FUND PROFILE grundbesitz global - RREEF Real Estate

FUND PROFILE grundbesitz global - RREEF Real Estate

FUND PROFILE grundbesitz global - RREEF Real Estate

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

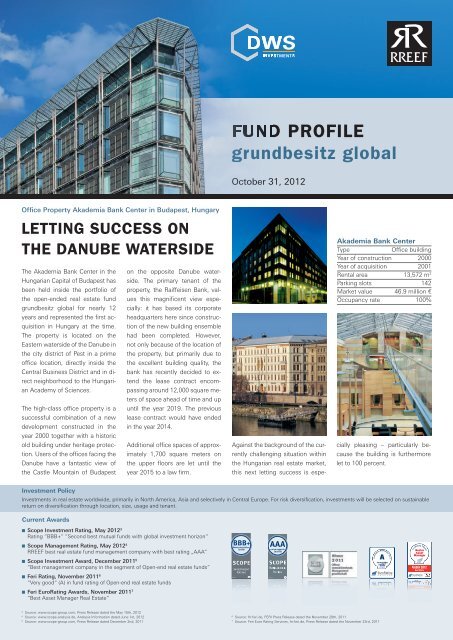

Offi ce Property Akademia Bank Center in Budapest, Hungary<br />

LETTING SUCCESS ON<br />

THE DANUBE WATERSIDE<br />

The Akademia Bank Center in the<br />

Hungarian Capital of Budapest has<br />

been held inside the portfolio of<br />

the open-ended real estate fund<br />

<strong>grundbesitz</strong> <strong>global</strong> for nearly 12<br />

years and represented the fi rst acquisition<br />

in Hungary at the time.<br />

The property is located on the<br />

Eastern waterside of the Danube in<br />

the city district of Pest in a prime<br />

offi ce location, directly inside the<br />

Central Business District and in direct<br />

neighborhood to the Hungarian<br />

Academy of Sciences.<br />

The high-class offi ce property is a<br />

successful combination of a new<br />

development constructed in the<br />

year 2000 together with a historic<br />

old building under heritage protection.<br />

Users of the offi ces facing the<br />

Danube have a fantastic view of<br />

the Castle Mountain of Budapest<br />

Current Awards<br />

Scope Investment Rating, May 20123 Rating “BBB+“ “Second best mutual funds with <strong>global</strong> investment horizon“<br />

Scope Management Rating, May 20124 <strong>RREEF</strong> best real estate fund management company with best rating „AAA“<br />

Scope Investment Award, December 20115 “Best management company in the segment of Open-end real estate funds“<br />

Feri Rating, November 20116 “Very good“ (A) in fund rating of Open-end real estate funds<br />

Feri EuroRating Awards, November 20117 “Best Asset Manager <strong>Real</strong> <strong>Estate</strong>“<br />

<strong>FUND</strong> <strong>PROFILE</strong><br />

<strong>grundbesitz</strong> <strong>global</strong><br />

October 31, 2012<br />

Investment Policy<br />

Investments in real estate worldwide, primarily in North America, Asia and selectively in Central Europe. For risk diversifi cation, investments will be selected on sustainable<br />

return on diversifi cation through location, size, usage and tenant.<br />

3 Source: www.scope-group.com, Press Release dated the May 15th, 2012<br />

4 Source: www.scope-analysis.de, Analysis Information dated June 1st, 2012<br />

5 Source: www.scope-group.com, Press Release dated December 2nd, 2011<br />

on the opposite Danube waterside.<br />

The primary tenant of the<br />

property, the Raiffeisen Bank, values<br />

this magnifi cent view especially:<br />

it has based its corporate<br />

headquarters here since construction<br />

of the new building ensemble<br />

had been completed. However,<br />

not only because of the location of<br />

the property, but primarily due to<br />

the excellent building quality, the<br />

bank has recently decided to extend<br />

the lease contract encompassing<br />

around 12,000 square meters<br />

of space ahead of time and up<br />

until the year 2019. The previous<br />

lease contract would have ended<br />

in the year 2014.<br />

Additional offi ce spaces of approximately<br />

1,700 square meters on<br />

the upper fl oors are let until the<br />

year 2015 to a law fi rm.<br />

Against the background of the currently<br />

challenging situation within<br />

the Hungarian real estate market,<br />

this next letting success is espe-<br />

6 Source: frr.feri.de, FERI Press Release dated the November 29th, 2011<br />

7 Source: Feri Euro Rating Services, frr.feri.de, Press Release dated the November 23rd, 2011<br />

Akademia Bank Center<br />

Type Offi ce building<br />

Year of construction 2000<br />

Year of acquisition 2001<br />

Rental area 13,572 m 2<br />

Parking slots 142<br />

Market value 46.9 million €<br />

Occupancy rate 100%<br />

cially pleasing – particularly because<br />

the building is furthermore<br />

let to 100 percent.<br />

Immobilien<br />

Fonds<br />

Fonds<br />

Immobilien

Fund Profi le <strong>grundbesitz</strong> <strong>global</strong> as of October 31, 2012 · Non-binding translation<br />

