sap finance.pdf - Ameerpet Pages

sap finance.pdf - Ameerpet Pages

sap finance.pdf - Ameerpet Pages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SAP-FI/CO<br />

SAP: Systems, application and products in data processing<br />

FI: Financials: co: controlling<br />

Version: 4.7 EE (Enterprise edition)<br />

No. of co. working with 4.6b<br />

4.6c<br />

SAP Started in 1972 � Head quarters in Germany<br />

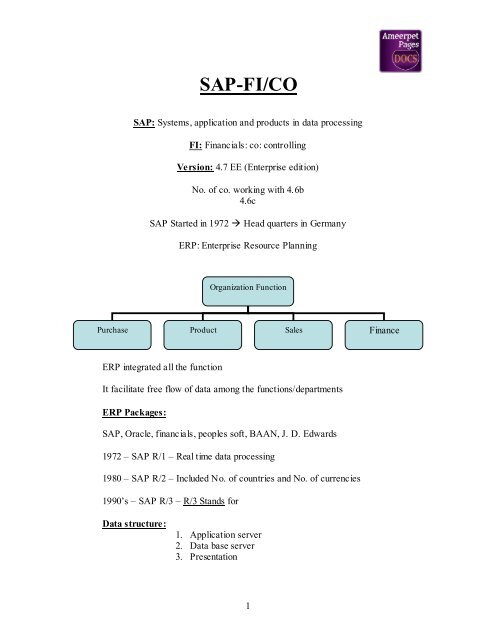

ERP integrated all the function<br />

ERP: Enterprise Resource Planning<br />

It facilitate free flow of data among the functions/departments<br />

ERP Packages:<br />

SAP, Oracle, financials, peoples soft, BAAN, J. D. Edwards<br />

1972 – SAP R/1 – Real time data processing<br />

1980 – SAP R/2 – Included No. of countries and No. of currencies<br />

1990‟s – SAP R/3 – R/3 Stands for<br />

Data structure:<br />

Organization Function<br />

Purchase Product Sales Finance<br />

1. Application server<br />

2. Data base server<br />

3. Presentation<br />

1

1999 – My SAP.com – Web based<br />

2004 – Net weaver - Integrates information, people and processes.<br />

Areas to be covered under FI/CO<br />

FI:<br />

CO:<br />

1. General ledger accounting<br />

2. Accounts payable<br />

3. Account receivable<br />

4. Asset accounting<br />

1. Cost element accounting<br />

2. Cost centre accounting<br />

3. Internal orders<br />

4. Profit centre accounting<br />

5. Product costing<br />

6. Profitability analysis.<br />

Integration of<br />

1. Material Management Module to Financial<br />

2. Sales & distribution module to financial module integrate<br />

3. Production planning module to controlling module integration<br />

4. Data take over<br />

5. Closing Procedure<br />

Reports:<br />

In all the module systems gives around 2000 reports<br />

You can attach the reports to favorites<br />

Some important reports you can attach the reports on desk top.<br />

Cross company code transactions:<br />

India version: T. D. S, Excise and sales tax.<br />

Companies Act: Schedule VI: Balance sheet and profit & loss A/C<br />

2

Basic Settings:<br />

Production dept<br />

A<br />

Fiscal Year: Indian companies � April to March + 4 special periods<br />

U. S � January to December<br />

Example: Account year � April 2005 to March 2006<br />

(12 + 4)<br />

25/04/06 – Profitability by Account dept – 13<br />

10/05/06 – Profitability by Management – 14<br />

05/06/06 – Profitability finalized by Auditors – 15<br />

Create a project<br />

Customization with different scenarios<br />

Testing<br />

SMB (Small and medium business companies)<br />

3<br />

Group<br />

Company 1 Company 2 Company 3<br />

Hyd Unit Mumbai Unit Bangalore unit<br />

Prod dept B<br />

Serv. dept

How to Open SAP<br />

Open: Double click on SAP Logon Icon<br />

Then double click on SAP class<br />

First screen;<br />

First field: Client: 2 clients<br />

1. Development Client<br />

2. Production Client<br />

In the Implementation SAP<br />

1. Consultants<br />

2. Company Staff (Core Team Members)<br />

The consultants they do the customization in development client.<br />

The company staff will do the testing.<br />

The customization will be transferred to client through transport requests.<br />

In the production client you enter your day to day transaction.<br />

Some companies they will give 3 clients<br />

1. Development client<br />

2. Testing client<br />

3. Production client<br />

Client: 800/000/810 – You can copy and give any number.<br />

User: Cost of Package will depend on the No. of users Licenses.<br />

100 Users License - used by 1000 Employees<br />

It fixes the responsibility on employee.<br />

User ID: SAP user: You can use small or capital letters (It‟s not case sensitive)<br />

4

Password: The length of password – Min3 – Max8.<br />

(It can be Numeric, Alpha Numeric, Alphabets, and special characters.<br />

Password is not case sensitive<br />

Not possible to change password more than once in a day.<br />

Latest 5 passwords can not be used<br />

Password can not be restored.<br />

* Money is the password.<br />

Language: Along with the packages you can get 41 languages.<br />

If the language not given or EN – Default English<br />

If you give DE – all fields on screens in German.<br />

Once you complete press Enter.<br />

One user can work in Number of sessions at a time (window)<br />

Maximum is six (6)<br />

1 st Row is called Menu Bar<br />

2 nd Row – standard tool bar.<br />

3 rd Row is called Title bar.<br />

4 th Row is called Application tool bar<br />

5- SAP Menu<br />

Last Row is called Status bar<br />

√ (Tick) is called Enter.<br />

Beside Tick there is Box � called command field.<br />

To open a new session from to Menu bar select systems � Create session.<br />

To move from one session to another session<br />

5

Use Alt + Tab<br />

To close the session the path is from Menu Bar Systems � End session<br />

How to use Transaction codes (TC)<br />

Standard codes one common in all over the world<br />

To go back to SAP easy access screen<br />

Example:<br />

Use /N in command field and press enter<br />

For posting of Transaction:<br />

F-02 Account display<br />

(FS10N)<br />

/N is command field and press enter � Easy Access<br />

Use FS10N in command field – you can directly enter into Accounts display<br />

/N FS10N – change session with new transaction code.<br />

/o FS10N – create session with new transaction code.<br />

How to close the system:<br />

*From the Menu bar select system Log off.<br />

Select yes button to Log off<br />

Go through the path<br />

Posting of document<br />

(2 ways)<br />

6<br />

Use transaction code in<br />

Command field and press<br />

enter

How to unlock screens:<br />

*Tools � Administration � Monitor � Lock Entries (Transaction code is /NSM12)<br />

Select list button<br />

From the Menu bar select Lock entry delete all.<br />

Press yes button to delete all lock entries.<br />

How to activate Transaction codes<br />

Path: From the Menu select extras � setting � Display Technical Name (check) Box �<br />

Enter<br />

Set start Transaction You can make screen as default screen<br />

How to set start transaction:<br />

From the Menu select extras set start transaction<br />

Give the transaction code „f-02‟ (start Transaction)<br />

Press enter<br />

Creation of project<br />

Group � Companies � Units<br />

In SAP – Group is called as company<br />

Company is called as company code.<br />

Unit is called as Business areas.<br />

Group--> Aravind group<br />

Aravind Mills Ltd (AML companies Ltd) () Aravind Steels Ltd<br />

(ASL)<br />

Hyd<br />

Mumbai Bangalore<br />

Hyd<br />

Mumbai Bangalore<br />

.The consultant does customization at company code level<br />

7<br />

Aravind Chemicals<br />

(ACL)<br />

Hyd Mumbai Bangalore

The company or group is only for information.<br />

Define Company:<br />

Path; SPRO � Enterprises Structure � Definition � Financial<br />

Accounts�Define Company. (T.CODE-/NOX15)<br />

The company or Groups is only for Information<br />

This is called customization area (or) configuration area (or) Implementation area.<br />

