The journey towards your eventual retirement is a long one with many challenges and obstacles to face. Contributing regularly to a superannuation/pension pot is one way of ensuring that you have the funds available to live the kind of lifestyle you wish when you eventually get there.

However, superannuation/pension contributions can take away a large chunk of your income and essentially lock away its value until you reach retirement age. This might present problems should you face short-term financial challenges along the way.

A transition to retirement (TTR) and recontribution strategy is one possible way of navigating these issues and allowing yourself a short-term fix, while still staying on course towards meeting your long-term goals, and transferring a UK pension to an Australian QROPS superannuation fund can help to super charge this strategy. Read on to find out more.

A TTR pension allows you to use your super fund to partially supplement your income once you’ve reached your preservation age

You can gain partial access to your super fund once you’ve reached your preservation age by utilising a TTR pension. Your preservation age is determined by your age and date of birth.

Individuals born before 1 July 1960 are able to access their super funds when they turn 55. However, age of access for anyone born after this date varies between 55 and 60.

You will need to know your respective preservation age before approaching a TTR pension. Once you reach the age of 65, you are free to withdraw from your super while simultaneously working.

A TTR pension, or income stream, is where a super fund pays an individual a portion of their super funds in regular payments – similar to a traditional pension – as a means of topping up or simply reducing their taxable income.

This allows for some added flexibility in the years between semi- and full-retirement.

Under the current TTR rules, this can allow you to:

- Remain in your current job, while reducing the hours you work without sacrificing your income

- Benefit from the tax relief on TTR pension payments, which attract a 15% tax offset on your marginal Income Tax rate between preservation age and 59 (payments at age 60 or over are tax-free)

- Draw investment earnings that are typically taxed at a maximum rate of 15% on capital gains, dividends, and interest generated.

A TTR allows you access to between 4% and 10% of your super fund each financial year (minimum reduced to 2% until 30 June 2023) prior to reaching retirement age, while also allowing you the option of putting funds back into the super in a tax efficient manner.

A TTR pension and recontribution strategy has seen positive benefits for our clients

Our case study details how we helped a client (referred to as Keith, although that’s not his given name) through the steps involved with TTR, a subsequent contribution strategy, and the benefits he yielded.

Pre-advice summary

Keith has a defined benefit/final salary UK pension he retains from seven years spent working for an employer in the UK. In addition, his employer sponsored superannuation accumulation fund, involves the employer contributing 10.5% of income as a super guaranteed contribution.

Keith at the time of seeking advice is 60 years of age. The normal retirement age of a UK defined benefit scheme is 65 and Keith’s intended retirement age is 67.

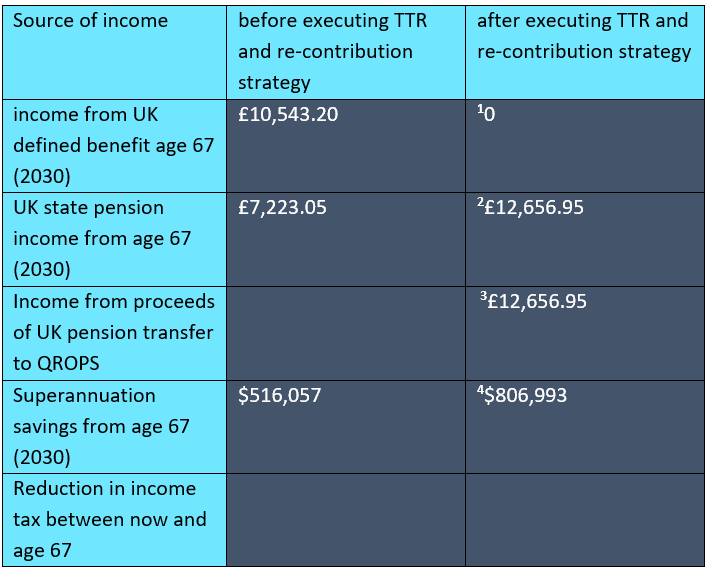

Keith’s estimated income from the age of 67, prior to engaging financial advice, is:

- An annual value of defined benefit taxable income of £10,543.20 or £878.58 each month

- An annual income from UK State Pension of £7,223.05.

This represents a total estimated fixed taxable income from age 67 of £17,766.25 each year.

Recommendation 1

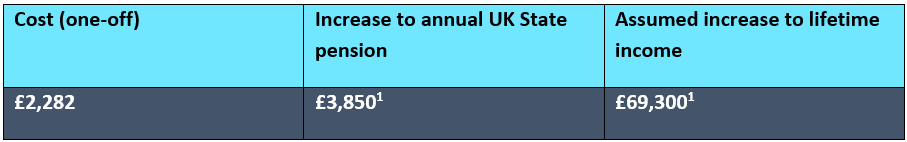

Keith could top-up his UK State Pension entitlement by opting to make 14 years of voluntary class 2 National Insurance Contributions (NICs) for the years worked directly prior to relocating from the UK to Australia, as well as those worked in Australia for the last 15 years.

