FORM 20-F THOMSON multimedia - Technicolor

FORM 20-F THOMSON multimedia - Technicolor

FORM 20-F THOMSON multimedia - Technicolor

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

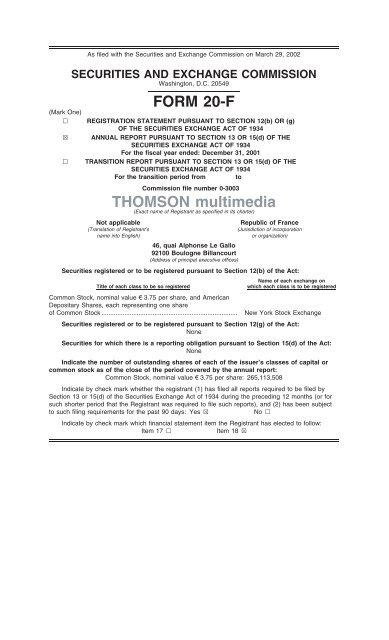

As filed with the Securities and Exchange Commission on March 29, <strong>20</strong>02<br />

SECURITIES AND EXCHANGE COMMISSION<br />

Washington, D.C. <strong>20</strong>549<br />

<strong>FORM</strong> <strong>20</strong>-F<br />

(Mark One)<br />

n REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g)<br />

OF THE SECURITIES EXCHANGE ACT OF 1934<br />

≤ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE<br />

SECURITIES EXCHANGE ACT OF 1934<br />

For the fiscal year ended: December 31, <strong>20</strong>01<br />

n TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE<br />

SECURITIES EXCHANGE ACT OF 1934<br />

For the transition period from to<br />

Commission file number 0-3003<br />

<strong>THOMSON</strong> <strong>multimedia</strong><br />

(Exact name of Registrant as specified in its charter)<br />

Not applicable Republic of France<br />

(Translation of Registrant’s (Jurisdiction of incorporation<br />

name into English) or organization)<br />

46, quai Alphonse Le Gallo<br />

92100 Boulogne Billancourt<br />

(Address of principal executive offices)<br />

Securities registered or to be registered pursuant to Section 12(b) of the Act:<br />

Name of each exchange on<br />

Title of each class to be so registered which each class is to be registered<br />

Common Stock, nominal value 0 3.75 per share, and American<br />

Depositary Shares, each representing one share<br />

of Common Stock ............................................................................. New York Stock Exchange<br />

Securities registered or to be registered pursuant to Section 12(g) of the Act:<br />

None<br />

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:<br />

None<br />

Indicate the number of outstanding shares of each of the issuer’s classes of capital or<br />

common stock as of the close of the period covered by the annual report:<br />

Common Stock, nominal value 0 3.75 per share: 265,113,508<br />

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by<br />

Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for<br />

such shorter period that the Registrant was required to file such reports), and (2) has been subject<br />

to such filing requirements for the past 90 days: Yes ≤ No n<br />

Indicate by check mark which financial statement item the Registrant has elected to follow:<br />

Item 17 n Item 18 ≤

<strong>20</strong>01 <strong>20</strong>-F<br />

Table of Contents<br />

INTRODUCTION............................................................................................................................ 3<br />

FORWARD-LOOKING STATEMENTS.......................................................................................... 3<br />

STATEMENTS REGARDING COMPETITIVE POSITION ............................................................ 4<br />

REPORTING CURRENCY ............................................................................................................<br />

PART I<br />

4<br />

ITEM 1 — IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS.................. 5<br />

ITEM 2 — OFFER STATISTICS AND EXPECTED TIMETABLE ................................................. 5<br />

ITEM 3 — KEY IN<strong>FORM</strong>ATION .................................................................................................... 6<br />

ITEM 4 — IN<strong>FORM</strong>ATION ON THE COMPANY .......................................................................... 14<br />

ITEM 5 — OPERATING AND FINANCIAL REVIEW AND PROSPECTS .................................... 35<br />

ITEM 6 — DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES ..................................... 57<br />

ITEM 7 — MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS ..................... 66<br />

ITEM 8 — FINANCIAL IN<strong>FORM</strong>ATION......................................................................................... 70<br />

ITEM 9 — THE OFFER AND LISTING ......................................................................................... 74<br />

ITEM 10 — ADDITIONAL IN<strong>FORM</strong>ATION .................................................................................... 79<br />

ITEM 11 — QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISKS...... 97<br />

ITEM 12 — DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES ................<br />

PART II<br />

101<br />

ITEM 13 — DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES ............................<br />

ITEM 14 — MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITIES HOLDERS<br />

102<br />

AND USE OF PROCEEDS ........................................................................................ 102<br />

ITEM 15 — RESERVED ................................................................................................................ —<br />

ITEM 16 — RESERVED ................................................................................................................<br />

PART III<br />

—<br />

ITEM 17 — FINANCIAL STATEMENTS........................................................................................ 103<br />

ITEM 18 — FINANCIAL STATEMENTS........................................................................................ 103<br />

ITEM 19 — EXHIBITS.................................................................................................................... 103<br />

2

INTRODUCTION<br />

In this Annual Report on Form <strong>20</strong>-F, the terms the ‘‘Company’’, the ‘‘Group’’, ‘‘Thomson’’,<br />

‘‘<strong>THOMSON</strong> <strong>multimedia</strong>’’, ‘‘we’’ and ‘‘our’’ mean <strong>THOMSON</strong> <strong>multimedia</strong> S.A. together with its<br />

consolidated subsidiaries.<br />

FORWARD-LOOKING STATEMENTS<br />

In order to utilize the ‘‘safe harbor’’ provisions of the U.S. Private Securities Litigation Reform<br />

Act of 1995, we are providing the following cautionary statement. This Annual Report contains<br />

certain forward-looking statements with respect to our financial condition, results of operations and<br />

business and certain of our plans and objectives. These statements are based on management’s<br />

current expectations and beliefs and are subject to a number of factors and uncertainties that could<br />

cause actual results to differ materially from those described in the forward-looking statements. In<br />

addition to statements that are forward-looking by reason or context, the words ‘‘may’’, ‘‘will’’,<br />

‘‘should’’, ‘‘expects’’, ‘‘plans’’, ‘‘intends’’, ‘‘anticipates’’, ‘‘believes’’, ‘‘estimates’’, ‘‘projects’’, ‘‘predicts’’<br />

and ‘‘continue’’ and similar expressions identify forward-looking statements. By their nature, forwardlooking<br />

statements involve risk and uncertainty because they relate to events and depend on<br />

circumstances that will occur in the future. Such statements are also subject to uncertain<br />

assumptions concerning, among other things: our anticipated growth strategies; our intention to<br />

introduce new products; anticipated trends in our business; and our ability to continue to control<br />

costs and maintain quality. We caution that these statements may, and often do, vary from actual<br />

results and the differences between these statements and actual results can be material.<br />

Accordingly, we cannot assure you that actual results will not differ materially from those expressed<br />

or implied by the forward-looking statements. Some of the factors that could cause actual results and<br />

events to differ materially from those expressed or implied in any forward-looking statements are:<br />

) economic conditions in countries in which our hardware devices and services are sold or<br />

patents licensed, particularly in the United States and Europe;<br />

) general economic trends, currency fluctuations, changes in raw materials and employee costs<br />

and political uncertainty in markets where we manufacture goods, purchase components and<br />

license patents, particularly in Latin America and Asia;<br />

) increased competition in video technologies, components, systems and services and hardware<br />

devices sold in the consumer electronics industry;<br />

) challenges inherent in our repositioning strategy;<br />

) future business combinations, acquisitions or dispositions;<br />

) technological advancements in the consumer electronics industry;<br />

) change in future exchange rates, notably between the euro and the U.S. dollar, Japanese<br />

yen, Canadian dollar, Mexican peso and Polish zloty;<br />

) our failure to maintain over the long term contractual arrangements with our customers,<br />

particularly in our Digital Media Solutions and Patents and Licensing divisions;<br />

