Recent Plan Notices - CFAO | Carpenter Funds Administrative Office

Recent Plan Notices - CFAO | Carpenter Funds Administrative Office

Recent Plan Notices - CFAO | Carpenter Funds Administrative Office

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

CARPENTER FUNDS ADMINISTRATIVE OFFICE<br />

OF NORTHERN CALIFORNIA, INC.<br />

265 Hegenberger Road, Suite 100 ▪ P.O. Box 2280<br />

Oakland, California 94621<br />

(510) 633-0333 ▪ (888) 547-2054<br />

www.carpenterfunds.com<br />

October 18, 2010<br />

TO:<br />

FROM:<br />

RE:<br />

All Active <strong>Plan</strong> A, B and R Participants<br />

BOARD OF TRUSTEES<br />

<strong>Carpenter</strong>s Health and Welfare Trust Fund for California<br />

Changes to Eligibility Rules and Disability Extension Filing Limit<br />

The Trustees have approved the following changes to the Health and Welfare <strong>Plan</strong> for Active <strong>Plan</strong> A,<br />

<strong>Plan</strong> B and <strong>Plan</strong> R Participants.<br />

‣ New Filing Limit for Disability Extension of Eligibility<br />

Effective for Disabilities that began on and after March 1, 2009<br />

The time limit for filing an application for a disability extension of eligibility has been increased<br />

from 6 months to 1 year. In order to qualify for the disability extension, you must send an<br />

application to the Fund <strong>Office</strong> no later than 1 year from the date of the onset of your disability.<br />

The disability extension is described in detail on pages 11 and 12 of the <strong>Plan</strong> A and <strong>Plan</strong> R<br />

benefit booklet and on page 11 of the <strong>Plan</strong> B benefit booklet.<br />

If you become disabled, you should obtain a Certificate of Disability form right away and mail the<br />

completed form to the Fund <strong>Office</strong>. You can call the Fund <strong>Office</strong> to request the form or visit the<br />

website at www.carpenterfunds.com and print a copy of the form. For purposes of determining<br />

the onset of disability, the <strong>Plan</strong> requires a statement from your attending physician verifying the<br />

beginning date of disability.<br />

‣ Maintaining Active Eligibility for Participants Receiving Mandatory Pension Payments<br />

Effective January 1, 2010<br />

If you are an Active <strong>Carpenter</strong> working in covered employment who is receiving mandatory<br />

pension payments from the <strong>Carpenter</strong>s Pension Trust Fund because of reaching the Required<br />

Beginning Date, which is the April 1 st following the calendar year you turn 70½, you will continue<br />

to be eligible as an Active Participant provided you have not had a separation from service and<br />

you meet all other eligibility requirements.<br />

Please keep this notice with your benefit booklet. If you have any questions, please call Benefit<br />

Services at the Fund <strong>Office</strong> at (510) 633-0333 or toll free at (888) 547-2054. You may also send an<br />

e-mail to benefitservices@carpenterfunds.com.<br />

The Board of Trustees maintains the right to change or discontinue the types and amounts of<br />

benefits under this <strong>Plan</strong>. This notice is intended as a summary only, and actual <strong>Plan</strong> documents will<br />

be used to interpret the <strong>Plan</strong>. Only the full Board of Trustees is authorized to interpret the <strong>Plan</strong>. The<br />

Board has discretion to decide all questions about the <strong>Plan</strong>, including questions about your eligibility<br />

for benefits and the amount of any benefits payable to you. No individual Trustee, Employer or Union<br />

Representative has authority to interpret this <strong>Plan</strong> on behalf of the Board or to act as an agent of the<br />

Board.

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

This group health plan believes this plan is a “grandfathered health plan” under the Patient Protection<br />

and Affordable Care Act (the Affordable Care Act). As permitted by the Affordable Care Act, a<br />

grandfathered health plan can preserve certain basic health coverage that was already in effect when<br />

that law was enacted.<br />

Being a grandfathered health plan means that your plan may not include certain consumer protections<br />

of the Affordable Care Act that apply to other plans, for example, the requirement for the provision of<br />

preventive health services without any cost sharing. However, grandfathered health plans must comply<br />

with certain other consumer protections in the Affordable Care Act, for example, the elimination of<br />

lifetime limits on benefits.<br />

Questions regarding which protections apply and which protections do not apply to a grandfathered<br />

health plan and what might cause a plan to change from grandfathered health plan status can be<br />

directed to the Trust Fund <strong>Office</strong> at the numbers listed above. You may also contact the Employee<br />

Benefits Security Administration, U.S. Department of Labor at 1-866-444-3272 or<br />

www.dol.gov/ebsa/healthreform. This website has a table summarizing which protections do and do not<br />

apply to grandfathered health plans.<br />

Active Participants in <strong>Plan</strong>s A, B and R 2

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

June 20, 2011<br />

CARPENTER FUNDS ADMINISTRATIVE OFFICE<br />

OF NORTHERN CALIFORNIA, INC.<br />

265 Hegenberger Road, Suite 100 P.O. Box 2280<br />

Oakland, California 94621-0180<br />

Tel. (510) 633-0333 (888) 547-2054 Fax (510) 633-0215<br />

www.carpenterfunds.com<br />

TO:<br />

FROM:<br />

RE:<br />

All Active <strong>Plan</strong> A, B, Flat Rate and R Participants and their Dependents, including<br />

COBRA Beneficiaries<br />

BOARD OF TRUSTEES<br />

<strong>Carpenter</strong>s Health and Welfare Trust Fund for California<br />

BENEFIT IMPROVEMENTS<br />

Adult Child Coverage<br />

Removal of Lifetime Limit and<br />

Re-Enrollment for Individuals who have Exceeded the Lifetime Maximum<br />

Annual Limit Changes<br />

Early Retiree Reinsurance Program<br />

Attention Parents – this notice is being transmitted to you on behalf of your children<br />

Effective September 1, 2011, the Board of Trustees has approved modifications to the <strong>Plan</strong> Rules and<br />

Regulations for the <strong>Carpenter</strong>s Health and Welfare Trust Fund for California which are explained in summary<br />

form below. In the event of a dispute between this summary notice and the Rules and Regulations of the <strong>Plan</strong>,<br />

the Rules and Regulations will prevail.<br />

In accordance with the Affordable Care Act (or “Health Care Reform”), the <strong>Plan</strong> is extending coverage for<br />

certain dependent children up to age 26, removing the overall lifetime dollar and specified annual maximums<br />

and adding an overall annual dollar maximum.<br />

1) Adult Child Coverage: Coverage for Participants’ adult natural, adopted or stepchildren age 19 up to the<br />

child’s 26 th birthday is offered starting September 1, 2011. Coverage will be provided to adult children<br />

who do not have access to group health coverage through their own, their spouse's, or their<br />

domestic partner’s employer. No action is required if you do not have an adult child to enroll, or if you<br />

choose not to enroll an adult child. If you elect to enroll an adult child, the child does not have to be<br />

unmarried, or be a full-time student, or even reside with the Participant in order to qualify for this extended<br />

coverage.<br />

Adult children whose coverage previously ended before their 26 th birthday, or who were denied coverage<br />

(or were not eligible for coverage) because the availability of dependent coverage ended before the<br />

attainment of age 26, may be eligible to enroll in the <strong>Plan</strong> during a Special Enrollment period*. This<br />

includes a child that is currently on COBRA continuation coverage. The Special Enrollment period ends<br />

July 31, 2011 for a September 1, 2011 coverage effective date. Any qualified children enrolled during this<br />

Special Enrollment opportunity will have all the same benefits that are available to similarly situated<br />

individuals, but in some cases will not have identical coverage as other dependent children. As stated<br />

above, adult children with access to employer sponsored health coverage through their own, their<br />

spouse's or domestic partner’s employer are not eligible to enroll. Also, certain mandated benefits required<br />

for minor children may not be available for adult children.<br />

Enclosed you will find the necessary form for enrollment. Complete the Enrollment Form and send in the<br />

required documentation of proof (see the back of the Enrollment Form for details). You must list all adult<br />

children to be enrolled in the "Adult Child Information" section. The Adult Child Special Enrollment Form<br />

must be returned to our office before July 31, 2011. If the enrollment form is not received by July 31,<br />

2011 but it is later determined that the adult child may be eligible to enroll at a later date, eligibility will be<br />

granted prospectively only, and will not be retroactive to September 1, 2011.

