Commodity Futures contracts were established in 1865, but commercially available data starts in 1959, leaving an 80+ year period of unstudied history. In our latest academic paper “Two Centuries of Commodity Futures Premia” Chris Geczy and I use hand-collected futures data to extend the well-known cross-sectional Value, Momentum and Basis factors in commodity futures back to 1877. This paper is part of an ongoing and growing effort by many researchers to extend known factor results into deep history (see a comprehensive list here).

The chart below captures the main result: a significant out-performance of the Combo strategy that holds the top third of commodities based on Value, Momentum and Basis rankings compared to the bottom third.

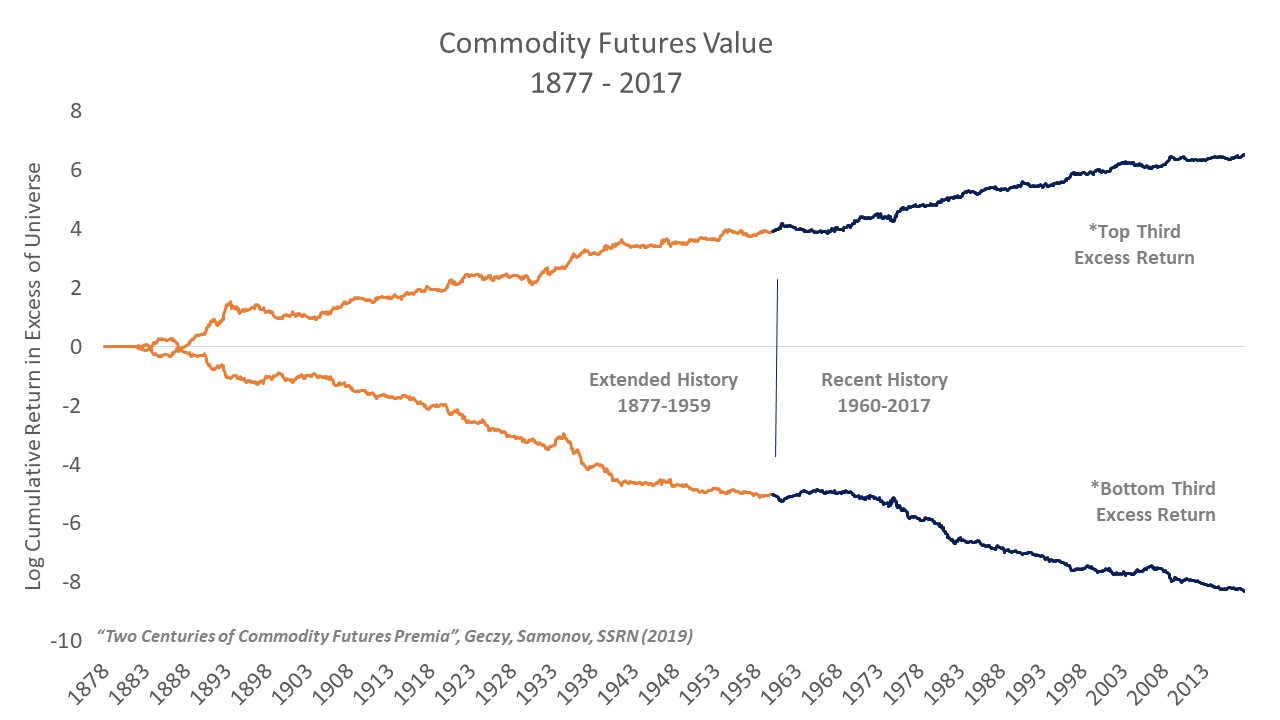

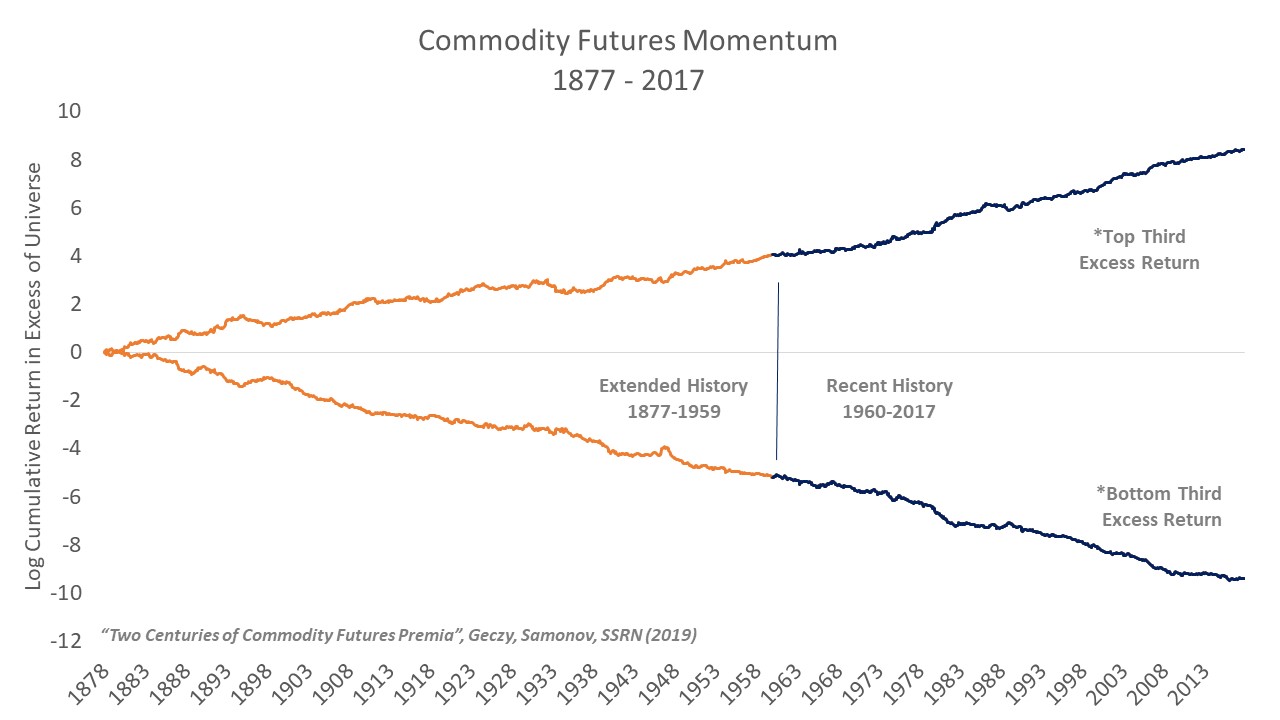

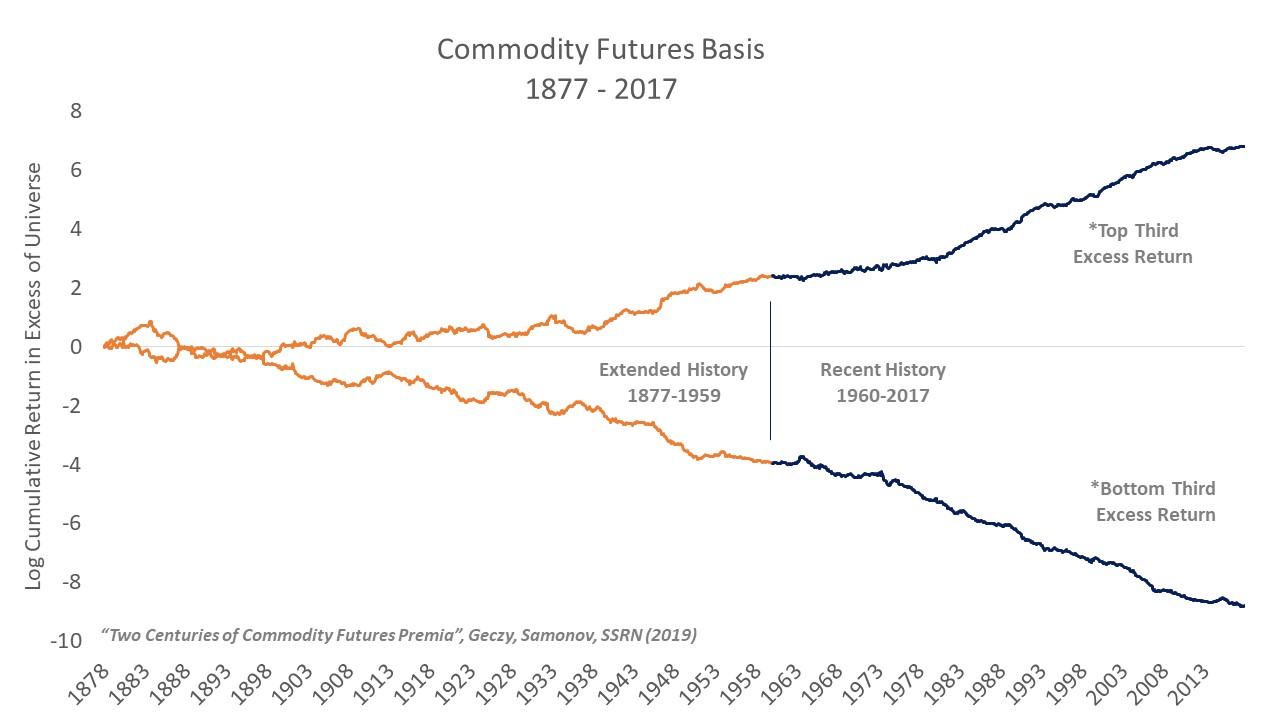

We find that all three factors have positive top minus bottom long-short spreads in the extended history. The table below summarizes average monthly excess returns, standard deviations, and Sharpe ratios for the long-short portfolios, long-only Combo portfolio, and the commodity universe.

Many institutional and family office portfolios have allocations to some commodity risk. Before 2007, it was a popular allocation to add for diversification reasons, and over-optimistic return expectations. During the decade that followed, the passive commodities asset class had disappointing results. Interestingly, our long-term data shows that commodity futures barely outperformed t-bills between 1878 and 1959, with most of the performance coming during the late 1940s. This new evidence puts into question whether having a long-run passive allocation to commodity futures in an asset allocation framework is still as clearly beneficial as once thought.

