A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BOUYGUES<br />

2005<br />

A N N U A L R E P O R T

C O N C O R D A N C E<br />

Headings of Annex I, EU Regulation N ° . 809/2004<br />

Annual Report<br />

1. Persons responsible inside back cover<br />

2. Statutory auditors 125; 205<br />

3. Selected financial information<br />

3.1 Historical financial information 2; 8-12; inside front cover<br />

3.2 Interim financial information not applicable<br />

4. Risk factors 92-102<br />

5. Information about the issuer<br />

5.1 History and development of the issuer 142<br />

5.1.1 Legal and commercial name 142<br />

5.1.2 Place of registration and registration number 142<br />

5.1.3 Date of incorporation and lifetime 142<br />

5.1.4 Registered office, legal form, governing law, country of incorporation, address and telephone number 142; back cover<br />

5.1.5 Important events in the development of business 142<br />

5.2 Investments<br />

5.2.1 Principal investments completed 11; 152; 154; 204<br />

5.2.2 Principal investments in progress 157<br />

5.2.3 Principal planned investments 19; 25; 31; 37; 43<br />

6. Business overview<br />

6.1 Principal activities 14-46<br />

6.2 Principal markets 14-46<br />

6.3 Exceptional factors not applicable<br />

6.4 Situations of dependence 98-100<br />

6.5 Competitive position 14-46<br />

7. Organisational structure<br />

7.1 Brief description 5<br />

7.2 Significant subsidiaries 5; 207-208<br />

8. Property, plant and equipment<br />

8.1 Major tangible fixed assets 173; 192<br />

8.2 Environmental issues that may affect utilisation of tangible fixed assets 48-102<br />

9. Operating and financial review<br />

9.1 Financial condition 9-12<br />

9.2 Operating results<br />

9.2.1 Significant factors materially affecting income from operations 157-158<br />

9.2.2 Material changes in net sales or revenues 158<br />

9.3 Governmental, economic, fiscal, monetary or political policies or factors that have materially affected<br />

or could materially affect operations, directly or indirectly<br />

not applicable<br />

10. Capital resources<br />

10.1 Short and long term capital resources 180-183<br />

10.2 Sources and amounts of cash flows 154; 193-194; 204<br />

10.3 Borrowing requirements and funding structure 186-187; 192-193<br />

10.4 Restrictions on the use of capital resources that have materially affected or could materially<br />

affect operations, directly or indirectly<br />

not applicable<br />

10.5 Anticipated sources of funds to carry out planned investments 9<br />

11. Research and development, patents and licences 104-106<br />

12. Trend information<br />

12.1 Most significant trends affecting production since the end of the last financial year not applicable<br />

12.2 Trends likely to have a material effect on prospects 19; 25; 31; 37; 43<br />

13. Profit forecasts or estimates not applicable<br />

14. Administrative, management and supervisory bodies and senior management<br />

14.1 Administrative, management and supervisory bodies and senior management 108-121<br />

14.2 Conflicts of interest relating to administrative, management and supervisory bodies and senior management 118<br />

15. Remuneration and benefits<br />

15.1 Amount of remuneration and benefits in kind 126-128<br />

15.2 Total amounts set aside or accrued to provide pension, retirement or similar benefits 128<br />

16. Board practices<br />

16.1 Date of expiration of current terms of office 108-117<br />

16.2 Service contracts with members of administrative, management or supervisory bodies 118<br />

16.3 Information about the audit committee and remuneration committee 120; 123-124<br />

16.4 Compliance with the prevailing corporate governance regime 118<br />

17. Employees<br />

17.1 Number of employees 51; 59; 65; 73; 79; 91<br />

17.2 Shareholdings and stock options 108-117; 126-132; 137-138<br />

17.3 Arrangements for involving employees in the capital 137<br />

18. Major shareholders<br />

18.1 Shareholders owning over 5% of the share capital or voting rights 131-132<br />

18.2 Existence of different voting rights 132<br />

18.3 Direct or indirect ownership or control 131-132<br />

18.4 Known arrangements, the operation of which may result in a change of control not applicable<br />

19. Related party transactions 216<br />

20. Financial information concerning assets and liabilities, financial position and profits and losses<br />

20.1 Historical financial information inside front cover; 152-218; 225-226<br />

20.2 Pro forma financial information (IFRS 5) 158<br />

20.3 Financial statements 152-218<br />

20.4 Auditing of historical annual financial information inside front cover; 225-226<br />

20.5 Age of latest financial information 147-150<br />

20.6 Interim and other financial information not applicable<br />

20.7 Dividend policy 7; 11<br />

20.8 Legal and arbitration proceedings 100-101<br />

20.9 Significant change in financial or trading position not applicable<br />

21. Additional information<br />

21.1 Share capital 135-139<br />

21.2 Memorandum and articles of association 142-143<br />

22. Material contracts 44<br />

23. Third party information, expert statements and declarations of interest 236-238<br />

24. Documents on display 143-150<br />

25. Information on holdings 218<br />

Historical financial information for 2003 and 2004<br />

The following information is included by reference in this Annual Report:<br />

• changes in the financial situation and operating result between 2003 and 2004, presented on pages 8 to 12 of the 2004 Financial<br />

Review filed with the Autorité des Marchés Financiers on 12 April 2005 as no. D. 05-0407;<br />

• the consolidated financial statements for the year ending 31 December 2004, the notes to the financial statements and the auditors’<br />

report relating thereto, presented on pages 94 to 122 and page 143 of the 2004 Financial Review filed with the Autorité des Marchés<br />

Financiers on 12 April 2005 as no. D. 05-0407;<br />

• the consolidated financial statements for the year ending 31 December 2003, the notes to the financial statements and the auditors’<br />

report relating thereto, presented on pages 88 to 116 and page 132 of the 2003 Financial Review filed with the Autorité des Marchés<br />

Financiers on 31 March 2004 as no. D. 04-369.<br />

B

CONTENTS<br />

Chairman’s statement 2<br />

Management team 4<br />

Simplified group organisation chart 5<br />

<strong>Bouygues</strong> and its shareholders 6<br />

Key figures 9<br />

Business activities<br />

<strong>Bouygues</strong> Construction, full-service contractor 14<br />

<strong>Bouygues</strong> Immobilier, France’s leading property developer 20<br />

Colas, the world leader in roadworks 26<br />

TF1, number one television group in France 32<br />

<strong>Bouygues</strong> Telecom, mobile communication services 38<br />

<strong>Bouygues</strong> SA 44<br />

Recent events since 1 January 2006 46<br />

Sustainable development<br />

Sustainable development in the Group 48<br />

<strong>Bouygues</strong> Construction 52<br />

<strong>Bouygues</strong> Immobilier 60<br />

Colas 66<br />

TF1 74<br />

<strong>Bouygues</strong> Telecom 80<br />

Risks 92<br />

Innovation, research and development<br />

Innovation, research and development 104<br />

Legal and financial information<br />

Corporate governance 108<br />

Remuneration of corporate officers – Stock options 126<br />

Share ownership 131<br />

Stock market 133<br />

Capital 135<br />

Results of <strong>Bouygues</strong> SA 140<br />

Legal information 142<br />

Annual publications 144<br />

Financial statements<br />

Consolidated financial statements 152<br />

Parent company financial statements 209<br />

Annual general meeting of 27 April 2006<br />

Agenda 220<br />

Board of Directors’ reports 221<br />

Auditors’ reports 225<br />

Reconstitution of investment certificates<br />

and voting right certificates as shares 233<br />

Draft resolutions 239<br />

This document is a free translation of the Annual Report filed with the Autorité des Marchés<br />

Financiers (AMF) on 12 April 2006 pursuant to Article 212-13 of the AMF’s General Regulations. It may<br />

be used in support of a financial transaction if supplemented by a stock exchange prospectus.<br />

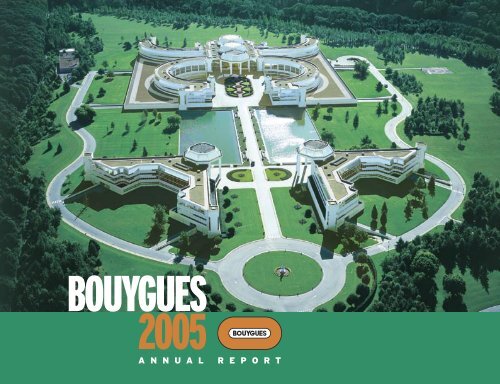

Cover photo: Challenger, main headquarters of <strong>Bouygues</strong> group until 1 July 2006.<br />

Photo credits: S. Arbour (p. 30), É. Avenel (p. 22-65), J-L Bellurget / Fondation Colas (p. 72), C. Berthet (p. 58), J. Bertrand (p. 29-70), G. Bosio/Yagan Productions/Ushuaïa Nature (p. 74), Buena Vista (p. 35), J. Cauvin (p. 34), CDL (p. 48), J-M Cédille (p. 41), Y. Chanoit<br />