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

Note: *Coverage up to age 26 is only available if the adult child is the Participant’s natural child, legally<br />

adopted child or stepchild and the Participant is eligible for coverage and maintains eligibility. An adult<br />

child may not establish independent eligibility except as provided by COBRA. Legal guardianship children<br />

and children of domestic partners are not included in the age 26 extension. A child may not be enrolled in<br />

the <strong>Plan</strong> unless the Participant is also enrolled. If you, as the Participant, are eligible for coverage but not<br />

currently enrolled in the <strong>Plan</strong>, you also have the opportunity to enroll for coverage and must do so in order<br />

for your dependent child to be able to enroll, however, again if the Special Window is missed, Adult Child<br />

coverage will be granted beginning the 1 st of the month following enrollment and not retroactively.<br />

Since the <strong>Plan</strong> qualifies as a Grandfathered <strong>Plan</strong> under Health Care Reform, adult children are not<br />

eligible to enroll if they have access to health coverage through their employer or through their spouse's or<br />

domestic partner’s employer. In addition, any children of the dependent child (the Participant’s grandchild)<br />

will not be covered.<br />

The <strong>Plan</strong> will continue to provide coverage for disabled children of any age in accordance with the<br />

eligibility rules set out in the <strong>Plan</strong> Rules and Regulations. These rules extend coverage when the<br />

Participant’s unmarried Dependent children are incapable of self-sustaining employment by reason of a<br />

mental or physical handicap and such incapacity commenced prior to the date the Dependent child’s<br />

coverage would otherwise have terminated, and provided that the child is dependent upon the Eligible<br />

Participant for support and maintenance.<br />

2) Removal of Lifetime Limit: The Active <strong>Plan</strong>s will no longer include overall lifetime benefit limits effective<br />

September 1, 2011. <strong>Plan</strong> lifetime maximum of $2,000,000 will be eliminated.<br />

Re-Enrollment for Individuals who have exceeded the Lifetime Maximum Benefit: Individuals whose<br />

coverage previously ended because they reached a lifetime limit under the <strong>Plan</strong> are eligible to re-enroll for<br />

benefit coverage under the <strong>Plan</strong> starting September 1, 2011. Please contact the Fund <strong>Office</strong> at<br />

benefitservices@carpenterfunds.com, call (510) 633-0333 or toll free (888) 547-2054 for an Enrollment<br />

Form.<br />

3) Annual Limit Changes: Beginning September 1, 2011, a calendar year annual overall maximum of<br />

$2,000,000 will be added to Active Indemnity <strong>Plan</strong>s for all Medical and Prescription Drug benefits paid for<br />

each Eligible Individual.<br />

On September 1, 2011, Active <strong>Plan</strong>s will remove the following calendar year maximums and will no longer<br />

have specific benefit limits:<br />

Chemical Dependency inpatient and outpatient treatment calendar year maximum of $25,000<br />

and lifetime maximum of $35,000.<br />

Pediatric Dental $2,500 (or $2,000 for Non-PPO dentists) calendar year maximum for children<br />

under age 19.<br />

Prescription Drug benefit limit of $75,000 per Eligible Individual per calendar year.<br />

Routine Physical Examination maximum payment limit of $250 for the Participant and Spouse.<br />

Diabetes Instruction Program lifetime limit of $500 per Eligible Individual.<br />

Hospice Care maximum <strong>Plan</strong> payment of $5,000 per Eligible Individual.<br />

Low Vision Benefit maximum benefit of $500 per person for children under age 19.<br />

4) Notice to <strong>Plan</strong> Participants about the Early Retiree Reinsurance Program: You are a <strong>Plan</strong><br />

Participant, or are being offered the opportunity to enroll as a <strong>Plan</strong> Participant, in an employment-based<br />

health plan that is certified for participation in the Early Retiree Reinsurance Program. The Early Retiree<br />

Reinsurance Program is a Federal program that was established under the Affordable Care Act. Under the<br />

Early Retiree Reinsurance Program, the Federal government reimburses a <strong>Plan</strong> Sponsor of an<br />

employment-based health plan for some of the costs of health care benefits paid on behalf of, or by, early<br />

retirees and certain family members of early retirees participating in the employment-based plan. By law,<br />

the program expires on January 1, 2014.<br />

2

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

Under the Early Retiree Reinsurance Program, your <strong>Plan</strong> Sponsor may choose to use any<br />

reimbursements it receives from this program to reduce or offset increases in <strong>Plan</strong> Participants’ premium<br />

contributions, co-payments, deductibles, co-insurance, or other out-of-pocket costs. If the <strong>Plan</strong> Sponsor<br />

chooses to use the Early Retiree Reinsurance Program reimbursements in this way, you, as a <strong>Plan</strong><br />

Participant, may experience changes that may be advantageous to you, in your health plan coverage<br />

terms and conditions, for so long as the reimbursements under this program are available and this <strong>Plan</strong><br />

Sponsor chooses to use the reimbursements for this purpose. A <strong>Plan</strong> Sponsor may also use the Early<br />

Retiree Reinsurance Program reimbursements to reduce or offset increases in its own costs for<br />

maintaining your health benefits coverage, which may increase the likelihood that it will continue to offer<br />

health benefits coverage to its retirees and employees and their families.<br />

Grandfathered Health <strong>Plan</strong>: The Board of Trustees of the <strong>Carpenter</strong>s Health and Welfare Trust Fund for<br />

California believes this <strong>Plan</strong> is a “grandfathered health plan” under the Patient Protection and Affordable Care<br />

Act (“the Affordable Care Act”). As permitted by the Affordable Care Act, a grandfathered health plan can<br />

preserve certain basic health coverage that was already in effect when that law was enacted. Being a<br />

grandfathered health plan means that your <strong>Plan</strong> may not include certain consumer protections of the<br />

Affordable Care Act that apply to other plans, for example, the requirement for the provision of preventative<br />

health services without any cost sharing. However, grandfathered health plans must comply with certain other<br />

consumer protections in the Affordable Care Act, for example the elimination of lifetime limits on benefits.<br />

Questions regarding which protections apply and which protections do not apply to a grandfathered health<br />

plan and what might cause a plan to change from grandfathered health plan status can be directed to the <strong>Plan</strong><br />

administrator or the Department of Labor at 1-866-444-3272 or www.dol.gov/ebsa/healthreform. This Web site<br />

has a table summarizing which protections do and do not apply to grandfathered health plans.<br />

Please keep this notice with your benefit booklet. If you have any questions, please contact Benefit Services<br />

at the Fund <strong>Office</strong> at (510) 633-0333 or toll free at (888) 547-2054. You may also send an e-mail to<br />

benefitservices@carpenterfunds.com. Forms and information can be found on our website at<br />

www.carpenterfunds.com.<br />

The Board of Trustees maintains the right to change or discontinue the types and amounts of benefits under<br />

this <strong>Plan</strong>. This notice is intended as a summary only, and actual <strong>Plan</strong> documents will be used to interpret the<br />

<strong>Plan</strong>. Only the full Board of Trustees is authorized to interpret the <strong>Plan</strong>. The Board has discretion to decide all<br />

questions about the <strong>Plan</strong>, including questions about your eligibility for benefits and the amount of any benefits<br />

payable to you. No individual Trustee, Employer or Union Representative has authority to interpret this <strong>Plan</strong> on<br />

behalf of the Board or to act as an agent of the Board.<br />

In accordance with ERISA reporting requirements this document serves as your Summary of Material<br />

Modifications to the <strong>Plan</strong>.<br />

3

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)<br />

NOTICE OF PRIVACY PRACTICES FOR PROTECTED HEALTH INFORMATION (PHI)<br />

<strong>Carpenter</strong>s Health and Welfare Trust Fund for California: Notice of Privacy Practices<br />

Esta noticia es disponible en espanol si usted lo suplica. Por favor contacte el Funcionario de Privacidad (510-639-4301).<br />

