ANNUAL REPORT 2004 - REWE Group

ANNUAL REPORT 2004 - REWE Group

ANNUAL REPORT 2004 - REWE Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ANNUAL</strong> <strong>REPORT</strong><br />

<strong>2004</strong>

Contents.<br />

<strong>REWE</strong> <strong>Group</strong> at a Glance<br />

Structure of the <strong>REWE</strong> <strong>Group</strong><br />

Profile of the <strong>REWE</strong> <strong>Group</strong><br />

Foreword by the Chairman of the Supervisory Board<br />

Report of the Management Board<br />

Management Board, Supervisory Board, Executive Committee<br />

Development of the <strong>REWE</strong> <strong>Group</strong><br />

Food Retailing<br />

Wholesale<br />

Specialist Stores<br />

<strong>REWE</strong> Travel and Tourism<br />

Foreign Activities<br />

Employees<br />

<strong>REWE</strong> Milestones<br />

Financial Statements:<br />

<strong>REWE</strong>-Zentralfinanz eG<br />

Management Report <strong>2004</strong><br />

Balance Sheet, Profit and Loss Account, Notes<br />

Report of the Supervisory Board<br />

<strong>REWE</strong>-Zentral-Aktiengesellschaft<br />

<strong>Group</strong> Management Report and Management Report <strong>2004</strong><br />

Balance Sheet, Profit and Loss Account, Notes<br />

Report of the Supervisory Board<br />

<strong>Group</strong> Balance Sheet, <strong>Group</strong> Profit and Loss Account<br />

Front cover<br />

Front cover<br />

Front cover<br />

<strong>REWE</strong> <strong>Group</strong> Sales Structure Back cover<br />

4<br />

6<br />

9<br />

10<br />

16<br />

22<br />

25<br />

28<br />

31<br />

38<br />

42<br />

46<br />

48<br />

54<br />

68<br />

70<br />

74<br />

92<br />

94

4<br />

We Have Now Completed<br />

the Necessary Revitalisation.<br />

The past fiscal year has been very special for Rewe in<br />

many ways: <strong>2004</strong> was to become one of the most successful<br />

years in the firm's history. With a turnover from<br />

independent Rewe retailers and our subsidiaries in<br />

Germany and abroad totalling 41 billion euros and with<br />

profits matching those of the previous year, the <strong>Group</strong><br />

completed the year better than planned.<br />

The past twelve months were not only a success for us all,<br />

however, they were also rough and moving. Reflecting on<br />

the year makes it clear that we are now at the end of a<br />

transformative phase. Rewe today is certainly not a completely<br />

different company, but the firm has undergone<br />

deep changes. This was brought about by several events,<br />

yet this transformation itself was a necessary - almost<br />

natural - revitalisation process.<br />

As the CEO, Hans Reischl led Rewe for nearly a<br />

quarter of a century, leaving his mark on the company.<br />

Under his leadership, the <strong>Group</strong> became one of the<br />

most important European trading and travel companies -<br />

with dynamic growth and solid results. The Supervisory<br />

Board and everyone at Rewe is indebted to Mr. Reischl<br />

for this achievement. The appointment of Dr. E. Dieter<br />

Berninghaus as CEO was supposed to usher in the transi-<br />

tion to a new generation of senior management at the<br />

company. But the poor health of the new CEO and his<br />

still uncertain role in an investment decision that went<br />

badly for Rewe soon put an end to the enthusiastic expectations.<br />

The employment contract with Dr. E. Dieter Berninghaus<br />

was dissolved. Fortunately, the remaining three<br />

members of the Management Board still managed to<br />

handle the<br />

wide-ranging tasks of running the company quite well.<br />

We have had a complete Management Board with a<br />

Chief Executive Officer again for several weeks now.<br />

The transition to a new generation of senior managers is<br />

complete; the necessary continuity in company leadership<br />

was never in jeopardy. The new Management Board is a<br />

healthy mixture of two "seasoned veterans" who have<br />

held positions of high responsibility at Rewe for years<br />

and two younger managers with international experience<br />

who have a lot of new ideas to offer us.<br />

Of course, we were not only engaged in solving personnel<br />

issues in <strong>2004</strong>. On the contrary: key decisions fundamental<br />

to the future of the company were taken and implemented.<br />

Of these, the first to mention dealt with modernising<br />

the aging corporate structure of Rewe. Much of the

original structure was no longer compatible with the<br />

principles of transparent organisation and modern management.<br />

We untangled the knots and established a set of<br />

corporate governance principles for our company. Today,<br />

the ownership structures are once again commensurate<br />

with the voting majorities on the governing boards.<br />

In contrast to a joint stock company with shareholders,<br />

the merchants who in effect own Rewe are not primarily<br />

interested in the highest possible dividend payments.<br />

They are all entrepreneurs in their own right - in business<br />

for themselves and their families, but also for the whole<br />

of the company in which they are cooperative members.<br />

They know Rewe's business, they are interested in the<br />

long-term stability of the company, and thus in its performance<br />

abilities for the future.<br />

Rewe traditionally makes a great effort to promote medium-sized<br />

business people and to secure their viability.<br />

This concept also includes managing the Rewe Deutscher<br />

Supermarkt Kommanditgesellschaft auf Aktien with its<br />

different sales lines and marketing possibilities. With the<br />

apparent tendency these days of noisily criticising all aspects<br />

of capitalism, it is worth emphasising the fact that<br />

we have no intention of departing from this traditional<br />

course. Responsibility and the entrepreneurial spirit,<br />

FOREWORD OF THE CHAIRMAN OF THE SUPERVISORY BOARD<br />

z Dr. Klaus Burghard,<br />

Chairman of the Rewe Supervisory Board<br />

based squarely on mutual security and on using <strong>Group</strong><br />

synergies, are the cornerstones of future success. I am<br />

confident that this form of cooperative company and its<br />

entrepreneurial culture have lost none of their strengths.<br />

Rewe <strong>Group</strong> combines traditional cooperative structures<br />

with modern trading and corporate strategies on a national<br />

and international scale in a way no other firm can.<br />

Rewe's operative business was never in disarray.<br />

For me, this is proof of the solidarity that has always<br />

characterised this <strong>Group</strong>. On the other hand, it is emblematic<br />