GRUNDBESITZ GLOBAL AT A GLANCE<br />

Locations of fund properties (number of properties per country)<br />

6<br />

1<br />

North America – 7 properties Asia – 7 properties Europe – 28 properties<br />

Geographical distribution of the 42 fund properties<br />

Europe 56.2%<br />

with<br />

France 21.5%<br />

United Kingdom 13.4%<br />

Poland 4.8%<br />

Austria 3.8%<br />

Hungary 3.7%<br />

Sweden 2.3%<br />

Other 6.7%<br />

Sales and Acquisitions in the business year 2012/2013<br />

Acquisitions<br />

Country Number Directly held or<br />

Equity hold in real<br />

estate comp.<br />

Total acquisitions<br />

Sales<br />

Country Number Sales price<br />

in million EUR 11<br />

Total sales<br />

Asia 25.5%<br />

with<br />

China 6.0%<br />

Japan 17.9%<br />

Rep. of Korea 1.6%<br />

USA 18.3%<br />

Base: Market value<br />

Net asset value 2,373.2<br />

<strong>Real</strong> estate assets (directly hold) 1,434.5<br />

Holdings in real estate company 1,077.8<br />

Loans (directly hold) -494.4<br />

Liquid assets3 422.9<br />

Other assets4 Fund key data (in million EUR)<br />

-67.6<br />

Liquidity5 17,8%<br />

Leverage6 34,2%<br />

Occupancy rate7 91,2%<br />

Investments in foreign currencies8 59,5%<br />

3 Incl. 5% legal minimum liquidity reserve of 119 million EUR (relative to fund volume)<br />

4 Balance from other assets and other liabilities<br />

5 Base: Fund volume<br />

6 Base: Market value<br />

7 Leases in relation to annual rental income fully let<br />

8 Made with currency exchange rate transactions<br />

Purchase price<br />

in million EUR 9<br />

1<br />

Incidential costs and<br />

fees in million EUR<br />

9 According to purchase contract, excluding any charges and rebates on transfer of ownership, benefi t, burden<br />

10 Including fund fees and all other associated purchase costs<br />

1<br />

Type of use of fund properties<br />

Residential 5.3%<br />

5<br />

Archive/storage 1.0%<br />

Retail 11.8%<br />

1<br />

Incidential acquisition<br />

costs in million<br />

EUR 10<br />

Proceeds<br />

in million EUR<br />

Errors and omissions excepted. Please regard the additional information and „Important information“ on last page.<br />

1<br />

Other = parking, communication systems, appartements etc. Basis: Annual rental income fully let<br />

Performance unit class RC<br />

Yearly performance<br />

6%<br />

4%<br />

2%<br />

0%<br />

Other 5.7%<br />

Hotel 2.0%<br />

0.8%<br />

5.9%<br />

2.5%<br />

Cumulative performance 1<br />

2.5%<br />

2.0%<br />

1 year 3 years 5 years Since inception of the fund (Jul. 25, 2000)<br />

7<br />

2.0% 7.1% 16.2% 64.8%<br />

Ø p.a. 2.0% 2.3% 3.0% 4.2%<br />

7<br />

1<br />

Investment volume<br />

in million EUR<br />

Profi t<br />

in million EUR 12<br />

1<br />

Net performance* Gross performance 1<br />

* The net performance includes fund costs as well as an issue surcharge amounting to 5% which relates<br />

to the purchase and is debited in the fi rst year. Custodian account costs can impair the performance<br />

additionally. Past performance is not a reliable indicator for future performance.<br />

1<br />

2<br />

1<br />

3<br />

3<br />

Offi ce 74.2%<br />

11/2007–10/2008 11/2008–10/2009 11/2009–10/2010 11/2010–10/2011 11/2011–10/2012<br />

2.0%<br />

2.9%<br />

2.9%<br />

2.0%<br />

Share of portfolio<br />

Last market value<br />

acc. to appraisal<br />

in million EUR<br />

11 Currencies are converted at the exchange rate applicable on the date of transfer.<br />

12 Inclusive income from reversal of provisions for taxation<br />

2.0%

Fund Profi le <strong>grundbesitz</strong> <strong>global</strong> as of October 31, 2012 · Non-binding translation<br />