(p. 14-18-19-36/ <strong>Bouygues</strong> Telecom-43-49-50-52-53-54-56), J-F Chapuis (p. 68), E. Chassaing (p. 61), C. Chevalin (p. 37-75-77), A. Chézière (p. 29-98), W. Choroszewski (p. 26), A. Da Silva (p. 17-22-40-41-43-48-80-85-88-102-106), J. David (p. 4-20-60), DDB Paris (p. 38-41), F. Deconinck<br />

(p. 38-84-89), C. Demonfaucon (p. 59), T. Deschamps (p. 90-100), F. Dunouau (p. 68-71), FCB/TPS (p. 36), FIA WTCC (p. 37), Free Lance’s (p. 29-31), Gautrain Rapid Rail Link (p. 19), B. Germain (p. 31), Getty Images/Red Line (p. 16), D. Giannelli (p. 26), J. Graf (p. 4-52-66-80), F-X Gros-<br />

Rosanvallon (p. 104), P. Guignard (cover; p. 18-56), J. Langevin (p. 106), P. Lefebvre (p. 99), P. Lesage (p. 4), D. Mac Allan (p. 46), É. Matheron Balaÿ (p. 40-83-87), B. Matussière (p. 57), G. Maucuit-Lecomte (p. 67), P. Maurein (p. 43-95), P. Muradian (p. 82), Paris Venise (p. 90), V. Paul<br />

(p. 49-58-63-64-69-101), M. Pelletier (p. 2), A. Picard (p. 42), Procitel (p. 20), F. Pugnet (p. 99), V. Rackelboom (p. 78), Rapp Collins (p. 40), M. Robinson (p. 93), J-C Roca (p. 34-76), P. Ruault (p. 104), Somaro (p. 70), Studio Mauve (p. 69), J-M Sureau (p. 32-74), É. Thibaud (p. 100), TPS<br />

(p. 78), TVO (p. 19), T-D Vidal (p. 72), Z. Waters (p. 30), L. Zylberman (p. 28-48-86-88-98-105). Photo libraries: <strong>Bouygues</strong> (p. 7), <strong>Bouygues</strong> Construction (p. 55-57), <strong>Bouygues</strong> Immobilier (p. 25-94), Colas (p. 30-73-102), TF1 (p. 35-36), <strong>Bouygues</strong> Telecom (p. 42-82-90-91-101). Architects:<br />

Arquitectonica/Arup Sustainable Design (p. 23), Atelier Lechuguette (p. 100), Baumann/Plobner (p. 25), Bernardo For Brescia/Bridot Willerwal (p. 22), BNT (p. 17), A. Derbesse (p. 25), Devillers/Brochet/Lajus/Puejo (p. 46), J. Dubus/G. Roustan (p. 62), Mário Sua Kay (p. 24), J-J Ory<br />

(p. 20), Partenaires et architectes/AGBF/Urban Concept (p. 60), K. Roche (cover, p. 44)/J-M Wilmotte (p. 44), RTLK/Valode & Pistre/Estudio Lamela/Allende Arquitectos/Estudio de Arquitectura Indya/Ana Ordás (p. 24), Solzic-Cléret (p. 22), Valode & Pistre (p. 16), Vincent Casinos<br />

Architectes (p. 83). i-mode TM and broadband i-mode TM are trademarks registered by NTT DoCoMo Inc. in Japan and other countries.

2005: an ex<br />

<strong>Bouygues</strong> had another excellent year in 2005, with all<br />

indicators showing substantial progress in relation to<br />

2004. Recurring net profit was up 19%, while the return<br />

on capital employed rose from 12.7% in 2004 to 16.5%.<br />

The long-term nature of <strong>Bouygues</strong>’ performance makes its<br />

achievement all the more significant. Sales have increased<br />

by 18% since 2001, operating profits have doubled and net<br />

profit has tripled. These figures show that we have made the<br />

right long-term choices.<br />

<strong>Bouygues</strong> Construction had a particularly bright year in<br />

terms of both the order book and profit.<br />

<strong>Bouygues</strong> Immobilier again improved its margins and reported<br />

remarkably vigorous sales on the housing market.<br />

Colas, the world’s leader in roadworks, once again had a<br />

record year, further consolidating its already strong positions<br />

on international markets.<br />

TF1 maintained its undisputed position as France’s<br />

top general-interest TV channel, borne out by audience<br />

2

CHAIRMAN'S STATEMENT<br />

cellent year<br />

figures. Despite tough conditions on the advertising market<br />

it returned a solid performance in terms of both profit and<br />

sales. Following the draft agreement on the future of TPS, TF1<br />

is refocusing on its core business as a content provider.<br />

Ten years after its commercial launch, <strong>Bouygues</strong> Telecom<br />

passed the milestone of eight million customers, including<br />

1.4 million for i-mode TM . Our strategic options for broadband<br />

have proved to be the most appropriate: first Edge, then<br />

second-generation UMTS (HSDPA). As a result, in 2005 we<br />

were able to offer a high-speed i-mode TM service combining<br />

nationwide coverage with high-quality service at prices that<br />

everyone can afford.<br />

Continuing its proactive policy of encouraging employee<br />

savings, <strong>Bouygues</strong> successfully carried out another capital<br />

increase reserved for employees. On completion of the<br />

operation, employees had become <strong>Bouygues</strong>’ second largest<br />

shareholder group with 13.3% of the capital and 17.5% of the<br />

voting rights.<br />

The ordinary dividend is up 20%. The Board will ask the<br />

AGM on 27 April 2006 to distribute a dividend of 0.90 euro<br />

per share.<br />

We have a strong corporate culture, which aims to satisfy<br />

customers and is based on respect for people and the environment.<br />

Taking the long-term view, it is expressed in entrepreneurial<br />

behaviour that is responsible in its commitments,<br />

creative in its proposals and prudent in its choices. That attitude<br />

has now been intensified, coordinated and given formal<br />

expression in our sustainable development policy.<br />

Bright prospects for 2006 mean that we can look forward to<br />

recruiting 14,000 new staff during the year, including 8,000<br />

in France. I should like to thank our shareholders for their<br />

confidence and all the Group’s employees for their work, their<br />

enthusiasm and their spirit. They are the real source of the<br />

Group’s present and future success.<br />

28 February 2006<br />

Martin <strong>Bouygues</strong><br />

Chairman and CEO<br />

BOUYGUES 2005<br />

3

MANAGEMENT TEAM<br />

<strong>Bouygues</strong><br />

parent company<br />

Olivier Poupart-Lafarge<br />

Deputy CEO<br />

Martin <strong>Bouygues</strong><br />

Chairman and CEO<br />

Olivier <strong>Bouygues</strong><br />

Deputy CEO<br />

Alain Pouyat<br />

Executive VP,<br />

Information Systems<br />

and New Technologies<br />

Jean-Claude Tostivin<br />

Senior VP,<br />

Human Resources<br />

and Administration<br />

Lionel Verdouck<br />

Senior VP,<br />

Cash Management<br />

and Finance<br />

Jean-François Guillemin<br />

Corporate Secretary<br />

Heads of the<br />

five business areas<br />

Yves Gabriel<br />

Chairman and CEO,<br />

<strong>Bouygues</strong> Construction<br />

François Bertière<br />

Chairman and CEO,<br />

<strong>Bouygues</strong> Immobilier<br />

Alain Dupont<br />

Chairman and CEO,<br />

Colas<br />

Patrick Le Lay<br />

Chairman and CEO,<br />

TF1<br />

Philippe Montagner<br />

Chairman and CEO,<br />

<strong>Bouygues</strong> Telecom<br />

4

<strong>Bouygues</strong> Telecom<br />

Tons directs<br />

Logotype BT Quadri<br />

Cyan Magenta Jaune -<br />

027_bt_logo_quadri.ai<br />

Couleurs autorisées à l'impression : 3<br />

- - - -<br />

Technique d'impression<br />

Tons à composer<br />

24/10/05<br />

Document<br />

C 100 + J 25 M 70 + J 100 C 100 + M70 -<br />

- - - -<br />

Ce fichier est un document d'exécution et non un document de gravure prêt à flasher (sauf<br />

indications contraires). La préparation technique reste à la charge du photograveur. La<br />

sortie laser papier de ce fichier ne constitue en aucun cas la cible couleur de référence à<br />

Interbrand ParisVenise<br />

obtenir lors de l'impression. Les images intégrées au document sont des imports de<br />

placement uniquement (sauf indications contraires). L'incorporation des illustratrions et<br />

Ektas originaux ou des imports haute définition fournis sera réalisée lors de la gravure.<br />