) capital and financial market conditions, prevailing interest rates and availability of<br />

financing; and<br />

) warranty claims, product recalls or litigation that exceed our available insurance coverage.<br />

Furthermore, a review of the reasons why actual results and developments may differ materially<br />

from the expectations disclosed or implied within forward-looking statements can be found under<br />

‘‘Risk Factors’’ below. Forward-looking statements speak only as of the date they are made, and we<br />

undertake no obligation to publicly update any of them in light of new information or future events.<br />

3

We advise you to consult any documents we may file or furnish with the U.S. Securities and<br />

Exchange Commission (‘‘SEC’’), as described under ‘‘Documents on Display’’.<br />

STATEMENTS REGARDING COMPETITIVE POSITION<br />

This Annual Report contains statements regarding our market share, market position and<br />

products and businesses. Unless otherwise noted herein, these market estimates are based on the<br />

following outside sources, in some cases in combination with internal estimates:<br />

) Understanding & Solutions for information on CD and DVD (Digital Media Solutions);<br />

) World Color Picture Tube Sales (‘‘W.C.P.T.S.’’) for information on tubes worldwide (Displays<br />

and Components);<br />

) Gesellschaft für Konsumer Markt- und Absatzforschung (‘‘GfK’’) for information on TV, VCR,<br />

DVD and audio in the ‘‘Europe 5’’ market which comprises France, Germany, the United<br />

Kingdom, Italy and Spain (Consumer Products); and<br />

) Institute for Market Research (‘‘IMR’’) for information on TV, VCR, DVD, audio and telephony<br />

in the Americas (Consumer Products).<br />

Statements contained in this Annual Report that make reference to ‘‘value market share’’ or<br />

market share ‘‘based on value’’ mean that the related market estimate is based on sales, and<br />

statements referring to ‘‘volume market share’’ or market share ‘‘based on volume’’ mean that the<br />

related market estimate is based on the number of units sold.<br />

Market share and market position statements are generally based on sources published in the<br />

third quarter of <strong>20</strong>01 unless otherwise indicated. Statements concerning our <strong>Technicolor</strong> businesses<br />

are based on a combination of internal estimates and external sources published at mid-year <strong>20</strong>01.<br />

REPORTING CURRENCY<br />

Our consolidated financial statements that form part of this Annual Report on Form <strong>20</strong>-F are<br />

presented in euro. Effective January 1, <strong>20</strong>01, our consolidated financial statements are presented<br />

using the euro as our reporting currency. Our consolidated financial statements for <strong>20</strong>00 and 1999,<br />

which were prepared in French francs, have been translated into euro using the legal rate of<br />

conversion between French francs and the euro which was fixed on December 31, 1998 at<br />

0 1.00 = FF 6.55957.<br />

The selected financial data for 1997 and 1998 were derived from our consolidated financial<br />

statements for those years and have been restated from French francs into euro using the official<br />

fixed exchange rate established at December 31, 1998. These selected financial data may not be<br />

comparable to those of other companies that are also reporting in euro if those companies restated<br />

their financial statements from a currency other than the French franc.<br />

For your convenience, this Annual Report contains translations of certain euro amounts into<br />

U.S. dollars. Unless otherwise indicated, dollar amounts have been translated from euro at the rate<br />

of 0 1.00 = U.S.$0.8713, the noon buying rate in New York City for cable transfers in euro as<br />

announced by the Federal Reserve Bank of New York for customs purposes (the ‘‘Noon Buying<br />

Rate’’) on February 25, <strong>20</strong>02.<br />

4

PART I<br />

ITEM 1 — IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS<br />

Not applicable.<br />

ITEM 2 — OFFER STATISTICS AND EXPECTED TIMETABLE<br />

Not applicable.<br />

5

ITEM 3 — KEY IN<strong>FORM</strong>ATION<br />

A — Selected Financial Data<br />

We have derived the following selected consolidated financial data from our consolidated<br />

financial statements for the five-year period ended December 31, <strong>20</strong>01. You should read the<br />

following selected consolidated financial data together with the section entitled Item 5: ‘‘Operating<br />

and Financial Review and Prospects’’ and our consolidated financial statements.<br />

Figures for 1997 and 1998 have been restated to take into account changes in our accounting<br />

methods adopted in 1999 with respect to ‘‘net cash discounts’’ and general and administrative<br />

expenses.<br />

Our consolidated financial statements have been prepared in accordance with French GAAP,<br />

which differs in certain significant respects from U.S. GAAP. Notes 29 and 30 to our consolidated<br />

financial statements describe the principal differences between French GAAP and U.S. GAAP as<br />

they relate to us and reconcile our net income and shareholders’ equity. We also summarize these<br />

differences in Item 5: ‘‘Operating and Financial Review and Prospects’’. We have provided below<br />

certain financial data prepared in accordance with U.S. GAAP.<br />

1997 1998 1999 <strong>20</strong>00 <strong>20</strong>01 (1)<br />

<strong>20</strong>01<br />

1 1 1 1 1 (U.S.$)<br />

(in millions except share and per-share data)<br />

Income Statement Data:<br />

Net sales................................................. 5,783 5,629 6,690 9,094 10,494 9,143<br />

Digital Media Solutions ........................ — — 184 148 1,821 1,586<br />

Displays and Components................... 1,232 1,151 1,279 1,686 1,642 1,431<br />

Consumer Products ............................. 4,470 4,405 4,940 6,862 6,582 5,735<br />

Patents and Licensing ......................... 67 67 278 378 395 344<br />

New Media Services ............................ — — — 9 44 38<br />

Corporate (2) ........................................... 14 6 9 11 10 9<br />

Cost of sales............................................ (4,677) (4,366) (5,065) (6,915) (8,116) (7,071)<br />

Gross margin ...........................................<br />

Selling, general and<br />

1,106 1,263 1,625 2,179 2,378 2,072<br />

administrative expense ........................ (823) (835) (969) (1,282) (1,374) (1,197)<br />

Research and development expense...... (283) (284) (290) (351) (368) (321)<br />

Operating income (loss) ....................... 0 144 366 546 636 554<br />

Digital Media Solutions ........................ — — 8 3 239 <strong>20</strong>8<br />

Displays and Components................... 177 216 216 262 105 91<br />

Consumer Products ............................. (96) (15) 85 172 134 117<br />

Patents and Licensing ......................... 53 47 218 319 350 305<br />

New Media Services ............................ — (9) (55) (83) (82) (71)<br />

Corporate (2) ........................................... (134) (95) (106) (127) (110) (96)<br />

Interest expense, net (3) ............................ (117) (54) (41) (10) (29) (25)<br />

Other financial expense, net (4) ................. (86) (37) (39) (67) (160) (139)<br />

Other income (expense), net (5) ................ (214) (27) (6) (81) 8 7<br />

Income tax (6) ............................................<br />

Net income (loss) before<br />

(2) (8) (50) 1 (139) (121)<br />

minority interests.................................. (424) 15 224 376 264 230<br />

Minority interests...................................... — 1 7 18 22 19<br />

Net income (loss) .................................. (424) 16 231 394 286 249<br />

Basic net income (loss) per share (7) ....... (5.96) 0.05 1.17 1.56 1.04 0.91<br />

Diluted net income (loss) per share (7)(8) ..<br />

Weighted average number of<br />

(5.96) 0.05 1.17 1.56 1.04 0.91<br />

shares outstanding............................... 71,101,816 282,443,712 197,526,322 252,039,992 274,181,607 274,181,607<br />