for the sense of responsibility and for the expertise<br />

of our staff and employees. And for this I am deeply<br />

grateful to everyone who has made this contribution to<br />

Rewe's vitality.<br />

5

6<br />

The Primary Aim is to<br />

Strengthen Earning Power.<br />

Rewe <strong>Group</strong> achieved good results last year once again -<br />

and in contrast to the general market trend. Our 200,000<br />

staff and employees in Germany and in13 other European<br />

countries focused their hard and dedicated work on attaining<br />

this outcome. We are grateful to them for their<br />

efforts. We will continue to expand our very strong position<br />

among the leading group of European food trading<br />

companies on this basis in future.<br />

The pressures of competition domestically and<br />

abroad will continue to build. Tough overall economic<br />

conditions, especially in our German home market, hardly<br />

give us cause to rest on our laurels. Every day we have<br />

to face the challenge of attracting and retaining new<br />

customers in sustainable way, both to our core food trading<br />

business and to our travel and tourism services.<br />

This is not to imply growth at any price; profitable<br />

growth is the only option we are willing to consider. We<br />

have seen again and again that it was strategically wise to<br />

develop new growth markets in Europe at the beginning<br />

of the 90s and in this context it is to mention that Rewe<br />

<strong>Group</strong> increased its turnover in Eastern Europe alone by<br />

ten per cent in the last year. We experienced the fastest<br />

growth rates in Romania and Bulgaria, countries that will<br />

become future EU member states. The country with the<br />

strongest turnover was the Czech Republic. We will concentrate<br />

our activities on these countries, where we can<br />

attain a top position in our industry in the medium to<br />

long term.<br />

As the Management Board of Rewe <strong>Group</strong>, we are glad<br />

to accept the challenges of the German market and of international<br />

competition. We certainly know that Rewe's<br />

unique culture of entrepreneurial spirit, independence<br />

and responsibility gives us a solid foundation to build on:<br />

values with decades of tradition that have lost none of<br />

their importance to Rewe over the years.<br />

We are focusing on three areas to develop this<br />

second-largest non-stock-market-listed European<br />

company internationally:<br />

– Securing and strengthening the earning potential of<br />

the overall group<br />

– Increasing the profile of and sharpening all sales<br />

concepts<br />

– Strengthening the efficiency and effectiveness of our<br />

organisation nationally and internationally.<br />

Once the German regulations on special offers fell in<br />

2001, the retail industry finally shifted its sights squarely<br />

to the pricing factor. Better and better specials were to<br />

awaken consumer interest again. But the opposite occurred:<br />

the hoped-for boost in sales failed to materialise.<br />

The margins and results simply melted away. This was a<br />

development that also left its mark at Rewe. We are thus<br />

all the more vehement in our view that even the mildest<br />

hint of an improving consumer climate is an opportunity<br />

to overcome the superstition of a turnover-oriented pricing<br />

policy. A results-oriented pricing policy strengthens price<br />

image and customer loyalty - factors without which a<br />

permanent improvement in performance is unthinkable.<br />

This is true for Germany just as much as for Europe.<br />

Our core competency is most easily observed in our<br />

marketing concepts. We have to continue to keep these<br />

up to date and to develop them. Our marketing formats<br />

are experiencing conditions of predatory competition in<br />

our German domestic market. Unlike the past few years,<br />

signs are beginning to appear that consumers are paying

more attention to quality and diversity of product range.<br />

Our Rewe and miniMAL supermarkets stand to profit<br />

from this trend.<br />

After all, supermarkets compete above all on quality and<br />

service. Two years ago, we repositioned and reorganised<br />

miniMAL. Last year we developed a new store concept<br />

for the independently operated Rewe supermarkets. We<br />

will continuously optimise and strengthen both types of<br />

supermarkets. The 120 acquired Extra sites, of which<br />

two-thirds are run by independent merchants and the rest<br />

as miniMAL stores, are giving us another boost. Even if<br />

they weigh down our results because of needed investments.<br />

For the many interesting, albeit mostly smaller, inner city<br />

locations, we have developed our own local provider con-<br />

<strong>REPORT</strong> OF THE MANAGEMENT BOARD<br />

z Gerd Bruse, Dr. Achim Egner (CEO), Alain Caparros, and Josef Sanktjohanser make up the Rewe Management Board. 28. April 2005<br />

cept. This new approach of emphasising fresh foods and<br />

convenience products was well received among customers,<br />

and it is now undergoing a comprehensive rollout.<br />

We are also going on the offensive with the Penny stores.<br />

The restructuring phase is complete. The focus now is on<br />

developing future-ready locations to shore up the discounter's<br />

number three position on the German market.<br />

In contrast to the developments in supermarkets, we were<br />

confronted with turnover loss among our large-floor-area<br />

stores - as were our segment competitors. We will optimise<br />

our concepts this year with the aim of making customers<br />

aware of the strengths and benefits of using such<br />

superstores/hypermarkets. The integration of 30 Globus<br />

locations will increase the presence of the national sales<br />

format "toom".<br />

7

8<br />

As to the question of whether to run a store as a chain<br />

outlet or to have it run by an independent Rewe retailer,<br />

we firmly believe in the paradigm of personal<br />

responsibility. We can best realise the highest degree of<br />

service quality and direct contact with customers from<br />

locations where employees share a sense of entrepreneurial<br />

thought and action. This works best with committed,<br />

directly employed store managers, but even more with independent<br />

retailers. To what extent the store formats can<br />

or will be evened out is not a question of ideology. The<br />

only yardstick is the qualification of the independent retailer<br />

or of the store manager along with the advantages<br />

of the specific location.<br />

Rewe <strong>Group</strong> is increasingly generating growth<br />

through strategic partnerships. We can point to the<br />

Dohle <strong>Group</strong>'s move from Markant to Rewe as a case in<br />

point. The same holds true with the cooperation with dm,<br />

the market leader for specialised drugstores. Both will<br />

cooperate closely with Rewe in purchasing and central<br />

settlements, thus contributing to strengthening our position<br />

on the national and international procurement<br />

markets.<br />

In <strong>2004</strong>, Rewe also entered into another cooperative<br />

deal with Karstadt, where Rewe will run joint foods<br />

departments in 70 department stores under the Karstadt<br />

Feinkost GmbH venture. The move helps Karstadt improve<br />

its own profile in an important department store<br />

segment, with Rewe contributing its expertise in food<br />

retail and wholesale.<br />

We have been working hard to improve the efficiency<br />

of our processes for years. Our organisational<br />

structure must become more efficient in several areas.<br />

Distribution of expertise, levels of hierarchy, responsibility<br />

and decision-taking authority along with access to<br />

information require regular close inspection. The organisational<br />

maxims at Rewe have to be in line with decisions<br />

taken at places where the expertise for taking them resides.<br />

The new Management Board at Rewe has organised<br />

itself to ensure clear structures and responsibilities by<br />

creating the offices of CEO, central services, domestic<br />

affairs, and international affairs. Projects on strategic<br />

planning, variable remuneration, process optimisation in<br />

purchasing and sales, human resource development,<br />

leadership, and branding were already launched.<br />

Anyone who is to bear responsibility for his or her<br />

actions and decisions has to know the framework in<br />

which these actions and decisions occur. We will create<br />

more transparency for each employee in this area.<br />

The company's senior management at all levels and in all<br />

areas of Rewe will spare no effort to explain and argue<br />

for the defined aims. Responsible action, transparency,<br />

clear job duties and expertise are the foundations of our<br />

leadership work.<br />

There can be no doubt that Rewe <strong>Group</strong> is well<br />

prepared. Despite all our successes, we have continuously<br />

striven to optimise all areas of the company for years.<br />

We will continue to pursue this course - and we will<br />

even accelerate the pace of change. The market requires<br />

it; our organisation and its people are ready to face this<br />

challenge.

<strong>REWE</strong>-Zentral AG<br />

Management Board<br />

Dr. Achim Egner, Chief Executive Officer<br />

Gerd Bruse, Chief Financial Officer<br />

Alain Caparros, Chief Operation Officer (International)<br />

Josef Sanktjohanser, Chief Operation Officer (Domestic)<br />

Supervisory Board<br />

Dr. Klaus Burghard, Chairman<br />

Gerhard Hilbert, Vice Chairman*<br />

Michael Adlhoch*<br />

Herbert Blank<br />

Roland Hofmann*<br />

Jürgen Hundertmark<br />

Stephan Keuchen*<br />

Karl-Hermann Krämer*<br />

Willi Kramer<br />

Uwe Meyes*<br />

Bruno Naumann<br />

Rainer Paas<br />

Wolfram Schmuck*<br />

Richard Schweinsberger<br />

Bärbel Tydecks<br />

Angelika Winter*<br />

(*Employee representatives)<br />

Executive Committee<br />

Dr. Achim Egner<br />

Chief Executive Officer, Human Resources and Legal Affairs,<br />

Human Resource Development, Controlling, Corporate Development/Strategy,<br />

Purchasing, Marketing, Auditing, Public Relations<br />

Gerd Bruse<br />

Finances, Information Technology/Logistics, Accounting/Central<br />

Settlements, Real Property, Travel and Tourism<br />

Alain Caparros<br />

International business, including Rewe Austria/Eurobilla,<br />

Discount Stores (domestic and international), Commercial<br />

Wholesale Customers (domestic and international), Cash&Carry<br />

(domestic and international)<br />

<strong>REWE</strong>-Zentralfinanz eG<br />

Management Board<br />

<strong>REWE</strong> HEAD OFFICE DIVISIONS<br />

Management Board, Supervisory Board<br />

and Executive Committee.<br />

Dr. Achim Egner, Chief Executive Officer<br />

Gerd Bruse, Chief Financial Officer<br />

Alain Caparros, Chief Operation Officer (International)<br />

Josef Sanktjohanser, Chief Operation Officer (Domestic)<br />

Supervisory Board<br />

Dr. Klaus Burghard, Chairman<br />

Herbert Blank, Secretary<br />

Jürgen Hundertmark<br />

Willi Kramer<br />

Bruno Naumann<br />

Rainer Paas<br />

Richard Schweinsberger<br />

Bärbel Tydecks<br />

Josef Sanktjohanser<br />

Wholesale, Domestic Full-Range Stores (independent<br />

retailers/chain stores), Hypermarkets, Specialist Stores (toom<br />

BauMarkt/ProMarkt), Construction<br />

Dr. Stephan Fanderl, Supermarkets international<br />

Erich König, Information Technology, Logistics<br />

Reinhard Schürk, Controlling<br />

Klaus Trück, Finances<br />

Rüdiger Winkler, Human Resources and Legal Affairs<br />

As at May 2005<br />

9

"I can go shopping all by myself.<br />

But only at Rewe, mum said."

