Joseph J. Porco, Managing Director, Independent Asset Management

Joseph J. Porco, Managing Director, Independent Asset Management

Joseph J. Porco, Managing Director, Independent Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

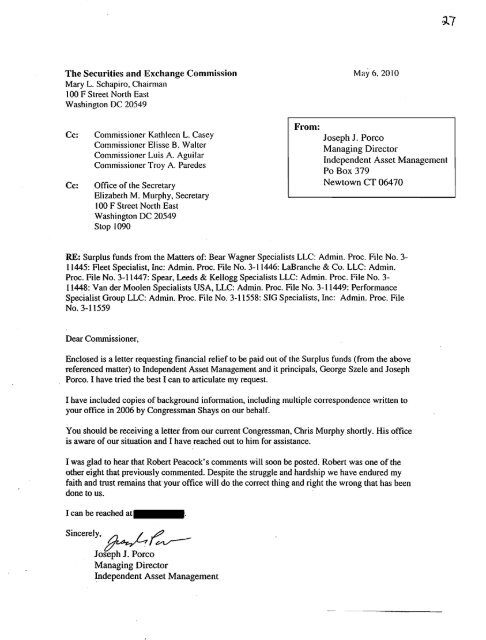

The Securities and Exchange Commission May 6, 2010<br />

Mary L. Schapiro, Chairman<br />

100 F Street North East<br />

Washington DC 20549<br />

From:<br />

Cc: Commissioner Kathleen L. Casey <strong>Joseph</strong> J. <strong>Porco</strong><br />

Commissioner Elisse B. Walter<br />

Commissioner Luis A. Aguilar<br />

Commissioner Troy A. Paredes<br />

XT<br />

<strong>Managing</strong> <strong>Director</strong><br />

<strong>Independent</strong> <strong>Asset</strong> <strong>Management</strong><br />

Po Box 379<br />

Cc: Office of the Secretary Newtown CT 06470<br />

Elizabeth M. Murphy, Secretary<br />

100 F Street North East<br />

Washington DC 20549<br />

Stop 1090<br />

RE: Surplus funds from the Matters of: Bear Wagner Specialists LLC: Admin. Proc. File No. 3<br />

11445: Fleet Specialist, Inc: Admin. Proc. File No. 3-11446: LaBranche & Co. LLC: Admin.<br />

Proc. File No. 3-11447: Spear, Leeds & Kellogg Specialists LLC: Admin. Proc. File No. 3<br />

11448: Van der Moolen Specialists USA, LLC: Admin. Proc. File No. 3-11449: Performance<br />

Specialist Group LLC: Admin. Proc. File No. 3-11558: SIG Specialists, Inc: Admin. Proc. File<br />

No. 3-11559<br />

Dear Commissioner,<br />

Enclosed is a letter requesting financial relief to be paid out of the Surplus funds (from the above<br />

referenced matter) to <strong>Independent</strong> <strong>Asset</strong> <strong>Management</strong> and it principals, George Szele and <strong>Joseph</strong><br />

<strong>Porco</strong>. I have tried the best I can to articulate my request.<br />

I have included copies of background information, including multiple correspondence written to<br />

your office in 2006 by Congressman Shays on our behalf.<br />

You should be receiving a letter from our current Congressman, Chris Murphy shortly. His office<br />

is aware of our situation and I have reached out to him for assistance.<br />

I was glad to hear that Robert Peacock's comments will soon be posted. Robert was one of the<br />

other eight that previously commented. Despite the struggle and hardship we have endured my<br />

faith and trust remains that your office will do the correct thing and right the wrong that has been<br />

done to us.<br />

I can be reached at .<br />

Sincerely,<br />

<strong>Joseph</strong> J. <strong>Porco</strong><br />

<strong>Managing</strong> <strong>Director</strong><br />

<strong>Independent</strong> <strong>Asset</strong> <strong>Management</strong>

The Securities and Exchange Commission May 4, 2010<br />

Mary L. Schapiro, Chairman<br />

100 F Street North East<br />

Washington DC 20549<br />

Cc: Commissioner Kathleen L. Casey<br />

Commissioner Elisse B. Walter<br />

Commissioner Luis A. Aguilar<br />

Commissioner Troy A. Paredes<br />

Cc: Office of the Secretary<br />

Elizabeth M. Murphy, Secretary<br />

100 F Street North East<br />

Washington DC 20549<br />

Stop 1090<br />

RE: Surplus funds from the Matters of: Bear Wagner Specialists LLC: Admin. Proc. File No. 3<br />

11445: Fleet Specialist, Inc: Admin. Proc. File No. 3-11446: LaBranche & Co. LLC: Admin.<br />

Proc. File No. 3-11447: Spear, Leeds & Kellogg Specialists LLC: Admin. Proc. File No. 3<br />

11448: Van der Moolen Specialists USA, LLC: Admin. Proc. File No. 3-11449: Performance<br />

Specialist Group LLC: Admin. Proc. File No. 3-11558: SIG Specialists, Inc: Admin. Proc. File<br />

No. 3-11559<br />

Dear Chairman Mary L. Schapiro,<br />

On behalf of <strong>Independent</strong> <strong>Asset</strong> <strong>Management</strong> LLC and its principals, I am writing to you to<br />

request emergency relief of our damages from the remaining surplus funds of 130 million dollars.<br />

We had previously provided our comments on January 24lh 2006 regarding the distribution of<br />

funds and asked for relief for the damages caused to our company. We provided evidence as to<br />

how the specialist fraud damaged our company and explained in detail the extent that this fraud<br />

hurt us personally.<br />

On October 17th, 2006, our CT Congressman Shays wrote to Chairman Cox (for a 2nd time) on<br />

our behalf regarding our meeting meting at your NYC office, which was held on September 29th<br />

2006 with David Rosenfeid, David Markowitz and Sanjay Wadhwa. That day we provided<br />

personal testimony regarding our damages for your records.<br />

In his letter to Chairman Cox, Congressman Shays noted that his understanding was that our<br />

meeting was productive, but our follow up request for further discussion was never granted. It<br />

seems our damages and need for relief has been forgotten or dismissed by the subjective<br />

narrowing of the definition of "injured customers". It is our position that the Distribution Plan

unreasonably failed to allocate compensatory damages to those injured, specifically, <strong>Independent</strong><br />

<strong>Asset</strong> <strong>Management</strong> lie (IAM), and its principal's, George Szele and <strong>Joseph</strong> J. <strong>Porco</strong>. Up until this<br />

point, the method of distribution unequally treated persons who were similarly situated. I beseech<br />

you to remedy this situation.<br />

Since we were not included, the Distribution Plan's method of distribution did not address our<br />

special damages, and thereby has fostered unfairness. Now that there is a surplus remaining, I<br />

respectfully request that David Rosenfeid, David Markowitz and Sanjay Wadhwa be consulted<br />

regarding the content of the meeting held onSeptember 29th 2006.<br />

To date, neither <strong>Independent</strong> <strong>Asset</strong> <strong>Management</strong> lie (IAM), nor its principal's, George Szele and<br />

<strong>Joseph</strong> J. <strong>Porco</strong> have received any relief for damages. In our letter we forwarded on October 6,<br />

2006, we again outlined why we were special victims of the fraud, with special and unique<br />

damages.<br />

Now that SEC has distributed all other funds as it determined was necessary and a surplus<br />

remains, I request that consideration be given address our damages. It would be extremely<br />

unfortunate if the Commission dismissed our damages, when it is within the Commission's power<br />

to right the wrong that has been done to us. The facts are that we were damaged by the fraud<br />

perpetrated by the Specialist firms and the NYSE failure to regulate them. It is my understanding<br />

that only eight comment letters were sent in and <strong>Independent</strong> <strong>Asset</strong> <strong>Management</strong>'s letter was one<br />

of them. Only eight entities responded with comment and request for relief or suggestions.<br />

The general response in the Order Approving a Distribution Plan,<br />

Release No. 53823 / May 17,2006: In the Matters of: Bear Wagner Specialists LLC: Admin.<br />

Proc. File No. 3-11445: Fleet Specialist, Inc: Admin. Proc. File No. 3-11446: LaBranche &<br />

Co. LLC: Admin. Proc. File No. 3-11447: Spear, Leeds & Kellogg Specialists LLC: Admin.<br />

Proc. File No. 3-11448: Van der Moolen Specialists USA, LLC: Admin. Proc. File No. 3<br />

11449: Performance Specialist Group LLC: Admin. Proc. File No. 3-11558: SIG Specialists,<br />

