Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

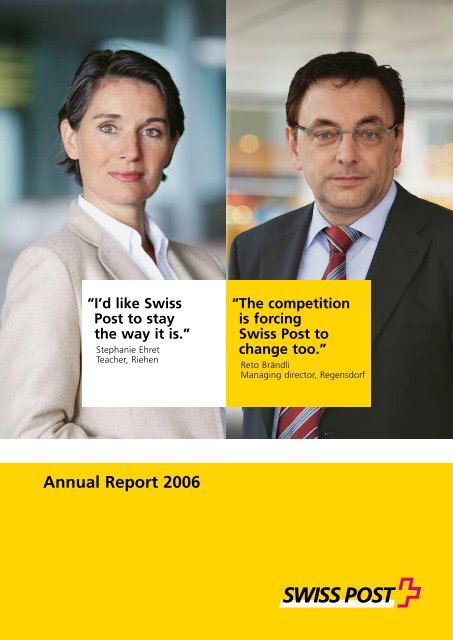

“ I’d like Swiss<br />

<strong>Post</strong> to stay<br />

the way it is.”<br />

Stephanie Ehret<br />

Teacher, Riehen<br />

Annual Report 2006<br />

“ The competition<br />

is forcing<br />

Swiss <strong>Post</strong> to<br />

change too.”<br />

Reto Brändli<br />

Managing director, Regensdorf

Annual Report | Contents<br />

Contents<br />

Annual Report<br />

Chairman’s foreword 6<br />

Interview with the Chief Executive Officer 8<br />

<strong>Service</strong>-<strong>oriented</strong>: An efficient Swiss <strong>Post</strong> for a strong Switzerland. 12<br />

Group 12<br />

Mail 18<br />

Financial <strong>Service</strong>s 20<br />

Logistics <strong>Service</strong>s 22<br />

Passenger Transport 24<br />

International 26<br />

<strong>Post</strong> Office Network 28<br />

Philately 30<br />

GHP and MailSource 32<br />

<strong>Service</strong> units 34<br />

Innovative: Even greater professionalism through innovation. 36<br />

Prudent: Genuine innovation that protects existing assets. 42<br />

Considerate: Keeping an eye on existing infrastructure while undergoing change. 48<br />

Responsible: We are a model of responsibility. 56<br />

Exemplary: The leader should set an example. 62<br />

Board of irectors and Executive Management 68<br />

Corporate Governance 73<br />

Financial Report 81<br />

GRI index 157<br />

“ I want to buy stamps<br />

and not jelly beans at<br />

the post office.”<br />

iana Tschui<br />

Administrative assistant, Wabern

Swiss <strong>Post</strong> – the backbone of the basic service –<br />

generates value and acts in a socially responsible manner.<br />

Verantwortungsbe Annual Report | Vision 3<br />

Our vision<br />

Our vision points the way forward for us. We want to continue providing<br />

an outstanding basic postal service for Switzerland’s people and its<br />

economy. We want to continue developing successfully as a company<br />

and live up to our social responsibility, both as an employer and towards<br />

society.<br />

Our long-term action<br />

Our vision and our core values of “entrepreneurial”, “credible” and “cooperative”<br />

constitute the basis for our long-term action. We are service<strong>oriented</strong><br />

and innovative – and our financial success depends on this.<br />

We try to use essential resources prudently and considerately. As the<br />

second-largest employer in Switzerland and as an autonomous institution<br />

under public law, we act in an exemplary and responsible manner.<br />

“ Our non-postal brand-<br />

name articles contribute<br />

towards financing<br />

the post office network.”<br />

Karl Kern<br />

Head of <strong>Post</strong> Offices & Sales, Berne

F<br />

4 Annual Report | Swiss <strong>Post</strong> in brief<br />

Swiss <strong>Post</strong><br />

in brief.<br />

Swiss <strong>Post</strong> is the second-biggest employer<br />

in Switzerland. We provide the<br />

public and the business community<br />

with postal, payment and passenger<br />

transport services. We ensure a basic<br />

postal service ( 1, 2, 3, 4, 5), increase<br />

the company’s value and operate a<br />

socially responsible human resources<br />

policy. The Federal Council sets out<br />

strategic objectives for Swiss <strong>Post</strong> for<br />

four years at a time. ( 6)<br />

Number one<br />

Swiss <strong>Post</strong> is highly profitable and the number<br />

one in its domestic market and in international<br />

business with Switzerland. Our core<br />

Functional organization<br />

Product Product<br />

Management Management<br />

Logistics & Logistics &<br />

Production Production<br />

E-Business<br />

Information Information<br />

Management Management<br />

Sales<br />

Mail<br />

Logistics Mail <strong>Service</strong>s<br />

Financial Logistics <strong>Service</strong>s <strong>Service</strong>s<br />

Passenger Financial <strong>Service</strong>s Transport<br />

business includes letters, promotional mailings,<br />

newspaper transport, parcels, express<br />

items, courier services, retail financial services,<br />

road-related passenger transport and<br />

goods logistics. In addition, we are expanding<br />

our post-related electronic services both<br />

in Switzerland and abroad, building up our<br />

distribution services in Switzerland and in<br />

neighbouring countries and are growing in<br />

profitable niches in the international letters<br />

market and in passenger transport.<br />

The highest organ of governance is the<br />

Board of irectors. The Executive Management<br />

is responsible for operational management.<br />

Swiss <strong>Post</strong> comprises four business<br />

Specialist committees Specialist committees Business area Business area<br />

Business units Business units<br />

E-Business<br />

Sales<br />

Passenger Transport<br />

International<br />

<strong>Post</strong> International Office Network<br />

Philately <strong>Post</strong> Office Network<br />

New Philately Business<br />

areas and four business units, which in turn<br />

include units of their own and possibly one<br />

or more subsidiaries. GHP and MailSource<br />

constitute the New Business segment. We<br />

operate under the core “Swiss <strong>Post</strong>” brand<br />

with our flagship brands “<strong>Post</strong>Mail”, “<strong>Post</strong>-<br />