6

1997 1998 1999 <strong>20</strong>00 <strong>20</strong>01 (1)<br />

<strong>20</strong>01<br />

1 1 1 1 1 (U.S.$)<br />

(in millions except share and per-share data)<br />

Approximate amounts in accordance<br />

with U.S. GAAP (9)<br />

Operating income (loss) .......................... (107) 69 169 284 <strong>20</strong>4 178<br />

Net income (loss) .................................... (330) (29) 148 136 191 167<br />

Basic income (loss) per share (7) .............. (17.86) (0.22) 0.77 0.54 0.72 0.63<br />

Diluted income (loss) per share (7)(8) ........ (17.86) (0.22) 0.76 0.54 0.69 0.60<br />

(1) The acquisition of <strong>Technicolor</strong> and the other companies purchased in <strong>20</strong>01 impacted our results of operations. Restated<br />

to eliminate the effect of these acquisitions, <strong>20</strong>01 net sales would have accounted for 3 8,777 million and operating<br />

income would have been 3 379 million. See Note 2 to our consolidated financial statements.<br />

(2) ‘‘Corporate’’ amounts consist principally of research carried out centrally by us and other corporate costs not allocated to<br />

our operating segments.<br />

(3) At the end of 1997, we used the proceeds from Thomson S.A.’s 3 1,657 million capital contribution to reduce our net debt<br />

by 3 1,514 million, which significantly reduced our net interest expense in 1998 compared with 1997. We used the<br />

3 610 million and part of the 3 844 million net proceeds from our public equity offerings realized in November 1999 and<br />

October <strong>20</strong>00 and concurrent capital increases to further reduce our net debt. Includes in <strong>20</strong>01 3 25 million of interest on<br />

the promissory notes due to Carlton and relating to the acquisition of <strong>Technicolor</strong>. See Note 5 to our consolidated<br />

financial statements.<br />

(4) Other financial expense, net, includes principally valuation allowances on investments carried at cost, interest on pension<br />

plans and other non-financial payables. For further details, please refer to Note 5 to our consolidated financial statements.<br />

(5) Other income (expense), net, is discussed further under Item 5: ‘‘Operating and Financial Review and Prospects’’. For<br />

further details, please refer to Note 6 of our consolidated financial statements.<br />

(6) Our income tax expense through the end of <strong>20</strong>00 was affected by the ‘‘tax indemnification agreement’’ with<br />

Thomson S.A., as described in Item 5: ‘‘Operating and Financial Review and Prospects’’. Pursuant to this agreement,<br />

Thomson S.A. paid to us 3 51 million in respect of the 1998 fiscal year, 3 58 million in respect of the 1999 fiscal year, and<br />

3 82 million in respect of the <strong>20</strong>00 fiscal year. This agreement expired at year-end <strong>20</strong>00.<br />

(7) Net income (loss) per share for each year shown equals net income (loss) for that year divided by average number of<br />

shares outstanding for such year. As the number of shares outstanding has varied from year to year since 1996, the net<br />

income (loss) per share figure is not comparable on a year-to-year basis. Includes in <strong>20</strong>01 redeemable bonds subscribed<br />

by Carlton, redeemed for 15.5 million of our shares on March 16, <strong>20</strong>02.<br />

(8) See Note 17 to our consolidated financial statements.<br />

(9) Please refer to Item 5: ‘‘Operating and Financial Review and Prospects — Overview — Principal Differences between<br />

French GAAP and U.S. GAAP’’ and Notes 29 and 30 to our consolidated financial statements for further details.<br />

7

1997 1998 1999 <strong>20</strong>00 <strong>20</strong>01 <strong>20</strong>01<br />

1 1 1 1 1 (U.S.$)<br />

(in millions)<br />

Balance Sheet Data:<br />

Intangible assets, net (1) ......................................... 78 67 168 196 1,696 1,478<br />

Property, plant and equipment, net....................... 1,107 994 1,090 1,122 1,536 1,338<br />

Total investments and other non-current assets.... 57 79 245 314 417 364<br />

Total fixed assets .................................................. 1,242 1,140 1,503 1,632 3,649 3,180<br />

Inventories ............................................................. 9<strong>20</strong> 907 1,108 1,477 1,1<strong>20</strong> 975<br />

Other current assets.............................................. 1,265 1,323 1,952 2,4<strong>20</strong> 3,489 3,040<br />

Cash and cash equivalents (2) ................................ 331 268 402 1,772 1,532 1,335<br />

Total assets.......................................................... 3,758 3,638 4,965 7,301 9,790 8,530<br />

Reserves for retirement benefits........................... 502 527 590 633 709 618<br />

Restructuring reserves .......................................... 290 152 156 179 183 159<br />

Other reserves....................................................... 212 235 225 277 246 214<br />

Financial debt (short-term and long-term) (3) .......... 1,183 777 361 1,143 1,131 986<br />

Total current liabilities (4) ......................................... 983 1,080 1,841 2,155 3,492 3,043<br />

Minority interests ................................................... 2 3 73 54 71 62<br />

Shareholders’ equity (5) ...........................................<br />

Total liabilities, shareholders’ equity and<br />

586 864 1,719 2,860 3,958 3,448<br />

minority interests.............................................<br />

Approximate amounts in accordance with<br />

U.S. GAAP<br />

3,758 3,638 4,965 7,301 9,790 8,530<br />

Shareholders’ equity.............................................. 834 1,144 2,794 3,411 3,399 2,962<br />

(1) Our intangible assets consist principally of goodwill, patents and trademarks, development costs that we capitalized until<br />

the end of 1997, and software. In <strong>20</strong>00, the goodwill related mainly to the ATLINKS acquisition (1999) and the<br />

Singingfish.com acquisition (<strong>20</strong>00). Our intangible assets at December 31, <strong>20</strong>01 included goodwill relating to our<br />

acquisition of <strong>Technicolor</strong> (3 712 million), the <strong>Technicolor</strong> trademark (3 261 million) and <strong>Technicolor</strong> customer relationships<br />

(3 340 million).<br />

(2) In October <strong>20</strong>00, we realized 3 844 million in net proceeds from our global equity offering. In addition, we issued<br />

11,175,385 convertible/exchangeable bonds (<strong>20</strong>00 OCEANEs) due <strong>20</strong>06 for an aggregate amount of 3 812 million.<br />

(3) In late 1999, we raised 3 610 million of new capital, which we also used to repay debt that the we owed to Thomson S.A.<br />

and Thomson Brandt International B.V., reducing our debt to these companies to 3 9 million. In October <strong>20</strong>00, we issued<br />

11,175,385 convertible/exchangeable bonds (<strong>20</strong>00 OCEANEs) due <strong>20</strong>06 for an aggregate amount of 3 812 million.<br />

(4) Includes in <strong>20</strong>01 U.S.$600 million of promissory notes due to Carlton for the acquisition of <strong>Technicolor</strong> (3 681 million at<br />

the December 31, <strong>20</strong>01 closing rate).<br />

(5) In <strong>20</strong>01 includes 3 761 million non-transferable, non-interest bearing bonds owed to Carlton, which were redeemed for<br />

15.5 million of our shares on March 16, <strong>20</strong>02.<br />

1997 1998 1999 <strong>20</strong>00 <strong>20</strong>01 <strong>20</strong>01<br />

1 1 1 1 1 (U.S.$)<br />

(in millions)<br />

Cash Flow Data:<br />

Net cash provided by (used in)<br />

operating activities ................................................ 252 236 435 410 1,005 876<br />

Net cash used by investing activities.......................<br />

Net cash provided by (used in)<br />

(280) (237) (366) (398) (1,173) (1,022)<br />

financing activities.................................................<br />

Net increase (decrease) in cash and<br />

151 (86) 17 1,413 (34) (30)<br />

cash equivalents ................................................... 144 (63) 134 1,370 (240) (<strong>20</strong>9)<br />