1 Note the UK State Pension is indexed (adjusted for the higher of inflation, average wage inflation or 2.5%) annually for Australian residents. However, under current legislation, indexation will cease at State Pension Age (currently 67 for most people) for Australian residents.

Recommendation 2

Keith could opt to commute the income from his UK defined benefit pension to a lump sum by transferring into an Australian qualifying recognised overseas pension scheme (QROPS) fund.

By doing so Keith will not be subject to Income Tax on income draw from the proceeds of the commutation and transfer of the UK defined benefit pension to Australian QROPS fund. However, any capital gains or dividends in the new fund will be taxed at 15% while in the accumulation phase.

The growth on the UK pension since becoming an Australian resident was taxed in the hands of the Australian QROPS fund at a concessional rate of 15% — equalling £1,854.44.

Recommendation 3

Keith could initialise a TTR with the Australian QROPS fund and draw 10% of its value in each financial year.

He could then recontribute to his current employer’s super fund which would allow him to:

- Utilise his catch up concessional contributions

- Make personal contributions to maximise his annual concessional contributions between now and retiring at age 67.

The benefits of this approach based on the expectation that his current annual salary, employer super contributions, and his marginal rate of income are in line with current estimated savings on Income Tax associated with employment up to age 67 — totals more than AUD $24,500.

In this instance, Keith’s employers’ super fund ongoing charges are less than the Australian QROPS fund. Making the recontribution from the TTR strategy to their employer super fund, reduces fees and leads to an estimated savings of more than $3,200 between now and retirement at age 67.

Outcomes

Before receiving advice, Keith was due to receive an annual fixed income from a UK defined benefit and UK State Pension from his desired retirement age of 67 totalling £17,766.25 or $31,090 (at an exchange rate of £1 to AUD $1.75).

The projections included are based on the following assumptions:

1 income commutted to lump sum and added superannuation savings 3

2 after topping up UK pension entitlement with indexation to age 67 estimated at 3% p.a.

3 Assumes annual net returns of 5.5% and annual income equal to 5% of the balance attributed to the proceeds of the UK pension transfer to Australian QROPS fund

4assumes current contributions continue at the relevant superannuation guarantee contribution rate to age 67 with 5.5% p.a. growth

The projections are for illustrative purposes only and are not an estimate of the investment returns you will receive or fees and costs you will incur.

After receiving advice, Keith moved to make voluntary contributions to maximise their UK State Pension entitlement, raising the annual amount to £12,656.95 or AUD $22,149.66 (assumes an annual indexation to age 67 of 3% from 2023/24 UK tax year).

There would no longer be a defined benefit income as the income has been commuted for a lump sum.

The initial increase to superannuation savings is an estimated AUD $200,000. This allows Keith to draw an annual income of 5% (or AUD $10,000) from his Australian QROPS super fund balance with income indexed by an assumed 2.5% rate of annual inflation.

The superannuation savings and the annual drawable income both assume annual net returns of 5.5%. They both also allow for the deduction of advice fees from the Australian QROPS fund and the replenishing of initial out of pocket expenses from TTR in the 2022/23 financial year.

So, Keith’s total annual income after implementing this strategy amounts to AUD $32,149.66 (State Pension combined with TTR payments) compared to AUD $31,090 beforehand. This is in addition to his AUD $24,5000 in Income Tax savings and AUD $3,200 in reduced QROPS fees.

The proceeds of the UK pension transfer would be exhausted by age 98 which is more than 12 years after life expectancy.

The advantages for Keith of acting upon all three recommendations:

· Commute income from UK defined benefit pension to a flexible lump sum

· Swaps lifetime assessable income on UK defined benefit pension with a once off tax on the growth of the fund since relocating to Australia

· Mitigate exposure to foreign currency (GBP) by exchanging for AUD upon transfer to Australian QROPS fund

· Reduce assessable income by claiming a deduction on the contributions re-contributed to his employer superannuation and reduce the product fees when compared with retaining the UK pension money in the Australian QROPS fund

· Increase lifetime (assume life expectancy of 85) UK State Pension income by £69,300 for a once off cost of £2,228 (based on class 2 contributions).

It is important to note that a TTR pension strategy can have drawbacks such as:

-

- A reduced super fund value come retirement

- A potential loss of associated insurance that some super funds have as an additional benefit

- Any income drawn through TTR is taxable before the age of 60

It can be a complicated process and it is vital that you seek professional advice before making any major decisions.

Get in touch

If you have a UK pension and would like to consider options to help you utilise it overseas, a good first step might be to get in touch. Please email jason@jasonoconnell.com.au or call 0498 740 840.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Workplace pensions are regulated by The Pension Regulator.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

This information in this email is general advice and does not take account of investors’ objectives, financial situation or needs. Before acting on this general advice, investors should therefore consider the appropriateness of the advice having regard to their objectives, financial situation or needs.

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Financial solutions for expatriates in Australia | Jason O’Connell is an Authorised Representative (“AR”) 1269423 Shartru Wealth Management. ABN: 46 158 536 871 operating in Australia under AFSL: 422409.

One comment