Logistics”, “<strong>Post</strong>Finance“ and “<strong>Post</strong>Bus”.<br />

Management and service units carry out key<br />

tasks. The product management, logistics<br />

and production, e-business, information<br />

management and sales cross-cutting activities<br />

are coordinated by specialist committees.<br />

Management Management Unit Unit<br />

Finance Finance<br />

Human Resources Human Resources<br />

General General Secretariat Secretariat<br />

Strategic Strategic Account Account Management Management<br />

Group Corporate Group Corporate Development Development<br />

Corporate Corporate Communication Communication<br />

Corporate Corporate Security Security<br />

Internal Internal Auditing* Auditing*<br />

<strong>Service</strong> Units <strong>Service</strong> Units<br />

Real Estate Real Estate<br />

<strong>Service</strong> House <strong>Service</strong> House<br />

Corporate Corporate Purchasing Purchasing<br />

Finance, Finance, Insurance Insurance Management Management<br />

Information Information Technology Technology<br />

New Business<br />

* reporting directly to the Chairman of the Board of irectors

Mail<br />

<strong>Post</strong>Mail delivers 15 million letters each<br />

day: from greetings cards through love<br />

letters to business correspondence, direct<br />

marketing letters and newspapers. <strong>Post</strong>-<br />

Mail operates in the following market<br />

segments: private customers, business<br />

mail (invoices, account statements), direct<br />

marketing, basic mail (daily mail, especially<br />

for public authorities) and print media.<br />

85% of revenue is generated by<br />

business customers. <strong>Post</strong>Mail provides<br />

around one hundred different services for<br />

its customers.<br />

Logistics services<br />

<strong>Post</strong>Logistics is the leading logistics provider<br />

in Switzerland. Business customers<br />

benefit from a range of services available<br />

from a single source and customized<br />

advice for shipping parcels, express and<br />

courier items, as well as the transport of<br />

goods and warehouse logistics. <strong>Post</strong>Logistics<br />

also offers tailor-made services for<br />

individual customers or specific customer<br />

groups, such as import, customs clearance<br />

and local distribution throughout<br />

Switzerland, operating a spare parts<br />

warehouse, returns handling and nighttime<br />

delivery. <strong>Post</strong>Logistics guarantees a<br />

nationwide basic service for parcels.<br />

Financial services<br />

Payments, investments, retirement provision<br />

and financing: <strong>Post</strong>Finance is a retail<br />

financial institution with a comprehensive<br />

range of products and services. With a<br />

market share of around 60 percent, it is<br />

the undisputed leader in the Swiss payments<br />

market and, with yellownet, a<br />

leader in e-finance services. <strong>Post</strong>Finance is<br />

a reliable partner for private customers<br />

with low to average income and assets as<br />

well as for SMEs; it also works with large<br />

companies, public entities, cantons,<br />

the Confederation and social insurance<br />

companies. <strong>Post</strong>Finance aims to provide<br />

them all with an excellent service.<br />

Passenger Transport<br />

<strong>Post</strong>Bus Switzerland AG, a wholly owned<br />

subsidiary of Swiss <strong>Post</strong>, has a network<br />

covering 12.268 kilometres and carries<br />

over 106 million passengers a year, making<br />

it the number one provider of regional<br />

public transport in Switzerland. Outside<br />

Switzerland, <strong>Post</strong>Bus operates scheduled<br />

services in France and the Principality of<br />

Liechtenstein. 1.994 vehicles are on the<br />

road daily, carrying commuters, travelling<br />

tourist routes or providing a dial-a-ride<br />

service. <strong>Post</strong>Bus is a reliable and efficient<br />

partner for municipalities and cantons –<br />

offering scheduled services and comprehensive<br />

transport management ranging<br />

from vehicle maintenance to marketing.<br />

<strong>Post</strong> Office Network<br />

With around 2,500 post offices throughout<br />

Switzerland, <strong>Post</strong> Offices & Sales offers<br />

a unique basic service throughout the<br />

country: Switzerland has one of the densest<br />

networks in the world in terms of<br />

access points. A broad range of brandname<br />

articles, both postal and non-postal,<br />

from stamps to stationery to mobile<br />

phones, are on sale at these outlets,<br />

catering for both private customers and<br />

corporate clients.<br />

International<br />

Swiss <strong>Post</strong> International offers customers<br />

in Switzerland and abroad an attractive<br />

bulk mailing service for letters, printed<br />

matter and small consignments. SPI is<br />

represented worldwide with subsidiaries,<br />

distribution partners and joint ventures<br />

in 13 European countries, the USA and<br />

four countries in Asia. Well over half of its<br />

1,000 or so employees are based in Switzerland.<br />

SPI works together with experienced<br />

specialists around the world. We<br />

have joined forces with partners in the<br />

area of customs clearance, parcel post,<br />

courier and express services to ensure that<br />

our customers have speedy access to a<br />

truly global distribution network.<br />

Philately<br />

The Philately unit issues around 40 new<br />

stamps each year. At a time when electronic<br />

services are pushing out physical<br />

letters and stamps, the unit is supporting<br />

its existing business with topical and<br />

popular issues such as the Alinghi stamp<br />

while attempting to win collectors abroad<br />

too. Given its current customer base<br />

and supported by the high cultural value<br />

placed on stamps, the unit is building<br />

up a second pillar by offering a mail-order<br />

business with high-quality products.<br />

GHP<br />

The German-based GHP Group, with<br />

around 2800 employees, operates in<br />

seven countries and was acquired by Swiss<br />

<strong>Post</strong> in 2006. As one of the biggest European<br />

providers of dialogue marketing<br />

and customer management services, it<br />

rounds out the Swiss <strong>Post</strong> range.<br />

MailSource<br />

MailSource offers in-house postal services<br />

for companies, scanning, archiving and<br />

reception services in Switzerland, the UK,<br />

Germany, Italy, Liechtenstein, France and<br />

the USA. MailSource was established in<br />

2000 as a subsidiary of Swiss <strong>Post</strong> and is<br />

the company’s fastest-growing unit.<br />

Read more online<br />

www.swisspost.ch/ar2006links<br />

1) <strong>Post</strong>al Act<br />

2) <strong>Post</strong>al Ordinance<br />

3) <strong>Post</strong>al Organization Act<br />

4) Overview of Swiss <strong>Post</strong>’s universal services<br />

5) Swiss <strong>Post</strong>’s basic service, terms and definitions<br />

6) The Federal Council’s strategic objectives for<br />

Swiss <strong>Post</strong> 2006–2009<br />

99) Figures for the 2006 Annual Report

H<br />

Swiss <strong>Post</strong> key figures<br />

<strong>Service</strong>-<strong>oriented</strong> 2006 2005<br />

Result<br />

Operating income CHF million 7895 7499<br />

of which: generated abroad1 % of operating income 17.6 14.5<br />

of which: reserved services % of operating income 25.7 31.9<br />

Operating result CHF million 823 805<br />

As a share of operating income % 10.4 10.7<br />

of which: generated abroad1 % of operating result 8.0 4.7<br />

Group profit for the year CHF million 837 811<br />

Added value2 Employees<br />

CHF million 4735 4716<br />

Employees at Swiss <strong>Post</strong> Group (excluding trainees) Full-time equivalents 42178 41073<br />

of which: abroad<br />

Financing<br />

Full-time equivalents 3379 1347<br />

Total assets CHF million 55600 50130<br />

of which: customer deposits CHF million 48364 43630<br />

Equity<br />

Investments<br />

CHF million 1605 922<br />

Investments CHF million 540 347<br />

of which: other tangible fixed assets, intangible assets CHF million 195 176<br />

of which: operating property CHF million 310 153<br />

of which: investments CHF million 35 18<br />

Ratio of self-financed investments<br />

Value generation<br />

% 100 100<br />

Cash flow from operating activities CHF million 3247 3603<br />

<strong>Post</strong> Value Added (PVA) CHF million 532 532<br />

Innovative 2006 2005<br />

<strong>Post</strong>Mail Share of new products as a % 3 1.32 0.99<br />

Swiss <strong>Post</strong> International Share of new products as a % 3 3.43 2.90<br />

<strong>Post</strong>Finance Share of new products as a % 3 4.40 2.88<br />

Logistics services Share of new products as a % 3 2.58 2.75<br />

<strong>Post</strong>Bus Share of new products as a % 3 0.00 0.00<br />

<strong>Post</strong> Office Network Share of new products as a % 3 3.61 1.10<br />

Prudent 2006 2005<br />

Employees (Swiss <strong>Post</strong> Group) Full-time equivalents 42178 41073<br />

Employees (Swiss <strong>Post</strong>) Full-time equivalents 35326 37033<br />

Trainees at Swiss <strong>Post</strong> Group in Switzerland Persons 1429 1465<br />

New trainees Persons 566 512<br />

Total departure rate at Swiss <strong>Post</strong> As a % of average headcount 10.9 8.3<br />

Fluctuation rate (voluntary departures) at Swiss <strong>Post</strong> As a % of average headcount 3.5 3.6<br />

Employee satisfaction Index 67 67<br />

Motivation/willingness to perform Index 70 –<br />

Monetary brand value of Swiss <strong>Post</strong> CHF million 535 479<br />

2005 2004<br />

Energy consumption Primary energy total year 4716832 4684751<br />

of which: electricity Primary energy total year 2001319 2081949<br />

of which: heat Primary energy total year 597880 517211<br />

of which: fuel Primary energy total year 2117632 2085591<br />

of which: energy from renewable sources % 8.9 9.2<br />

Paper Millions of A4 sheets 108.2 91.9<br />

1 efinition of “abroad” in accordance with secondary segmentation in the Financial Report.<br />

2 Added value = operating result + staff costs + depreciation – income from sale of property, plant and<br />

equipment, intangible assets and investments<br />

3 Share of net sales from newly launched products (in the past four years) in terms of net sales for the unit<br />

4 In accordance with the CEC, the employment relationship continues for two years. For employment<br />

contracts in accordance with the Swiss Code of Obligations, the employment relationship is discontinued<br />

after six months. The figures are therefore not comparable with other companies.<br />

