The demise of cheques - a lesson for paper contracts

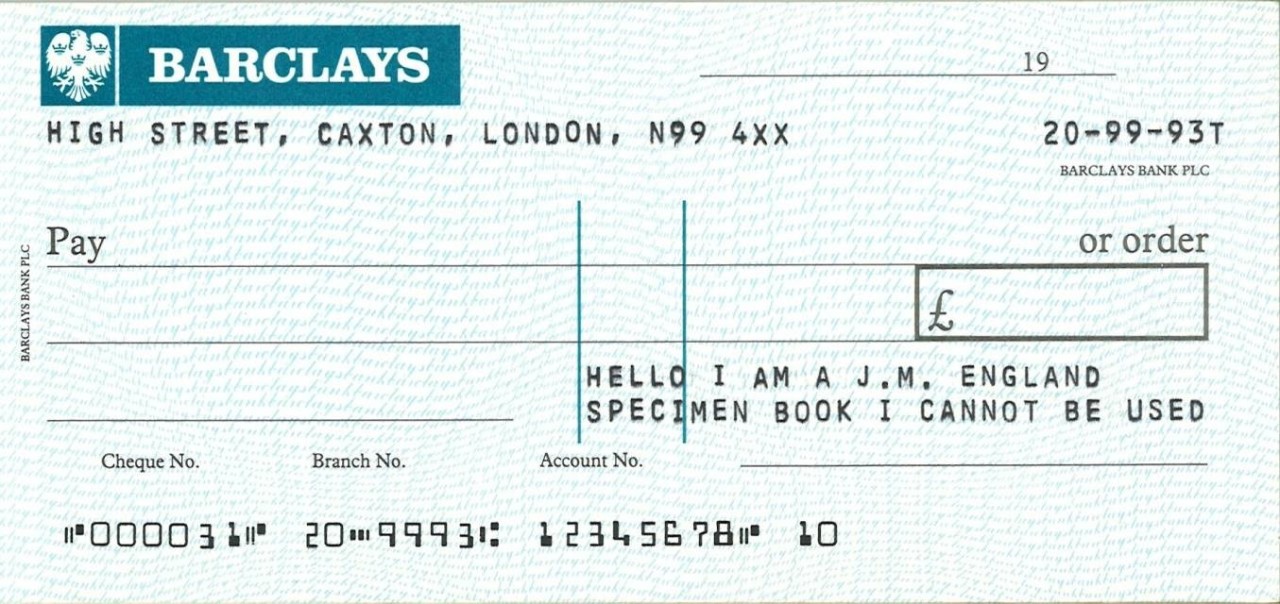

I always enjoy thinking of analogies to help me understand the market direction for the industry I work in, and have been thinking about the decline of cheques as an analogy for the current decline in paper contracts. Below is a paragraph from Wikipedia about cheques, and below that I’ve swapped some of the words for the contracting process.

--------------------------

The decline in cheques

Source: Wikipedia

Cheque usage has been declining for some years, both for point of sale transactions (for which credit cards and debit cards are increasingly preferred) and for third party payments (for example, bill payments), where the decline has been accelerated by the emergence of telephone banking and online banking. Being paper-based, cheques are costly for banks to process in comparison to electronic payments, so banks in many countries now discourage the use of cheques, either by charging for cheques or by making the alternatives more attractive to customers. In particular the handling of money transfer requires more effort and is time consuming. The cheque has to be handed over in person or sent through mail.

--------------------------

A potential future article on the decline of paper contracts?

Paper contract usage has been declining for some years, both for online transactions (for which checkbox terms and conditions are increasingly preferred) and for third party agreements (for example, supplier and customer agreements), where the decline has been accelerated by the emergence of online and smart agreements. Being paper-based, traditional contracts are costly for companies to process in comparison to online agreements, so companies in many countries now discourage the use of paper contracts, either by charging for paper contracts or by making the alternatives more attractive to their customers and suppliers. In particular the handling of paper contracts requires more effort and is time consuming and bad for the environment. The paper contract has to be printed, handed over in person or sent through mail.

--------------------------

The first lesson for me is to imagine a post-paper contract world - what does that look like, how do the commitments flow from one company or individual to another? Apps, Web, Code and API’s is the likely answer just as it is with online banking, mobile bank apps and contactless payments. You don't go to the branch, you expect things to flow automatically.

The second lesson is that one of the contributors to the cheque's downfall was the amount of work the person receiving it had to commit to - they had to dedicate time to physically go to a branch, normally during work time because banks shut at the weekend in order to pay it in. For a small value cheque this was inefficient and a bad customer experience for the person receiving a small refund from a utility or a payment for a service.

The third lesson is how fast the decline of cheques was - once better solutions were available it was matter of a just a few years between cheques being a normal way of transacting and them becoming the thing your grandparents used to send a birthday present.

I like this analogy! Will spend more time thinking about it!

Read more about the decline of cheques here.