Inc: Admin. Proc. File No. 3-11559,<br />

indicated that the Commission's position at that time was that damages of the sort claimed by<br />

IAM and the SC Traders were speculative, remote, and "notoriously" difficult to calculate. We<br />

outlined our damages and gave testimony on Friday, September 29,', 2006 at your NYC office. It<br />

is not difficult to calculate our damages and we are ready to assist you in doing so. We ask that<br />

the Commission reconsider its position and pay us out of the 130 million dollar surplus, which is<br />

left over. We estimated our damages appropriately and again, implore you for relief.<br />

The Commission stated that neither it's staff nor the fund administrator has the knowledge or<br />

expertise to evaluate these claims, and doing so would require the expenditure of considerable<br />

resources. I respectfully ask...is this our fault? Shouldn't the SEC have or be given the resources and<br />

expertise to protect and reimburse United States citizens with the very funds it collects from penalties<br />

paid by those which committed the fraud?<br />

If considerable effort is required to address our concerns, shouldn't the effort be made? Is it not the<br />

role of the Commission to undertake what is necessary to do the right thing? The mission of the U.S.<br />

Securities and Exchange Commission is to protect investors, maintain fair, orderly, and efficient<br />

markets, and facilitate capital formation. Our company was damaged. If we are not given relief from<br />

the damages of the fraud, how were we protected?

I don't believe that David Rosenfeid, David Markowitz and Sanjay Wadhwa dispute that we were<br />

damaged. You now have 130 million dollar surplus left over. What considerable resources would it<br />

take to sit down with us and determine an amount, which the Commission feels is reasonable to<br />

reimburse us for our lost income caused by the specialist fraud?<br />

The Commission stated that "if speculative consequential damages are entertained, there are<br />

potentially millions of claimants (there are over 2.6 million violative trades, each of which may have<br />

resulted in some consequential harm to some person), and the process of adjudicating the relative<br />

merits of all these claims would quickly dissipate the Remaining Funds." Respectfully, this position is<br />

now erroneous because the funds have not been dissipated and there is a surplus. Furthermore, have<br />

any other people (of these potentially millions of claimants) who suffered consequential harm from<br />

the 2.6 million violative trades come forward to ask for relief? I do not believe they have. Still, to<br />

date, only a handful of comments have been submitted. We however, did come forward and have<br />

made every effort and have endured much personal hardship while we pursued this matter over the<br />

last few years.<br />

The Commission disagreed with Empire's suggestion that the Remaining Funds should be<br />

distributed pro-rata to the injured, because The Commission believed at the time that such<br />

payments would result in the injured customers obtaining an undeserved windfall. <strong>Independent</strong><br />

<strong>Asset</strong> <strong>Management</strong> and its principals never asked the Commission for a pro-rata distribution and<br />

we are not asking the Commission for a windfall. Rather, we ask for reasonable payment for<br />

damages, from which we have never recovered. Our damages are not speculative, remote, nor<br />

"notoriously" difficult to calculate.<br />

I therefore request that the SEC reconsider our special circumstances, and recognize that were<br />

financially devastated by the NYSE Fraud, and therefore conclude that we are entitled to financial<br />

relief. We seek and claim damages suffered as a result of the NYSE Fraud. We seek and claim<br />

that we are entitled to an amount to be paid from the estimated $130 million of funds left over<br />

now that the contemplated payments have been made. We hope that your office will consider our<br />

original request, submitted on January 24th 2006, but we areopen to any discussions with your<br />

office that will result in a fair resolution to this matter. Our previous office location has been<br />

closed. I can be reached at the address below.<br />

Sincerely, ^<br />

/<strong>Joseph</strong>J. <strong>Porco</strong>,<br />

<strong>Managing</strong> <strong>Director</strong><br />

<strong>Independent</strong> <strong>Asset</strong> <strong>Management</strong> LLC<br />

PO Box 379<br />

Newtown CT 06470<br />

jp@independentfunds.com<br />

http://www.sec.gOv/litigation/admin/311445.shtml

Congressman<br />

Christopher Shays<br />

Fourth District Connecticut<br />

Office*:<br />

10 Sh-Jvilc Mrtvi. "i Uh H'> •'<br />

ftndii'p.ii.'J «Y*4-42i><br />

•.^•\'erunifnt (.cW«r<br />

.%S M'j3>hmpu>« B«K-\ iTii<br />

Suniiofd.fTiW»r-Wr<br />

J126 S.oiv^'Mth BuiUlinji<br />

ttashinpwi,1.k: 20515 -«HH<br />

Telephones:<br />

"Cur*aim .Sttt-VHW<br />

V.llw.^KM'. J.*'S Wl<br />

jm.-i "J«« •»• «»* «•«*»•<br />

sj.vvihw: .V **i2"*<br />

\X «-.{;n vP< • -•*- 22> s

Congressman<br />

Christopher Shays<br />

Fourth District Connecticut<br />

Offices:<br />

[0Middle Street. 11th Floor<br />

Bridgeport, CT06(604-4223<br />

Government Center<br />

8S8 Washington Boulevard<br />

Stamford. CT 06901-2927<br />

Il261ongworth Building<br />

Washinj^.n. 1X12fl5i>-0?04<br />

Telephones:<br />

DRIDCEFoft.T: 579-3870<br />

NoR*-AtK: 866-6469<br />

RlDGEFIEIXfc 438-3955<br />

SKEl*ON: 402-0426<br />

StamkjM* JS7-&77<br />

Washington.DO 202 225-5541<br />

E-mail:<br />

rcp.shjv\{«',maU.housc.2

Broadening the class of "Injured Customers" and distributing<br />

penalties to derivative claimants will further thestated goals of the<br />

Fair Fund, because ViolativeTransactionstriggered a chain of<br />

devastating consequential damages. Unfortunately, the Plan's<br />

current form mistakenlyassumesthe activities undertaken by certain<br />

Specialists at the NYSE victimized onlythose persons or entities<br />

thatopened an account, in their name, with a clearing member.<br />

Furthermore, Section 308(a) of theSarbanes-Oxley Act provides that<br />

civil penalties canbe added to Disgorgement Funds for the"reliefof<br />

victims" and that civil penalties can be addedto and becomepart of<br />

thedisgorgement fund "forthebenefit of the victims ofsuch<br />

violations." The Sarbanes-Oxley Act specifically uses the term<br />

"victims." The Act does not use the term "owners ofa security<br />

account" which is what the SEC definition of"injured customer"<br />

really means.<br />

At least one company in Connecticut, <strong>Independent</strong><strong>Asset</strong><br />

<strong>Management</strong> (IAM), is adversely affected by the currentdefinition<br />

of "injured customer" andI refer to IAM's letterto myoffice and<br />

comments to the SEC dated January 24,2006, which are enclosed.<br />

If you have any questions, pleasedo not hesitate to contact me or<br />

Jordan Press ofmy staffat 202/225-5541. Thank you for your<br />

consideration.<br />

Member ofQongress<br />

Enc.<br />

cc: Commissioner Cynthia Classman<br />

Commissioner Paul Atkins<br />

Commissioner Roel Campos<br />

Commissioner Annette Nazareth<br />

Linda C. Thomseri, <strong>Director</strong> ofEnforcement<br />

The Honorable Mike Oxley, Chairman House Financial<br />

Services Committee<br />

The Honorable Richard Baker, Chairman, House Financial<br />

Services Subcommittee on Capital Markets, Insurance and<br />

Government Sponsored Enterprises

Congressman<br />

Christopher Shays<br />

Fourth District Connecticut<br />

Offices;<br />

l

The Honorable Christopher Cox - October 17, 2006 - Page 2<br />

Enclosure<br />

cc: Commissioner Paul Atkins<br />

Commissioner Roe! Campos<br />

Commissioner Annette Nazareth<br />

Commissioner Kathleen Casey

Office of the Secretary<br />

United States Securities and Exchange Commission<br />

100 F Street N.E.<br />

Washington, D.C. 20549-9303<br />

George Szele & <strong>Joseph</strong> <strong>Porco</strong><br />

Principals and <strong>Managing</strong> <strong>Director</strong>s<br />

<strong>Independent</strong> <strong>Asset</strong> <strong>Management</strong>, LLC<br />

