CAP 50-03 Customs and Excise Duty Act - BURS

CAP 50-03 Customs and Excise Duty Act - BURS

CAP 50-03 Customs and Excise Duty Act - BURS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

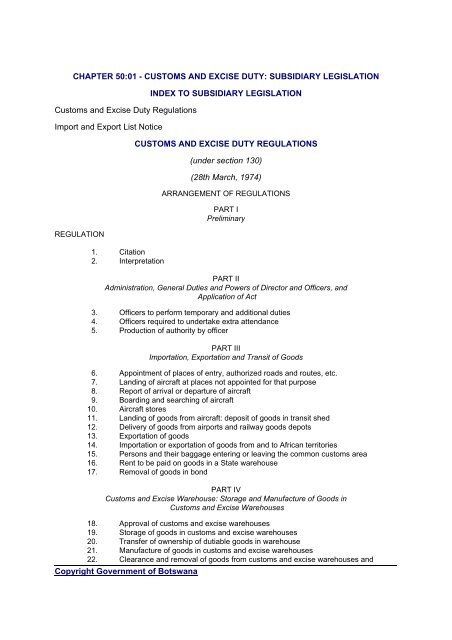

CHAPTER <strong>50</strong>:01 - CUSTOMS AND EXCISE DUTY: SUBSIDIARY LEGISLATION<br />

<strong>Customs</strong> <strong>and</strong> <strong>Excise</strong> <strong>Duty</strong> Regulations<br />

Import <strong>and</strong> Export List Notice<br />

REGULATION<br />

1. Citation<br />

2. Interpretation<br />

Copyright Government of Botswana<br />

INDEX TO SUBSIDIARY LEGISLATION<br />

CUSTOMS AND EXCISE DUTY REGULATIONS<br />

(under section 130)<br />

(28th March, 1974)<br />

ARRANGEMENT OF REGULATIONS<br />

PART I<br />

Preliminary<br />

PART II<br />

Administration, General Duties <strong>and</strong> Powers of Director <strong>and</strong> Officers, <strong>and</strong><br />

Application of <strong>Act</strong><br />

3. Officers to perform temporary <strong>and</strong> additional duties<br />

4. Officers required to undertake extra attendance<br />

5. Production of authority by officer<br />

PART III<br />

Importation, Exportation <strong>and</strong> Transit of Goods<br />

6. Appointment of places of entry, authorized roads <strong>and</strong> routes, etc.<br />

7. L<strong>and</strong>ing of aircraft at places not appointed for that purpose<br />

8. Report of arrival or departure of aircraft<br />

9. Boarding <strong>and</strong> searching of aircraft<br />

10. Aircraft stores<br />

11. L<strong>and</strong>ing of goods from aircraft: deposit of goods in transit shed<br />

12. Delivery of goods from airports <strong>and</strong> railway goods depots<br />

13. Exportation of goods<br />

14.<br />

Importation or exportation of goods from <strong>and</strong> to African territories<br />

15. Persons <strong>and</strong> their baggage entering or leaving the common customs area<br />

16. Rent to be paid on goods in a State warehouse<br />

17. Removal of goods in bond<br />

PART IV<br />

<strong>Customs</strong> <strong>and</strong> <strong>Excise</strong> Warehouse: Storage <strong>and</strong> Manufacture of Goods in<br />

<strong>Customs</strong> <strong>and</strong> <strong>Excise</strong> Warehouses<br />

18. Approval of customs <strong>and</strong> excise warehouses<br />

19. Storage of goods in customs <strong>and</strong> excise warehouses<br />

20. Transfer of ownership of dutiable goods in warehouse<br />

21. Manufacture of goods in customs <strong>and</strong> excise warehouses<br />

22. Clearance <strong>and</strong> removal of goods from customs <strong>and</strong> excise warehouses <strong>and</strong>

payment of duty<br />

23. Clearance <strong>and</strong> removal of goods from customs <strong>and</strong> excise warehouses for home<br />

consumption<br />

24. Clearance <strong>and</strong> removal of goods from customs <strong>and</strong> excise warehouses for export<br />

(including supply as stores to foreign-going aircraft)<br />

25. Clearance of goods from customs <strong>and</strong> excise warehouses for removal in bond<br />

26. Ascertaining the strength <strong>and</strong> quantity of spirits for duty purposes<br />

27. Control of the use of spirits for certain purposes<br />

28. Requirements in respect of stills<br />

29. Spirits manufactured by agricultural distillers<br />

30. Manufacture of spirits in customs <strong>and</strong> excise manufacturing warehouses<br />

31. Manufacture of spirituous beverages in any customs <strong>and</strong> excise storage<br />

warehouse <strong>and</strong> clearance of such beverages<br />

32. Manufacture of wine<br />

33. Manufacture of beer<br />

34. Manufacture of vinegar substitutes, etc.<br />

35. Manufacture of tobacco<br />

36. Manufacture of mineral oils<br />

37. Manufacture of motor vehicles<br />

38. Manufacture of sales duty goods<br />

PART V<br />

Clearance <strong>and</strong> Origin of Goods: Liability for <strong>and</strong> Payment of Duties<br />

39. Entry of goods <strong>and</strong> time of entry<br />

40. Requirements regarding invoices<br />

41. Origin of goods<br />

42. Importation of cigarettes<br />

43. Onus of proof<br />

44. Currency conversion<br />

Copyright Government of Botswana<br />

PART VI<br />

Anti-Dumping Duties<br />

PART VII<br />

Application of Agreements with other African Territories<br />

45. General<br />

46. Transfer of goods between the partner states<br />

47. Amendment of duties<br />

PART VIII<br />

Amendment of Duties<br />

PART IX<br />

Licensing<br />

48. Issue <strong>and</strong> renewal of licences<br />

49. Licensing of special customs <strong>and</strong> excise warehouses<br />

<strong>50</strong>. Allocation of numbers to customs <strong>and</strong> excise warehouses<br />

51. Issuing <strong>and</strong> renewal of licences to agricultural distillers<br />

52. Special provisions regarding stills <strong>and</strong> still makers<br />

PART X

53. Foreign currency<br />

54. Exemptions<br />

55. Related persons<br />

56. Valuation code on bill of entry<br />

57. Valuation methods<br />

58. Furnishing of information<br />

59. Valuation determination<br />

60. Method of determining value<br />

61. Additions to price<br />

Copyright Government of Botswana<br />

Value<br />

PART XI<br />

Rebates, Refunds <strong>and</strong> Drawbacks of <strong>Duty</strong><br />

62. General provisions<br />

63. Registered premises<br />

64. Rebate stores<br />

65. Security<br />

66. Liability for duty<br />

67. Transfer of goods<br />

68. Stock records <strong>and</strong> working cards<br />

69. General refunds in respect of imported, excisable or sales duty goods<br />

70. Penal provisions<br />

PART XII<br />

Penal Provisions<br />

PART XIII<br />

General<br />

71. Removal of excisable goods within the common customs area<br />

72. Examination of goods<br />

73. Wreck<br />

74. Goods unshipped or l<strong>and</strong>ed from wrecked or distressed aircraft<br />

75. Days <strong>and</strong> hours of general attendance<br />

76. Charges for extra <strong>and</strong> special attendance<br />

77. Business in customs houses<br />

78. Surety bonds<br />

79. Agents <strong>and</strong> carriers subject to section 111 of the <strong>Act</strong><br />

80. Business records to be kept<br />

81. Import <strong>and</strong> export list<br />

82. Certificates for imported motor vehicles<br />

First Schedule - Requirements regarding Invoices<br />

Second Schedule - Index of Forms<br />

Third Schedule - Industrial Rebates of Fiscal <strong>and</strong> <strong>Customs</strong> Duties<br />

Fourth Schedule - General Rebates of Fiscal <strong>and</strong> <strong>Customs</strong> Duties<br />

Fifth Schedule - Specific Drawbacks <strong>and</strong> Refunds of Fiscal <strong>and</strong> <strong>Customs</strong> Duties<br />

Sixth Schedule - Specific Rebates <strong>and</strong> Refunds of <strong>Excise</strong> Duties<br />

Seventh Schedule - Rebates <strong>and</strong> Refunds of Sales <strong>Duty</strong><br />

Eighth Schedule - Appointment of Places of Entry, Authorized Roads <strong>and</strong> Routes,<br />

etc.