1 st button is called IMG documentation (Description path about Company)<br />

2 nd button is called IMG activity.<br />

If you want to customization select IMG Activity.<br />

Double click on IMG Activity Button<br />

Select New Entries Button.<br />

Enter company name AVG (optional)<br />

Company name is Aravind group<br />

Name of the Company2 � if groups has any second Name<br />

Street � <strong>Ameerpet</strong><br />

Postal Code � 500 000<br />

City � Hyderabad<br />

Country � one button is called drop down button or pull down button<br />

For country select drop down button � 236 Countries<br />

Select IN � for India.<br />

Language key: select drop down button � 41 languages<br />

8

Select EN for English<br />

Currency: select the drop down button – 183 Currencies.<br />

Select INR – Indian Rupee.<br />

Select Save button or (ctrl + s)<br />

Before saving, the screen gives you latest transport request<br />

Select create request button (F8)<br />

Short description - FI Basic settings for Aravind Mills Ltd<br />

Press enter � Press Enter once again to saving the request.<br />

You can see the system data saved.<br />

It can saved in client 800 AML Company<br />

Define Company code:<br />

Tools � Customizing � IMG� Edit Project � SAP reference IMG button�<br />

(SPRO) � Enterprises structure � definition � Financial Accounting � Edit,<br />

copy, delete, check company code. (T.CODE-/NOX02)<br />

Double click on IMG Activity button.<br />

Double click on Edit company code data<br />

Select new entries button.<br />

Company code � AML (Max 4 characters)<br />

Company Name � Aravind Mills Ltd<br />

City � Hyd<br />

Country � IN<br />

Currency � INR<br />

Language � EN<br />

9

Once you can complete the data, select save button or (ctrl + s).<br />

It gives a big screen<br />

Title: Company<br />

Name: Aravind Mills Ltd.<br />

Address: Street � <strong>Ameerpet</strong><br />

Postal code � 500 000<br />

City � Hyd<br />

Country � IN<br />

Once you complete press Enter<br />

You can enter it gives you latest request<br />

To choose your request � select drop down button beside<br />

Requests number � it gives the entire request.<br />

Select your request number � press Enter to save in the request.<br />

It saved in two places<br />

1. Client 800<br />

2. Request<br />

Assign company code to company: (T.CODE-/NOX16)<br />

Path is SPRO � Enterprise structure � Assignment � Financial Accounting �<br />

Assign company code to company.<br />

Double click on IMG Activity button.<br />

Shortcut:<br />

Select position button � Give you company code AML press Enter.<br />

For company code (AML) Assign Company (AVG) select save button or (ctrl + s)<br />

Press Enter to save your request.<br />

10

Define Business Areas: (T.CODE-/NOX03)<br />

Business Areas assignment to company code is not required.<br />

The same Business area can be used by any company code.<br />

Path: SPRO � Enterprises structure � definition � financial accounting � define<br />

business area<br />

Double click on IMG Activity button<br />

Select new entries button.<br />

Code May be numerical or Characters – Max 4<br />

Code: AMH � Hyderabad business Area.<br />

AMB � Bangalore Business Area<br />

AMM � Mumbai Business Area<br />

Select save button or (ctrl + s)<br />

Select drop Box.<br />

Press enter to save in your request.<br />

Chart of Accounts:<br />

1. Common set of Accounts � accounting coding should be same, and then only you can<br />

compare and consolidate between company code or business areas.<br />

2. Separate set of Accounts:<br />

3. Group chart of Accounts:<br />

In this case you have to give 2 No (Company code Number + Group code<br />

Number)<br />

*Companies they follow common set of Accounts<br />

Chart of Accounts name<br />

Description<br />

Maintenance language<br />

11

Length of the Account Number � Max 10 digits<br />

But companies are normally using 6 digits.<br />

Path of chart of Accounts<br />

SPRO � Financial Accounting � General Ledger Accounting<br />

G/L Accounts � Master Records � Preparation � Edit chart of Accounts list<br />

Double click on IMG Activity button (T.Code OB13)<br />

From the Menu select system status � short cut<br />

Select New Entries button<br />

Chart of Accounts ---> AML (Max 4 characters)<br />

Description � Chart of Accounts for Aravind Group<br />

Maintenance Language --> Select English<br />

Length of G/L Account no: enter 6<br />

Controlling integration � Select Manual creation of cost element<br />

Group chart of Accounts � Blank<br />

Under status � Blocked � Deselect Blocked Check Box<br />

Use of Block is to avoid duplicate Accounts creation.<br />

Once you complete you can select save button<br />

Press Enter to save in your request.<br />

Assign Company Code to chart of Accounts:<br />

Path: SPRO �Financial Accounting � General Ledger Account�G/L Accounts �<br />

Master Records � Preparations � Assign company code to chart of Accounts. (T. code<br />

OB62)<br />

Select Position Button<br />

Give the Company code AML � press Enter.<br />

12

For the company code AML assign chart of accounts AML<br />

Select save button or (ctrl + s) button<br />

Press Enter to save your request.<br />

Account Groups:<br />

1. Liabilities - 1.series<br />

2. Assets - 2.series<br />

3. Income- 3.series<br />

4. Expenditure- 4.series<br />

Path: SPRO � SAP Ref IMG � Financial Accounting � General Ledger Accounting<br />

� G/L Accounts � Master Records � Preparations � Define Account Group<br />

(Transaction code OBD4)<br />

Select New Entries button.<br />

Chart of Accounts:<br />

Give the chart of Accounts --> AML<br />

Chart of Account Name<br />

From Account To Account<br />

accounts group<br />

AML SCPL Share Capital 100000 100099<br />

AML RSPL Reserves &<br />

Surplus<br />

100100 100199<br />

AML ACDN Accumulated<br />

depreciation<br />

100200 100299<br />

AML SCLN Secured Loans 100300 100399<br />

AML UNSL Unsecured Loans 100400 100499<br />

AML CLPR Current liabilities<br />

&provisions<br />

100500 100599<br />

AML FAST Fixed assets 200000 200099<br />

AML CAST Current Assets,<br />

Loans and<br />

advance<br />

200100 200199<br />

AML SALE Sales 300000 300099<br />

AML OTHR Other Income 300100 300199<br />

AML INCR Increase/Decrease<br />

in stocks<br />

300200 300299<br />

AML RMCN Raw Material<br />

consumption<br />

400000 400099<br />

AML PRSN Personnel Cost<br />

(Staff cost)<br />

400100 400199<br />

13

AML MFRG Manufacturing 400200 400299<br />

AML ADMN Administration 400300 400399<br />

AML INTR Interest 400400 400499<br />

AML DEPR Depreciation 400500 400599<br />

Once you complete select save button or (ctrl +s) save in your request.<br />

Retained Earnings Account:<br />

Year Ending<br />

P&L Account Balance � Surplus in P&L A/Cs transfer to Reserves & Surplus.<br />

Balance sheet Account balance � carry forwards to next year � Opening Balance for<br />

next year.<br />

Assign one Account for retained earnings � 100100.<br />

Path: SPRO � Financial Accounting � General Ledger Accounting � G/L Accounts<br />

� Master Records � Preparations � Define Retained Earnings Accounts. (T. Code<br />

OB53<br />

Give your chart of Accounts AML<br />

Press Enter.<br />

P&L Statements Accounts Type Account<br />

X 100100<br />

Select save button or (ctrl + s)<br />

It gives the Message, Account 100100 not created in chart of Accounts AML<br />

Ignore the message press Enter. Press Enter once again to save in your request.<br />

Fiscal Year<br />

14

Indian Company – Apr to March + 4 Special Periods –V3<br />

U.S.Company - Jan to Dec + 4 Special Periods -K4<br />

How to convert Calendar your Periods to Accounting your periods<br />

Path: SPRO�. Financial Accounting � Financial Accounting Global settings � fiscal<br />

year � Maintain fiscal year variant (Maintain shortened fiscal year) (T. Code OB29)<br />

Select position button<br />

Give fiscal year variant –V3<br />

Enter<br />

Select fiscal year variant – V3<br />

Double click on period‟s folder<br />

Select back arrow (or) F3<br />

Select new entries button<br />

Fiscal variant � Give A3 - Max 2 characters<br />

Description � April – March + 4 special periods<br />

Deselect- year dependant check Box<br />

Deselect calendar year check Box<br />

No. of posting periods 12<br />

No. of special periods 4<br />

Once you complete select save button (or) (ctrl +s)<br />

Save in your request<br />

Select fiscal year variant: A3<br />

Double click on period‟s folder<br />

Select new entries button.<br />

15

Conversion table:<br />

Month Days Period Year shift<br />

January (1) 31 10 -1<br />

February (2) 29 11 -1<br />

March (3) 31 12 -1<br />

April (4) 30 1 0<br />

May (5) 31 2 0<br />

June (6) 30 3 0<br />

July (7) 31 4 0<br />

August (8) 31 5 0<br />

September(9) 30 6 0<br />

October (10) 31 7 0<br />

November (11) 30 8 0<br />

December (12) 31 9 0<br />

Once you complete select save button or (ctrl + s)<br />

Assign company code to a fiscal year variant<br />

SPRO � Financial Accounting � Global Settings � Fiscal Year � Assign Company<br />