28, rue Broca 75005 Paris France<br />

Paris Venise Design préconise le nombre et l'utilisation en tons directs ou à composer des www.interbrand.fr<br />

couleurs de ce document mais leur validation reste à la charge de l'annonceur et de ses<br />

tél +33 (0)1 40 53 85 85 fax +33 (0)1 40 53 85 84<br />

photograveurs/imprimeurs.<br />

0cm 1 2 3 4 5<br />

SIMPLIFIED GROUP ORGANISATION CHART at 15 February 2006<br />

BOARD OF DIRECTORS<br />

Chairman and CEO<br />

Martin <strong>Bouygues</strong><br />

CONSTRUCTION<br />

TELECOMS AND MEDIA<br />

Executive Directors<br />

Olivier Poupart-Lafarge<br />

Deputy CEO<br />

Olivier <strong>Bouygues</strong><br />

Deputy CEO and standing<br />

representative of SCDM, Director<br />

100% 100% 96.4% 42.9% 83%*<br />

CONSTRUCTION PROPERTY ROADS MEDIA TELECOMS<br />

Directors<br />

Pierre Barberis<br />

Deputy CEO, Oberthur<br />

Patricia Barbizet<br />

CEO and Director, Artémis<br />

Madame Francis <strong>Bouygues</strong><br />

Georges Chodron de Courcel<br />

Deputy CEO, BNP Paribas<br />

Charles de Croisset<br />

Vice-Chairman,<br />

Goldman Sachs Europe<br />

Michel Derbesse<br />

Lucien Douroux<br />

Chairman and Director, Banque de<br />

Gestion Privée Indosuez<br />

Alain Dupont<br />

Chairman and CEO, Colas SA<br />

Yves Gabriel<br />

Chairman and CEO,<br />

<strong>Bouygues</strong> Construction<br />

Patrick Le Lay<br />

Chairman and CEO, TF1<br />

Jean Peyrelevade<br />

Vice-Chairman, Quadrature<br />

François-Henri Pinault<br />

Chairman and CEO, PPR<br />

Alain Pouyat<br />

Executive Vice-President, Information<br />

Systems and New Technologies,<br />

<strong>Bouygues</strong><br />

Michel Rouger<br />

Former Presiding Judge<br />

of Paris Commercial Court<br />

100% Building<br />

100% Civil Works<br />

100% Electrical contracting (ETDE)<br />

Representatives of employee<br />

mutual funds<br />

Jean-Michel Gras<br />

Thierry Jourdaine<br />

Non-voting supervisor<br />

Philippe Montagner<br />

BOARD COMMITTEES<br />

Accounts committee<br />

Michel Rouger (Chairman)<br />

Patricia Barbizet<br />

Georges Chodron de Courcel<br />

Charles de Croisset<br />

Selection committee<br />

Jean Peyrelevade (Chairman)<br />

100% LCI<br />

100% Eurosport<br />

66% TPS (held for sale)<br />

Remuneration committee<br />

Pierre Barberis (Chairman)<br />

Patricia Barbizet<br />

Ethics and sponsorship committee<br />

Lucien Douroux (Chairman)<br />

Michel Derbesse<br />

François-Henri Pinault<br />

* consolidated at 89.5% since June 2005<br />

François-Henri Pinault<br />

BOUYGUES 2005<br />

5

BOUYGUES AND ITS SHAREHOLDERS<br />

More than 35 years after its first listing on the Paris<br />

Stock Exchange, <strong>Bouygues</strong> continues to be one of<br />

the leading stocks in the market, as demonstrated<br />

by its inclusion in the CAC 40 index. We have<br />

always involved our shareholders in our numerous<br />

value-creating initiatives, combining a responsible<br />

attitude with an entrepreneurial spirit.<br />

FFCI/CLIFF information meeting at Montpellier (June 2005)<br />

Communicating with our<br />

shareholders<br />

We are committed to ensuring that all<br />

our institutional and individual shareholders<br />

can always have easy access<br />

to full and transparent financial information.<br />

Financial releases<br />

• Our financial releases (including<br />

sales and earnings figures, and<br />

announcements of major financial<br />

transactions) are distributed widely<br />

and immediately in France and<br />

around the world, by different information<br />

networks via press agencies<br />

and the internet. In 2005, we published<br />

15 financial releases.<br />

• This information is also published in<br />

notices placed in leading French and<br />

international financial, economic<br />

and investment press. In 2005, 14<br />

newspapers and magazines published<br />

these notices.<br />

In the interests of transparency and<br />

equal access to information, our<br />

website www.bouygues.com provides<br />

shareholders with detailed, constantlyupdated<br />

material on <strong>Bouygues</strong>, including<br />

key performance indicators and<br />

information about our management,<br />

businesses and values.<br />

All press releases issued by the Group<br />

and its businesses are available on<br />

the site, along with all other documents<br />

of interest to shareholders<br />

such as annual reports, full financial<br />

statements for the last six years,<br />

and documents relating to the Annual<br />

General Meeting. All presentations<br />

made to equity and bond investors<br />

can be viewed on the site. Separate<br />

sections are devoted to specific issues<br />

including corporate governance, IFRS,<br />

Standard & Poor’s credit rating and<br />

sustainable development.<br />

The website includes a section specifically<br />

targeted at individual shareholders<br />

containing more accessible<br />

and user-friendly information and a<br />

frequently asked questions page. Live<br />

and recorded webcasts of major earnings<br />

presentations are also carried<br />

on the site.<br />

Shareholders can contact us directly<br />

via two dedicated e-mail addresses:<br />

investors@bouygues.com and service.<br />

titres.actionnaires@bouygues.com<br />

Publications<br />

We regularly send shareholders our<br />

most important publications: the<br />

abridged annual report, the Annual<br />

Report, and our in-house magazine<br />

Le Minorange.<br />

Results announcements<br />

• In line with our commitment to providing<br />

transparent financial information<br />

on a regular basis, we publish<br />

quarterly results. This policy enables<br />

our shareholders and the broader<br />

financial community to monitor the<br />

performance of the <strong>Bouygues</strong> Group<br />

and its component businesses all<br />

year round.<br />

• Detailed financial statements for<br />

the Group, the <strong>Bouygues</strong> SA parent<br />

company, and the Group’s five businesses<br />

are published twice a year.<br />

Meeting investors<br />

Our senior management arranges<br />

regular meetings with our shareholders<br />

and with the broader financial<br />

community, in order to establish and<br />

foster genuine dialogue.<br />

• Three major meetings are held<br />

each year. Two of these coincide<br />

6

with the announcement of our<br />

annual and first-half results, and<br />

the third is our Annual General<br />

Meeting, held at Challenger in<br />

Saint-Quentin-en-Yvelines near Paris.<br />

The publication of our quarterly<br />

results is accompanied by conference<br />

calls for institutional investors<br />

and financial analysts.<br />

• On 7 June 2005, we went on the road<br />

to meet our individual shareholders,<br />

at a meeting held in Montpellier with<br />

the support of the FFCI (the French<br />

Federation of Investment Clubs)<br />

and CLIFF (the French Association<br />

of Investor Relations Professionals).<br />

The next such meeting is scheduled<br />

for 9 October 2006 in Marseille.<br />

• Over 300 contacts a year between<br />

<strong>Bouygues</strong> and investors and analysts<br />

from France and abroad help<br />

maintain a constant dialogue.<br />

Outside France, our roadshows give<br />

major international investors the<br />

opportunity to meet <strong>Bouygues</strong> management<br />

and raise our worldwide<br />

profile. During 2005, we held twelve<br />

roadshows, meeting investors in<br />

the United Kingdom, the United<br />

States, Germany, Japan, Switzerland,<br />

Scandinavia, Italy, the Netherlands<br />

and Belgium, etc.<br />

• We also take part in sector conferences<br />

attended by major telecommunications<br />

companies, aimed at<br />

French and international institutional<br />

investors.<br />

2006 diary dates<br />

• 27 April 2006:<br />

Annual General Meeting<br />

• 3 May 2006:<br />

Dividend payment<br />

• 11 May 2006:<br />

2006 first-quarter sales<br />

• 8 June 2006:<br />

2006 first-quarter earnings<br />

• 10 August 2006:<br />

2006 first-half sales<br />

• 6 September 2006:<br />

2006 first-half earnings<br />

• 9 October 2006:<br />

FFCI/CLIFF shareholder<br />

information meeting, Marseille<br />

• 9 November 2006:<br />

2006 9-month sales<br />

• 7 December 2006:<br />

2006 9-month earnings<br />

• During 2005, coverage of our stock<br />

by financial analysts increased further.<br />

Currently, 18 brokers in France<br />

and abroad are actively following<br />

the company, compared with 15<br />

at end 2004. Of these, 10 had Buy<br />

recommendations on the share,<br />

against 8 at end 2004.<br />

Registered share service<br />

Since 1990, we have provided a free<br />

registered share service, which maintains<br />

accounts for holders of pure registered<br />

shares. Investors who choose<br />

to hold shares in this form receive<br />

regular information from <strong>Bouygues</strong><br />

and have direct access to the company;<br />

they also enjoy double voting<br />

rights once their shares have been<br />

