6 Bookkeeping Tools for Self-Employed Musicians

Fun fact: When you run your own small business, you're the CEO, the CFO, the marketing team, the legal department, and yes, the accountant.

So you pull out your trusty TI-83 calculator from high school calculus and start plugging in some numbers.

Gross margin, net profit, revenue—what's the difference?

How are direct expenses different from operating expenses?

Is my business even profitable? How can I tell?

You know these things are important to running a profitable business, but some of this feels like learning to speak a foreign language.

You have three options:

Enjoy being *blissfully unaware* of what you don't know.

Learn how to live with that overwhelming feeling of Am I doing this right?

Invest a little time learning the basics so you feel confident managing your own books.

If you chose option #3, you're in the right place. We're here to help (and—good news—we already did the research for you).

In this post, you’ll learn about six bookkeeping tools and accounting software options for self-employed musicians—some are free forever, some are free to start, and the rest are less than $20/mo. We even included a free option for our UK friends that includes VAT submissions.

And for those of you who prefer the DIY approach, we made something for you: A set of customizable bookkeeping templates designed specifically for musicians to help you get *clarity* on your business finances and manage your books with confidence. Learn more >>

Bookkeeper vs. Accountant vs. CPA: What’s the Difference?

First, you may have heard these terms used in business. Are they all the same? Not quite:

“Bookkeepers record a business's day-to-day financial transactions. Accountants focus more on the big picture.” (Source: Investopedia)

A bookkeeper may have certifications (CPB or CB after their names), but these are optional. An accountant is someone who has earned a bachelor's degree in accounting and can provide tax and financial advice. A Certified Public Accountant (CPA) is an accountant who has earned a CPA license through additional training, education, and experience. (Source: NerdWallet)

3 Things You Should Know About Bookkeeping

If you’re just getting started and trying to make sense of your business finances, there are a few things you should know.

1. You can *be your own* bookkeeper.

You don’t need an accounting degree to do your own bookkeeping. You can learn the basics to keep track of your books and manage your business finances.

You can always outsource this task down the road, but we recommend learning the basics and doing it on your own before outsourcing so you’re aware of how money moves through your business.

Recommended Resource: Bookkeeping Basics for Entrepreneurs (Bench Accounting)

2. It doesn’t have to be as complicated as it sounds.

Net margin, accounts receivable, cash flow forecasting… these and other accounting terms can make the job feel more intimidating and inaccessible, but the truth is, there are two basic logs you need to keep in your business: income and expenses. It’s important to track what money is coming into your business and what’s going out.

Review your bank and credit card statements; PayPal, Stripe, Venmo accounts; and be sure to track any cash you earn or spend in your business.

Keep copies of all of your receipts. This includes things like:

sheet music

office supplies (e.g. paper, printer ink, pencils)

instrument maintenance (e.g. piano tuning, repairs)

materials (e.g. reeds, strings, rosin)

payment fees (e.g. PayPal, Stripe, Venmo, bank)

software you use in your business

materials and supplies you purchase for your students

home office deductions (e.g. office furniture)

hosting fees

services you pay for (e.g. tax preparation, legal, bookkeeping)

professional development (e.g. conference registration, concerts)

travel expenses related to your self-employment work

books + eBooks related to your profession

and more!

You can keep hard copies of receipts in an envelope during the year or use one of the tools below to capture and organize your receipts digitally. Use this at tax time to make sure you’ve written off all your deductions and keep them with your tax files (again, hard copy or digital) in case of an audit. Basically, you want to be able to prove how you spent money in your business and it helps if you already have this organized by year.

Recommended Resource: Free Tax Basics Workbook (Musician & Co.)

3. Put it on your calendar.

One of the challenges of being your own bookkeeper is being consistent. It’s important to set aside time at the end of each week, bi-weekly, or once a month to review your books and update things. Pro tip: Don’t wait until the end of the year to get your books in order.

Related post: My Finance Friday Workflow: Tips for Entrepreneurs

Ready to get started?

Here are six bookkeeping and accounting tools built for small businesses + a customizable Google Sheets bookkeeping template suite for the DIYers that we designed specifically for musicians.

