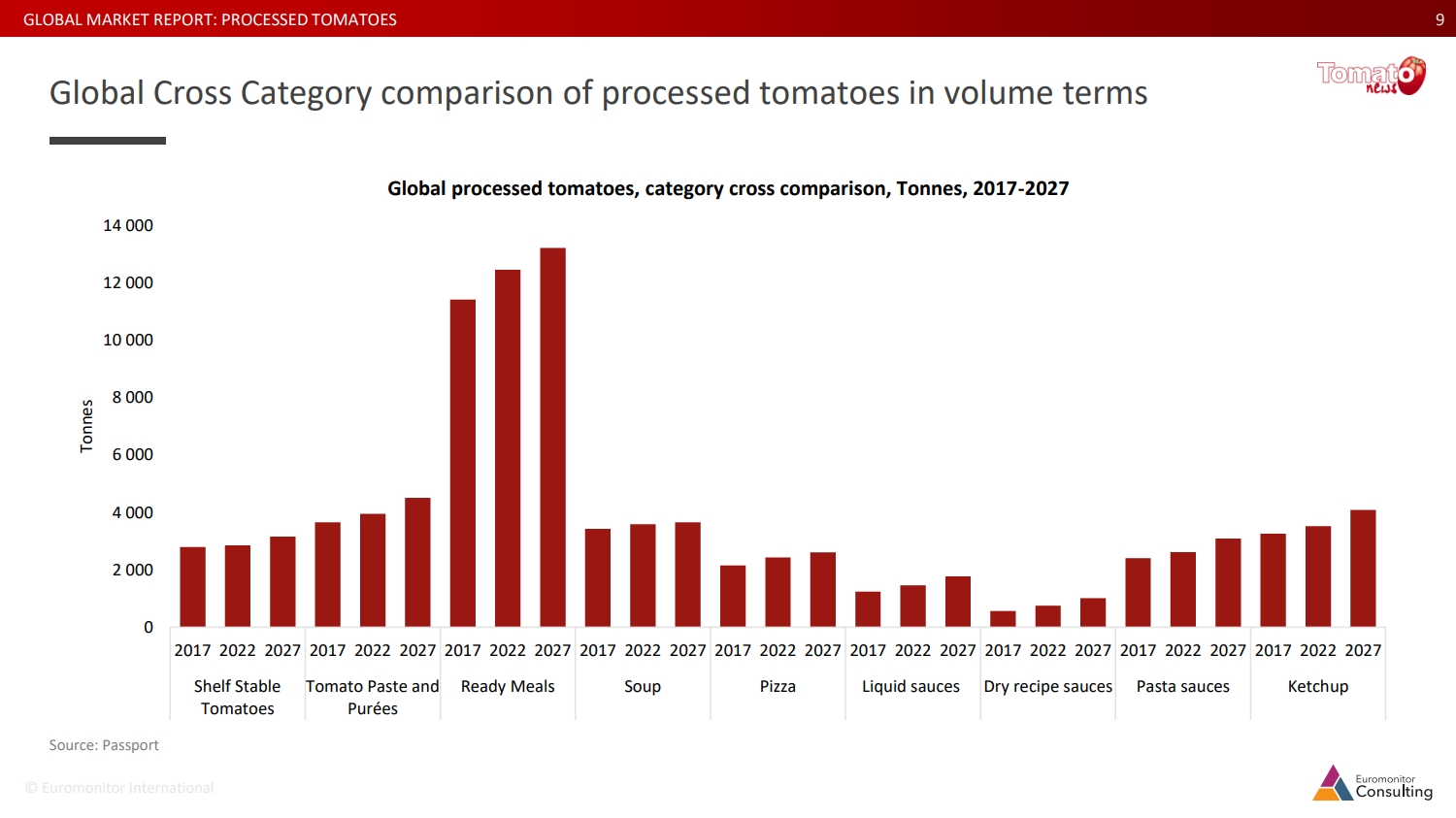

The contribution of the different categories in terms of quantities confirms the clear predominance of prepared meals (shelf stable, dried, chilled and frozen ready meals, with a high degree of readiness and convenience, in most instances ready-to-heat or ready-to-eat, requiring few or no extra ingredients) and the importance of categories already mentioned such as soups. Tomato pastes, purées and ketchup also feature among the main product categories consumed. Pizzas (2.5%), liquid sauces (3.4%) and powdered sauces (5.7%) have seen the most rapid development in recent years, with the last two offering the best growth prospects for the years ahead (4.0% and 6.2%, respectively).

Three comments are in order in the current context marked by the conflict between Russia and Ukraine, by rising labor and input costs in general, and by the reorientation of consumer interest towards less expensive solutions.

