Table of Contents

The Negotiable Instruments Act is a crucial piece of legislation that governs the use and transfer of negotiable instruments in India. These instruments, such as promissory notes, bills of exchange, and cheques, play a significant role in commercial transactions and financial dealings. Understanding the provisions and implications of this Act is essential for both businesses and individuals. In this article, we will delve into the key insights of the Negotiable Instruments Act, exploring its importance, provisions, parties involved, creation and transfer of instruments, legal remedies, recent amendments, and practical applications.

Understanding Negotiable Instruments

Negotiable instruments are documents that guarantee the payment of a specific amount of money to the bearer or the person named in the instrument. These instruments are transferable from one person to another, enabling easy and secure transactions. The Negotiable Instruments Act provides a framework for the use, transfer, and enforcement of these instruments, ensuring a smooth flow of commerce and financial transactions.

Importance of the Negotiable Instruments Act for Businesses

For businesses, the Negotiable Instruments Act holds immense significance. It provides a legal framework for the issuance, acceptance, and enforcement of negotiable instruments, instilling confidence and reliability in commercial dealings. By adhering to the Act’s provisions, businesses can ensure the smooth flow of funds, minimize the risk of financial disputes, and enhance their credibility in the market. Understanding the Act’s nuances is crucial for businesses to effectively leverage negotiable instruments and safeguard their financial interests.

Key Provisions of the Negotiable Instruments Act

The Negotiable Instruments Act encompasses several key provisions that govern the rights and liabilities of parties involved in negotiable instruments. These provisions are designed to protect the interests of both the payee and the payer, ensuring fair and transparent transactions. Some of the essential provisions include:

- Definition of Negotiable Instruments: The Act provides a comprehensive definition of negotiable instruments, encompassing various types such as promissory notes, bills of exchange, and cheques.

- Holder in Due Course: The Act establishes the concept of a holder in due course, who acquires the instrument in good faith and for value, without any notice of defects or irregularities. A holder in due course enjoys certain advantages and protections under the Act.

- Liability of Parties: The Act outlines the liability of parties involved in negotiable instruments, such as the maker of a promissory note, the drawer of a bill of exchange, and the issuer of a cheque. It defines their obligations and responsibilities in case of dishonor or default.