held in registered form for more than<br />

two years. Shareholders wishing to<br />

hold their shares as pure registered<br />

shares should send their request<br />

directly to their financial intermediary.<br />

Registered Share Account<br />

Department contact details:<br />

➤ Tel.: +33 (0)1 30 60 35 82<br />

+33 (0)1 30 60 32 64<br />

➤ Toll-free (from fixed lines in France):<br />

0805 120 007<br />

➤ e-mail:<br />

service.titres.actionnaires@bouygues.com<br />

Creating value<br />

(€ million,<br />

at 31 December)<br />

Market capitalisation,<br />

2002 to 2005<br />

9,060 9,224<br />

2002 2003<br />

11,314<br />

13,908<br />

2004 2005<br />

At end 2005, <strong>Bouygues</strong> had a market<br />

capitalisation of €13.9 billion,<br />

23% higher than at the end of 2004.<br />

Because the number of shares outstanding<br />

was virtually unchanged, this<br />

performance was due primarily to the<br />

increased share price. At 31 December<br />

2005, <strong>Bouygues</strong> ranked 24 th in the<br />

CAC 40 index by market capitalisation.<br />

Exceptional payout<br />

On 7 January 2005, <strong>Bouygues</strong> made an<br />

exceptional payout of €5 per share, as<br />

proposed by the Board of Directors in<br />

July 2004. The total amount paid out<br />

to shareholders was €1.7 billion, equivalent<br />

to 15% of the company’s market<br />

capitalisation at that time. This payout<br />

rewarded our shareholders after<br />

several years of heavy investment in<br />

growth businesses with rising profitability<br />

(<strong>Bouygues</strong> Telecom, Colas).<br />

Ordinary dividend<br />

Every year since 2003, we have<br />

increased the dividend paid out to our<br />

shareholders, with dividend growth<br />

close to the rate of growth in recurring<br />

net profits. In March 2006, the<br />

Board of Directors decided to ask the<br />

Annual General Meeting to approve<br />

a substantially higher dividend for<br />

2005; the proposed dividend of €0.90<br />

per share represents a 20% increase<br />

on the 2004 dividend of €0.75. This<br />

dividend reflects our commitment<br />

to increase ordinary dividends and<br />

0.26<br />

Net dividend per share,<br />

1999 to 2005<br />

0.9O*<br />

0.36 0.36 0.36<br />

shareholder returns over the long<br />

term. Excluding the exceptional payout,<br />

the dividend-to-earnings ratio for<br />

2005 is 36%.<br />

Share buybacks<br />

0.50<br />

0.75<br />

1999 2000 2001 2002 2003 2004 2005<br />

* to be proposed at the AGM on 27 April 2006<br />

Since 2002, <strong>Bouygues</strong> has had a policy<br />

of buying back its own shares on the<br />

market in order to optimise return<br />

on equity and compensate for the<br />

dilutive effect of newly-issued shares.<br />

During 2005, <strong>Bouygues</strong> cancelled 8.4<br />

million shares (2.5% of the share<br />

capital as at 31 December 2005) to<br />

reduce the dilutive effect of the new<br />

shares issued in connection with the<br />

<strong>Bouygues</strong> Confiance 3 employee share<br />

ownership plan launched at end 2005<br />

and on the exercise of stock options.<br />

BOUYGUES 2005<br />

7

BOUYGUES AND ITS SHAREHOLDERS<br />

ROCE<br />

(Return on Capital<br />

Employed)<br />

One way to measure the value created<br />

by a business is to compare the return<br />

generated by the capital employed<br />

in the business (equity contributed<br />

by the shareholders and debt provided<br />

by banks) with the cost of that<br />

capital.<br />

In 2005, the <strong>Bouygues</strong> Group achieved<br />

ROCE of 16.5%, significantly higher<br />

than 2004. The Group’s ROCE is clearly<br />

superior to the weighted average cost<br />

of capital.<br />

8.6%<br />

2003<br />

French GAAP<br />

12.7%<br />

2004<br />

IFRS<br />

16.5%<br />

2005<br />

ROCE = (current operating profit after tax + share of profits<br />

and losses of associates) ÷ average capital employed<br />

(shareholders’ equity + debt).<br />

Share ownership<br />

at 15 February 2006<br />

• Since the end of 2004, there have<br />

been four main changes in the share<br />

ownership structure of <strong>Bouygues</strong><br />

SA. SCDM, a company controlled by<br />

Martin and Olivier <strong>Bouygues</strong>, raised<br />

its interest by 1.5 percentage points.<br />

The Artemis group (F. Pinault)<br />

reduced its interest slightly by 0.5<br />

of a point. Following the capital<br />

increase made in connection with<br />

the <strong>Bouygues</strong> Confiance 3 employee<br />

share ownership plan, the employees<br />

own 13.3% of the capital, compared<br />

with 11.5% at end 2004. Finally,<br />

the percentage interest held by<br />

non-French shareholders increased<br />

significantly, reflecting the higher<br />

profile of <strong>Bouygues</strong> among international<br />

investors.<br />

Foreign<br />

shareholders<br />

35.5%<br />

Other<br />

French<br />

shareholders<br />

25.4%<br />

Share ownership<br />

at 15 February 2006<br />

SCDM*<br />

18.5% Groupe<br />

Artémis<br />

(F. Pinault)*<br />

7.3%<br />

Employees<br />

13.3%<br />

Number of shares: 337,150,519<br />

* SCDM is a company controlled by Olivier and Martin<br />

<strong>Bouygues</strong>. SCDM and the Artémis group are bound by<br />

a shareholder agreement.<br />

Foreign<br />

shareholders<br />

28.3%<br />

Other<br />

French<br />

shareholders<br />

22%<br />

Voting rights<br />

at 15 February 2006<br />

SCDM*<br />

25.6%<br />

Employees<br />

17.5%<br />

Groupe<br />

Artémis<br />

(F. Pinault)*<br />

6.6%<br />

Number of voting rights: 423,787,714<br />

* SCDM is a company controlled by Olivier and Martin<br />

<strong>Bouygues</strong>. SCDM and the Artémis group are bound by<br />

a shareholder agreement.<br />

• The difference between percentage<br />

ownership and voting rights is due<br />

to the fact that all investors who<br />

hold their shares in registered form<br />

for more than two years are given<br />

double voting rights.<br />

Share price performance in 2005<br />

<strong>Bouygues</strong> <strong>Bouygues</strong> + €5 reinvested CAC<br />

Share price since the<br />

beginning of 2005<br />

During 2005, the <strong>Bouygues</strong> share price<br />

showed a nominal increase of 21%,<br />

in line with the CAC 40 (up 23%).<br />

However, on 7 January 2005 the<br />

exceptional payout of €5 per share<br />

led to an automatic correction of €5<br />

in the share price as the share went<br />

ex-coupon. Since then, the share price<br />

has done far more than simply reverse<br />

this correction, rising to €44.8 on<br />

16 February 2006. The adjusted share<br />

price (with reinvestment of the exceptional<br />

payout) is the true indicator<br />

of the market performance enjoyed<br />

by our shareholders. On this basis,<br />

<strong>Bouygues</strong> shares rose by 42% in<br />

2005, the 9 th best performance in the<br />

CAC 40.<br />

54<br />

52<br />

50<br />

48<br />

46<br />

44<br />

42<br />

40<br />

38<br />

36 €34<br />

34<br />

32<br />

30<br />

28<br />

Dec. Jan. Feb. Mar. April May June Jul. Aug. Sept. Oct. Nov. Dec. Jan.<br />

16 February 2006<br />

€52.3<br />

+54%<br />

€44.8<br />

+32%<br />

+30%<br />

<strong>Bouygues</strong> share factsheet<br />

• Listing: Eurolist of Euronext<br />

(compartment A)<br />

• ISIN code:<br />

FR0000120503<br />

• Identification codes:<br />

Bloomberg: ENFP,<br />

Reuters: BOUY.PA<br />

• Par value: €1<br />

• Indices:<br />

CAC 40, Euronext 100, FTSE<br />

Eurofirst 80 and Dow Jones<br />

Stoxx 600<br />

• Sector classification:<br />

- MSCI/S&P indices:<br />

Telecommunication services<br />

- FTSE and Dow Jones indices:<br />

Construction & Materials<br />

• Eligible for deferred settlement<br />

service (“SRD”) and French<br />

equity savings plans (“PEAs”)<br />

Contact<br />

Anthony Mellor<br />

Investor Relations Director<br />

Tel. +33 (0)1 30 60 22 77<br />

Fax: +33 (0)1 30 60 31 40<br />

Address: Challenger<br />

1 avenue Eugène Freyssinet<br />

78061 St-Quentin-en-Yvelines cedex<br />

France<br />

e-mail: investors@bouygues.com<br />

8

KEY FIGURES<br />

FINANCIAL HIGHLIGHTS<br />

(€ million) – IFRS 2004 2005 2005/2004<br />

Sales<br />

of which international<br />

20,894<br />

5,989<br />

24,073<br />

7,127<br />

+15%<br />

+19%<br />

EBITDA (1) 2,943 3,505 +19%<br />

Current operating profit 1,557 1,852 +19%<br />

Operating profit 1,557 1,748 +12%<br />

Net profit attributable to the Group 909 832 - 8%<br />

Recurring net profit (2) 700 832 +19%<br />

Return on capital employed (ROCE) 12.7% 16.5% +3.8 pts<br />

Cash flow 2,714 3,090 +14%<br />

Free cash flow (3) 1,007 1,104 +10%<br />

Shareholders’ equity (period-end) 4,978 5,561 +12%<br />

Net debt (period-end) 1,875 2,352 +25%<br />

Gearing (period-end) 50% 42% -8 pts<br />

Market capitalisation (period-end) 11,314 13,908 +23%<br />

Net dividend 0.75 0.90 (4) +20%<br />

Number of employees 113,334 115,441 +2%<br />

As TPS was held for sale at end December 2005, only its share of net profit was booked in 2004 and 2005.<br />