5 Excl. Executive Management<br />

6 Excl. CEO<br />

7 Swiss <strong>Post</strong> Group in Switzerland, excl. Members of Exec. Mgmt.<br />

8 18 years, excl. trainees<br />

9 Average remuneration paid to Members of Executive Management in relation to average employee salary

Considerate 2006 2005<br />

Individual consultations by job centre Number 1362 1337<br />

Job centre seminars Participants 1497 1762<br />

Notice given by employer for economic reasons Number 68 161<br />

Occupational accidents at Swiss <strong>Post</strong> Number per 100 FTEs 6.1 6.5<br />

Non-occupational accidents at Swiss <strong>Post</strong> Number per 100 FTEs 16.3 16.2<br />

Costs generated by accidents at Swiss <strong>Post</strong> CHF million 79.0 84.8<br />

ays lost due to illness and accidents Absentee days per employee 4 11.5 12.0<br />

ays lost due to illness and accidents ays per year 394105 432160<br />

2005 2004<br />

Total environmental impact Env. impact points (millions) 299203 306125<br />

Total climate-related burden t CO2 equivalent 281249 280472<br />

Climate-related burden of goods transports t CO2 equivalent 53634 55451<br />

of which: rail t CO2 equivalent 6034 7851<br />

of which: road t CO2 equivalent 47600 47600<br />

Climate-related burden of passenger transports t CO2 equivalent 122165 119700<br />

Climate-related burden of journeys to work t CO2 equivalent 46809 49259<br />

Responsible 2006 2005<br />

Jobs in Switzerland Swiss <strong>Post</strong> employees per 1000 employees 12.9 13.6<br />

Jobs in marginal areas Swiss <strong>Post</strong> employees per 1000 employees 13.4 14.0<br />

Employees aged 50–59 % 25.0 24.0<br />

Employees aged 60 and over % 4.1 3.8<br />

Average age of staff Years 42.7 42.3<br />

egree of employment 90% or higher (full-time), total % 56.0 56.9<br />

egree of employment 90% or higher (full-time), men % 85.4 85.6<br />

egree of employment 90% or higher (full-time), women % 26.5 27.3<br />

egree of employment under 90% (part-time), management % 8.5 7.9<br />

egree of employment under 90% (part-time), management, men % 5.3 4.9<br />

egree of employment under 90% (part-time), management, women % 30.5 29.9<br />

Sports sponsorship CHF million 9.7 9.6<br />

Cultural sponsorship CHF million 3.6 5.1<br />

Social commitments/donations/gifts CHF million 3.4 3.1<br />

onations to political parties CHF million 0 0<br />

Exemplary 2006 2005<br />

Employment in accordance with Swiss <strong>Post</strong> CEC FTEs as a % 80.6 86.6<br />

Men % 50.1 50.8<br />

Women % 49.9 49.2<br />

Proportion of women in senior management posts 5 % 9.1 9.3<br />

Average remuneration to Members of Executive Management 6 CHF per year 444187 426498<br />

Average salary (employees) 7 CHF per year 75127 73593<br />

Minimum salary Swiss <strong>Post</strong> CEC 8 CHF per year 41006 40400<br />

Salary bandwidth 9 Factor 5.9 5.8<br />

Cover of Swiss <strong>Post</strong> pension fund in accordance with occupational<br />

benefit plan % 103.9 101.1<br />

Added value generated2 CHF million 4735 4716<br />

Of which paid to: employees CHF million 3711 3704<br />

Of which paid to: creditors CHF million 11 9<br />

Of which paid to: public sector CHF million 2 4<br />

Of which paid to: owner CHF million 0 0<br />

Of which paid to: company CHF million 1011 999<br />

Of which for: transfer to Swiss <strong>Post</strong> pension fund CHF million 350 350<br />