CARPENTERS HEALTH AND WELFARE<br />

TRUST FUND FOR CALIFORNIA<br />

Notice of Privacy Practices<br />

THIS NOTICE DESCRIBES HOW MEDICAL INFORMATION ABOUT YOU<br />

MAY BE USED AND DISCLOSED AND HOW YOU CAN GET ACCESS TO<br />

THIS INFORMATION. PLEASE REVIEW IT CAREFULLY.<br />

In this notice, the name “<strong>Carpenter</strong>s Health and Welfare Fund” and the terms “we”, “us”, and “our”<br />

encompass not only this health plan itself but also Business Associates acting on behalf of the plan or<br />

providing services to the plan. These Business Associates may include a third party administrator, a<br />

pharmacy benefits manager, and professionals such as attorneys, auditors, and consultants. It does not<br />

include the Board of Trustees, the <strong>Plan</strong> Sponsor, which will be specified where appropriate.<br />

DUTIES OF CARPENTERS HEALTH AND WELFARE FUND<br />

We are required by law to maintain the privacy of your health information. We must provide you with<br />

this Notice of our legal duties and privacy practices with respect to your health information, we are<br />

required to notify you if there is a breach of your unsecured protected health information, and we are also<br />

required to abide by the terms of this Notice, which may be amended from time to time.<br />

We reserve the right to change the terms of this Notice at any time in the future and to make the new<br />

provisions effective for all health information that we maintain. We will promptly revise our Notice and<br />

distribute it to all <strong>Plan</strong> Participants whenever we make material changes to our privacy policies and<br />

procedures within 60 days of such change. This Notice will also be provided to all new enrollees as<br />

required.<br />

HOW CARPENTERS HEALTH AND WELFARE FUND MAY USE OR DISCLOSE<br />

YOUR HEALTH INFORMATION<br />

We are permitted by law to use or disclose your “health information” to conduct activities necessary for<br />

“payment” and “health care operations” (as those terms are defined in the attached Glossary). These are<br />

the main purposes for which we will use or disclose your health information. For each of these purposes<br />

we list below examples of these kinds of uses and disclosures. These are only examples and are not<br />

intended to be a complete list of all the ways we may use or disclose your health information.<br />

Payment. We may use or disclose health information about you for purposes within the definition of<br />

“payment”. These include, but are not limited to, the following purposes and example:<br />

Determining your eligibility for plan benefits. For example, we may use information obtained from<br />

your employer to determine whether you have satisfied the plan’s requirements for active eligibility.<br />

P a g e | 6

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

CARPENTERS HEALTH AND WELFARE<br />

TRUST FUND FOR CALIFORNIA<br />

Notice of Privacy Practices<br />

Obtaining contributions from you or your employer. For example, we may send your employer a<br />

request for payment of contributions on your behalf, and we may send you information about<br />

premiums for COBRA continuation coverage.<br />

Pre-certifying or pre-authorizing health care services. For example, we may consider a request<br />

from you or your physician to verify coverage for a specific hospital admission or surgical procedure.<br />

Determining and fulfilling the plan’s responsibility for benefits. For example, we may review<br />

health care claims to determine if specific services that were provided by your physician are covered<br />

by the plan.<br />

Providing reimbursement for the treatment and services you received from health care<br />

providers. For example, we may send your physician a payment with an explanation of how the<br />

amount of the payment was determined.<br />

Subrogating health claim benefits for which a third party is liable. For example, we may<br />

exchange information about an accidental injury with your attorney who is pursuing reimbursement<br />

from another party.<br />

Coordinating benefits with other plans under which you have health coverage. For example, we<br />

may disclose information about your plan benefits to another group health plan in which you<br />

participate.<br />

Obtaining payment under a contract of reinsurance. For example, if the total amount of your<br />

claims exceeds a certain amount we may disclose information about your claims to our stop-loss<br />

insurance carrier.<br />

Health Care Operations. We may use and disclose health information about you for purposes within the<br />

definition of “health care operations”. These purposes include, but are not limited to:<br />

Conducting quality assessment and improvement activities. For example, a supervisor or quality<br />

specialist may review health care claims to determine the accuracy of a processor’s work.<br />

Case management and care coordination. For example, a case manager may contact home health<br />

agencies to determine their ability to provide the specific services you need.<br />

Contacting you regarding treatment alternatives or other benefits and services that may be of<br />

interest to you. For example, a case manager may contact you to give you information about<br />

alternative treatments which are neither included nor excluded in the plan’s documentation of benefits<br />

but which may nevertheless be available in your situation.<br />

Contacting health care providers with information about treatment alternatives. For example, a<br />

case manager may contact your physician to discuss moving you from an acute care facility to a more<br />

appropriate care setting.<br />

Employee training. For example, training of new claims processors may include processing of<br />

claims for health benefits under close supervision.<br />

P a g e | 7

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

CARPENTERS HEALTH AND WELFARE<br />

TRUST FUND FOR CALIFORNIA<br />

Notice of Privacy Practices<br />

Accreditation, certification, licensing, or credentialing activities. For example, a company that<br />

provides professional services to the plan may disclose your health information to an auditor that is<br />

determining or verifying its compliance with standards for professional accreditation.<br />

Securing or placing a contract for reinsurance of risk relating to claims for health care. For<br />

example, your demographic information (such as age and sex) may be disclosed to carriers of stop<br />

loss insurance to obtain premium quotes.<br />

Conducting or arranging for legal and auditing services. For example, your health information<br />

may be disclosed to an auditor who is auditing the accuracy of claim adjudications.<br />

Management activities relating to compliance with privacy regulations. For example, the Privacy<br />

<strong>Office</strong>r may use your health information while investigating a complaint regarding a reported or<br />

suspected violation of your privacy.<br />

Resolution of internal grievances. For example, your health information may be used in the process<br />

of settling a dispute about whether or not a violation of our privacy policies and procedures actually<br />

occurred.<br />

Disclosures to <strong>Plan</strong> Sponsor (Board of Trustees). In addition to the circumstances and examples<br />

described above, there are three types of health information about you that we may disclose to the Board<br />

of Trustees. The disclosures described below are included within the definitions of “payment” or “health<br />

care operations”.<br />

We may disclose to the Board of Trustees whether or not you have enrolled in, are participating in, or<br />

have disenrolled from this health plan.<br />

We may provide the Board of Trustees with “summary health information”, which includes claims<br />

totals without any personal identification except your ZIP code, for these two purposes:<br />

- To obtain health insurance premium bids from other health plans, or<br />

- To consider modifying, amending, or terminating the health plan.<br />

We may disclose your health information to the Board of Trustees for purposes of administering<br />

benefits under the plan. These purposes may include, but are not limited to:<br />

- Reviewing and making determinations regarding an appeal of a denial or reduction of benefits.<br />

- Evaluating situations involving suspected or actual fraudulent claims.<br />

- Monitoring benefit claims that may or do involve stop-loss insurance.<br />

P a g e | 8

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

CARPENTERS HEALTH AND WELFARE<br />

TRUST FUND FOR CALIFORNIA<br />

Notice of Privacy Practices<br />

Other Uses and Disclosures. The following categories describe other ways that <strong>Carpenter</strong>s Health and<br />

Welfare Fund may use and disclose your health information. Each category is illustrated with one or<br />

more examples. Not every potential use or disclosure in each category will be listed, and those that are<br />

listed may never actually occur.<br />

Involvement in Payment. With your agreement, we may disclose your health information to a<br />

relative, friend, or other person designated by you as being involved in payment for your health care.<br />

For example, if we are discussing your health benefits with you, and you wish to include your spouse<br />

or child in the conversation, we may disclose information to that person during the course of the<br />

conversation.<br />

Required by Law. We will disclose your health information when required to do so by Federal,<br />

state, or local law. For example, we may disclose your information to a representative of the U.S.<br />

Department of Health and Human Services who is conducting a privacy regulations compliance<br />

review.<br />

Public Health. As permitted by law, we may disclose your health information as described below:<br />

- To an authorized public health authority, for purposes of preventing or controlling disease, injury<br />

or disability;<br />

- To a government entity authorized to receive reports of child abuse or neglect;<br />