(1) current operating profit plus net depreciation and amortisation expense and net increases in provisions<br />

(2) recurring net income before exceptional transactions (e.g. gain on sale of Saur in 2004)<br />

(3) cash flow minus cost of net debt minus tax and minus net capital expenditure<br />

(4) to be proposed to the Annual General Meeting of 27 April 2006<br />

2005 was another excellent year for the<br />

<strong>Bouygues</strong> group both in terms of sales and profit.<br />

Its construction businesses performed strongly and<br />

recorded a sharp increase in orders booked.<br />

Steep rise in profitability<br />

Full-year 2005 sales amounted to €24.1 billion, up<br />

15% on 2004. Current operating profit climbed 19%.<br />

Recurring net profit stood at €832 million, 19%<br />

higher than 2004. Return on capital employed was<br />

16.5%, compared with 12.7% in 2004.<br />

A solid financial structure<br />

Net debt amounted to €2,352 million at 31 December<br />

2005, giving a debt-to-equity ratio of 42%.<br />

Standard & Poor’s maintained its credit rating for<br />

<strong>Bouygues</strong>: A- with stable outlook.<br />

Cash flow rose by 14% to €3,090 million and free<br />

cash flow by 10% to €1,104 million.<br />

SALES: €24.1 billion (up 15%)<br />

20,894*<br />

of which international<br />

24,073*<br />

5,989 7,127<br />

2004 2005<br />

* excluding TPS,<br />

held for sale<br />

at end 2005<br />

4,525<br />

2,489<br />

263<br />

9,424<br />

5,815<br />

1,557<br />

Contribution to the <strong>Bouygues</strong> Group<br />

<strong>Bouygues</strong> group. Consolidated sales for 2005 were<br />

15% up on the previous year. This figure factors in<br />

mobile-to-mobile billing between GSM operators,<br />

effective from 1 January 2005. For comparability,<br />

2004 sales have been increased to reflect mobile-tomobile<br />

billing as adjusted to 2004 call termination<br />

rates. On this basis, sales were 11% higher.<br />

<strong>Bouygues</strong> Construction. Sales rose by 13% in<br />

France and by 9% on international markets, with<br />

continued strong growth in the electrical contracting<br />

and maintenance business (ETDE), which hit the<br />

€1 billion euro mark.<br />

<strong>Bouygues</strong> Immobilier. The 20% increase in sales<br />

was due to the start of building work on a large<br />

number of housing units reserved in 2004 and the<br />

dynamic corporate and commercial property sector<br />

in Spain and Portugal.<br />

Colas. Sales showed robust growth (19%), especially<br />

outside France and more particularly in Central<br />

Europe. Like-for-like and at constant exchange rates,<br />

sales rose by 11% overall, including 7% in France and<br />

16% on international markets.<br />

(€ million – IFRS)<br />

■ <strong>Bouygues</strong> Construction<br />

■ <strong>Bouygues</strong> Immobilier<br />

■ Colas<br />

■ TF1<br />

■ <strong>Bouygues</strong> Telecom<br />

■ Holding and other<br />

TF1. Sales were stable. The channel’s net advertising<br />

revenues were virtually unchanged from 2004,<br />

resulting from a rise of 3% in the fourth quarter,<br />

while full-year sales from other activities grew by<br />

0.6%.<br />

<strong>Bouygues</strong> Telecom. In 2005, the mobile telephony<br />

business posted net sales from network of €4,240<br />

million, up 27% due primarily to mobile-to-mobile<br />

billing, effective from 1 January 2005. Had the system<br />

been in place in 2004 (billing estimated using<br />

the 2004 call termination rate), the increase in net<br />

sales from network would have been 4%.<br />

Holding and other. Saur activities retained by<br />

<strong>Bouygues</strong> represented sales of €245 million at end-<br />

2005, down slightly on the same period in 2004.<br />

BOUYGUES 2005<br />

9

KEY FIGURES<br />

OPERATING PROFIT:<br />

€1,748 million (up 12%)<br />

(€ million – IFRS)<br />

1,557<br />

1,748<br />

NET PROFIT ATTRIBUTABLE<br />

TO THE GROUP:<br />

€832 million (down 8%)<br />

(€ million – IFRS)<br />

909*<br />

832<br />

RECURRING NET PROFIT:<br />

€832 million (up 19%)<br />

700*<br />

832<br />

RECURRING EARNINGS<br />

PER SHARE:<br />

€2.51 (up 20%)<br />

Non-recurring items<br />

Recurring items<br />

<br />

<br />

<br />

<br />

598<br />

2004 2005<br />

14<br />

353<br />

238<br />

156<br />

389<br />

Contribution to the <strong>Bouygues</strong> Group<br />

■ <strong>Bouygues</strong> Construction<br />

■ <strong>Bouygues</strong> Immobilier<br />

■ Colas<br />

■ TF1<br />

■ <strong>Bouygues</strong> Telecom<br />

■ Holding and other<br />

301<br />

101<br />

2004 2005<br />

* including €209m capital<br />

gain from Saur<br />

176<br />

296<br />

Net loss from holding and other: -€132m<br />

Contribution to the <strong>Bouygues</strong> Group<br />

■ <strong>Bouygues</strong> Construction<br />

■ <strong>Bouygues</strong> Immobilier<br />

■ Colas<br />

90<br />

■ TF1<br />

■ <strong>Bouygues</strong> Telecom<br />

2004 2005<br />

* excluding capital gain from Saur<br />

Net profit attributable to the Group in 2005 does not<br />

include non-recurring items. It is 8% lower than the<br />

figure for 2004, which factored in the €209 million<br />

gain on the disposal of Saur. Excluding this capital<br />

gain, net profit rose by 19%.<br />

The contribution of all business areas to Group net<br />

profit grew.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Over the last four years, recurring earnings per<br />

share has increased 3.3 times.<br />

Earnings per share for 2005 was €2.51. Based on<br />

recurring net earnings (excluding the gain on Saur<br />

in 2004), this represents a year-on-year increase<br />

of 20%.<br />

At 31 December 2005, a total of 336,762,896 million<br />

shares and investment certificates were in<br />

issue, slightly more than at 31 December 2004<br />

(332,758,624).<br />

Operating profit advanced broadly in line with sales<br />

during 2005.<br />

The Construction businesses achieved a further<br />

improvement in operating margin in 2005.<br />

10

NET DIVIDEND PER SHARE:<br />

€0.90 (up 20%)<br />

0.26<br />

0.36 0.36 0.36<br />

Once again, <strong>Bouygues</strong> increased the dividend payout<br />

to its shareholders in 2005. Based on the good<br />

results achieved by the Group during the year and<br />

a fine outlook, <strong>Bouygues</strong> is able to propose a further<br />

substantial increase in the dividend, which if<br />

approved will mean that dividends will have virtually<br />

doubled in two years.<br />

The Board of Directors is asking the Annual General<br />

Meeting of 27 April 2006 to approve a dividend of<br />

€0.90 per share, representing an increase of 20%,<br />

in line with the growth in recurring net profit. This<br />

dividend will be paid on 3 May 2006.<br />

The exceptional payout of €5 per share announced<br />

in July 2004 was made on 7 January 2005, representing<br />

a total of €1.7 billion, equivalent to 15% of<br />

the market capitalisation at that time. This payout<br />

enabled our shareholders to share the excellent<br />

results achieved following the investments made by<br />

the Group since 1999.<br />

0.5<br />

0.75<br />

0.90*<br />

1999 2000 2001 2002 2003 2004 2005<br />

* to be proposed at the AGM on 27 April 2006<br />

CASH FLOW:<br />

€3,090 million (up 14%)<br />

1,261<br />

2,714<br />

(€ million – IFRS)<br />

23<br />

453<br />

3,090<br />

2004 2005<br />

411<br />

161<br />

781<br />

Contribution to the <strong>Bouygues</strong> Group<br />

■ <strong>Bouygues</strong> Construction<br />

■ <strong>Bouygues</strong> Immobilier<br />

■ Colas<br />

■ TF1<br />

■ <strong>Bouygues</strong> Telecom<br />

■ Holding and other<br />

Virtually all our businesses recorded a further<br />

increase in cash flow during 2005, reflecting their<br />

strong positions in buoyant markets.<br />

Overall, cash flow rose by 14%, giving <strong>Bouygues</strong> substantial<br />