177 Broad Street, Suite 1051<br />

Stamford, CT 06901<br />

(203)355-1160<br />

January 24, 2006<br />

Comments<br />

Admin. Proc. File Nos. 3-11445,3-11446,3-11447,<br />

3-11448,3-11449,3-11558,3-11559 ("NYSE Fraud")<br />

FUND ADMINISTRATOR'S PROPOSED FAIR FUND DISTRIBUTION PLAN<br />

I. Factual Background<br />

<strong>Independent</strong> <strong>Asset</strong> <strong>Management</strong>, LLC ("IAM") is a trading manager, commodity pool<br />

operator, and commodity trading advisor. Established on February 16, 2001, IAM is the<br />

trading manager for The <strong>Independent</strong> Fund Limited ("IFL"), a Bermuda fund registered<br />

with the Bermuda Monetary Authority ("BMA").<br />

In the months of January 2003 to March 2003, under the direction of IAM and with IFL<br />

investors' approval, IFL invested $4,500,000 in Sea Carriers Limited Partnership I ("Sea<br />

Carriers"). Furthermore, IAM introduced investors to Sea Carriers, which resulted in an<br />

additional $2,350,000 being invested in Sea Carriers. Therefore, IAM/IFL efforts<br />

represented approximately 34.5% of Sea Carriers assets (at peak assets under management)<br />

at the inception of Sea Carriers trading. By October of 2003, as investors redeemed from<br />

Sea Carriers, IAM/IFL efforts represented approximately 61% ofSea Carriers assets.<br />

The expertise of Sea Carriers was trading baskets of stocks listed on the NYSE, by<br />

transmitting unconditional market orders to buy or sell though the NYSE's Super DOT<br />

system. Agreeing to have IFL and its other investor contacts make this asset allocation<br />

decision, IAM did not know that the fraudulent practices of NYSE Specialists primarily<br />

targeted the order flow of Sea Carriers. Subsequently, according to press reports on the<br />

criminal investigation by Federal prosecutors, certain Specialists had a "screw the DOT<br />

orders" mentality.

<strong>Independent</strong>ly of IAM and before IAM's involvement in this matter, a securities account<br />

was opened at Spear, Leeds & Kellogg by R. Allan Martin in the name of Empire<br />

Programs. Mr. Martin/Empire had a joint venture1 with Sea Carriers, whereby Empire<br />

Programs provided trading capital, and Sea Carriersand its independent traders/contractors<br />

designed and. executed the trading strategy.2<br />

In naming Empire Programs as co-lead plaintiff in the class action lawsuit against the<br />

NYSE and its member firms, Federal Judge Robert Sweet determined that Empire<br />

Programs has the largest financial interest in the matter of the NYSE Fraud. As such,<br />

Empire is likely to be paid a larger sum of money than any other "Injured Customer"<br />

identified by the Fund Administrator.<br />

In court papers filed during his bid to be named lead plaintiff, Mr. Martin asserted that he<br />

has no obligation to share or allocate with any other parties the settlement amounts to<br />

which Empire Programs may be entitled. Specifically, Mr. Martin, in his May 12, 2004<br />

Declaration in connection with Empire's Lead Plaintiff Motion filed in U.S. District Court,<br />

stated, "Empire and Empire alone owns its claims herein. . ." (the "claims herein" being<br />

any disbursements of reimbursement of losses, prejudgment interest, and/or penalties). As<br />

a result of Mr. Martin's claims, Sea Carriers filed a lawsuit against Empire Programs in the<br />

U.S. District Court, Southern District of New York (Index No. 04-CV-7395). Among<br />

other things, Sea Carriers has petitioned Judge Sweet to block any payments to Empire<br />

Programs by the Fund Administrator.<br />

The NYSE Fraud diminished Net Trading Profits generated by both the Empire<br />

Programs/Sea Carriers joint venture and the capital invested in Sea Carriers by IFL. As<br />

such, it adversely affected not only Empire Programs but also Sea Carriers, IAM and the<br />

other traders Sea Carriers had independently contracted. Sea Carriers and its independent<br />

traders were all compensated based solely upon performance. The NYSE Fraud<br />

diminished the actual performance and therefore the amount that Sea Carriers and its<br />

independent traders earned.<br />

II. Summary ofComments<br />

A. The class of "Injured Customers" in the Fund Administrator's Distribution<br />

Plan should be changed to include certain injured persons other than<br />

account parties and Nominees identified by Clearing Members, and these<br />

additional injured persons ("Derivative Claimants") should be eligible to<br />

receive distributions of compensatory Disgorgement Amounts, with<br />

prejudgment interest.<br />

1"Joint venture" is the term R. Allan Martin used todescribe the arrangement between Empire Programs and<br />

Sea Carriers.<br />

2The terms of the Empire Programs/Sea Carriers jointventure were straightforward. Ona monthly basis, 20<br />

25% of Net Trading Profits (trading profits less commissions and SEC fees) were paid out to traders that Sea<br />

Carriers independently contracted. Joint venture expenses (which included but were not limited to utility<br />

costs, office rent, and data costs) were then deducted from the remaining Net Trading Profits, if any. Any<br />

amount remaining was split 50% to Empire Programs, 50% to Sea Carriers.

B. Derivative Claimants should be eligible to receive distributions of penalties<br />

and consequential damages, whether Derivative Claimants receive<br />

compensatory Disgorgement Amounts or not.<br />

C. If the Plan is not changed to accommodate the two requests above, language<br />

in the Commission's final order should nevertheless:<br />

III. Discussion<br />

1. Maintain jurisdiction over this matter even after the Fund<br />

Administrator has made all distributions;<br />

2. Issue an express finding that the Specialist Firms' trading violations<br />

have injured persons besides account parties—specifically, third<br />

parties positioned to benefit (or lose) from transactions involving the<br />

Specialist Firms and the account parties;<br />

3. Make Injured Customers acknowledge, as a precondition to their<br />

receipt of distributions, their legal obligation to share distributions<br />

with third party beneficiaries of the transactions at issue; and<br />

4. Permit Derivative Claimants to seek further SEC review if such<br />

Injured Customers do not so share the distributions received.<br />

A. The class of "Injured Customers" should include certain injured persons<br />

other than account parties.<br />

The class of "Injured Customers" should be broadened for three reasons. First, this<br />

interpretation is consistent with the stated goals of the Fair Fund. Second, some Injured<br />

Customers have expressed a subversive intention not to share distributions with other<br />

parties whom Violative Transactions affect. Third, the nature of the entity comprising an<br />

Injured Customer might give the partner of an Injured Customer a direct pro rata interest in<br />

distribution proceeds.<br />

First, according to the Commission, Fair Fund distributions aspire to redress injuries<br />

arising "as a result of the Specialist Firms' trading violations."3 The current Distribution<br />

Plan therefore limits the class of claimants to "the customers who were injured as a result<br />

of Violative Transactions.4 Without any stated legal justification, however, the Plan<br />

interprets "Injured Customers" to include only account parties identified by Clearing<br />

Members or Nominees.5 This interpretation clashes with the Commission's stated intent,<br />

because Violative Transactions were the proximate cause of substantial economic injuries<br />

beyond those to account parties. The Plan acknowledges that "one transaction could<br />

3Notice of Proposed Distribution Plan and Opportunity for Comment at2.<br />

4Fund Administrator's Proposed Fair Fund Distribution Plan at4.<br />

5Fund Administrator's Proposed Fair Fund Distribution Plan at5.

epresent a block of trades from more than one Injured Customer."6 Thus, if a Clearing<br />

Member identifies "multiple Injured Customers" for one transaction, the Fund<br />

Administrator allocates the Disgorgement Amount "to each Injured Customer pro rata."7<br />

If, however, a Violative Transaction caused an Injured Customer in turn to injure multiple<br />

Derivative Claimants, and a Derivative Claimant therefore loses investors, the Plan<br />

unreasonably fails to allocate compensatory distributions pro rata to each injured<br />

Derivative Claimant. Such a failure unequally treats persons who are similarly situated.<br />

Second, the Distribution Plan should not make it easy for Injured Customers to subvert the<br />

Commission's intent by withholding distributions from other parties whom Violative<br />

Transactions affect. Perhaps the Fund Administrator has assumed that consequential<br />

injuries are matters to be resolved between an Injured Customer and a Derivative<br />

Claimant—not between them and the Commission. As shown by the example of Empire,<br />

however, some Injured Customers have already decided, if possible, not to share their<br />

distributions with Derivative Claimants. The statements by Empire do not directly affect<br />