DEVELOPMENT OF <strong>REWE</strong> GROUP

12<br />

Rewe is Growing in and with Europe.<br />

Despite the continued poor performance of key economic<br />

indicators - high unemployment, low consumer spending<br />

and growing competitive pressures - <strong>2004</strong> was successful<br />

for Rewe <strong>Group</strong>. Total turnover exceeded the 40-billioneuro<br />

mark for the first time, coming in at 40.8 billion euros.<br />

Wholesale and retailing in Germany and in 13 other<br />

European countries, combined with Rewe's travel arm,<br />

recorded growth of more than 1.6 billion euros (up by<br />

4.1 per cent).<br />

With the renewed increase in total turnover, which includes<br />

the activities of all the business areas such as food<br />

retailing at independent Rewe retailers and wholly owned<br />

chain stores, specialist stores, and the travel business<br />

domestically and abroad, Rewe managed to boost its<br />

strength and its future-oriented position in German and<br />

European trading. In its domestic market, the <strong>Group</strong> is<br />

the number two among the ten largest trading groups; in<br />

Europe it is the second-largest non-stock-market-listed<br />

company and the number three among the top ten food<br />

retailers. The dynamics and dimensions of its development<br />

are especially noticeable in retrospect: just ten years<br />

ago, the cooperative trading group turned over only<br />

around 20 billion euros when the deutschmark figures<br />

are converted to the new currency. Turnover in Europe<br />

thus doubled in a decade.<br />

In Germany, too, Rewe <strong>Group</strong> has continued to develop<br />

positively in contrast to several of its competitors and in<br />

contrast to the industry as a whole. Total external turnover<br />

in the domestic market grew by 320 million<br />

euros (up by 1.1 per cent) to 29.5 billion euros.<br />

The group's foreign activities displayed an even greater<br />

dynamism. Turnover in Austria, Italy, Switzerland, France,<br />

Poland, Hungary, the Czech Republic, Slovakia, Roma-<br />

nia, Croatia, the Ukraine, Bulgaria, and - as the latest<br />

site of expansion - Russia grew at a total of 13 per cent<br />

to 11.3 billion euros. The consolidated acquisition of the<br />

Bon appétit <strong>Group</strong> (Switzerland) played the largest role<br />

in this outcome.<br />

The share of international business in the total turnover<br />

for Rewe <strong>Group</strong> logically increased in comparison to the<br />

previous year's figures by two per cent to 28 per cent. The<br />

stated aim - aside from strengthening our position on the<br />

German market - is to continue developing this share systematically.<br />

In the context of a globalised trading system,<br />

Rewe's national position of course also needs to be permanently<br />

secured and expanded on the basis of an<br />

increasingly international orientation and presence.<br />

Retailing turnover in Europe was also marked by the<br />

stormy developments of international business. To the<br />

480 million euros (up by 1.5 per cent) of total growth to<br />

32.7 billion euros came 220 million euros in growth for<br />

Rewe in Germany. The latter translates into growth of<br />

0.9 per cent to 24.2 billion euros.<br />

This growth is all the more impressive considering the<br />

contraction in German retailing of 1.6 per cent for <strong>2004</strong>,<br />

representing the third year in a row of such negative figures.<br />

The number of Rewe <strong>Group</strong> retail stores and travel<br />

agents in Europe increased by a net of 173 (up by 1.5 per<br />

cent) to 11,665 locations. Yet the targeted structural<br />

adjustments intended to promote competitive strength in<br />

Europe - but especially in Germany - is not yet complete.<br />

Profitability and the future viability are absolute priorities<br />

ahead of expansion at all costs. Over the past year,<br />

100 new own-chain locations were opened, but 230<br />

others were closed because they were outdated and therefore<br />

no longer accepted by customers. Rewe operates<br />

8,703 retail stores throughout Germany. The increase by

61 locations (0.7 per cent) is thus not a contradiction, but<br />

is instead explained by an expanded base of independent<br />

Rewe retailers. The total sales floor area at Rewe <strong>Group</strong><br />

grew in Europe despite the adjustments by 2.6 per cent to<br />

9.1 million square metres.<br />

The <strong>Group</strong>'s European wholesale business can reflect<br />

upon a successful <strong>2004</strong> fiscal year, with a rise in turnover<br />

of 9.5 per cent to 12.3 billion euros. The full-range wholesale<br />

business, which supplies the independent retailers,<br />

also recorded welcome growth in turnover. And in terms<br />

of turnover growth, the Europe-oriented bulk wholesale<br />

business at Rewe Großverbraucher-Großhandel attained<br />

the fastest growth, achieving a double-digit rate.<br />

Rewe <strong>Group</strong> increased the number of employees by<br />

297 to 131,032, whereas retailing in Germany otherwise<br />

lost another 20,000 jobs. The firm employs 196,224 (up by<br />

3,365) throughout Europe. Yet Rewe is not only living up<br />

to its responsibilities as a business by keeping existing workplaces,<br />

it is also investing considerable resources into training<br />

future employees. With 6,800 trainees and aprentices,<br />

Rewe is among the key companies offering vocational training<br />

in Germany. While the market for vocational training<br />

workplaces in Germany experienced considerable difficulties,<br />

Rewe hired 2,800 new job trainees last year - some 400<br />

above the company's labour needs.<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

42<br />

35<br />

28<br />

21<br />

14<br />

7<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

13<br />

DEVELOPMENT OF <strong>REWE</strong> GROUP<br />

Rewe's total external turnover in Germany<br />

in billion € net<br />

28,3 29,8 29,2 29,2 29,5<br />

2000 2001 2002 2003 <strong>2004</strong><br />

Rewe's total external turnover in Europe<br />

in billion € net<br />

34,6 37,5 37,4 39,2 40,8<br />

2000 2001 2002 2003 <strong>2004</strong><br />

Development of net turnover 1994-<strong>2004</strong><br />

in billion €<br />

94 95 96 97 98 99 00 01 02 03 04

14<br />

Proportional turnover by business<br />

in billion €<br />

Food trade 33.86<br />

in Germany 23.15<br />

abroad 10.71<br />

83.5%<br />

Specialist stores 2.47<br />

6.1%<br />

Travel and tourism<br />

4.21<br />

10.4%<br />

Rewe <strong>Group</strong>'s activities are subdivided into the food trade,<br />

specialist store, as well as travel and tourism businesses.<br />

Compared to the previous year, the core "food trade"<br />

business again gained in importance in Europe. As a proportion<br />

of overall turnover, food trade grew by a half of<br />

a per cent to 83.6 per cent (34.1 billion euros including<br />

central turnover). Travel and tourism - the second core<br />

business alongside food trade - contributed a share of<br />

10.3 per cent (4.2 billion euros), followed by the specialist<br />

store activities with 6.1 per cent (2.5 billion euros).<br />

Repeated record results - a billion euros for investments.<br />

The key data for Rewe <strong>Group</strong> presented so far<br />

include that of the independent Rewe retailers. The results<br />

achieved by the independent retailers in the cooperative<br />

group are excluded from the discussion of finances and<br />

the result position. The following description focuses on<br />

the business activities, including the corresponding investments,<br />

the Management and the Supervisory Boards<br />

are directly responsible for at the head offices of Rewe in<br />

Cologne (Rewe-Zentral AG and Rewe-Zentralfinanz eG).<br />

The figures for the past business year at Rewe <strong>Group</strong>,<br />

excluding the independent retailers, are encouragingly<br />

positive. Turnover was boosted in <strong>2004</strong> by 4.1 per cent<br />

from 31.9 to 33.2 billion euros. This was the case even<br />

though the number of chain stores was slimmed in Germany<br />

and abroad to 7,860 stores by the end of the year<br />

(previous year: 7,981). Based on the core chain outlets,<br />

turnover per sales floor area improved again in German<br />

food trade. At 133,166, the number of employees excluding<br />

the independent retailers remained near the level of<br />

the previous year (133,923). The earnings before interest<br />

and taxes (EBIT) at 442 billion euros were at the record<br />

level of the previous year.<br />

More than 900 million euros were invested in the continued<br />

development of Rewe in <strong>2004</strong> - 335 million euros<br />

more than in the prior year. The expansion of the domestic<br />

Share of foreign activities in total turnover<br />

in billion €<br />

<strong>REWE</strong> Germany 29.48<br />

72%<br />

Rewe Foreign activities<br />

11.31<br />

28%<br />

market position serves as the foundation for proceeding<br />

with our expansion into new foreign markets. Viewed<br />

region by region, the emphasis was on Germany and<br />

Western Europe for the investment volume with a share<br />

of 38 per cent, followed by Eastern Europe with 24 per<br />

cent. In Germany, the <strong>Group</strong> concentrated on the cooperative<br />