capacity to fund future development.<br />

NET OPERATING INVESTMENT:<br />

€1,229 million (up 17%)<br />

€ million – IFRS 2004 2005<br />

<strong>Bouygues</strong> Construction 73 56<br />

<strong>Bouygues</strong> Immobilier 4 4<br />

Colas 348 411<br />

TF1 79 155<br />

<strong>Bouygues</strong> Telecom 502 584<br />

<strong>Bouygues</strong> SA and other 41 19<br />

TOTAL 1,047 1,229<br />

FREE CASH FLOW: €1,104 million (up 10%)<br />

(€ million – IFRS)<br />

1,007<br />

1,104<br />

2004 2005<br />

431<br />

Free cash flow represents the ability of the Group<br />

to generate surplus cash after financing the cost of<br />

debt, income taxes, and net capital expenditure.<br />

<strong>Bouygues</strong> generated cash flow of €3,090m in 2005.<br />

170<br />

239<br />

273<br />

Free cash flow at holding and other: -€114m.<br />

105<br />

Contribution to the <strong>Bouygues</strong> Group<br />

■ <strong>Bouygues</strong> Construction<br />

■ <strong>Bouygues</strong> Immobilier<br />

■ Colas<br />

■ TF1<br />

■ <strong>Bouygues</strong> Telecom<br />

After deducting the cost of net debt (€187m),<br />

income tax expense for the year (€570m) and net<br />

capital expenditure (€1,229m), free cash flow was<br />

€1,104m.<br />

BOUYGUES 2005<br />

11

KEY FIGURES<br />

NET DEBT:<br />

€2,352 million (up 25%)<br />

ROCE (Return on Capital Employed) (1) :<br />

2006 SALES TARGET<br />

€25,300 million (up 5%)<br />

(€ million – IFRS) 2003<br />

French GAAP<br />

2004<br />

IFRS<br />

2005<br />

IFRS<br />

(€ million – IFRS)<br />

1,875<br />

2,352<br />

2004 2005<br />

At the start of 2005, <strong>Bouygues</strong> recorded a cash outflow<br />

of €1.7bn due to the exceptional payout, and a<br />

cash inflow of €1bn due to the sale of Saur.<br />

<strong>Bouygues</strong>' financial position remained healthy at<br />

end 2005, with net debt standing at €2.4bn, or<br />

42% of equity. This debt figure includes a liability<br />

of €460m relating to the reciprocal call and put<br />

options exchanged with BNP Paribas relating to its<br />

6.5% interest in <strong>Bouygues</strong> Telecom, and excludes<br />

debt carried by TPS which is held for sale.<br />

<strong>Bouygues</strong> Telecom and TF1 reported net debt of<br />

€441m and €351m respectively. The other businesses<br />

reported cash surpluses: €1,874m for <strong>Bouygues</strong><br />

Construction, €415m for Colas, and €150m for<br />

<strong>Bouygues</strong> Immobilier. Debt carried by <strong>Bouygues</strong> SA<br />

and other activities amounted to €3,999m.<br />

In view of this robust financial position, with an<br />

evenly spread debt maturity profile and excellent<br />

liquidity, Standard & Poor’s has maintained<br />

<strong>Bouygues</strong>’ A- rating with stable outlook.<br />

Group level<br />

<strong>Bouygues</strong> Group 8.6% 12.7% 16.5%<br />

Business level<br />

<strong>Bouygues</strong> Construction +++ (2) +++ (2) +++ (2)<br />

<strong>Bouygues</strong> Immobilier +++ (3) +++ (3) +++ (3)<br />

Colas 22.8% 26.8% 34.6%<br />

TF1 16.0% 17.9% 15.5%<br />

<strong>Bouygues</strong> Telecom 8.5% 12.3% 15.4%<br />

(1) current operating profit after tax and share of profits/losses of associates divided by average capital employed (equity + debt)<br />

(2) ROCE is not meaningful for <strong>Bouygues</strong> Construction because its activities generate high levels of surplus cash. One of the key strengths of<br />

this business is its ability to grow without tying up capital.<br />

(3) <strong>Bouygues</strong> Immobilier has a very high cash surplus, because <strong>Bouygues</strong> Immobilier has for some years been generating exceptionally high<br />

cash flows because of favourable economic conditions.<br />

The <strong>Bouygues</strong> Group achieved a substantial improvement in ROCE during 2005, from 12.7% to 16.5%. In the two<br />

years since 2003, ROCE has virtually doubled.<br />

The current level of ROCE is significantly higher than the weighted average cost of capital.<br />