Code to a fiscal year variant (T.Code is OB37)<br />

Select position Button<br />

Ignore the Message press Enter<br />

Give your Company Code AML<br />

Press Enter<br />

For company code AML, Assign Fiscal Year variant V3 (or) A3<br />

Select save button (or) (ctrl + s)<br />

Ignore the Warning Message Press Enter<br />

Press Enter to save in your request.<br />

Document Types and No. Ranges<br />

Stores (factory) Sales (Depot) Accounts(City<br />

office)<br />

RE RV SA Document type<br />

03 02 01 Number Range<br />

200001 To 300000 100001 To 200000 1 To 100000 Number Range<br />

16

17<br />

Intervals<br />

Path: SPRO � Financial Accounting � Financial Accounting Global Settings �<br />

Document � Document Header � Define document types. (T. Code OBA7).<br />

Select position Button<br />

Give the document type SA.<br />

Press Enter.<br />

Select Type: SA<br />

Select details button<br />

Note down to No. Range 01<br />

Select No. Range Information button.<br />

Give your company code AML<br />

Screen Shows:<br />

Intervals � It show what no. we are give<br />

Status � Change status � how many documents we have posted.<br />

Intervals � Change intervals � to give document Number.<br />

Select change Intervals button.<br />

Select Intervals button.<br />

Give the Number Range – 01.<br />

Year – 2006<br />

From Number1 to Number 100000<br />

Current Number – 0<br />

Deselect External check box.<br />

Press Enter<br />

Select save button.<br />

Number range intervals can not be transferred to production client.<br />

Ignore the message. Press Enter.<br />

SAP also gives voucher numbers in two ways.<br />

Example:<br />

Scenario: - I<br />

01 2006 1 – 100000

01 2007 1 – 100000<br />

01 2008 1 - 100000<br />

Same session for each year.<br />

Scenario: -II<br />

01 9999 (Any year) (We do not know how<br />

many document we have<br />

posted in each year)<br />

Note: Companies normally follows Scenario I.<br />

Field status variant & field status groups<br />

At the time of entry the system gives 70 fields.<br />

Examples: Quantity, text, business area, value date.<br />

(Around 140 fields to use, all the fields are (70 debits + 70 credits).<br />

You can make any field as<br />

1. Surplus field – Field will not be visible.<br />

2. Required field – To enter the values.<br />

3. Optional field – Choice to enter or not enter.<br />

Entry lay out based on field‟s selection in the field status group which is assigned to G/L<br />

Account.<br />

Field Status group one Created under field status variants and field status variant is<br />

assigned to company code:<br />

Example: Cash A/C Dr<br />

To Share Capital A/C<br />

Equity share capital<br />

(General)<br />

Text & Business area Required fields<br />

Cash Account Text & Business area Required fields<br />

Bank Account Text & Business area &<br />

Value date<br />

Required fields<br />

Path: SPRO � Financial Accounting � Financial Accounting Global settings �<br />

document � Line Item � Controls � Maintain field status variants.<br />

18

Select field status 1000<br />

Select copy as button<br />

Change the field status variant AML<br />

Field status name:<br />

Field status variant for AML<br />

Press Enter<br />

Select copy all button.<br />

No. of dependent entries copied 45.<br />

Enter.<br />

Select save button (or) (ctrl + s).<br />

Save in your request<br />

Select field status variant AML<br />

Double click field status group folder<br />

Select G001 – General and double click on General data.<br />

Text make it required entry field.<br />

Select next group button.<br />

Select next page or page down button.<br />

Select required entry for business area.<br />

Select save button (or) (ctrl + s).<br />

Select 005 Bank Accounts and double click.<br />

Double click on general data.<br />

Text field make it required entry field.<br />

Select new group button.<br />

Select next page (or) page down button.<br />

Business area make it required entry field.<br />

19

Select next group button 2 times.<br />

Value date make it required entry field.<br />

Press save button<br />

Assign company code to field status variant:<br />

Path: SPRO � Financial Accounting � Financial Accounting Global settings �<br />

document � Line item � controls � Assign company code to field status variants.<br />

Select position button.<br />

Give your company code AML.<br />

Enter.<br />

For company code AML, Assign field status variant AML<br />

Save, save in your request.<br />

Posting periods:<br />

a. Define posting period variant.<br />

b. Assign posting periods to company code.<br />

c. Define open and close periods for variant.<br />

April, 2006 to March 2007 � Fiscal year 2006<br />

If company is completed quarterly results<br />

July 2006 to March 2007<br />

(4, 2006) to (12, 2006)<br />

Define posting period variant:<br />

Path: SPRO � financial accounting � financial accounting Global settings �<br />

document � posting periods � define variants open posting periods.<br />

Select new entries button.<br />

Give the variant AML.<br />

Give the name � posting period variant for AML.<br />

20

Select save button (or) (ctrl + s).<br />

Save in your request<br />

Assign variants to company code:<br />

Path: SPRO � Financial Accounting � Financial Accounting Global settings �<br />

document � posting periods � Assign variants to Company code.<br />

Select position button.<br />

Give your company code AML.<br />

Press Enter.<br />

For Company code AML – Assign variant AML.<br />

Save, save in your request.<br />

Define open and close posting periods:<br />

Path: SPRO � Financial Accounting � Financial Accounting Global settings �<br />

document � Posting periods � Open and close posting periods.<br />

Select New Entries button.<br />

Select variant AML.<br />

A – for Account Type.<br />

Select + variant for all accounts type<br />

From Account – Blank<br />

To Account – Blank.<br />

From period 1 is = 4 (July)<br />

Year is 2005.<br />

To period is = 12 (March)<br />

21

Year is 2006.<br />

If Audit is not over (March 2006 to March to 2006)<br />

(13, 2005) (13, 2005)<br />

From period 13 (special Period) – Year 2005<br />

To Period 13 (Special Period) –Year 2005<br />

Authorization Group:<br />

Authorization will give to some persons like Manager (Accounts) –ID,<br />

Dy. Managers (Accounts) – ID at user level.<br />

Once you complete select save button (or) (ctrl + s).<br />

Press enter to save in your request.<br />

Path for posting periods at user level:<br />

Path: Accounting � Financial Accounting � General Ledger � Environment current<br />

setting � Open and close posting periods (T. Code is S _ALR _ 87003642).<br />

How to give the transaction code when you get SPRO<br />

Path: SPRO � from the Menu select additional information, once again additional<br />

function � display key � IMG activity.<br />

Note down the last 4 (OBBO) (OB52) (OBBP).<br />

OB52 (is open and closing periods).<br />

Open Item Management<br />

Tolerance groups for G/L Accounts<br />

(2 types)<br />

G/L Accounts<br />

(Tolerance Group)<br />

Used for vendors/customers/Balance sheet Accounts where clearing is required<br />

22<br />

Employee<br />

(Tolerance Group)

Out standing expenses A/C<br />

Salaries 1,00,000<br />

Bank cash 15,000 Wages 1,00,000<br />

Rent 15,000<br />

We can see the items in three ways:<br />

1. Open Item: We can see only outstanding – Payable Item.<br />

2. Cleared: We can see only cleared Item – Paid Item.<br />

3. All: We can see all items included Paid/Payable Items.<br />

Tolerance Group:<br />

Amount Percentage<br />

A 1000 0%<br />

B 0 5%<br />

C<br />

If you commission is payable 100020� only paid 100000 the remaining balance<br />

(20/-) may be transferred to payment difference Account (or) payable (Partial payment).<br />

Disadvantages:<br />

a. It given at account level and not at transaction level<br />

b. No flexibility.<br />

Path: SPRO � Financial Accounting � General Ledger Accounting � Business<br />

transactions � Open item clearing � clearing differences � define Tolerance group for<br />