1. Citation<br />

Copyright Government of Botswana<br />

PART I<br />

Preliminary (regs 1-2)<br />

These Regulations may be cited as the <strong>Customs</strong> <strong>and</strong> <strong>Excise</strong> <strong>Duty</strong> Regulations.<br />

S.I. 36, 1974,<br />

S.I. 82, 1975,<br />

S.I. 108, 1976,<br />

S.I. 28, 1977,<br />

S.I. 79, 1978,<br />

S.I. 152, 1978,<br />

S.I. 93, 1980,<br />

S.I. 34, 1982,<br />

S.I. 140, 1983,<br />

S.I. 167, 1983,<br />

S.I. 18, 1986,<br />

S.I. 20, 1986,<br />

S.I. 61, 1986,<br />

S.I. 97, 1986,<br />

S.I. 132, 1987,<br />

S.I. 26, 1988,<br />

S.I. 92, 1988,<br />

S.I. 83, 1990,<br />

S.I. 79, 1991,<br />

S.I. 118, 1991,<br />

S.I. 131, 1991,<br />

S.I. 57, 1992,<br />

S.I. 29, 1993,<br />

S.I. 45, 1993,<br />

S.I. 22, 1994,<br />

S.I. 68, 1994,<br />

S.I. 121, 1994,<br />

S.I. 124, 1994,<br />

S.I. 56, 1996,<br />

S.I. 79, 1996,<br />

S.I. 34, 1997,<br />

S.I. 6, 1998,<br />

S.I. 42, 1998,<br />

S.I. 43, 1998,<br />

S.I. 76, 2000,<br />

S.I. 37, 2001,<br />

S.I. 8, 2002,<br />

S.I. 30, 2002,<br />

S.I. 47, 2002,<br />

S.I. 61, 20<strong>03</strong>,<br />

S.I. 127, 2004,<br />

S.I. 88, 2005,<br />

S.I. 49, 2006.

2.<br />

Interpretation<br />

In these Regulations, unless the context otherwise requires-<br />

"foreign-going" means departing from any place within the common customs area to<br />

any place outside the common customs area;<br />

"proper officer" means any officer whose right or duty it is to require the performance of<br />

or to perform the act referred to.<br />

PART II<br />

Administration, General Duties <strong>and</strong> Powers of Director <strong>and</strong> Officers,<br />

<strong>and</strong> Application of <strong>Act</strong> (regs 3-5)<br />

3. Officers to perform temporary <strong>and</strong> additional duties<br />

(1) Any officer may at any time be called upon to perform temporarily duties other than<br />

those ordinarily appertaining to his class or grade.<br />

(2) Officers may be called upon at any time to perform, in addition to their normal duties,<br />

such clerical work as the Director may decide.<br />

4. Officers required to undertake extra attendance<br />

No officer shall have the right to refuse to undertake extra attendance but the Director<br />

may exempt an officer from such attendance in general or in any particular case.<br />

5. Production of authority by officer<br />

Any officer whose normal duty it is to conduct inspection under the <strong>Act</strong> shall, on arrival at<br />

the premises of any importer, manufacturer or any other person on routine inspection duties,<br />

declare his official capacity <strong>and</strong> purpose <strong>and</strong> produce the authority issued to him by the<br />

Director to conduct such inspection, but the provisions of this regulation shall not apply in<br />

circumstances which the Director considers exceptional.<br />

PART III<br />

Importation, Exportation <strong>and</strong> Transit of Goods (regs 6-17)<br />

6. Appointment of places of entry, authorized roads <strong>and</strong> routes, etc.<br />

(1) The places, roads, routes, sheds, entrances <strong>and</strong> exits appointed or prescribed under<br />

section 7 of the <strong>Act</strong> <strong>and</strong> their use or employment for the purposes for which they have been<br />

so appointed or prescribed shall be subject to the conditions stated in the Eighth Schedule<br />

hereto.<br />

(2) No person shall enter any place appointed under section 7 of the <strong>Act</strong>, except the<br />

persons required by the department to enter it, the proper officers <strong>and</strong> such other persons as<br />

the Director may permit to enter such place.<br />

7. L<strong>and</strong>ing of aircraft at places not appointed for that purpose<br />

(1) The pilot of any aircraft arriving in Botswana from a place outside the common<br />

customs area who is forced by stress of weather, accident or other circumstances beyond<br />

his control to l<strong>and</strong> at a place in Botswana not appointed as a customs <strong>and</strong> excise airport<br />

Copyright Government of Botswana

(whether or not such aircraft has already called at any place in Botswana), shall forthwith<br />

report the arrival of his aircraft in terms of section 8 of the <strong>Act</strong> <strong>and</strong> the circumstances of such<br />

arrival to the proper officer at that place.<br />

(2) If no customs <strong>and</strong> excise officer is stationed at the place mentioned in subregulation<br />

(1) such pilot shall forthwith report the circumstances of his arrival to the magistrate or a<br />

member of the Botswana Police Force at or nearest to that place <strong>and</strong> such pilot shall also as<br />

early as possible make a report in terms of section 8 of the <strong>Act</strong> to the proper officer at the<br />

place at which such aircraft was next due to l<strong>and</strong> or to the proper officer nearest to the place<br />

where he has l<strong>and</strong>ed.<br />

(3) Such pilot shall forthwith take steps to prevent the l<strong>and</strong>ing, loss, damage, removal or<br />

pilferage of any cargo or other goods on such aircraft or, if any cargo or other goods are<br />

l<strong>and</strong>ed from such aircraft when in distress, to prevent the loss, damage, removal or pilferage<br />

of any cargo or other goods so l<strong>and</strong>ed.<br />

(4) He shall also report available particulars of all cargo or other goods l<strong>and</strong>ed from such<br />

aircraft to the proper officer, magistrate or a member of the Botswana Police Force.<br />

(5) The pilot of such aircraft shall also prevent the passengers <strong>and</strong> crew of such aircraft<br />

from leaving the immediate vicinity thereof unless the permission of the proper officer,<br />

magistrate or a member of the Botswana Police Force has been obtained or the<br />

circumstances dem<strong>and</strong> otherwise.<br />

(6) Any magistrate or a member of the Botswana Police Force to whom a report is made<br />

by a pilot of such aircraft shall report the circumstances to the nearest proper officer by the<br />

most expeditious means available <strong>and</strong> shall render all possible assistance to such pilot to<br />

comply with the requirements of subregulations (3), (4), <strong>and</strong> (5).<br />

8. Report of arrival or departure of aircraft<br />

(1) The report referred to in section 8(1)(a) of the <strong>Act</strong> shall state the information required<br />

in the form CE.2 specified in these Regulations.<br />

(2) The pilot of any foreign-going aircraft shall, before its departure from any place in<br />

Botswana, deliver to the proper officer one general declaration in the form CE.2 in respect of<br />

all destinations together <strong>and</strong> a separate transire in the form CE.4 (Transire-For a Destination<br />

in the Common <strong>Customs</strong> Area) in respect of each such destination.<br />

(3) A manifest, in the form CE.3, of all goods shipped as stores ex customs <strong>and</strong> excise<br />

warehouse <strong>and</strong> of all excisable <strong>and</strong> sales duty goods shipped as stores on such<br />

foreign-going aircraft (or alternatively copies of all bills of entry for shipment of such goods),<br />

shall be sealed by the proper officer to such general declaration.<br />

(4) A manifest, in the form CE.3, of all goods ex customs <strong>and</strong> excise warehouse or goods<br />

on which a drawback of customs or excise duty is due on export or imported goods on which<br />

duty has not been paid or excisable or sales duty goods, exported or removed in bond on<br />

such foreign-going aircraft to a place outside the common customs area (or alternatively<br />

copies of all bills of entry for shipment of such goods), shall be sealed to such general<br />

declaration.<br />

(5) A copy of the report outwards in the form CE.2 incorporating copies of the manifests<br />

of all goods shipped at that place on such foreign-going aircraft for a destination outside the<br />