- To a person under the jurisdiction of the Food and Drug Administration, for activities related<br />

to the quality, safety, or effectiveness of FDA-regulated products.<br />

Health Oversight Activities. We may disclose your health information to health agencies during the<br />

course of audits, investigations, inspections, licensure and other proceedings related to oversight of<br />

the health care system or compliance with civil rights laws. However, this permission to disclose your<br />

health information does not apply to any investigation of you which is directly related to your health<br />

care.<br />

Judicial and <strong>Administrative</strong> Proceedings. We may disclose your health information in the course<br />

of any administrative or judicial proceeding:<br />

- In response to an order of a court or administrative tribunal, or<br />

- In response to a subpoena, discovery request, or other lawful process.<br />

Specific circumstances may require us to make reasonable efforts to notify you about the request or to<br />

obtain a court order protecting your health information.<br />

Law Enforcement. We may disclose your health information to a law enforcement official for<br />

various purposes, such as identifying or locating a suspect, fugitive, material witness or missing<br />

person.<br />

Coroners, Medical Examiners and Funeral Directors. We may disclose your health information to<br />

coroners, medical examiners and funeral directors. For example, this may be necessary to identify a<br />

deceased person or determine the cause of death.<br />

Organ and Tissue Donation. We may disclose your health information to organizations involved in<br />

procuring, banking or transplanting organs and tissues, to facilitate such.<br />

P a g e | 9

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

CARPENTERS HEALTH AND WELFARE<br />

TRUST FUND FOR CALIFORNIA<br />

Notice of Privacy Practices<br />

WHEN CARPENTERS HEALTH AND WELFARE FUND MAY NOT USE OR<br />

DISCLOSE YOUR HEALTH INFORMATION<br />

Except as described in this Notice of Privacy Practices, we will not use or disclose your health<br />

information without written authorization from you. Specifically, most uses and disclosures of your<br />

psychotherapy notes (where appropriate), uses and disclosures of your protected health information for<br />

marketing purposes, and disclosures that constitute a sale of your protected health information require<br />

your written authorization. If you have authorized us to use or disclose your health information for<br />

another purpose, you may revoke your authorization in writing at any time. If you revoke your<br />

authorization, we will no longer be able to use or disclose health information about you for the reasons<br />

covered by your written authorization. However, we will be unable to take back any disclosures we have<br />

already made with your permission. Requests to revoke a prior authorization must be submitted in<br />

writing to the Privacy <strong>Office</strong>r at the address shown below.<br />

The <strong>Carpenter</strong>s Health and Welfare Fund will not use or disclose your genetic health information for<br />

underwriting purposes. Additionally, you have the right to opt out of receiving any communications<br />

concerning fund raising activities in which the <strong>Carpenter</strong>s Health and Welfare Fund may engage.<br />

Right to Request Restrictions. You have the right to request restrictions on certain uses and disclosures<br />

of your health information. We are not required to agree to restrictions that you request except if the<br />

disclosure involves payment or health care operations not required by law and the information pertains<br />

solely to a health care item or service that you have paid for out of pocket in full. If you would like to<br />

make a request for restrictions, you must submit your request in writing to the Privacy <strong>Office</strong>r at the<br />

address shown below.<br />

Right to Request Confidential Communications. You have the right to ask us to communicate with<br />

you using an alternative means or at an alternative location. Requests for confidential communications<br />

must be submitted in writing to the Privacy <strong>Office</strong>r at the address shown below. We are not required to<br />

agree to your request unless disclosure of your health information could endanger you.<br />

Right to Inspect and Copy. You have the right to inspect and copy health information about you that<br />

may be used to make decisions about your plan benefits. To inspect or copy such information, you must<br />

submit your request in writing to the Privacy <strong>Office</strong>r at the address shown below. If you request a copy of<br />

the information, we may charge you a reasonable fee to cover expenses associated with your request.<br />

Right to Request Amendment. If you believe that we possess health information about you that is<br />

incorrect or incomplete, you have a right to ask us to change it. To request an amendment of health<br />

records, you must make your request in writing to the Privacy <strong>Office</strong>r at the address shown below. Your<br />

request must include a reason for the request. We are not required to change your health information. If<br />

your request is denied, we will provide you with information about our denial and how you can disagree<br />

with the denial.<br />

P a g e | 10

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

CARPENTERS HEALTH AND WELFARE<br />

TRUST FUND FOR CALIFORNIA<br />

Notice of Privacy Practices<br />

Right to Accounting of Disclosures. You have the right to receive a list or “accounting” of disclosures<br />

of your health information made by us. However, we do not have to account for disclosures that were:<br />

made to you or were authorized by you, or<br />

for purposes of payment functions or health care operations.<br />

Requests for an accounting of disclosures must be submitted in writing to the Privacy <strong>Office</strong>r at the<br />

address shown below. Your request should specify a time period within the last six years and may not<br />

include dates before April 14, 2003. We will provide one free list per twelve-month period, but we may<br />

charge you for additional lists.<br />

Right to Paper Copy. You have a right to receive a paper copy of this Notice of Privacy Practices at any<br />

time. To obtain a paper copy of this Notice, send your written request to the Privacy <strong>Office</strong>r at the<br />

address shown below or you can download a copy at www.carpenterfunds.com.<br />

Your Personal Representative<br />

You may exercise your rights to your PHI by designating a personal representative. Your personal<br />

representative will be required to produce evidence of the authority to act on your behalf before the<br />

personal representative will be given access to your PHI or be allowed to take any action for you. Under<br />

this <strong>Plan</strong>, proof of such authority will include a completed, signed and approved form. You may obtain<br />

this form by contacting the Privacy <strong>Office</strong>r or his or her designee at their address listed on the first page of<br />

this Notice. The <strong>Plan</strong> retains discretion to deny access to your PHI to a personal representative to provide<br />

protection to those vulnerable people who depend on others to exercise their rights under these rules and<br />

who may be subject to abuse or neglect.<br />

This <strong>Plan</strong> will recognize certain individuals as Personal Representatives without you having to complete<br />

a Personal Representative form. You may however request that the <strong>Plan</strong> not automatically honor the<br />

following individuals as your Personal Representative by completing a form to Revoke a Personal<br />

Representative available from the Privacy <strong>Office</strong>r or their designee.<br />

For example, the <strong>Plan</strong> will automatically consider a spouse to be the personal representative of a <strong>Plan</strong><br />

Participant and vice versa. The recognition of your spouse as your personal representative (and vice<br />

versa) is for the use and disclosure of PHI under this <strong>Plan</strong> and is not intended to expand such<br />

designation beyond what is necessary for this <strong>Plan</strong> to comply with HIPAA privacy regulations. You<br />

should also review the <strong>Plan</strong>’s Policy and Procedure regarding Personal Representatives (available<br />

from the Privacy <strong>Office</strong>r) for a more complete description of the circumstances where the <strong>Plan</strong> will<br />

automatically consider an individual to be a personal representative.<br />

If you would like to obtain a more detailed explanation of these rights, or if you would like to exercise<br />

one or more of these rights, contact:<br />

HIPAA Privacy <strong>Office</strong>r<br />

<strong>Carpenter</strong>s Health and Welfare Trust Fund for California<br />

P.O. Box 2280<br />

Oakland, CA 94621-0181<br />

P a g e | 11

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

CARPENTERS HEALTH AND WELFARE<br />

TRUST FUND FOR CALIFORNIA<br />

Notice of Privacy Practices<br />

Complaints. If you believe that your privacy rights have been violated by <strong>Carpenter</strong>s Health and Welfare<br />

Trust Fund for California, or by anyone acting on our behalf, you may file a complaint. Complaints to us<br />

must be submitted in writing to the Privacy <strong>Office</strong>r at the above address. You may also file a complaint<br />

with the Secretary of the Department of Health and Human Services at:<br />

200 Independence Avenue, SW<br />

Washington, DC 20201<br />

We will not retaliate against you in any way for filing a complaint.<br />

Questions. If you have questions about any part of this Notice or if you want more information about the<br />

privacy practices at <strong>Carpenter</strong>s Health and Welfare Fund, please contact the Privacy <strong>Office</strong>r at the above<br />

address.<br />

P a g e | 12

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

CARPENTERS HEALTH AND WELFARE TRUST FUND<br />

FOR CALIFORNIA<br />

265 Hegenberger Road, Suite 100<br />

P.O. Box 2280<br />

Oakland, California 94621-0180<br />

Tel. (510) 633-0333 (888) 547-2054 Fax (510) 633-0215<br />

www.carpenterfunds.com<br />

November 8, 2013<br />

To:<br />

From:<br />

Re:<br />

All Active and Retired Participants of the <strong>Carpenter</strong>s Health and Welfare Trust Fund for California<br />

