Estimate Template

An estimate is a formal approximation of the costs of providing goods or services. Estimates are an essential part of doing business in almost every industry because they allow buyers to plan how much they will have to spend on particular projects, and they promote transparency among vendors. A buyer of goods and services will commonly use an estimate to decide whether or not to select a specific company to fulfill a contract or provide a recurring service.

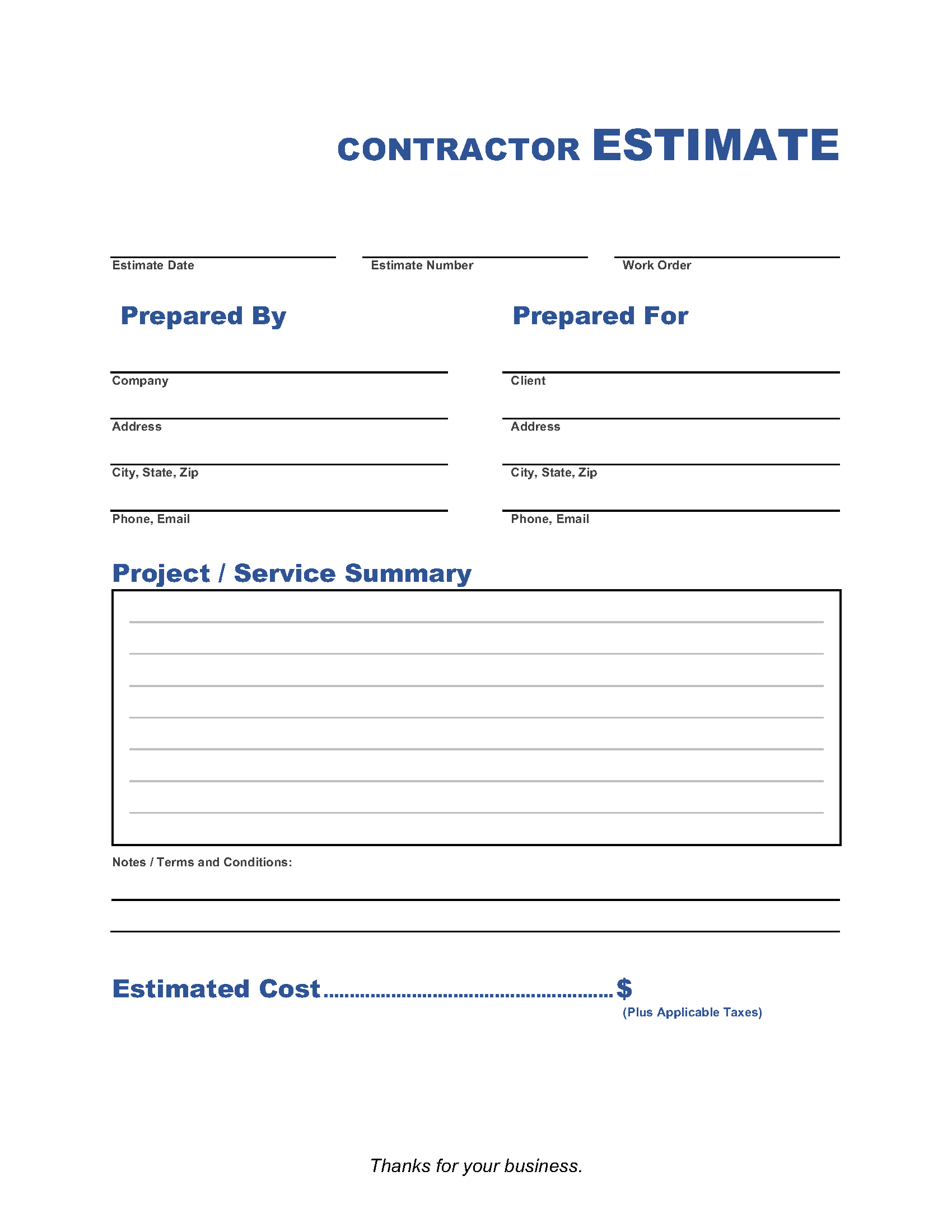

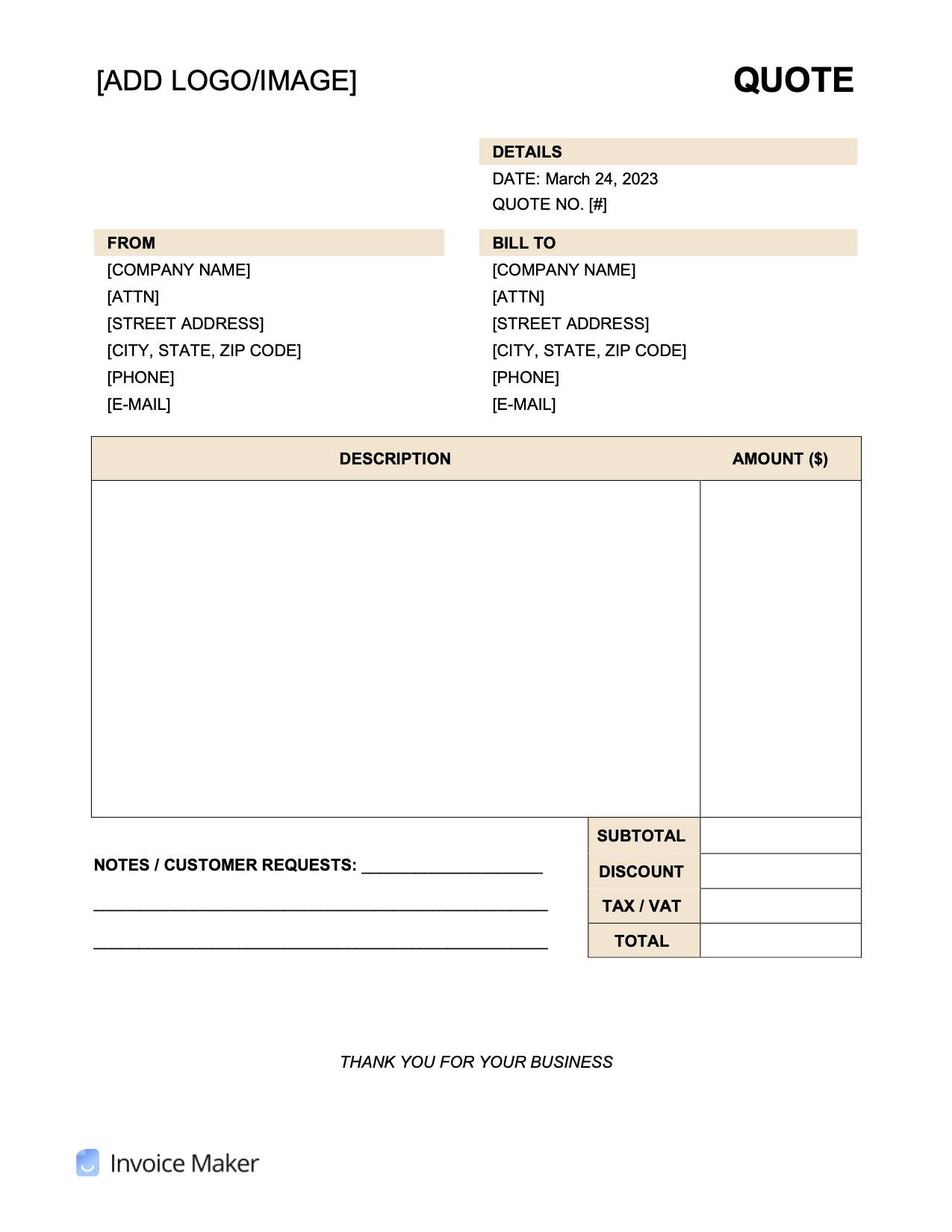

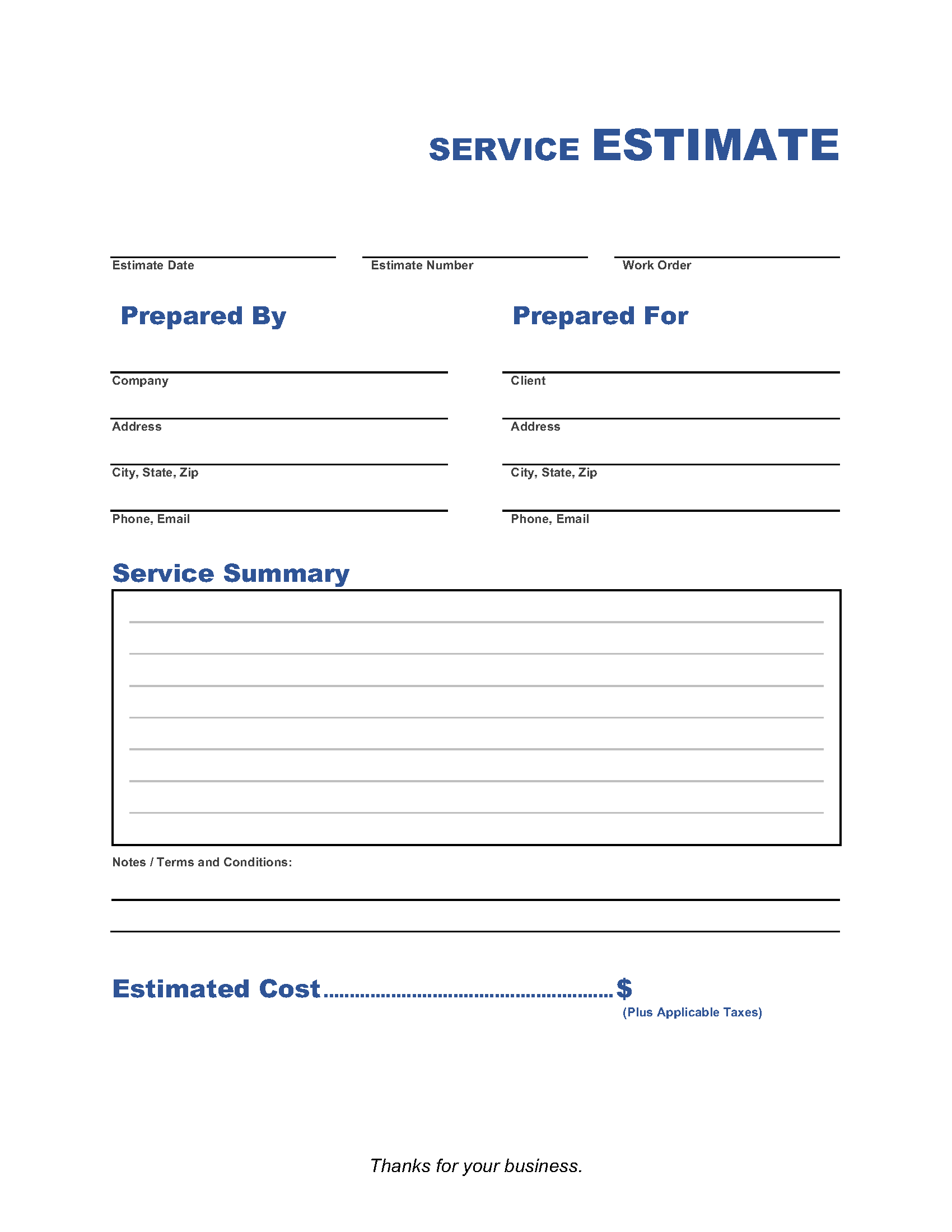

Estimate Templates: By Type (3)

What is an Estimate?

An estimate provides a supported hypothesis of how much a project will cost. When used colloquially, “estimate” often means to guess with little preparation. Still, in the professional world, an estimate is expected to have a significant amount of research and analysis to make it as accurate as possible. But because estimates are provided before work on a project begins, the figures they present are generally not considered final prices, which should be clarified in the document.

Estimate vs. Invoice

While an estimate is provided before a good or service is delivered and reflects an approximation of what the customer will likely owe, an invoice usually comes afterward and reflects what the customer owes. In other words, the main difference between an invoice and an estimate is finality: The price quoted in an estimate can change, while the price quoted in an invoice will not.