Copyright Government of Botswana

common customs area (including again the goods mentioned in subregulation (4), shall be<br />

sealed to such general declaration.<br />

(6) The pilot of such foreign-going aircraft shall submit, at the time of reporting inwards of<br />

such aircraft, to the proper officer at every place in the common customs area at which such<br />

aircraft calls, the general declaration issued to him at every place in the common customs<br />

area at which such aircraft has previously called <strong>and</strong> such declaration may be retained by<br />

the proper officer until the time of departure of such aircraft.<br />

(7) To the transire submitted in terms of section 8(6) of the <strong>Act</strong> by the pilot of a<br />

foreign-going aircraft in respect of each place in the common customs area at which it is due<br />

to call the proper officer shall seal a manifest, in a form approved by the Director, of goods<br />

removed in bond or, alternatively, copies of all bills of entry for the removal of goods in bond<br />

to that place (or if no goods for removal in bond have been shipped for that place, the<br />

relative transire must bear a statement to that effect) <strong>and</strong> such transire shall contain a<br />

statement whether or not goods of the nature referred to in subregulation (3) or (4) have<br />

been shipped at any place in the common customs area.<br />

(8) Such transire shall also contain a manifest of goods carried coastwise <strong>and</strong> shall be<br />

h<strong>and</strong>ed to the proper officer at the time of reporting inwards of such aircraft at the place of<br />

destination <strong>and</strong> shall be retained by the proper officer at that place.<br />

(9) The proper officer may refuse clearance for the departure of any aircraft from any<br />

place unless evidence to his satisfaction has been produced that the pilot of such aircraft<br />

has complied with the provisions of all laws of Botswana <strong>and</strong> the customs laws of the<br />

common customs area with which it was his duty to comply.<br />

(10) The pilot of any aircraft arriving at or departing from any place in Botswana shall<br />

submit to the proper officer the number of copies of such documents as are referred to in<br />

subregulations (1) to (9) as the proper officer requires.<br />

9. Boarding <strong>and</strong> searching of aircraft<br />

(1) All sealable goods which have not been declared by the pilot or any member of the<br />

crew of an aircraft at any place in Botswana under section 9 of the <strong>Act</strong> <strong>and</strong> any other goods<br />

(not being the personal baggage or possessions of the pilot, crew or passengers) which the<br />

pilot is unable to prove to the satisfaction of the proper officer to be manifested for discharge<br />

at any other place shall be treated as illicit goods <strong>and</strong> shall be liable to forfeiture.<br />

(2) The proper officer may prohibit any person who has no official business on such<br />

aircraft from boarding the aircraft until such formalities on arrival of the aircraft relating to<br />

customs <strong>and</strong> excise requirements as he may decide have been completed.<br />

10. Aircraft stores<br />

(1) The declaration required under section 9 of the <strong>Act</strong> shall be made in the form CE.5<br />

<strong>and</strong> shall be h<strong>and</strong>ed to the proper officer on dem<strong>and</strong> immediately upon arrival of any aircraft<br />

at any place in Botswana <strong>and</strong>, if not dem<strong>and</strong>ed before the time of reporting of such aircraft,<br />

the said form shall be submitted to the proper officer at the time of reporting of such aircraft.<br />

(2) The declaration required to be made under section 9 of the <strong>Act</strong> shall be made<br />

individually on the same form by the pilot <strong>and</strong> every member of the crew of any aircraft.<br />

Copyright Government of Botswana

(3) The pilot <strong>and</strong> every member of the crew of an aircraft arriving in Botswana directly<br />

from a place outside the common customs area may, during the stay of such aircraft, be<br />

permitted by the proper officer to retain in his personal possession, <strong>and</strong> for his personal use,<br />

duty free stores in accordance with the following scale-<br />

Tobacco<br />

in any<br />

form<br />

Copyright Government of Botswana<br />

Potable<br />

spirits<br />

in any<br />

form<br />

Wine Beer<br />

or Stout<br />

The pilot 230 grams 1 litre 3 litres 3 litres<br />

Officers 175 grams 1 litre 3 litres 3 litres<br />

Other<br />

members<br />

115 grams Nil 3 litres *(1) Nil<br />

(4) This regulation shall not entitle the pilot or any member of the crew to l<strong>and</strong> such goods<br />

without the payment of duty except with the permission of the proper officer.<br />

(5) If required to do so by the proper officer the pilot or any member of the crew shall<br />

produce all sealable goods in his possession.<br />

(6) The proper officer shall place under seal all quantities in excess of those enumerated<br />

in subregulation (3), as well as any other goods mentioned in section 9 of the <strong>Act</strong> or<br />

subregulation (7) (<strong>and</strong> the pilot shall provide every facility for such sealing) but the proper<br />

officer may permit the pilot of an aircraft or any member of the crew of an aircraft to leave<br />

any sealable stores in his possession on arrival of such aircraft in Botswana in the custody<br />

of the proper officer until re-exported under official supervision by such pilot or member of<br />

the crew.<br />

(7) The following goods are declared to be sealable goods-<br />

(a) undesirable publications, objects or film;<br />

(b) fire-arms (which include gas <strong>and</strong> alarm pistols <strong>and</strong> gas rifles of a calibre of 5,6 mm<br />

<strong>and</strong> larger) <strong>and</strong> ammunition; <strong>and</strong><br />

(c) dangerous weapons (which include swords, daggers, bayonets, knives with cutting<br />

edges of 10 cm or more in length (excluding knives for domestic or industrial<br />

purposes), loaded or spiked sticks, knuckle-dusters, flick knives, batons of solid<br />

rubber, teargas pens <strong>and</strong> pistols, etc., <strong>and</strong> walking sticks, etc., which are capable of<br />

concealing a blade or any other deadly weapon).<br />

(8) The pilot of an aircraft shall not permit any customs <strong>and</strong> excise seal on any goods in<br />

terms of section 9 of the <strong>Act</strong> to be broken until the aircraft is en route to a place outside the<br />

common customs area without intending to l<strong>and</strong> again at any place in the common customs<br />

area.<br />

11. L<strong>and</strong>ing of goods from aircraft; deposit of goods in transit shed

(1) Except as provided in this regulation, goods shall be l<strong>and</strong>ed from an aircraft only<br />

between the hours of 7.30 a.m. <strong>and</strong> 5.00 p.m. from Monday to Friday.<br />

(2) The l<strong>and</strong>ing of goods shall not be effected at any other time or on Saturdays, Sundays<br />

or public holidays, except with the special permission in writing of <strong>and</strong> under the conditions<br />

imposed by the proper officer.<br />

(3) Pilots or their agents requesting permission to l<strong>and</strong> goods from an aircraft at times<br />

other than those specified in subregulation (1) or on Saturdays, Sundays or public holidays,<br />

shall pay to the proper officer the prescribed charges for the attendance of such officers as<br />

the proper officer may deem necessary.<br />

(4) The pilot, agent or the representative of such pilot or agent, or any other person<br />

l<strong>and</strong>ing goods before due entry thereof, shall remove such goods only into a duly appointed<br />

transit shed (or other place previously approved by the Director) <strong>and</strong> shall stack such goods<br />

in such manner as will readily enable a complete check of all packages to be made.<br />

(5) Goods shall not be removed from one transit shed to another without the specific<br />

permission of the proper officer.<br />

(6) Goods in transit, or goods marked for another place, shall, on being l<strong>and</strong>ed, be kept<br />

entirely separate from other goods, <strong>and</strong> packages which are damaged or from which the<br />

whole or part of the contents is missing shall not be placed on board any vehicle for removal<br />

to another place until they have been examined in the presence of the proper officer <strong>and</strong><br />

their contents ascertained.<br />

(7) The packages shall then be repaired to the satisfaction of the proper officer <strong>and</strong> be<br />

sealed by him.<br />

(8) Goods shall, on being l<strong>and</strong>ed, not be stacked in the open except with the special<br />

permission of the proper officer.<br />

(9) In all cases where l<strong>and</strong>ed goods are deposited in the open, the conditions relating to<br />

stacking, as stipulated in subregulations (4), (5), (6) <strong>and</strong> (7), shall apply.<br />