IAM, because Empire has not been IAM's partner. Moreover, IAM is confident that its<br />

own partner, Sea Carriers, will not similarly fail to share distributions with IAM. Empire's<br />

statements, however, exemplify a problem that will only worsen if the Commission does<br />

not speak to the issue. Indeed, the Plan's failure to address this issue has perhaps<br />

prevented even IAM's partner, Sea Carriers, from granting written assurances that<br />

distributions will be shared without litigation.<br />

Third, the Plan fails to recognize that the nature of the entity comprising an Injured<br />

Customer might give the partner of an Injured Customer a direct pro rata interest in<br />

distribution proceeds. The Uniform Partnership Act, for example, rebuttably presumes<br />

property purchased with partnership funds to be partnership property, notwithstanding the<br />

name in which title is held.8 The current Plan's simplistic method ignores such<br />

complexities, thereby fostering unfairness.<br />

B. Derivative Claimants should be eligible to receive distributions of penalties<br />

and consequential damages.<br />

By definition, a"penalty" punishes a person for the commission of a crime.9 Accordingly,<br />

the essential element of the penalties in this matter is the fact that they deprive the<br />

Specialists of certain monies—not the fact that Injured Customers receive them.<br />

Distributions of penalties will therefore penalize the Specialists just as much if Derivative<br />

Claimants receive them as if Injured Customers receive them.<br />

6Fund Administrator's Proposed Fair Fund Distribution Plan at 5.<br />

7Fund Administrator's Proposed Fair Fund Distribution Plan at 6.<br />

"Property is presumed to be partnership property if purchased with partnership assets, even if not acquired<br />

in thename of thepartnership or of one or more partners with an indication in the instrument transferring title<br />

to the property of the person's capacity as a partner or of the existence of a partnership." Uniform<br />

Partnership Act§ 204(c) (1997), posted at http://www.law.upenn.edu/bll/ulc/fnact99/1990s/upa97fa.htm (last<br />

visited Jan. 23, 2006). The Uniform Partnership Act of 1997 has been adopted in every state except<br />

Louisiana.<br />

9See, e.g.. Black's Law Dictionary: Pocket Edition, ed. Bryan A. Garner (West Group 1996) at475.

Similarly, by definition, "consequential damages" arise not from the immediate act of the<br />

party, but in consequence of such act—such as if a person throws a log into the public<br />

streets and another falls upon it and becomes injured by the fall.10 Violative Transactions<br />

in the current matter triggered a chain of effects that resulted in numerous consequential<br />

damages. Injuries to Derivative Claimants fall under the heading of "consequential<br />

damages," both because Injured Customers passed their losses on to Derivative Claimants<br />

and because Derivative Claimants suffered further financial harm as a result of their<br />

injured track record.<br />

IAM's and IFL's clients and contacts included a pension fund, as well as other institutional<br />

and high net worth investors. Because IAM is a young firm, performance is the most<br />

critical element to growth, in terms of raising funds under management. Performance<br />

(growth) is critical both to survival and to maintaining strategic relationships with<br />

operations including, but not limited to, administration, accounting and auditing.11<br />

The NYSE Fraud robbed IAM (the trading manager), IFL (the fund) and its contacts of<br />

performance. The NYSE Fraud thereby materially damaged the ability of IAM and IFL to<br />

raise assets from 2003 through 2005. 2 During this very period, the rest of the hedge<br />

fund/alternative investment sector experienced explosive and unprecedented growth.<br />

Moreover, as investors began to withdraw their funds from IFL, and as assets under<br />

management declined, management fees were lost—management fees that were necessary<br />

for the principals of IAM personally to survive. Therefore, besides diminishing the<br />

performance generated by Sea Carriers, the NYSE Fraud set off a wave of related events<br />

that drove IAM to the brink of financial ruin and in doing so caused IAM's principals and<br />

10 See id. at 163.<br />

11 Despite its relative youth, IAM quickly established a strong reputation, until the NYSE Fraud took this<br />

major asset away. Before founding LAM, George Szele worked at Societe Generale, Goldman Sachs, and<br />

State Street Global Advisors. Raising the capital to found IAM, setting up a premier team of administrators<br />

and accountants, setting up an office in Stamford, and securing the necessary regulatory registrations—all<br />

these accomplishments directly resulted from hard work and the reputation George had nurtured over ten<br />

years. In buildinga fully scalablebusiness, whichcouldhandle assetsup to $1 billion, the principalsofIAM<br />

negotiated and secured contracts with companies regarded by investors as "pillars in the institutional<br />

community," thereby ensuring investor confidence in proper administration, reporting and auditing for the<br />

fund. IAM secured back office relationships with OSI (now part of Sungard), Forum Fund Services (now<br />

part of CitiGroup) and KPMG. Each of these groups took 1AM and the fund on with the expectation of<br />

significant growth of assets over two to three years.<br />

Specifically, as existing investors grew more and more discontent with performance, IAM began to lose<br />

credibility with its back office vendors and its administrator. OSI/Sungard was the first to resign. This event<br />

triggered concern among the remaining investors but also required LAM to spend time and effort to find a<br />

replacement administrator and in essence start over. Next, IAM's offshore administrator, Forum Fund<br />

Services, resigned. This eventcaused further concern with remaining investors and required IAM to spend<br />

the time andeffort to find a replacement offshore administrator. Remaining investors had concerns regarding<br />

performance and concerns regarding the resignations of IAM's strategic administrative partners. Then<br />

KPMG suggested that it would be mutually practical, due to the fund's size and the cost to audit the fund,<br />

that the auditing relationship be terminated. This event caused additional concern with the remaining<br />

investors and required LAM to spend the time and effort to find a replacement auditor. Each required restart<br />

consumed significant resources.

their families to accumulate personal debt and to suffer credit damage, as well as<br />

professional and personal embarrassment.13<br />

The Administrator has properly identified Sea Carriers as an Injured Customer. As Sea<br />

Carriers receives payments of Disgorgement Amounts and prejudgment interest from the<br />

Escrow Agent, it will pass on the appropriate share of such payments to IAM/IFL.14 In<br />

addition to any such compensatory payments by Sea Carriers, however, IAM and its<br />

principals (George B. Szele and <strong>Joseph</strong> J. <strong>Porco</strong>) have suffered extraordinary consequential<br />

damages. They therefore seek reimbursement for such damages from the Fair Fund. The<br />

Proposed Distribution Plan assumes that the only victims of the NYSE Fraud are those<br />

persons or entities that opened an account, in their name, with a clearing member. This is<br />

not a valid assumption. Accordingly, the SEC should consider the special circumstances<br />

of those consequential victims, like IAM/IFL, whom the NYSE Fraud financially<br />

devastated, and should make special payments to those victims out of any funds left over,<br />

now estimated to be $50-70 million.<br />

C. If the Plan is not changed to accommodate the two requests above, and if<br />

Injured Customers do not so share the distributions received, language in<br />

the Commission's final order should empower Derivative Claimants to seek<br />

further SEC review.<br />

Administrative burdens might prevent the Commission from granting our requests above.<br />

If so, certain provisions in the Commission's final order could, in the alternative, mitigate<br />

the kinds of problem that our requests anticipate. First, an express finding that the<br />

Specialist Firms' trading violations have injured persons besides account parties—<br />

specifically, third parties positioned to benefit (or lose) from Violative Transactions—<br />

13 Upon launching the company, IAM had borrowed money from family and friends. IAM has been unable<br />

to repay these obligations, which exceed $500,000. In an effort to keep the company going, the principals of<br />

IAM worked tirelessly to develop alternatives to generate income and were forced to dilute equity to raise<br />

capital to pay the rent and other expenses. IAM's principals have not received their full salaries for several<br />

years. Both principals have been forced to borrow additional funds to pay personal creditors and basic living<br />

expenses, and both have incurred tremendous personal debt. To date the company owes its<br />

principals/managing directors in excess of about $1,000,000. Even if IAM survives, the equity interest of its<br />

principals has been significantly diluted as a result ofthe sale ofequity.<br />

The intimate partnership between IAM/IFL and Sea Carriers caused IAM/IFL to invest in Sea Carriers in<br />

human ways that increased the consequential damages arising after the Specialists injured Sea Carriers. In<br />

addition to IFL being an investor in Sea Carriers, IAM's principal, George Szele, also bought and sold<br />

baskets of stock for the Partnership. At the request of IFL's investors, George spent the majority of his time<br />

from 2003 to March 2005 in the Sea Carriers office. George traded approximately 200,000,000 shares of<br />

stock listed on the NYSE as a Sea Carriers trader or independent contractor in overseeing the interests of<br />