Parts of an Estimate

The components of any estimate will depend on the kind of project the forecast is for. The following sections are considered standard components of any complete estimate.

Scope of Work

This is a statement of what the project is. While the customer is already familiar with this information, including this section can help make things easier for the person reviewing the estimate. It is mainly if the estimate is for a project composed of multiple, interdependent tasks because other participants may use or rely on the information provided here.

Assumptions and Risks

Every project comes with unknowns. Construction costs, for example, can be significantly impacted by weather, which can be challenging to predict the time horizon necessary for an estimate. Parties offering estimates are not punished for this.

Still, along with clarifying that the final price invoiced may be different from the figure offered in the estimate, there should be a section describing which factors in the estimate rely on necessarily incomplete information—what parts of the estimate are known and what are assumptions. The estimate should also make clear how much the risk factors identified could potentially affect the final price charged to the customer, a process known as a sensitivity analysis. This is typically expressed as a percentage of the entire project’s cost.

Methodology

The document should make clear how it arrived at the figure it provides. There are dozens of possible methods for arriving at an estimate; deciding on the right one will depend on the type of work or good being provided and the amount of information available when the estimate is due. This section is sometimes known as a Basis of Estimate or BOE. It should include an overview of how the work will proceed, commonly called a work breakdown structure or WBS.

The most common estimate methodologies include top-down, bottom-up, expert judgment, analogous or comparative, parametric, and three-point. Some estimation methods are specific to the construction industry.

Cost Components

This section identifies and describes costs that the person performing the estimate is likely to incur in handling the project and is expected to be the most extensive section of an estimate. Hard costs typically include:

- Labor: The labor costs of all people that the estimating party is responsible for paying. The estimate should make clear how much of this cost comes from workers paid by the hour, salaried staff, and independent contractors.