Efforts to explore alternative trade routes aim to stabilize supplies for tomato processing industries. Governments are also considering actions to safeguard global food security.

Efforts to explore alternative trade routes aim to stabilize supplies for tomato processing industries. Governments are also considering actions to safeguard global food security.  Due to the increase in prices for organic foods, consumers are switching from organic to more conventional options. Similarly, processed tomatoes have gained traction as an affordable and convenient choice, aligning with shifting consumer preferences and budget constraints.

Due to the increase in prices for organic foods, consumers are switching from organic to more conventional options. Similarly, processed tomatoes have gained traction as an affordable and convenient choice, aligning with shifting consumer preferences and budget constraints.  Consumers are opting for affordable alternatives. Regarding processed tomatoes, this shift translates into increased demand for budget-friendly private-label tomato products.

Consumers are opting for affordable alternatives. Regarding processed tomatoes, this shift translates into increased demand for budget-friendly private-label tomato products.

Regional overview

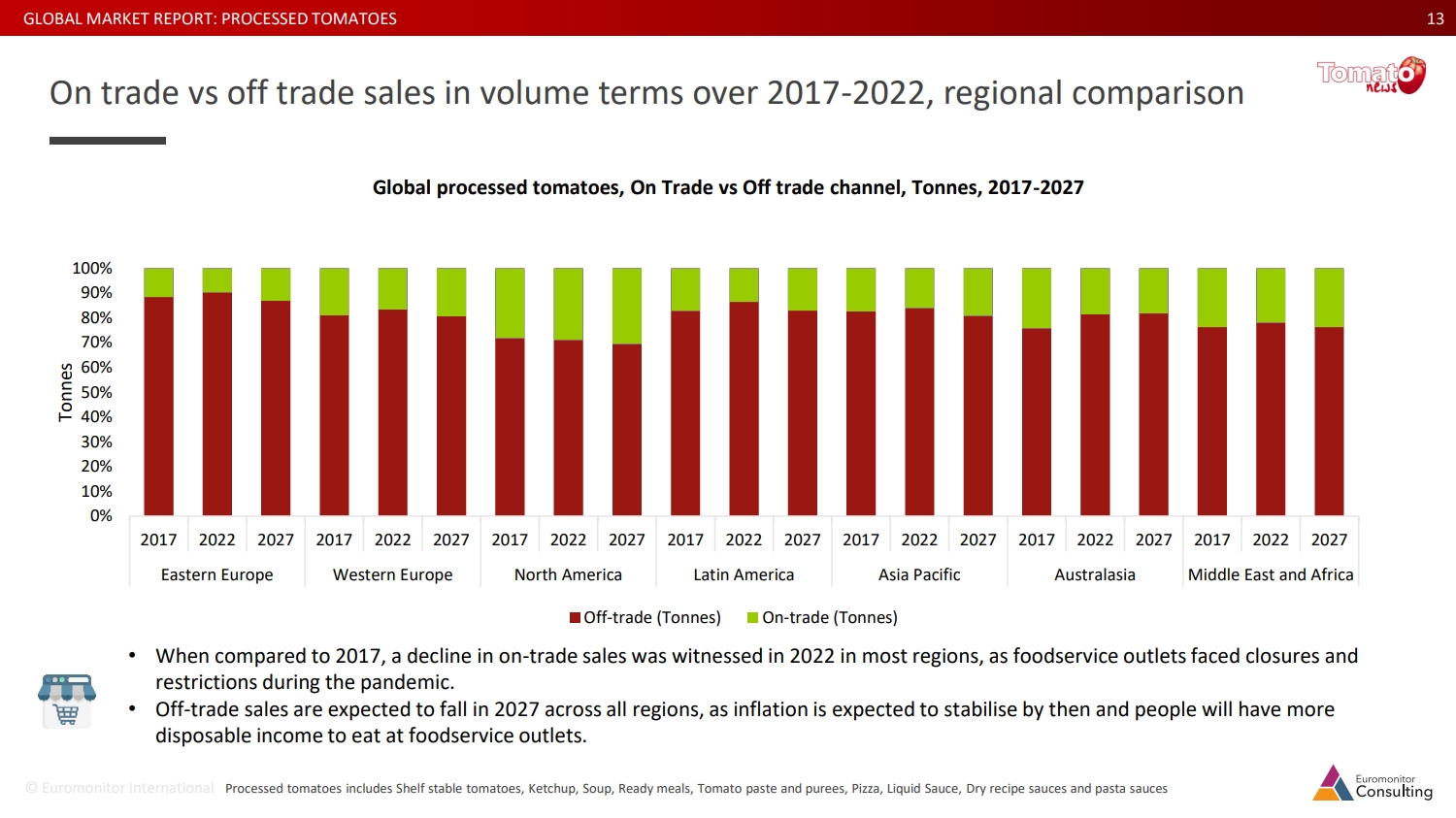

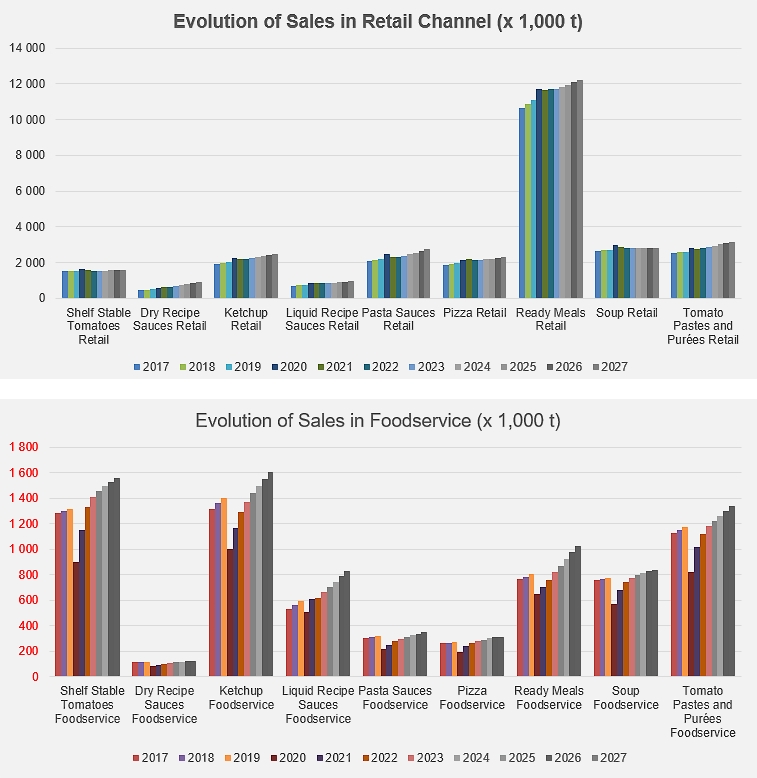

According to Euromonitor's commentary, when compared to 2017, a decline in on-trade sales (foodservices) was recorded in 2020 in some regions, as foodservice outlets faced closures and restrictions during the pandemic. This decline mainly concerned Western and Eastern Europe, along with Latin America and Australasia, while regions with strong on-trade sales (North America, Asia Pacific and to a lesser extent the Middle East and Africa) do not seem to have seen any slowdown in 2022.

The outlook for the next four years shows that sales in the Horeca sector are set to grow faster than in the retail sector, to the point that off-trade (or retail) sales are expected to fall in 2027 across all regions, as inflation is likely to stabilize by then and people will have more disposable income to eat at foodservice outlets.

Inter-category comparisons in terms of value and volume for the year 2022 identify "ready meals" as the most developed segment in most of the regions studied (Asia Pacific, Australasia, North America, Western and Eastern Europe), while markets in the Middle East and Africa tend to be driven by tomato pastes and purees. Several regional markets also show a fairly marked focus in terms of quantities, particularly in Asia Pacific, Middle East & Africa and, to a lesser extent, Eastern Europe. Conversely, Australasia, Latin and North America and Western Europe show much more diversified and balanced profiles in terms of segmentation.

A relative polarization in terms of product categories seems to go hand in hand with fairly high growth potential (CAGR), as is the case in Asia Pacific, Eastern Europe, and Middle East & Africa. On the other hand, the weakest development prospects are mostly found in Australasia, North America and Western Europe. The exception is Latin America, where several segments are credited with encouraging growth prospects (though not exceptional), making this region a clear market of opportunity.