IAM/IFL clients. Some 20%-25% of the net trading results from his activity as a trader on behalf of IFL<br />

would have been payable at the end of each month and paid to the fund. The NYSE Fraud diminished his<br />

actual trading performance and as a direct result, diminished the share of the distribution of trading profits for<br />

the fund. Furthermore, as the NYSE Fraud became public knowledge, 1AM allocated time and resources to<br />

assist Sea Carriers in its various legal activities to recover damages. IAM also felt it had a fiduciary duty to<br />

its clients and contacts to solicit the assistance of persons including, but not limited to, Connecticut<br />

Congressman Shavs. particularly when the NYSE failed to turn the violation data over to the Administrator<br />

in a timely fashion (the NYSE had been named as a defendant in the class action lawsuit).

would facilitate efforts by Derivative Claimants to seek redress from Injured Parties.<br />

Second, making Injured Customers acknowledge, as a precondition to their receipt of<br />

distributions, their legal obligation to share distributions with third party beneficiaries<br />

would encourage Derivative Claimants and Injured Customers to resolve any dispute<br />

without litigation. Finally, by maintaining jurisdiction after the Fund Administrator has<br />

made all distributions, the Commission should make provisions for Derivative Claimants<br />

to seek further SEC review if Injured Customers do not so share the distributions received.<br />

IV. Conclusion (Specific Actions Sought)<br />

The NYSE Fraud has created a mess. Judging by the data released in the Proposed Plan<br />

(i.e., $157,624,364 in disgorgement amounts on over 2.6 million transactions identified by<br />

the NYSE's Self Regulatory Organization as "Violative Transactions"), the NYSE Fraud<br />

was a "skimming scheme," skimming (stealing) anywhere from a fraction of a cent per<br />

share to three cents, five cents, or twenty five cents or more per share.<br />

Because the NYSE Fraud skimmed just pennies off the reported execution price ,some<br />

Injured Customers, unaware that they had been victimized in the first place, will be<br />

shocked to get a check from the escrow agent of the Fund Administrator. Certain of these<br />

victims may not even be aware that the NYSE Fraud took place. Some of the large Wall<br />

Street firms that routinely participate in what is known as "program trading" will not be<br />

surprised when they receive a check, but they will likely have no clue as to when specific<br />

violations occurred. Nor will the amount of check be material to their overall financial<br />

statements, as such program trading activity is a miniscule percentage of their overall<br />

business models.<br />

One category of victims, however, was devastated by the NYSE Fraud. This category<br />

includes a small business (IAM) that focused all of its resources and assets in a trading<br />

strategy that fell smack in the crosshairs of the NYSE Fraud. The traded stocks included<br />

TXN, MOT, MER, C, EMC, GLW, GE, GS, JPM, JNJ, MWD, TYC, MRK, AOL, IBM,<br />

AIG, TER, VZ, PFE, LLY, ADI, GTE and others—the most liquid and largest capitalized<br />

stocks listed on the NYSE. According to the SEC, six particular stocks per Specialist firm<br />

accounted for the vast majority of Violative Transactions. The SEC listing included all the<br />

stocks listed above. The trading strategy transmitted all of its orders (unconditional market<br />

orders to buy or sell) through the NYSE's Super DOT system, the epicenter of the NYSE<br />

Fraud. Under the circumstances, a small business has little or no chance to survive.<br />

Upon the request of IAM's principal, George Szele, Congressman Christopher Shays<br />

forwarded correspondence to the SEC regarding the Distribution Plan. In his letter to<br />

Chairman W.H. Donaldson, on September 22, 2004, Congressman Shays not only points<br />

his concern for smaller firms but also emphasizes the degree of financial hardship that the<br />

NYSE Fraud has forced smaller firms to endure.<br />

" ...I am particularly concerned because Sea Carriers, a small trading firm<br />

in Greenwich, Connecticut that expects to be a beneficiary of the SEC's<br />

settlement with the specialist firms, is on the verge of bankruptcy while

awaiting settled reimbursement. While I realize that some beneficiaries of<br />

the disbursement fund may be large firms that are financially able to be<br />

patient during the delay, this is not the case with a small firm such as Sea<br />

Carriers."<br />

A. Summary ofComments on the Proposed Distribution Plan:<br />

1. IAM requests that the Administrator provide (in the form of a computer file)<br />

immediate access to all the Violative Transactions that have been identified to date<br />

as being allocated to Sea Carriers, including the detailed explanation for^each<br />

transaction, which includes:<br />

Prejudgment Interest Amount<br />

Clearing member number<br />

Clearing member name<br />

Trade date<br />

Security symbol<br />

Firm mnemonics<br />

Branch and sequence codes<br />

Turn around code<br />

Transaction type<br />

Number of shares<br />

Time of trade<br />

Specialist Firm<br />

Disgorgement Amount<br />

Execution Price<br />

CUSIP number<br />

Principal/agency code<br />

2. IAM requests that, as new Violative Transactions are identified by the clearing<br />

members (i.e., Calyon or SLK), IAM be granted immediate access to the new<br />

trades being added.<br />

3. When making a distribution to Sea Carriers, the Administrator should include a<br />

detailed breakdown, per Violative Transaction, of the all the information listed in<br />

comment #1 above. With this information, Sea Carriers will be able to determine<br />

the exact amount owed to IAM and its clients. With this information, Sea Carriers<br />

will be able precisely to calculate the amount due to IFL for the trading activity<br />

performed by George Szele in his capacity as a trader for the Partnership.<br />

4. The delay in reimbursing damages caused by the NYSE Fraud has only<br />

exacerbated the financial devastation of IAM. The SEC and Fund Administrator<br />

should take all actions necessary immediately to reimburse damages to all the<br />

victims. Specifically, Goldman Sachs/Spear, Leeds & Kellogg should be given an<br />

order by the SEC to complete the entire required submission to the Fund

Administrator within 7 days or face a $100,000 per day fine until Fund<br />

Administrator's request for information is completely fulfilled. Goldman Sachs<br />

and SLK are named as defendants in the ongoing class action lawsuit.<br />

Furthermore, the SEC and Fund Administrator should streamline future interactions<br />

so as to permit the reimbursement of damages as soon as possible.<br />

5. On the top of page 4 of his proposed Distribution Plan, the Administrator described<br />

a "retroactive surveillance" conducted by the NYSE to identify Violative<br />

Transactions. The Administrator also indicated that the surveillance used "certain<br />

time parameters." The particulars of such "retroactive surveillance" should be<br />

publicly disclosed in its entirety and without ambiguity as to methods/parameters,<br />

scope, etc. Public disclosure of this information, however, should not delay the<br />

distribution of funds to the NYSE Fraud victims.<br />

B. Summary of comments on "the use to be made of any funds left over after the<br />

contemplated payments have been made" (currently estimated to be $50-70<br />

million).<br />

The NYSE Fraud caused material consequential damages to IAM/IFL, as outlined<br />

herein. It caused investor withdrawals, strategic partners' resignations, and loss of<br />

income to principals, all of whom had to focus on recovering damages, thereby<br />

diverting limited resources away from core business activities, etc. These damages<br />

are over and above the calculated damages that the Administrator will be<br />

forwarding to Sea Carriers.<br />

IAM therefore asks that the SEC consider IAM's special circumstances, its<br />

financial devastation by the NYSE Fraud, and conclude that IAM is entitled to<br />

additional compensation with respect toall the consequential damages suffered as a<br />

result of the NYSE Fraud. IAM seeks and claims it is entitled to a direct payment<br />

of $10 million to be paid from the estimated $50-70 million of funds left over.<br />

C. Summary of further comments<br />

If the Plan is not changed to accommodate the requests above, and if Injured<br />

Customers do notso share the distributions received, language in the Commission's<br />

final order should empower DerivativeClaimants to seek further SEC review.<br />

Sincerely yours,<br />

George Szele and <strong>Joseph</strong> <strong>Porco</strong><br />

Principalsand <strong>Managing</strong> <strong>Director</strong>s<br />

<strong>Independent</strong><strong>Asset</strong> <strong>Management</strong>, LLC.