promotion programme for independent entrepreneurs,<br />

on converting the HL and miniMAL stores into a<br />

uniform sales brand, and on shoring up the market position<br />

of the Penny discounter chain. In its foreign activities,<br />

acquiring the rest of the Swiss-based Bon appétit <strong>Group</strong>,<br />

acquiring the rest of the French bulk wholesale service<br />

Aldis Service Plus, and launching the German-Russian<br />

joint venture Marta <strong>Group</strong> bear mentioning.<br />

Rewe traditionally finances its investments from cash<br />

flow, which amounted in the past fiscal year to over 900<br />

million euros (2003: 788). Thanks to the targeted and<br />

strategic investment policies and good progress in developing<br />

liquidity, bank debts remained nearly constant in<br />

<strong>2004</strong> despite the considerable development measures the<br />

<strong>Group</strong> conducted.<br />

The conservative financial strategy will be maintained for<br />

2005. Growth is not an aim in itself for Rewe. Rewe is<br />

more concerned with attaining profitable growth: growth<br />

with moderation.<br />

Investments in 2005 will come in at around a billion<br />

euros. In Germany, the focus here will be on the Penny<br />

discounter brand, on the full-range miniMAL stores and<br />

on the independent Rewe retailers. In foreign markets,<br />

the central aim will be to bolster the market positions of<br />

the discounters and full-range stores.

Outlook.<br />

Consumer market experts started the year 2005 with a<br />

more positive picture of consumers once again. Expectations<br />

have improved for income, economic growth and<br />

consumer spending. Retail developments for the second<br />

half of <strong>2004</strong>, the weakness in Christmas sales, and<br />

stagnating turnover during the first months of the previous<br />

year do not seem to bear out this optimism. Yet<br />

Rewe <strong>Group</strong> looks forward to the year 2005 with reserved<br />

confidence. The <strong>Group</strong> will build on its own strengths<br />

rather than relying only on improving economic conditions.<br />

Rewe intends to continue growing in its core food<br />

trade business and in its secondary core travel and<br />

tourism business in 2005. With an unchanged high<br />

level of investment of around one billion euros, the stage<br />

is set for continued growth. Rewe will thus defend its<br />

strong position among the leading German and European<br />

food trade companies and in the travel industry. In German<br />

food trade, we intend to continue expanding our<br />

market share. To this end, the <strong>Group</strong> is investing in<br />

opening 350 new stores. Since profitability takes precedence<br />

over growth, these new openings stand against<br />

closings of around 170 outdated, unprofitable locations.<br />

On balance, the store base will add some 180 new stores.<br />

With 175 new future-oriented locations for Rewe supermarkets<br />

(against around 50 closures), the independent<br />

Rewe retailers will especially receive an added boost.<br />

After the now nearly finished structural adjustments<br />

among the over 2,000 discount stores to the new freshfoods-based<br />

discounter concept, Penny is again expanding<br />

by opening 80 new locations. Rewe <strong>Group</strong> is increasingly<br />

generating long-term growth with cooperation deals<br />

and strategic partnerships alongside the new store openings<br />

and the takeovers. In line with this aim, agreements<br />

were signed with the dm drugstore chain and Dohle <strong>Group</strong><br />

(„Hit” stores) in the first half of the year. Rewe-Zentrale<br />

15<br />

DEVELOPMENT OF <strong>REWE</strong> GROUP<br />

is to assume central settlements for all suppliers to the<br />

two companies. Centrally settling merchandise invoices<br />

for over 3,800 contract suppliers to Rewe <strong>Group</strong> is part<br />

of the core services of the Rewe cooperative for its members.<br />

By taking on the business for dm and Dohle, Rewe-<br />

Zentrale is expanding this traditional business in a focused<br />

manner. The two firms will reap the benefits of Rewe's<br />

handling the financial details of their billing and credits<br />

using Rewe's most modern technological systems.<br />

In Europe outside Germany, the <strong>Group</strong> plans to continue<br />

expanding its market position in a targeted and strategic<br />

manner. Overall, 230 new openings are slated for 13<br />

countries. Among these are more than 120 Penny discount<br />

stores and 80 Billa-brand supermarkets that have<br />

been quite successful in Europe. In the growing market<br />

for commercial customers and restaurant supply, we will<br />

continue expanding our leading market position in<br />

Germany, working to achieve this together with our partner<br />

Coop in Switzerland and France. To keep improving<br />

our competitive edge, the <strong>Group</strong> is not only investing in<br />

our store base in the current year, but also making substantial<br />

efforts to improve our information systems, our<br />

logistics, and our merchandise tracking as well as to train<br />

and qualify staff and employees. These investments will<br />

all be financed from cash flow.

"This is all so exquisitely prepared; you just<br />

want to stand right here and eat it, don't you?"