Of which for: building up equity CHF million 487 461<br />

Of which for: depreciation CHF million 257 252<br />

Of which: other CHF million –83 –64<br />

Additional key figures are set out in the table of figures. ( 99)<br />

Annual Report | key figures<br />

5

6 Annual Geschäftsbericht Report | Chairman’s foreword<br />

Dear Sir or Madam<br />

For the first time you are being presented<br />

with an annual report that contains a<br />

comprehensive overview of our values and<br />

key principles. It includes information<br />

about sustainability at Swiss <strong>Post</strong> as well<br />

as the environmental and social affairs<br />

reports, which were previously published<br />

separately. In addition to our usual review<br />

of business you will also be able to read<br />

about innovative projects, our prudent<br />

handling of resources, our endeavours to<br />

take our surroundings into consideration<br />

as much as possible, our management<br />

philosophy and our responsibility to<br />

society.<br />

The only constant in today’s society is<br />

change. If Swiss <strong>Post</strong> wants to be successful<br />

and safeguard its future, it must anticipate<br />

economic, technological and political<br />

trends and gear its actions accordingly.<br />

It is important to us that our employees<br />

and our partners – and of course our customers<br />

– know where Swiss <strong>Post</strong> is headed<br />

in the years to come.<br />

We therefore developed our “vision” further<br />

in 2006. It points the way toward the<br />

future and shows us where we would like<br />

to be a few years from now. We will con-<br />

tinue to develop the basic service and<br />

adapt it in line with customer behaviour.<br />

We will remain a progressive and socially<br />

responsible employer, even in the face of<br />

increasing competition. Swiss <strong>Post</strong> wants<br />

to increase the value of the company<br />

through all its business activities. It wants<br />

to remain the market leader in its core<br />

business and develop profitably in new,<br />

related markets, in the interests of its<br />

customers and together with motivated<br />

staff and strong partners. This is summed<br />

up in our vision statement: Swiss <strong>Post</strong> –<br />

guaranteeing a basic service – generates<br />

value and acts in a socially responsible<br />

manner.<br />

Swiss <strong>Post</strong> lived up to its vision in 2006.<br />

Over the past year we served 3.1 million<br />

households in Switzerland on at least<br />

five days a week, delivering letters, parcels<br />

and newspapers. 9 out of 10 of the country’s<br />

inhabitants can reach their nearest<br />

post office or obtain postal services for<br />

private customers and SMEs either on foot<br />

or by public transport within 20 minutes<br />

on average. Independent studies confirm<br />

that the quality of our basic postal service<br />

is excellent. This is also backed up by the<br />

high level of customer satisfaction, which<br />

rose again slightly in 2006.<br />

“ If Swiss <strong>Post</strong> wants to be successful<br />

and safeguard its future, it must<br />

anticipate economic, technological<br />

and political trends and gear its<br />

actions accordingly.”<br />

Anton Menth<br />

Chairman<br />

Staff at Swiss <strong>Post</strong> enjoy excellent employment<br />

conditions, according to a nationwide<br />

comparison. As in 2005, employee<br />

satisfaction came to a good 67 out of 100<br />

index points. Motivation was measured<br />

for the first time and, at 70 points, is an<br />

indication of just how keen our employees<br />

are to perform.<br />

Competitive in the market<br />

In an environment shaped by far-reaching<br />

change and fierce competition, we generated<br />

sales of 7,895 million francs. Of<br />

this, the monopoly business accounted for<br />

1,834 million francs or 23.2 percent of<br />

sales, while the lion’s share was generated<br />

in free competition in the postal market.<br />

Swiss <strong>Post</strong> lifted its sales to 837 million<br />

francs. The strong economic trend as well<br />

as our willingness to be innovative and<br />

provide efficient services contributed to<br />

this result.<br />

We thus increased the equity base by<br />

1,605 million, bringing it to 683 million<br />

francs. However, in this respect Swiss <strong>Post</strong><br />

is still below the levels customary for the<br />

industry. If we are allowed to go on accumulating<br />

our profit, it will take until 2009<br />

to increase equity to the level required for<br />

operating purposes and create the obliga-

tions expected of us as an employer to<br />

ensure the long-term pension fund benefits.<br />

Over 900 million francs were<br />

channelled into the Swiss <strong>Post</strong> pension<br />

fund between 2005 and 2007 as financing<br />

generally and specifically for the<br />

change from a defined benefit to a defined<br />

contribution scheme.<br />

The acquisition of the German-based GHP<br />

Group – as the biggest takeover Swiss<br />

<strong>Post</strong> has ever completed – contributed to<br />

our strategic development. GHP is a group<br />

of companies active in the fields of<br />

comprehensive dialogue marketing and<br />

customer management. By developing<br />

related services, Swiss <strong>Post</strong> aims to counter<br />

the declining letter and parcel volumes<br />

and to create synergies for its Swiss and<br />

international business.<br />

Swiss <strong>Post</strong> today and tomorrow<br />

eregulation of postal markets is proceeding<br />

apace worldwide. In Switzerland international<br />

logistics companies compete with<br />

Swiss <strong>Post</strong> in the area of parcels and letters<br />

weighing over 100 grams where the<br />

monopoly has been abolished over the<br />

last few years. Unlike Swiss <strong>Post</strong>, our competitors<br />

are not obliged to provide a costly<br />

nationwide basic service and, because<br />

they are not bound by the Public Officials<br />

Act, they can adapt their wage costs and<br />

employment conditions flexibly, in line<br />

with the respective segments and geographic<br />

regions. Swiss <strong>Post</strong> must use the<br />

time still remaining to prepare for the<br />

deregulated market and to become more<br />

competitive.<br />

On the technological front, e-substitution<br />

is developing. Physical letters are being<br />

replaced to an increasing extent by mod-<br />

ern electronic forms of communication<br />

such as e-mail and text messages (SMS).<br />

The letter volume declined by 1.8 percent<br />

over the past year. As the basic service is<br />

financed in part from revenue generated<br />

by the letters monopoly, this trend must<br />

be monitored very closely. Moreover,<br />

customers are using actual post offices<br />

less and less often, which is forcing us to<br />

adapt our post office network and also<br />

to ensure that we have sufficient access<br />

points.<br />

This is the backdrop against which the<br />

reform of postal legislation initiated by the<br />

Federal Council in May 2006, will be implemented<br />

( 7). For Swiss <strong>Post</strong> it is important<br />

to provide an up-to-date, high-quality<br />

basic service ( 6) in future too. The crucial<br />

aspect will be the scope it will take, as<br />

envisaged by politicians and inhabitants,<br />

and how it will be financed. If we want to<br />

retain a basic service on today’s scale, the<br />

residual monopoly is the most efficient<br />

financing option.<br />

However, should the postal market be<br />

completely deregulated, Swiss <strong>Post</strong> will<br />

campaign to ensure fair conditions for<br />

all market players. This means, above all,<br />

adapting the basic service mandate to a<br />

competitive level. To make Swiss <strong>Post</strong><br />

more competitive in those markets that<br />

have already been deregulated, it is calling<br />

for the abolition of the Public Officials Act<br />

and the need to have employees bound<br />

by the Swiss Code of Obligations and for<br />

a change in the legal status of Swiss <strong>Post</strong><br />

to bring it into line with the shift in conditions<br />

since the previous postal reform in<br />

1998. However, the employees should not<br />

be forced to bear the brunt of deregulation.<br />

Instead, Swiss <strong>Post</strong> advocates standardizing<br />

employment conditions throughout<br />

the entire industry. If <strong>Post</strong>Finance is<br />

to develop further and continue making a<br />

substantial contribution to Swiss <strong>Post</strong>’s<br />

results, it will need the possibility of engaging<br />

in the lending business.<br />

Annual Report Verantwor | Chairmtungsbewusst<br />

an’s foreword 7<br />

“ We will remain a progressive and<br />

socially responsible employer,<br />

even<br />

in the face of increasing competition.”<br />

Thanks<br />

On behalf of the Board of irectors and<br />

Executive Management I would like to<br />

thank all our customers for their loyalty.<br />

Particular thanks are due to our employees<br />

for their dedication and motivation.<br />

The results they produced on a daily basis<br />

are among the best at an international<br />

level, despite the difficult operating environment.<br />

I would especially like to thank Rocco Cattaneo,<br />

who is leaving the Board of irectors<br />

after eight years. Nicola Thibaudeau<br />

and Rolf Ritschard were elected as new<br />

members of the Board. We were deeply<br />

saddened to learn that Rolf Ritschard died<br />

unexpectedly at the beginning of 2007.<br />

Finally, I would also like to thank Karl<br />

Kern, who retired as the Head of the <strong>Post</strong><br />

Office Network and as Member of Executive<br />

Management at the end of 2006. The<br />

post office network was modernized<br />

under his leadership, between 2000 and<br />

2006. I would like to wish his successor<br />

Patrick Salamin every success.<br />

Read more online<br />

www.swisspost.ch/ar2006links<br />

6) The Federal Council’s strategic objectives for<br />

Swiss <strong>Post</strong> 2006–2009<br />

7) Swiss <strong>Post</strong> before reform of postal legislation

8 Annual Geschäftsberich Report | Interview<br />

Ulrich Gygi, Chief Executive Officer<br />

“ Our uppermost goal is<br />

still to provide an excellent<br />

basic service for all of<br />

Switzerland.”<br />

Interview: Andreas Sturm, Marcel Suter Mr Gygi, Swiss <strong>Post</strong> is facing major<br />