G/L Accounts.<br />

Select new entries button.<br />

Company code: AML<br />

Tolerance group: Blank.<br />

Name of tolerance group: Tolerance group for AML.<br />

Debit amount – 0<br />

Credit amount – 0<br />

Percentage of debit – 0<br />

Percentage of credit – 0<br />

23

Deselect value date (VD) check box<br />

Select save button (or) (ctrl + s)<br />

Save in your request<br />

Value date (effective date)<br />

If I received term loan from I.D.B.I on 15/07/06<br />

If I deposited in Bank on 17/07/06<br />

Document date: 17/07/06<br />

Posted date: 17/07/06<br />

*Value date: 15/07/06 �(effective date)<br />

Tolerance group for employees<br />

Here we give user wise upper limits for posting<br />

Amount per document<br />

Amount per open item Account item<br />

Open item: Vendors/customers.<br />

Cash discount<br />

Payments difference we can accept.<br />

*Path: SPRO � Financial Accounting � General Ledger Accounting � business<br />

transactions � Open item clearing � clearing differences �<br />

Select new entries button<br />

Group Blank<br />

24

Company Code � AML<br />

Amount document – 9999999999<br />

Amount for open item account item – 9999999999<br />

Cash discount per line item: 10%<br />

Permitted payment differences: Blank<br />

Select save button or save button<br />

Press enter to save your request.<br />

Calculation procedure<br />

Basic xxx<br />

+ Excise xxx<br />

xxx<br />

Sales Tax<br />

Sales Tax on (Basic + Excise)<br />

It is temporary assignment G/L Accounts<br />

In � Tax Us (Sales Tax USA)<br />

IN � Tax Ind (Sales Tax India)<br />

|<br />

Tax US<br />

IN is assigned to company code AML<br />

25

Path: SPRO � Financial Accounting � Financial Accounting Global Setting � Tax on<br />

sales or purchases � Basic settings � Assign country to calculation procedure.<br />

Select position button<br />

Give the country IN for India<br />

Enter<br />

For country IN Assign Tax US (Sales Tax USA)<br />

Save. Press enter to save in your request.<br />

Global Parameters<br />

1. Enter Global Parameters;<br />

Path: SPRO � Financial Accounting � Financial Accounting Global settings �<br />

Company code � Enter Global parameters.<br />

Select position button<br />

Give your company code AML<br />

Press Enter<br />

Select company code AML<br />

Select details button<br />

Select Business area financial statements check box<br />

Select propose fiscal year check box<br />

Select Define default value date check box<br />

Select negative posting allowed check box<br />

When you reverse a document it reduces from the same side.<br />

Ex: - Cash A/C Dr 500000<br />

To Equity share capital 500000<br />

And another posting for 300000<br />

26

Periods<br />

1<br />

2<br />

Debit<br />

Credit<br />

Balance for the month<br />

balance<br />

3<br />

4 (July) 800000 800000 800000<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

27<br />

Cumulative<br />

If the 2 nd Entry 300000 is wrongly entered in equity share capital – Actual entry<br />

in preference share capital.<br />

Reversal A/C<br />

1. Equity share capital A/C Dr 300000<br />

To Cash A/C 300000<br />

2. Cash A/C Dr 300000<br />

To preference Share capital 300000<br />

(Or)<br />

Rectification Entry<br />

Equity share capital A/C 300000<br />

To Preference share capital A/C 300000<br />

Then the Equity Share Capital Summary is

Periods<br />

1<br />

2<br />

3<br />

Debit<br />

Credit<br />

Balance for the Month<br />

28<br />

Cumulative balance<br />

4(July) 300000 500000 500000 500000<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

Select additional details button<br />

49A – PAN (Permanent Account No)<br />

49B – TDS No (Tax deduction of source)<br />

PAN & TDS Number given at company code level<br />

TDS No. AP 945678906<br />

PAN No. AP 7890000 A<br />

Select back arrow and save<br />

Save in your request<br />

General ledger master creation (G/L Masters)<br />

G/L Masters created at<br />

Field Year:<br />

Chart of Accounts Area Company Code Area Centrally

G/L Account No.<br />

Account group<br />

P&L A/C (or) B/S A/C<br />

Short Text<br />

Long Text<br />

Account Currency<br />

Tolerance group<br />

Open item management<br />

Line item display<br />

Short Key<br />

Field status group<br />

To check Account groups for giving Account no.s<br />

29<br />

It having both charts of<br />

Account fields + company<br />

code Area fields.<br />

Path: SPRO � Financial Accounting � General Ledger Accounting � G/L Accounts<br />

� Master Records � Preparations � Define account group (T.Code OBD4)<br />

Select position button<br />

Give your chart of accounts AML<br />

Enter<br />

Reserves & Surplus - 100100 to 100199<br />

Equity share capitals - 100000 to 100099<br />

Current Assets - 200100 to 200199<br />

Creation of G/L Master (user levels)<br />

Path: Accounting � Financial Accounting � General Ledger � Master records �<br />

Individual processing � Centrally (T. Code FS00)<br />

Give the G/L Account No: 100100

Company code AML<br />

From the Menu select G/L Account create<br />

Select the Account group: Reserves & Surplus<br />

Select Balance Sheet A/C Radio button<br />

Short Text – Surplus in P/L Account<br />

G/L Account Log Text – Surplus in Profit and Loss A/C<br />

Select Control data Tab<br />

Select only balances in currency check box<br />

Tolerance group � Blank<br />

Select Line Item display check box<br />

Note: All Accounts give line item display check box.<br />

Sort key � Select 001 posting date<br />

Select create/bank/interest tab<br />

Field status group � Select 001 General<br />

Select save button (or) (ctrl + s)<br />

2. One more G/L Account – FS00<br />

Give the G/L Account no: 100000<br />

Company code AML<br />

30

Select with Template button<br />

Give G/L Account No. 100100<br />

Company code AML<br />

Press Enter<br />

Select the Account Group: Share Capital<br />

Change the Short text to equity share capital<br />

Change the G/L Account long text equity share capital<br />

Other fields are common<br />

Select save button (or) (ctrl + s)<br />

Give the G/L Account No. 200100<br />

Company code AML<br />

Select with Template button (w-Template)<br />

Give the G/L Account no. 100100 (Reserves & Surplus)<br />

Company code AML<br />

Press Enter<br />

Change the Account group to Current Assets & Loans and Advances<br />

Change short text to cash account<br />

Change G/L Account log text to cash account<br />

Select create/bank/Interest tab<br />

Change the field status group G005 (Bank Accounts)<br />

Select relevant to cash flow check box<br />

Select save button (or) (ctrl + s).<br />

To give the list of Accounts created<br />

Select drop button beside G/L Account No. (Or) (T. code OBD4)<br />

31

The screen is called as Match code.<br />

Give the company code AML<br />

Enter<br />

It gives the what Accounts that are created.<br />

Posting of Transactions<br />

Path: Accounting� Financial Accounting � General Ledger � Document entry �<br />

General posting (F-02)<br />

Document date: Party bill date � F4 – Calendar.<br />

F2 - Selection of date.<br />

Posting date : Server date, Ledger updating based on posting date period comes<br />

automatically.<br />

Ref – Party Bill No<br />

Document No:<br />

Type: SA<br />

Company code: AML<br />

Currency – INR<br />

To differentiate between debit and credit<br />

You are using posting key<br />

Posting key (PST Key)<br />

40 – G/L Account debit<br />

50 – G/L Account credit<br />

Select posting key: 40<br />

The next field is account:<br />

Select A/C No: 200100<br />

32

Press Enter<br />

Give the amount 100000<br />

The fields are come on the basis of selection of Field Status Group<br />

Business Area: AMH (Hyderabad Business area)<br />

Text enter: Equity share capital receipt<br />

Select posting key: Select 50<br />

For Account: Select the drop down button<br />

Give the company code AML<br />

And press Enter<br />

Select Account No: 100000 (Equity Share Capital)<br />

Press Enter<br />

You can make Enter amount manually i.e. 100000 (or)<br />

Enter * (* makes debit and credit equal)<br />

Business area: AMH<br />

Text: Enter (+) (plus): Copying the latest line item narration (or) make manually<br />

Press Enter<br />

From the menu select document� simulate<br />

In once document you can post up to 999 line item in a document<br />

Debit will be with out sign<br />

Credit will be with Minus (-) sign<br />

Once you complete select save button or (ctrl + s)<br />

It gives the message document „1‟ was posted in company code AML.<br />

How to view the latest document<br />

33

From the menu select document display<br />

Select display document header button (F5).<br />

Change document<br />

Path: Accounting � Financial Accounting� General Ledger � Document � Change<br />

(Transaction code FB02)<br />

Press Enter<br />

Double click on 1 st line item<br />

Enter<br />

We can change only value date, assignment and text<br />

How to view the documents:<br />

Path: Accounting � Financial accounting � General Ledger � Document � Display<br />

(Transaction code (FB03)<br />

Select document list button<br />

Give your company code: AML<br />

Give the document type: SA<br />

To give the posting date: From and to (Specific date)<br />

To view the document posted by a particular user<br />

From the menu select edit dynamic selections (shift + F4)<br />

Give the user name: SAP user<br />

Select execute button (F8)<br />

Double click on document No.1<br />

It shows the document<br />

Display Ledger<br />

34

Path: Accounting � Financial Accounting� General Ledger � Account � Display<br />