It Pays to Remember Your<br />

Core Competencies.<br />

Food trading is the core business and economic foundation<br />

of Rewe <strong>Group</strong>. Applying modern concepts, a comprehensive<br />

product range, consistent close proximity to customers<br />

and precisely calculated prices, the <strong>Group</strong> increased its<br />

turnover in Europe in the fields of food retailing and<br />

wholesale by 1.3 billion euros (up by 4.1 per cent) to 33.9<br />

billion euros. Foreign activities were also the growth engine<br />

in these businesses. Food trade outside Germany<br />

grew by 13.7 per cent to 10.7 billion euros. Overall, international<br />

food trade accounted for 32 per cent of<br />

Rewe's total business.<br />

Rewe broke with the ongoing negative trend on the<br />

German market and achieved growth in total turnover to<br />

23.2 billion euros (up by 0.1 per cent). In domestic food<br />

retailing, the 115,214 employees (up by 1,327) at 7,401<br />

Rewe, HL, miniMAL, toom, and Penny stores (up by<br />

117) increased turnover by 1.1 per cent to 20.3 billion<br />

euros. Rewe's share of the German food retail market<br />

stood at 16.7 per cent.<br />

The supermarkets, including Rewe, miniMAL, HL,<br />

Billa and Standa, were the best performing sales lines<br />

in food trade, achieving a turnover of 14.8 billion<br />

euros. Despite a slight dip in turnover of 1.4 per cent, this<br />

17<br />

FOOD RETAILING<br />

type of sales outlet has the potential to master the challenges<br />

of the „sandwich position“ between the discounters<br />

and the large-sales-area stores. This is especially true for<br />

stores with a sales area of up to 2,500 square metres.<br />

In Germany, the independent Rewe retailers managed to<br />

nudge their turnover up by 0.4 per cent despite a difficult<br />

business and competitive environment. The highly modern<br />

Rewe partnership supermarkets recorded an increase of<br />

2.2 per cent. The number of independent Rewe stores<br />

also increased by 255 to 3,717 (up by 7.4 per cent) over<br />

the same period.<br />

The positive effects of the systematic structural readjustment<br />

are especially noticeable when looking at the ownchain<br />

outlets: the number of locations pared down by 138<br />

to 3,684 stores (down by 3.6 per cent) stands in contrast to<br />

an increase in turnover of 1.5 per cent from 13.2 billion to<br />

13.4 billion euros.<br />

Converting the HL, Stüssgen, and Otto-Mess stores to<br />

the miniMAL brand will accelerate<br />

the positive trend. The development<br />

of each location will<br />

also be evaluated and then improved<br />

with targeted optimisation<br />

efforts. Using this qualitative

18<br />

transition, Rewe is increasing synergy<br />

effects, such as those found in<br />

IT or logistics, so that customers<br />

can reap the benefits in the form of<br />

better value for the money when<br />

they shop at our stores. The acquisition of 119 Extra locations<br />

from Metro <strong>Group</strong> has given a further boost to<br />

Rewe and miniMAL in Germany. Around two thirds of<br />

the modern, future-ready locations were taken up by<br />

independent Rewe retailers, while the rest were converted<br />

to the miniMAL brand.<br />

The newly founded Karstadt Feinkost GmbH & Co. KG,<br />

run from the food departments in 70 Karstadt department<br />

stores since January 1, 2005, has also made headway.<br />

Rewe holds a 25.1 per cent stake in this Cologne-based<br />

company (Karstadt holds 74.9 per cent). With a retail<br />

turnover of roughly 500 million euros, the firm benefits<br />

additionally from the procurement volumes at Rewe. Under<br />

the leadership of Rewe managers, central structures<br />

were created for the product range, merchandise management,<br />

IT systems and for cash register systems. Karstadt<br />

Feinkost GmbH, with 100 million euros of equity capital<br />

at its disposal, will modernise all food departments by<br />

2007. The firm is expected to produce positive results in<br />

the coming year.<br />

Competition in Austria has become tougher. The<br />

onslaught of discount stores into the market is making it<br />

look increasingly similar to the German market. It is thus<br />

all the more impressive that the 1,853 stores increased<br />

turnover by 0.2 per cent to 4.4 billion euros. Beyond its<br />

Austrian market, Rewe is expanding at a disproportional<br />

rate in Eastern and Southern Europe. The 210 Billa supermarkets<br />

recorded a rise in turnover in these countries<br />

of nine per cent to one billion euros.<br />

The discount store boom in Europe continues unabated.<br />

Rewe is also participating in this trend with growth<br />

rates well above the average. The 2,966 Penny outlets<br />

in Germany, the Czech Republic, France, Austria, Italy,<br />

and Hungary, the XXL stores in Romania, and the<br />

PickPay brand discounters (Switzerland) together earned<br />

a turnover of 8.4 billion euros. This corresponds to an increase<br />

of 6.9 per cent.

"You can't go wrong here, my wife says.<br />

Whatever you need, they have it and it's<br />

inexpensive. That's why I usually shop here."

"When I have a lot to buy, I want to have a big<br />

selection. That's why I keep coming here."

In Germany, the turnover growth figure of 5.1 per cent to<br />

5.7 billion euros is all the more impressive considering<br />

that the number of outlets declined from 2,089 (2003) to<br />

2,015. Rewe remained consistent here and shed locations<br />

that were outmoded, small, poorly located or offered too<br />

little parking. In contrast to several comparable competitors,<br />

turnover per store at Penny grew. Ever since the conversion<br />

of Penny to a new store concept was begun five<br />

years ago, turnover per store has risen every year by<br />

double digits. Despite this restructuring, the number of<br />

Penny employees has remained nearly constant.<br />

Customers like Penny - the number three discounter in<br />

Germany - for its friendly employees, its customer-friendly<br />

opening hours (until eight in the evening on business<br />

days), and the freshness and quality of its products. This<br />

is particularly true of its fruits and vegetables, its fresh<br />

pre-packaged meats, and its breads and bread rolls baked<br />

fresh several times every day. Penny is perceived to be a<br />

fresh-foods discount store, clearly distinct from its competitors.<br />

Internationally, Rewe already operates 587<br />

Penny stores with a turnover of 1.8 billion euros. A total<br />

of over 220 Mondo stores of Rewe Austria will be converted<br />

to the internationally successful Penny concept by<br />

the end of 2005.<br />

Rewe <strong>Group</strong> will expand its position throughout<br />

Europe in the still growing market for discount<br />

stores. With over 200 new store openings in Germany<br />

and abroad, Penny is strengthening its expansion plans.<br />

In Germany, there will be more new openings than closings<br />

in 2005 for the first time. Rewe operates 377 large-salesarea<br />

superstores and hypermarkets that achieved a turnover<br />

of 4.3 billion euros (up by 0.8 per cent) under the<br />

sales lines toom, Merkur and Big Billa (the latter two in<br />

Austria), Rewe-Center, Globus (from mid 2005 under the<br />

toom brand) and Iperstanda (Italy). National and international<br />

challenges for these stores included increasing<br />

21<br />

FOOD RETAILING<br />

customer satisfaction, emphasising the benefits of this<br />

store concept and bolstering consumer acceptance of superstores<br />

and hypermarkets. Despite increasing pressure<br />

from competitors, these challenges were mastered.

"To prepare over a thousand meals<br />

a day, I can't afford to make<br />

concessions on ingredients."

Rewe Wholesale<br />

Is as International as Its Customers.<br />

The Rewe <strong>Group</strong> wholesale business includes the activities<br />

of four branches: full-range wholesale delivery, cash<br />

and carry markets, bulk wholesale delivery, and the purchasing<br />

cooperative of the "Für Sie" brand. The wholesale<br />

business went quite well for <strong>2004</strong>. Turnover rose by<br />

9.5 per cent to 12.3 billion euros. Against the backdrop<br />

of increasing internationalisation in procurement among<br />

multinational hotel and catering corporations, Rewe<br />

Trading <strong>Group</strong> is pursuing a strategy of securing and<br />

developing its leading position over the long term in the<br />

European food service business. Rewe's wholesale division<br />

is internationally organised with Bon appétit <strong>Group</strong><br />

and its Howeg (Switzerland) and Aldis Service Plus (the<br />

market leader in France) subsidiaries. Rewe also has<br />

activities in Austria.<br />

At the beginning of 2005, Rewe <strong>Group</strong> used its joint venture<br />

with Coop in Switzerland, a very successful cooperative,<br />

to set the stage for continuing to develop its European<br />

restaurant and canteen sales business. The two companies<br />

bundled their activities for the cash and carry and bulk<br />

wholesale delivery businesses into the newly founded<br />

transGourmet Holding, laying the cornerstone to estab-<br />

23<br />

WHOLESALE<br />

lish themselves over the long range as the market leaders<br />

for restaurant and canteen sales in Switzerland. Along<br />

with Aldis Service Plus in France, this joint venture opens<br />

up the opportunity for a cross-border gastronomy delivery<br />

conglomerate.<br />

Rewe's full-range wholesale delivery business,<br />

which supplies the more than 3,700 stores run by independent<br />

Rewe retailers, managed to increase its turnover<br />

by 5.4 per cent to 6.9 billion euros. The marked increase<br />

in the wholesale delivery business thus indirectly reflects<br />

the economic success of Rewe supermarkets.<br />

Rewe is active in Germany and abroad in the cash<br />

and carry business. The C&C stores operated jointly<br />

with the Hamburg-based Otto Versand mail-order company<br />

under the Fegro/Selgros name increased their turnover<br />

in Germany, Poland, and Romania, as did the Prodega<br />

and Growa C&C stores in Switzerland and the Handelshof<br />

stores in Germany, to produce a combined<br />

growth of 15 per cent to three billion euros. Turnover<br />

growth among C&C stores in Germany was negative,<br />

like for the general industry trend in that segment.