BOARD OF TRUSTEES<br />

<strong>Carpenter</strong>s Health and Welfare Trust Fund for California<br />

Medical and Prescription Drug <strong>Plan</strong> Benefit Changes Effective January 1, 2014 (Indemnity <strong>Plan</strong> Only)<br />

Service Pension Retiree Health and Welfare Window Period Closes on August 31, 2013<br />

Effective January 1, 2014, the Board of Trustees have adopted the following two changes to the Indemnity Medical<br />

and Prescription Drug plans only.<br />

1) CT Scans and MRIs<br />

Imaging services such as CT scans and MRIs give you and your doctor a valuable look at the inside of your<br />

body. These services can fluctuate in cost from as little as $300 to as much as $3,000* without quality<br />

differences. Therefore, if your doctor refers you to an imaging provider for a CT scan or MRI, your referral will<br />

be reviewed to see if the imaging provider selected offers the best quality of care and price in your area. If it<br />

doesn’t, starting January 1, 2014, a representative from Anthem Blue Cross will call you and let you know of<br />

other imaging provider choices close by. While the choice to choose the more expensive option will be yours,<br />

your personal share of costs will increase. We strongly recommend accepting Anthem’s recommendation to a<br />

high quality, lower cost provider.<br />

*Source: AIM Specialty Health internal cost analysis<br />

2) New Rules for Proton Pump Inhibitors (PPIs), Opiates, Antidepressants, Antipsychotics, and Stimulants<br />

To ensure the health safety of <strong>Plan</strong> Participants and Dependents, enhanced <strong>Plan</strong> coverage rules have been<br />

adopted for stomach acid reducing medications, known as Proton Pump Inhibitors (PPIs), and opiate pain<br />

medications like Vicodin, or Oxycodone. Effective January 1, 2014, unless clinical documentation verifies a<br />

longer duration is medically necessary, a course of treatment for PPIs will be limited to a maximum of eight (8)<br />

weeks and a course of treatment for opiates will be limited to a maximum of 90 days. The <strong>Plan</strong> also adopted<br />

changes effective January 1, 2014 for Antidepressants, Antipsychotics, and Stimulants, including mandatory<br />

generics for new starts, step therapy programs, and prior authorization rules.<br />

Retiree Health and Welfare – Out of Work Special Window Period Closed<br />

Service Type Pension<br />

Beginning September 2010 a window period of time was created for Retirees awarded a Service Pension from the<br />

<strong>Carpenter</strong>s Pension Trust Fund for Northern California and whose last work was in covered employment for a<br />

Contributing Employer so that the “hours in covered employment” requirements for Retiree Health and Welfare<br />

eligibility could be satisfied by proof that he or she was on the “out-of-work” list at a Local Union affiliated with the<br />

<strong>Carpenter</strong>s 46 Northern California Counties Conference Board. On August 31, 2013 that window period of time was<br />

closed and all Pensioners must satisfy “hours in covered employment” primarily through work hours.

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

GRANDFATHERED HEALTH PLAN:<br />

The Board of Trustees of the <strong>Carpenter</strong>s Health and Welfare Trust Fund for California believes the Medical <strong>Plan</strong> is a<br />

“grandfathered health plan” under the Patient Protection and Affordable Care Act (“the Affordable Care Act”). As<br />

permitted by the Affordable Care Act, a grandfathered health plan can preserve certain basic health coverage that<br />

was already in effect when that law was enacted. Being a grandfathered health plan means that your <strong>Plan</strong> may not<br />

include certain consumer protections of the Affordable Care Act that apply to other plans, for example, the<br />

requirement for the provision of preventative health services without any cost sharing. However, grandfathered health<br />

plans must comply with certain other consumer protections in the Affordable Care Act, for example the elimination of<br />

lifetime limits on benefits. Questions regarding which protections apply and which protections do not apply to a<br />

grandfathered health plan and what might cause a plan to change from grandfathered health plan status can be<br />

directed to the <strong>Plan</strong> administrator or the Department of Labor at 1-866-444-3272 or www.dol.gov/ebsa/healthreform.<br />

This website has a table summarizing which protections do and do not apply to grandfathered health plans. Please<br />

keep this notice with your benefit booklet. If you have any questions, please contact Benefit Services at the Fund<br />

<strong>Office</strong> at (510) 633-0333 or toll free at (888) 547-2054. You may also send an e-mail to<br />

benefitservices@carpenterfunds.com. Forms and information can be found on our website at<br />

www.carpenterfunds.com.<br />

The Trustees work diligently to protect your <strong>Plan</strong> and access to your <strong>Plan</strong> and only the Board of Trustees maintains<br />

the right to change or discontinue the types and amounts of benefits under this <strong>Plan</strong>. This notice is intended as a<br />

summary only, and actual <strong>Plan</strong> documents will be used to interpret the <strong>Plan</strong>. Only the full Board of Trustees is<br />

authorized to interpret the <strong>Plan</strong>. The Board has discretion to decide all questions about the <strong>Plan</strong>, including questions<br />

about your eligibility for benefits and the amount of any benefits payable to you. No individual Trustee, Employer or<br />

Union Representative has authority to interpret this <strong>Plan</strong> on behalf of the Board or to act as an agent of the Board. In<br />

the event of a dispute between this summary notice and the Rules and Regulations of the <strong>Plan</strong>, the Rules and<br />

Regulations will prevail.

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

CARPENTER FUNDS ADMINISTRATIVE OFFICE<br />

OF NORTHERN CALIFORNIA, INC.<br />

265 Hegenberger Road, Suite 100 ▪ P.O. Box 2280<br />

Oakland, California 94621<br />

(510) 633-0333 ▪ (888) 547-2054<br />

www.carpenterfunds.com<br />

November 25, 2013<br />

MEMORANDUM<br />

TO:<br />

FROM:<br />

RE:<br />

Retirees of the<br />

<strong>Carpenter</strong>s Pension Trust Fund for Northern California<br />

<strong>Carpenter</strong>s Annuity Trust Fund for Northern California<br />

Boards of Trustees<br />

Post-Retirement Prohibited Employment<br />

Restated Clarification of Policy of Prohibited Employment Guidelines<br />

The Trustees of the <strong>Carpenter</strong>s Pension Trust Fund for Northern California and the <strong>Carpenter</strong>s Annuity Trust Fund for<br />

Northern California recognize that from time to time Retirees may be required to supplement Retiree income through<br />

post-retirement employment. However, so that active non-retired Participants may continue to earn retirement benefits,<br />

Prohibited Employment rules have been part of the retirement <strong>Plan</strong>s since inception.<br />

The purpose of “Prohibited Employment” is to help individuals comply with IRS separation from service requirements and<br />

discourage Retirees already receiving a Pension from the <strong>Carpenter</strong>s Pension Trust Fund for Northern California and/or<br />

the <strong>Carpenter</strong>s Annuity Trust Fund for Northern California, from engaging in activities that adversely affect the ability of<br />

other <strong>Plan</strong> Participants to accumulate benefits under the Northern California <strong>Carpenter</strong>s’ Pension and/or Annuity <strong>Funds</strong>.<br />

In June 2009, Trustees of the <strong>Carpenter</strong>s Pension and Annuity Trust <strong>Funds</strong> approved a Special Temporary Window<br />

Period through August 31, 2011 in which post-retirement employment Prohibited Employment rules were temporarily<br />

modified. In 2011 the window was extended through December 31, 2013. <strong>Recent</strong>ly the Boards of Trustees adopted<br />

Restated Clarification of Policy of Prohibited Employment Guidelines with no sunset provisions. Therefore, when<br />

considering if post-retirement employment will result in the suspension of an individual’s Pension payments, the following<br />

rules will be used:<br />

Prohibited Employment means employment after retirement for wages or profit in the Building and Construction Industry<br />

that will result in the suspension of retirement benefits. The determination as to whether or not a type of employment is<br />

Prohibited shall be at the sole discretion of the Boards of Trustees.<br />

Whether post-retirement employment is Prohibited, or not, will depend on which of the following three categories the job<br />

falls:<br />

1. Non-Prohibited Employment outside the Building and Construction Industry<br />

2. Non-Prohibited Employment within the Building and Construction Industry<br />

3. Prohibited Employment within the Building and Construction Industry that will result in the suspension<br />

of benefit payments<br />

With the division of employment into these three categories many post-retirement work opportunities are allowed for<br />

Retirees receiving monthly payments. However, many jobs which involve a type of work covered by the Collective<br />

Bargaining Agreement in Northern California are still Prohibited and will result in the suspension of benefit payments.<br />

Whether or not a job will result in the suspension of benefit payments is subject to Trustee interpretation. Only the full<br />

Board of Trustees is authorized to interpret the Pension and/or Annuity <strong>Plan</strong>s and any conflict between this<br />

notice and <strong>Plan</strong> documents will be resolved in favor of the <strong>Plan</strong> documents.