GRUNDBESITZ GLOBAL<br />

(UNIT CLASS RC)<br />

Issue price 54.36 €<br />

Repurchase price 51.77 €<br />

Number of units 45,632,436<br />

General Fund Data<br />

Unit Class RC<br />

<strong>RREEF</strong> Investment<br />

Fund issuer<br />

GmbH<br />

Fund name <strong>grundbesitz</strong> <strong>global</strong><br />

ISIN DE 000 9807057<br />

SIN 980705<br />

Fund type Open-end real<br />

estate fund<br />

Issue date July 25, 2000<br />

Business year April 1 – March 31<br />

Fund currency EUR<br />

Issue surcharge 5.0%<br />

Admin. of yield Distribution<br />

Distribution Annually<br />

Fund charge 1.0% p.a. 8<br />

(as of October 31, 2012)<br />

Total expense ratio 1.06% (as of March 31, 2012)<br />

8 Plus performance related comission of up to 0.1% p.a.,<br />

in accordance with contractual terms<br />

Plus additional charges in accordance with contractual<br />

terms<br />

The Fountains at Moorpark, Moorpark,<br />

California/USA, apartment building<br />

Performance net asset value per unit for unit class RC<br />

55.00 €<br />

54.50 €<br />

54.00 €<br />

53.50 €<br />

53.00 €<br />

52.50 €<br />

52.00 €<br />

51.50 €<br />

Overview of distribution performance for the RC Unit Class<br />

Investment performance<br />

<strong>grundbesitz</strong><br />

<strong>global</strong> RC<br />

(01.04.2002-31.03.2012)<br />

4.16% p.a. 5.07% p.a.<br />

converted as a fully<br />

taxable capital investment<br />

this equates to<br />

a comparative pre-tax<br />

yield at a tax rate3 26.375%<br />

3 Withholding tax (25%) incl. solidarity surcharge (5.5% on withholding<br />

tax)<br />

Errors and omissions excepted. Please regard the additional information and „Important information“ on last page.<br />

- For the last ten years distribution comprises a taxexempt<br />

portion of 60.94% provided the units are held<br />

in private assets.<br />

- To achieve an equivalent after-tax distribution level, a<br />

fully taxable alternative investment (tax rate 26.375%<br />

domestic withholding tax on capital income incl.<br />

solidarity surcharge excl. church tax) would have a<br />

comparative pre-tax return of 5.07% per year.<br />

Net asset value 2,373.2 2,362.5<br />

<strong>Real</strong> estate assets (directly hold) 1,434.5 1,428.0<br />

Holdings in real estate company 1,077.8 1,072.9<br />

Loans (directly hold) -494.4 -492.2<br />

Liquid assets4 422.9 421.0<br />

Other assets5 Fund key data (in million EUR) Total Unit class RC<br />

4 Incl. 5% legal minimum liquidity reserve of 119 million EUR (relative to fund volume)<br />

5 Balance from other assets and other liabilities<br />

-67.6 -67.3<br />

Yield unit class RC 2<br />

Net asset value RC Asset value RC without distribution<br />

31.10.11 30.11.11 31.12.11 31.01.12 29.02.12 31.03.12 30.04.12 31.05.12 30.06.12 31.07.12 31.08.12 30.09.12 31.10.12<br />

Last business year 2011/2012<br />

(01.04.2011–31.03.2012)<br />

<strong>Real</strong> estate yield6 (before deduction of fund costs) 4.6%<br />

Liquidity yield7 (before deduction of fund costs) 1.8%<br />

Fund yield1 (BVI Method) 3.2%<br />

6 In relation to average real estate assets of the direct investments and special purpose vehicles following deduction of borrowed funds<br />

7 In relation to average liquid assets<br />

Distribution overview (unit class RC)<br />

Distribution date as of 12.07.2012 13.07.2011 14.07.2010<br />

Amount per unit certifi cate<br />

Tax on earnings – per unit certifi cate, held as:<br />

1.70 € 1.10 € 1.30 €<br />

Private asset - taxable<br />

Commercial asset - taxable<br />

1.5279 € 0.4224 € 0.4707 €<br />

Commercial asset - income taxable 0.9310 € 0.3818 € 0.3537 €<br />

Commercial asset - corporation taxable 0.0358 € 0.3208 € 0.0713 €<br />

Income tax-exempt for units held as private assets,<br />

concerning distribution<br />

10% 62% 64%<br />

The statements on tax regulations apply only to investors who are fully liable for tax in Germany<br />

The Helicon, London, Great Britain, offi ce<br />

building<br />

G Square, Tokyo, Japan, offi ce and commercial<br />

building

Fund Profi le <strong>grundbesitz</strong> <strong>global</strong> as of October 31, 2012 · Non-binding translation<br />