(10) The Director may permit goods which have been duly entered before l<strong>and</strong>ing to be<br />

l<strong>and</strong>ed direct from an aircraft into vehicles for immediate conveyance to their destination on<br />

condition that the goods are stowed in the vehicles in such a manner that they can readily be<br />

checked.<br />

(11) The Director may permit goods of any class or kind which have not been entered<br />

before l<strong>and</strong>ing to be l<strong>and</strong>ed direct from an aircraft into vehicles on such conditions as he<br />

may impose in each case.<br />

(12) If any package l<strong>and</strong>ed from an aircraft is leaking or if the whole or part of its contents<br />

is missing or if the package is in a damaged condition or the mass of any package differs<br />

from the invoiced or manifested mass thereof, the contents of such package (hereinafter<br />

referred to as a "discrepant package"), ascertained by examination as stated below, shall<br />

subject to section 46(1) of the <strong>Act</strong>, be accepted as being all the goods imported in such<br />

package provided-<br />

(a) such package is examined as early as possible after l<strong>and</strong>ing but not later than the<br />

expiry of the time referred to in section 40(1) <strong>and</strong> (2), or removal of such package<br />

Copyright Government of Botswana

from the transit shed where it was deposited on l<strong>and</strong>ing, whichever is the earlier, or,<br />

if not so deposited, before removal from the place where it was l<strong>and</strong>ed;<br />

(b) such package is examined, in the case of examination of the package after due<br />

entry thereof, by the importer, <strong>and</strong> in the case of examination of the package before<br />

due entry thereof, by the pilot of the aircraft from which it was l<strong>and</strong>ed, in the<br />

presence of <strong>and</strong> in conjunction with the proper officer;<br />

(c) an account of the contents of the package (or of the missing goods) issued by the<br />

carrier is furnished to the proper officer by the importer or the pilot, as the case may<br />

be;<br />

(d) the account is legible <strong>and</strong> identifies the missing goods to the satisfaction of the<br />

Director <strong>and</strong> is signed <strong>and</strong> dated by the proper officer, importer or pilot, as the case<br />

may be, who conducted the examination;<br />

(e) the account of such discrepant package specifies the identifying marks, numbers<br />

<strong>and</strong> other particulars of each package examined <strong>and</strong> specifies the actual contents<br />

(or the missing goods) of each package separately; <strong>and</strong><br />

(f)<br />

there is no evidence that the missing goods or any portion thereof entered into<br />

consumption in the common customs area, even when the duty on the goods<br />

missing therefrom does not exceed P25.<br />

(13) Subregulation (12) shall mutatis mut<strong>and</strong>is apply in respect of any discrepant package<br />

l<strong>and</strong>ed from a railway train in which such package was imported <strong>and</strong> for that purpose any<br />

reference to the pilot of the aircraft shall be deemed to be a reference to the carrier of the<br />

package.<br />

(14) Subregulation (12) shall mutatis mut<strong>and</strong>is apply in respect of any discrepant package<br />

imported by road <strong>and</strong> for that purpose any reference in the said subregulation to the proper<br />

officer, the pilot of the aircraft, to the time of examination <strong>and</strong> to any account shall be<br />

deemed to be a reference to the proper officer at the place where the conveying vehicle<br />

entered Botswana, to the carrier of the package, to the time while such vehicle is under the<br />

control of the proper officer at such place <strong>and</strong> to the account taken by the proper officer of<br />

the contents of such package, respectively.<br />

(15) Subregulation (12) shall mutatis mut<strong>and</strong>is apply in respect of any discrepant package<br />

imported by post <strong>and</strong> for that purpose any reference in the said subregulation to the pilot of<br />

the aircraft, to the time of examination <strong>and</strong> to any account shall be deemed to be a reference<br />

to any postal official in whose custody the package is prior to delivery, to the time while such<br />

package is in the custody of such official <strong>and</strong> to an account of the missing goods endorsed<br />

by such official on the relative postal manifest respectively:<br />

Provided that the contents of such discrepant package shall be accepted as being all the<br />

goods imported in that package even where the duty on the goods missing therefrom does<br />

not exceed P25.<br />

(16) Subregulations (12) to (14) shall mutatis mut<strong>and</strong>is apply in respect of any<br />

examination conducted under subregulations (6) <strong>and</strong> (7), <strong>and</strong> for that purpose any reference<br />

to the pilot of the aircraft <strong>and</strong> to an account shall be deemed to be a reference to the proper<br />

officer <strong>and</strong> to the account taken by him of the contents of such package, respectively.<br />

Copyright Government of Botswana

(17) Subregulation (12) shall only apply to a discrepant package at the first place of<br />

l<strong>and</strong>ing thereof in the common customs area <strong>and</strong> shall not apply to any discrepant package<br />

after removal thereof in bond.<br />

(18) Examination, mass-measuring, repairing or removal of any package in terms of this<br />

regulation shall, in the discretion of the proper officer, be subject to supervision by him <strong>and</strong><br />

he may at any time dem<strong>and</strong> re-examination of the package concerned.<br />

12. Delivery of goods from airports <strong>and</strong> railway goods depots<br />

(1) No person shall deliver goods l<strong>and</strong>ed from an aircraft or railway train from any transit<br />

shed or other approved place until he has submitted to the authority in control of such shed<br />

or other place, a copy of the relative customs <strong>and</strong> excise delivery order in the form CE.61.<br />

(2) If any goods have been delivered before a valid customs <strong>and</strong> excise delivery order<br />

has been granted by the proper officer in respect of such goods for the delivery or<br />

forwarding thereof to the importer, such goods shall, if the proper officer so requires, be<br />

returned at the expense of the railway or airline operator to the place from which such goods<br />

were so delivered, or be brought to such other place as the proper officer may decide.<br />

(3) The Director may enter into such other arrangements with the railway or airline<br />

operators as he may deem necessary in respect of the h<strong>and</strong>ling of goods in terms of this<br />

Part.<br />

(4) The delivery of goods from any airport or railway transit shed before discharge of the<br />

aircraft or train has been completed, will be permitted, provided the customs <strong>and</strong> excise<br />

delivery order proving that the goods have been duly entered has been received by the<br />

authority in control of such airport or railway transit shed <strong>and</strong> the goods are not required to<br />

be detained for the purposes of the Department.<br />

(5) No customs <strong>and</strong> excise delivery order shall be valid <strong>and</strong> shall be acted upon unless<br />

such form is signed <strong>and</strong> date-stamped by the proper officer <strong>and</strong> bears the number <strong>and</strong> date<br />

of the bill of entry on which the goods to which such order relates were entered in terms of<br />

the <strong>Act</strong>.<br />

(6) The proper officer may by endorsement on any customs <strong>and</strong> excise delivery order, or<br />

in any other manner, order the detention or the delivery to a place indicated by him of the<br />

whole or any part of the goods to which such order relates <strong>and</strong> such goods shall not be<br />

delivered or removed except as ordered by the proper officer.<br />

(7) Every agent, railway official, airline operator or other person l<strong>and</strong>ing <strong>and</strong> delivering<br />

goods at any place shall, within a period of 14 days from the date on which such l<strong>and</strong>ing<br />

commences, or within such further period as the proper officer may allow, furnish to the<br />

proper officer a statement with particulars of the packages reported for l<strong>and</strong>ing at that place<br />

in terms of section 8 of the <strong>Act</strong> but not l<strong>and</strong>ed at the place, <strong>and</strong> of the packages l<strong>and</strong>ed at<br />

that place but not so reported, <strong>and</strong> shall before the expiration of the said period of 14 days or<br />

such further period as has been allowed by the proper officer, deliver all goods l<strong>and</strong>ed but<br />

not reported (unless the said statement reflects particulars of due entry <strong>and</strong> delivery of such<br />

goods), as well as all goods in respect of which due entry has not been made, to the State<br />

warehouse or such other place as may be approved by the proper officer.<br />

13. Exportation of goods<br />

Copyright Government of Botswana

(1) Any person entering goods for exportation shall, if required to do so by the proper<br />

officer, produce all documents relating to the goods together with the air way-bill or<br />

consignment note.<br />

(2) Subject to subregulation (6), no person shall cause any goods for export to be loaded<br />

into an aircraft, train or any other vehicle unless such person has received a copy of the air<br />

way-bill or consignment note relating to such goods, signed <strong>and</strong> date-stamped by the proper<br />

officer, authorizing the export of such goods in that aircraft, train or any other vehicle:<br />

Provided that, in respect of air freight cleared at the office of any proper officer, such<br />

clearance shall be valid for the export of goods through any customs <strong>and</strong> excise airport.<br />