8

B — Exchange Rate Information<br />

Our shares are denominated in euro. Fluctuations in the exchange rate between the euro and<br />

the U.S. dollar will affect the U.S. dollar price of our American Depositary Shares (‘‘ADSs’’) on the<br />

New York Stock Exchange. In addition, as we intend to pay any cash dividends in euro, exchange<br />

rate fluctuations will affect the U.S. dollar amounts that owners of ADSs will receive on conversion of<br />

dividends. In addition, fluctuations in the exchange rate between the euro and the U.S. dollar will<br />

affect the U.S. dollar equivalent of the price of our shares on Euronext Paris S.A.<br />

The following table shows the U.S. dollar/euro exchange rate for the periods presented based<br />

on the Noon Buying Rate. Because the euro did not exist prior to January 1, 1999, it is not possible<br />

to present exchange rates between euro and U.S. dollars for earlier periods, and euro/U.S. dollar<br />

exchange rates for these periods converted from currencies other than the French franc will differ.<br />

Exchange rates for 1997 and 1998 have been taken from exchange rates between the U.S. dollar<br />

and the French franc for those periods and translated to euro using the legal exchange rate of<br />

0 1.00 = FF 6.55957. We do not make any representations that French francs or euro could have<br />

been converted into dollars at the rates shown or at any other rate.<br />

Month Period End<br />

Average<br />

Rate (1)<br />

High Low<br />

(U.S. dollar/euro)<br />

February <strong>20</strong>02 .......................................................................... 0.87 0.87 0.88 0.86<br />

January <strong>20</strong>02............................................................................ 0.86 0.88 0.90 0.86<br />

December <strong>20</strong>01........................................................................ 0.89 0.89 0.90 0.88<br />

November <strong>20</strong>01........................................................................ 0.90 0.89 0.90 0.88<br />

October <strong>20</strong>01............................................................................ 0.90 0.91 0.92 0.89<br />

September <strong>20</strong>01....................................................................... 0.91 0.91 0.93 0.89<br />

(1) The average of the Noon Buying Rates for euro on the business days of each month during the relevant period.<br />

Source: Federal Reserve Bank of New York<br />

Year Period End<br />

Average<br />

Rate (1)<br />

High Low<br />

(U.S. dollar/euro)<br />

<strong>20</strong>01.......................................................................................... 0.89 0.89 0.95 0.84<br />

<strong>20</strong>00.......................................................................................... 0.94 0.92 1.03 0.83<br />

1999.......................................................................................... 1.00 1.07 1.18 1.00<br />

1998.......................................................................................... 0.86 0.90 0.95 0.82<br />

1997.......................................................................................... 0.92 0.89 0.97 0.79<br />

(1) The average of the Noon Buying Rates for euro (or French francs translated into euro for 1997 and 1998) on the last<br />

business day of each month during the relevant period.<br />

Source: Federal Reserve Bank of New York<br />

The euro/U.S. dollar exchange rate for March 27, <strong>20</strong>02 was 0 1.00 = U.S. 0.8726 and is based<br />

on the Noon Buying Rate for such date.<br />

C — Risk factors<br />

This section describes some of the risks that could affect our businesses. The factors below<br />

should be considered in connection with any forward-looking statements in this document and with<br />

the cautionary statements contained in ‘‘Forward-Looking Statements’’ at the beginning of this<br />

document.<br />

The risks below are not the only ones that we face — some risks may not yet be known to us<br />

and some that we do not currently believe to be material could later turn out to be material. Any of<br />

9

these risks could materially affect our business, our revenues, operating income, net income, net<br />

assets, liquidity and our capital resources.<br />

Economic conditions may adversely affect our results and financial condition.<br />

General economic trends in the countries in which our products and services are sold, primarily<br />

in North America and Europe, can have a significant impact on prices and demand for such products<br />

and services.<br />

Decreases in prices and demand in the markets in which we sell our products and services<br />

could result in further pressure on our profit margins, particularly in our Displays and Components<br />

and Consumer Products divisions, which could in turn adversely affect our financial results.<br />

Prices for hardware devices and components for the consumer electronics industry are affected<br />

also by economic trends in the countries or regions in which these products are manufactured. An<br />

economic crisis in a producing region can lead to a decrease in local demand and, if the value of<br />

the local currency decreases, a decrease in the production costs of local producers. These factors<br />

could lead to intensified export competition and aggressive price-cutting by these producers. This<br />

could result in pressure on profit margins.<br />

In addition, we produce and purchase a large number of goods in emerging markets and are<br />

subject to risks inherent in such markets, including currency fluctuations, political uncertainty,<br />

exchange controls and expropriation of assets. These risks could disrupt our production in such<br />

countries and our ability to produce and procure goods for sale in our principal North American and<br />

European markets. For more detailed discussions on our sales in our principal markets, see Item 5:<br />

‘‘Operating and Financial Review and Prospects’’, and for more information on our main production<br />

sites, see Item 4: ‘‘Information on the Company — Property, Plants and Equipment’’.<br />

We face strong competition in our consumer electronics activity. Competition may push<br />

prices to unprofitable levels, which could adversely affect our financial results.<br />

Hardware devices and components for consumer electronics markets are subject to intense<br />

price competition. Furthermore, due to technological innovation and ease of imitation, new products<br />

tend to become standardized rapidly, leading to intense competition and price declines. As a result<br />

of these factors, the hardware devices and components sold in the consumer electronics industry<br />

have experienced and continue to experience long-term price declines. In addition, the production of<br />

some of the components for televisions and other audiovisual products, such as tubes, may carry<br />

high fixed costs that do not vary with output levels. As a result, producers of such components must<br />

maintain a minimum sales volume to cover their fixed costs. When many producers resort to<br />

maintaining minimum sales volumes during periods of falling demand for these components, market<br />

prices tend to fall. Price-driven competition may result in reduction of profit margins and, in some<br />

cases, losses, in our Displays and Components and Consumer Products divisions. In order to<br />

protect our margins and improve our operating efficiency in the face of continuing price pressure, we<br />

have implemented a number of restructuring plans and expect that restructuring will remain an<br />

integral part of our business.<br />

We are implementing a repositioning strategy. This strategy may fail.<br />

Since the second half of <strong>20</strong>00, we have been implementing a strategy to occupy leading<br />

positions in the video chain, particularly within our Digital Media Solutions division, and to take<br />

advantage of the ongoing transition within the entertainment and media industries to digital<br />

technologies. For a more detailed discussion of our repositioning strategy, see Item 4: ‘‘Information<br />

on the Company — History and Development of the Company — Our Strategy’’. The success of this<br />

strategy depends on a number of factors outside of our control, including the continued growth in<br />

demand for our video and digital products and services, our ability to develop or acquire new<br />

products and services to complement our existing offering, our ability to compete in markets in which<br />

10

we have limited operating history, the acceptance of our new products and services and expanded<br />

market presence by existing and new customers, the development of working relationships with new<br />

partners and the development of synergies among new and existing businesses. This strategy may<br />

encounter problems as we move into new business areas, and as new risks, some not yet known,<br />

related to dependence on new technologies or customers may develop and harm our future<br />

business prospects.<br />

Our acquisition strategy poses risks and uncertainties typical of such transactions.<br />

Our strategy and future growth depends in part on our ability to identify suitable acquisition<br />

targets, to finance and to achieve such acquisitions and to achieve and to obtain regulatory approval<br />

for these acquisitions. In addition, we will face risks associated with these acquisitions, including the<br />

integration of numerous entities and organizations, large numbers of persons and facilities and new<br />

relationships with different customers. We may also face an increase in our debt and interest<br />

expense. Potential difficulties inherent in mergers and acquisitions, such as delays in implementation<br />

or unexpected costs or liabilities, as well as the risk of not realizing operating benefits or synergies<br />

from completed transactions, may adversely affect our results.<br />

Technological innovations can make older products less competitive. We could be at a<br />

competitive disadvantage if we are unable to develop or have access, either independently or<br />

through alliances, to new products and technologies in advance of our competitors.<br />