Yahoo! Mail - robertpeacockl@yahoo.com Page 1 of 2<br />

^ MAIL Print -Close Window<br />

Date: Fri, 6 Oct 2006 07:48:36 -0700 (POT)<br />

From: "Robert Peacock"<br />

Subject: Request for Meeting<br />

To: "Christopher Cox" <br />

"Jordan Press" , "David Rosenfeid" >, "David A.<br />

_ Markowitz" , "Sanjay Wadhwa" < >, 'Thomas B. McVey"<br />

, "George Szele" , "Joe <strong>Porco</strong>"<br />

Yahoo! Mail - Page 2 of2<br />

George Szele<br />

<strong>Joseph</strong> <strong>Porco</strong><br />

Principals and <strong>Managing</strong> <strong>Director</strong>s of <strong>Independent</strong> <strong>Asset</strong> <strong>Management</strong><br />

Stamford, Connecticut<br />

Robert Peacock<br />

<strong>Independent</strong> Contractor/Trader<br />

Summit, New Jersey<br />

cc: Christopher Shays<br />

Member of Congress<br />

David Rosenfeid, Associate Regional <strong>Director</strong>, SEC, New York<br />

David Markowitz, Assistant Regional <strong>Director</strong>, SEC, New York<br />

Sanjay Wadhwa, Branch Chief, SEC, New York<br />

Thomas B. McVey<br />

Williams Mullen, attorney for <strong>Independent</strong> <strong>Asset</strong> <strong>Management</strong>, LLC<br />

Washington, DC<br />

http://us.f515.mail.yahoo.com/ym/ShowLetter?box=Sent&MsgId=6116_1086005_300212... 10/6/2006

SECURITES EXCHANGE ACT OF 1934<br />

Release No. 53823 / May 17,2006<br />

In the Matters of<br />

Bear Wagner Specialists LLC<br />

Admin. Proc. File No. 3-11445<br />

Fleet Specialist, Inc.<br />

Admin. Proc. File No. 3-11446<br />

LaBranche & Co. LLC<br />

UNITED STATES OF AMERICA<br />

Before the<br />

SECURITIES AND EXCHANGE COMMISSION<br />

Admin. Proc. File No. 3-11447<br />

Spear, Leeds & Kellogg Specialists LLC ORDER APPROVING A<br />

Admin. Proc. File No. 3-11448 DISTRIBUTION PLAN<br />

Van der Moolen Specialists USA, LLC<br />

Admin. Proc. File No. 3-11449<br />

Performance Specialist Group LLC<br />

Admin. Proc. File No. 3-11558<br />

SIG Specialists, Inc.<br />

Admin. Proc. File No. 3-11559<br />

Respondents.<br />

SUMMARY<br />

In March and July 2004, the Commission entered into settlements with the seven<br />

specialistfirms operatingon the New York Stock Exchange ("NYSE"). The Commission's<br />

orders (Securities Exchange Act Release Nos. 49498 - 49502, and Nos. 50075 - 50076) (the<br />

"Settlement Orders") provided, among other things, for payment ofdisgorgement and civil<br />

penalties totaling, in theaggregate, over$247 million. The Settlement Orders further provided<br />

that the disgorgement and civil penalties were to be placed in Fair Funds to be distributed<br />

pursuant to a distribution plan drawn up by a fund administrator, Heffler, Radetich & Saitta<br />

L.L.P. ("Hefiler") was appointed the fund administrator in October 2004.<br />

On September 8, 2005, Heffler submitted a proposeddistribution plan to the<br />

Commission's Office of the Secretary. In accordance with the previousorders in this matter, the<br />

Plansets forth the steps Heffler has taken, and will take, to identify the customers injured as a<br />

result ofeach specialist firm's trading violationsas determinedby the Commission staff and the<br />

NYSE in connection with the Settlement Orders. The Plan further prpvides a mechanism for<br />

calculating each injured customer'sdistribution amount anda mechanism for making actual

distributions. Finally the Plan provides a verification procedure whereby persons may determine<br />

whether they are in the classof injured customers, and, if so, verify the accuracy of their<br />

distribution amount.<br />

On December 27, 2005, the Commission published a Notice of Proposed Distribution<br />

Planand Opportunity forComment ("Notice") inconnection with the above proceedings<br />

(Securities Exchange Act Release No. 53025) pursuant to Rule 1103 of the Commission's Rules<br />

on Fair Fund and Disgorgement Plans, 17 C.F.R. § 201.1103. This Notice advised interested<br />

parties that they could obtain a copy ofthe proposed plan ofdistribution ofmonies placed into<br />

Fair Funds authorized by the Commission, pursuant to Section 308(a)ofthe Sarbanes-Oxley Act<br />

of 2002 (the "Plan"), by visiting http://www.sec.gov/litigation/admin/34-53025-pdp.htm or<br />

www.hrsclaimsadministration.com. or by submitting a written request to Ronald A. Bertino, c/o<br />

Heffler, Radetich & Saitta, LLP, 1515 Market Street, Suite 1700, Philadelphia, PA 19102. The<br />

Notice also advised that all persons desiring to comment on the Plan, or the use to be made of<br />

any funds left after the contemplated payments have been made ("Remaining Funds"), may<br />

submit their views, in writing, no later than January 26, 2006. The Notice stated that such<br />

Remaining Funds could total anywhere between $50 and $70 million.<br />

In response to the Notice, eight persons (five individuals and three entities) submitted<br />

comments to the Office of the Secretary. Five of the comment letters were submitted by persons<br />

formerly associated or affiliated with an entity namedSea Carriers Limited Partnership I ("Sea<br />

Carriers"), who argue, generally, that the Plan should not be limited to compensating injured<br />

customers who actually traded, but should be broadened to provide compensation to persons who<br />

allegedly suffered derivative or consequential harm from the improper trading. Some of these<br />

persons also claim that they should receive significant portions ofany Remaining Funds because<br />

they were particularly harmed by the specialist firms' misconduct. Another comment letter<br />

suggests that the Commission should publish a list of the violative trades and the identities of the<br />

injured customers. The two remaining comment letters address only the use of the Remaining<br />

Funds, both suggesting that such funds be paid to the injured customers either on a pro-rata basis<br />

or in the form of post-judgment interest calculated through the date of distribution.<br />

After careful consideration, the Commission has concluded that the Plan should be<br />

modified to include the payment ofpost-judgment interest to injured customers, subject to<br />

adequate tax documentation, calculated through the date ofdistribution, and approved with such<br />

modification.<br />

FACTS<br />

A. The Commission's Actions and the Fund Administrator's Proposed Plan<br />

In the Settlement Orders, the Commission found that the specialist firms had been filling<br />

customer orders through proprietary trades rather than throughother customer orders, thereby<br />

causing customer orders to be disadvantaged. The extent of the violative trading was determined<br />

through the use ofa retroactive surveillanceconductedby the NYSE, which identified a large<br />

number ofspecific transactions where specialists had unlawfully either traded ahead of<br />

executable customer orders, or interpositioned themselves between two customer orders that

should have been matched against one another. The surveillance enabled the Commission staff<br />

and the NYSE to calculate precisely the dollar amount by which a particular customer order had<br />

been disadvantaged by a specific violative trade. The disgorgement paid by each specialist firm<br />

was therefore tied to the specific violative trades identified by the Commission staff and the<br />

NYSE. The specialist firms were also ordered to pay civil penalties tied to the amount of<br />

customer harm caused by the identified violative trades. All told, the seven specialist firms paid<br />

$247,028,778 in disgorgement and civil penalties.<br />

Each of the Settlement Orders provided for the appointment of a fund administrator, and<br />

specified the fund administrator's function and the uses to which the disgorgement and civil<br />

penalties are to be used:<br />

The disgorgement and the civil penalties which shall be added to a<br />

Fair Fund (the "Distribution Fund") shall be maintained in an<br />

interest-bearing account and shall be distributed pursuant to a<br />

distribution plan (the "Plan") drawn up by an administrator (the<br />

"Administrator") to be chosen by the staffofthe Commission and<br />

the NYSE. The Administrator shall identify the customers who<br />

were injured as a result of [the specialist firm's] trading violations<br />

as determined [in the Settlement Order] by the Commission staff<br />

and the NYSE. The Distribution Fund shall be used: (i) to pay the<br />

costs of administering the Plan; (ii) to reimburse injured customers<br />

for their loss; and (iii) to pay prejudgment interest to injured<br />

customers. The Commission shall determine the appropriate use<br />

for the benefit ofinvestors ofany funds left in the Distribution<br />

Fund following such payments. Under no circumstances shall any<br />

partofthe Distribution Fund be returned to [the specialist firm].<br />

In October 2004, the Commission issued orders that, among other things, created Fair<br />

Funds, appointed Heffler administrator of the Fair Funds, and directed the transfer ofsettlement<br />

funds into escrow accounts for investment and subsequent disbursement to injured customers.<br />

On September 8, 2005, Heffler submitted a proposed Plan for Commission approval. The<br />

proposed Plan is divided into three phases: the initial phase requires Heffler to identify the<br />

customers who were injuredas a result ofthe previously identified violative trades. The second<br />

phase requires Heffler to calculate each injured customer's distribution amount, which is the sum<br />

of the disgorgement amount and prejudgment interest. The final phase ofthe Plan requires<br />

Heffler to distribute the distribution amounts to the injured customers. In addition, the Plan sets<br />

forth verification procedures to afford injured customersan opportunity to verify their status and<br />

the amount of their distribution. On December 27,2005, the Commission issued the Notice,<br />

which gave the public 30 days to submit comments on the various procedures set forth in the<br />

Plan, as well as the use to be made ofany Remaining Funds.