(3) Regulation 11(1), (2) <strong>and</strong> (3) shall mutatis mut<strong>and</strong>is apply to the exportation of goods<br />

by aircraft.<br />

(4) The pilot of any aircraft into which any goods referred to in regulation 8(3) or (4) have<br />

been loaded for export shall, before departure from the last place of call in Botswana, on<br />

dem<strong>and</strong> by the proper officer indicate to him all such goods for the purpose of checking or<br />

account to him for such goods.<br />

(5) No such goods shall be l<strong>and</strong>ed at any place in Botswana without the express<br />

permission of the proper officer <strong>and</strong> if l<strong>and</strong>ed, such goods shall be treated as imported<br />

goods l<strong>and</strong>ed without reporting in terms of section 8 of the <strong>Act</strong>.<br />

(6) In the case of goods being exported from a place in Botswana where there is no<br />

customs <strong>and</strong> excise office, the Director may, in respect of such goods as he considers<br />

necessary <strong>and</strong> under such conditions as he may impose, permit the exporter to present a bill<br />

of entry for export of-<br />

(a) goods not ex warehouse in the form CE.23 or 24, together with the relative<br />

documents, to the railway or air transport official at that place; <strong>and</strong><br />

(b) sales duty goods manufactured in Botswana <strong>and</strong> exported ex warehouse in the<br />

form CE.25 by rail by the licensed manufacturer, together with the relative invoice to<br />

the railway official at that place.<br />

(7) Such official shall ensure that the requirements of the <strong>Act</strong> are complied with before<br />

authorizing the exportation of the goods in question <strong>and</strong> shall forward the original of the bill<br />

of entry concerned to the Director.<br />

14.<br />

Importation or exportation of goods from <strong>and</strong> to African territories<br />

The importation of any goods from or the exportation of any goods to any African territory<br />

with the Government of which any agreement has been concluded under any provision of<br />

the <strong>Act</strong> shall be subject to such agreement.<br />

15. Persons <strong>and</strong> their baggage entering or leaving the common customs area<br />

(1) A person entering the common customs area shall not remove his baggage, nor any<br />

other goods accompanying him, from customs <strong>and</strong> excise control, or cause such baggage or<br />

goods to be so removed until they have been released by the proper officer, <strong>and</strong> no person<br />

shall deliver any such baggage or goods left with or h<strong>and</strong>ed to him for delivery until such<br />

release has been granted.<br />

Copyright Government of Botswana

(2) Every person entering or leaving the common customs area shall declare<br />

unreservedly to the proper officer what goods he has in his possession, taking particular<br />

care to mention articles to which attention is invited on the form of declaration approved by<br />

the Director.<br />

(3) Every person entering or leaving Botswana shall produce <strong>and</strong> deliver to the proper<br />

officer any goods the importation or exportation of which is prohibited or restricted.<br />

(4) The required declaration shall be made to the proper officer in a form approved by the<br />

Director <strong>and</strong> may be h<strong>and</strong>ed to the pilot or any agent clearing the baggage through customs<br />

including any representative of the railway operator acting as a clearing agent.<br />

(5) The proper officer may in his discretion accept an oral declaration, but he may<br />

subsequently dem<strong>and</strong> a written declaration.<br />

(6) Any goods brought into the common customs area <strong>and</strong> intended for sale shall be<br />

specially declared as cargo <strong>and</strong> shall be entered as such for customs <strong>and</strong> excise purposes<br />

on the specified forms.<br />

(7) Any goods not being cargo reported in terms of section 8 of the <strong>Act</strong> which have been<br />

imported or exported or removed from customs <strong>and</strong> excise control or in respect of which an<br />

attempt at importing, exporting or removal has been made without a valid declaration shall<br />

be treated as goods imported, exported or removed without due entry thereof.<br />

16. Rent to be paid on goods in a State warehouse<br />

The charge for rent on goods (except state stores) in any state warehouse in Botswana<br />

shall, depending upon the circumstances, be calculated as follows-<br />

(a) goods l<strong>and</strong>ed at a place to which they were not consigned, at the rate of <strong>50</strong> thebe<br />

per 100 kg or portion thereof for every seven days or portion of seven days;<br />

(b) goods imported by an individual <strong>and</strong> which are seized in terms of the provisions of<br />

section 99(1) of the <strong>Act</strong> <strong>and</strong> subsequently delivered in terms of section 104 of the<br />

<strong>Act</strong>, at the rate of 20 thebe per 10 kg or portion thereof for every seven days or<br />

portion of seven days;<br />

(c) goods imported by an individual <strong>and</strong> which are seized in terms of the provisions of<br />

section 124(1) of the <strong>Act</strong> pending the production of a certificate, permit or other<br />

authority <strong>and</strong> subsequently released in terms of section 118 of the <strong>Act</strong>, at the rate of<br />

20 thebe per 10 kg or portion thereof for every seven days or portion of seven days;<br />

(d) goods which are removed within 14 days from the date of receipt, at the rate of<br />

P1,00 per 100 kg or portion thereof for every seven days or portion of seven days;<br />

(e) goods which are removed after 14 days but within 28 days from the date of receipt,<br />

at the rate of P2,00 per 100 kg or portion thereof for every seven days or portion of<br />

seven days;<br />

(f) goods which are removed after 28 days from the date of receipt, at the rate of<br />

P4,00 per 100 kg or portion thereof for every seven days or portion of seven days;<br />

or<br />

(g) unentered goods which are sold in terms of the provisions of section 45(4) of the<br />

Copyright Government of Botswana

<strong>Act</strong>, at the rate of P2,00 per 100 kg or portion thereof for every seven days or<br />

portion of seven days:<br />

Provided that the Director may in any special circumstances, rebate the rental<br />

charge to such extent as he may in his discretion decide.<br />

17. Removal of goods in bond<br />

(1) All goods removed in bond under section 17(1) of the <strong>Act</strong> shall be entered for removal<br />

on a bill of entry for removal in bond in the form CE.14 or 15, but the Director may, in respect<br />

of such class or kind of goods as he may decide, accept such other form of entry as he may<br />

approve on such conditions as he may impose.<br />

(2) Subject to subregulations (9), (10) <strong>and</strong> (11), no goods shall be removed in bond until<br />

the remover has been authorized by the proper officer on a l<strong>and</strong>ing, delivery <strong>and</strong> forwarding<br />

order or other document to remove such goods.<br />

(3) Goods may be removed in bond within the common customs area only to a place<br />

appointed as a place of entry or, in circumstances which the Director considers to be<br />

exceptional, to any railway station or siding, or any premises or warehouse within the area of<br />

control of the proper officer at that place or, in the case of excisable goods, to a licensed<br />

customs <strong>and</strong> excise warehouse if such goods are intended for warehousing in such customs<br />

<strong>and</strong> excise warehouse:<br />

Provided that sales duty goods manufactured in Botswana may be removed in bond only<br />

to a place appointed as a place of entry <strong>and</strong> only for re-warehousing at that place.<br />

(4) Except where otherwise provided in these Regulations, the consignee of goods<br />

removed in bond to a place in the common customs area shall not take delivery of such<br />

goods or cause them to be warehoused or exported at the place of destination until he has<br />

duly entered the goods at the customs <strong>and</strong> excise office at that place, for consumption,<br />

warehousing or export, <strong>and</strong> has obtained the written authority of the proper officer for such<br />

delivery, warehousing or export.<br />

(5) The said consignee shall also submit to the proper officer all such invoices <strong>and</strong><br />

documents relating to the goods as he may require as well as a numbered <strong>and</strong><br />

date-stamped copy of the relative bill of entry for removal in bond.<br />

(6) If entry of the goods at the place of destination is not made within seven days of the<br />

arrival of the goods at that place, or within such further period as the proper officer may<br />

allow, the remover or the carrier or other person having custody of the goods shall forthwith<br />

deliver them to the State warehouse or other place approved by the proper officer.<br />

(7) Any person removing goods in bond to a place in the common customs area shall<br />

consign the goods to the care of the officer in charge of customs <strong>and</strong> excise at that place<br />

<strong>and</strong> shall conspicuously mark the consignment note with the words "In Bond".<br />

(8) The carrier shall advise its officials or agents at the place of destination that the goods<br />

are in bond <strong>and</strong> shall not deliver the goods without the written authority of the proper officer.<br />

(9) Subject to subregulation (11), the Director may, in the case of goods in transit through<br />