Balance (Transaction code FS10N)<br />

To give multiple Accounts – Select right arrow beside G/L Account<br />

To view continuous number select ranges tab with green pound symbol<br />

To exclude any account select singly values tab with ‘Red’<br />

Pound symbol<br />

Green – Inclusion<br />

Red – Exclusion<br />

Once you complete select copy button<br />

To give singly Account � Select drop don button beside G/L Account<br />

Give your company code AML<br />

Press Enter<br />

Select your account number 100000 – Equity share capital<br />

Give your company code AML<br />

Fiscal year 2006<br />

Business Area, select AMH<br />

Select execute button (F8)<br />

Double click on Cumulative balance amount<br />

Double click on document No. 1<br />

Select call up document over view button<br />

Select back arrow<br />

35

How to create own line layout:<br />

Select change layout button<br />

Select the fields which one not required under column content<br />

Document no, Amount, Text not select<br />

Select right arrow (or) Hide selected field‟s button<br />

For the hidden fields column select posting date,<br />

Select left arrow (or) show selected field‟s button.<br />

Change the column positions:<br />

Document N0. Should be one (1)<br />

Posting date should be two (2)<br />

Text should be three (3)<br />

Amount in local currency (4)<br />

Text column length change to 35<br />

For amount in local currency – Select total check box<br />

Select copy button.<br />

How to save the layout<br />

2 Lay notes<br />

1. User specific<br />

2. Common to All.<br />

User specific: It can be saved with any number or name.<br />

Common to all: It should be saved with/any number or name<br />

Select save lay out button (ctrl + F12)<br />

Lay out: /AML<br />

Description: Standard layout for AML<br />

Select save button (or) (ctrl + s).<br />

36

How to choose your layout<br />

From the Menu select select lay out button<br />

Select /AML<br />

How to make default layout<br />

Path: Accounting � Financial Accounting � General Ledger � Environment � User<br />

parameters � Editing options (T. Code FB00)<br />

Select Line Items Tab.<br />

For default select on screen under G/L Account layout<br />

Select /AML<br />

Select save button<br />

Go and see the G/L Account � Path FS10N<br />

Select G/L Account No. 200100 (cash account)<br />

Company code AML<br />

Fiscal year 2006<br />

Business area - AMH<br />

Select execute button (or) F8<br />

Double click on cumulative balance<br />

Accrual/deferred document<br />

a. Creation of 3 G/L Accounts<br />

i) Salaries A/C – Personnel cost<br />

ii) Rent A/C – Administration<br />

iii) Outstanding expenses – Current liabilities & provisions<br />

b) Define reversal reason and reversal reason should allow us to reverse on any day.<br />

c) Creation of accrual/deferred document<br />

One provision is today date and one for month ending date.<br />

24/07/06 - Rent<br />

37

31/07/06 - Salaries<br />

d. Reversal of accrual/Deferred documents<br />

Creation 3 G/L Accounts:<br />

In this case first to check Accounts groups for giving Account group<br />

Give the Transaction Code OBD4<br />

Select position button<br />

Give the chart of Accounts AML � Enter.<br />

Note down personnel cost range � 400400 to 400199<br />

Note down the range for administration� 400300 to 400399<br />

Note down the range for current Liabilities & provisions � 100500 to 100599<br />

Creation of G/L Masters (FS00)<br />

Give G/L Account No. 400100<br />

Company code: AML<br />

Select with template button<br />

Give G/L Account No: 100000 (Equity share capital)<br />

Company code: AML<br />

Press Enter.<br />

Change the account group to personnel cost<br />

Select P&L Statement Account Radio Button<br />

Change short text to salaries account.<br />

Change G/L Account Long Text to Salaries Account<br />

Other fields are common.<br />

Select save button (or) (ctrl + s).<br />

38

2. G/L Account No: 400300<br />

Company code: AML<br />

Select with template button<br />

Give G/L Account No: 400100 (salaries A/C)<br />

Enter.<br />

Change the Account group to administration.<br />

Change the short text: Change to Rent Account<br />

G/L Account long text: Change to Rent Account<br />

Save.<br />

3. G/L Account No. 100500<br />

Company code: AML.<br />

Select with template button.<br />

Give G/L Account No: 100000 (Equity share capital)<br />

Company code AML � Enter.<br />

Change the A/C group to current liabilities & provisions<br />

Change short text & long text to outstanding expenses.<br />

Select control data tab.<br />

Select open item management check box.<br />

Save.<br />

39

Reversal Entries<br />

Define: Reversal reason and reversal reason should allow is to reverse on any day.<br />

Path: SPRO � Financial Accounting � General ledger accounting � Business<br />

Transactions � Adjustment posting/Reversal � Define reasons for reversal<br />

(T. code: FBS1)<br />

Select new entries button.<br />

Reason is 41 (Text field).<br />

Give the text accrual/deferral document.<br />

Give the document date: 28.07.06<br />

Type: SA<br />

Company Code: AML.<br />

Reversal reason: 41.<br />

Reversal date: 01.08.2006.<br />

Posting Key: 40<br />

A/C No: 400300 (Rent Account).<br />

Enter.<br />

Give the amount Rs. 10000/-<br />

Business area – AMH<br />

Text: Rent provision for July.<br />

Posting Key: 50<br />

Account No: 100500 (Outstanding expenses)<br />

Enter.<br />

40

Amount: „*‟.<br />

Business Area: AMH.<br />

Text: „+‟<br />

Document � Simulate and save.<br />

Same Path: FBS1.<br />

Salary Provision<br />

Give the document date and posting date: 31.07.06.<br />

Type: SA.<br />

Company code: AML.<br />

Reversal reason: 41.<br />

Posting Key: 40<br />

A/C No: 400100 (Salaries Account), Enter.<br />

Ignore the warning message, Press Enter.<br />

Give the amount Rs.200000.<br />

Business Area: AMH.<br />

Text: Salary provision for July.<br />

Posting Key: 50<br />

A/C No. 100500 (Out standing expenses).<br />

Enter.<br />

Amount: „*‟<br />

Business Area: AMH.<br />

Text: „+‟<br />

Document � Simulate and save.<br />

41

Reversal Accrual/Referral document<br />

Path: Accounting � Financial Accounting � General Ledger � Periodic process �<br />

Closing � Valuate � Reversal accrual referral � Document.<br />

Transaction Code: F 81<br />

Give the company code: AML.<br />

Give the reversal posting date: 01.08.2006.<br />

Select text new check box.<br />

Select execute documents button.<br />

Select reverse documents button.<br />

Open item management<br />

Vendor Accounts<br />

Customers Accounts<br />

Balance sheets Accounts where clearing required.<br />

Provision – payment – outstanding expenses<br />

Recovery – payment – PF, TDS<br />

In G/L Masters we have to select open items management check II (Refer<br />

Tolerance Group)<br />

3 Scenarios:<br />

Full clearing – Partial clearing – Residual clearing<br />

Provision Payment - Partial clearing – Residual clearing<br />

42

1. Full Clearing Scenario:<br />

1. Rent Provision: User transaction code: F-02<br />

Give the document date: 28.07.06<br />

Type SA: Company code: AML: Posting key: 40<br />

Account No: 400300 (Rent Account)<br />

Enter.<br />

Amount is 5555<br />

Business area: AMH<br />

Rent provision for July.<br />

Posting Key: 50<br />

A/C No: 100500 (Outstanding expenses)<br />

Enter.<br />

Amount: „*‟<br />

Business Area: AMH.<br />

Text: „+‟<br />

Document � Simulate and save.<br />

2. How to view open item repaid A/C<br />

Path: Accounting � Financial Accounting � General Ledger � Account display/check<br />

line items (T. Code: FBL3N)<br />

Give the G/L Account No. 100500 (outstanding expenses).<br />

43

Company code: AML.<br />

Select open items radio button.<br />

Select execute button.<br />

3. Outgoing payment with clearing:<br />

Path: Accounting � Financial Accounting � General Ledger � Document entry � out<br />