B. Public Comments Concerning the Proposed Distribution Plan<br />

Eight persons submitted comments in response to the Notice. Five of the letters came<br />

from persons formerly associated or affiliated with Sea Carriers, a Connecticut-based trading<br />

company that ceased operations in March 2005, who claim that they suffered injury as a result of<br />

the specialists' trading violations and deserve compensation, even though they are not the named<br />

customers connected to the disadvantaged trades. Two comment letters were submitted<br />

concerning the use of the Remaining Funds, one by a trading company, Empire Programs Inc.<br />

("Empire"), and the other by a Washington-based advocacy group, the Washington Legal<br />

Foundation ("WLF"). These comments are limited to the use to be made of the Remaining<br />

Funds, and suggest that such funds should be paid to the injured customers either on a pro-rata<br />

basis or in the form of post-judgment interest calculated through the date of distribution. The<br />

final comment, which was submitted by an individual affiliated with Zermatt Capital<br />

<strong>Management</strong>, a Utah-based investment adviser, suggests that the Commission publish a list of<br />

the violative trades and the identities of the injured customers on its website. The Commission's<br />

responses to these comments are discussed below.<br />

1. Comments from Persons Formerly Associated with Sea Carriers<br />

The five persons formerly associated with Sea Carriers include three individuals who<br />

identify themselves as former "independent contractors/traders" for Sea Carriers (the "SC<br />

Traders"), an entity, <strong>Independent</strong> <strong>Asset</strong> <strong>Management</strong> ("IAM"), which managed a fund that<br />

invested in Sea Carriers, and an individual who describes herself as a former<br />

"programmer/trader" at Sea Carriers who also invested in Sea Carriers and in IAM. The letters<br />

assert, in nearly identical language, that the Plan should not be limited to compensating injured<br />

customers who actually traded, but should be broadened to allow compensation of persons who<br />

may have derivative claims or may have suffered consequential damages as a result of the<br />

specialist misconduct. Although the arguments overlap, these commentators appear to be<br />

making three distinct claims: a) that the fund administrator should look past the account holder<br />

and distribute funds to persons who have a derivative interest in the account; b) that the class of<br />

claimants eligible to receive disgorgement funds should not be limited to injured customers but<br />

should be broadened to include other persons who were derivatively injured by the specialists'<br />

misconduct; and c) that the Remaining Funds should be used to pay consequential damages to<br />

persons who were affected by the misconduct. The Commission addresses each of these claims<br />

in turn:<br />

a. Looking Past the Account Holder<br />

Some of the Sea Carriers commentators argue that the Plan unfairly limits the class of<br />

"injured customers" to the account holders, identified by clearing firms and nominees, whose<br />

trades were disadvantaged.! These commentators claim that they have a derivative interest in the<br />

1The Plan defines a "Nominee" as "a brokerage firm, bank, investment firm, etc., with current or<br />

former clients that are Injured Customers." When a disadvantaged trade is placed through what<br />

appears to be a nominee account, Heffler contacts the named account holder to verify whether

usiness of the account holder, or in the trades themselves, and are thus entitled to compensation.<br />

For example, the SC Traders claim that Sea Carriers had a joint venture agreement with Empire,<br />

a large trading firm, pursuant to which Empire provided trading capital and Sea Carriers and the<br />

SC Traders designed a trading strategy and executed trades through an account held in Empire's<br />

name. The SC Traders claim that they were supposed to sharein the net trading profits their<br />

trades generated. The SC Traders argue that they were deprived of trading profits by the<br />

specialists' misconduct, and thus have a derivative claim to any recovery obtained by Empire.<br />

As a result, the SC Traders want Heffler to allocate any funds that Empire may be due to Sea<br />

Carriers and the SC Traders on a pro rata basis,consistent with the terms ofthe alleged joint<br />

venture agreement. Similarly, IAM wants the Plan to specifically recognize the validity of<br />

derivative claims IAM may have - as the manager of a fund that invested in Sea Carriers <br />

against Sea Carriers.<br />

The Commission disagrees with the suggestion that the fund administrator should look<br />

beyond the account holders to determine whether any other person has a claim, contractual or<br />

otherwise, to the assets ofan account that might be entitled to a distribution. These are<br />

essentially disputes among private parties that are best resolved by the parties themselves or<br />

through the judicial system. The Commission is aware that Sea Carriers is presently involved in<br />

a lawsuit against Empire in federal district court, Sea Carriers Corp. v. Empire Programs, Inc.,<br />

04-CV-7395 (SDNY 2004), regarding this same issue, namely whether Sea Carriers should share<br />

in any recovery Empire might obtain in a distribution from Heffler or in a related class action.<br />

Among the matters at issue in that lawsuit are whether Sea Carriers ever had a joint venture<br />

agreement with Empire, and the terms of that agreement. These matters are most appropriately<br />

resolved in the context of that lawsuit rather than by the fund administrator.2 Heffler has neither<br />

the account is a proprietary account or a nominee account. If the account is a nominee account,<br />

Heffler asks the nominee to identify the clients who placed the disadvantaged trades.<br />

2As part ofthe lawsuit, Sea Carriers moved the court inJanuary 2005 for emergency relief to<br />

enjoin Heffler from distributing any funds to Empire, and to enjoin Empire from accepting any<br />

such funds, until Sea Carrier's right to share in the distribution is adjudicated. On February 16,<br />

2005, the court denied the motion, without prejudice, because ofthe absence ofany need for<br />

immediate relief. In November 2005, Sea Carriers filed a motion for partial summary judgment<br />

on the issue ofwhether there was a joint venture between Sea Carriers and Empire. Opposing<br />

and reply papers have been filed and the summary judgment motion is presently pending before<br />

the court. On January23,2006, Sea Carriers asked Heffler to withhold any payments to Empire,<br />

and informed Heffler that Sea Carriers planned to renew its motion for injunctive relief. On<br />

March 22, 2006, Sea Carriers again filed a motion for injunctive relief, seeking, among other<br />

things, to enjoin Empire and its President, Robert A. Martin ("Martin"), from receiving or<br />

accepting any distributions from Heffler, or to compel Empire and Martin to deposit all<br />

distributions with the clerk of the court. This motion was instituted by Order to Show Cause and<br />

included an application for a temporary restraining order ("TRO"). On March 23, 2006, the<br />

court, after a hearing on the merits, denied Sea Carriers' application for a TRO. The preliminary<br />

injunction hearingwas adjournedwithout date. All ofthe issues concerning the disposition of<br />

any distribution funds that Empire may receive are therefore pending before the federal district

the resources northe expertise to makesuchjudgments, which require complex legal and factual<br />

findings about the business arrangements and contractual undertakings of the parties. Heffler's<br />

identification ofthe customers injured asa result ofthe specialists' trading violations is properly<br />

limitedto identifying the account holder whose trade was disadvantaged and making<br />

distributions to thataccount holder. If others have claims to that money - because they are<br />

partners, joint venturers, shareholders, investors, or otherwise have an interest in the business of<br />

the accountholder- those disputes shouldbe resolved in another forum, rather than by the fund<br />

administrator.3<br />

b. Expanding the Class of Injured Customers to Include Other Injured Persons<br />

Several of the commentators argue generally that the class of injured customers should<br />

not be limited to persons who actually traded, but should be broadened to include any person<br />

who suffered some loss that can be derivatively connected to the specialists' misconduct. For<br />

example, IAM asserts that "the class of'Injured Customers' in the Fund Administrator's<br />

Distribution Plan should be changed to include certain injured persons other than account parties<br />

and Nominees identified by Clearing Members, and these additional injured persons ("Derivative<br />

Claimants") should be eligible to receive distributions of compensatory Disgorgement Amounts,<br />

with prejudgment interest." There are two possible ways to interpret such claims: (i) the<br />

commentators are seeking to be added to the class of injured customers; and (ii) the<br />

commentators are suggesting that, in the alternative, their claims should be satisfied out of the<br />