GRUNDBESITZ GLOBAL<br />

(UNIT CLASS IC)<br />

Issue price 54.49 €<br />

Repurchase price 51.89 €<br />

Number of units 207,313<br />

General Fund Data<br />

Unit Class IC<br />

<strong>RREEF</strong> Investment<br />

Fund issuer<br />

GmbH<br />

Fund name <strong>grundbesitz</strong> <strong>global</strong><br />

ISIN DE 000 A0NCT95<br />

SIN A0NCT9<br />

Fund type Open-end real<br />

estate fund<br />

Issue date April 1, 2008<br />

Business year April 1 – March 31<br />

Fund currency EUR<br />

Issue surcharge 5.0% 11<br />

Admin. of yield Distribution<br />

Distribution Annually<br />

Fund charge<br />

(as of October 31, 2012)<br />

0.55% p.a. of<br />

average real estate<br />

assets12 0.05% p.a. of average<br />

liquid assets12 Total expense ratio 0.43% (as of March 31, 2012)<br />

11 No issuing premium in the event of compliance with<br />

the subscription slip procedure described in the sales<br />

prospectus<br />

12 Plus performance related comission of up to 20% p.a.of<br />

the additional proceeds, in accordance with contractual<br />

terms<br />

Plus additional charges in accordance with contractual<br />

terms<br />

Xiwang Tower, Dalian, China, offi ce building<br />

Total Unit class IC<br />

million EUR million EUR<br />

Net asset value 2,373.2 10.8<br />

<strong>Real</strong> estate assets (directly hold) 1,434.5 6.5<br />

Holdings in real estate company 1,077.8 4.9<br />

Loans (directly hold) -494.4 -2.2<br />

Liquid assets3 422.9 1.9<br />

Other assets4 Fund key data<br />

-67.6 -0.3<br />

Liquidity5 17.8% –<br />

Leverage6 34.2% –<br />

Occupancy rate7 91.2% –<br />

Investments in foreign currencies8 3 Incl. 5% legal minimum liquidity reserve of 119 million EUR (relative to fund volume)<br />

4 Balance from other assets and other liabilities<br />

5 Base: Fund volume<br />

6 Base: Market value<br />

7 Leases in relation to annual rental income fully let<br />

8 Made with currency exchange rate transactions<br />

59.5% –<br />

Performance unit class IC<br />

Yearly performance1 Performance net asset value per unit for unit class IC<br />

Yield unit class IC 2<br />

Errors and omissions excepted. Please regard the additional information and „Important information“ on last page.<br />

6%<br />

4%<br />

2%<br />

0%<br />

The charts above contains only the performance information as the net performance does not differ from the gross performance in any year<br />

and an issue surcharge is not charged because of the subscription slip procedure. Custodian account costs can impair the performance additionally.<br />

Past performance is not a reliable indicator for future performance.<br />

Cumulative performance1 1 year 3 years 5 years Since inception of unit class IC (Apr. 1, 2008)<br />

2.4% 8.3% – 15.0%<br />

Ø p.a. 2.4% 2.7% – 3.1%<br />

55.00 €<br />

54.50 €<br />

54.00 €<br />

53.50 €<br />

53.00 €<br />

52.50 €<br />

52.00 €<br />

51.50 €<br />

2.7%<br />

2.4%<br />

11/2007–10/2008 11/2008–10/2009 11/2009–10/2010 11/2010–10/2011 11/2011–10/2012<br />

Asset value IC Asset value IC without distribution<br />

31.10.11 30.11.11 31.12.11 31.01.12 29.02.12 31.03.12 30.04.12 31.05.12 30.06.12 31.07.12 31.08.12 30.09.12 31.10.12<br />

Last business year 2011/2012<br />

(01.04.2011–31.03.2012)<br />

<strong>Real</strong> estate yield9 (before deduction of fund costs) 4.6%<br />

<strong>Real</strong> estate yield following deduction of fund costs9 3.7%<br />

Liquidity yield10 (before deduction of fund costs) 1.8%<br />

Liquidity yield following deduction of fund costs10 1.8%<br />

Fund yield1 (BVI Method)<br />

9 In relation to average real estate assets of the direct investments and special purpose vehicles following deduction of borrowed funds<br />

10 In relation to average liquid assets<br />

3.6%<br />

Distribution overview (unit class IC)<br />

Distribution date as of 12.07.2012 13.07.2011 14.07.2010<br />

Amount per unit certifi cate<br />

Tax on earnings – per unit certifi cate, held as:<br />

1.90 € 1.30 € 1.45 €<br />

Private asset - taxable<br />

Commercial asset - taxable<br />

1.6234 € 0.3891 € 0.6600 €<br />

Commercial asset - income taxable 1.0104 € 0.3308 € 0.4645 €<br />

Commercial asset - corporation taxable 0.0908 € 0.2434 € 0.0082 €<br />

Income tax-exempt for units held as private assets,<br />

concerning distribution<br />

15% 70% 54%<br />

The statements on tax regulations apply only to investors who are fully liable for tax in Germany<br />