In addition, our study shows that having a long-only commodity exposure that is tilted towards Value, Momentum, and Basis can make a big improvement. Both in the recent history, as well as the extended history, the Combo long-only commodity futures portfolio significantly outperforms the average universe, returning 0.7% per month above the risk free rate before 1959 and 1.2% after, compared to 0.2% and 0.6% per month for the average commodity universe during the same time-frames.

Compared to factor tilted strategies in other asset classes, commodity futures have the additional benefit of not requiring increased turnover, because to achieve the passive commodity futures return, one already needs to constantly roll the futures near their expirations.

The extended data reveals other important deviations from recent history. The relative size of the long-short spreads of the three factors appears in reverse, with value leading the way, followed by momentum and basis taking the third place. The opposite holds in the post-1959 sample, where basis has the highest spread, followed by momentum and value. We also observe a deterioration of the size of these premia in the pre-sample, which also coincides with lower average commodity future returns in general. For example, the Combo portfolio that invests equally in all three long-short premia strategies averages 7.9% per year return in excess of the risk-free rate in the pre-sample period (1870-1959) compared to 14.2% in the recent sample (1959-2017). By comparison, average commodity futures universe has generated an excess return of 3.0% in the pre-1959 vs. 6.8% in the post-1959 period.

We document new episodes of factor crashes previously unobserved in recent history. For example, the basis factor reaches the minimum draw-down of -83% in the early sample, compared to -39% in recent history. Though the increase in risk can be partially attributed to the decreased sample size in the extended history, it is still critical to account for the large potential premia crashes to avoid underestimation of the left-tail risks. These critical deviations from recent history in both returns and risks are important outcomes of long-run studies and point to the danger of over-reliance on short data in forming expectations about return and risk properties of factor premia, and in this case, the entire asset class.

In summary, on the one hand, these results strongly suggest that all three of these premia are real effects since they persist in the data that was previously not touched by academic backtests and hence cannot be a result of data-mining. On the other hand, two out of three premia (momentum and basis), as well as the average commodity futures returns are much lower in the early sample, pointing to a potential over-estimation of the expected size of these premia. Finally, factor tilting commodity portfolios appears beneficial in both recent and deep histories, without an increase of turnover.

See the complete results here.