Types of Negotiable Instruments Covered under the Act

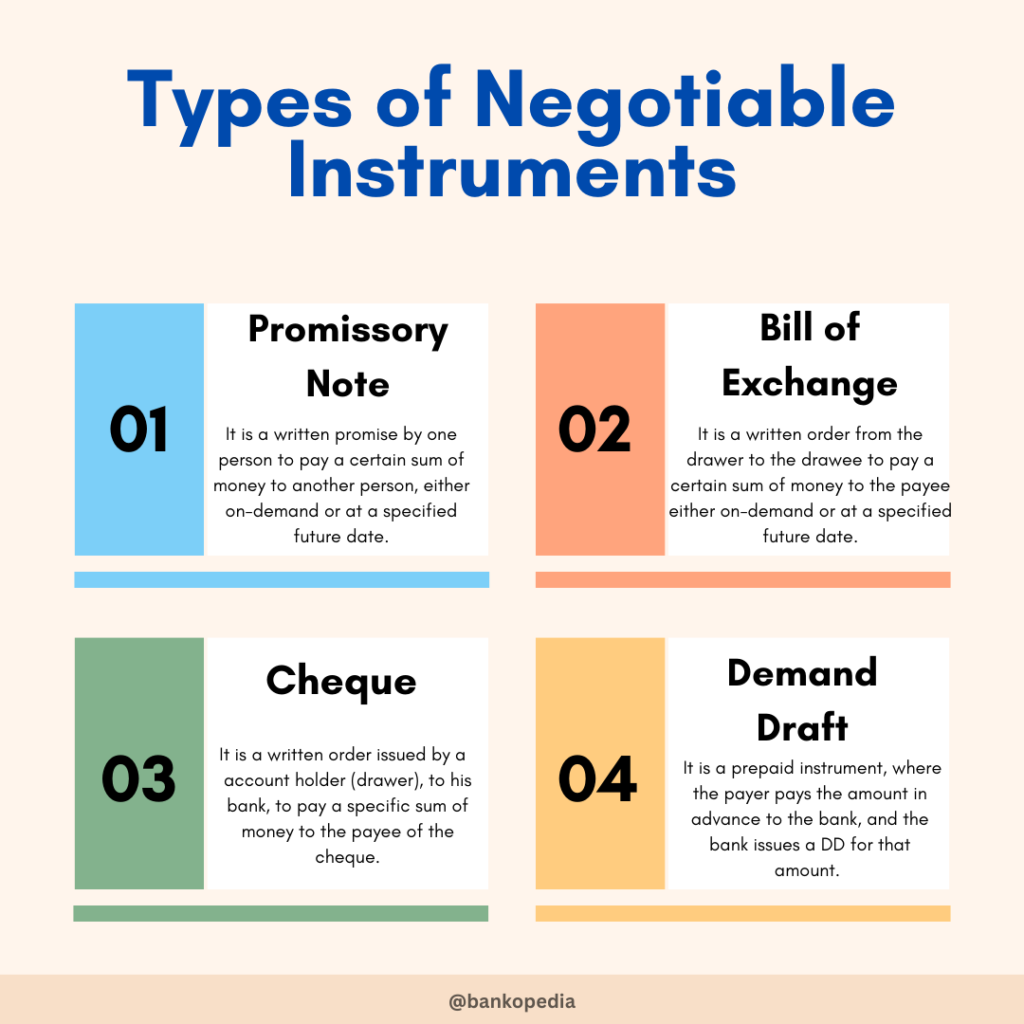

The Negotiable Instruments Act covers various types of negotiable instruments that are commonly used in commercial transactions. These instruments include:

- Promissory Notes: A promissory note is a written promise by one party to pay a specific amount of money to another party at a future date or on demand.

- Bills of Exchange: A bill of exchange is an unconditional written order by one party to another, directing the latter to pay a specific amount of money to a third party at a future date or on demand.

- Cheques: A cheque is a written order by an account holder to their bank, instructing the bank to pay a specific amount of money to the bearer or a named person.

Understanding the characteristics and legal implications of each type of negotiable instrument is crucial for businesses and individuals engaging in financial transactions.

Parties Involved in Negotiable Instruments

Negotiable instruments involve several parties, each with specific roles and responsibilities. The key parties involved in negotiable instruments are:

- Drawer: The party who creates and signs the negotiable instrument, such as the person writing a cheque or issuing a promissory note.

- Payee: The party to whom the payment is to be made, such as the person or entity receiving the funds mentioned in the instrument.

- Drawee: In the case of a bill of exchange or a cheque, the drawee is the party on whom the instrument is drawn. For example, the bank on which a cheque is drawn is the drawee.

It is crucial for all parties involved to understand their rights, obligations, and potential liabilities under the Negotiable Instruments Act to ensure smooth and legally compliant transactions.

Rights and Liabilities of Parties under the Act

The Negotiable Instruments Act outlines the rights and liabilities of the parties involved in negotiable instruments. These rights and liabilities provide a framework for resolving disputes, ensuring fair treatment, and protecting the interests of all parties. Some of the key rights and liabilities include:

- Rights of a Holder in Due Course: A holder in due course enjoys several rights, such as the right to enforce payment, the right to sue in their own name, and protection against certain defenses.

- Liability of Parties: The Act establishes the liability of parties involved in negotiable instruments. For example, the drawer of a bill of exchange is liable to compensate the payee in case of dishonor or default.

- Discharge of Liability: The Act also provides for the discharge of liability under negotiable instruments. For instance, a party can be discharged from liability if the instrument is canceled, paid, or returned.

Understanding these rights and liabilities is essential for businesses and individuals to navigate negotiable instruments effectively and protect their interests.

How to Create a Negotiable Instrument

Creating a negotiable instrument involves following certain legal requirements and procedures. The Negotiable Instruments Act provides guidelines for the proper creation and execution of these instruments. Some essential steps for creating a negotiable instrument include:

- Proper Form and Language: The instrument should be in writing, using appropriate language that clearly expresses the promise or order to pay. It should also contain essential details such as the amount payable, the date of payment, and the parties involved.

- Proper Signatures: The instrument should be signed by the party creating it, such as the drawer of a bill of exchange or the issuer of a cheque. The signature should be valid and legally binding.

- Delivery of the Instrument: The instrument must be delivered to the payee or the intended recipient for it to be valid. Delivery signifies the intention to transfer ownership and rights associated with the instrument.

By adhering to these guidelines, businesses and individuals can ensure the proper creation of negotiable instruments, minimizing the risk of disputes and legal complications.

Endorsement and Transfer of Negotiable Instruments

Negotiable instruments are often transferred from one party to another to facilitate payments or financing arrangements. The Negotiable Instruments Act provides provisions for the endorsement and transfer of these instruments. Some key points to consider regarding endorsement and transfer include:

- Endorsement: An endorsement is a written signature on the back of the instrument that signifies the transfer of rights to another party. Endorsements can be in a blank, restrictive, or special form, depending on the intended transfer.

- Negotiation by Delivery: In certain cases, negotiable instruments can be negotiated by mere delivery. This means that the possession of the instrument itself represents the transfer of ownership and rights, without the need for a written endorsement.

- Rights of Transferee: A transferee or holder of a negotiable instrument acquires the rights of the transferor, including the right to enforce payment and sue in case of dishonor.

Understanding the rules and procedures for endorsement and transfer is essential for businesses and individuals engaging in the transfer of negotiable instruments.