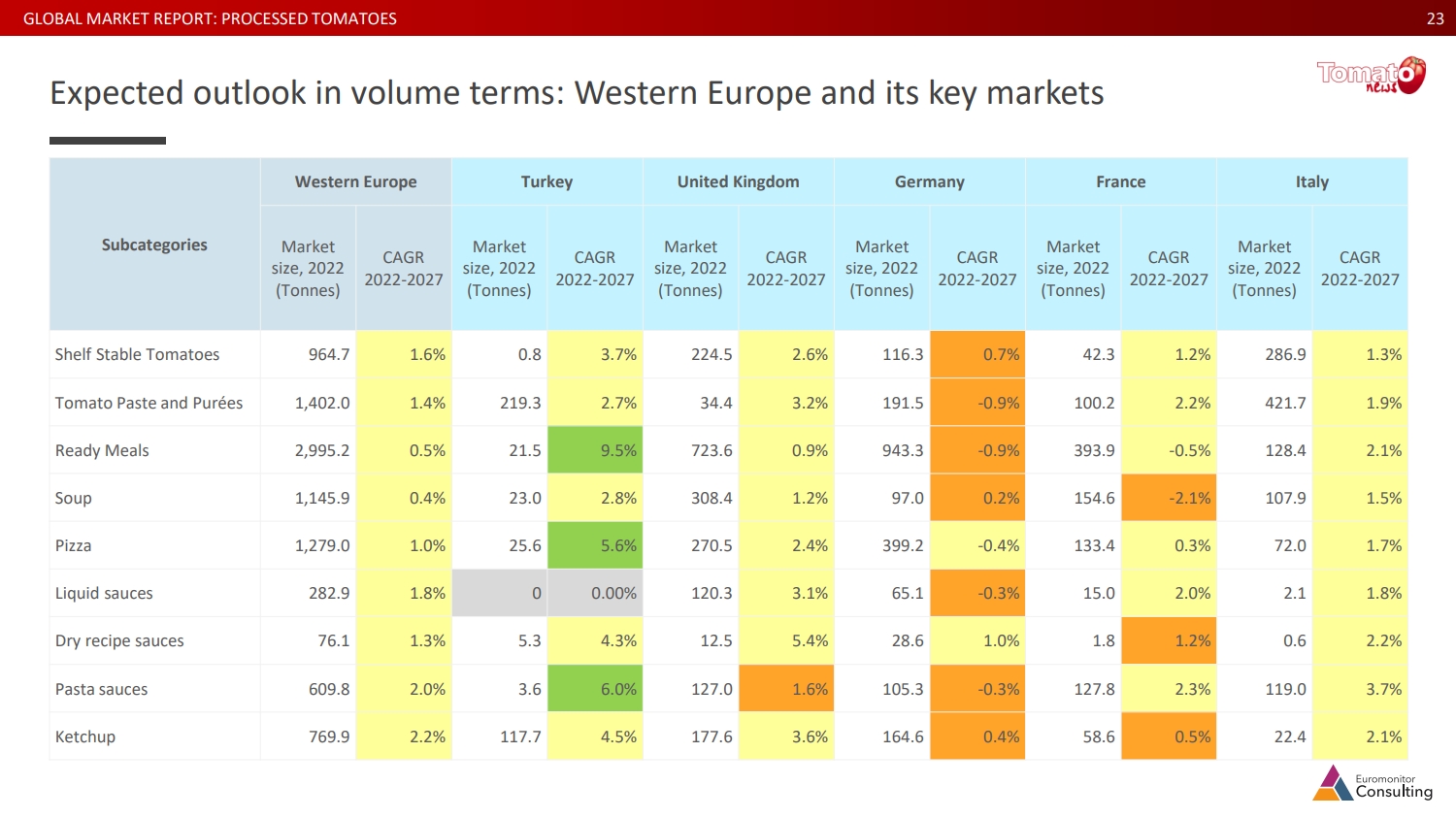

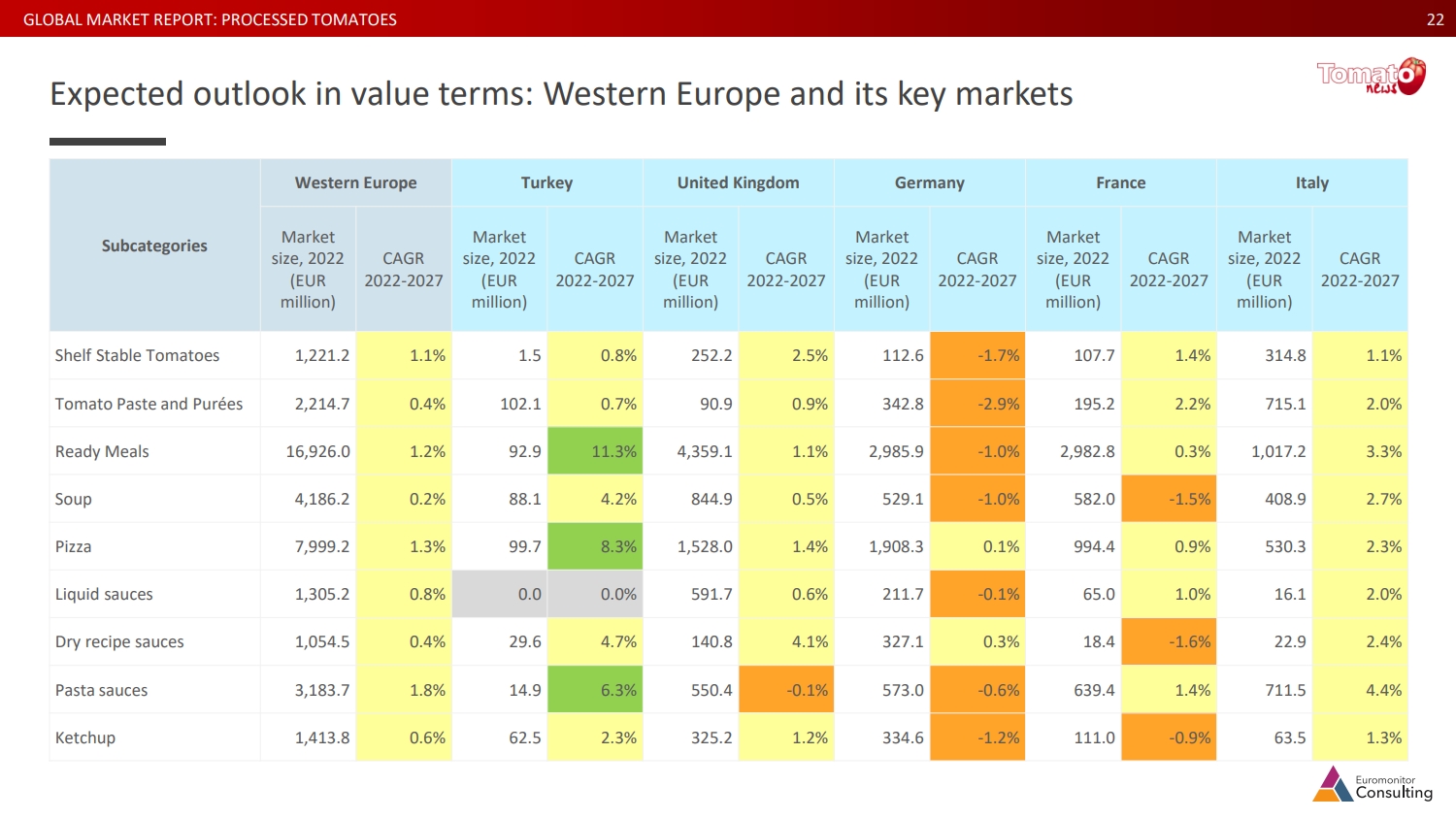

Outlook in value terms

In a market dominated by ready meals, pizzas and pasta sauces, the best growth prospects in terms of value for the 2022-2027 period in Western Europe are linked to growth in volumes in the same categories (pasta sauces (1.8%), pizzas (1.3%), and ready meals (1.2%)). These are also the product categories that are expected to see the strongest growth on the Turkish market. Conversely, the German and French markets are likely to record slowdowns in several categories, while Italy and the United Kingdom are likely to see growth in most market segments.

According to the data compiled by Euromonitor, similar dynamics should drive volume increases.

(see also additional information below)

In Latin America, the above-mentioned developments in terms of value and volume apply to all categories to varying degrees, including those that are already popular with consumers (pasta sauces, pastes and purées, and ketchup). These dynamics can also be observed on the Brazilian market, where most categories are expected to record annual volume growth of between 3% and 7%.

(see also additional information below)