3.3%<br />

2.4%

Fund Profi le <strong>grundbesitz</strong> <strong>global</strong> as of October 31, 2012 · Non-binding translation<br />

INFORMATION ON REAL ESTATE PORTFOLIO<br />

Occupancy rate<br />

100%<br />

97%<br />

94%<br />

91%<br />

88%<br />

85%<br />

Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12 Jun 12 Jul 12 Aug 12 Sep 12 Oct 12<br />

Top 10 properties (measured at market value)<br />

Properties Percentage<br />

Osaka, Uniqlo Building (J) 6.5%<br />

Dalian, Xiwang Tower (CN) 6.0%<br />

Tokyo, Nikko Building (J) 5.1%<br />

Burbank, The Pinnacle (USA) 4.8%<br />

Paris, Le Monde (F) 4.3%<br />

Puteaux, Kupka A (F) 4.0%<br />

London, The Helicon (GB) 4.0%<br />

London, Queen Victoria Street (GB) 4.0%<br />

Daly City, Pacifi c Plaza (USA) 3.8%<br />

St.-Quentin-en-Yvelines, Energies Building (F) 3.1%<br />

Total 45.6%<br />

Commercial age structure of fund properties<br />

More than 20 years old<br />

16.7%<br />

15 to 20 years old<br />

4.0%<br />

10 to 15 years old<br />

38.6%<br />

as measured by annual rental income fully let<br />

Occupancy rate in October 2012 91.2%<br />

Annual rental income of the fund<br />

(contractual rent)<br />

193.7 million €<br />

Europlaza, Vienna, Austria, offi ce building<br />

Less than 5 years old<br />

11.7%<br />

5 to 10 years old<br />

29.0%<br />

Basis: Market value<br />

Errors and omissions excepted. Please regard the additional information and „Important information“ on last page.<br />

Mietverträge<br />

Expiring tenancy<br />

in Asien<br />

agreements<br />

sowie Wohnungsmietverträge in den USA werden<br />

ortsüblich mit kurzfristiger Laufzeit und hoher Verlängerungswahrschein-<br />

35% lichkeit abgeschlossen. In der Grafi k wird die Verlängerungswahrschein-<br />

on exercising special termination rights<br />

lichkeit 30% nicht abgebildet. Bei Mietverträgen mit Sonderkündigungsrechten<br />

25% wird das Ziehen des Sonderkündigungsrechtes angenommen.<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

until<br />

31.12.2012<br />

until<br />

31.12.2012<br />

2013 2014 2015 2016 2017 2018 2019 2020 2021 from 2022<br />

as measured by current contractual rent of the fund in %<br />

Europe USA Asia<br />

without exercising special termination rights<br />

2013 2014 2015 2016 2017 2018 2019 2020 2021 from 2022<br />

as measured by current contractual rent of the fund in %<br />

Lease contracts in Asia and rental agreements for apartments in the USA are<br />

mainly short-term signed with a high chance for reletting. The chart does not<br />

show the probability for reletting.<br />

For lease contracts with extraordinary termination rights, the earliest possible<br />

termination of the lease agreement is assumed. The presentation without<br />

consideration of the extraordinary termination rights emphasizes how the<br />

lease contract terms would be postponed in favour of the contractually<br />

agreed lease revenues of the fund.<br />

Top 5 tenancy structure (Basis: current rental income)<br />

Sectors Percentage<br />

Technology and software 15.5%<br />

Consumer goods & retail 14.7%<br />

Bank and fi nancial service 8.5%<br />

Media 7.2%<br />

Consultancy / legal and tax advisory 6.4%<br />

Total 52.3%<br />

Enterprise Drive Aliso Viejo, Aliso Viejo, California/USA, offi ce building

Fund Profi le <strong>grundbesitz</strong> <strong>global</strong> as of October 31, 2012 · Non-binding translation<br />