2,600<br />

4,560<br />

10,050<br />

240<br />

6,100<br />

1,750<br />

Contribution to the <strong>Bouygues</strong> Group<br />

■ <strong>Bouygues</strong> Construction<br />

■ <strong>Bouygues</strong> Immobilier<br />

■ Colas<br />

■ TF1<br />

■ <strong>Bouygues</strong> Telecom<br />

■ Holding and other<br />

In 2006, Group sales are expected to hit €25.3<br />

billion, up 5% on 2005 (6% in France and 4% on<br />

international markets).<br />

Construction businesses should continue to thrive<br />

and are likely to show a rise of 5% at <strong>Bouygues</strong><br />

Construction, 12% at <strong>Bouygues</strong> Immobilier and 7%<br />

at Colas.<br />

Sales should grow by 4% at TF1 and by a modest 1%<br />

at <strong>Bouygues</strong> Telecom due to a reduction in incoming<br />

rates.<br />

12

Business<br />

activities<br />

<strong>Bouygues</strong> Construction 14<br />

<strong>Bouygues</strong> Immobilier 20<br />

Colas 26<br />

TF1 32<br />

<strong>Bouygues</strong> Telecom 38<br />

<strong>Bouygues</strong> SA 44<br />

Recent events<br />

since 1 January 2006 46

FULL-SERVICE CONTR<br />

<strong>Bouygues</strong> Construction is one of the world’s leading<br />

construction companies, offering customers<br />

comprehensive building, civil works and electrical<br />

contracting skills and services ranging from<br />

project design to maintenance. It combines the<br />

strength of a large group with the responsiveness<br />

of a network of smaller contracting businesses.<br />

Highlights<br />

New concessions<br />

• A41 motorway (€500m).<br />

• Cyprus airports (€500m).<br />

• Gautrain, the Pretoria-Johannesburg<br />

rail link in South Africa (€500m).<br />

Major new contracts<br />

• T1 tower at La Défense, in France (€97m).<br />

• Renault logistics platform at Sens in France<br />

(€77m).<br />

• Olkiluoto EPR nuclear power station in Finland<br />

(€170m).<br />

• Hotel and office complex in Trinidad & Tobago<br />

(€165m).<br />

Projects under construction<br />

• Lok Ma Chau tunnel in Hong Kong (€290m).<br />

• Port of Tangier in Morocco (€170m).<br />

Projects delivered<br />

• A28 motorway in France (€658m).<br />

• Hong Kong Exhibition Centre (€245m).<br />

• UK Home Office (€325m).<br />

Sales 2005<br />

€6,131m<br />

(+11%)<br />

Operating profit<br />

€238m<br />

(+42%)<br />

Net profit (Group share)<br />

€175m<br />

(+25%)<br />

Employees<br />

38,500<br />

Sales target 2006<br />

€6,450m<br />

(+5%)<br />

The port of Tangier in Morocco<br />

Excellent commercial<br />

and financial<br />

performance<br />

Record level of orders booked:<br />

€6,510 million<br />

In favourable economic conditions,<br />

<strong>Bouygues</strong> Construction achieved<br />

some notable commercial successes<br />

in 2005. Orders booked in France<br />

amounted to €3,958 million, €933 million<br />

more than in 2004, while orders<br />

on international markets increased by<br />

€459 million to €2,552 million.<br />

Orders overtook sales in 2005, a performance<br />

all the more remarkable in<br />

that it does not include three major<br />

contracts won in 2005 but awaiting<br />

finalisation at year-end: the A41 motorway<br />

(€500m), the Cyprus airports<br />

(€500m) and the Gautrain rail link<br />

between Pretoria and Johannesburg<br />

in South Africa (€500m).<br />

Rising sales: €6,131 million<br />

With an 11% increase in sales, <strong>Bouygues</strong><br />

Construction turned in an excellent<br />

performance boosted by delivery of<br />

the A28 motorway in France, the Home<br />

Office headquarters in the UK and<br />

AsiaWorld Expo in Hong Kong.<br />

On a buoyant French<br />

market, sales rose by<br />

13% to €3,653 million.<br />

Sales outside France rose by 9% to<br />

€2,478 million.<br />

Strong growth at ETDE was a contributing<br />

factor to a robust sales performance:<br />

for the first time in its history,<br />

ETDE’s sales broke the billion euro<br />

barrier. A policy of external growth<br />

since 2001 and a dynamic sales force<br />

have enabled ETDE to double its sales<br />

in three years.<br />

IFRS<br />

14

ACTOR<br />

> Excellent commercial and financial performance in 2005<br />

A sharp increase in net profit:<br />

€175 million (+25%)<br />

Higher earnings are due in particular<br />

to the Vision & Performance project,<br />

which has brought major changes to<br />

<strong>Bouygues</strong> Construction’s organisation<br />

and operating methods since 2003.<br />

The net margin rose from 2.5% in<br />

2004 to 2.9% in 2005. The net profit<br />

figure in 2004 included non-recurring<br />

income of €37 million.<br />

A record cash surplus<br />

The net cash surplus reached a record<br />

€1,874 million, €351 million more than<br />

in 2004.<br />

Cash flow rose by 41% to €410 million,<br />

reflecting the improvement in the<br />

company’s margins.<br />

<strong>Bouygues</strong> Construction pursued an<br />

active development policy in 2005,<br />

with a net capital outlay (cash flow) of<br />

€148 million.<br />

<strong>Bouygues</strong> Construction’s available<br />

cash is a major asset in controlling<br />

construction risks, giving the group<br />

the capacity to pursue its development<br />

policy.<br />

Priorities for growth<br />

in high value-added<br />

activities<br />

<strong>Bouygues</strong> Construction has continued<br />

to pursue its development strategy,<br />

focusing on four priorities for growth.<br />

Sales<br />

€bn<br />

5.5<br />

2004 2005 2006 (o.)<br />

(o.) : objective<br />

Sales by business segment<br />

€m<br />

B/CW<br />

International<br />

2,323<br />

Order book<br />

€bn<br />

of which France and Europe<br />

5.0<br />

6.1<br />

Electrical contracting<br />

and maintenance<br />

951<br />

4.6<br />

3.6 3.4<br />

6.45<br />

5.2<br />

4.0<br />

2003 2004 2005<br />

B/CW<br />

France<br />

2,857<br />

Net profit (Group share)<br />

€m<br />

140<br />

175<br />

2004 2005<br />

Net cash<br />

€m<br />

1,346*<br />

2003 2004 2005<br />

* French GAAP<br />

1,523<br />

1,874<br />

Order book<br />

by geographical area<br />

Americas<br />

Africa and other<br />

5%<br />

5%<br />

Asia<br />

14%<br />

Europe (excl. France)<br />

20%<br />

France<br />

56%<br />

IFRS<br />

CONSOLIDATED BALANCE SHEET AT 31 DECEMBER<br />

ASSETS (€m - IFRS) 2004 2005<br />

• Tangible and intangible fixed assets 296 265<br />

• Goodwill 145 175<br />

• Non-current financial assets 170 218<br />

NON-CURRENT ASSETS 611 658<br />

• Current assets 1,972 2,255<br />

• Cash and equivalents 1,773 2,074<br />

• Financial instruments (debt-related) - -<br />

CURRENT ASSETS 3,745 4,329<br />

TOTAL ASSETS 4,356 4,987<br />

LIABILITIES (€m - IFRS)<br />

• Shareholders’ equity attributable to the Group 302 414<br />

• Minority interests 3 4<br />

SHAREHOLDERS’ EQUITY 305 418<br />

• Long-term debt 134 122<br />

• Non-current provisions 437 519<br />

• Other non-current liabilities 1 1<br />

NON-CURRENT LIABILITIES 572 642<br />

• Debt (amount due within one year) 24 4<br />

• Current liabilities 3,363 3,849<br />

• Short-term bank borrowings and overdrafts 92 74<br />

• Financial instruments (debt-related) - -<br />

CURRENT LIABILITIES 3,479 3,927<br />

TOTAL LIABILITIES 4,356 4,987<br />

NET DEBT (1,523) (1,874)<br />

CONSOLIDATED INCOME STATEMENT<br />

(€m - IFRS) 2004 2005<br />

SALES 5,512 6,131<br />

CURRENT OPERATING PROFIT 168 249<br />

• Other operating income and expenses - (11)<br />

OPERATING PROFIT 168 238<br />

• Income from net debt 26 32<br />

• Other financial income and expenses 2 1<br />

• Income tax expense (59) (114)<br />

• Share of profits and losses of associates 3 19<br />

NET PROFIT BEFORE DISCONTINUED<br />

OR HELD-FOR-SALE OPERATIONS 140 176<br />

• Net profit of discontinued or held-for-sale operations - -<br />

TOTAL NET PROFIT 140 176<br />

• Minority interests - 1<br />

CONSOLIDATED NET PROFIT ATTRIBUTABLE TO THE GROUP 140 175<br />

BUSINESS ACTIVITIES<br />

15

T1 tower, Paris La Défense<br />

teaching hospital in Caen, a logistics<br />

hub for a hospital in Douai and a<br />

street lighting maintenance contract<br />

at Auvers-sur-Oise. The group has created<br />

Challenger Investissements so as<br />

to provide local authorities and public<br />

institutions with fast-track, competitive<br />

PPP solutions for medium-sized<br />

investments.<br />

Electrical contracting and<br />

maintenance<br />

Growth in the electrical contracting<br />

and maintenance sector helps<br />

<strong>Bouygues</strong> Construction to consolidate<br />

its activities with complementary life<br />

cycles and to boost profitability. ETDE<br />

is pursuing two main objectives: to<br />

complete nationwide coverage and<br />

to acquire new technical skills. ETDE<br />

achieved organic growth of 14% in<br />

2005, while acquisitions brought in<br />

additional sales of €173 million.<br />

Public-private partnerships<br />

<strong>Bouygues</strong> Construction aims to stake<br />

out a significant position on the buoyant<br />

market for public-private partnerships<br />

(PPP) in France, meeting needs<br />

for infrastructure such as hospitals,<br />

prisons, schools and street lighting.<br />

It has already won its first PPP contracts,<br />

including the construction and<br />

maintenance for 25 years of a Women,<br />

Children and Haematology unit at the<br />

As well as taking an interest in<br />

social housing projects in the United<br />

Kingdom, <strong>Bouygues</strong> Construction won<br />

its first street lighting contract under<br />

a PFI and expects to finalise a number<br />

of other projects in 2006, including<br />

Broomfield Hospital, worth £220m,<br />

and a school in Lewisham, worth<br />

£70m. Having delivered AsiaWorld<br />

Expo, <strong>Bouygues</strong> Construction is now<br />

beginning to operate the 130,000 m 2<br />

international exhibition centre in<br />

Hong Kong.<br />

Property development<br />

This high value-added line of business<br />

involves providing customers with<br />

turnkey projects on the best possible<br />

terms, whether legal, financial<br />

or administrative. It accounts for a<br />

growing share of the group’s business.<br />

Quille and DV Construction have<br />

won a contract to build a logistics<br />

platform for Renault at Sens. Losinger<br />

has concluded a number of contracts<br />

in Switzerland, including the<br />

One Roof project involving construction<br />

of 30,000 m 2 of office space.<br />

<strong>Bouygues</strong> Bâtiment International has<br />

also strengthened its positions in the<br />

segment.<br />

The creation of AdValys, an asset management<br />

firm, will enable the group to<br />

offer property investors opportunities<br />

to invest in all types of property asset<br />

in France and Europe. AdValys will also<br />

track and manage the assets until<br />

disposal of the investment.<br />

Transport infrastructure<br />

concessions<br />

<strong>Bouygues</strong> Construction aims to get<br />

involved as far upstream as possible<br />

in order to create projects that<br />