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

March 1, 2014<br />

CARPENTER FUNDS ADMINISTRATIVE OFFICE<br />

OF NORTHERN CALIFORNIA, INC.<br />

265 Hegenberger Road, Suite 100 ▪ P.O. Box 2280<br />

Oakland, California 94621<br />

(510) 633-0333 ▪ (888) 547-2054<br />

www.carpenterfunds.com<br />

RE:<br />

<strong>Carpenter</strong>s Pension Trust Fund for Northern California<br />

<strong>Carpenter</strong>s Annuity Trust Fund for Northern California<br />

Income Tax Withholding<br />

Dear Retiree/Beneficiary:<br />

As a reminder, you may choose the number of withholding allowances used to determine how much<br />

Federal Income Tax is withheld from your retirement payments. You may also elect to have no<br />

withholding.<br />

If your monthly Retirement Payments are less than $1,680 per month in 2014<br />

We will not automatically withhold taxes<br />

You may elect withholding if you like<br />

If you previously requested withholding, we will continue to withhold taxes<br />

If your monthly Retirement Payments are greater than $1,680 per month in 2014<br />

We will automatically withhold taxes assuming "Married, 3 exemptions" (IRS requirement)<br />

However, you may elect withholding based on the following:<br />

A different marital status, and/or<br />

A different number of exemptions, or<br />

No withholding at all<br />

If you previously requested withholding, we will continue to withhold taxes<br />

The 2013 rate was also $1,680 and remains the same in 2014. If you wish to change your income tax<br />

deductions you must submit a new Form W-4P Withholding Certificate for Pension or Annuity<br />

Payments. To obtain a W-4P withholding form:<br />

• Contact the Fund <strong>Office</strong> Benefit Services Department<br />

Phone: (510) 633-0333 or Toll Free at (888) 547-2054<br />

Email: benefitservices@carpenterfunds.com<br />

Visit: www.carpenterfunds.com/par_downloads.html<br />

• Visit the Internal Revenue Service’s website: www.irs.gov<br />

If you request a change, it will be put into effect within 60 days after receipt of the form.<br />

Withholding is one way for you to pay a portion of your income tax. If no tax, or not enough tax,<br />

is withheld from your benefits, you may have to pay estimated taxes during the year or a tax<br />

penalty at the end of the year. Of course, whether you have to pay federal income tax on your<br />

benefit payments depends on the total amount of your taxable income. Your decision on<br />

withholding is an important one, and you may wish to discuss it with a qualified tax adviser.<br />

Sincerely,<br />

BOARD OF TRUSTEES

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

June 13, 2014<br />

CARPENTERS PENSION TRUST FUND<br />

FOR NORTHERN CALIFORNIA<br />

265 Hegenberger Road, Suite 100 P.O. Box 2280<br />

Oakland, California 94621-0180<br />

Tel. (510) 633-0333 (888) 547-2054 Fax (510) 633-0215<br />

www.carpenterfunds.com<br />

TO:<br />

FROM:<br />

RE:<br />

All Participants, Beneficiaries, Participating Local Unions, and Contributing Employers<br />

Board of Trustees<br />

<strong>Carpenter</strong>s Pension Trust Fund for Northern California<br />

Notice of Reduction in Future Accruals<br />

Effective July 1, 2014, the Collective Bargaining Agreement provides for increases in the Contributions paid into<br />

the <strong>Carpenter</strong>s Health and Welfare and Pension Trust <strong>Funds</strong>. We have been advised that of the new money<br />

earmarked for benefits, $0.50 is to be allocated to Health and Welfare and $0.35 to Pension. These increases<br />

will not reduce wages. Even though many Employers are already party to the extended agreement, those<br />

Employers who do not sign the new extended agreement prior to July 1, 2014, pay an additional $0.75 per hour<br />

that will be allocated to Pension “off benefit”. The additional $0.75 will be applied to general Pension liabilities<br />

and will not be reflected on individual Participant Pension Statements. Those employees working for nonextended<br />

employers will be credited in the same manner and at the same contribution rates as employees<br />

working for extended employers.<br />

Even though the Scheduled Contribution Rate for Pension is increasing, in order to keep the Monthly Benefit at<br />

approximately the same amount each year, the Accrual Rate Percentage of Contribution Factor will continue to<br />

decrease. The new money is intended to increase the financial stability of the Pension Fund by paying more<br />

towards unfunded liabilities. The same number of Hours in Covered Employment will continue to earn<br />

approximately the same dollar value benefit each year.<br />

These changes do not affect benefits earned prior to July 2014. If you are currently retired and receiving a<br />

monthly benefit payment from the Pension Fund, your payments will continue uninterrupted.<br />

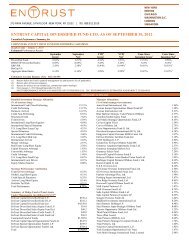

Effective Date<br />

Scheduled<br />

Contribution<br />

Rate<br />

Accrual Rate<br />

Percentage of<br />

Contribution Factor<br />

Monthly Benefit,<br />

Assuming 1,740 Hours<br />

(Sample)<br />

July 1, 2014 to June 30, 2015 $9.20 1.31% $209.70<br />

July 1, 2015 to June 30, 2016 $9.35 1.29% $209.87<br />

July 1, 2016 to June 30, 2017 $9.50 1.27% $209.93<br />

July 1, 2017 to June 30, 2018 $9.65 1.25% $209.89<br />

Starting July 1, 2018 $9.80 1.23% $209.74<br />

For more information about this notice or the Pension <strong>Plan</strong> in general, please contact the Trust Fund <strong>Office</strong> at:<br />

<strong>Carpenter</strong> <strong>Funds</strong> <strong>Administrative</strong> <strong>Office</strong> of Northern California, Inc.<br />

P.O. Box 2280<br />

Oakland, California 94621-1418<br />

Toll-Free: (888) 547-2054 or (510) 633-0333<br />

www.carpenterfunds.com<br />

benefitservices@carpenterfunds.com<br />

Only the full Board of Trustees is authorized to interpret the Pension <strong>Plan</strong>. The Board has discretion to decide<br />

all questions about the <strong>Plan</strong>, including questions about your eligibility for benefits and the amount of any benefits<br />

payable to you. <strong>Plan</strong> rules and benefits may change from time to time. If this occurs, a written notice will be<br />

issued explaining the change. Please be sure to read all <strong>Plan</strong> communications and keep information about<br />

changes with your <strong>Plan</strong> booklet.

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

June 2014<br />

To:<br />

From:<br />

Re:<br />

All Eligible Employees<br />

CARPENTER FUNDS ADMINISTRATIVE OFFICE<br />

OF NORTHERN CALIFORNIA, INC.<br />

265 Hegenberger Road Suite 100- P.O. Box 2280<br />

Oakland, California 94621<br />

(510) 633-0333- (888) 547-2054<br />

www.carpenterfunds.com<br />

Board of Trustees<br />

Northern California <strong>Carpenter</strong>s 401 (k) <strong>Plan</strong> (the "<strong>Plan</strong>")<br />

IMPORTANT INFORMATION REGARDING<br />

THE NORTHERN CALIFORNIA CARPENTERS 401 (k) PLAN<br />

The following information is required by law to be provided on an annual basis to all participants and employees<br />

eligible to participate in the <strong>Plan</strong>.<br />

Please read this notice carefully, as it contains important information about certain features of your <strong>Plan</strong>. To<br />

obtain more general information about the <strong>Plan</strong>, you should obtain a copy of the <strong>Plan</strong>'s Summary <strong>Plan</strong><br />

Description ("SPDj. See "FOR ADDITIONAL INFORMATION," beiON, for information on how you can obtain a<br />

copy of the <strong>Plan</strong>'s current SPD.<br />

NOTE:<br />

Many of your <strong>Plan</strong> elections are made by contacting New York Life Retirement <strong>Plan</strong> Services ("New<br />