KEY DATA OF <strong>FUND</strong> PROPERTIES<br />

Additional information on fund properties<br />

Address Type of use<br />

Lettable area<br />

in sqm<br />

Current appraiserassessed<br />

market<br />

value in TEUR 3<br />

I, Directly held properties in Eurozone countries 4 976,140<br />

Austria<br />

1120 Vienna, Am Europlatz 1, 3, 5, ”Europlaza” Offi ce building 27,189 76,980<br />

1030 Vienna, Rennweg 12, ”Am Belvedere” Hotel 14,767 37,600<br />

Belgium<br />

1200 Brussels, Avenue Marcel Thiry 75-77, ”Marcel Thiry” Offi ce building 10,821 16,930<br />

Spain<br />

28027 Madrid, Calle Albacete 1, ”Puente de la Paz” Hotel 10,873 27,150<br />

France<br />

92320 Châtillon, 125, avenue de Paris, ”Le Prisme” Offi ce building 14,363 79,700<br />

92110 Clichy, 14–16, rue Marc Bloch, ”Oxygène” Offi ce building 19,272 93,700<br />

92100 Montrouge, 144–150, avenue Marx Dormoy, ”Plein Sud“ Offi ce building 11,292 54,900<br />

75013 Paris, 74–84, boulevard Auguste Blanqui, ”Le Monde“ Offi ce building 16,618 130,100<br />

92800 Puteaux, 18, rue Hoche, ”Kupka A“ Offi ce building 17,563 120,750<br />

78884 St.-Quentin-en-Yvelines, 1–7, avenue San Fernando, ”Energies Building“ Offi ce building 26,676 94,800<br />

92150 Suresnes, 13–17, rue Pages<br />

31–32, rue Verdun, 6–10, rue Gustave Flourens, ”Horizon Défense“<br />

Italy<br />

Offi ce building 16,348 74,600<br />

00142 Rome, Via Mario Bianchini 13–15, ”Mario Bianchini“<br />

Poland<br />

Offi ce building 9,660 38,000<br />

02-486 Warsaw, Aleje Jerozolimskie 172, 174, 176, 178, ”Kopernik B - E“ Offi ce building 18,833 47,880<br />

50-365 Wroclaw, Plac Grunwaldski 23, 25, 27, ”Grunwaldzki Center“ Offi ce building 27,753 83,050<br />

II. Directly held properties in countries with other currencies<br />

Great Britain<br />

Edinburgh, 129, 133 Fountainbridge, Edinburgh EH3 9QG<br />

458,408<br />

1, 2 Fountainbridge Square, Edinburgh EH3 9QB<br />

4 Lower Gilmore Bank, Edinburgh EH3 9QP<br />

127 Fountainbridge, Edinburgh EH3 9QG, ”Edinburgh Quay“<br />

Offi ce building 10,463 49,750<br />

Glasgow G2 7NP, 55 Douglas Street, ”Cerium Building“ Offi ce building 7,486 34,827<br />

London EC4, 60 Queen Victoria Street, ”Queen Victoria Street“ Offi ce building 10,724 119,441<br />

London EC2, 1 South Place, ”The Helicon“<br />

Japan<br />

Offi ce building 11,638 120,434<br />

Tokyo, 3-16-11 Nishi Shinbashi, Minato-ku, ”ATAGO East Building”<br />

Republic of Korea<br />

Offi ce building 6,695 86,578<br />

Seoul, 70 Seorin-Dong, Jongno-Gu, ”Alpha Building“ Offi ce building 9,503 47,378<br />

III. Properties held through real estate companies in Eurozone countries4 Czech Republic<br />

247,780<br />

100% Shares in DB <strong>Real</strong> <strong>Estate</strong> II KC s.r.o., Prague<br />

Property: 14000 Prague 4, Olbrachtova 9, ”Raiffeisen“<br />

Hungary<br />

Offi ce building 18,927 52,650<br />

100% Shares in Rakpart 3 Ingatlanhasznosito Kft., Budapest<br />

Property: 1054 Budapest, Akademia utca 6, Szechenyi rakpart 3, ”Akademia Bank Center“<br />

Offi ce building 13,572 46,900<br />

100% Shares in Mom Park Torony Kft., Budapest<br />

Property: 1124 Budapest, Csörsz utca 41–45, ”Mom Park“<br />

Offi ce building 11,926 34,600<br />

100% Shares in AIAS Ingatlanbefektetési Kft., Budapest<br />

Property: 1139 Budapest, Váci út 140, ”BC 140“<br />

Portugal<br />

100% Shares in DB <strong>Real</strong> <strong>Estate</strong> Investment Madeira Sociedade Imobiliária<br />

Offi ce building 16,430 32,000<br />

Unipessoal Lda Comandita<br />

Property: Madeira, 9004-568 Funchal, Estrada Monumental 390, ”Forum Madeira“<br />

Poland<br />

Shopping center 20,279 66,330<br />

100% Shares in DB <strong>Real</strong> <strong>Estate</strong> Polska 2 Spolka z o. o., Warsaw<br />

Property: 02-486 Warsaw, Aleje Jerozolimskie 180, ”Kopernik A“<br />

Offi ce building 5,984 15,300<br />

3 Market values in foreign currencies converted at month’s end rate of exchange<br />

4 Includes countries with Euro-based tenancy agreements.<br />

Errors and omissions excepted. Please regard the additional information and „Important information“ on last page.<br />