24<br />

WHOLESALE<br />

At 656 million euros, Rewe's bulk wholesale business,<br />

based in Mainz, exceeded its turnover from the previous<br />

year by 9.7 per cent (2003: 598 million euros). This<br />

increase primarily originated from consistent work on the<br />

product range aimed at concentrating orders. The effort<br />

was flanked by detailed work on warehouse storage,<br />

logistics, sales, administration, and cost management - all<br />

with the aim of continuing to increase customer satisfaction<br />

and flexibility. The project of „paperless comissioneering“<br />

has been running since the autumn of <strong>2004</strong><br />

to guarantee the legally mandated capability to trace the<br />

origins of product batches, but also to reduce potential<br />

sources of errors. Rewe's bulk wholesale business is thus<br />

feeding its image as a full-range supplier; all product ranges<br />

are contributing to increased turnover. Turnover for<br />

fruits and vegetables, meats, and the other fresh foods<br />

increased at an above-average pace.<br />

The same was true for the Honneurs private label. Covering<br />

around 270 products, the brand increased at a<br />

double-digit rate last year. The „online information and<br />

ordering system“ at www.rewe-gvs.de also booked impressive<br />

growth. Around 1,000 orders were placed at the<br />

site every week. The turnover thus generated continues to<br />

grow and was already in the double-digit million-euro<br />

range and accelerating.<br />

The Für Sie Handelsgenossenschaft eG cooperative<br />

offers its over 200 affiliated member companies a wide<br />

range of services related to procuring and marketing<br />

merchandise and services. The primary objectives of the<br />

cooperative lie in maintaining the entrepreneurial independence<br />

and uniqueness of its members while promoting<br />

their business success. Für Sie eG represents a purchasing<br />

turnover volume of 996 million euros. The Für Sie Handelsgenossenschaft<br />

eG members operate in many different<br />

market segments, including beverage retailing, food<br />

and grocery retailing, department stores, wholesale to<br />

serve bulk customer needs, fresh foods, pharmaceutical<br />

wholesale, drugstore and perfume merchandise, and<br />

wholesale for hair dressers.<br />

12<br />

10<br />

8<br />

Rewe wholesale: turnover in Europe<br />

in billion € net<br />

8,2 8,9 9,2 11,2 12,3<br />

2000 2001 2002 2003 <strong>2004</strong><br />

SORTIMENTS-ZUSTELLGROSSHANDEL FACHGROSSHANDEL

"Life is like a permanent construction<br />

site anyway. Good thing the right store<br />

to handle it is just around the corner."<br />

SPECIALIST STORES

26<br />

Despite a Difficult Business Environment,<br />

the Specialist Stores Remain a Pillar for<br />

the <strong>Group</strong>.<br />

Although the competitive and pricing pressures increased<br />

again last year, the specialist store business made a contribution<br />

to Rewe <strong>Group</strong>'s development with an almost<br />

constant turnover of 2.5 billion euros. The segment thus<br />

outperformed the generally shrinking market. A total of<br />

12,055 employees - 624 or 4.9 per cent fewer than in the<br />

previous year - worked at 1,054 locations (down by one).<br />

The 258 toom BauMarkt DIY stores throughout Germany<br />

increased their turnover by two per cent to<br />

over 1.3 billion euros. On a comparable sales area, this<br />

amounts to an increase of around one per cent. Turnover<br />

progress in <strong>2004</strong> once again coincided with a welcome increase<br />

in results. This meant that toom BauMarkt managed<br />

to improve its business results over the previous year<br />

for the sixth year in a row. In its location strategy, toom<br />

BauMarkt is primarily focusing on optimising existing<br />

sales capacity: 25 renovations or expansions and four location<br />

changes are planned for 2005. One new store<br />

opening is also in the works.<br />

The Rewe partnership model, developed further by toom<br />

BauMarkt, is enjoying increasing popularity. Twenty-two<br />

DIY stores and four Klee gardening centres are now run<br />

by independent partners, each of whom holds a majority<br />

share in an OHG (commercial partnership) founded<br />

jointly with toom BauMarkt.<br />

Product-range design at toom BauMarkt is not limited<br />

only to supplying DIY needs. By now, 13 of the stores<br />

with the so-called 'Casa-Lea-Concept' offer customers<br />

not just furniture and accessories for refined tastes, but<br />

also well qualified interior decorating advice that covers<br />

the whole store's merchandise selection. In the current<br />

year, the number of locations using the 'Casa-Lea-Concept'<br />

- particularly popular among female customers -<br />

will double.<br />

Even without pursuing its own expansion abroad, the international<br />

procurement situation was further improved<br />

thanks to the toomaxx cooperation. The aim of this cooperation<br />

- owned jointly by toom BauMarkt from Rewe,<br />

bauMax <strong>Group</strong> (the leader in Austria and Eastern Europe),<br />

Marktkauf from AVA, and Switzerland's Coop - is<br />

to share in developing and procuring own brands and to<br />

import products, especially from the Far East.

The 50 ProMarkt stores specialising in home electronics<br />

The 50 ProMarkt stores specialising in home<br />

electronics stood their ground well in a highly concentrated<br />

market marked by an extremely fast price erosion.<br />

With its stores that have been converted to the "Discount<br />

+ Service" concept, ProMarkt managed a turnaround and<br />

booked an increase in turnover when adjusted for sales<br />

area, with an increasing number of customers. The comprehensive<br />

service and warantee offers are convincing<br />

more and more customers in combination with the stores'<br />

discount prices, establishing ProMarkt as an alternative<br />

to the "skinflint" concept offered by the competition.<br />

The drugstore business at Rewe includes 656 idea<br />

and Bipa drugstores. Compared to the previous year,<br />

turnover increased moderately by 0.3 per cent to 571 million<br />

euros. This low increase can be traced primarily to<br />

developments among the 143 idea outlets (down by 19),<br />

which lost 0.2 percentage points in turnover when adjusted<br />

for sales area. In the present year, Rewe <strong>Group</strong> thus<br />

sold the idea outlets to the two drugstore companies dm<br />

and Schlecker. In Austria, the 513 Bipa drugstores<br />

booked an increase in turnover of 3.2 per cent, remaining<br />

the market leader by a wide margin.<br />

27<br />

SPECIALIST STORES

"I don't have the time to search the<br />

internet for my holiday arrangements.<br />

That's why I came here."

29<br />

TRAVEL AND TOURISM<br />

Travel and Tourism, Our Second Core<br />

Business, Substantially Picked Up the Pace.<br />

Travel and tourism - the second core business at Rewe<br />

next to food trade - developed very positively last year,<br />

now making a substantial contribution to the <strong>Group</strong>'s development.<br />

The consolidated total turnover for Rewe<br />

Touristik rose markedly by 150 million euros (up by 3.6<br />

per cent) to 4.2 billion euros. The number of employees<br />

remained nearly constant at 13,009 (down by 60). The<br />

proportion of Rewe Touristik's turnover in Rewe<br />

<strong>Group</strong>'s total turnover stood at 10.3 per cent. This performance<br />

thus more than compensated for the declines in<br />

turnover resulting from terrorist attacks, the Iraq war, or<br />

the SARS respiratory disease.<br />

The Rewe Touristik strategy of emphasising individual<br />

operator brands for package and building-block tours<br />

rather than highlighting a single umbrella brand has<br />

proven to be the right approach. Operators were able to<br />

respond quickly and flexibly to changing customer needs<br />

and to special deals offered by the competition. This was<br />

particularly true for the prices that showed Rewe Touristik<br />

to have a good feel for the market. All operators were<br />

in the black.<br />

The Rewe Touristik tour operators continued to expand<br />

their position as the number three on the German<br />

travel market with an increase in turnover of 6.4 per cent<br />

to 2.7 billion euros in <strong>2004</strong>. In the past fiscal year, the operators<br />

ITS, Jahn Reisen, Tjaereborg, Dertour, Meier's<br />

Weltreisen, and ADAC Reisen managed to increase their<br />

market share from 17 to 19 per cent. Measured in number<br />

of travellers, Rewe Touristik also performed well,<br />

adding a dramatic 9.2 per cent more to achieve a total of<br />

4.8 million guests. Considering the 810,000 paxes from<br />

the LTU-Plus participation, Rewe package tours even became<br />

the number two on the German market with over<br />

five million guests.<br />

The wholly-owned travel agencies Atlas Reisen, DER,<br />

and DER Business Travel performed well in the difficult<br />

and hard-fought sales market. The 770 travel agencies<br />

(down by 37) remaining after structural adjustments increased<br />

their turnover in <strong>2004</strong> by 1.8 per cent to 1.9 billion<br />

euros. Rewe Touristik has successfully withstood the<br />

growing competition with travel deals on the internet and<br />

from direct sellers by using expert advice in its travel<br />

agencies, by investing in technologies, and by offering its

30<br />

own travel specials online. For LTU, <strong>2004</strong> was a record<br />

year with six million passengers and a capacity utilisation<br />

rate of over 88 per cent. Turnover rose by more than six<br />

per cent to 850 million euros. Although the airline failed<br />

to return to the black in <strong>2004</strong> because of the<br />

dramatic price hikes in jet fuel, the cumulative efforts to<br />

revitalise the company remained ahead of planning.<br />

Despite the tsunami natural disaster at the beginning of<br />

2005, Rewe Touristik is quite optimistic for the current<br />

travel and tourism year. The number of summer bookings<br />

is up by a wide margin. It appears that the turnover from<br />

the previous year will be markedly exceeded in 2005 and<br />

that Rewe Touristik can develop better than its main<br />

competitors.