York Life"). If you need to contact New York Life, you may do so:<br />

• 24 hours a day via the internet at www.mylife.newyorklife.com, or by calling New York Life's<br />

automated telephone system at: (800) 294-3575. To speak with a Service Representative, call<br />

(800) 294-3575 between 8:00AM to 1 O:OOPM Eastern.<br />

• For advisory help you may contact Pensionmark Retirement Group at www.pensionmark.com or by<br />

calling (888) 201-5488 between 8:30AM to 5:00PM Pacific Time.<br />

Enroll in the Northern California <strong>Carpenter</strong>s 401(k) <strong>Plan</strong> today! Complete an Enrollment/Contribution Change<br />

Form indicating the hourly amount you wish to defer and return it to your employer to begin payroll contributions.<br />

The enrollment form is available on-line at www.carpenterfunds.com.<br />

IRS SAFE-HARBOR NOTICE - 2014 PLAN YEAR<br />

This notice is designed to inform participants of their related rights and obligations under the <strong>Plan</strong>, and satisfy the<br />

requirements of the final regulations under Internal Revenue Code Sections 401 (k) and 401 (m).<br />

Safe Harbor Non-Elective Contribution- 2014 <strong>Plan</strong> Year<br />

If you are an elig!ble participant under the <strong>Plan</strong>, your employer will make a contribution on your behalf equal to at<br />

least 3% of your pay to either the <strong>Carpenter</strong>s Annuity Trust Fund for Northern California or to the Northern<br />

California <strong>Carpenter</strong>s 401 (k) <strong>Plan</strong> as follows:<br />

• If you are a collectively bargained employee, you will receive an employer contribution to the<strong>Carpenter</strong>s<br />

Annuity Trust Fund for Northern California equal to at least 3% of your pay.<br />

• If you are a non-collectively bargained employee, your employer will make a contribution to the Northern<br />

California <strong>Carpenter</strong>s 401(k) <strong>Plan</strong> on your behalf equal to 3o/oof your pay.<br />

For Example: Assume you are paid $30,000 for the <strong>Plan</strong> Year. Your employer will contribute at least $900 (3% x<br />

$30,000) for the <strong>Plan</strong> Year, whether or not you elect to make any deferred contributions to the <strong>Plan</strong>.<br />

NOTE: If you are a collectively bargained employee participating in the <strong>Carpenter</strong>s Annuity Trust Fund for<br />

Northern California, the employer contribution you receive under that <strong>Plan</strong> for the <strong>Plan</strong> Year will<br />

be treated as your Safe Harbor Non-Elective Contribution for purposes of this <strong>Plan</strong> - provided it equals<br />

at least 3% of your pay for the <strong>Plan</strong> Year. You will not receive an additional three percent (3%)<br />

contribution to the Northern California <strong>Carpenter</strong>s 401(k) <strong>Plan</strong>.

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

Other Employer Contributions<br />

No additional employer contributions will be made under the <strong>Plan</strong>.<br />

Type and Amount of Compensation that May Be Deferred<br />

As a participant in the <strong>Plan</strong>, you may elect to defer a portion of your pay each <strong>Plan</strong> Year. Your employer will<br />

contribute this amount (your "deferral contributions") tothe <strong>Plan</strong>.<br />

You may make either regular 401 (k) deferrals (pre-tax) or Roth 401 (k) deferrals (after-tax). Your election<br />

regarding the amount and type of deferrals is irrevocable with respect to any deferrals already withheld from your<br />

pay. If you make regular 401 (k) deferrals, your deferrals are not subject to income tax until distributed from the<br />

<strong>Plan</strong>. If you make Roth 401 (k) deferrals, your deferrals are subject to income tax at the time of deferral.<br />

However, if you satisfy certain distribution requiements, your Roth 401 (k) deferrals and earnings on the deferrals<br />

will not be subject to income tax when distributed from the <strong>Plan</strong>. Both types of deferrals are subject to Social<br />

Security taxes at the time of deferral. Your employer will deduct Social SeCLiity taxes, and in the case of Roth<br />

deferrals will deduct income taxes, from your remaining pay.<br />

You may defer up to $10.75 per hour (not to exceed 100% of your pay) each <strong>Plan</strong> Year, but not more than the<br />

annual deferral limit in effect each calendar year (this limit is $17,500 for 2014, and as indexed by the IRS for<br />

inflation thereafter). Participants who will be age 50 or older during 2014 can contribute additional "catcll-up"<br />

contributions up to $5,500 for 2014 (or up to $14.00 per hour).<br />

For purposes of your deferral election, "pay" (available for deferrals) is generally defined as your compensation<br />

reported on Form W-2, and any amounts deferred under this <strong>Plan</strong>, as well as under any cafeteria plan sponsored<br />

by your employer. However, under the federal tax laws, pay in excess of $260,000 (for 2014) may not be taken<br />

into account for <strong>Plan</strong> purposes. Please refer to the SPD for additional information regarding the type and amount<br />

of pay that may be deferred.<br />

See the "FOR ADDITIONAL INFORMATION," section of this notice, to find out how to get a copy of the current<br />

SPD and other information about the <strong>Plan</strong>.<br />

How to Make Cash or Deferred Elections<br />

To defer a portion of your pay, you must complete and submit the appropriate form. The Northern California<br />

<strong>Carpenter</strong>s 401(k) <strong>Plan</strong> Enrollment/Contribution Change Form is available from the Fund <strong>Office</strong>, found by<br />

accessing our website at www.carpentertunds.com, or by scanning the QR barcode located at the end of this<br />

notice. Once enrolled, you must also contact New York Life to make investment elections for future contributions.<br />

Periods Available for Making Cash or Deferred Elections<br />

In accordance with <strong>Plan</strong> rules, you may change your deferral contribution election (pre-tax and/or Roth) at any<br />

time by completing and submitting the proper form to your employer. The Northern California <strong>Carpenter</strong>s<br />

401(k) <strong>Plan</strong> Enrollment/Contribution Change Formis available at the Fund <strong>Office</strong>, or found by accessing our<br />

website at www.carpenterfunds.com, or found by scanning the QR barcode located at the end of this notice. The<br />

change in contribution amount will be effective as soon as administratively possible (but no later than one month<br />

following the election to change). Participants can stop contributing by completing a Contribution Change Form.<br />

Contributions should stop as soon as administratively possible. (PLEASE NOTE: Even though the <strong>Plan</strong> rules<br />

allow an election change at any time, for administrative purposes your Employer may limit changes to once in a<br />

30 day period.}<br />

Applicable Vesting Provisions<br />

You are always 100% vested in your deferral contributions (pre-tax and/or Roth}, any rollover contributions you<br />

may have made, and any employer "safe-harbor'' non-elective contributions made on your behalf (adjusted for<br />

investment gains and losses}.<br />

Applicable Withdrawal Provisions<br />

You generally may not withdraw your deferral contributions (pre-tax and/or Roth) or any safe-harbor non-elective<br />

contributions except when one of the following events occurs: severance from employment with your employer,<br />

death, disability, or attainment of age 59Yz. You may, however, obtain a "hardship withdrawal" that includes your<br />

deferral contributions if you satisfy certain IRS requirements.