The markets in which we operate are undergoing a rapid technological evolution resulting from<br />

the increasing use of digital technology and an increasing overlap among television, telecommunications<br />

and personal computers. Technological advances and new product introductions may render<br />

obsolete or significantly reduce the value of previously existing technologies, products and<br />

inventories. This could have a significant adverse effect on our ability to sell these products and to<br />

make a profit from these sales. For example, the emergence of digital technology has had this effect<br />

on many products using older analog technology. The emergence of new technologies could also<br />

have an adverse effect on the value of our existing patents.<br />

We expect that the development of digitalization and the convergence of television, telecommunications<br />

and personal computers will increase the pace and importance of technological<br />

advancement in our industry. As a result, we are investing large sums in the development and<br />

marketing of new products and services. These investments might be made in unproven<br />

technologies or for products with no proven markets and may therefore yield limited returns.<br />

Currency exchange rate fluctuations may lead to decreases in our financial results.<br />

To the extent that we incur costs in one currency and make our sales in another, our profit<br />

margins may be affected by changes in the exchange rates between the two currencies. Most of our<br />

sales are in U.S. dollars and in euro; however, a large portion of our expenses are denominated in<br />

Japanese yen, Mexican peso and Polish zloty, in particular those of our significant production<br />

facilities in Asia, Mexico and Poland. Ongoing plant relocation initiatives are likely to continue to<br />

increase the proportion of expenses incurred in emerging market currencies. While most emerging<br />

market currencies have been in decline in the recent past and have thus allowed us to reduce our<br />

manufacturing and procurement costs, an unhedged increase in the value of these currencies would<br />

increase these costs. Although our general policy is to hedge against these currency transaction<br />

risks on an annual or six month basis, given the volatility of currency exchange rates, we cannot<br />

assure you that we will be able to manage effectively these risks. Volatility in currency exchange<br />

rates may generate losses, which could have a material adverse effect on our financial condition or<br />

results of operations. For more detailed information on our hedging policies, see Item 11:<br />

‘‘Quantitative and Qualitative Disclosures about Market Risks’’.<br />

11

Product defects resulting in a large-scale product recall or successful product liability claims<br />

against us could result in significant costs or negatively impact our reputation and could<br />

adversely affect our business results and financial condition.<br />

We are sometimes exposed to warranty and product liability claims in cases of product failure.<br />

There can be no assurance that we will not experience material product liability losses arising from<br />

such claims in the future and that these will not have a negative impact on our reputation and,<br />

consequently, our sales. We maintain insurance against such product liability claims and record<br />

warranty provisions in our accounts based on its historical defect rates, but there can be no<br />

assurance that these coverage and warranty provisions will be adequate for liabilities ultimately<br />

incurred. In addition, there is no assurance that insurance will continue to be available on terms<br />

acceptable to us. A successful claim that exceeds our available insurance coverage or a product<br />

recall could have a material adverse impact on our financial condition and results of operations.<br />

The performance of several of our businesses is dependant in large part on the long-term<br />

maintenance of contractual arrangements with our customers. Our financial results may<br />

suffer if we are unable to renew these contracts when they expire or if we are only able to<br />

renew them under significantly less favorable terms.<br />

The net sales of certain of our business activities, particularly those in our Digital Media<br />

Solutions and Patents and Licensing divisions, depend on contracts that may have a duration of<br />

several years or are expected to be renewed at their expiration. In addition, in certain cases these<br />

contractual relationships may be with a relatively limited number of customers. Although most of our<br />

major client relationships are typically the result of multiple contractual arrangements of varying<br />

terms, in any given year certain of these contracts come up for renewal. For example, the<br />

performance of <strong>Technicolor</strong>, the largest contributor to the net sales of our Digital Media Solutions<br />

division, currently depends on a concentrated customer base that accounts for a substantial portion<br />

of the division’s net sales, including several contracts with major U.S. film studios, software and<br />

games manufacturers and television studios, with whom we generally negotiate exclusive, long-term<br />

contracts. The licensing agreements that generate our Patents and Licensing division’s net sales<br />

typically have a duration of five years, and our top-ten licensees account for approximately 60% of<br />

the division’s total licensing revenues. If several major contracts were to come up for renewal at the<br />

same time, and we were unable to renew them under similar or more favorable terms, our financial<br />

results could suffer.<br />

Our success depends upon recruiting and retaining key personnel.<br />

Our products, services and technologies are complex, and our future growth and success<br />

depend to a significant extent on the skills of capable engineers and other key personnel. Continued<br />

re-training of currently competent personnel is also necessary to maintain a superior level of<br />

innovation and technological advance. The ability to recruit, retain and develop quality staff is a<br />

critical success factor for us.<br />

Our major shareholders retain significant voting rights and representation on our Board of<br />

Directors, giving them the ability to influence our affairs.<br />

Thomson S.A., Alcatel, DIRECTV, Microsoft and NEC have significant shareholdings in<br />

Thomson. Carlton became a significant shareholder as of March 16, <strong>20</strong>02, upon the mandatory<br />

conversion of outstanding redeemable bonds (ORAs). Furthermore, as part of the industrial<br />

partnerships developed with leaders in related industries in order to strengthen our position in<br />

different markets, we have worked on several business initiatives with Alcatel, DIRECTV, Microsoft<br />

and NEC since 1997 and with Carlton since <strong>20</strong>01. Each of these entities is represented on our<br />

Board of Directors, and while none of these shareholders individually has the ability to control the<br />

our affairs, each may have some ability to influence our decision making and to directly impact the<br />

12

projects that such shareholder may be implementing jointly with us. For more detailed information on<br />

our shareholders, see Item 7: ‘‘Major Shareholders and Related Party Transactions’’.<br />

Our share price has been volatile in recent years.<br />

The stock market in recent years has experienced extreme price and volume fluctuations which<br />

have particularly affected the market prices of technology companies. Volatility in our share price has<br />

also been significant during this period. This volatility can result in losses for investors in a relatively<br />

short period of time.<br />

13

ITEM 4 — IN<strong>FORM</strong>ATION ON THE COMPANY<br />

A — History and Development of the Company<br />

Company Profile<br />

Legal and Commercial name: <strong>THOMSON</strong> <strong>multimedia</strong> S.A.<br />

Registered office address: <strong>THOMSON</strong> <strong>multimedia</strong><br />

46, quai Alphonse Le Gallo<br />

92100 Boulogne-Billancourt France<br />

Tel.: 33 (0) 1 41 86 50 00<br />

Fax: 33 (0) 1 41 86 58 59<br />

E-mail: webmasterhq@thmulti.com<br />

Name and address of agent for service of process in the U.S.:<br />

<strong>THOMSON</strong> <strong>multimedia</strong>, Inc.<br />

10330 North Meridian Street<br />

Indianapolis, IN 46290<br />

Domicile, legal form and applicable legislation: Thomson is a French corporation (société<br />

anonyme) with a Board of Directors, governed by the French Commercial Code (Livre II du Code de<br />

Commerce) pertaining to corporations and by all laws and regulations pertaining to corporations.<br />

Date of incorporation and length of life of the Company: Thomson was formed on August 24,<br />

1985. It was registered on November 7, 1985 for a term of 99 years, expiring on November 6, <strong>20</strong>84.<br />

Fiscal year: January 1 to December 31.<br />

We provide a wide range of technologies, systems, finished products and services, with a<br />

particular focus on video, to consumers and professionals in the entertainment and media industries.<br />

In recent years we have expanded beyond our traditional consumer electronics activities to<br />

reposition ourselves as a solutions provider present on each link of the video chain. In fiscal year<br />