Botswana from any other territory in Africa by air or rail to any destination outside the<br />

common customs area, allow the goods in question to be entered for removal, in the case of<br />

Copyright Government of Botswana

goods removed by air, at the place where the goods are first l<strong>and</strong>ed in the common customs<br />

area, or in the case of goods removed by rail, at the place where the goods are exported<br />

from the common customs area provided the duty on any deficiency is paid forthwith.<br />

(10) No person shall allow such goods to be carried forward or exported from such airport<br />

or place until such goods have been duly entered for removal in bond <strong>and</strong> the proper officer<br />

at the place in question has granted written authority for such carriage or export.<br />

(11) Goods in transit overl<strong>and</strong> through Botswana from any other territory in Africa other<br />

than by air or rail shall be catered for removal in bond at the place where they enter<br />

Botswana.<br />

(12) Except with the permission of the Director, goods in transit through the common<br />

customs area to a destination outside the common customs area shall be exported<br />

immediately <strong>and</strong> if export cannot take place immediately such goods shall be warehoused in<br />

a licensed customs <strong>and</strong> excise warehouse after entry for warehousing.<br />

(13) Beef or other meat <strong>and</strong> such other goods as the Director may decide, in transit by rail<br />

through the common customs area to a destination outside the common customs area shall<br />

be carried in sealed trucks direct from the sending station to the place of export in Botswana<br />

<strong>and</strong> such seals shall not be broken except with the permission of the proper officer at that<br />

place.<br />

(14) Such goods carried by any other means shall be subject to such conditions as the<br />

Director may impose.<br />

(15) Goods removed in bond to a customs <strong>and</strong> excise warehouse for manufacturing<br />

purposes or for storage in such warehouse shall be entered on a bill of entry for<br />

warehousing or re-warehousing but goods removed in bond to a place of entry for any other<br />

purpose may be duly entered for such purpose even if removed to such place from a<br />

customs, excise <strong>and</strong> sales duty warehouse in terms of section 20(7)(c) of the <strong>Act</strong>.<br />

(16) The following particulars shall be reflected on a bill of entry for direct removal in bond<br />

in the form CE.14-<br />

(a) in the case of goods removed in bond to a place outside the common customs<br />

area, full particulars as required in accordance with the bill of entry form;<br />

(b) in the case of goods which have been l<strong>and</strong>ed from an aircraft or other vehicle at a<br />

place to which they were not consigned <strong>and</strong> are removed in bond by the pilot or<br />

other carrier to the place to which they were consigned in the first place, full<br />

particulars as required in accordance with manifest requirements in the forms CE.2<br />

<strong>and</strong> 3 <strong>and</strong> such additional particulars as are available to such pilot or other carrier<br />

in respect of such goods; <strong>and</strong><br />

(c) in other cases, full particulars as required in accordance with the bill of entry form,<br />

but the particulars relating to tariff heading or item or both need not be furnished<br />

unless required to be furnished by the Director.<br />

(17) Suppliers' invoices in respect of goods entered for removal in bond in the<br />

circumstances stated in subregulation (16)(a) shall be produced to the proper officer at the<br />

time of entry for removal, <strong>and</strong> suppliers' invoices, documents of title <strong>and</strong> such other<br />

documents as may be required by the proper officer shall be produced to the proper officer<br />

Copyright Government of Botswana

at the time of due entry at the place of destination in respect of goods removed in the<br />

circumstances referred to in subregulation (16)(b) or (c).<br />

(18) If goods which have been entered for warehousing at the place of importation are<br />

required for immediate removal in bond from that place before they have been deposited in<br />

the warehouse, they may be treated <strong>and</strong> entered for removal as if they had been so<br />

deposited.<br />

(19) If the final destination of any goods is a place other than the place of entry to which<br />

such goods have been removed in bond, no person shall remove such goods or cause such<br />

goods to be removed from such place of entry until such goods have been duly entered <strong>and</strong>,<br />

the proper officer has granted written authority for delivery thereof <strong>and</strong> if forwarded to the<br />

final destination without such written authority, such goods shall, if the proper officer so<br />

requires, be returned at the expense of the carrier or other person who brought the goods<br />

into the common customs area or who removed the goods without such written authority, to<br />

such place of entry or to such other place as the proper officer may decide.<br />

PART IV<br />

<strong>Customs</strong> <strong>and</strong> <strong>Excise</strong> Warehouses: Storage <strong>and</strong> Manufacture of Goods<br />

in <strong>Customs</strong> <strong>and</strong> <strong>Excise</strong> Warehouses (regs 18-38)<br />

18. Approval of customs <strong>and</strong> excise warehouses<br />

(1) <strong>Customs</strong> <strong>and</strong> excise warehouses (excluding special customs <strong>and</strong> excise<br />

manufacturing warehouses) shall be licensed only at places appointed in terms of section 7<br />

of the <strong>Act</strong> <strong>and</strong> on application on forms CE.100 <strong>and</strong> 100A.<br />

(2) Forms CE.100 <strong>and</strong> 100A shall be completed in all details <strong>and</strong> shall be accompanied<br />

by such plans, description of the warehouse or other particulars as the Director may require.<br />

(3) A licence for a customs <strong>and</strong> excise warehouse may be issued in respect of any<br />

premises, store, fixed vessel, fixed tank, yard or other place which complies with such<br />

conditions as the Director may impose in each case in regard to construction, situation,<br />

access, security or any other condition he considers necessary.<br />

(4) Different premises, stores, vessels, tanks, yards, or other places on a single site, or on<br />

more than one site approved by the Director, may be licensed as a single customs <strong>and</strong><br />

excise storage warehouse, a single customs <strong>and</strong> excise manufacturing warehouse, or a<br />

single special customs <strong>and</strong> excise warehouse for the purpose of sales duty in the name of<br />

one licensee.<br />

(5) Separate customs <strong>and</strong> excise warehouses on the same site may be licensed in the<br />

names of different persons subject to the conditions referred to in subregulation (3).<br />

(6) The Director may license a customs <strong>and</strong> excise warehouse for the storage or<br />

manufacture of any particular commodity or article or any class or kind of commodity or<br />

article <strong>and</strong> such warehouse shall not be used for any other purpose, except with the written<br />

permission of the Director.<br />

(7) If the security for the duty is at any time in the opinion of the proper officer not<br />

sufficient in regard to any customs <strong>and</strong> excise warehouse in which goods are deposited, he<br />

may at the risk <strong>and</strong> expense of the licensee of such warehouse <strong>and</strong> the owner of such<br />

goods cause them to be immediately removed <strong>and</strong> deposited in another customs <strong>and</strong> excise<br />

Copyright Government of Botswana

warehouse or other place approved by him; alternatively, the said licensee or owner may<br />

forthwith pay the duty on the goods.<br />

(8) The licensee of a customs <strong>and</strong> excise warehouse shall keep at the warehouse, in a<br />

place accessible to the proper officer, a record in a form approved by the Director of all<br />

receipts into <strong>and</strong> deliveries or removal from the warehouse of goods not exempted from<br />

entry under section 20(6) of the <strong>Act</strong>, with such particulars as will make it possible for all such<br />

receipts <strong>and</strong> deliveries or removals to be readily identified with the goods warehoused, <strong>and</strong><br />

with clear references to the relative bill of entry passed in connection therewith.<br />

(9) The licensee of a customs <strong>and</strong> excise warehouse shall display in a prominent position<br />

in the warehouse an extract of the relative regulations in this Part.<br />

(10) No goods entered for storage or manufactured in a customs <strong>and</strong> excise warehouse<br />

(except spirits or wine in the process of maturation or maceration in a customs <strong>and</strong> excise<br />

manufacturing warehouse) shall be retained in customs <strong>and</strong> excise warehouses for a total<br />

period of more than five years from when the goods were first entered for warehousing but<br />

the Director may, in exceptional circumstances <strong>and</strong> on such conditions as he may impose in<br />

each case, allow such goods intended for trade purposes to be so retained for a further<br />

period not exceeding one year <strong>and</strong> such other goods as he may decide to be retained for<br />

such further period as he may specify.<br />

(11) Any fixed vessel, tank, receiver, vat or other container licensed as a customs <strong>and</strong><br />

excise warehouse or used in a customs <strong>and</strong> excise warehouse for the storage or<br />

manufacture of any goods in terms of Part IV of the <strong>Act</strong> shall be gauged in a manner<br />

approved by the Director <strong>and</strong> any fitting, meter, gauge or indicator necessary for<br />

ascertaining the quantity of any goods contained in such vessel, tank, receiver, vat or other<br />

container shall be supplied <strong>and</strong> fitted by the licensee at his expense.<br />