Dishonor and Discharge of Negotiable Instruments

The Negotiable Instruments Act provides guidelines for dealing with dishonor and discharge of negotiable instruments. Dishonor occurs when a negotiable instrument is not honored or accepted by the party liable to make the payment. Some key points regarding dishonor and discharge include:

- Dishonor: Dishonor can occur due to various reasons, such as insufficient funds, irregularities in the instrument, or non-acceptance by the drawee. The Act provides procedures for giving notice of dishonor and seeking remedies for the same.

- Liability for Dishonor: Parties involved in negotiable instruments can be held liable for dishonor. The Act establishes the obligations and responsibilities of each party in case of dishonor, including the right to claim damages.

- Discharge: A negotiable instrument can be discharged by various means, such as payment, cancellation, or return of the instrument. Discharge relieves the parties from further liabilities or obligations associated with the instrument.

Understanding the process of dishonor and discharge is crucial for businesses and individuals to navigate negotiable instruments effectively and seek appropriate legal remedies.

Legal Remedies under the Negotiable Instruments Act

The Negotiable Instruments Act provides legal remedies to parties aggrieved by the dishonor or default of negotiable instruments. These remedies are designed to protect the interests of the affected party and ensure fair resolution of disputes. Some crucial legal remedies under the Act include:

- Filing a Suit: An aggrieved party can file a suit against the party liable for dishonor or default, seeking appropriate relief, such as the recovery of the amount due, damages, or compensation.

- Insolvency Proceedings: In certain cases, insolvency proceedings can be initiated against the party liable for dishonor, providing additional legal remedies to the affected party.

- Criminal Proceedings: The Act also makes provisions for initiating criminal proceedings in case of fraudulent or dishonest acts related to negotiable instruments. This serves as a deterrent against fraudulent practices.

Understanding the available legal remedies is essential for businesses and individuals to protect their rights and seek appropriate redressal in case of disputes arising from negotiable instruments.

Recent Amendments to the Act

The Negotiable Instruments Act has undergone certain amendments in recent years to address emerging challenges and enhance its effectiveness. These amendments aim to streamline processes, improve transparency, and align the Act with the changing business landscape. Some significant recent amendments to the Act include:

- Digitalization of Payments: The Act has been amended to incorporate digital payment mechanisms, such as electronic funds transfer and online banking, to keep pace with technological advancements.

- Cheque Truncation System: The introduction of the Cheque Truncation System (CTS) aims to expedite the processing of cheques and enhance security by eliminating physical movement of cheques.

- Strengthening Legal Framework: The Act has been amended to strengthen the legal framework for the timely resolution of disputes related to negotiable instruments and ensure the speedy recovery of dues.

These recent amendments reflect the evolving nature of negotiable instruments and the need to adapt to the changing business environment.

Case Studies Highlighting the Practical Applications of the Act

To illustrate the practical applications of the Negotiable Instruments Act, let us consider two case studies:

- Case Study 1: Dishonor of a Cheque: Mr. A issues a post-dated cheque to Mr. B for a business transaction. However, the cheque is dishonored due to insufficient funds in Mr. A’s account. Mr. B, the aggrieved party, can seek legal remedies under the Negotiable Instruments Act to recover the amount due and claim damages.

- Case Study 2: Bill of Exchange Dispute: Company X issues a bill of exchange to Company Y for the payment of goods received. However, Company Y refuses to accept the bill and defaults on the payment. Company X can initiate legal proceedings under the Negotiable Instruments Act to seek appropriate redressal and recover the outstanding amount.

These case studies highlight the importance of understanding the provisions and legal remedies provided by the Negotiable Instruments Act in real-life business scenarios.

Tips for Businesses and Individuals to Effectively Navigate the Act

Navigating the Negotiable Instruments Act effectively requires a thorough understanding of its provisions, procedures, and legal remedies. Here are some tips for businesses and individuals to navigate the Act:

- Stay Updated: Keep abreast of the latest amendments, circulars, and guidelines issued by regulatory authorities to ensure compliance with the Act.

- Maintain Proper Documentation: Maintain accurate records and documentation of all negotiable instruments, transactions, and communications related to them. This can serve as crucial evidence in case of disputes or legal proceedings.

- Seek Legal Advice: In complex or high-value transactions, it is advisable to seek legal advice from professionals well-versed in negotiable instruments and the related legal framework.

By following these tips, businesses and individuals can navigate the Negotiable Instruments Act more effectively, minimize risks, and protect their financial interests.

Conclusion

Mastering the Negotiable Instruments Act is essential for businesses and individuals engaging in financial transactions. This Act provides a comprehensive legal framework for the use, transfer, and enforcement of negotiable instruments, ensuring transparency, reliability, and fair treatment. By understanding the Act’s provisions, parties involved in negotiable instruments can protect their rights, seek appropriate legal remedies, and navigate the complexities of commercial transactions effectively. In an ever-evolving business landscape, staying updated with recent amendments and seeking professional advice are crucial for effectively leveraging negotiable instruments and safeguarding financial interests.