changes. Where do you feel this process<br />

of change the most in terms of<br />

operations?<br />

Of course we realize that we are facing<br />

competition. We are losing market<br />

shares in our logistics services and our<br />

margins are dwindling. On the other<br />

hand, the letters volume has continued<br />

to decline, partly as a result of electronic<br />

communication. In 2006, Swiss <strong>Post</strong><br />

processed 1.8 percent fewer addressed<br />

and 1 percent fewer unaddressed letters.<br />

Customer behaviour has also changed;<br />

in other words, our dense post office<br />

network is not being used to the same<br />

extent as in the past. Since 2000,<br />

42 percent fewer letters and 42 percent<br />

fewer parcels were handed in at post<br />

offices, and the volume of inpayments<br />

was down by 14 percent. To meet these<br />

challenges we are attempting to boost<br />

productivity and promote innovation<br />

in all units so that we can offer our<br />

customers practical services.<br />

Where was this process of change<br />

felt the most last year?<br />

First and foremost, probably with the<br />

Ymago ( 8) project. This involves the internal<br />

redistribution of tasks among the<br />

post offices in addition to the agency<br />

model, known as the “post office in the<br />

village shop”. With Ymago we will be<br />

able to make the network more customer-friendly<br />

and also more efficient. This<br />

is a process of optimization that is necessary<br />

for operational purposes but which<br />

is also controversial because it affects the<br />

salary structure, among other things.<br />

I have noticed that understanding of the<br />

need for change has grown, both within<br />

the company and among the public.<br />

Unfortunately, implementation of the<br />

legal merger of <strong>Post</strong>Parcels, Express<strong>Post</strong>

AG and our goods logistics was not possible.<br />

The Federal Office for Justice denied<br />

permission to outsource the universal<br />

services from <strong>Post</strong>Parcels. However,<br />

these three units will operate in the market<br />

as a single company with a single<br />

offering from a single source.<br />

By contrast, we were given permission to<br />

implement outsourcing in connection<br />

with <strong>Post</strong>Bus. As a public company, the<br />

unit will be able to act more flexibly in future<br />

and will find it easier to work closely<br />

together with other public transport providers.<br />

I also hope that resources can be<br />

managed leanly.<br />

Swiss <strong>Post</strong> is reporting a profit of 837<br />

million francs for the year under review.<br />

Many people view this as a contradiction<br />

to the salary and job cuts<br />

resulting from Ymago.<br />

Let me say first of all that we are proud<br />

of this result; it is appropriate for a<br />

company of our size and bears comparison<br />

in international terms. However,<br />

profit and a simultaneous reduction in<br />

headcount do not constitute a contradiction.<br />

Swiss <strong>Post</strong> is being increasingly<br />

exposed to competition, and technology<br />

is making manual work redundant.<br />

Fighting this trend would pose a threat<br />

to our very existence. It makes more<br />

sense to seek new business opportunities<br />

and to create jobs there. We are<br />

doing this all the time. For instance at<br />

<strong>Post</strong>Finance, with in-house postal services<br />

for large customers, document<br />

management, direct marketing and other<br />

services. We can deal actively with<br />

the ongoing process of change and<br />

with the future in mind only if we are<br />

financially fit. This is the only way for us<br />

to implement projects such as Ymago in<br />

a socially responsible manner and to<br />

finance the necessary structural adjustments<br />

and investments. Finally, our result<br />

will serve to secure the future of<br />

jobs at Swiss <strong>Post</strong>. And besides, only a<br />

commercially successful company attracts<br />

potential employees and customers.<br />

Why isn’t Swiss <strong>Post</strong> cutting prices if<br />

its profit figure is this good?<br />

Prices in the competitive business are shaped<br />

by the market and are in a constant<br />

state of flux. The monopoly prices are<br />

approved by the Federal epartment of<br />

Environment, Transport, Energy, and<br />

Communications. The quality that our<br />

customers want and appreciate comes at<br />

a price. In an international comparison<br />

we are in the lowest third. ( 9)<br />

Annual Verantwortungsbewusst<br />

Report | Interview<br />

9<br />

The owner also wants us to build up an<br />

industry-standard level of equity. Our<br />

target is three billion francs. At the same<br />

time we had to ensure a solid basis for<br />

our pension fund, in the interests of<br />

both our employees and the tax-payers.<br />

Our good results have now provided the<br />

necessary funding. Further funds will be<br />

needed for the switch to a defined contribution<br />

scheme. Finally, we have to<br />

finance our investments from resources<br />

we generate ourselves. Once we have<br />

reached these goals and can sustain<br />

them, the Confederation can look forward<br />

to receiving some of the profit. The<br />

Federal Council has the last word on<br />

profit appropriation.<br />

<strong>Post</strong>Finance again made a major contribution<br />

to profit. Swiss <strong>Post</strong> is seeking<br />

a banking licence and would thus compete<br />

directly with the banks, in particular<br />

the cantonal banks. But does Switzerland<br />

really need another bank?<br />

<strong>Post</strong>Finance currently has 2.31 million<br />

customers, many of whom are small customers<br />

and small and medium-sized enterprises.<br />

We handle a good portion of<br />

all the payment transactions in Switzerland.<br />

We want to be able to offer these<br />

customers the entire range of financial<br />

services at attractive and fair conditions.