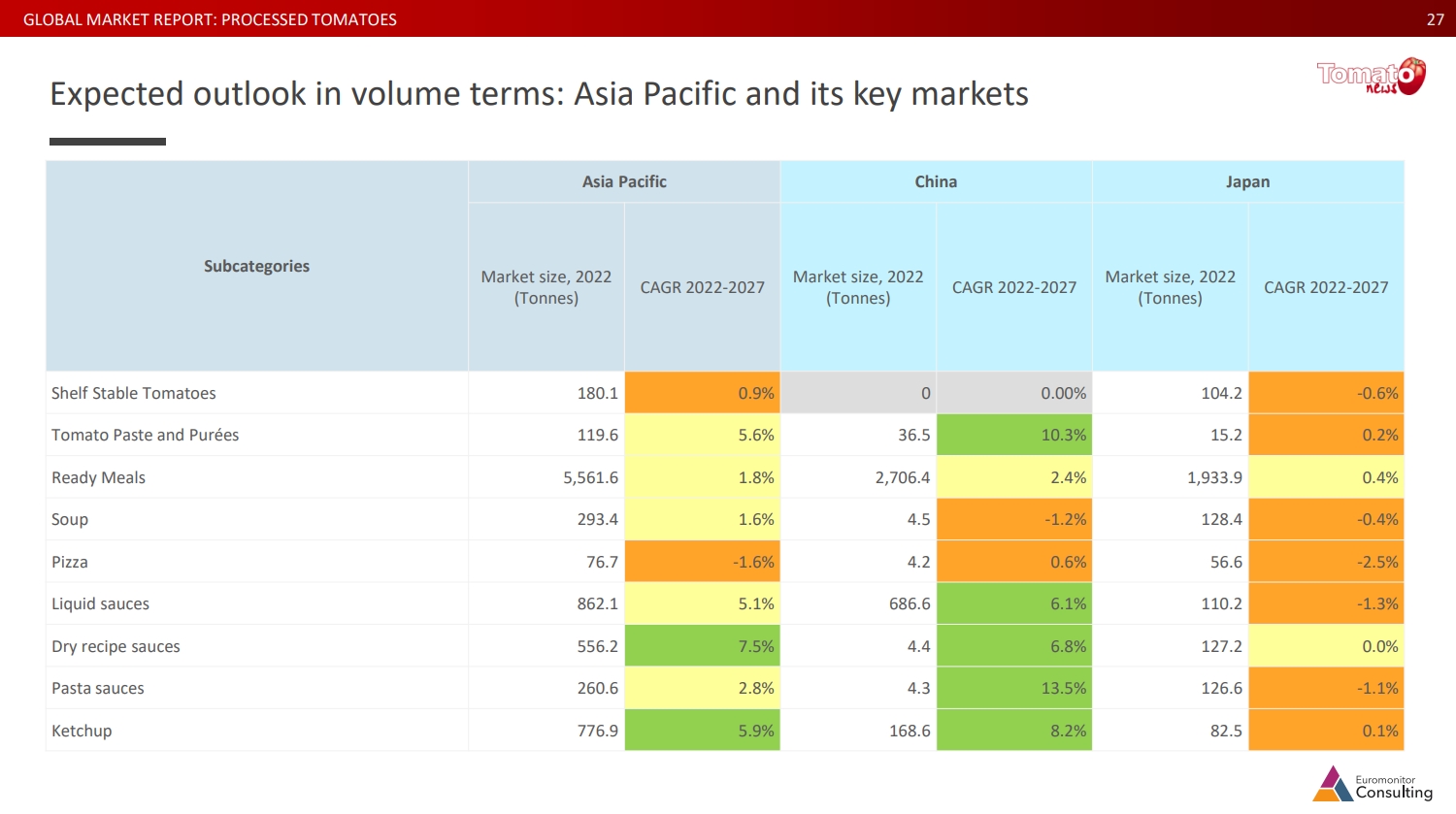

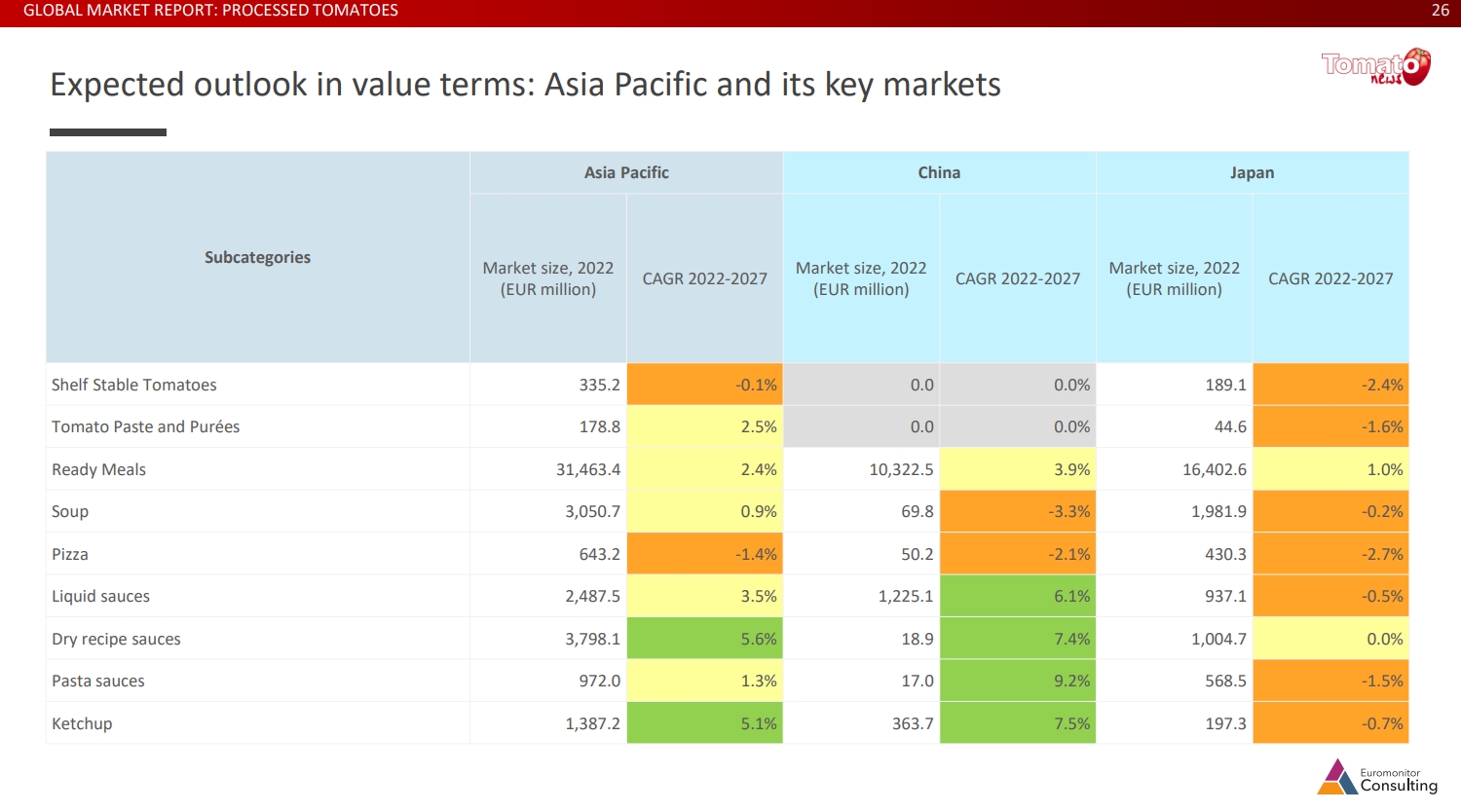

For the Far-Eastern market, clearly polarized around ready meals, which account for almost two-thirds of the volumes sold, Euromonitor forecasts slower growth in the flagship ready meals sector between 2022 and 2027, but sometimes spectacular developments in other segments (powdered sauces, ketchup, liquid sauces and pastes and purées). While the major Japanese market appears to be contracting, with negative forecast growth rates for virtually all categories, the regional market as a whole is set to be "pulled" upwards by Chinese demand. With the exception of soups (-1.2%) and pizzas (+0.6%), all segments show forecast growth of between 6% (liquid sauces, excluding pasta sauces) and 13% (pasta sauces).

(see also additional information below)