Exchange rate (foreign currency / EUR) 31.10.2012<br />

Country Exchange rate Currency<br />

Sweden 8.63486 SEK<br />

Great Britain 0.80542 GBP<br />

USA 1.2937 USD<br />

Japan 102.797 JPY<br />

Rep. of. Korea 1,412.041 KRW<br />

China 8.07333 CNY

Fund Profi le <strong>grundbesitz</strong> <strong>global</strong> as of October 31, 2012 · Non-binding translation<br />

KEY DATA OF <strong>FUND</strong> PROPERTIES (CONT.)<br />

Additional information on fund properties<br />

Address Type of use<br />

Lettable area<br />

in sqm<br />

Current appraiserassessed<br />

market<br />

value in TEUR 3<br />

IV, Properties held through real estate companies in countries with other currencies 1,340,894<br />

China<br />

100% Shares in Dalian Xiwang Building Company Ltd.<br />

Property: Dalian, Zhongshan District, 136 Zhongshan Road, ”Xiwang Tower“<br />

Great Britain<br />

100% Shares in Huris (Farnborough) Ltd.<br />

Property: Farnborough, Hampshire GU14 6YU, Areospace Boulevard<br />

Farnborough Areospace Centre, Building S6 (West Park Two), ”Chester House“<br />

100% Shares in Huris (Swindon) Ltd.<br />

Property: Swindon, SN5 6PE, PHH Centre, ”Windmill Hill Business Park“<br />

100% Shares in Huris (Thames Park) Ltd.<br />

Property: Reading, RG6 1PU, Building 420, ”Thames Valley Park“<br />

Japan<br />

100% Shares in Ryugasaki SC TMK<br />

Property: Ibaraki, Ryugasaki-shi, Kodori Koyamachi aza Nemoto 288-28, ”Qiz Ryugasaki“<br />

100% Shares in <strong>RREEF</strong> Marble Pte. Ltd.<br />

Property: Tokyo, 1-14-11 Nishi-Shinjuku, Shinjuku-ku, ”Nikko Building“<br />

100% Shares in Unique Osaka LLC<br />

Property: Osaka, 1-2 Shinsaibashi-suji, Chuo-ku, ”Uniqlo Building“<br />

100% Shares in G Square Tokyo LLC<br />

Property: Tokyo, 2-11-1 Dogenzaka, Shibuya-ku, ”G Square“<br />

Sweden<br />

100% Shares in DB <strong>Real</strong> <strong>Estate</strong> Mvik 28 KB, Stockholm<br />

Property: 117 43 Stockholm, Arstaängsvägen 19 A-F, ”Marievik 28“<br />

USA<br />

100% Shares in DBRE California Residential 2 LLC<br />

Property: Apartments ”Natomas Ridge“<br />

2025 West EI Camino Avenue, Sacramento, CA 95833<br />

100% Shares in DBRE One Enterprise L.L.C., Delaware<br />

Property: Aliso Viejo, Kalifornien 92656, 1 Enterprise Drive, ”Aliso Viejo“<br />

95% Shares in DB <strong>Real</strong> <strong>Estate</strong> The Pinnacle, L. P., Delaware<br />

Property: Burbank, Kalifornien 91505, 3400 West Olive Avenue, ”The Pinnacle“<br />

100% Shares in DB <strong>Real</strong> <strong>Estate</strong> Pacifi c Plaza, L. P., Delaware<br />

Property: Daly City, Kalifornien 94014, 1901 und 2001 Junipero Serra Boulevard, ”Pacifi c Plaza“<br />

100% Shares in DBRE Moorpark L.L.C., Delaware<br />

Property: Moorpark, Ventura County, Kalifornien 93021, 51 Majestic Court,<br />

”The Fountains at Moorpark“<br />

100% Shares in DBRE Roosevelt Commons L.L.C., Delaware<br />

Property: Seattle, Washington 98015, 4300 Roosevelt Way NE/ 4311 11th Avenue NE,<br />

”Roosevelt Commons“<br />

100% Shares in DB <strong>Real</strong> <strong>Estate</strong> Crossroads L. P., Delaware<br />

Property: Sunnyvale, Kalifornien 94085, 950 und 1000 West Maude Avenue, „Crossroads Center“<br />

Offi ce building 67,688 180,842<br />

Offi ce building 4,590 20,126<br />

Offi ce building 9,752 28,681<br />

Offi ce building 6,798 32,281<br />

Shopping center 19,404 27,238<br />

Offi ce building 6,967 155,938<br />

Shopping center 3,907 196,017<br />

Offi ce and<br />

commercial building<br />

5,013 74,613<br />

Offi ce building 20,805 70,644<br />

Residential 54,372 51,673<br />

Offi ce building 10,214 24,349<br />

Offi ce and<br />

commercial building<br />

36,583 144,912<br />

Offi ce building 43,685 114,401<br />

Residential 30,488 54,108<br />

Offi ce building 20,737 72,544<br />

Offi ce building 23,720 92,525<br />

I, + II, Market value of directly held properties 1,434,548<br />

III, + IV, Market value of properties held by holding companies 1,588,674<br />

Total: Market value of all properties 3,023,222<br />

3 Market values in foreign currencies converted at month’s end rate of exchange<br />

Errors and omissions excepted. Please regard the additional information and „Important information“ on last page.<br />

