In the realm of property transactions, an Encumbrance Certificate (EC) holds significant importance. It is a crucial document that provides information about the legal status of a property. Whether you are buying, selling, or applying for a loan against a property, understanding the concept and significance of an EC is essential. This blog aims to provide a comprehensive understanding of the Encumbrance Certificate, its purpose, its application process, and how it helps in ensuring a secure property transaction.

Table of Content

What is an Encumbrance Certificate?

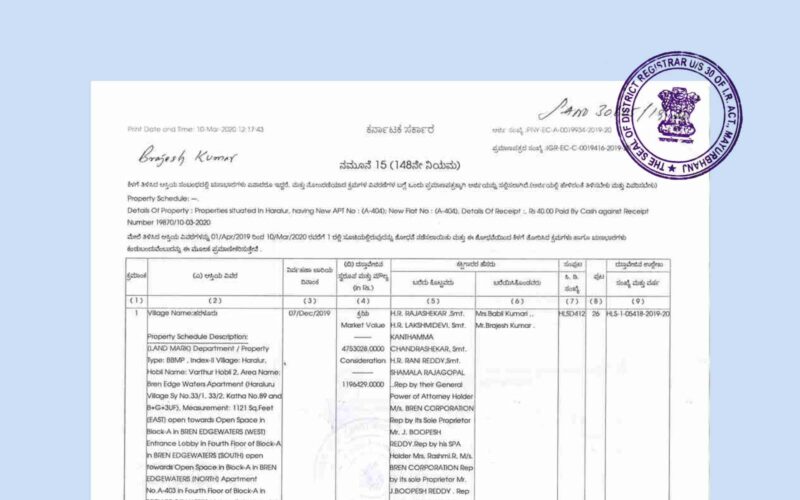

An Encumbrance Certificate (EC) is an official document that provides information about the legal and financial status of a property. It is issued by the Sub-Registrar’s Office and serves as proof of ownership, as well as any encumbrances or liabilities that may be associated with the property.

The EC contains a chronological record of all registered transactions, such as sale deeds, mortgages, leases, or any other encumbrances that have been registered against the property during a specified period. It helps potential buyers, sellers, and financial institutions assess the property’s marketability and verify its legal status before engaging in any property transaction.

The EC is an essential document for various purposes, including property registration, availing loans against the property, and conducting due diligence while buying or selling real estate. It helps individuals ensure that the property that they intend to buy or sell is free from any legal disputes, pending loans, or other encumbrances that could affect its ownership or marketability.

Significance and Uses of Encumbrance Certificate

- Property Ownership Verification: An EC serves as proof of ownership and establishes that the property is free from any legal disputes or claims. It helps buyers to verify the ownership details and ensures a smooth transfer of property.

- Legal Due Diligence: Before purchasing a property, it is crucial to conduct a thorough due diligence process. An EC helps in assessing the property’s marketability and legal status by revealing any outstanding mortgages, loans, or legal disputes associated with the property.

- Loan Application: Financial institutions require an Encumbrance Certificate as a mandatory document while processing loan applications against a property. It helps the lending institution evaluate the property’s value and ascertain whether it can be accepted as collateral.

- Resale of Property: When selling a property, an EC becomes essential for potential buyers to ensure that the property is free from any encumbrances. It provides transparency and builds trust in the transaction.

Application Process for Encumbrance Certificate

To obtain an Encumbrance Certificate follow these general steps:

- Visit the sub-registrar’s Office: Approach the sub-registrar’s Office where the property is registered. Fill out the application form for the EC, providing accurate details such as property address, survey number, and applicant’s details.

- Required Documents: Along with the application form, submit supporting documents such as property documents, proof of identification, address proof, and any other documents specified by the authorities.

- Payment of Fees: Pay the prescribed fee for obtaining the Encumbrance Certificate. The fee structure may vary from state to state.