going Payment (T. Code: F -07)<br />

Give document date: 28.07.2006.<br />

Type: SA.<br />

Company code: AML.<br />

Clearing Text: Out going payment<br />

Account under bank data: 200100 Cash A/C.<br />

Business Area: AMH.<br />

Amount: 5555.<br />

Text: Out going payment.<br />

Account under open item selection: 100500 (Outstanding expenses).<br />

Account Type: „S‟ comes by default.<br />

„S‟ stands for G/L Accounting.<br />

Select process open items button.<br />

Double click on 5555 payable.<br />

Documents simulate and save.<br />

4. Go and see the G/L Account (FBL3N)<br />

Give G/L Account No: 100500.<br />

44

Company code: AML.<br />

Select cleared items radio button.<br />

Execute.<br />

Select back arrow.<br />

Select open items radios button.<br />

Execute.<br />

Partial clearing – Net payable<br />

To check what steps you have done in your reverse.<br />

Path: SPRO � Financial Accounting Global Settings � Company code � Enter<br />

Global Parameters.<br />

Select your company code: AML.<br />

Select details button.<br />

From the menu select utilities.<br />

Change reverses (customization)<br />

Select the folder for your reverse no.<br />

Select sub folder customizing table.<br />

Partial clearing Method:<br />

Vendors/Customers -<br />

1. Rent provision F-02):<br />

Document date: 31-07-2006.<br />

Type: SA.<br />

Company code: AML.<br />

Reference Bill No. 1234.<br />

Posting Key: 40<br />

Account No: 400300 (Rent Account).<br />

Enter.<br />

Amount: 50000.<br />

Business Area: AMH.<br />

45

Text: Rent provision for July<br />

Posting Key: 50<br />

Account No. 100500 (Outstanding expenses)<br />

Enter<br />

Amount: „*‟<br />

Business Area: AMH<br />

Text: „+‟<br />

Document � Simulate & Save.<br />

Out going payment using partial clearing method<br />

Transaction code: F -07<br />

Document date: 31-07-06<br />

Type: SA<br />

Company code: AML<br />

Reference: 1234<br />

Clearing Text: Out going payment<br />

Account: 200100 (Cash/Bank Accounts)<br />

Business Area: AMH<br />

Amount: 15,000<br />

Text: Out going payment<br />

Account: Under open item selection<br />

100500 (Outstanding Expenses)<br />

Account type: S comes by default<br />

Select process open items button<br />

Keep the cursor the amount fields of the line items against which we want adjust<br />

Select Partial payment tab<br />

It creates payment amount column<br />

46

Double click on Net amount 50000<br />

Double click on payment amount 50000<br />

Document simulate<br />

It gives the message correct the marked line item<br />

Double click on blue font line item<br />

Text Enter „+‟<br />

Save (or) (ctrl +s)<br />

Go and see the G/L Accounts (FBL3N)<br />

Give the G/L Account No: 100500<br />

Company Code: AML<br />

Select open items radio button<br />

Execute<br />

Select change layout button<br />

From the hidden fields column select reference field<br />

Select “Text” field under column content<br />

Select left arrow (or) show selected fields‟ button<br />

Select copy button<br />

Keep the cursor on reference field<br />

Select sub total button<br />

Making the balance payment and clearing the account<br />

(Transaction code F-07)<br />

Document date: 31-07-06<br />

Company code: AML<br />

Reference: 1234<br />

Clearing text: Out going payment<br />

47

Account No: Under Bank data: 200100<br />

Business Area: AMH<br />

Amount: 35000<br />

Text: Out going payment<br />

Account: Under open item selection – 100500 (Outstanding expenses)<br />

Account type: „S‟ comes by default<br />

Select process open items button<br />

Double click on payable Amount 50000<br />

Double click on part paid amount: 15000<br />

Documents simulate and save<br />

Go and see the G/L Account: (FBL3N)<br />

Give G/L Account No: 100500<br />

Company Code: AML<br />

Select clear items radio button<br />

Execute<br />

Residual Payment (Residual clearing)<br />

1. Rent Provision (F-02)<br />

Document date: 31-07-2006<br />

Type: SA<br />

Company code: AML<br />

Posting Key: 40<br />

Account No: 400300 (Rent account)<br />

Enter<br />

Amount: 60000<br />

Business Area: AMH<br />

Text: Rent provision for July<br />

Posting Key: 50<br />

48

Account No: 100500 (Outstanding expenses)<br />

Enter<br />

Amount: „*‟<br />

Business Area: AMH<br />

Text: „+‟<br />

Document � Simulate & save<br />

Outgoing payment using residual clearing method<br />

User Transaction code F-07 (Payable amount)<br />

Document date: 31-07-2006<br />

Type: SA<br />

Company code: AML<br />

Clearing text: Out going payment<br />

Account under bank date: 200100 (Cash Account)<br />

Business Area: AMH<br />

Amount: 20000<br />

Text: Out going payment<br />

Account: Under open item selection: 100500<br />

Account type: „S‟ default<br />

Select process open items button<br />

Keep the cursor on the amount field of the line item on<br />

Which we want to adjust<br />

Select residual items tab<br />

49

It creates residual items column<br />

Double click on Net amount 60000<br />

Double click on residual items<br />

Document simulate<br />

It gives the message correct the marked line item<br />

Double click on blue font line item<br />

Text enter „+‟<br />

Save (or) (ctrl + s)<br />

Go and see the G/L Accounts (FBL3N)<br />

Give the G/L Account No: 100500 (Out standing Expenses)<br />

Company code: AML<br />

Select open items radio button<br />

Execute<br />

Check exchange rate types;<br />

Foreign currency postings:<br />

Bank buying – Export – G Type<br />

Bank Setting – Imports/Expenditure – B Type<br />

Average Rate: Used by MM/SD People – M Type<br />

Path: SPRO � General settings � Currencies � Check exchange rate types.<br />

Select types<br />

Select position button<br />

Enter „B‟<br />

Enter<br />

Define transaction ratios for currency transaction<br />

50

Path: SPRO � General settings � Currencies � Define translation radio for currency<br />

translation.<br />

This defines the conversion factory between two currencies.<br />

year.<br />

USD INR<br />

1 1<br />

Japanese year INR<br />

100 1<br />

Europe INR<br />

1 1<br />

Once we follow one conversion factory, follow continuously the same for all the<br />

This is at client level<br />

Double click on IMG Activity button<br />

Ignore the message select “yes” button<br />

Select new entries button<br />

Ext rt: (Exchange rate type)<br />

Select „G‟ – Bank buying<br />

From: Select USD (American Dollar)<br />

To: Select INR<br />

Valid from: 10-07-2006<br />

Ration (From) – 1<br />

Radio (To) – 1<br />

Exchange rate: Select B (Bank setting)<br />

From: USD<br />

To: INR<br />

51

Valid from: 10-07-2006<br />

From ratio – 1<br />

To ration - 1<br />

Exchange rate: Select M (Average)<br />

From currency: USD<br />

To currency: INR<br />

Valid from: 10.07.2006<br />

Ratio from – 1<br />

Ratio to – 1<br />

Save (or) (ctrl + s)<br />

Save in your request<br />

Enter exchange rates:<br />

Path: SPRO � General settings � Currencies � Enter exchange rates<br />

Select new entries button<br />

Exchange rate type: G (Bank buying)<br />

Valid date: 25-07-2006<br />

From Currency: USD<br />

To select: INR<br />

Direct quotation: 44/-<br />

Enter<br />

Exchange rate type: Select B<br />

Valid date: 25-07-2006<br />

From currency: USD<br />

To currency: INR<br />

Direct quotation: 46/-<br />

Exchange rate type: M<br />

52

Valid from: 25-07-2006<br />

From currency: USD<br />

To currency: INR<br />

Direct quotation: 45/-<br />

Save<br />

Save in your request<br />

You can enter each type for each day only<br />

Path for forex rates at user level<br />

Accounting � Financial Accounting � General Ledger � Environment �<br />

Current settings � Events translation rates (S_BCE_68000174)<br />

When the rate is not given:<br />

It takes the rates from forex table<br />

It takes the latest date rate<br />

To enter default exchange rate<br />

Type based on document type<br />

G/L Posting – SA � b (Bank selling)<br />

Purchase invoice posting � G (Bank buying)<br />

(If we don‟t specify it takes „M‟ type by default. „M Average rate‟<br />

To enter default exchange rate type „B‟ (Bank selling) for document type – „SA‟<br />