Remaining Funds. The Commission's response to item (ii) is discussed in paragraph c. below.<br />

court, and the Commission anticipates that the court will be able to take any steps necessary to<br />

protect the interests of the parties involved in this active litigation.<br />

3The types of judgments that IAM and the SC Traders would have the fund administrator make<br />

are very different from those that the fund administrator will make when it looks behind nominee<br />

accounts to determine the identity of the customer who placed the disadvantaged trade. A<br />

nominee is, by definition, acting on behalfofanother person. When a client ofa brokerage firm<br />

or other financial institution places a trade, the broker will often execute the trade through an<br />

omnibus or other joint trading account in the name of the broker, and then allocate the trade to<br />

the customer's account. In those situations it is appropriate for the fund administrator to seek<br />

from the broker the name ofthe actual customer who placed the trade in order to make a<br />

distribution to that client. IAM and the SC Traders, on the other hand, are asking the fund<br />

administrator to look behind proprietary accounts to determine whether any person other than<br />

the named account holder has an interest, contractual or otherwise, in that account. In the case of<br />

nominee accounts, the fund administrator's task is fairly mechanical: it involves seeking from the<br />

nominee the name ofthe client on whose behalf the nominee placed the trade, and to whose<br />

account the trade is subsequently allocated. To go behind proprietary accounts to determine<br />

whether some person other than the account holder has a derivative interest in the account is a far<br />

more complicated task, involving complex factual and legal determinations that the fund<br />

administrator is ill-equipped to make.

The Commission disagrees with the suggestion that persons who suffered some loss that<br />

might be derivatively connected to the specialists' misconduct should be included in the class of<br />

injured customers. This approach would not be consistent with the theory of the underlying case<br />

as embodied in the Settlement Orders entered in this matter. The Settlement Ordersrequire the<br />

fund administratorto "identify the customers who were injured as a result of the [specialist<br />

firm's] trading violations as determined [in the Settlement Orders] by the Commission staff and<br />

the NYSE," and specify that the distribution funds are to be used to pay administrative expenses,<br />

"to reimburse injured customers for their loss" and "to pay prejudgment interest to injured<br />

customers" Emphasisadded. The disgorgement obtained in this matter was tied to specific<br />

violative transactions that disadvantaged "customerorders," resulting in precisely quantifiable<br />

harm to identifiable customers. The Settlement Orders were structured to ensure that the<br />

disgorged funds are returned to those customers as compensation for the quantifiable harm they<br />

suffered. The Settlement Orders also make clear that the injured customers are to be the priority<br />

recipients of further distributions by specifying that they should receive prejudgment interest.<br />

Changing the class of"injured customers" to include "additional injured persons" who have<br />

derivative claims would not be consistent with the plain language and intent of the Settlement<br />

Orders.4<br />

c. Use of the Remaining Funds<br />

The Settlement Orders provide that "the Commission shall determine the appropriate use<br />

for the benefit of investors of any funds left in the Distribution Fund" after the contemplated<br />

payments to injured customers and for administrative expenses have been made. Several of the<br />

commentators argue that even if the class ofinjured customers is not broadened to include<br />

additional persons who suffered derivative injuries, the Remaining Funds could be used to<br />

compensate persons who suffered derivative or consequential damages. For example, two of the<br />

SC Traders and IAM argue that they should receive large sums of money - ranging from 1.5<br />

million to 10 million dollars - out ofthe Remaining Funds, because they claim that the specialist<br />

firms' improper conduct ultimately led Sea Carriers to go out ofbusiness, causing the SC<br />

Traders to lose their jobs and miss out on large profits they would have otherwise obtained, and<br />

causing IAM's business to suffer.<br />

As discussed below, the Commission finds that the Plan should be modified to provide<br />

for the payment of post-judgment interest to injured customers, but should not be further<br />

modified at this time to address the use of any Remaining Funds. Although the Notice solicited<br />

comment regarding the Remaining Funds, the comments received reflect a fairly narrow range of<br />

options that may not be in the best interest of investors overall. Using the Remaining Funds to<br />

pay consequential damages would be particularly problematic. For example, the SC Traders and<br />

IAM seek compensation for such things as loss of future business, loss of earnings, loss of<br />

investment opportunities, and loss ofbusiness reputation. One ofthe SC Traders, without<br />

elaboration/asserts a claim to 1.5 million dollars ofthe Remaining Funds because he was<br />

4Expanding the class of claimants eligible to receive disgorgement funds to include persons<br />

other than the injured customers would necessarily reduce the pool of money available to<br />

compensate the actual customers. Depending on how broadly the claimant class was expanded,<br />

this approachcould result in the injured customers not being made whole.

"deprived ofcurrentand potential future income as a trader" resulting from "the financial<br />

hardship and damages inflicted as a result of the fraudulent activity of the N.Y.S.E. specialist<br />

firms." A second SC Trader, who was a partnerat Sea Carriers, claims that he is "entitled to a<br />

direct paymentof$4,000,000" because his "income and equity in Sea Carriers could have grown<br />

by tens ofmillions ofdollars" in the absence ofthe specialist firms' improper conduct. IAM,<br />

which manages a fund that invested $4.5 million in Sea Carriers, asserts that the derivative or<br />

consequential damages suffered by Sea Carriers, resulting from its alleged joint venture with<br />

Empire, caused IAM and its fund, in turn, to suffer material consequential damages, resulting in<br />

"investor withdrawals, strategic partners' resignations, and loss of income to principals, thereby<br />

diverting limited resources away from core business activities, etc." Claiming that it was<br />

"financially devastated" by the specialist firms' improper conduct, IAM states that "it is entitled<br />

to a direct payment of $10 million to be paid from the [Remaining Funds]."<br />

Consequential damages of the sort claimed by IAM and the SC Traders are speculative,<br />

remote, and notoriously difficult to calculate. Neither the Commission staff nor the fund<br />

administrator has the knowledge or expertise to evaluate these claims, and doing so would<br />

require the expenditure ofconsiderable resources. If speculative consequential damages are<br />

entertained, there are potentially millions ofclaimants (there are over 2.6 million violative trades,<br />

each of which may have resulted in some consequential harm to some person), and the process of<br />

adjudicating the relative merits ofall these claims would quickly dissipate the Remaining Funds.<br />

The Commission shall therefore address the use to be made ofany Remaining Funds at a later<br />

date, after the public is given further opportunity for comment. In the meantime, the<br />

Commission shall approve the Plan, as modified to provide post-judgment interest payments, so<br />

that injured customers can begin receiving funds as soon as possible.<br />

2. Other Comments Concerning the Use of the Remaining Funds<br />

Two other commentators wrote with suggestions concerning the use of the Remaining<br />

Funds. In its comment letter, WLF urges the Commission to provide more detail as to how it<br />

intends to use the Remaining Funds. WLF contends that it is not sufficient, under Rule<br />

1101(b)(5) ofthe Fair Fund Rules, for the Plan to merely provide that the Commission shall<br />

determine the appropriate use ofany Remaining Funds at some unspecified date in the future.<br />

Instead, WLF argues that the Plan should set forth those appropriate uses, and provide interested<br />

parties an opportunity to comment on those uses. However, Rule 1101(b)(5) of the Fair Fund<br />

Rules merely requires there be "a provision for the disposition ofany funds not otherwise<br />

distributed." The Commission believes that by setting forth a termination date for the Fair Funds<br />

and providing that the Commission shall determine the appropriate use for the benefit of<br />

investors of any funds left in the Fund following all payments, the Plan satisfies the requirements<br />

ofRule 1101(b)(5). The Commission, however, agreeswith WLF's suggestion that there be<br />

further opportunity for public comment on the use of the Remaining Funds.<br />

Substantively, WLF suggests that the Commission distribute the Remaining Funds to the<br />

injured customers, in the form of post-judgment interest, and Empire, in its comment letter,<br />

suggests that the Commission distribute the Remaining Funds to the injured customers on a pro<br />

rata basis. Specifically, WLF argues that it "would be wholly appropriate for the Commission to<br />

awardadditional interest - calculated through the date ofdistribution - for the Injured

Customers." The Commission agrees with WLF's suggestion that injured customers should<br />

receive post-judgment interest:5 such payments will more fully compensate injured customers by<br />

taking account of the time-value of the money they are owed. The Commission, however,<br />

disagrees with Empire's suggestion that the Remaining Funds should be distributed pro-rata to<br />