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

You may also withdraw any rollover contributions you may have made (adjusted for investment gains and losses)<br />

at any time. You may withdraw all or any portion of your vested account once you have attained age 59Yz. The<br />

minimum amount you can withdraw is $500.<br />

If you are a collectively bargained employee, you may request a distribution of your entire vested account if you<br />

have ceased working in "covered employmene (i.e., employment with an employer that allows participa1on in this<br />

<strong>Plan</strong>) for at least six (6) months. If you are not a collectively bargained employee, you may request a distribution<br />

of your entire vested account immediately following yourtermination of employment. In either case, you may also<br />

elect to defer payment until a later date, as permitted by law.<br />

All withdrawals are subject to rules and procedures as may be established by the <strong>Plan</strong> Administrator. These are<br />

described in more detail in the <strong>Plan</strong>'s SPD.<br />

See the section below "FOR ADDITIONAL INFORMATION" to find out how to get a copy of the current SPD and<br />

other information about the <strong>Plan</strong>.<br />

<strong>Plan</strong> Amendment and Tennination<br />

The Trustees retain the right to amend the <strong>Plan</strong>, including the right to terminate the <strong>Plan</strong> and discontinue all<br />

contributions (including the safe harbor non-elective contribution) under the <strong>Plan</strong>. Termination of the <strong>Plan</strong> will not<br />

affect your right to receive any contributions you have accrued adjusted for investment gains and losses as of the<br />

effective date of the termination.<br />

FOR ADDITIONAL INFORMATION<br />

You should consult the <strong>Plan</strong> document and SPD for a complete explanation of the <strong>Plan</strong>'s features and information<br />

regarding your rights under the <strong>Plan</strong>. You may access the SPD on-line at www.carpenterfunds.com or by<br />

contacting New York Life. You may access your account information via the Internet<br />

(www.mylife.newyorklife.com) or by phone at (800) 294-3575.<br />

You can also obtain additional information about the <strong>Plan</strong> through New York Life or by contacting the Board of<br />

Trustees, Northern California <strong>Carpenter</strong>s 401 (k) <strong>Plan</strong> (the "Trustees"). The Trustees also serve as the <strong>Plan</strong><br />

Administrator and may be contacted at:<br />

Board of Trustees, Northern California <strong>Carpenter</strong>s 401 (k) <strong>Plan</strong><br />

265 Hegenberger Road, Suite 100 - Oakland, CA 94621-0180<br />

Phone: (510) 633-0333; (888) 547-2054<br />

www.carpenterfunds.com<br />

EIN: 80-0204601<br />

This Notice is not intended, nor should you construe it, to modify any aspect of the current <strong>Plan</strong> document or<br />

Summary <strong>Plan</strong> Description.<br />

Forms and information can be found by accessing our website at www.carpenterfunds.com<br />

Scan the QR barcode below for a direct link to a<br />

Northern California <strong>Carpenter</strong>s 401(k) <strong>Plan</strong> Enrollment/Contribution Change Form<br />

Note: In order to scan QR codes, your mobile device must have a QR code reader installed.<br />

You may be able to find a QR code application aRline or bundled with your phone.

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

CARPENTER FUNDS ADMINISTRATIVE OFFICE<br />

OF NORTHERN CALIFORNIA, INC.<br />

265 Hegenberger Road, Suite 100 ~ P .0. Box 2280<br />

Oakland, California 94621-0180<br />

Tel. (510) 633-0333 ~ (888) 547-2054 ~ Fax (510) 633-0215<br />

www.carpenterfunds.com<br />

August 14, 2014<br />

To:<br />

From:<br />

Re:<br />

All Active Participants<br />

<strong>Carpenter</strong>s Health and Welfare Trust Fund for California<br />

);> <strong>Plan</strong> A & <strong>Plan</strong> R<br />

<strong>Carpenter</strong>s Annuity Trust Fund for Northam California<br />

<strong>Carpenter</strong>s Vacation and Holiday Trust Fund for Northern California<br />

Northern California <strong>Carpenter</strong>s 401(k) Trust Fund<br />

Boards of Trustees<br />

IMPORTANT PLAN INFORMATION- ANNUAL NOTICES<br />

The enclosed notices provide important infonnation regarding your various <strong>Carpenter</strong> <strong>Plan</strong>s. Please review this<br />

infonnation carefully, and keep it where you can find it with your other <strong>Plan</strong> documents.<br />

. . ·<br />

· NoricE.s AND oiscRIPTtONs<br />

' . "<br />

..<br />

. .<br />

.· ·Palil{$) .<br />

ELECTRONIC DELIVERY OF PLAN MATERIALS (E-delivery)<br />

./ Have you considered receiving <strong>Plan</strong> materials and communications from the Fund <strong>Office</strong> electronically?<br />

Electronic delivery of <strong>Plan</strong> documents Is convenient, simplifies your recordkeeping, reduces paper<br />

clutter; ensuf9s fast delivery, and allows more of your contributions to be spent on benefits by saving on<br />

printing and postage costs. ENROLL TODAY and join the incf9asing number of those participating in<br />

E-delivery. To get started complete and retum the enrollment form provided on the following<br />

page.<br />

SUMMARY OF BENEFITS AND COVERAGE (<strong>Plan</strong> A & <strong>Plan</strong> R)<br />

-/ As required by law, group health plans like ours are providing plan participants with a Summary of<br />

Benefits and Coverage (SBC) as a way to help understand and compare medical benefits. The SBC<br />

provides a brief overview of the medical plan benefits provided by the <strong>Carpenter</strong>s Health and Welfare<br />

Trost Fund for CBiifomia. Please share this SBC with your family members who are also covered by the<br />

<strong>Plan</strong>.<br />

NOTICE OF CREDITABLE COVERAGE (Applicable to those eligible for Medicare)<br />

./ A notice for palticipants with Medicare stating that your group carpenters Health & Welfaf9 <strong>Plan</strong>'s<br />

pT9scriptlon drug coverage Is, on averege, at least as good as standard prescription drug coverage<br />

under Medicare Part D.<br />

HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)<br />

NOTICE OF PRIVACY PRACTICES FOR PROTECTED HEALTH INFORMATION (PHI)<br />

./ Notice to participants describing their rights for obtaining a copy of the <strong>Plan</strong>'s legal duties with T9Spect<br />

to PHI and <strong>Plan</strong> uses and disclosures of PHI.<br />

WOMEN'S HEALTH AND CANCER RIGHTS ACT (WHCRA) NOTICE<br />

-/ A description of benefits under the WHCRA and any deductibles, co-payments, coinsurance, and lim;ts<br />

applicable to such benefits.<br />

SPECIAL EXTENSION OF COVERAGE FOR CERTAIN DEPENDENT STUDENTS ON A MEDICALLY<br />

NECESSARY LEAVE OF ABSENCE<br />

./ A notice explaining that extended coverage is available for post-secondary education students on<br />

medical leave.<br />

Group 1/Actlve/A&R

ERISA - <strong>Plan</strong> A/R 1/13/2015<br />

DISCLOSURE OF "GRANDFATHER" STATUS<br />

./ A grandfathered plan must include a statement to that effect in any materials describing benefits<br />

provided under a plan to alert participants and beneficiaries that certain consumer protections may not<br />

apply.<br />

MEDICAID AND THE CHILDREN'S HEALTH INSURANCE PROGRAM (CHIP) NOTICE<br />

OFFER FREE OR LOW-COST HEALTH COVERAGE TO CHILDREN AND FAMILIES<br />

./ A group health plan in a state that provides premium assistance under Medicaid or Children's Health<br />

Insurance Program (CHIP) must notify all employees of potential opportunities for premium assistance<br />

in the state in which employee resides.<br />

SUMMARY ANNUAL REPORTS<br />

./ The enclosed reports are summaries of the annual reports filed for the <strong>Carpenter</strong>s Health and Welfare<br />

Trust Fund for California, the <strong>Carpenter</strong>s Annuity Trust Fund for Northern California, the Northern<br />

California <strong>Carpenter</strong>s 401(k) Trust Fund, and the <strong>Carpenter</strong>s Vacation and Holiday Trust Fund for<br />

Northern California.<br />

FEE DISCLOSURE NOTICE<br />

./ This document includes important information to help you carefully compare the investment options<br />

available under your retirement <strong>Plan</strong>(s). To comply with federal regulations this Information, which<br />

contains retirement plan fee information, is being distributed for participant directed individual account<br />

plans. If you have not elected to self-direct investments in your Annuity Account, or have not enrolled in<br />

the Northam California <strong>Carpenter</strong>s 401 (k) <strong>Plan</strong>, these Investment options and fees do not apply.<br />

For more information about these notices, or the <strong>Plan</strong>s in general, please contact the Trust Fund <strong>Office</strong> at:<br />

<strong>Carpenter</strong> <strong>Funds</strong> <strong>Administrative</strong> <strong>Office</strong> of Northern California, Inc.<br />

P.O. Box 2280<br />

Oakland, California 94621-1418<br />

Toll-Free: (888) 547-2054 or (510) 633-0333<br />

benefrtservices@carpenterfunds.com<br />

carpenterfunds.com<br />

The Board af Trustees of each of the <strong>Carpenter</strong> <strong>Plan</strong>s maintains the right ta change or discontinue the types and<br />

amounts of benefits under each <strong>Plan</strong>. This notice is intended as a summary only, and actual <strong>Plan</strong> documents will be<br />