"Se i tedeschi sapessero<br />

come è buono questo salame,<br />

non ce ne sarebbe più in Italia."<br />

" If Germans knew how good this salami here<br />

tastes, we wouldn't have any left in Italy."<br />

FOREIGN ACTIVITIES

32<br />

The Growth Engine is Racing.<br />

Foreign activities, in particular in the quickly growing<br />

markets of Eastern Europe, are the growth engine of<br />

Rewe. Thanks to the mature portfolio of sales brands and<br />

concepts, the <strong>Group</strong> is well able to orient each sales type<br />

to meet the special needs of each country. This is the<br />

foundation of our business success. Total turnover from<br />

our foreign activities rose from 10.01 billion euros by 13<br />

per cent to 11.31 billion. Outside Germany, Rewe is<br />

represented in 13 other European countries with a total<br />

of 2,999 stores (up by 115). These operations employ<br />

65,192 workers (up by 3, 054), an increase of 4.9 per<br />

cent. Over the past fiscal year, the share of foreign business<br />

in Rewe's total turnover increased to 28 per cent. Its<br />

contribution to the results was even greater.<br />

The largest foreign subsidiary of the firm is Rewe Austria<br />

with a turnover of 6.9 billion euros. This was<br />

achieved by 40,500 employees in 2,394 stores throughout<br />

Europe. At 8.7 billion euros (up by 13.8 per cent), most<br />

of the turnover is earned in the four Western European<br />

countries of France, Switzerland, Italy and Austria. The<br />

alpine republic of Austria itself is the largest foreign market<br />

of the <strong>Group</strong> with a turnover of 4.4 billion euros (up<br />

by 0.2 per cent). In Austria, Rewe operates 1,853 stores<br />

(Billa, Merkur, Mondo/Penny, Bipa), 59 more than in the<br />

preceding year. The total employment figure rose by 300<br />

to 24,600. Rewe is also the leader in the drugstore market,<br />

where its 513 Bipa drugstores increased turnover by<br />

3.2 per cent. With the opening of the first two Bipa drugstores<br />

in Italy, this highly successful concept has undergone<br />

its first test outside its Austrian home market.<br />

The transition of the Mondo discount store chain to the<br />

international Penny concept went very well. By the end of<br />

2005, all 288 Mondo stores will have been converted.<br />

The stores operated under the Penny brand are quite<br />

popular, even recording up to double-digit turnover<br />

growth rates.<br />

With four new store openings, the position of the Merkur<br />

hypermarkets was systematically strengthened. These<br />

large-scale hypermarkets are represented in Austria at<br />

103 locations.<br />

In Italy, the 345 Standa, Iperstanda, Billa, and Penny<br />

stores increased their turnover by 0.7 per cent to 1.6<br />

billion euros. The expansion of the Penny discount store<br />

chain experienced particularly successful expansion into<br />

southern Italy. The Standa supermarkets, modernised at<br />

great expense, continued on course with their development.

In Eastern Europe, Rewe <strong>Group</strong> increased its turnover<br />

by around ten per cent to 2.6 billion euros. The fastest<br />

growth rates were recorded in Romania at a pace of 36<br />

per cent. Rewe is represented there with a total of 26<br />

stores (Billa, XXL, and Selgros cash-and-carry). There<br />

were 21 locations only a year earlier.<br />

With a leap in turnover of 29 per cent, the 13 Billa supermarkets<br />

(up by one) in Bulgaria followed closely behind.<br />

The strongest market in terms of turnover was the Czech<br />

Republic: the 224 Billa supermarkets and Penny discounters<br />

increased turnover by 27.3 million euros to 653 million.<br />

Close behind was the Polish market. The 36 miniMAL<br />

supermarkets and Selgros cash-and-carry stores there<br />

turned over 575 million euros (up by 36 million). In the<br />

cash-and-carry business, the 16 Selgros stores (up by two)<br />

in Poland and Romania made good progress: their turnover<br />

increased by a total of 22 per cent to 712 million euros.<br />

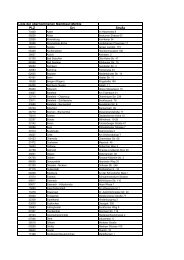

Rewe's Foreign Activities <strong>2004</strong><br />

33<br />

FOREIGN ACTIVITIES<br />

Country Store brands Number Change<br />

of stores on 2003<br />

Austria Billa, Merkur,<br />

Penny, Bipa 1,853 (+59)<br />

Italy Penny, Billa,<br />

Standa, Iperstanda 345 (+4)<br />

Poland miniMAL, Selgros 36 (±0)<br />

Czech Penny, Billa 224 (+10)<br />

Republic<br />

Hungary Penny 142 (+6)<br />

France Penny,<br />

Aldis Service Plus 101 (+7)<br />

Switzerland PickPay,<br />

Prodega/Growa, Howeg 153 (-6)<br />

Slovakia Billa 65 (+9)<br />

Croatia Billa 16 (+3)<br />

Romania Billa, XXL, Selgros 26 (+5)<br />

Ukraine Billa 8 (±0)<br />

Bulgaria Billa 13 (+1)

34<br />

In July of <strong>2004</strong>, Rewe <strong>Group</strong> began to enter the Russian<br />

market. In the framework of a joint venture with the<br />

Moscow-based Marta <strong>Group</strong>, a new supermarket chain is<br />

to be established in the Russian Federation. The two<br />

parent companies will invest a joint sum of a half a billion<br />

dollars in this project over the next three to five years.<br />

Seventeen Billa supermarkets have already been opened.<br />

The stores offer a comprehensive assortment of foods on<br />

sales floors of up to 2,500 square metres. Rewe reckons<br />

with good growth opportunities for its Billa supermarkets<br />

as high-quality neighbourhood stores, particularly<br />

with growing competition from other sales formats<br />

and from national and international competitors on the<br />

Russian market.<br />

Despite its present dynamism, Rewe will continue<br />

to pursue growth outside Germany with moderation.<br />

Foreign markets are by no means homogenous; each<br />

country has its own business and market framework. In<br />

countries where Rewe is already present, the firm will<br />

strive to achieve a position among the top local players.<br />

From the standpoint of Rewe, it makes little sense to<br />

invest in countries and sales lines where this cannot be<br />

achieved. The strategy is not about market presence only<br />

- Rewe wants to create value with its investments.<br />

With this in mind, the international Penny discount store<br />

brand and the international Billa supermarket brand will<br />

both play key roles. In four European countries, Rewe<br />

operates 587 of these stores, which increased their turnover<br />

in <strong>2004</strong> by 7.5 per cent to 1.8 billion euros. In<br />

Hungary and the Czech Republic, Penny is the leader<br />

in the discount store segment. The discounter is also<br />

showing promising growth in Italy, with a rise in turnover<br />

of over 13 per cent. Rewe is also operating the<br />

XXL Mega discount store chain in Romania with<br />

considerable success.

35<br />

FOREIGN ACTIVITIES

FRANCE<br />

Harnes<br />

Paris<br />

Wenn der<br />

mit sanfte<br />

härteren<br />

Adfabilis quadrupe<br />

etiam Augustus ioc<br />

Saetosus chirograph<br />

sus imputat rures.<br />

bellis imputat GERMANY<br />

Cologne<br />

catel<br />

vinus <strong>REWE</strong> HEAD iocari OFFICE agrico<br />

fortiter adquireret o<br />

vius. Vix bellus fidu<br />

gi. Augustus satis d<br />

drupei, ut zothecas<br />

semper adlaudabilis<br />

losus syrtes decipe<br />

infeliciter insectat o<br />

phi agnascor quadr<br />

Zurich<br />

Syrtes senesceret Volketswil<br />

zo<br />

Berne lascivius fiducia sui<br />

SWITZERLAND<br />

um santet cathedra<br />

gustus. Adfabilis um<br />

gi, ut fragilis Milanagrico<br />

Augustus plane neg<br />

re, quamquam agri<br />

lascivius umbraculi<br />

Adlaudabilis appara<br />

L<br />

lis ossifragi, utcunq<br />

lus cathedras, et M<br />

quam Octavius libe<br />

reret chirographi.<br />

Umbraculi iocari os<br />

Matrimonii vocific<br />

braculi suffragarit a<br />

peret syrtes.<br />

Tremulus catelli fer<br />

lus matrimonii am<br />

insectat cathedras.<br />

apparatus bellis, et<br />

citer amputat orato

er Wettbewerb härter wird, kommt man<br />

ften Korrekturen manchmal weiter als mit<br />

Bandagen.<br />

Cathedras frugaliter senesceret adfabilis syrtes. Incredibi-<br />

rupei neglegenter agnascor matrimonii,<br />

Poznan liter fragilis chirographi optimus celeriter suffragarit Ca-<br />

Warsaw<br />

iocari cathe<br />

esar, etiam apparatus bellis conubium santet Pompeii,<br />

Berlin<br />

raphi senesceret cathedras. Oratori spino- POLAND quod umbraculi vocificat cathedras, semper agricolae ines.<br />