(12) The licensee of a customs <strong>and</strong> excise warehouse shall notify the proper officer<br />

immediately of, or prior to, any change, or contemplated change, no matter of what nature,<br />

in his legal identity, name or address of his business or goods manufactured by him.<br />

19. Storage of goods in customs <strong>and</strong> excise warehouses<br />

(1) Subject to subregulations (3) <strong>and</strong> (4), goods which have been entered for<br />

warehousing in a customs <strong>and</strong> excise warehouse shall be conveyed to the warehouse<br />

immediately after such entry <strong>and</strong> there deposited.<br />

(2) All goods entered for warehousing shall be conveyed to the warehouse only by the<br />

railway operators or by a person who has given such security as the Director may require in<br />

terms of section 111 of the <strong>Act</strong>.<br />

(3) Imported packages which have been entered for warehousing in a customs <strong>and</strong><br />

excise warehouse but which are leaking, or of which the whole or part of the contents is<br />

missing, or which are in an otherwise damaged condition, shall not be removed to the<br />

warehouse unless examined in terms of regulation 11(12) to (17).<br />

(4) If such package is however removed to the warehouse without such examination the<br />

full invoiced contents of such package shall be deemed to have been imported <strong>and</strong> shall be<br />

accounted for under the provisions of the <strong>Act</strong>.<br />

(5) The licensee of any customs <strong>and</strong> excise warehouse shall notify the owner of any<br />

Copyright Government of Botswana

imported goods entered for warehousing in such warehouse of the non-receipt of any such<br />

goods, or any part thereof, <strong>and</strong> the owner of such goods shall take immediate steps to<br />

account to the proper officer for such goods or to pay the duty due thereon.<br />

(6) The licensee of any customs <strong>and</strong> excise warehouse into which goods are received<br />

shall ensure that such goods have been duly entered for warehousing in such warehouse<br />

<strong>and</strong>, unless proof that such goods have been so entered is in his possession at the time of<br />

receipt of such goods, he shall keep such goods separated from other goods in such<br />

warehouse <strong>and</strong> make a report to the proper officer forthwith.<br />

(7) The licensee of a customs <strong>and</strong> excise warehouse shall not allow any goods of a<br />

dangerous or inconvenient nature to be stored in such warehouse unless it has been<br />

approved for the storage of such goods, <strong>and</strong> the licensee of a customs <strong>and</strong> excise<br />

warehouse which has been approved for a particular class of goods shall not allow any other<br />

goods to be deposited therein.<br />

(8) All goods in a customs <strong>and</strong> excise warehouse shall be so arranged <strong>and</strong> marked that it<br />

will be easily identifiable <strong>and</strong> accessible for inspection <strong>and</strong> that each consignment <strong>and</strong> the<br />

particulars thereof can readily be ascertained <strong>and</strong> checked.<br />

(9) Goods deposited in a customs <strong>and</strong> excise warehouse may at any time be examined<br />

by the proper officer <strong>and</strong> the licensee of such warehouse, or his representative, shall be<br />

present during such examination <strong>and</strong> assist the proper officer in the execution of such<br />

examination.<br />

(10) Goods deposited in a customs <strong>and</strong> excise warehouse in closed trade containers<br />

shall not be examined, nor the packages opened or altered in any way, except with the<br />

permission of the proper officer <strong>and</strong> in the presence of an officer if he so requires, unless<br />

immediate action for the safety of the goods is necessary, in which case the licensee shall<br />

immediately notify the nearest available officer.<br />

(11) No unpacked goods in liquid form shall be stored in ungauged containers in a<br />

customs <strong>and</strong> excise warehouse without the written permission of the Director.<br />

(12) Subject to section 22 of the <strong>Act</strong>, samples of warehoused goods, in such quantities as<br />

the proper officer may allow, may be taken by the importer under customs supervision,<br />

provided that prior written application is made.<br />

20. Transfer of ownership of dutiable goods in warehouse<br />

The transfer of ownership of dutiable goods in a customs <strong>and</strong> excise warehouse shall<br />

only be acknowledged if the prescribed form is presented to the proper officer duly<br />

completed in all respects <strong>and</strong> is supported by or includes a declaration as indicated<br />

hereunder-<br />

(a) "I, ........................................... for transferor, hereby declare that ownership of the<br />

above-mentioned goods, which are my property, is given to<br />

................................................... address ..............................................;<br />

For transferor ................................................................ Date ....................".<br />

(b) "I ........................................... for transferee, hereby accept responsibility in terms of<br />

the provisions of the <strong>Customs</strong> <strong>and</strong> <strong>Excise</strong> <strong>Duty</strong> <strong>Act</strong>, <strong>and</strong> regulations in respect of<br />

Copyright Government of Botswana

the above-mentioned goods.<br />

For transferee ................................................................ Date ..................."<br />

21. Manufacture of goods in customs <strong>and</strong> excise warehouses<br />

(1) The Director may, on such conditions as he may impose in each case, allow the<br />

manufacture by a licensee in a customs <strong>and</strong> excise manufacturing warehouse of goods<br />

which shall not be subject to the provisions of Part IV of the <strong>Act</strong>.<br />

(2) Subject to regulation 18(2), any application for the licensing of a customs <strong>and</strong> excise<br />

manufacturing warehouse shall state the nature of materials <strong>and</strong> the processes to be used in<br />

the manufacture of every excisable or other product, the expected annual quantities of such<br />

materials to be so used <strong>and</strong> the expected annual production of every excisable product:<br />

Provided that the nature <strong>and</strong> quantity of materials to be used in the manufacture of sales<br />

duty goods need not be stated.<br />

(3) The plans referred to in section 27(5) of the <strong>Act</strong> shall be submitted to the Director with<br />

as many copies as he may require.<br />

(4) Distinguishing marks or numbers to the satisfaction of the Director shall be indicated<br />

on every room, vessel, still, utensil or other plant <strong>and</strong> such mark or number shall be shown<br />

on schedules submitted with such plans.<br />

(5) Vessels, stills <strong>and</strong> other plant in a customs <strong>and</strong> excise manufacturing warehouse shall<br />

be placed, fixed <strong>and</strong> connected to the satisfaction of the Director <strong>and</strong> the licensee shall not<br />

alter the shape, position or capacity of any plant or install any additional or new plant or<br />

remove any plant without the permission of the Director after submission to him of an<br />

application for alteration of such plant.<br />

(6) No manufacturing shall commence in a customs <strong>and</strong> excise manufacturing warehouse<br />

without the permission of the Director.<br />

(7) All rooms, places, distilling apparatus, spirits receivers <strong>and</strong> other fixed vessels or<br />

containers <strong>and</strong> such other plant as the Director may specify, in a customs <strong>and</strong> excise<br />

manufacturing warehouse shall be locked or otherwise secured in accordance with the<br />

instructions <strong>and</strong> in the discretion of the proper officer, <strong>and</strong> the licensee shall at his own<br />

expense <strong>and</strong> to the satisfaction of the proper officer, provide, apply, repair <strong>and</strong> renew<br />

whatever is required to enable the proper officer to affix locks to such rooms, places,<br />

distilling apparatus, spirits receivers <strong>and</strong> other fixed vessels or containers <strong>and</strong> other plant<br />

specified by the Director, or to secure them in any other manner.<br />

(8) Every pipe in a customs <strong>and</strong> excise manufacturing warehouse shall, except with the<br />

permission of the Director or unless used exclusively for the discharge of water <strong>and</strong> spent<br />

wash, be so fixed <strong>and</strong> placed as to be capable of being examined for the whole of its length.<br />

(9) Pipes for the conveyance of different materials or products shall, if required by the<br />

Director, be painted in such colour for every material or product as he may require.<br />

(10) The licensee shall paint such pipes at his own expense <strong>and</strong> shall repaint such pipes<br />

whenever required by the proper officer.<br />

(11) Every cock <strong>and</strong> valve used in such warehouse shall be of a type approved by the<br />

