Founder of Troubled CEFC Hobnobbed With Europe’s Elite to Build Empire

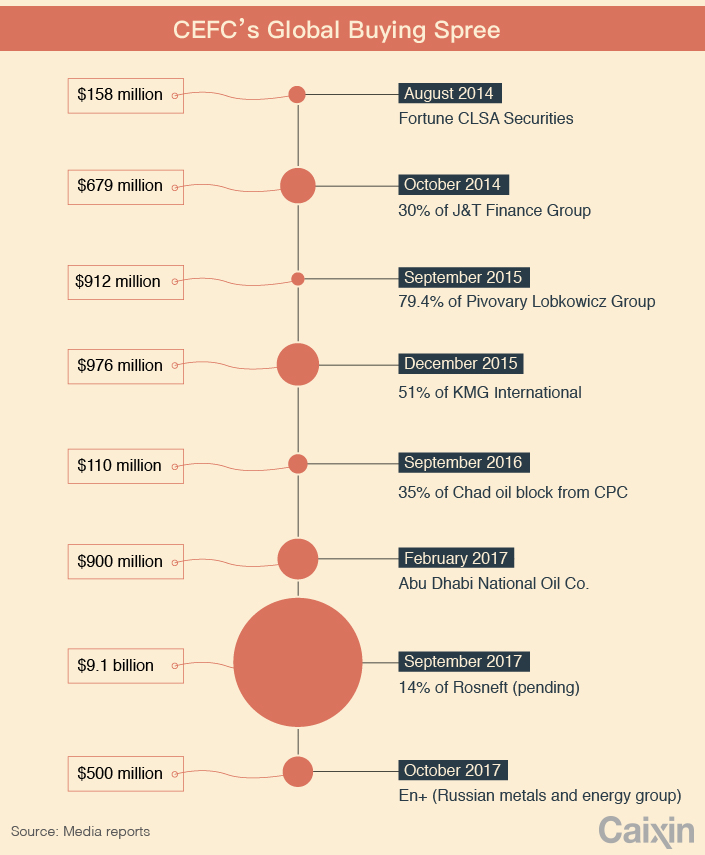

The chairman of private conglomerate CEFC China Energy, who is now under investigation, built an impressive network with Europe’s political world to pave the way for his massive overseas buying spree, including a pending $9 billion stake purchase in Russia’s state-controlled oil major Rosneft.

But CEFC’s high-profile buying spree of the last four years, which took it to Romania, Russia, the Czech Republic and as far afield as Chad, was largely smoke-and-mirrors, as many of its deals ran into difficulty and others generated lackluster returns.

CEFC’s global expansion started in 2014 when it announced a 643 million euro ($784 million) investment for 30% of the Czech Republic’s J&T Finance Group, a local banking, investment and finance giant. That deal launched a CEFC-Czech honeymoon, with the Chinese company planning to invest up to $1.5 billion in the eastern European country.

|

“It is not hard to get connected to big names, and an intermediary plays an important role here,” a CEFC board member told Caixin. For the Czech case, Jaroslav Tvrdik, a Czech politician and businessman, “has contributed more than half” to the company’s ties with the European country.

Tvrdik was the Czech Republic’s minister of defense for two years before joining Czech Airlines as chairman in 2004. He has formed closer ties with China since 2012 as the chairman of a Sino-Czech business association, and started to advise Zeman on China affairs in 2013.

Tvrdik paid a visit to CEFC headquarters in Shanghai in 2014, a month before the CEFC-J&T deal was announced.

CEFC’s later investments in a series of Czech companies included football club SK Slavia Prague, which counts Tvrdik as a fan, and travel company Travle Service, a shareholder of Tvrdik’s former employer Czech Airlines. They also include a brewing group, several properties, and steel and media companies — all with the apparent backing of Chinese and Czech political leaders.

CEFC had originally said it would hold a 30% stake in J&T, and announced plans to boost the ownership to 50% for 800 million euros ($977.13 million) in 2016. The Chinese company had planned to use J&T as a vehicle to set up a bank in Shanghai and a loan and settlement center in Europe. It also planned to use the financial firm to set up a fund of 16 Central and eastern European countries for China’s “Belt and Road Initiative” investing in infrastructure along the ancient land-based and maritime Silk Roads, according to CEFC’s website.

However, the deals didn’t go smoothly. According to the latest public record, CEFC holds only 17.9% of J&T. Approvals for a larger stake are still pending regulatory approval in the six European countries where J&T operates.

CEFC wasn’t prepared very well to conduct business in the Czech Republic either, and was unable to find enough Chinese employees with good language skills, a company executive said.

After buying some of its other Czech assets in the travel and steel sectors, CEFC would sell them to its “core executives” to repay bank loans and concentrate on finance and energy, Chairman Ye told Caixin in a previous interview.

Like the J&T purchase, CEFC’s other deals also progressed slowly, including the purchase of a 14.16% stake in Rosneft for $9.1 billion, for which CEFC is still trying to obtain financing.

Its $680 million purchase of a 51% stake in former Romanian national oil developer, now named KMGI and owned by Kazakhstan’s national KazMunayGas (KMG), was greenlighted by Romania, but still requires approval from the European Union. In 2016, the company also paid $100 million for a 35% stake of exploration rights for another oil and gas block in Chad, but it has yet to exploit those rights.

Ye told Caixin in an interview in April that the company didn’t transfer money from China for its overseas acquisitions, but set up funds abroad that involved “a few hundred billion” for investment in Europe, without specifying the currency of the number.

In another interview in November, Ye said the money for the KMGI and J&T deals came from the company itself, plus bonds of “1 to 2 million” it issued, again without being more specific.

Contact reporter Coco Feng (renkefeng@caixin.com)

- 1Cover Story: How Do the West’s Concerns About China’s Overcapacity Stack Up?

- 2Analysis: China’s EV Whiz Kids Are Flipping the Script on Joint Ventures

- 3‘Green Hydrogen’ Machine China’s Next Hot Export

- 4Chinese Leaders Hints at New Pivot in Tackling Property Downturn

- 5Overseas Investment Through China’s Stock Connect Nearly Doubles 2023’s Total

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas