Navigating the Nuances of Investment Due Diligence

Investment due diligence is a necessary process for both buyers and sellers to undertake to ensure the swift execution of their envisaged transaction. Although, with the stakes high, there are certain challenges that can arise throughout the process which, with careful planning and execution, can be mitigated.

Investment due diligence is a necessary process for both buyers and sellers to undertake to ensure the swift execution of their envisaged transaction. Although, with the stakes high, there are certain challenges that can arise throughout the process which, with careful planning and execution, can be mitigated.

Stela has 15 years of M&A track record in Europe. At EY and Raiffeisenbank she has worked on acquisitions and disposals of up to $1bn.

Expertise

PREVIOUSLY AT

Why is Due Diligence Necessary

- Due diligence is the detailed investigation that a potential investor carries out on a target business after successfully completing preliminary negotiations with its owner.

- Notwithstanding, the differences in scope due to different investing scenarios, there are typically four types of due diligence. These include commercial, legal, financial, and tax checks.

- As a result of the due diligence, the investor may come to a different or more nuanced understanding of the opportunity and seek to renegotiate the initially agreed terms or even decide to decline the investment.

- Due diligence commonly results in the investor negotiating additional, more detailed terms and conditions in its final agreement with the business's owner.

- Caveat emptor dictates that it is a buyer's absolute prerogative to undertake a due diligence on a potential acquisition. This was one red flag that was openly apparent within the example of Theranos, where investors largely forwent their checks.

What are the Steps Required for Investment Due Diligence

- Due diligence begins after an investment has been tabled via a letter of intent, or term sheet. At this point, a team is assembled to conduct the exercise with relevant rules of engagement agreed between both parties.

- The exercise is usually undertaken over a period of between 30 and 60 days, involving remote assessment of electronic assets and live site visits.

- In the end, a report will be compiled and presented to the investor with recommendations of potential additional terms and conditions required in the transaction.

How to Overcome the Challenges

- A healthy degree of reciprocity is required from both buyer and seller during the due diligence process to ensure the transaction can proceed as initially envisaged.

- The ability of the seller to provide certain types of information can be a challenge. This may be in part due to a lack of experience and/or extensive information for the area in question.

- Similarly, the willingness of the seller to open its doors to certain areas can come into question. This may relate to the sensitivity of the data, or due to insecurities about how such information will be absorbed by the buyer.

- Acting with a non-aggressive mentality can really assist a buyer to extract the required information and bridge the information gaps.

- Using specialists within the due diligence team can assist with building out analysis on incomplete data sets and educating the seller towards the necessary requirements.

Caveat Emptor and Due Diligence for Investors

In 2016, self-proclaimed “iPod of healthcare” tech startup Theranos began to unravel spectacularly. Its downfall started with reporting of fraud by the WSJ, followed by a criminal investigation by the SEC, and revocation of lab licenses by the CMS regulator. The business, which, at the height of a funding frenzy, had been valued at $9 billion, was exposed as a hoax and its private investors reportedly lost $600 million. Subsequent analyses demonstrated that there had been red flags all along, but they were overlooked or ignored.

Benefits of hindsight aside, the $9 billion burst bubble of Theranos is a high profile reminder of the importance of due diligence before investing in a company. Despite being an extreme case of founders intentionally misleading investors, it is still a stark illustration of the perils of not doing proper due diligence, even in good faith situations. Investments are inherently risky, but the awareness of risk should not be an excuse for skipping on a due diligence investigation. As Theranos investors found at their own cost, it meant jumping into an incredibly complex industry such as Biotech, with their eyes closed.

The widely accepted practice of doing due diligence before committing to an investment mostly derives from common sense and, in some cases, a legal obligation. Nevertheless, there are studies indicating a positive correlation between the extent of the investor’s due diligence and the investment’s subsequent performance. The correlation appears to span different types of investment scenarios, being noted for both angel and PE investments, and it strongly supports the case for due diligence.

A further important factor is not just whether, but also how you “do” due diligence. Both common sense, again, and the above-cited study suggests that the quality of due diligence matters as much as the quantity undertaken. A meaningful due diligence is a customized exercise which is well integrated into the overall investment process and relies on effective interaction between all participants. It must be able to address different types of challenges, including both the ability and the willingness on the part of the investee to meet the investor’s information requirements. Fortunately, for prospective investors, there are well-established tools and practices supporting the investor’s due diligence which are available to everyone.

What is Investment Due Diligence?

The present meaning of the term “due diligence” originated in the 1930s in legal parlance relating to broker-dealers’ duty of care toward investors. It described the required level of reasonable investigation broker-dealers were expected to conduct on the securities they were selling. The term quickly transferred over to describe the investigation process itself and was adopted beyond its original province of public offerings to private M&A and other types of investment transactions.

Nowadays you can encounter the term “due diligence” to signify investigations performed in a wide variety of business situations and at different stages of the investment process. However, in this article we are focusing on the most common use of the term in the financial world:

Due diligence is the detailed investigation a potential investor carries out on a target business after successfully completing preliminary negotiations with the business’s owner.

This definition excludes preliminary investigations conducted, using publicly available information, to identify and screen investment opportunities. It also excludes very specialized types of investigation, such as those that aim to check compliance with specific rules and requirements.

Investment due diligence, as discussed here, still covers a wide range of investors and investing scenarios, including startup and VC funding, M&A, debt finance, and long-term supply contracts. The nature and scope of the due diligence can vary significantly depending on the scenario. Some variations of the due diligence approach under the different scenarios will be highlighted later, but the general principles reviewed apply in all cases.

The purpose of investment due diligence as defined by us here is to confirm the investor’s initial understanding of the investment opportunity, underpinning the terms agreed with the business’s owner in the preliminary negotiations. Hence, the particular scope of a due diligence and the procedures performed as part of it must be selected, so as to substantiate the key assumptions made by the investor in valuing the opportunity and identify risks and uncertainties not captured in its initial assessment.

As a result of the due diligence, the investor may come to a different or more nuanced understanding of the opportunity and seek to renegotiate the initially agreed terms or even decide to decline the investment. For the same reason, investment due diligence commonly results in the investor negotiating additional, more detailed terms and conditions in its final agreement with the business’s owner.

Referring back to Theranos, it did not raise any money from any renowned life sciences VCs, instead, raising money from mostly private individuals, without relevant industry backgrounds. One reasoning behind this situation was due to the reluctance of the company to “open the kimono” to extensive due diligence proceedings, which could have compromised the investment terms at the time.

Types of Investment Due Diligence

As I mentioned, investment due diligence does not have a strict formulation; it should be designed to address the specific circumstances. The matters which will be investigated depend on the structure of the contemplated transaction – what the investor will receive in exchange for its investment. If the transaction is structured so that certain assets, liabilities or segments of the business are excluded, there is no reason for the investigation to cover them. The matters to be investigated also depend on the stage of maturity of the investee business or stage in the funding cycle, referred to earlier as “investing scenarios”. Certain areas of investigation which are critical in some scenarios, e.g. historical performance for M&A transactions, may not be relevant in other – in the same example, for seed/VC funding where the business does not yet have traction so that other types of historical information, such as founders’ backgrounds, are investigated instead.

Notwithstanding the differences in scope due to different investing scenarios, a typical due diligence will include commercial, legal, financial and tax due diligence.

- Commercial due diligence covers the target business’s market positioning and market share, including drivers and prospects. It seeks to obtain an independent perspective on the sales forecast as the most critical component of the target’s business plan.

- Legal due diligence covers a wide scope of legal matters, including proper incorporation and ownership, contractual obligations, ownership of assets, compliance, and litigation. It seeks to confirm the validity of the rights being acquired by the investor and the absence of legal risks which could undermine the value of the investment.

-

Financial due diligence has a wider perspective because it seeks to both:

- Validate the investor’s valuation assumptions by looking at historical performance, if available, and concluding on whether it is consistent with projections and

- Identify financial uncertainties and exposures which could disrupt the business, or result in additional costs to the investor.

- Tax due diligence could be viewed as an extension of the financial due diligence, where the focus is on identifying potential additional tax liabilities arising from non-compliance or errors.

Further types of investment due diligence are technical, environmental and regulatory, performed when the impact of these areas on the business is significant. Depending on the situation, the due diligence may need to address very specific and narrowly defined topics, as long as they are factors for the valuation and assessment of the risks of the investment opportunity.

What is the Due Diligence Process?

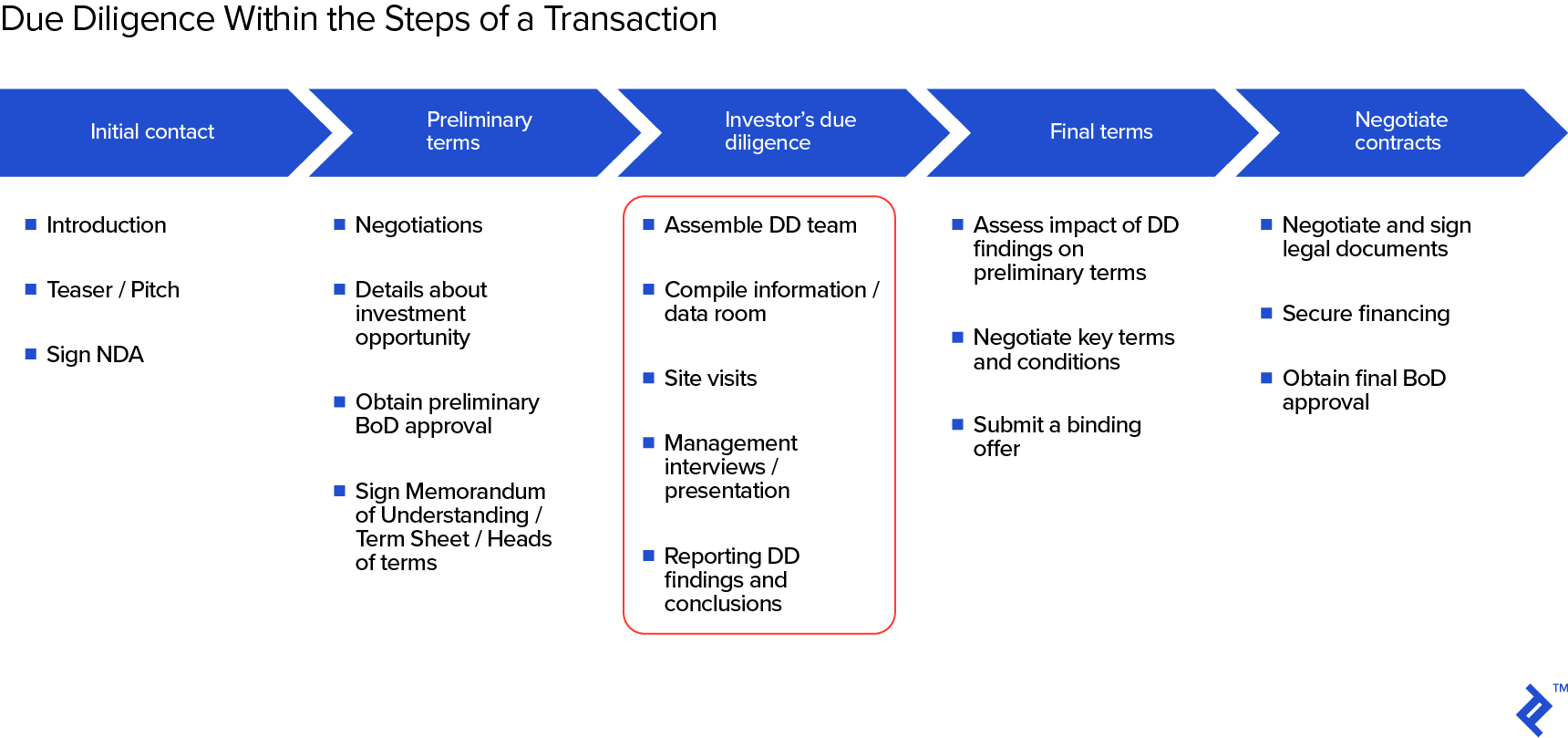

Investor due diligence typically takes a center position along the timeline of the investment process, as illustrated by the figure below.

However, to serve its purpose, investment due diligence must be performed in coordination with the other activities within the process and the due diligence team needs to actively communicate with the other participants. There are actually no clear-cut boundaries between the due diligence and the other phases of the process. To illustrate how this works we summarize below the usual sequence of activities and events.

Before the Due Diligence

- The potential investor has expressed its interest in the opportunity presented by the investee (founder, business owner, supplier, etc).

- The two sides have met and established a relationship, discussed the opportunity, and agreed in principle on the key terms of the investment (transaction).

- The key terms agreed in the preliminary stage typically include transaction structure (what does the investor receive?), price (what does the investor pay?) and process (what steps must be completed to close the transaction?). Frequently such terms are laid out in a non-binding document called Letter of Intent, Term Sheet or Memorandum of Understanding.

Due Diligence Kick-off

- The investor typically introduces a wider team into the process, including external advisers which may be assigned to perform due diligence in specific areas (e.g. legal, financial and tax, technical).

- The investor and the investee agree on the terms of access to information about the target business, including confidentiality undertakings, scope, and limitations of the investigation, communication protocol and points of contact.

- Access to information can be arranged through a virtual data room (VDR) facility which takes care of most aspects of the information exchange protocol. The cost of using a VDR by an external provider is usually justified in larger processes involving multiple bidders.

- A timeline is established including deadlines for receiving the information, issuing the investment due diligence report(s) and returning to the negotiating table.

Due Diligence Process

- Information requesting and receiving; Q&A

- Site visits at the target business by the due diligence team

- Interviews with management

- Internal communication and discussion of findings; progress reports and clearing of procedural issues with the investee

- Preparation of one or more investment due diligence reports

- Completion and next steps.

- The investor reads and discusses the reports of the different work streams.

- It considers the implications of the findings for the valuation of the investment and the additional terms and conditions which need to be negotiated to properly secure its rights and fend against undertaking undesired exposures.

- The investor puts the investment due diligence findings on the table in order to negotiate the changes or additions to the terms of the transaction.

Investment Due Diligence Challenges

For the most part, the due diligence investigation is carried out on information provided by the target business. Effectively, at the due diligence stage the target business “opens up” to the investor in order to substantiate the claims about the opportunity made at the initial stage of the negotiations. Hence, a sufficient level of cooperation by the investee or its owner is critical for a successful due diligence. There are two aspects to the investee’s cooperation: its (i) ability and (ii) willingness to provide appropriate information.

The Ability to Provide Information

An investor’s information requirements in order to assess an opportunity may be more sophisticated and/or more detailed compared to the information the investee has available. This is commonly the case where a larger, more developed business invests in a smaller business, or where an institutional investor funds an entrepreneur. The business owner is focused on developing and running the business rather than on reporting and is not prepared for the investor’s scrutiny.

Here are some examples of how this could happen during investment due diligence:

| Scenario | Problem | Resolution |

| The target business has the information, but it is difficult to extract and present in a meaningful manner as required by the investor. | The business cannot provide a rigorous analysis of what part of turnover growth is due to sales volume and what to price increases | The due diligence provider can assist with this. A financial adviser can process the granular sales data generated by the accounting system to produce an appropriate analysis. |

| The detailed information provided does not (fully) support the claims made by the investee at the initial stage of negotiations because the investee itself did not have a good understanding of its finances. | Management was focused on managing the cash flow, but investment due diligence uncovers significant unbilled payables to suppliers of the business which had not been accrued and hence the business's costs were understated. | Interviewing suppliers is an effective way of getting a clearer picture. With this in place, the financial statements can be restated correctly. |

| Financial and tax reporting is riddled with technical errors of which the owner/management is not aware, but which result in distorted financial information or non-compliance with tax regulation posing a risk of fines. | The business does not allocate its production costs by product correctly, resulting in misleading profitability indicators by market segment. | A financial adviser can quantify the errors and produce adjusted results for the purposes of the negotiations. |

As illustrated by the examples, a proper due diligence process will not only analyze the available information, but it will also assist with procuring the right information if the investee’s ability is limited. In certain situations, this may be critical for the success of the transaction.

The Willingness to Disclose Information

By disclosing a large amount of internal information about its business, an investee exposes itself to leakage of sensitive data and trade secrets to the outside. The investee’s vulnerability increases, if the investor is a competitor, i.e. another business in the same industry.

In many cases, investees will limit their risk by putting restrictions on the information they will provide for the purposes of a due diligence. Restrictions frequently cover areas such as customer and supplier lists, prices and benefits provided to key talent. However, restricting the information subject to due diligence increases the investor’s risk and may result in a lower valuation and ultimately in an unsuccessful transaction.

Tools commonly employed to manage the investee’s risk of improper disclosure include:

- Formal confidentiality undertakings (non-disclosure agreements)

- Employing reputable professional advisors with established confidentiality protocols and practices to perform the due diligence

- Agreeing in advance (i.e. in the Memorandum of Understanding) on the areas the investment due diligence will cover and the extent of the information which will be provided.

- Organizing the due diligence in two stages where restrictions are imposed on the information at the first stage and are lifted at the second stage after the investor makes a binding commitment to the transaction.

I would like to highlight that, notwithstanding the use of the above tools, a certain level of trust and commitment to the transaction between the negotiating parties is a prerequisite for a successful due diligence. The lack of a common ground in the investment process cannot be compensated for by techniques and procedures.

Reverse Due Diligence: by the Investee on the Investor

Although the primary risk of a transaction is borne by the investor, by engaging in a process the investee takes risks, too. The main risk to the investee is that the investor won’t deliver on its obligations: won’t pay the price or won’t develop the business as agreed. As already mentioned, the investee is also vulnerable due to its extensive disclosure of information during the investment due diligence process. Furthermore, involvement in a transaction process by the investee has a cost of its own, since it consumes management’s time, typically requires the use of advisors and may disrupt the business. In the event of an unsuccessful transaction, such costs are not recovered.

To limit the risks arising from extensive disclosure, an investee would be well advised to do an informal “due diligence” of the investor itself at an earlier stage. The objective would be to ensure that it is engaging in a costly transaction process only with investors who are:

- Trustworthy to act in good faith and deliver on the contracts they enter into

- Seriously interested in the investment opportunity and motivated to see the process through

- Reliable in terms of confidentiality and information security

Unlike the investor’s due diligence, there is no commonly accepted protocol for the investee’s due diligence of the investor. Nevertheless, it would be reasonable for an investee to do a thorough background investigation of the investor before engaging in the process with it. Such an investigation could include the following:

- History and track record of the investor from publicly available sources, especially in relation to similar prior transactions

- Investor’s reputation in the industry, possibility to obtain references from its business partners

- Check for “red flags” such as non-transparent ownership, lack of public history, association with questionable individuals, unusual business practices

- Direct Q&A with the investor to probe its stance on key matters of importance to the investee and its degree of openness.

- Analysis of the investor’s potential conflicts of interest and possible different motivations to engage in the investment process, other than the investment opportunity itself.

In larger, more structured transaction processes, the investee’s due diligence may even take of the form of a list of criteria bidders must demonstrably meet in order to enter the process. But even for small-scale transactions, the investee should make sure the investor ticks off its list.

Always a Necessary Precaution

Investment due diligence is a necessary component of the transaction process which benefits both parties by providing a basis in reality of the hopes and expectations for the opportunity.

Due diligence is commonly organized as a process within the process in which various experts perform specific roles. However, even though it resembles a stand-alone exercise, due diligence should not be considered as a formality detached from the actual investment decision.

A meaningful due diligence which actually helps mitigate the investment risk usually meets the following conditions:

- Both sides plan for investment due diligence early on, conduct preparation and allow sufficient time for it to take place at an appropriate point of the transaction process

- A mechanism is put in place to modify the transaction terms as a result of the due diligence findings, as opposed to committing to a decision beforehand and not expecting to have to change it as a result of the due diligence

- The scope of the due diligence corresponds to the matters of importance to the investment decision, i.e. it properly reflects the valuation drivers and the transaction structure

Finally, but not last in importance, employing the right experts to perform investment due diligence is also a factor for getting the right outputs. In addition to specialization in regulatory, accounting, tax and technical matters, the due diligence team needs to be advised by transaction experts. To ensure that there is proper perspective to the investigation and that it serves its purpose to support the investor’s decision.

Understanding the basics

What is the due diligence process?

Prior to executing an investment transaction, due diligence is the investigative process of verifying that the asset in question matches the expectations set forth in the sale proposal.

How long does it take to do a due diligence?

For physical asset purchases, such as businesses or property, the due diligence process can take between 30 and 60 days to complete.

Stela Ivancheva

Sofia, Bulgaria

Member since September 5, 2017

About the author

Stela has 15 years of M&A track record in Europe. At EY and Raiffeisenbank she has worked on acquisitions and disposals of up to $1bn.

Expertise

PREVIOUSLY AT