How do I clear Indiana EF message 1269?

IN EF Message 1269 states:

Schedule K-1 - If the Federal K1P and/or K1S screens are present, then the Indiana screen K1 must be completed for electronic filing purposes. Also, if State Tax Withheld or State Specific amount 1 is present on the Federal K1P, K1S, or K1F screens then those withholding amounts will not flow to the IN Schedule 5/F and IN-W until the Indiana screen K1 is completed for each applicable Schedule K-1.

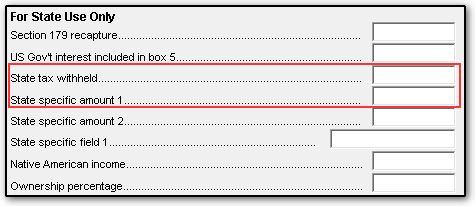

- State withholding entered on the Federal K1P or K1S screen will flow to the IN Schedule 5/F Line 1.

- County withholding can be entered on the Federal K1P or K1S screen as "State Specific Amount 1" or on the Indiana screen K1. This value will flow to the IN Schedule 5/F Line 2.

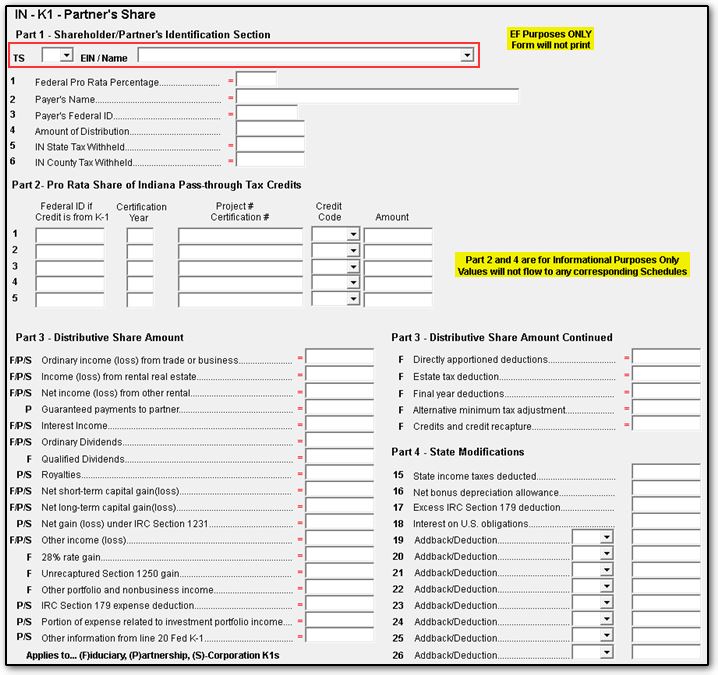

To clear this message, you must go to the States tab > IN > Other tab > K1 screen, and create an instance of this screen for each K1 entered in your federal data entry that flows to the Indiana return.

Note: The minimum entries required are the T/S drop list and the EIN / Name drop list at the top of the screen. Part 2 and Part 4 can be completed on this screen; however, the entries for these parts are for informational purposes only and do not flow anywhere in the return.

The state and county tax withheld data entry points that the message refers to can be found on the second tab of the federal K1 data entry screens.