10 Annual Geschäftsbericht Report | Interview 2006<br />

In the current situation we are allowed<br />

to sell mortgages only in cooperation<br />

with UBS and have to share the margins<br />

with it. Naturally this limits our room to<br />

manoeuvre. We are prepared to enter<br />

the retail market under the same conditions<br />

as our competitors. For this we<br />

need the appropriate legal basis. ( 7)<br />

Swiss <strong>Post</strong> is calling for employment<br />

contracts to be subject to the Swiss<br />

Code of Obligations and is also outsourcing<br />

more and more of its service<br />

from the parent company to public<br />

companies. Does this mean the end of<br />

the social partnership?<br />

This brings us to the topic of equal conditions<br />

for all market players. We are<br />

in favour of collective employment contracts<br />

for certain sectors (industry CECs)<br />

on the basis of the Swiss Code of Obligations<br />

( 10), as we believe that competition<br />

should be based not on salaries<br />

but on the quality of services. Swiss <strong>Post</strong><br />

operates in several sectors open to competition.<br />

To ensure that everyone has the<br />

same opportunities we must bring about<br />

these CECs in the medium term. Of<br />

course we stand behind the principle of<br />

social partnership.<br />

Swiss <strong>Post</strong> is a traditional Swiss institution<br />

that is now expanding abroad<br />

on the profit it generates with its monopoly<br />

business. Why?<br />

First of all: Of the sum which you call the<br />

profit from the monopoly business,<br />

which is 837 million francs, we generate<br />

the lion’s share in direct competition.<br />

Less than one third is generated by<br />

monopoly business, and this is used to<br />

finance the basic service.<br />

And now to your question: in Switzerland<br />

we are facing declining mail volumes.<br />

One major reason for this is<br />

substitution of letters and other postal<br />

items with electronic forms of communication.<br />

In order to counter these lost<br />

earnings we are looking beyond Switzerland’s<br />

borders and want to grow abroad<br />

in post-related niche markets. ( 6)<br />

Essentially, our subsidiaries operate in<br />

three areas abroad. Swiss <strong>Post</strong> International<br />

(SPI) focuses on cross-border traffic<br />

in the business customer segment.<br />

SPI’s business is geared primarily to safeguarding<br />

the domestic market. The rapidly<br />

growing MailSource Group offers<br />

successful in-house postal services for<br />

companies. MailSource also generates<br />

business for the other units of Swiss<br />

<strong>Post</strong>. The third unit is GHP Group, in<br />

which we acquired a two-thirds stake in<br />

2006. It operates in the growing market<br />

for customer loyalty programmes and<br />

dialogue marketing. With GHP we aim<br />

to globalize our business even further<br />

and develop activities that will ultimately<br />

generate postal items. New strategic<br />

options are opening up for Swiss <strong>Post</strong><br />

International and MailSource in terms of<br />

delivery to end customers and in the<br />

field of document management. Sophisticated<br />

GHP services such as integrated,<br />

card-based customer loyalty programmes<br />

can be adapted to Swiss needs. GHP is<br />

the market leader in Germany for health<br />

insurance cards. This will create synergies<br />

for the future Swiss health card.<br />

These three units employ almost 3,400<br />

people and contribute around 17.6 percent<br />

to Group sales, and the trend is on<br />

the increase.<br />

Let’s stay in the international arena:<br />

what is Swiss <strong>Post</strong>’s stance, as a company<br />

owned by the Confederation,<br />

on the obligations entered into by<br />

Switzerland under the Kyoto Protocol<br />

on climate protection?<br />

At Swiss <strong>Post</strong> we have adopted the obligations<br />

and targets of the Kyoto Protocol.<br />

In this way we also acknowledge<br />

that climate change will mean a need for<br />

us as a company to take specific action.<br />

We are, for instance, also optimizing our<br />

transport system to bring it into line with<br />

ecological requirements. Although, for<br />

economic reasons, we currently handle a<br />

slightly higher portion of our goods<br />

transport by road, the overall result in<br />

terms of energy and the climate is better

with multi-modal transport. The ideal<br />

mix of road and rail-based transport,<br />

combined with intelligent transport planning<br />

and the use of state-of-the-art vehicles,<br />

is the key to success. We have already<br />

achieved a good part of the<br />

energy and climate goals ( 11, 12) we<br />

set for 2010. We are confident that we<br />

will reach the objectives of the Kyoto<br />

Protocol.<br />

However, we also comply with international<br />

standards and agreements in<br />

terms of social accountability. Since<br />

2006, all suppliers have had to comply<br />

in writing with our comprehensive social<br />

and ethics code ( 13). In this way<br />

we want to ensure that competition<br />

among suppliers is based on the quality<br />

of the service and not on working conditions<br />

or low environmental standards.<br />

The <strong>Post</strong>al Act is being revised. What<br />

are your messages for the legislator?<br />

Our uppermost goal in revising the <strong>Post</strong>al<br />

Act is to go on providing an excellent<br />

basic service for the whole of Switzerland.<br />

However, we also want to remain a<br />

socially responsible employer and ensure<br />

our further development on the basis of<br />

our own resources, i.e. be financially<br />

independent. This means that there must<br />

be fair rules for Swiss <strong>Post</strong> too. ( 7)<br />

We are therefore supporting the residual<br />

monopoly for letters. This is the best way<br />

to finance our basic service. If the postal<br />

market should nevertheless be deregulated,<br />

there must first be clarity as to the<br />

scope and financing of the basic service.<br />

Here, the question is: What acceptance<br />

and distribution network would a company<br />

operate and how would it organize<br />

delivery if it did not have to fulfil a basic<br />

service mandate? It would build up several<br />

hundred post offices, and not 2.500.<br />

And it would not offer such a frequent<br />

delivery service in more sparsely populated<br />

regions. This difference between<br />

our current postal network and one that<br />

makes sense in operational terms accounts<br />

for the additional costs of the<br />

basic service. Today we can cover these<br />

costs with the letters monopoly. If parliament<br />

lowers the monopoly limit further<br />

or if the market is fully liberalized, financing<br />

of the basic service or of other<br />

political requirements imposed by the<br />

Federal Council would no longer be ensured,<br />

and new rules would have to be<br />

drawn up.<br />

Wherever Swiss <strong>Post</strong> faces competition,<br />

the same, fair operating conditions<br />

would have to apply to all market players<br />

– again, the concept of a level playing<br />

field. We would like to be able to employ<br />

our staff under the terms of the<br />

Swiss Code of Obligations – just as our<br />

competitors do. To ensure that our em-<br />

Annual Verantwortungsbewusst<br />

Report | Interview<br />

“I have noticed that understanding<br />

of the need for change has<br />

grown, both within the company<br />

and among the public.”<br />

ployees do not suffer from competition,<br />

we are in favour of collective employment<br />

contracts for the entire industry.<br />

11<br />

Read more online<br />

www.swisspost.ch/ar2006links<br />

6) The Federal Council’s strategic objectives for<br />

Swiss <strong>Post</strong> 2006–2009<br />

7) Swiss <strong>Post</strong> before reform of postal legislation<br />

8) <strong>Post</strong> office network: the only constant is change<br />

9) Swiss <strong>Post</strong> and attractive letter prices<br />

10) Public Officials Act<br />

11) Swiss <strong>Post</strong>’s environmental objectives<br />

12) Climate change and political initiatives<br />

13) Social and ethics code

12 Annual Geschäftsbericht Report | <strong>Service</strong>-<strong>oriented</strong> 2006 | Group<br />

<strong>Service</strong>-<strong>oriented</strong> | Group<br />

An efficient<br />

Swiss <strong>Post</strong> for<br />

a strong<br />