(Use the transaction code (OBA7).<br />

Select position button<br />

Give the document type „SA‟<br />

Postings<br />

When the rate is not given When the rate is given<br />

53

Enter<br />

Select document type „SA‟.<br />

Select details button<br />

Under default values exchange rate type for foreign currency documents<br />

Enter B<br />

Select save button (or) (ctrl + s)<br />

Save in your request<br />

Foreign Currency Posting (F-02)<br />

Document date 02-08-2006<br />

Type: SA<br />

Company code: AML<br />

Currency: USD<br />

Posting key: 40<br />

Give account No. 400100 (Salaries account)<br />

Enter<br />

Give the amount 1000$<br />

Business area: AMH<br />

Text: Salary payment<br />

Enter<br />

Posting key: 50<br />

Account No. 200100 (Cash account)<br />

54

Enter<br />

Amount: „*‟<br />

Business area: AMH<br />

Text: „+‟<br />

Document �Simulate<br />

To view in INR � Select display currency button.<br />

Select save button (or) (ctrl + s).<br />

When the rate is given at the time of posting<br />

Use the transaction code (F-02)<br />

Give the document date: 02-08-2006<br />

Type: SA<br />

Company code: AML<br />

Currency: USD<br />

Give the rate: 48/-<br />

Posting key: 40<br />

Account: 400100 (Salaries Account)<br />

Enter<br />

It gives message<br />

Exchange rate: 48$ deviate the increase 4.38%<br />

Ignore message and Enter<br />

Give the amount: 1000$<br />

55

Business area: AMH<br />

Text: Salary payment<br />

Press: Enter<br />

Posting key: 50<br />

Give the account no: 200100 (Cash account)<br />

Enter<br />

Amount: *.<br />

Business area: AMH<br />

Text: +<br />

Documents � Simulate & save.<br />

Reversals<br />

| | | | |<br />

Individual Reversal of Mass Cleared Accrual/deferral<br />

Document reverse Reversal items reversal<br />

Reversal document reversal<br />

Individual document reversal<br />

This is used to reversal one document at a time<br />

To give reversal reason<br />

If we don‟t specify reversal date, it takes original document posting date<br />

That period should be open.<br />

Path: Accounting� Financial Accounting � General Ledger � Document � Reverse<br />

� Individual reversal (FB08)<br />

Give the document No: 1<br />

Company code: AML<br />

Fiscal year: 2006<br />

Reversal reason:<br />

56

Select 01 (reversal in current period)<br />

Posting date: Blank<br />

Select display before reversal button<br />

Select back arrow<br />

Select save button<br />

From the menu select „document display‟<br />

Select display document header button<br />

Double click on 1 (Reverse document for)<br />

Select display document header button<br />

SA – Original document list<br />

AB – reversal document list<br />

Details button<br />

No range – 01<br />

FB03 – Document display<br />

Company code: AML<br />

Document type: SA – Original document<br />

AB – Reversal document<br />

(System defined)<br />

Reversal of reverse document<br />

Use the transaction code (F-02)<br />

From the menu select document Post with reference<br />

Give the document No. 15<br />

Company code: AML<br />

Fiscal year: 2006<br />

57

Select generate reverse posting check box<br />

Select display line items check box<br />

Enter<br />

Enter once again<br />

Change Text: Reversal for document No. 15<br />

Enter<br />

Text: „+‟<br />

Enter: Save (or) (ctrl + s).<br />

Enter<br />

From the menu select document display<br />

Select display document header button<br />

Mass Reversal<br />

To reverse more than one document at a time, we use mass reversal; it can be<br />

continuous or random.<br />

Path: Accounting � Financial Accounting � General Ledger � Document � Reverse<br />

� Mass reversal (F-80)<br />

Give the company code: AML<br />

To reverse random Numbers � Select multiple selection<br />

Beside document number<br />

Give the document No. 2 & 4<br />

Select copy button<br />

Give the reason for reversal „01‟<br />

Select text run check box<br />

Select execute button<br />

58

Instead of 2 and 4, Give document No: 13 & 16<br />

If documents are O.K<br />

Select reverse document button<br />

Clear item reversal<br />

Use the transaction code: (FBL3N)<br />

Give the G/L Account No: 100500 (Outstanding expenses)<br />

Company code: AML<br />

Select cleared items button<br />

Execute<br />

Full cleared items<br />

Out standing expenses<br />

Cash/Bank 5555 Document N0 – Rent A/C 5555<br />

(7) (6)<br />

If cheque dishonored it must be reversal<br />

Here i.e. Full cleared items this is not possible to reversal<br />

But you can make it as open items then reverse<br />

Path: For reversal of cleared items<br />

Accounting � financial accounting � General Ledger � Document � Reset<br />

cleared items (Transaction code FBRA)<br />

Give the clearing document No.7<br />

Company code: AML<br />

59

Fiscal Year: 2006<br />

Select save button (or) (ctrl + s)<br />

Select resetting & Reserves<br />

Give the reversal reason – 01 (Reversal in current period)<br />

Enter<br />

It gives the message clearing 7 reset.<br />

Enter<br />

Go and see the G/L Account FBL3N<br />

Give the G/L Account No: 100500<br />

Company code: AML<br />

Select open items radio button<br />

Execute<br />

Defined „S‟ type<br />

Define interest calculation Type:<br />

Path: SPRO � Financial Accounting � General ledger accounting � Business<br />

transactions � Bank Account in test calculation � Interest calculation Global settings �<br />

Define interest calculation types<br />

Select new entries button<br />

Interest calculations<br />

Balance Interest calculations Item interest calculations<br />

Use fro G/L Accounts<br />

60<br />

„P‟ Type<br />

Use for vendors/customers.

Interest Indicator (Ind Id): M1<br />

Name: 10% Monthly<br />

Interest calculation Type: Select „S‟ Balance interest calculation<br />

Save<br />

Save in your request<br />

Prepare Account balance interest calculation:<br />

Same path (Next step)<br />

Transaction code (OBAA)<br />

Select new entries button<br />

Interest calculation Indicator – M1<br />

Interest calculation frequency: Select 01 – 1 Month.<br />

Calendar type<br />

In case of rupee term loan – Select G (28, 29, 30, 31 /365)<br />

In case of foreign currency Term loan: Select F (28, 29, 30, 31 /360)<br />

This is based on LBOR (London Inter bank offer rate)<br />

Select G<br />

Select balance plus interest check box<br />

Select save button (or) (ctrl + s)<br />

Save in your request<br />

Define reference interest rates:<br />

Path: SPRO � Financial Accounting � General Ledger Accounting � Business<br />

Transactions � Bank account interest calculation � Interest calculation � Define<br />

reference interest rates (Transaction Code OBAL)<br />

Interest may be calculated – Method (i)<br />

61

10/04/06 to 31/3 100000 * 1o/100 * 355/365 = Say 15000<br />

10/09/06 to 31/03 10000 * 10/100 * 205/365 = Say 3000<br />

---------<br />

12000<br />

----------<br />

(Method – ii)<br />

10/04/06 to 09/09/06 100000 * 10/100 * 150/365 = 5000<br />

10/09/06 to 31/03 90000 * 10/100 * 205/365 = 7000<br />

Here<br />

Normally banks follow 2 typed of interest rates<br />

In SAP you have two options for this one<br />

You can create 2 interest rates for debit & credit items<br />

Interest indicator -<br />

In India & US follows the same rate of interest rates<br />

Hence give „M2‟ for (debit & credit items)<br />

Select new entries button<br />

M1<br />

Credit Items Debit items<br />

Ref int rate (M2)<br />

10%<br />

62<br />

Ref int rate (M3)<br />

8%

Ref Interest rate M2<br />

Long Text: 10% Monthly<br />

Short Text: 10% Monthly<br />

Date from: 01-04-2006<br />

Currency: INR<br />

Select save button (or) (ctrl + s)<br />

Save in your request<br />

Define time – dependent terms:<br />

Same path<br />

Select new entries button<br />

Interest calculation indicator M1<br />

Currency key: INR<br />

Effective from: 01-04-2006<br />

Sequential Number: 1<br />

Terms: Select credit testing column balance interest calculation<br />

Ref interest rate: M2<br />

Save (or) (ctrl + s)<br />

Save in your request<br />

Select next entry button<br />

Interest calculators Indicator: M1<br />

Currency Key: INR<br />

Effective from 01.04.2006<br />

63

Sequential No. 2<br />

Term: Select debit interest column balance interest calculation<br />

Ref. Interest rate: M2<br />

Save<br />

Enter interest values:<br />

Same path: Transaction code (0B83)<br />

Select new entries button<br />

Give the reference interest rate M2<br />

Effective from 01-04-2006<br />

Interest rate: 10%<br />

Save<br />

Save in your request<br />

Creation of 2 G/L Accounts;<br />

1 st Accounts: SBI Rupee term loan under secured loans.<br />

2 nd Account: Interest Account under interest group<br />

To check account groups for giving account number (Transaction code OBD4)<br />

Select position button<br />

Give the chart of account: AML<br />

Enter<br />

Note down the range for secured loans: 100300 to 100399<br />

Note down the range of interest: 400400 to 400499<br />

64

Creation of G/L Masters:<br />

Transaction code FS00<br />

Give the G/L Account No. 100300<br />

Company code: AML<br />

Select with Template button<br />

Give the G/L Account No. 100000 (Equity share capital)<br />

Company code: AML<br />

Enter<br />

Save.<br />

2 nd Account:<br />

Change account group: Secured Loans<br />

Change short text and G/L Account log text: SBI Rupee term loan<br />

Select create/bank/interest<br />

Field status Group: Select 005<br />

Interest Indicator: Select M1<br />

G/L Account No: 400400<br />

Company code: AML<br />

Select with template button<br />

Give the G/L Account No: 400300<br />

Company code: AML<br />

Enter<br />

Select type/description tab<br />

65

Account group: Select interest<br />

Change short text & Long text: Interest Account<br />

Select save button (or) (ctrl +s)<br />

Assignment of Accounts for automatic posting<br />

Path: SPRO � Financial Accounting � General Ledger Accounting � Business<br />

transactions � Bank Account interest calculation � Interest posting � Prepare G/L<br />