<strong>20</strong>01, we generated net sales of 0 10.5 billion. At December 31, <strong>20</strong>01, we had approximately 64,000<br />

employees in more than thirty countries.<br />

The Video Chain<br />

The video chain covers the space over which video images are developed, distributed and<br />

accessed and across which the players in the entertainment and media industries interact. We rely<br />

upon our technological expertise, the breadth of our hardware and service offerings, the reputation<br />

and position of our brands and our network of leading partners to serve the needs of customers at<br />

each of the three key links in the video chain:<br />

) content development, the first link and entry point in the video chain, comprises products and<br />

services that enable the capture, creation, post-production, preparation and management of<br />

<strong>multimedia</strong> content consisting of video images and associated sound and data. Customers are<br />

primarily film studios and other content creators as well as broadcasters. Their needs range<br />

from film colorization and digital post-production services, to digital broadcast equipment and<br />

systems integration.<br />

) content distribution, the middle link in the chain, involves products and services that together<br />

enable content to be transmitted from the creator to the end-consumer for use typically in the<br />

movie theater or in the home. Key customers include film studios, software and game<br />

14

publishers, network operators and exhibitors. These customers have needs that encompass<br />

the processing, packaging, and distribution of analog and digital content in both physical and<br />

electronic media formats via physical distribution channels or electronic distribution networks.<br />

) content access, the final link of the video chain, consists of products and services that allow<br />

consumers to access, view and interact with content and that provide a means for content<br />

creators and advertisers to reach these consumers using a variety of media formats and<br />

devices. The content access link includes consumer electronics and other devices that directly<br />

receive, store and display media content along with critical components that enable specific<br />

video-related functionality within these devices. Key customers are electronics manufacturers,<br />

advertisers, retailers of consumer electronics and end consumers.<br />

Underlying the video chain is a group of coherent technologies which allow players in the<br />

entertainment and media industries to interact within and among the various links in the video chain.<br />

The entertainment and media industries are experiencing transformations due to the transition<br />

from analog to digital technologies, and in addition, the development of broadband penetration.<br />

Since the mid-1990s, far-reaching technological changes, driven in large part by the emergence of<br />

digital technologies along with the increased convergence of consumer electronics, telecommunications<br />

and information technologies, have led to new products and forms of content delivery. The<br />

transition to digital technology is proceeding at different speeds and has reached various stages of<br />

progress for participants within each video industry segment. We believe that this trend will continue<br />

over the medium and long term and that analog and digital content delivery, storage and access<br />

technologies will co-exist for several years. The length of the transition will depend, among other<br />

factors, upon the pace of technological development, deployment of infrastructure, introduction of<br />

finished products and acceptance by players in the entertainment and media industries and of<br />

course consumers.<br />

Our Strategy<br />

Our overall strategy is to occupy leading positions within each of the links in the video chain.<br />

We implement this strategy by supplying products, equipment and services that enable video content<br />

to flow from one end of the chain to the other. We strive to provide our clients with the range of<br />

products and services that enable them to transition to digital technology at their own pace and in<br />

line with the needs of their particular markets. We believe that our presence throughout the video<br />

chain allows us to improve our understanding of the varying needs of our diverse customer base<br />

and enables us to develop and share technologies both within and among our business divisions. It<br />

also provides us close contact with consumers on the one hand, which helps us to assess their<br />

needs and preferences, and with content producers and distributors on the other hand, improving<br />

our ability to anticipate future developments. As a result, we are able to develop new solutions for<br />

participants in the video chain, and propose a more integrated product and services offering.<br />

We believe that as a result of our strategy we will expand and diversify our scope of business<br />

within the professional and higher growth markets of the entertainment and media industries while<br />

reducing our emphasis on lower growth retail consumer electronics activities. We also believe our<br />

presence throughout the video chain and our focus on higher value-added segments will allow us to<br />

increase the stability of our revenues and to improve operating income by diversifying our customer<br />

base within the video chain as well as allowing us to play a greater role in the development of<br />

products and technology standards that are driving the digital transition.<br />

In addition to relying upon organic growth, our strategy contemplates selective acquisitions to<br />

acquire key technology and strengthen our position along the video chain.<br />

15

Our Group<br />

In order effectively to pursue our strategy and to serve our wide customer base, we are<br />

organized into divisions that cover the entire video chain and address our principal customer<br />

categories: media/entertainment groups, manufacturers and technology groups and retailers and<br />

consumers.<br />

) Digital Media Solutions, a new division in <strong>20</strong>01 which recorded consolidated net sales of<br />

0 1.8 billion, positions us along the content development and content distribution links of the<br />

video chain through the delivery of products and solutions for professionals in the<br />

entertainment and media industry (mainly film studios and broadcasters). Through this<br />

division’s activities, we are the world leader in content preparation and distribution services to<br />

the film and media industry. We also believe that we are the second-largest supplier of<br />

broadcast equipment.<br />

) Displays and Components, which generated 0 2.4 billion in total net sales in <strong>20</strong>01 (including<br />

internal sales), covers the content access link of the video chain and provides key<br />

components, which are sold both internally and to original equipment manufacturers<br />

(‘‘OEMs’’), for products in the electronics industry. In <strong>20</strong>01, these components included<br />

displays for television sets, digital optical components for DVD players and game consoles<br />

and the development of integrated circuits. Through this division, we are the second-largest<br />

producer of large and very large size TV picture tubes in the world based on volume and are<br />

also a leader in optical components.<br />

) Consumer Products, which in <strong>20</strong>01 recorded consolidated net sales of 0 6.6 billion, also<br />

covers the content access link of the video chain and provides traditional consumer<br />

electronics products such as television sets, DVD and VCR players, audio systems and<br />

residential telephones to retailers and eventually, the end-customer. This division also<br />

develops and markets broadband access products such as digital set-top boxes, cable<br />

modems and DSL modems for network operators.<br />

Thomson markets these products primarily under its two key brands: RCA˛ in the United<br />

States and <strong>THOMSON</strong>˛ in Europe. Through this division, we are the leader in the United<br />

States and third in Europe in TV, the second in consumer audio markets in the United States,<br />

the third-largest DVD player supplier in the United States and hold strong positions in TV<br />

accessories. We believe that we are the world-wide leader in digital set-top boxes, and with<br />

ATLINKS, a joint venture with Alcatel, are a world leader in home telephony.<br />

) Patents and Licensing, which in <strong>20</strong>01 recorded consolidated net sales of 0 395 million,<br />

underlies and supports all three key links in the video chain. Through this division, we<br />

manage a major portfolio of patents relating principally to video technologies which we license<br />

to other manufacturers and technology groups.<br />

) New Media Services, which in <strong>20</strong>01 recorded consolidated net sales of 0 44 million, is<br />

positioned along both the content distribution and content access links of the video chain. This<br />

division develops technologies and solutions that enable interactivity for a wide range of<br />

customers including media groups, advertisers and consumers.<br />

Our offering to network operators for the transmission of video content to consumers is made<br />

through Nextream’s infrastructure business and our Broadband Access Products activity. These two<br />

businesses work together to address the needs of network operators and are managed together.<br />

Our repositioning along the entire video chain has diversified our customer base. In the past, we<br />

developed strong relationships with retailers through our emphasis on the consumer electronics<br />

business. Since 1997, we have expanded our customer base through our Displays and Components<br />

business to include manufacturers and technology companies. We are also developing and<br />

strengthening our relationships with media industry professionals through our Digital Media Solutions<br />

16

division. Our relative decrease in consumer electronics activity is a result of our repositioning<br />

strategy.<br />

The activities of our divisions are described in detail below in ‘‘— Business Overview’’. For<br />

information on geographic breakdown of revenues by division, see Item 5: ‘‘Operating and Financial<br />