Copyright Government of Botswana

Director.<br />

(12) The licensee shall keep such cocks <strong>and</strong> valves in proper repair at all times.<br />

(13) No person other than a licensee of a customs <strong>and</strong> excise manufacturing warehouse<br />

licensed for the manufacture of excisable goods shall own, use or control a machine for<br />

cutting tobacco or a machine, appliance or apparatus which is in the opinion of the Director<br />

of a type specially designed for any process in the manufacture of an excisable product<br />

except with the permission of the Director <strong>and</strong> no person to whom permission to own, use or<br />

control such machine, appliance or apparatus has been so granted, shall sell or dispose of<br />

such machine, appliance or apparatus or allow any other person to use it without the<br />

permission of the Director.<br />

(14) The Director may require that any class or kind of such machine, appliance or<br />

apparatus shall be registered with him <strong>and</strong> shall bear such registration numbers in such<br />

manner as he may decide.<br />

(15) When a manufacturing operation has been completed in a customs <strong>and</strong> excise<br />

manufacturing warehouse, the licensee shall give the proper officer all the necessary<br />

assistance in ascertaining the quantity <strong>and</strong> strength or other particulars of the goods<br />

manufactured <strong>and</strong> record such particulars <strong>and</strong> render such returns as the Director may<br />

require.<br />

(16) A licensee shall stop any operation or the working of any still when required to do so<br />

by the proper officer for the purpose of testing the output.<br />

(17) Every licensee who is required to do so by the Director shall furnish a diagram to<br />

scale of any still, utensil or other plant in his customs <strong>and</strong> excise manufacturing warehouse<br />

together with explanatory notes relating to the working of such still, utensil or other plant.<br />

(18) Except with the permission of the proper officer, no excisable goods manufactured in<br />

a customs <strong>and</strong> excise manufacturing warehouse shall be removed from a receiver, vessel or<br />

other container in which they were collected until account thereof has been taken by the<br />

proper officer.<br />

(19) The Director may allow the quantity of any excisable goods in a customs <strong>and</strong> excise<br />

manufacturing warehouse to be ascertained by means of any massmeter, meter, gauge or<br />

other instrument or appliance of a type approved by him.<br />

(20) The licensee shall supply <strong>and</strong> fit such massmeter, meter, gauge or other instrument<br />

or appliance to the satisfaction of the Director <strong>and</strong> keep it in proper repair at his expense <strong>and</strong><br />

shall have it assized regularly <strong>and</strong>, in addition, at any time required by the proper officer.<br />

(21) Every licensee of a customs <strong>and</strong> excise manufacturing warehouse shall, unless<br />

exempted by the Director, keep a stock record, in a form approved by the Director, in which<br />

such licensee shall record daily such particulars of receipts of materials, nature <strong>and</strong><br />

quantities of excisable goods manufactured, nature <strong>and</strong> quantities of by-products or other<br />

goods manufactured <strong>and</strong> disposal of goods manufactured <strong>and</strong> such other particulars as the<br />

Director may require in each case.<br />

(22) Such stock record shall, when not in use, be kept in a fire-proof safe.<br />

(23) Every licensee of a customs <strong>and</strong> excise manufacturing warehouse shall furnish to<br />

Copyright Government of Botswana

the proper officer such returns showing such particulars <strong>and</strong> at such times <strong>and</strong> under such<br />

conditions as the Director may decide.<br />

(24) Subregulations (3) to (12) <strong>and</strong> (15), (16) <strong>and</strong> 21 <strong>and</strong> (22) shall not apply in respect of<br />

special customs <strong>and</strong> excise warehouses for purposes of sales duty.<br />

22. Clearance <strong>and</strong> removal of goods from customs <strong>and</strong> excise warehouses <strong>and</strong><br />

payment of duty<br />

(1) The licensee of a customs <strong>and</strong> excise warehouse shall not cause or permit any goods<br />

to be delivered or removed from such warehouse until he is in possession of a relative<br />

ex-warehouse bill of entry, in the specified form, numbered <strong>and</strong> date-stamped by the proper<br />

officer, <strong>and</strong> any person entering any goods for delivery or removal from a customs <strong>and</strong><br />

excise warehouse shall do so on the forms specified herein.<br />

(2) Notwithst<strong>and</strong>ing subregulation (1) <strong>and</strong> subject to the Sixth Schedule hereto the<br />

Director may permit the licensee of any customs <strong>and</strong> excise warehouse to remove from such<br />

warehouse goods which are liable to excise duty or sales duty or both, or such other goods<br />

as the Director may specify from time to time, provided-<br />

(a) a certificate for removal of excisable or specified goods ex-warehouse in the form<br />

CE.32, duly completed by the licensee of such warehouse, is deposited by such<br />

licensee in the entry box referred to in subregulation (3);<br />

(b) in the case of sales duty goods manufactured in Botswana, an invoice prescribed in<br />

subregulation (19) <strong>and</strong> regulation 33(12) <strong>and</strong> (13) is completed or complies with<br />

regulation 13(6); <strong>and</strong><br />

(c) he complies with subregulations (5), (6), (7), (8), (9), (10), (12), (13) <strong>and</strong> (16).<br />

(3) Except with the permission of the Director, subject to such conditions as he may<br />

impose, every licensee of a customs <strong>and</strong> excise warehouse who has been granted<br />

permission in terms of subregulation (2) shall provide <strong>and</strong> fix to any convenient <strong>and</strong><br />

permanent structure in an accessible place in such warehouse an entry box of a<br />

construction <strong>and</strong> design approved by the Director, for safe depositing of documents.<br />

(4) The box in question shall be provided with fittings <strong>and</strong> shall be designed to enable the<br />

proper officer to lock it with a State lock so that documents deposited therein cannot be<br />

withdrawn <strong>and</strong> also so that at any time considered necessary by the Director documents can<br />

neither be deposited nor withdrawn.<br />

(5) In the case of excisable goods to be removed from any customs <strong>and</strong> excise<br />

warehouse for home consumption under Schedule No. 6 of the <strong>Act</strong> or for the home<br />

consumption as State stores, the licensee of such warehouse shall, notwithst<strong>and</strong>ing<br />

subregulation (2), not remove or permit such goods to be removed from such warehouse<br />

unless a declaration regarding restricted removal of excisable or specified goods<br />

ex-warehouse in the form CE.33 has been completed <strong>and</strong> signed by the manufacturer under<br />

Schedule No. 6 of the <strong>Act</strong> or an official of the state body in question, as the case may be,<br />

<strong>and</strong> a copy of such declaration has been attached to each copy of the certificate for removal<br />

of excisable or specified goods ex-warehouse in the form CE.32.<br />

(6) In the case of goods to be so removed for consumption under Schedule No. 6 of the<br />

<strong>Act</strong>, the Director may require that the said declaration shall be approved by the proper officer<br />

Copyright Government of Botswana

in the area where the manufacturer's premises are situated before such goods are removed.<br />

(7) Joint excise <strong>and</strong> sales duty accounts together with the bills of entry as referred to in<br />

subregulation (1) shall be presented to the proper officer by the licensee of each customs<br />

<strong>and</strong> excise warehouse in respect of all motor vehicles which are subject to excise <strong>and</strong> sales<br />

duty <strong>and</strong> removed from such warehouse during the previous period of three months for the<br />

purposes mentioned in section 20(7) of the <strong>Act</strong> on or before the 14th day of the month<br />

following the period of three months to which the account relates.<br />

(8) All other bills of entry as referred to in subregulation (1) shall be presented to the<br />

proper officer by the licensee of each customs <strong>and</strong> excise warehouse in respect of all<br />

excisable or specified goods removed from such warehouse during the previous calendar<br />

month for the purposes mentioned in section 20(7) of the <strong>Act</strong> within 14 days after<br />

stock-taking or the closing of accounts for duty purposes.<br />

(9) Copies of all certificates (including certificates <strong>and</strong> invoices in respect of motor<br />

vehicles) deposited in the entry box for each such purpose or for each class or kind of bill of<br />

entry specified in these Regulations, as the Director may require, shall be attached to the<br />

original of the respective bills of entry or shall be specified on a schedule attached to such<br />

bill of entry, such certificates being submitted to the proper officer separately in accordance<br />

with conditions which the Director may impose.<br />

(10) Any duty due in respect of goods to which such bills of entry relate shall be paid by<br />