Switzerland.<br />

“I want to hand in<br />

my letters and parcels<br />

at our post office in<br />

St Antönien.”<br />

Andreas Luck<br />

Small business owner, Ascharina<br />

Swiss <strong>Post</strong> meets the public’s high<br />

expectations in terms of its basic service<br />

and fulfils its service mandate to<br />

a high standard. In 2006, it was able<br />

to maintain or improve on the customer<br />

satisfaction levels in all business<br />

units. By increasing our competitiveness<br />

we have created the ideal<br />

platform from which to defend our<br />

position in a hotly contested environment.<br />

We are: continuing our policy<br />

of ensuring broader-based contributions<br />

to the result, increasing the<br />

company value as requested by the<br />

Federal Council, providing support for<br />

economic development in all parts of<br />

the country, and offering our employees<br />

good prospects.<br />

In the 2006 business year, Swiss <strong>Post</strong> generated<br />

Group profit of 837 million francs,<br />

which is 26 million francs more than in<br />

the previous year. Compared with 2005,<br />

operating income rose by 396 million<br />

francs to 7,895 million francs. Of this,<br />

197 million francs are attributable to<br />

acquisitions. We were again able to<br />

increase the value of the company as a<br />

whole – by 1,605 million francs (2005:<br />

532 million francs). Thanks to the positive<br />

result, Swiss <strong>Post</strong>’s equity increased to<br />

1,605 million francs but this is still not<br />

in line with the industry. All business<br />

areas and units again contributed to Group<br />

profit.

Developments in the economic<br />

environment<br />

The good result was achieved in a gratifying<br />

economic environment: the strong<br />

expansion in the global economy continued<br />

in the second half of 2006. Although<br />

the sustained upswing in the USA lost<br />

momentum, growth in the EU picked up.<br />

The economic upturn continued in Japan<br />

and in most other countries in Asia, in<br />

particular in China. This trend occurred<br />

against a backdrop of sharply fluctuating<br />

oil prices.<br />

In Switzerland, economic growth was<br />

balanced and broadly based. The situation<br />

on the labour market continued to<br />

improve, with the brighter mood boosting<br />

job security and consumer confidence.<br />

In 2006, the provisional G P<br />

growth rate was 2.7 percent.<br />

emand for logistics and financial services<br />

depends on the general economic<br />

trend as well as on the related interest<br />

rate trend. Retail trade benefited from the<br />

favourable macro-economic conditions.<br />

The transport and logistics industry profited<br />

from the positive impetus of foreign<br />

trade and the upbeat consumer mood,<br />

and the telecoms sector was again one of<br />

the growth engines. These trends benefited<br />

the financial and logistics sectors of<br />

Swiss <strong>Post</strong> in particular.<br />

Volumes/traffic<br />

The downtrend in mail volumes for domestic<br />

and international letters continued.<br />

The 2005 results were not matched<br />

this year, especially in the field of nonpriority<br />

single items (B Mail), owing to a<br />

shift towards less expensive bulk mailings<br />

and the ongoing optimization in the mailing<br />

of account statements in the financial<br />

sector. On the other hand, the overall<br />

volume of parcels was in line with the<br />

previous year’s level, and the number of<br />

Swiss-Express items was higher. The inflow<br />

of new money at <strong>Post</strong>Finance was<br />

again positive. The number of passengers<br />

was slightly higher, thanks to the favourable<br />

trend in commissioned services.<br />

Buoyed by the sound economic environment<br />

(tourism, exports), international<br />

letter post increased year on year. 1<br />

Our success strategy<br />

In order to ensure sustainable success and<br />

safeguard our core business in the long<br />

term, we mean to increase our competitiveness<br />

even further. We therefore intend<br />

to improve and expand our services in<br />

the existing markets. The focus will be on<br />

industry solutions such as repairs and<br />

hospital logistics, innovative services for<br />

payments and digital signatures, as well<br />

as intensified advisory services such as the<br />

video consulting service from <strong>Post</strong>Finance.<br />

By adjusting the post office network to<br />

customer behaviour, expanding the range<br />

“ Why does the cost of mailing a letter<br />

include paying for structures<br />

that are used by only a few people?”<br />

Christian Bütikofer<br />

Attorney, Gossau (SG)<br />

Annual Report | <strong>Service</strong>-<strong>oriented</strong> | Group 13

14 Annual Geschäftsbericht Report | <strong>Service</strong>-<strong>oriented</strong> 2006 | Group<br />

of <strong>Post</strong>Finance services and products on<br />

offer at post offices and setting up our<br />

own <strong>Post</strong>Finance branches as well as expanding<br />

our sales platforms on the Internet,<br />

we want to coordinate our distribution<br />

channels more effectively with one<br />

another.<br />

By steadily adapting structures and processes,<br />

dividing in-house tasks among post<br />

offices, using state-of-the-art technology<br />

and adopting a lean approach to cost<br />

management we will continue to boost<br />

productivity. Maintaining a dialogue with<br />

those around us, we are committed to<br />

further developing the regulatory conditions<br />

under which we operate, in order to<br />

safeguard our entrepreneurial scope and<br />

reach and to ensure fair “rules of the<br />

game” for all market players. Industryspecific<br />

employment conditions and contracts<br />

subject to the Swiss Code of Obligations<br />

are a key aspect if we are to enjoy<br />

a level playing field and succeed in the<br />

fiercely competitive market.<br />

We aim to compensate the decline in our<br />

core postal business: by profitable growth<br />

in international niche markets, by internal<br />

postal services for companies and institutions<br />

and by taking over business proc-<br />

esses in the value chains of third parties<br />

(incl. order platforms, fulfilment, invoicing).<br />

This will provide us with growth in<br />

our post-related markets and enable us to<br />

reduce our dependency on both our core<br />

business and the domestic market. In the<br />

long term, <strong>Post</strong>Finance should be granted<br />

a banking licence and thus be able to<br />

expand the range of its financial services.<br />

In order to make use of this potential for<br />

success, we want to maintain a high level<br />

of motivation and willingness to per-form<br />

among our staff. By pursuing this strategic<br />

direction, we will be able to implement<br />

our vision of an efficient and socially<br />

responsible Swiss <strong>Post</strong>.<br />

Important steps<br />

In implementing our vision and strategy<br />

we achieved the following important<br />

milestones in 2006:<br />

We began building the two letter centres<br />

in Eclépens and Härkingen as part of<br />

the REMA (Reengineering Mail Processing)<br />

project. The Zurich-Mulligen centre<br />

has been undergoing refurbishment since<br />

February 2005. The three letter centres<br />

will be among the most modern in the<br />

world. Zurich-Mulligen will commence<br />

operations in summer 2007, and Härkingen<br />

and Eclépens will become operational<br />

in the summer and autumn of 2008 respectively.<br />

In addition to the three new<br />

letter centres, there will be six sub-centres<br />

in Switzerland for letter processing and<br />

two locations for video coding and returns<br />

processing (Chur and Sion). REMA<br />

will enable us to save 170 million francs<br />

in letter-processing operating costs<br />

each year. Swiss <strong>Post</strong> will invest over one<br />

billion francs in the entire project.<br />

On 14 January 2007, <strong>Post</strong>Finance took<br />

over the processing of payments for<br />

Glarner Kantonalbank. This is an important<br />

step along the way to becoming<br />

a leading provider of payments processing<br />

for other financial institutions. <strong>Post</strong>-<br />

Finance has now been processing slipbased<br />

payment transactions on behalf of<br />

UBS since autumn 2005.<br />

The <strong>Post</strong>Bus unit of Swiss <strong>Post</strong> was transferred<br />