Our Favorite Bookkeeping Tools for Musicians

In this section, we’re sharing our research into bookkeeping tools and apps for musicians. Here are some of the things we looked for:

free plans or low monthly fees

features that were relevant to self-employed musicians and freelancers

ease and simplicity of setup

overall value

As with most things, we recommend starting with a free option and testing it out for a few months before signing up for a paid plan. You may find that you can get by just fine with a plain old spreadsheet—save yourself the business expense! Or, you may discover that the $15/mo. you spend on accounting software to have some of these bookkeeping tasks automated for you is the best money you can spend in your business.

Here are our curated recommendations:

Wave Accounting

Features:

free forever

unlimited income and expense reporting

unlimited bank and credit card connections

automatically pulls transactions

categorize transactions automatically

Wave Receipts feature

accounting reports (P&L, balance sheet, cash flow statement)

double-entry accounting

mobile app

About Wave:

We like Wave Accounting because it’s a one-stop shop for small business owners. Not only can you manage your income and expense reports, categorize transactions (which saves time during tax season), and organize receipts, but you can also use it to send invoices and accept payments.

Zoho Books

Features:

free for businesses with revenue <$50k/year

expenses and mileage tracking

add multiple bank and credit card accounts

import bank and credit card statements

categorize transactions automatically

accounting reports

$15/mo. for a standard account

mobile app

About Zoho Books:

Zoho Books is a great choice for startups (particularly if you use other Zoho apps). They offer free income and expense reporting, automatic transaction sorting, and the ability to link multiple accounts. We also love the mileage tracking feature, which is great if you’re a freelancer who travels a lot.

FreshBooks

Features:

$17/mo. for Lite

unlimited expenses

limited invoicing

automatic bank import

mobile mileage tracking

accounting reports

mobile app

About Freshbooks:

FreshBooks is a popular choice among small business owners. They offer a range of accounting reports, mileage tracking through their mobile app, limited invoicing, and automatic import of your monthly bank statements (vs. having to upload them manually).