Review and Prospects — Overview’’.<br />

Historical Background<br />

Our current business situation results from the restructuring and repositioning strategy in place<br />

since 1997. Following the appointment of Thierry Breton as Chairman and Chief Executive Officer of<br />

Thomson in 1997 and the arrival of a new management team in the context of a significant<br />

deterioration in our results of operation and financial condition in the early and mid-1990s, we<br />

benefited from a recapitalization by the French State, through Thomson S.A., and launched several<br />

restructuring and reengineering initiatives which enabled the restoration of profitable business<br />

operations. In the second half of <strong>20</strong>00, we developed our repositioning strategy by expanding our<br />

business and customer base beyond the traditional consumer electronics market to include new<br />

segments of the video industry. Starting in the latter part of <strong>20</strong>00 and continuing into <strong>20</strong>02, we have<br />

made several acquisitions, including <strong>Technicolor</strong> and Philips’ professional broadcast business, to<br />

accelerate this strategic repositioning and to take advantage of the industry’s transition to digital<br />

technologies.<br />

Our restructuring and repositioning strategy has been accompanied and facilitated by a<br />

significant shift in our equity structure. Four years ago, <strong>THOMSON</strong> <strong>multimedia</strong> was wholly owned by<br />

Thomson S.A., which in turn is wholly owned by the French State. Following a series of offerings<br />

and placements of our shares in the period 1998-<strong>20</strong>02, as of March 16, <strong>20</strong>02 (and giving effect to<br />

the payment of Carlton’s obligations remboursables en actions (‘‘ORAs’’) in newly issued shares on<br />

this date), to the best of our knowledge our share capital was held as follows: (i) Thomson S.A.<br />

owned 22.42%, (ii) our strategic partners (Alcatel, DIRECTV, Microsoft and NEC) together owned<br />

15.79%, (iii) the public owned 50.83%, (iv) our employees owned 4.24%, (v) 1.<strong>20</strong>% were held by us<br />

as treasury shares and (vi) the remaining 5.52% of our shares are held by Carlton. On<br />

November 29, <strong>20</strong>01, Carlton issued bonds to a number of institutional investors exchangeable for<br />

15.5 million of our shares. For more details on our share capital, please see Item 7: ‘‘Major<br />

Shareholders and Related Party Transactions — Distribution of Share Capital’’.<br />

Strategic Relationships<br />

Within the context of the digital transition and the convergence of technologies, devices and<br />

media within the video industry, we believe it is essential to develop strategic relationships with<br />

leaders in related industries in order to strengthen our position in various markets and to capitalize<br />

on emerging trends that are influencing the video industry. Thus, we established strategic alliances<br />

in 1998 with Alcatel, DIRECTV, Microsoft, NEC, and in <strong>20</strong>01 with Carlton. Within the framework of<br />

these alliances, we have developed significant business initiatives, which are discussed below in<br />

‘‘— Business Overview’’.<br />

In addition to the five companies mentioned above, which each have a seat on our Board of<br />

Directors, we have developed other alliances which we believe enable us more effectively to<br />

implement our strategy.<br />

17

B — Business Overview<br />

The table below sets forth the consolidated net sales of each division in 1999, <strong>20</strong>00 and <strong>20</strong>01.<br />

These consolidated figures exclude internal sales, notably those sales by our Displays and<br />

Components division to our Consumer Products division.<br />

1999 % <strong>20</strong>00 % <strong>20</strong>01 %<br />

(1 in millions)<br />

Digital Media Solutions (1) .................................. 184 2.8% 148 1.6% 1,821 17.4%<br />

Displays and Components ............................... 1,279 19.1% 1,686 18.6% 1,642 15.6%<br />

Consumer Products.......................................... 4,940 73.8% 6,862 75.5% 6,582 62.7%<br />

Patents and Licensing ...................................... 278 4.2% 378 4.2% 395 3.8%<br />

New Media Services......................................... — — 9 N/A 44 0.4%<br />

Other ................................................................. 9 0.1% 11 0.1% 10 0.1%<br />

Total .................................................................. 6,690 100% 9,094 100% 10,494 100%<br />

(1) The Digital Media Solutions division was established in <strong>20</strong>01 and includes, among other businesses acquired or formed<br />

by us in the first half of <strong>20</strong>01, the professional equipment and infrastructure businesses previously managed by the<br />

Consumer Products division. These professional equipment and infrastructure businesses have been consequently<br />

reclassified from the Consumer Products division to the Digital Media Solutions division for 1999 and <strong>20</strong>00, and the<br />

percentages in this table reflect the restatement of these figures.<br />

Digital Media Solutions<br />

Digital Media Solutions (DMS) generated consolidated net sales of 0 1,821 million in <strong>20</strong>01,<br />

representing 17.4% of our <strong>20</strong>01 net sales. Operating income for the division in <strong>20</strong>01 was<br />

0 239 million. These figures reflect the consolidation of <strong>Technicolor</strong> from March 17, <strong>20</strong>01. At<br />

December 31, <strong>20</strong>01, DMS had 11,832 employees.<br />

DMS forms our entry point into the video chain, anchoring our positions on the content<br />

development and content distribution links of the chain. Through DMS, we offer products and<br />

services that directly address the needs of entertainment and media professionals, from content<br />

owners, such as movie studios and broadcasting companies, to network and service operators.<br />

DMS’s business-to-business driven strategy focuses on providing integrated solutions designed to<br />

assist its professional customers to manage their transition to digital technology and to deliver more<br />

entertainment content to more end-users.<br />

Digital penetration and broadband penetration are fundamental technology shifts redefining all<br />

business models within the video chain. The transition to new forms of content delivery, especially<br />

through broadband networks, has created new needs for content providers and network operators, in<br />

particular for encoding, security, transmission, research, indexation and digital rights management. In<br />

addition, consumers are progressively adopting new forms of digital entertainment, in particular DVD,<br />

video on demand (‘‘VOD’’) and streaming media. DMS was formed in <strong>20</strong>01 to answer these new<br />

demands and provides products and services to film studios, broadcasters, network operators and<br />

other integrated media groups. DMS focuses on a number of critical technologies along the video<br />

chain, including digital content acquisition, content preparation and enhancement, content management<br />

and distribution, and content monetization. DMS strives to guide its customers through<br />

technology-induced business changes while allowing them to maintain control over their content and<br />

the distribution process.<br />

We intend for DMS to grow by continuing to develop its product and service range for its<br />

professional customers, in particular by leveraging technologies already managed by us such as<br />

Moving Picture Experts Group (‘‘MPEG’’) video compression. We also expect DMS to grow through<br />

opportunities presented by industry consolidation and through the acquisition of complementary<br />

digital media technologies, the formation of new strategic partnerships and alliances, and the<br />

reinforcement of business relationships with leading content providers and media groups. In addition,<br />

18

we initiated at the end of <strong>20</strong>01 our TWICE program to expand our business offerings and our client<br />

base, including an emphasis on geographic expansion.<br />

) <strong>Technicolor</strong> businesses<br />

In March <strong>20</strong>01, we completed our acquisition of the <strong>Technicolor</strong> businesses and assets from<br />

Carlton. <strong>Technicolor</strong>, the largest contributor to DMS consolidated net sales, is the world leader in<br />

content preparation and distribution services to the media industry based on leadership positions<br />

within each of the services provided. It is a key supplier of digital post-production services and<br />

processes and distributes motion picture film. Based on volume, <strong>Technicolor</strong> is also the largest<br />

independent manufacturer and distributor of pre-recorded DVDs and, we believe, of videocassettes.<br />