to <strong>Post</strong>Bus Switzerland AG on<br />

1 July 2006. The Federal Office for Justice<br />

had previously looked into the project,<br />

before issuing an expert opinion that<br />

deemed it to be legally permissible. The<br />

subsequent agreement affiliating <strong>Post</strong>Bus<br />

staff to the collective employment con-<br />

“ In future, Swiss <strong>Post</strong> should<br />

deliver mail throughout<br />

the week at a standard price<br />

to places like St Antönien.”<br />

Silvia Brembilla<br />

Mayor of municipality, St Antönien

tract for subsidiaries of Swiss <strong>Post</strong> guarantees<br />

them good working conditions in the<br />

future too. At the same time, by transferring<br />

<strong>Post</strong>Bus to the public company, we<br />

are creating the basis for <strong>Post</strong>Bus Switzerland<br />

AG to gear its activities more closely<br />

to the needs of the market and thus<br />

remain the number one provider of roadbased<br />

public passenger transport.<br />

In the autumn, the Board of irectors<br />

gave the go-ahead to implement the<br />

Ymago project. Swiss <strong>Post</strong> will conduct<br />

an internal reorganization of its post offices<br />

in 2007. ( 8) By the end of 2008<br />

we aim to set up 200 new agencies.<br />

These measures will help us respond even<br />

faster and better to customer behaviour<br />

and make our network more efficient.<br />

Following completion of the project by<br />

the end of 2008, Swiss <strong>Post</strong> expects to<br />

improve its annual results to the tune of<br />

somewhat more than 50 million francs.<br />

Ymago is expected to result in between<br />

400 and 500 jobs being cut over the<br />

course of two years. We do not anticipate<br />

that Ymago will lead to dismissals, in line<br />

with previous reorganizations.<br />

In ecember 2006, Swiss <strong>Post</strong> signed an<br />

agreement on the future of the Swiss<br />

<strong>Post</strong> pension fund with the Communications<br />

and transfair unions. In particular,<br />

it sets out the transition from a defined<br />

benefit to a defined contribution plan.<br />

Swiss <strong>Post</strong> is committed to financing the<br />

pension fund within the bounds of the<br />

financially possible and within the confines<br />

of the Federal Council’s decisions<br />

regarding appropriation of profit. As the<br />

Confederation had not fully financed the<br />

Swiss <strong>Post</strong> pension fund when it was established<br />

on 1 January 2002, this course<br />

was the one taken. Around one billion<br />

francs will be channelled into the pension<br />

fund from profit.<br />

The monopoly limit ( 4, 5) for letters<br />

was lowered to 100 grams on 1 April. A<br />

further section of our core postal business<br />

is thus open to competition. Thanks<br />

not least to our high quality and the<br />

good price-performance ratio, the impact<br />

on our business has so far been slight.<br />

The residual monopoly in the letters market<br />

remains, in our opinion, the most<br />

efficient way of funding the basic service.<br />

Further deregulation steps will call into<br />

question the present quality of supply<br />

and the current level of service and<br />

should be delayed until the political authorities<br />

have clarified the future scope<br />

Annual Report | <strong>Service</strong>-<strong>oriented</strong> | Group<br />

of the basic service and how it will be<br />

funded.<br />

The acquisition of the German-based<br />

GHP Group will strengthen our position<br />

in the future-proof markets for customer<br />

loyalty programmes and dialogue marketing.<br />

GHP will continue to operate under<br />

its own name.<br />

Our MailSource subsidiary acquired several<br />

companies in the USA, France and<br />

Switzerland and thus expanded its new<br />

business to include internal postal services,<br />

scanning and archiving for companies.<br />

Group results<br />

In 2006, we successfully implemented our<br />

strategy: Group profit in 2006 of 837<br />

million francs was 3.2 percent or 26 million<br />

francs higher than the previous<br />

year’s result of 811 million francs. All segments<br />

contributed to the positive result,<br />

albeit to varying degrees. We were again<br />

able to increase the value of the company<br />

as a whole by 532 million francs (2005:<br />

532 million francs).<br />

Operating income came to 7,895 million<br />

francs (2005: 7,499 million francs). The<br />

“ Sending a letter from<br />

Gossau (Canton St Gallen)<br />

to St Antönien costs more<br />

than the franked amount.”<br />

Peter Mürner<br />

<strong>Post</strong>Mail controller, Berne<br />

15

16 Annual Report | <strong>Service</strong>-<strong>oriented</strong> | Group<br />

main contributors to the growth in operating<br />

income with third parties were the<br />

Financial <strong>Service</strong>s, International, Other<br />

(primarily Real Estate) and New Businesses<br />

segments. The further increase in customer<br />

deposits had a positive impact on<br />

income from financial services. Operating<br />

income in the Mail and <strong>Post</strong> Office Network<br />

segments, by contrast, has fallen.<br />

The effect of acquisitions on operating<br />

income amounted to 197 million francs.<br />

Operating expenses of 7,072 million francs<br />

were up 378 million francs or 5.7% on<br />

the previous year. Half (190 million francs)<br />

is attributable to acquisitions. As a result<br />

of lower employee benefit expense, staff<br />

costs increased by just 7 million francs<br />

despite the acquisitions. The lower<br />

employee benefit obligations are a result<br />

of deposits (350 million francs) made to<br />

the pension fund from 2005 profit. Resale<br />

merchandise and service expenses and<br />

expenses for financial services were<br />

up 269 million francs compared with 2005.<br />

Writedowns changed only slightly, up<br />

5 million francs on the previous year to<br />

257 million francs. The investments<br />

for the new letter centres as part of the<br />

REMA project will lead to higher writedowns<br />

in future.<br />

The carrying amount of property, plant<br />

and equipment was up 317 million francs<br />

compared with the prior year, owing,<br />

among other things, to investments in<br />

REMA. The increase in provisions (excluding<br />

employee benefits) of 24 million<br />

francs is due mainly to the acquisition of<br />

the GHP Group. Thanks mainly to a<br />

renewed deposit of 350 million francs<br />

into the employer’s contribution reserve in<br />

connection with the appropriation of<br />

profit in 2005, the liability for employee<br />

benefit obligations was reduced to 2,627<br />

million francs as at 31 ecember 2006.<br />

Consolidated equity came to 1,605 million<br />

francs as at 31 ecember 2006, an<br />

increase of 683 million francs compared<br />

with the previous year. We expect the<br />

necessary equity of around three billion<br />

francs to have been accumulated by<br />

2009.<br />

Investments in property, plant and equipment,<br />

intangible assets and participations<br />

amounted to 540 million francs and were<br />

higher than in 2005 (347 million francs).<br />

Investments in participations came to 35<br />

million francs. As in 2005, the investment<br />

volume was financed entirely out of funds<br />

generated by Swiss <strong>Post</strong> itself. Investment<br />

activity was focused on the construction<br />

and equipment of the REMA centres as<br />

well as on streamlining and optimization<br />

projects.<br />

Outlook<br />

Technological developments and changing<br />

customer behaviour will continue to<br />

result in increased substitution and declining<br />

letter volumes in future. New technologies<br />

will contribute to efficiency<br />

increases and process optimization, e.g.<br />

in sorting. Customer behaviour and technological<br />

developments are opening<br />

up new potential for developing innovative<br />

and service-<strong>oriented</strong> services, e.g.<br />

in the field of direct mail. The emergence<br />

of value chains in many sectors is increasingly<br />

leading to business activities such as<br />

scanning, archiving, printing and the<br />

Key figures – Swiss <strong>Post</strong> Group<br />

Result<br />

2006 2005<br />

Operating income CHF million 7895 7499<br />

Of which: generated abroad1 CHF million 1391 1089<br />

% of operating income 17.6 14.5<br />

Of which: reserved services CHF million 2028 2395<br />

% of operating income 25.7 31.9<br />

Operating result CHF million 823 805<br />

As a share of operating income % 10.4 10.7<br />

Of which: generated abroad1 CHF million 66.5 38.0<br />

% of operating result 8.0 4.7<br />

Group profit for the year CHF million 837 811<br />

Added value2 Employees<br />

Employees at Swiss <strong>Post</strong> Group<br />

CHF million 4735 4716<br />

(excluding trainees) Full-time equivalents 42178 41073<br />

Of which: abroad Full-time equivalents 3379 1347

management of internal postal services<br />

being outsourced. This results in new<br />

business opportunities for Swiss <strong>Post</strong>. By<br />

contrast, electronic substitution and<br />

changing customer behaviour, declining<br />

use of post offices and a failure to cover<br />

the costs of operating a nationwide post<br />

office network have all had a negative<br />

impact on the development of Swiss <strong>Post</strong>.<br />

The Swiss National Bank is predicting a<br />

slowdown in economic momentum for<br />

2007. Almost all the components on the<br />

demand side will continue to grow but at<br />

a more modest pace. Consumer spending<br />

will benefit from the robust trend in disposable<br />

incomes. Swiss <strong>Post</strong> will continue<br />

to profit from the favourable economic<br />

trend.<br />

The expected positive economic trend<br />

and growth in imports, exports, willingness<br />

to invest and G P, coupled with low<br />

real interest rates will boost our business<br />

in the financial and logistics sector in particular.<br />

The strongest growth is expected<br />

in the telecommunications and financial<br />

sectors. A growing number of scheduled<br />

services will probably be put out to tender<br />

in the passenger transport sector. As regards<br />

financial services, competition in<br />

the mortgage market remains very active.<br />

<strong>Post</strong>Finance wants to grow in terms of<br />

customer deposits in particular. Crossborder<br />

competition will also continue to<br />

increase, which will have a significant<br />

impact on the Logistics business area and<br />

the International business unit.<br />

Swiss <strong>Post</strong> will probably increase its company<br />

value again in 2007 and thus meet<br />

the Federal Council’s target ( 6). Given<br />

the increasingly fierce competition and<br />

sustained impact of substitution, today’s<br />

healthy profit figure should not deter us<br />

from continuing to pursue our strategy. In<br />

order to implement it successfully we will<br />

take all the necessary steps on the income<br />

and expenditure front.<br />

1 etails on volume trends can be seen in the section on the respective<br />

unit.<br />

Annual Report | <strong>Service</strong>-<strong>oriented</strong> | Group<br />

17<br />

Read more online<br />

www.swisspost.ch/ar2006links<br />

4) Overview of Swiss <strong>Post</strong>’s universal services<br />

5) Swiss <strong>Post</strong>’s basic service, terms and definitions<br />

6) The Federal Council’s strategic objectives for<br />

Swiss <strong>Post</strong> 2006–2009<br />

8) <strong>Post</strong> office network: the only constant is change<br />

99) Figures for the 2006 Annual Report<br />

Key figures – Swiss <strong>Post</strong> Group<br />

Financing<br />

2006 2005<br />

Total assets CHF million 55600 50130<br />

Of which: customer deposits CHF million 48364 43630<br />

Equity<br />

Investments<br />

CHF million 1605 922<br />

Investments CHF million 540 347<br />

Of which: other tangible fixed assets, intangible assets CHF million 195 176<br />

Of which: operating property CHF million 310 153<br />

Of which: investments CHF million 35 18<br />

Ratio of self-financed investments<br />

Value generation<br />

% 100 100<br />

Cash flow from operating activities CHF million 3247 3603<br />

<strong>Post</strong> Value Added (PVA) CHF million 532 532<br />

1 efinition of “abroad” in accordance with secondary segmentation in the Financial Report.<br />

2 Added value = operating result + staff costs + depreciation – income from sale of property, plant and equipment, intangible assets and investments<br />

Additional key figures are set out in the table of figures. ( 99)

18 Annual Geschäftsbericht Report | <strong>Service</strong>-<strong>oriented</strong> 2006 | Mail<br />

<strong>Service</strong>-<strong>oriented</strong> | Mail<br />

Fewer letters,<br />

higher productivity.<br />

As in previous years, letter volumes<br />

declined again in 2006. <strong>Post</strong>Mail is<br />

responding to this challenge with<br />

high quality and customer-<strong>oriented</strong><br />

services, but especially with the reorganization<br />

of its letter processing<br />

operations (REMA project). The new<br />

letter centres will increase <strong>Post</strong>Mail’s<br />

productivity. The range of services<br />

will remain unchanged, but customers<br />

will benefit from optimized quality<br />

in letter processing. So far, the<br />

liberalization of the market for letters<br />

weighing over 100 grams has had<br />

hardly any visible effect.<br />

Letter volumes are still declining. Whereas<br />

Swiss <strong>Post</strong> handled 2.98 billion letters<br />

in 1995, the figure stood at 2.87 billion in<br />

2000 and had dropped to 2.76 billion by<br />

the end of 2006. By the late 1990s, the<br />

trend for letter volumes was more or less<br />

in line with that of G P. If this development<br />

had continued, there would be<br />

far more letters today than there were<br />

five years ago. However, the letter volume<br />

declined substantially over this period.<br />

This phenomenon is due both to the<br />

merger and elimination of postal items<br />

and to e-substitution, where physical mail<br />

is being pushed out by electronic means<br />

of communication such as e-mail and text<br />

messages (SMS).<br />

On 1 April 2006, the market for letters<br />

weighing more than100 grams was<br />

opened up to competition. ( 4, 5) Since<br />

then, a further 350 million francs of Swiss<br />

<strong>Post</strong>’s turnover has been subject to competition.<br />

The effects of this liberalization<br />

on the Mail business area were hardly felt<br />

in 2006.<br />

In 2006, Mail generated operating<br />

income of 3,083 million francs and an<br />

operating result of 239 million francs.<br />

This corresponds to an increase of<br />

9.6 percent.<br />

The main challenge facing the Mail business<br />

area is to be “fit for the market”.<br />

To achieve this, it is pursuing four main<br />

strategic directions: safeguarding existing<br />

revenues, generating new revenues,<br />

cutting costs and shaping change in good<br />

time together with its employees and<br />

customers.<br />

In order to safeguard its existing revenues,<br />

<strong>Post</strong>Mail is putting its faith in customer<br />

loyalty, offering the best value for<br />

money ( 9), providing a service from a<br />

single source and customer-<strong>oriented</strong> services.<br />

<strong>Post</strong>Mail still stands for impeccable<br />

Key figures – Mail<br />

Result<br />

2006 2005<br />

Operating income CHF million 3083 3178<br />

Of which: reserved services % 59.5 68.3<br />

Operating result<br />

Quantities<br />

CHF million 239 218<br />

Addressed letters Millions of items sent 2762 28131 Of which: priority items Millions of items sent 742 7511 Of which: non-priority individual items Millions of items sent 806 9191 Of which: non-priority bulk items Millions of items sent 1178 11031 Unaddressed mailings Millions of items sent 1159 12111 Newspapers Millions of items sent 1196 12011 Employees<br />

Headcount Full-time equivalents 15183 15364<br />

1 Previous year‘s figures adjusted

quality. 98 percent of all A Mail and 98.3<br />

percent of all B Mail letters reached their<br />

destination on time. <strong>Post</strong>Mail therefore<br />

once again ranked among the leaders<br />