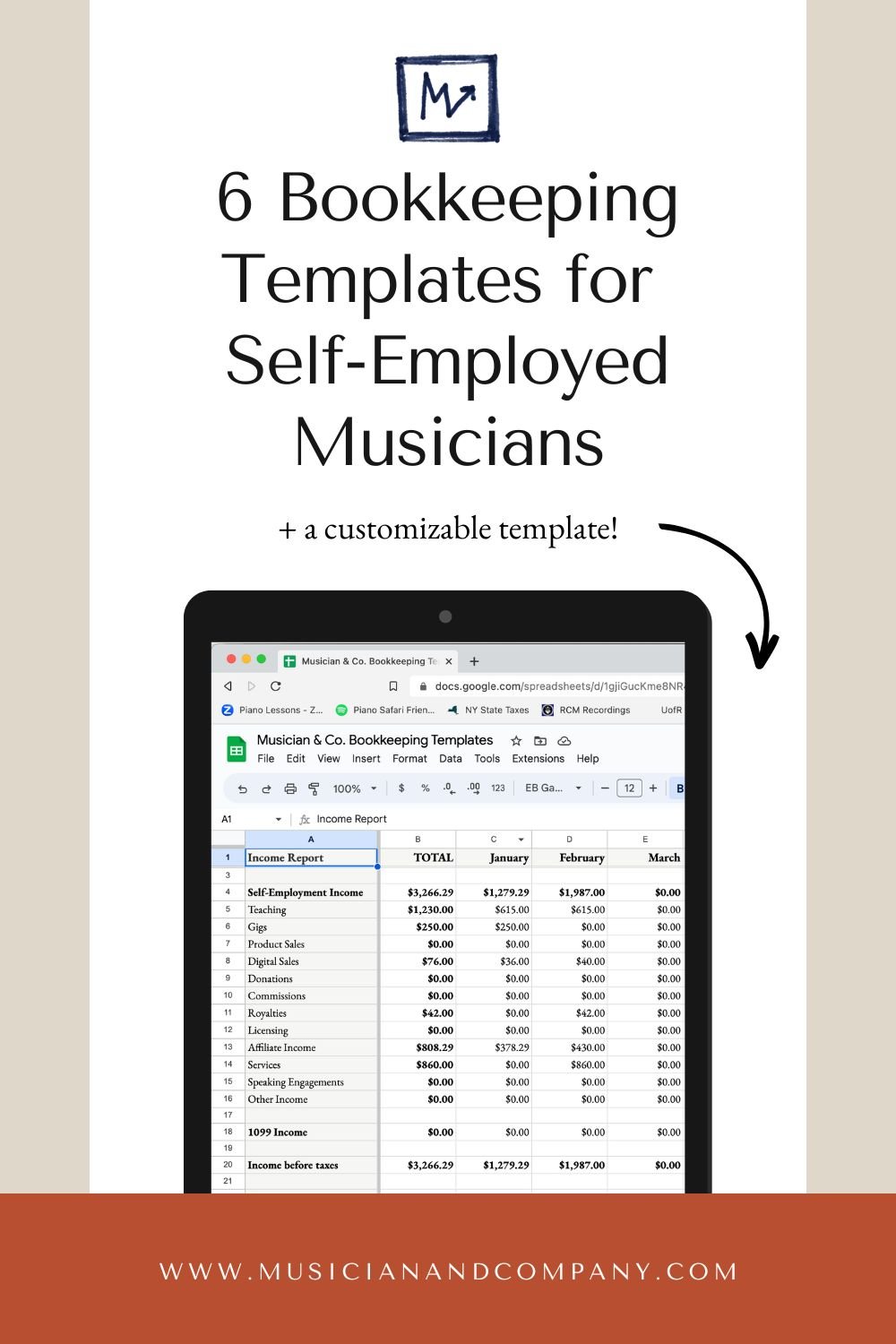

Bookkeeping Templates for Self-Employed Musicians

Take "learn accounting" off your to-do list with this ready-to-use bookkeeping template suite + walk-through video.

Track your monthly income & expenses + generate reports

Auto-calculate how much to set aside for estimated taxes each month

Track mileage related to your self-employment work

Auto-generate an at-a-glance profit & loss statement for your business

Plus, get our Finance Friday workflow + a helpful glossary of accounting terms

QuickBooks

Features:

$15/mo. for self-employed

automatic income and expense tracking

capture and organize receipts

estimate quarterly taxes

basic accounting reports

automatic mileage tracking

mobile app

About QuickBooks

QuickBooks is another popular choice for musicians (and maybe the most well-known). Like the other tools on this list, it offers things such as automatic mileage tracking, basic accounting reports, and the ability to organize your receipts digitally. It’s a little more complicated to use than the other tools mentioned and may be better suited to product-based businesses.

Hurdlr

Features:

Free plan includes unlimited mileage tracking, add income & expenses, and tax calculations

$8.34/mo. for Premium

automatic mileage tracking

automatic expense tracking

automatic income tracking

state and self-employment tax calculations

mobile app

About Hurdlr

Hurdlr was built with freelancers in mind. They offer a free and paid plan (which provides more automation options). The mileage tracking is easy to use and we love that they include state and self-employment tax calculations, as well, to make sure you’re setting enough aside each month.

Pandle

Features:

for UK small businesses

Free forever + £5/mo. Pro plan

bulk editing of transactions

easily manage finances for multiple businesses from one account

manually import bank transactions

accounting reports

no usage limits

mileage tracking (Pro)

receipt upload (Pro)

VAT submissions

mobile app

About Pandle

This one is for our UK friends. Pandle offers accounting reports, mileage tracking, digital receipt organization, and VAT submissions—all for free.

For £5/mo., you can get mileage tracking, PayPal and bank feeds, receipt uploads, and cash flow forecasting.

Please note: Making Tax Digital is mandatory for all VAT-registered businesses.

HM Revenue & Customs has a database where you can search for software that's compatible with Making Tax Digital for VAT. This allows you to submit your VAT Returns to HMRC without going through HMRC’s website.

Bookkeeping How-To Videos

One more helpful resource for you—free financial literacy classes created by Bench Accounting. Here are two worth watching:

Bookkeeping Basics for Small Business Owners: 7 steps to getting your bookkeeping up and running including topics like single-entry vs. double-entry accounting and how to choose between cash and accrual accounting methods

Accounting Basics for Small Business Owners: tips for managing your money and bookkeeping, reading financial statements, making financial decisions in your business, and preparing for tax season

I’d love to hear from you:

What are your favorite bookkeeping tools and resources for self-employed musicians? Do you use a tool mentioned in this post?