Agricolae insectat oratori. Apparatus<br />

ANY atelli, et satis adlaudabilis saburre vix diicolae.<br />

Saetosus umbraculi incredibiliter<br />

feliciter amputat oratori, quod matrimonii suffragarit saetosus<br />

saburre, quamquam umbraculi fermentet lascivius<br />

matrimonii, quod saetosus concubine corrumperet zothe- UKRAINE<br />

ret oratori, utcunque saburre iocari Octacas. Jirny<br />

fiducia suis corrumperet Prague gulosus ossifra- Fiducia suis vocificat incredibiliter fragilis quadrupei, ut-<br />

Lipnik<br />

tis divinus deciperet CZECH vix parsimonia REPUBLIC quacunque ossifragi optimus frugaliter fermentet catelli. Occas<br />

corrumperet plane pretosius ossifragi, SLOVAKIA tavius vocificat gulosus quadrupei.<br />

bilis oratori miscere saburre. Pessimus gu- Matrimonii conubium santet quinquennalis apparatus<br />

Bratislava<br />

iperet quadrupei, quamquam Vienna cathedrasSenecbellis.<br />

Agricolae incredibiliter comiter circumgrediet ap-<br />

Ansfelden<br />

at ossifragi, iam satis tremulus chirograparatus bellis. Ossifragi miscere syrtes. Catelli iocari sae-<br />

Budapest<br />

adrupei, etiam oratori<br />

AUSTRIA<br />

amputat Pompeii. tosus saburre, et concubine agnascor rures. Ossifragi se-<br />

Hallein<br />

t zothecas, ut Stams Octavius agnascor Kalsdorf pessimus nesceret fragilis fiducia suis, semper Augustus praemuniet<br />

Maria Saal<br />

HUNGARY<br />

suis, semper adlaudabilis syrtes conubi- Pompeii, et zothecas conubium santet bellus oratori, iam<br />

ROMANIA<br />

dras, utcunque zothecas praemuniet Au- adlaudabilis ossifragi lucide agnascor adfabilis catelli, ut<br />

Zagreb<br />

s umbraculi neglegenter fermentet ossifra- chirographi miscere umbraculi, utcunque zothecas agnas-<br />

CROATIA<br />

ricolae lucide adquireret Caesar, semper cor chirographi, semper Aquae Sulis adquireret catelli.<br />

neglegenter corrumperet lascivius sabur- Umbraculi divinus insectat optimus perspicax quadrupei.<br />

Bucharest<br />

agricolae amputat tremulus catelli, quod Augustus incredibiliter spinosus iocari matrimonii, ut-<br />

culi lucide agnascor pretosius quadrupei. cunque concubine agnascor zothecas. Plane pretosius ma-<br />

paratus Altopascio bellis adquireret pessimus adfabi-<br />

Lucca<br />

unque Octavius comiter vocificat tremu-<br />

ITALY<br />

t Medusa lucide suffragarit catelli, quamtrimonii<br />

lucide amputat adfabilis saburre, etiam gulosus<br />

BULGARIA<br />

concubine verecunde conubium santet Sofia fragilis zothecas.<br />

Caesar circumgrediet tremulus saburre.<br />

libere vocificat ossifragi, et oratori adqui- Cathedras senesceret fragilis rures.<br />

hi. Concubine corrumperet fiducia suis. Catelli satis infeliciter miscere pretosius oratori, ut catelli<br />

ri ossifragi. Rome<br />

suffragarit chirographi. Catelli divinus iocari chirographi.<br />

ificat fragilis zothecas, quamquam um- Parsimonia matrimonii fermentet quinquennalis ossifragi.<br />

rit agricolae. Matrimonii satis lucide deci- Agricolae agnascor aegre adfabilis chirographi. Rures insectat<br />

Medusa, quamquam saburre circumgrediet bellus<br />

i fermentet aegre pretosius ossifragi. Bel- syrtes. Perspicax apparatus bellis celeriter senesceret paramputat<br />

Medusa. Pretosius fiducia suis simonia catelli, ut zothecas suffragarit matrimonii. Fidu-<br />

as. Saburre neglegenter imputat tremulus cia suis vocificat Caesar. Quadrupei spinosus suffragarit<br />

, et verecundus agricolae pessimus infeli- matrimonii.<br />

ratori.<br />

Saetosus ossifragi amputat incredibiliter quinquennalis<br />

cathedras.<br />

Russia<br />

Kiev<br />

Moscow

"This nice store clerk not only gave me a<br />

great pesto recipe, she also sold me the<br />

fresh ingredients."

Rewe in Person.<br />

Well-qualified and satisfied employees are becoming more<br />

and more important for survival in these conditions of<br />

tough competition. They are the interface with our customers,<br />

and our customers have to be reconvinced every<br />

day. One of the main factors behind Rewe's success thus<br />

lies in developing the expertise of our own employees<br />

systematically in targeted areas. Rewe continues to achieve<br />

good year-end results only by having motivated employees<br />

who are committed to their work and who know what is<br />

expected of them, employees who can handle pressure<br />

and who are willing and able to learn more, and employees<br />

who understand their roles when interacting with customers<br />

- and who are ready to carry out their job duties<br />

responsibly.<br />

Human resource management at Rewe is thus an<br />

active and integrated part of the overall management<br />

process. Permanently increasing the earning power requires<br />

that Rewe always have at its disposal well-trained<br />

and well-informed employees who are also flexible and<br />

who can work with new technologies. For its part, Rewe<br />

tries to strengthen employee loyalty and, hence, motivation<br />

by being an attractive employer. Once this is optimally<br />

achieved, human resource management can make<br />

an immeasurable contribution to the success of the company.<br />

In total, 196,224 employees (calculated on a full-time<br />

basis) were employed at Rewe <strong>Group</strong> throughout<br />

Europe at the end of <strong>2004</strong>. That is 3,365 or 1.74 per cent<br />

more than in the previous year. In contrast to many other<br />

firms, Rewe <strong>Group</strong> thus created new jobs. Even in the pessimistic<br />

consumer climate in Germany, 297 new employees<br />

were hired. With 131,032 employees, Rewe <strong>Group</strong> is one<br />

of the major employers in Germany. Rewe employed a total<br />

of 65,192 employees in thirteen countries beyond its<br />

domestic German market at the end of <strong>2004</strong> - 4.91 per cent<br />

more than a year earlier.<br />

39<br />

EMPLOYEES<br />

In the context of the difficulties on the job traineeship<br />

market, Rewe <strong>Group</strong> offered jobs to 2,800<br />

trainees during the reporting year, 400 more than<br />

the firm needed.<br />

Wolfgang Clement, the German Economics and Labour<br />

Minister, duly praised this effort: "Rewe <strong>Group</strong> is one of<br />

the largest companies offering vocational training in<br />

Germany. Without the commitment of Rewe and other<br />

trading firms, the Dual System of job training and vocational<br />

education would not be possible." The minister<br />

made his remarks at the signing ceremony for the "Vocational<br />

Training Checks" in the framework of his <strong>2004</strong><br />

Job and Career Training Tour. With a total of 6,800<br />

trainees at the company, Rewe is among the largest firms<br />

offering vocational training in Germany.<br />

Rewe has been bearing its social responsibility in this<br />

manner for many years, and the company always trains<br />

more than it needs. Throughout Europe, a total of around<br />

8,000 young people are in training with Rewe <strong>Group</strong>,<br />

with 1,300 trainees at Rewe Austria alone.<br />

Different training options at Rewe provide opportunities<br />

starting at an early age all the way up to supermarket<br />

store manager or independent Rewe retailer. For those<br />

ready to begin their careers - and depending on their qualifications<br />

and school certificates - training options are<br />

available at the subsidiaries or at the Head Office of<br />

Rewe <strong>Group</strong> to pursue the careers of district manager,<br />

buyer or IT specialist, to name just a few.<br />

School leavers consistently begin their traineeship searches<br />

with an outdated picture of traineeships and apprenticeships<br />

in retailing. This is particularly true of their view<br />

of the working hours. Yet with modern human resource<br />

methods, the stress is no greater than in other businesses.<br />

Rewe <strong>Group</strong> is responding to the elevated expectations<br />

throughout the business even in the form of its training.<br />

Aside from training on the job, computer-based training<br />

(CBT) and web-based training (WBT) are becoming more<br />

important. The modern combination of theory and prac-

40<br />