Account balance Interest calculation (Transaction code (OBV2)<br />

Select symbols button<br />

Example:<br />

100300 - SBI Term Loan<br />

100301 - ICICI Term Loan<br />

100302 - IDBI Term Loan<br />

If we have more than one term loan then give 10 pluses (+ + + + + + + + + +)<br />

Select Accounts button<br />

Give your chart of Accounts AML<br />

Enter<br />

Give the account symbol – 0002<br />

Currency – INR<br />

Give the G/L Account: 400400<br />

Give the Account symbol – 2000<br />

Currency – INR<br />

G/L Accounts, Mark with 10 times plus + + + + + + + + + +<br />

Select save button (or) (ctrl + s)<br />

Save in your request<br />

User levels: To open posting period April:<br />

66

Use the Transaction code OB52<br />

Select position button<br />

Give the posting period variant AML<br />

Enter<br />

From Period – 1<br />

Save<br />

Save in your request<br />

Term Loan receipt (F – 02)<br />

Give the document data and posting date: 12-04-2006<br />

Type – SA<br />

Company code: AML<br />

Currency: INR<br />

Posting Key: 40<br />

Give the G/L Account No. 200100<br />

Enter<br />

Give the amount: 100000<br />

Business area: AMH<br />

Value date: 10-04-2006<br />

Text: SBI Rupee term loan receipt<br />

Posting Key: 50<br />

Account No: 100300 (SBI Rupee Term Loan)<br />

Enter<br />

67

Amount: *<br />

Business area: AMH<br />

Value date: 10-04-2006<br />

Text: „+‟<br />

Documents simulate and save<br />

Term Loan repayment:<br />

Give the document data and posting date: 06-09-06<br />

Type: SA<br />

Company Code: AML<br />

Posting Key: 40<br />

Account No: 100300 (SBI Rupee term loan)<br />

Enter<br />

Ignore the messages, press enter<br />

Give the amount: 10000<br />

Business area: AMH<br />

Value date: 10-09-2006<br />

Text: SBI Term loan repayment<br />

Give the posting key: 50<br />

Account No: 200100 (Cash Account)<br />

Enter<br />

Amount: *<br />

Business Area: AMH<br />

Value date: 10-09-2006<br />

68

Text:‟+‟<br />

Documents simulate and save<br />

Interest Calculations:<br />

Path: Accounting � Financial accounting � General ledger � periodic processing �<br />

Interest calculation � Balances (F.52)<br />

Give the G/L Account: 100300 (SBI Term Loans)<br />

Give the Company code: AML<br />

Calculation period: 01.04.2006 to 31.03.2007<br />

Execute<br />

To view line item wise interest:<br />

Select back arrow<br />

Select additional balance line check box<br />

Execute<br />

In case of floating rate of interest<br />

Select back arrow: To give effect for floating rate of interest open one more session<br />

with SPRO<br />

Financial Accounting � General Ledger Accounting � Business transactions �<br />

Bank Account interest calculation � Interest calculation<br />

Enter Interest values<br />

Transaction Code: OB83<br />

Select new entries button<br />

Give the reference interest rate: M2<br />

Effective from 01.06.2006<br />

Interest Rate: 12%<br />

Save<br />

69

Save in your request<br />

Come to the first session<br />

Execute<br />

Select back arrow<br />

For interest posting<br />

Give the calculation period 01.04.2006 to 30.04.2006<br />

Execute<br />

Select back arrow<br />

Select post interest settlements check box<br />

Select update master record check box<br />

Batch input session<br />

Give the session name: AML<br />

Posting to business area: AMH<br />

Posting date of session: 30.04.2006<br />

Document date of session: 30.04.2006<br />

Posting segment text: Interest for April 2006<br />

Select execute button<br />

To post the batch input session<br />

From the menu select system � Services � Batch input � Sessions<br />

Select the session Name: AML<br />

Select process button<br />

Select display errors only radio button<br />

Select process button<br />

70

It gives the message: Processing of batch input session complete<br />

Select exit batch input button<br />

To view all document posted use the transaction code FB03<br />

Enter<br />

Enter once again<br />

Go and see the G/L Master – FS00<br />

Give the G/L Account No. 100300<br />

Company code: AML<br />

Select create/bank/interest tab<br />

Foreign currency balances revaluation;<br />

Foreign currency term loan – may be used<br />

Long term working capital Fixed assets Purchases<br />

Local assets Import assets<br />

Example: If we take foreign currency term loan.<br />

Exchange rate Amount payable<br />

On 09.08.2006 – 100000$ 45 4500000<br />

On 31.03.2007 - 50 5000000<br />

---------------<br />

Excess payable 500000<br />

---------------<br />

71

As per account standard<br />

The variation is charge to P&L Accounts.<br />

In case of purchased imported assets<br />

Add to asset value and calculate depreciation over balance life of asset.<br />

Customization of Foreign currency<br />

Creation of 3 G/L Account<br />

1. SBI Foreign currency term loan – under secured loans group<br />

2. Exchange gain under other income/ exchange loss under administration<br />

To check account groups for giving account Number (OBD4)<br />

Select position button<br />

Give the chart of accounts: AML<br />

Enter<br />

Note down the range for other Income group 300100 to 300199.<br />

Creation of G/L Masters (FS00)<br />

Give the G/L Account No: 100301.<br />

Company code: AML<br />

Select with template button<br />

Give the G/L Account No: 100300<br />

Company code: AML<br />

Enter.<br />

Change the long text, short text to: (SBI FC term loan)<br />

Select control data Tab<br />

Give the account currency: USA<br />

Deselect only balances in local currency check box<br />

Select create bank/interest tab<br />

72

Remove interest indicator<br />

Remove the dates also<br />

Save.<br />

2 nd G/L Account: 300100:<br />

Company code: AML<br />

Select with template button<br />

Give the G/L Account No: 400300 (Rent)<br />

Company code: AML<br />

Enter<br />

Select type/description tab<br />

Change the account group to other income<br />

Change short text and long text to exchange gain<br />

Other fields are common<br />

Save (or) (ctrl + s)<br />

G/L Account No: 400301<br />

Company code: AML<br />

Select with template button<br />

Give the G/L Account: 400300 (Rent account)<br />

Enter<br />

Change the short text and long text: Exchange loss<br />

Other fields are common – Save.<br />

Define valuation methods:<br />

Path: SPRO � Financial Accounting � General Ledger Accounting � Business<br />

transactions � Closing � Valuating � Foreign Currency Valuation � Define Valuation<br />

Methods. (Transaction Code OB59).<br />

73

Select new entries button<br />

Valuation Methods: AML1<br />

Description: FC Valuation Bank Selling for AML<br />

Document Type: SA<br />

Debit balance exchange rate type (B) (Bank Selling)<br />

Credit balance exchange rate type – B (Bank Selling)<br />

Select determine rate type from account balance<br />

Select save button (or) (ctrl + s)<br />

Save in your request<br />

Prepare automatic postings for Foreign Currency valuation<br />

Transaction code OBA1<br />

Double click on exchange rate defining using exchange rate key<br />

Give your chart of accounts: AML<br />

Enter<br />

Exchange rate difference key: SD<br />

Expenses account: 400301<br />

E/R (Exchange rate) gain account: 300100<br />

Save<br />

Save in your request<br />

Assign exchange rate difference key in loan account: (Transaction code is FS00)<br />

Give the G/L Account No: 100300 (SBI F/C Term loans)<br />

Company code: AML<br />

From the menu select G/L Account charge<br />

74

Select control data tab<br />

Exchange rate difference key<br />

Select USD<br />

Save.<br />

Foreign currency term loan receipt (F – 02)<br />

Give the document data and posting date: 11/08/06<br />

Type: SA<br />

Company Code: AML<br />

Currency: USD: Rate: 45/-<br />

Posting Key: 40<br />

Give the account No: 200100 (Cash Account)<br />

Enter<br />