- Materials: Materials usually refer to goods that need to be acquired and incorporated into the finished product, such as concrete for building a driveway. Particularly for materials that represent a significant part of the project, the estimate should make clear the amount of material to purchase and the cost per unit.

- Equipment: Equipment also refers to goods, but unlike materials, equipment generally does not form part of the final product. A forklift used to move heavy materials around a job site would be a typical example. Equipment may be rented or purchased, with costs reflected accordingly. It’s also possible that the party offering the estimate already owns the necessary equipment, so equipment costs may reflect fuel or maintenance expenses.

Soft costs are essential to a project but don’t represent labor or a physical entity. Soft costs include insurance, bonding, and permits.

Profit Margin

Businesses seek to make a profit, and the estimate should identify how much profit the project cost will generate. This is typically presented as a percentage of the total cost. It may also be included in the previous section as a cost. Generally, exceptionally risky fields or those reliant on new technology tend to command higher profits. At the same time, those with many competitors or low-entry costs usually have higher profit margins.

Supporting Documentation

Including proof of the figures offered in an estimate makes it more reliable. This could include, for example, photocopies of contracts for materials to be used in the project that reflect the unit rate quoted in the component section. Supporting documentation can be included as an appendix to the estimate.

When is it Typical to Send an Estimate?

Estimates are offered before work on a project begins. A buyer may solicit multiple estimates from various providers of goods and services to select the best combination of price and offer. The more complex a project is, or the more it requires different providers of goods and services to work together, the more lead time is likely to be required.

What Professions Use Estimates?

The requirement to provide an estimate, or variations like a bid, quote, and proposal, can be found in almost every industry. However, estimates are most common in construction, particularly among general contractors. Because the field typically requires the participation of numerous firms, often called subcontractors, the lack of an estimate can make it difficult to see how much the project might cost.

Can an Estimate Change?

Estimates can change. For example, a party may offer an assessment before selecting a job and then deliver another estimate after more detailed information is available. Rather than provide multiple, different estimates, it’s more likely that a party will acknowledge that the project’s final invoiced cost may differ by some margin from the estimated cost. For example, in home improvement projects, it’s common for the final price to vary from the estimate by at least 5 %.

Is an Estimate a Legal Document?

An estimate is a legal document, but it is not the same as a contractual promise to deliver goods or services for a fixed price. Some element of uncertainty is built in.

Some industries make use of what are called “good faith” estimates. These documents provide potential customers with an estimated price for goods and services and only permit certain deviation levels. For example, some medical providers offer good faith estimates for healthcare. If a patient’s final bill exceeds the estimate by more than $400, the patient may be eligible for a refund. Good faith estimates also address third-party lending costs in residential mortgages.

These examples are from highly regulated fields with specific laws governing the estimate process. However, the idea of negotiating in “good faith” applies to all industries, and if a party’s conduct is later disputed, an estimate may be relevant.

“Bad Faith” Estimate Example

Suppose Contractor X was to offer an estimate far below what X knew was possible for the job. As a result, it gets chosen over Contractor Y, who provides a realistic assessment. Contractor X takes the job, knowing that once work starts, the client will rely on X to complete the job within a particular time. Suppose X’s final invoiced price is far above the amount of Y’s initial estimate. In that case, the client could sue, arguing that X had acted in bad faith by offering an artificially low estimate.

How Long to Keep Estimates

Maintaining estimates is part of sound recordkeeping practices. Even though the estimate is not a final price, it’s useful for each party to hang on to the estimate. Over time, comparing estimates and invoices can help reveal to clients whether their project specifications are sufficiently detailed to allow for accurate estimates. They can also help contractors assess whether their estimate techniques need to be adjusted.

Two primary considerations help determine how long an estimate should be retained: litigation and taxes. Suppose there is a possibility that an estimate will be relevant to a potential lawsuit. In that case, it should be retained for at least as long as the statute of limitations allows for the type of lawsuit envisioned. Determining whether a statute of limitations has passed can be a complex legal question and may require the assistance of an attorney.

In terms of taxes, the IRS recommends keeping records that may be related to a claim of a write-off or loss for at least seven years. Otherwise, the IRS suggests maintaining records for at least three years. Finally, a business may confront particular rules about keeping estimates. Insurance providers, or financial groups that provide loans or bonds to a company, may have requirements about how long estimates should be retained.

How to Send an Estimate Instantly

Estimates can be created and sent instantly using Invoice Maker. The services make it easy to build an estimate by indicating the necessary terms and letting parties customize the fields to meet their need. Once done, the estimate can be sent to the receiving party, and the creator can download the invoice for recordkeeping.