- Verification and Processing: The Sub-Registrar’s Office will initiate the verification process and conduct a thorough search of the property’s records. This process may take several days or weeks, depending on the complexity of the property’s history.

- Issuance of EC: Once the verification process is complete, the Encumbrance Certificate will be issued, providing details of all transactions and encumbrances recorded against the property during the specified period.

How to Get an Encumbrance Certificate Online?

To obtain an encumbrance certificate online in India, you can follow the steps outlined below:

- Visit the Official Website: Go to the official website of the concerned State’s Department of Stamps and Registration or the Registration and Stamps Department. Each state in India may have its own dedicated website for this purpose.

- Registration/Login: Look for the option to register or log in to the website. If you are a new user, you may need to create an account by providing your details and creating a username and password.

- Select the Encumbrance Certificate Option: Once logged in, navigate to the section related to encumbrance certificates or property information.

- Fill in Property Details: Provide the necessary details related to the property for which you require the encumbrance certificate. This includes the property’s unique identification number, the district, and other relevant information.

- Pay the Fee: There is typically a fee associated with obtaining an encumbrance certificate. Pay the required fee online using the available payment options on the website.

- Submit the Request: After completing the payment, submit the request for the encumbrance certificate through the online portal. Ensure that all the provided details are accurate and complete.

- Verification and Processing: The concerned department will verify the details provided and process your request. This may take some time, depending on the workload and processes of the department.

- Download the Encumbrance Certificate: Once the certificate is processed, you will receive a notification or an option to download the encumbrance certificate from the online portal. Download and save the certificate for your records.

It is important to note that the process and requirements may vary slightly from state to state in India. Therefore, it is advisable to refer to the specific website of the concerned department in your state for accurate information and instructions on obtaining an encumbrance certificate online.

Documents Required to Obtain an Encumbrance Certificate

To obtain an Encumbrance Certificate (EC) in India, the following documents are generally required:

- Application Form: Fill out the application form for the EC, which can be obtained from the concerned Sub-Registrar’s Office.

- Proof of Identity: Provide a copy of a valid identification document, such as Aadhaar Card, PAN Card, Passport, or Voter ID Card.

- Proof of Address: Submit a copy of a recent utility bill (electricity bill, water bill, etc.), ration card, Aadhaar Card, or any other document that serves as proof of your current address.

- Property Details: Provide accurate information about the property for which the EC is being sought. This includes the property’s address, survey number, and other relevant details.

- Proof of Ownership: Submit copies of relevant property documents that establish your ownership, such as a sale deed, gift deed, partition deed, or any other document that proves your legal right to the property.

- Fee Payment: Pay the prescribed fee for obtaining the Encumbrance Certificate. The fee structure may vary from state to state.

It is important to note that the specific requirements may vary slightly depending on the state or jurisdiction where the property is located. Hence, it is advisable to check with the local Sub-Registrar’s Office or consult the official website of the concerned authority to get accurate and updated information on the documents required for obtaining an Encumbrance Certificate in a particular region of India.

Validity and Limitations of Encumbrance Certificate

- An Encumbrance Certificate is typically issued for a specific period, usually for the past 15 years.

- It is important to note that an EC is not a guarantee of the property’s current status; it only provides historical information up to the specified period.

- Any transactions or encumbrances that occurred before the specified period will not be reflected in the certificate.

Conclusion

In the realm of property transactions, an Encumbrance Certificate plays a crucial role in ensuring transparency and safeguarding the interests of all parties involved. It serves as a vital document for property buyers, sellers, and financial institutions, providing a comprehensive record of a property’s ownership and encumbrance status. By understanding the purpose, application process, and limitations of an EC, individuals can make informed decisions and secure their property transactions.

In summary, an Encumbrance Certificate is a crucial document in the Indian context that helps individuals assess the legal and financial status of a property. It ensures transparency, safeguards the interests of all parties involved in property transactions, and plays a vital role in securing property transactions in India.