combine financing, construction,<br />

operation and maintenance. It won<br />

three major concession contracts in<br />

2005: the A41 motorway in France,<br />

the Cyprus airports and the Gautrain<br />

project in South Africa.<br />

The three projects will be finalised and<br />

work will start in 2006.<br />

<strong>Bouygues</strong> Construction’s Concessions<br />

division had an excellent year in 2005,<br />

boosted by the opening of the A28<br />

motorway at the end of the year.<br />

Building and Civil Works<br />

Sales at the Building and Civil Works<br />

division rose by 7% to €5,144 million<br />

in 2005. France accounted for<br />

€2,857 million, 56% of the total, and<br />

international markets for €2,287 million<br />

(44%).<br />

France<br />

The construction market in France<br />

held firm in 2005. 410,000 new housing<br />

starts were recorded, a 25-year<br />

high, and the market for industrial<br />

16

uildings and offices was stable, with<br />

authorisations on the rise. Demand for<br />

public buildings remained steady.<br />

The French construction industry has<br />

two distinctive features: a dense network<br />

of regional players with solid<br />

positions on local markets and three<br />

majors, <strong>Bouygues</strong>, Vinci and Eiffage.<br />

The market leader in the Paris region,<br />

<strong>Bouygues</strong> Construction is also one<br />

of the top four construction firms in<br />

each of the five main French regions.<br />

<strong>Bouygues</strong> Bâtiment Île-de-France had<br />

an excellent year, recording a 7% rise<br />

in sales to €1,166 million and delivering<br />

several prestige projects.<br />

The €64m Actualis development<br />

comprises 16,000 m 2 of office space,<br />

5,000 m 2 of retail space, apartments<br />

and a car park. 96 boulevard<br />

Haussmann, a €54m, 23,000 m 2 development<br />

owned by Calyon, will house<br />

a business centre, apartments, shops<br />

and a day nursery for the City of Paris.<br />

The new €49m museum at quai Branly,<br />

devoted to the arts and civilisations of<br />

Africa, Asia, Oceania and the Americas,<br />

comprises four buildings with a total<br />

surface area of 57,000 m 2 . <strong>Bouygues</strong><br />

Bâtiment Île-de-France won two other<br />

major projects in 2005: the €68m<br />

Porte des Poissonniers development<br />

for the City of Paris, and the €97m<br />

T1 tower, a 38-floor, 70,000 m 2 office<br />

block in Courbevoie.<br />

The regional subsidiaries of <strong>Bouygues</strong><br />

Entreprises France-Europe operate<br />

on both building and civil engineering<br />

markets. They reported a strong<br />

13% rise in sales to €1,291 million,<br />

mostly attributable to the growing<br />

proportion of large-scale projects<br />

and property development contracts.<br />

The A28 motorway (€670m), built<br />

by <strong>Bouygues</strong> Travaux Publics, DTP<br />

Terrassement and Quille, was delivered<br />

five weeks ahead of schedule.<br />

<strong>Bouygues</strong> Entreprises France-Europe<br />

won contracts to renovate and build<br />

hospitals at Caen, Douai and Vesoul<br />

and a €77m contract to build a logistics<br />

platform for Renault at Sens. The<br />

project involves the construction of<br />

four buildings with a surface area of<br />

156,000 m 2 extendable to 200,000 m 2<br />

for the storage and shipment of spare<br />

parts and accessories.<br />

<strong>Bouygues</strong> Travaux Publics reported<br />

sales of €277 million in France in<br />

2005, the same level as in 2004. The<br />

Actualis, Paris<br />

year’s main projects were completion<br />

of the A28 motorway and a<br />

€46m contract to renovate the 7 km<br />

Maurice Lemaire tunnel in the Vosges<br />

(eastern France). <strong>Bouygues</strong> Travaux<br />

Publics won a €500m concession for<br />

the A41 motorway in partnership with<br />

GFC Construction, DTP Terrassement,<br />

Losinger Construction, Colas, SETEC,<br />

Caisse d’Epargne et de Prévoyance<br />

des Alpes and Area. The 19 km motorway<br />

through the mountains will link<br />

Geneva and Annecy. <strong>Bouygues</strong> Travaux<br />

Publics is continuing to increase the<br />

proportion of international business<br />

in its sales mix.<br />

DTP Terrassement reported sales<br />

of €109 million in France in 2005,<br />

compared with €140 million in 2004.<br />

The fall is mainly due to the end<br />

of major work on the A28 motorway.<br />

However, with earthworks for<br />

the Grands Goulets tunnel starting<br />

in 2005 and for the A41 motorway in<br />

2006, the medium-term outlook for<br />

DTP Terrassement is secure.<br />

International<br />

Internationally, <strong>Bouygues</strong> Construction<br />

operates through local subsidiaries or<br />

consortia formed for specific projects.<br />

According to the annual survey conducted<br />

by the magazine Engineering<br />

News Record in December 2005, the<br />

top 225 international construction<br />

firms generated sales of €123 billion<br />

The A41 motorway will link Geneva and Annecy<br />

(USD 168 million) outside their home<br />

markets in 2004, an increase of 20%<br />

in dollar terms (stable in euro terms)<br />

in relation to 2003.<br />

Competition is fierce on international<br />

markets in general and on<br />

the European market in particular,<br />

characterised by concentration<br />

among European groups, the return<br />

of American firms since 2003 and<br />

the rise of players from emerging<br />

countries.<br />

In Western Europe, <strong>Bouygues</strong> UK is<br />

continuing to expand in Britain, specialising<br />

in PFI projects involving the<br />

design, financing, construction and<br />

management of infrastructure delegated<br />

by the government to the private<br />

sector, especially hospitals and<br />

schools. Deliveries in 2005 included<br />

the €325m Home Office building and<br />

the €68m Barking Schools project, a<br />

second reference in the education sector<br />

after the King’s College project for<br />

London University delivered in 1999.<br />

The €110m Central Middlesex Hospital<br />

was under construction, another<br />

success that confirms <strong>Bouygues</strong><br />

Construction’s position as a prime PFI<br />

player in the UK hospital sector.<br />

Losinger, a subsidiary of <strong>Bouygues</strong><br />

Entreprises France-Europe, reported<br />

sales of €291 million in 2005 and<br />

can look forward to further growth<br />

following the conclusion of several<br />

substantial contracts, including the<br />

construction of two sorting centres<br />

for the Swiss post office worth €90<br />

million.<br />

<strong>Bouygues</strong> Bâtiment International has<br />

won a 25-year concession for the<br />

Cyprus airports (€500m of works),<br />

the group’s first airport concession.<br />

<strong>Bouygues</strong> Travaux Publics also won<br />

a €170m contract from Areva and<br />

Siemens to build the Olkiluoto nuclear<br />

power station, its first major project<br />

in Finland. The company’s nuclear civil<br />

engineering expertise gave it the edge<br />

over its international rivals.<br />

BUSINESS ACTIVITIES<br />

17

A28 motorway, France<br />

In Eastern Europe, a number of major<br />

projects were delivered in 2005, including<br />

phase 2 of the M5 motorway in<br />

Hungary. Growth will continue following<br />

the conclusion of major contracts<br />

in Russia, such as a €70m design-build<br />

contract for the Tax Ministry. Russia is<br />

becoming a significant growth area<br />

for the group.<br />

In Macau, <strong>Bouygues</strong> Bâtiment<br />

International and VSL have won a<br />

€63m contract to build the superstructure<br />

of the podium that will<br />

accommodate the future Venetian<br />

Cotai casino and a 250,000 m 2 shopping<br />

mall.<br />

In South Korea, <strong>Bouygues</strong> Travaux<br />

Publics is continuing work on the<br />

Masan Bay bridge, a €250m project<br />

of which <strong>Bouygues</strong> Travaux Publics<br />

has a €180m share. A joint venture<br />

with Hyundai Engineering Corp., the<br />

project involves the design, financing,<br />

construction, operation and maintenance<br />

of the Masan Bay bridge under<br />

a 30-year concession. The 1,700 metre<br />

bridge is the second-longest in South<br />

Korea.<br />

In Thailand, <strong>Bouygues</strong> Bâtiment<br />

International has taken orders for several<br />

hotels and residential buildings,<br />

including the €34m Athénée tower. It<br />

is also involved in major projects in<br />

Turkmenistan.<br />

VSL won the biggest contract in its<br />

history for the construction of 45 km<br />

of elevated viaducts for the Dubai<br />

Metro. VSL’s share of the contract,<br />

concluded with two partners, is worth<br />

€33 million.<br />

In South Africa, <strong>Bouygues</strong> Travaux<br />

Publics won the €500m contract to<br />

build the Gautrain rail link between<br />

Johannesburg and Pretoria as part<br />

of a consortium including RATP,<br />

the Paris metro operator. A PPP<br />

contract, it involves the financing,<br />

design, construction, operation and<br />

maintenance of an 80 km line linking<br />

Johannesburg, Pretoria and<br />

Johannesburg International Airport.<br />

<strong>Bouygues</strong> TP reduced its stake in its<br />

South African subsidiary Basil Read<br />

from 71% to 19% at the end of 2005.<br />

In the Americas/Caribbean zone,<br />

<strong>Bouygues</strong> Construction has achieved<br />

some notable commercial successes.<br />

An example of PFI:<br />

the Home Office building in London<br />

<strong>Bouygues</strong> Construction also won<br />

motorway infrastructure concessions<br />

and PPP contracts, including a €56m<br />

contract for phase 3 of the M5 motorway<br />

in Hungary and a €58m contract<br />

for phase 1B3 of the Istria motorway<br />

in Croatia.<br />

<strong>Bouygues</strong> Construction has a longstanding<br />

presence in the Asia-Pacific<br />

zone through its Dragages subsidiary,<br />

established in Hong Kong since 1955.<br />

Development of the New Territories is<br />

creating numerous opportunities and<br />

Dragages Hong Kong has concluded<br />

a €39m contract to build Castle Peak<br />

tunnel.<br />

18

Gautrain link project, South Africa<br />

<strong>Bouygues</strong> Bâtiment International<br />

has concluded the €165m Waterfront<br />

International Development contract<br />

in Trinidad and Tobago. The project<br />

includes a 150,000 m 2 development<br />

comprising a 5-star Hyatt hotel with<br />

428 rooms on 22 floors, a conference<br />

centre, two 26-storey office buildings<br />

and a car park.<br />

A contract to build a ninth hotel in<br />

Cuba was concluded for €39 million.<br />

kets, which generated €118 million,<br />

ETDE operates alone or in tandem with<br />

other <strong>Bouygues</strong> Construction entities,<br />

as on the €30m Waterfront contract in<br />

Trinidad and Tobago.<br />

ETDE contributed €987 million to<br />

<strong>Bouygues</strong> Construction’s consolidated<br />

sales in 2005, an increase of 39%<br />