Exchange rate (foreign currency / EUR) 31.10.2012<br />

Country Exchange rate Currency<br />

Sweden 8.63486 SEK<br />

Great Britain 0.80542 GBP<br />

USA 1.2937 USD<br />

Japan 102.797 JPY<br />

Rep. of. Korea 1,412.041 KRW<br />

China 8.07333 CNY

Fund Profile <strong>grundbesitz</strong> <strong>global</strong> as of October 31, 2012 · Non-binding translation<br />

<strong>RREEF</strong> Investment GmbH<br />

Mainzer Landstraße 178–190<br />

60327 Frankfurt am Main<br />

Internet: www.rreef.com<br />

* Provides sales support services for <strong>RREEF</strong> Investment GmbH.<br />

Opportunities<br />

Important information:<br />

Further information obtainable at:<br />

DWS Investment GmbH *<br />

60612 Frankfurt am Main<br />

Telephone: +49 (0) 69 / 7 19 09-23 89<br />

Fax: +49 (0) 69 / 7 19 09-90 90<br />

Internet: www.dws.de<br />

E-mail: info@dws.com<br />

Return in taking advantage of the respective market development<br />

of the <strong>global</strong> real estate markets<br />

Broadly diversified real estate portfolio through diversification:<br />

- in several regions (<strong>global</strong>)<br />

- in different sectors (Office, retail, others)<br />

Benefit from the professional real estate managers of the particular<br />

local <strong>RREEF</strong> entity<br />

Regular distribution with tax-exempt portion<br />

Rental revenues calculable in the long term may contribute to<br />

reduce volatility of the unit price<br />

This profile of the open-end real estate fund <strong>grundbesitz</strong> <strong>global</strong> is only a brief presentation and does not constitute investment counselling.<br />

In any event, an investment decision should be made based upon the key investor information and the sales prospectus in addition to the<br />

last annual report or the semi annual report which is more recent as the last annual report. These documents represent a sole basis for the<br />

purchase. The documents are available in printed form at branches of Deutsche Bank or from DWS Investment GmbH, Mainzer Landstraße<br />

178–190, 60612 Frankfurt am Main (provides sales support services for <strong>RREEF</strong> Investment GmbH) as well as in electronic form from<br />

www.rreef.com. The sales prospectus contains detailed information on the risks related to the products.<br />

This profile of the open-ended real estate fund <strong>grundbesitz</strong> <strong>global</strong> is only a non-binding translation of the German original. Should there be<br />

discrepancies between this English version and the German one, the German version shall be decisive.<br />

1 Gross performance in accordance with the BVI method, including costs incurred by the fund such as management fee. Individual costs such as<br />

issue surcharges and custodian account costs are not taken into consideration. Past performance is not a reliable indicator for future performance.<br />

2 Fund key data, Complementary Fund key data and Yield until 31.03.2012 are certified by an auditor. The data starting from 01.04.2012 are<br />

preliminary. <strong>RREEF</strong> Investment GmbH does not take any guarantee for rightness.<br />

Risks<br />

Dependency on the development of the respective real estate<br />

markets<br />

Liquidity risk, i.e. no redemption of fund units at the favoured<br />

time and the risk for the investor to not being in the position to<br />

dispose of the invested capital for a certain period of time.<br />

The fund unit value may drop below the purchase price, for<br />

which the customer had originally acquired the fund unit, at<br />

any point in time due to:<br />

- Letting and valuation risks<br />

- Interest rate risks<br />

- Currency exchange risks<br />

- Risks caused by currency exchange rate transactions<br />

Higher risks for planned investments in less transparent real<br />

estate markets (emerging markets, Asia)<br />

Due to new legal regulations contained in the Investment Law, new contractual terms will apply for <strong>grundbesitz</strong> <strong>global</strong> starting on the<br />

1 st of January 2013. Following this transition of the contractual terms, the investor will still be able to return fund units of <strong>grundbesitz</strong><br />

europa up to a value of 30,000 Euro per calendar half-year on every trading day. In the future, the return of fund units with a value of<br />

more than 30,000 Euro per calendar half-year are subject to an irrevocable return term of 12 months. The general risk of a suspension<br />

of fund unit repurchases by the capital investment company (e.g. in case of unexpected high cash outflows) also exists for these fund<br />

units.