Based in Camarillo, California, <strong>Technicolor</strong>’s operations are global in scale, spanning nine countries<br />

with twenty-two operating locations across North America and Europe.<br />

<strong>Technicolor</strong>’s competitive advantages are based upon technical superiority, economies of scale<br />

and an integrated and secure service offering to its customers. Key customers include major film<br />

studios such as Disney, Warner Brothers and DreamWorks, software and games manufacturers<br />

such as Microsoft and Electronic Arts and television stations such as ABC. Most major contracts are<br />

negotiated on the basis of exclusive, long-term arrangements. In any given year certain contracts<br />

come up for renewal. Major client relationships are typically the result of multiple contractual<br />

arrangements which include a fixed duration, a type of service and rights to a particular geographical<br />

zone.<br />

Through <strong>Technicolor</strong>, we offer a differentiated set of services to both theatrical and broadcast<br />

content creators. For theatrical content creators, <strong>Technicolor</strong> provides post-production, film<br />

developing, assembly and colorization services prior to the release of films to theaters. For<br />

broadcast customers, services start with its post-production offering through which <strong>Technicolor</strong> offers<br />

colorization, editing, digitization (where required) and mastering of original content for broadcast<br />

producers. <strong>Technicolor</strong> recently introduced Technique, a new digital imaging facility, to expand its<br />

digital service offerings and to enable its customers to transition to digital media. With digitalization,<br />

the <strong>Technicolor</strong> offering evolves progressively towards the management of digital media assets. We<br />

are in the process of evaluating the market for media asset management solutions, which entails the<br />

storage and retrieval of archived content for distribution through several distribution channels.<br />

<strong>Technicolor</strong> is also a leader in film processing and theatrical distribution services. We believe<br />

that <strong>Technicolor</strong> holds a 36% market share, based on footage of film sold, of the U.S. and European<br />

film processing market. Our main competitor in this activity is Deluxe.<br />

Because the distribution of content to theaters will progressively employ digital technology,<br />

<strong>Technicolor</strong> formed a joint venture with Qualcomm in <strong>20</strong>00 for digital cinema, of which <strong>Technicolor</strong> is<br />

the 80% owner. The goal of the joint venture is to provide turnkey digital cinema systems to<br />

exhibitors worldwide based on best-in-class theater management system technologies and to provide<br />

content management and delivery services. The venture delivered its first commercial film release<br />

‘‘Ocean’s Eleven’’ in December <strong>20</strong>01.<br />

<strong>Technicolor</strong> manufactures and distributes videocassettes, DVD and CD packaged media via<br />

sixteen facilities located in North America and Europe. The company also distributes Microsoft Xbox<br />

game consoles. <strong>Technicolor</strong> provides a turnkey integrated service for audio and video content<br />

creators that spans mastering, manufacturing, packaging, distribution, including direct-to-retail and<br />

direct-to-consumer (e-commerce), as well as procurement, information services and retail inventory<br />

management systems. The packaged media industry continues to grow steadily, most recently<br />

fueled by consumer demand for DVD video as well as game consoles and software. <strong>Technicolor</strong>’s<br />

main competitors in videocassettes are Deluxe and Cinram, with <strong>Technicolor</strong> holding, based on our<br />

internal estimates, a 35% U.S. and 30% European market share in <strong>20</strong>01. In CD and DVD,<br />

competitors include WAMO, Sony DADC, PDSC, Sonopress, Ritek, Infodisc and Cinram, with<br />

<strong>Technicolor</strong> holding a 25% U.S. and 15% European market share for DVD in <strong>20</strong>01. <strong>Technicolor</strong><br />

19

competes on its ability to provide, on a cost-effective basis, fully integrated services, technological<br />

leadership, industry-leading replication capacity and quality, broad geographic coverage and a high<br />

degree of content security.<br />

<strong>Technicolor</strong> supports and guides its clients through the digital evolution occurring within its<br />

industry by increasing its digital offerings. Its role as a content and information manager, as well as<br />

an intermediary between content creators and exhibitors, is comparable in the digital and analog<br />

media worlds. We believe that <strong>Technicolor</strong>’s current and targeted client base offers substantial<br />

growth opportunities, in particular in the areas of DVD, digital cinema, digital post-production, digital<br />

media management services and future services for broadband networks. Additionally, we believe<br />

opportunities exist to expand retail inventory management systems (‘‘RIMS’’), e-commerce and to<br />

explore pan-European distribution. Natural synergies exist between <strong>Technicolor</strong> and our other units<br />

for the next generation of technologies for VOD, including copy protection and digital rights<br />

management, media asset management and networking technologies.<br />

) Broadcast Solutions<br />

Broadcast Solutions provides digital broadcasting products, equipment and services to the<br />

professional broadcast industry. Its products include cameras for outside broadcast and studio use,<br />

equipment for TV studios and mobile broadcast vehicles, film imaging and signal processing, and<br />

management and delivery systems. Customers include major broadcasters and networks, multichannel<br />

operators, transmission and distribution operators along with production and post-production<br />

facilities. Professional Broadcast Solutions seeks to exploit growth opportunities, in particular the<br />

rapid migration by the broadcast industry to server-based network architectures, and the creation of<br />

integrated digital solutions. Opportunities also exist for us to utilize our compression and network<br />

technologies from our Broadband Access Products and Network Equipment and Systems businesses<br />

within the Broadcast Solutions customer base.<br />

Through Broadcast Solutions, we operate in more than twenty-two countries and have a leading<br />

market position in Europe. Based on internal estimates, we hold the second position worldwide for<br />

digital broadcast systems (cameras, video switchers and servers) based on value, giving us an<br />

overall worldwide market share of 12% at year-end <strong>20</strong>01. Our main competitors are Sony and<br />

Panasonic.<br />

In March <strong>20</strong>01, we completed the acquisition of Philips’ professional broadcast businesses<br />

which complemented our existing professional broadcast business. At the end of <strong>20</strong>01, we held a<br />

66.7% ownership stake, with Philips holding the remaining 33.3%. In January <strong>20</strong>02, Philips exercised<br />

its right to sell us 50% of its stake in accordance with the terms of the acquisition agreement, giving<br />

us an 83.3% ownership stake. Under the acquisition agreement, Philips has the right to sell to us its<br />

remaining stake in January <strong>20</strong>03.<br />

In December <strong>20</strong>01, we announced the acquisition of Grass Valley Group, Inc. (‘‘Grass Valley’’),<br />

a leading supplier of professional broadcast equipment and solutions with a strong presence in<br />

the digital broadcast and Internet streaming markets, particularly in the area of video server<br />

technologies. The acquisition, which closed on March 1, <strong>20</strong>02, further extends Thomson’s Broadcast<br />

Solutions’ digital portfolio and strengthens its position as a key supplier of integrated and networked<br />

broadcast solutions for content providers. The acquisition will expand our geographic reach, product<br />

portfolio and broadband offering. Grass Valley’s <strong>20</strong>01 estimated net sales were approximately<br />

0 <strong>20</strong>0 million.<br />

) Network Equipment and Systems<br />

In February <strong>20</strong>01, Thomson and Alcatel formed Nextream (75% and 25%, respectively),<br />

combining their interactive video network businesses. Under the terms of the agreement, Alcatel may<br />

require us to purchase all of its interest in the venture at any time between February <strong>20</strong>02 and<br />

February <strong>20</strong>07, or in the event there is a deadlock concerning any of the decisions requiring joint<br />

<strong>20</strong>

approval. Nextream combines businesses in MPEG network products and <strong>multimedia</strong> head-ends for<br />

cable TV networks, and is a leader in the European market for professional equipment for digital<br />

interactive video networks. Nextream’s primary purpose is to enable the delivery of entertainment to<br />

subscribers over multi-platform transmission end-to-end solutions that include digital head-ends,<br />

video sources, video servers, encoders, IP encapsulation and network management software for<br />

interactive digital TV (‘‘IDTV managers’’). Its customers include satellite (Pay TV), cable, and telecom<br />

operators, ISPs and broadcasters. Nextream holds a leading position in Europe in video network<br />

equipment and, according to internal estimates, the fourth position worldwide based on value at<br />