Pricing of processed tomatoes, according to category

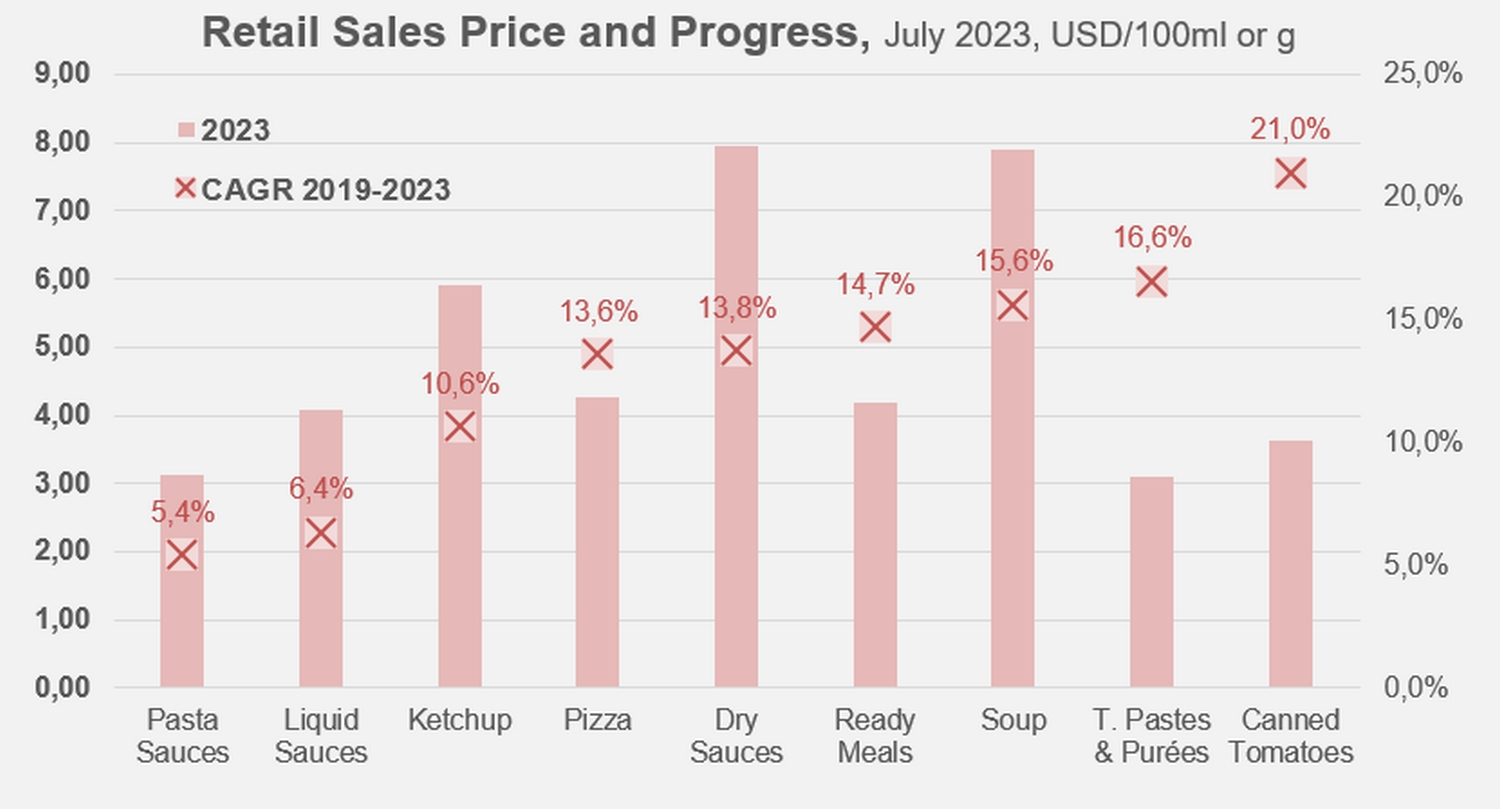

A closer look at retail prices (per 100 ml or 100 g of product) for the various categories above all reveals wide disparities between regions, and confirms that from July 2021 onwards, in all regions – with the possible exception of North America, where the trend is less clear-cut – retail prices for the various products have recorded gradual increases, taking them to the fairly high levels recorded in July 2023.

With a few local exceptions for ketchup, powdered sauces and pasta sauces, particularly in Asia Pacific and North America, retail prices for all product categories have risen significantly. According to Euromonitor, between July 2019 – i.e., before the emergence of the Covid health crisis – and July 2023, the smallest increase in the average global retail price was for pasta sauces, which rose at an annual rate of around 5.4%. Over the past four years, the average retail price of ketchup has risen by over 10%, and that of pastes and purees by over 16%. The increase in the price of tomato as a "raw material" partly explains this pattern, which is even more marked for canned tomatoes, whose retail price has risen by 21% over the same period.

In short, the patterns highlighted by Euromonitor's study clearly show that inflation impacts consumer spending.

As the world faces the effects of rising inflation and supply bottlenecks, the cost-of-living crisis is very much felt in the food industry. To address this, consumers are adopting cost-effective measures such as trading down within categories, which has increased demand for discounted or private label items, with the latter recording a notable 8.3% growth in the packaged food industry in 2022.

Nevertheless, some regions are posting high sales growth rates. Developing regions like Asia Pacific are the largest contributors to sales of cooking ingredients and meals. Asia Pacific is predicted to see the second-highest CAGR over the forecast period, while the Middle East & Africa and Latin America are predicted to see the fastest growth over the forecast period. This signals a rising interest in culinary diversity and international cuisines. Businesses can leverage this trend by investing in innovation, such as introducing new tomato-based products tailored to regional tastes.

In terms of product segments, ready meals are the most popular subcategory in most regions. This is because they are convenient and time-saving, as people are spending more time outside their homes in 2023. Hence demand for tomatoes as an ingredient in ready meals is expected to remain high as such food products are inspired by different international cuisines that often contain tomatoes as a key ingredient.

Some complementary data

Comparative trends in retail and hospitality sales for the different categories.

Outlook for the Western European market and some of its key submarkets.

Outlook for the Latin American market and for Brazil, its key national market.

Outlook for the Asia-Pacific market and two of its key submarkets.

We will come back over the next few weeks with more targeted analysis of the data we purchased from Euromonitor.

* article amended on 12 December 2023 to clarify the difference between the term "processed tomatoes" used by Euromonitor for the study with that of the fresh tomatoes used to manufacture the products usually used by Tomato News.

Source: Euromonitor International